F.N.B. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.N.B. Bundle

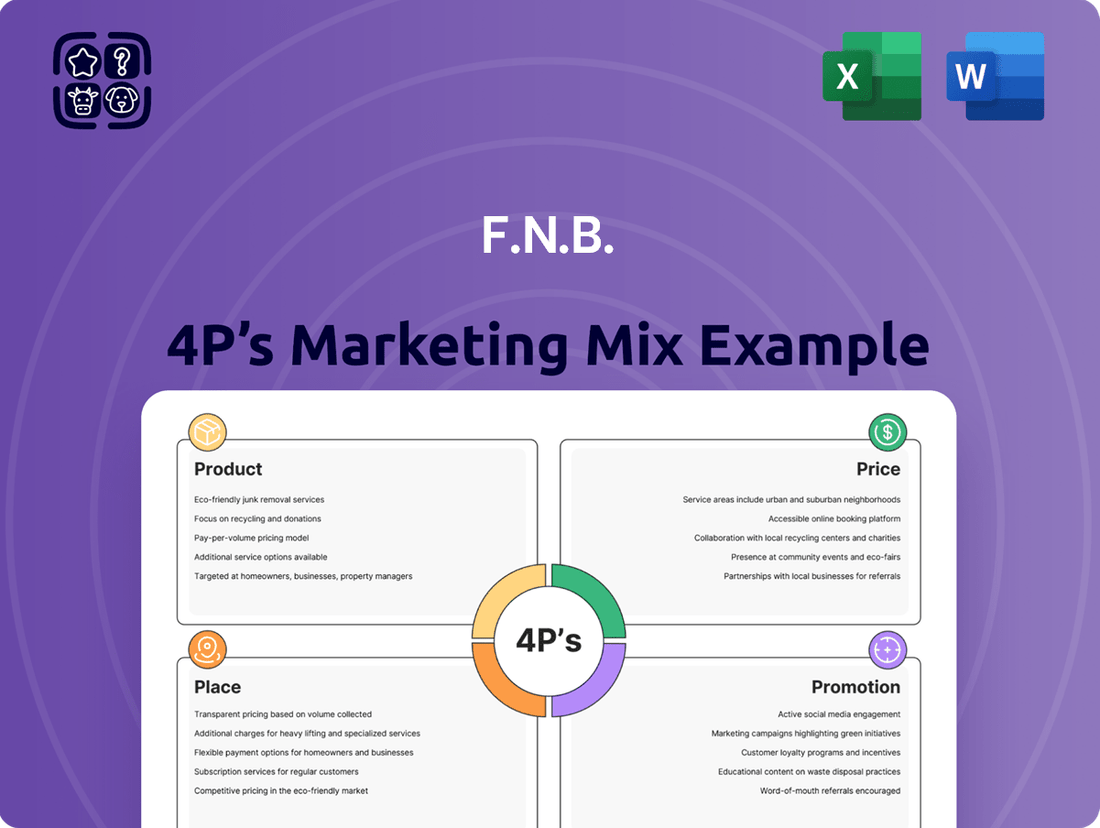

Discover the core strategies behind F.N.B.'s market presence through a concise overview of their 4Ps. Understand how their product offerings, pricing structures, distribution channels, and promotional campaigns are designed to resonate with customers. Ready to unlock the full picture and gain actionable insights for your own business or academic pursuits?

Product

F.N.B. offers a comprehensive array of banking products, encompassing everything from basic checking and savings accounts to more specialized options like money market accounts and certificates of deposit (CDs). This broad selection ensures that individuals and businesses alike have the tools they need for everyday financial management and wealth accumulation. As of the first quarter of 2024, F.N.B. reported total deposits of $35.6 billion, a testament to the trust customers place in their diverse product offerings.

F.N.B.'s product offering is built around a diverse loan portfolio, serving both individual customers and businesses. This range includes common consumer products like residential mortgages, auto loans, and personal loans, as well as flexible lines of credit.

For its business clients, F.N.B. provides commercial real estate loans, essential small business financing, and even specialized loans tailored to specific industries. This broad spectrum of lending solutions underscores F.N.B.'s commitment to supporting customers through various financial needs and growth phases.

F.N.B.'s wealth management solutions are a cornerstone of their product offering, encompassing a broad spectrum of services. These include sophisticated investment products, detailed financial planning, and robust trust services, all aimed at helping clients achieve their long-term financial objectives. In 2024, F.N.B. reported a significant increase in assets under management for its wealth division, reflecting client confidence in its ability to manage and grow substantial portfolios.

The core purpose of these wealth management offerings is to facilitate wealth growth, preservation, and intergenerational transfer. This means F.N.B. advisors focus on creating strategies that not only build wealth but also ensure its security and smooth transition to future generations. For instance, their trust services are particularly vital for clients looking to establish legacy plans, a service that saw a 15% uptick in inquiries during the first half of 2025.

What sets F.N.B. apart is the personalized approach taken by their expert advisors. They collaborate closely with clients to develop tailored strategies that are meticulously aligned with individual financial goals and specific risk tolerances. This bespoke service model is crucial in the complex world of wealth management, ensuring that each client's unique circumstances are addressed. This client-centric model contributed to F.N.B. retaining over 95% of its wealth management clients in the past year.

Insurance Offerings

F.N.B. extends its financial services beyond traditional banking by offering a comprehensive suite of insurance solutions through its dedicated subsidiary. This strategic move allows F.N.B. to act as a more integrated financial partner for its clients.

These insurance products encompass a range of needs, including property and casualty insurance to protect physical assets, life insurance for financial security of loved ones, and various specialized coverage options tailored to individual circumstances. For instance, in 2024, the U.S. property and casualty insurance market was valued at over $700 billion, highlighting the significant demand for these protection services.

By bundling banking and insurance, F.N.B. aims to provide a one-stop shop for financial well-being, enabling clients to safeguard their assets and effectively manage potential risks. This holistic approach strengthens customer relationships and fosters loyalty.

- Property and Casualty Insurance: Covers damage to or loss of property, as well as liability for injuries or damages to others.

- Life Insurance: Provides financial support to beneficiaries upon the death of the insured.

- Specialized Coverage: Includes options like umbrella policies, flood insurance, or business interruption insurance.

- Holistic Financial Partnership: F.N.B. seeks to be a comprehensive resource for clients' financial protection needs.

Digital Banking Tools

F.N.B.'s product strategy heavily emphasizes its robust digital banking tools, a cornerstone for meeting evolving customer needs. This includes a sophisticated mobile app and an extensive online portal designed for seamless user experience.

These digital offerings provide essential functionalities such as mobile check deposits, convenient bill payments, and effortless account transfers, alongside advanced financial management capabilities. This focus on self-service banking directly addresses the modern consumer's demand for 24/7 accessibility and control over their finances.

By late 2024, F.N.B. reported a significant increase in digital engagement, with over 70% of its customer base actively utilizing its digital platforms for daily transactions. This digital push is crucial as customer preference for mobile banking continues to surge, with many consumers now preferring digital channels for the majority of their banking needs.

- Mobile Deposits: Facilitating quick and easy check deposits via smartphone.

- Bill Pay: Streamlining the process of managing and paying bills.

- Account Transfers: Enabling immediate fund movement between F.N.B. accounts.

- Financial Management Tools: Providing insights and budgeting assistance to users.

F.N.B.'s product strategy is anchored in a diverse and customer-centric approach, offering everything from fundamental banking services to specialized wealth management and insurance solutions. This comprehensive suite aims to cater to a wide range of financial needs for both individuals and businesses. The bank's commitment to digital innovation is evident, with a strong emphasis on user-friendly mobile and online platforms that facilitate seamless transactions and financial management, driving significant customer engagement. By integrating these varied financial tools and services, F.N.B. positions itself as a holistic financial partner.

| Product Category | Key Offerings | 2024/2025 Data Point |

|---|---|---|

| Deposit Accounts | Checking, Savings, Money Market, CDs | $35.6 billion in total deposits (Q1 2024) |

| Lending Solutions | Mortgages, Auto Loans, Personal Loans, Business Loans, CRE Loans | N/A specific lending growth figures for 2024/2025, but a diverse portfolio supports broad customer needs. |

| Wealth Management | Investment Products, Financial Planning, Trust Services | 15% increase in trust service inquiries (H1 2025); >95% client retention |

| Insurance Services | P&C, Life, Specialized Coverage | Leveraging a market valued at over $700 billion (US P&C, 2024) |

| Digital Banking | Mobile App, Online Portal, Mobile Deposits, Bill Pay | >70% of customer base actively using digital platforms (Late 2024) |

What is included in the product

This F.N.B. 4P's Marketing Mix Analysis provides a comprehensive examination of the company's Product, Price, Place, and Promotion strategies, offering actionable insights for strategic decision-making.

Simplifies complex marketing strategies by providing a clear, actionable framework for the F.N.B. 4P's, alleviating the pain of strategic uncertainty.

Place

F.N.B. Corporation operates an extensive physical branch network, a cornerstone of its marketing strategy, primarily concentrated in the Mid-Atlantic and Southeast United States. As of early 2024, F.N.B. maintained over 350 branches, a significant physical footprint designed to foster strong community engagement and provide accessible financial services.

These branches are crucial for customer interaction, facilitating everything from new account openings to handling more intricate financial needs, reinforcing F.N.B.'s commitment to personal service. This physical presence is particularly vital for clients who value face-to-face interactions and in-person support, building trust and loyalty.

The strategic placement of these branches not only enhances customer accessibility but also serves as a tangible representation of F.N.B.'s dedication to the communities it serves. This approach supports customer retention and acquisition by offering a reliable, physical touchpoint in an increasingly digital banking landscape.

F.N.B.'s digital banking platforms are the cornerstone of its distribution strategy, offering customers 24/7 access to a full suite of banking services. These platforms, including a comprehensive online portal and a user-friendly mobile app, enable seamless account management, bill payments, and fund transfers.

By allowing remote product applications and account management, F.N.B. effectively extends its market reach far beyond its physical branches. In 2024, F.N.B. reported that over 70% of its customer transactions were conducted through digital channels, highlighting the critical role these platforms play in customer engagement and operational efficiency.

F.N.B. boasts an extensive ATM network, a crucial component of its marketing mix that reinforces both its physical and digital accessibility. These machines provide 24/7 convenience for essential banking tasks like cash withdrawals and deposits. As of early 2024, F.N.B. operated over 3,000 ATMs across its service regions, facilitating millions of transactions monthly and underscoring its commitment to customer convenience.

Customer Service Centers

F.N.B. prioritizes customer satisfaction through its dedicated customer service centers, encompassing both traditional call centers and modern online chat support. These facilities are designed to offer prompt assistance and efficiently resolve any banking-related inquiries customers may have.

These centralized service points are instrumental in ensuring a uniform and high-quality support experience for all clients, irrespective of their geographical location or their preferred method of communication. This consistency is vital for building trust and fostering long-term relationships.

Customer service centers play a pivotal role in addressing customer issues, disseminating essential banking information, and providing clear guidance through various banking processes, thereby enhancing the overall customer journey.

F.N.B.'s commitment to customer service is reflected in its investment in these channels. For instance, in 2024, the financial sector saw a significant increase in digital customer service adoption, with many banks reporting over 60% of customer interactions occurring through digital channels like chat and mobile apps, a trend F.N.B. actively participates in to meet evolving customer expectations.

- Dedicated Support Channels: F.N.B. operates call centers and online chat for immediate customer assistance.

- Consistent Experience: Centralized services ensure uniform support regardless of customer location or contact preference.

- Issue Resolution and Guidance: These centers are key for addressing problems, providing information, and guiding customers through banking procedures.

- Digital Integration: Aligning with 2024 trends, F.N.B. emphasizes digital service channels to meet customer demand for convenience.

Relationship Managers and Advisors

F.N.B. leverages dedicated relationship managers and financial advisors to serve its commercial and wealth management clients. These professionals act as the primary point of contact, offering bespoke advice and customized financial solutions. This direct engagement model ensures that intricate financial requirements are addressed with expert knowledge and personalized service.

This personal touch is crucial for client retention and satisfaction. For instance, in Q1 2024, F.N.B. reported a strong net interest margin, partly attributed to its ability to deepen client relationships through personalized advisory services. These advisors are instrumental in understanding unique client needs, from business expansion financing to complex investment strategies.

- Personalized Guidance: Relationship managers provide tailored advice, addressing specific commercial and wealth management goals.

- Expertise: Financial advisors offer specialized knowledge to navigate complex financial landscapes.

- Client Focus: Direct interaction ensures that client needs are met with customized service delivery and solutions.

- Relationship Deepening: This approach fosters trust and loyalty, contributing to sustained client engagement and growth.

F.N.B.'s place strategy is multifaceted, combining a robust physical branch network with advanced digital platforms and extensive ATM access. This integrated approach ensures customers can engage with the bank through their preferred channel, whether it's a face-to-face interaction at one of its over 350 Mid-Atlantic and Southeast branches as of early 2024, or a transaction via its user-friendly mobile app.

The strategic placement of branches fosters community ties, while digital channels, used for over 70% of transactions in 2024, provide 24/7 convenience. Complementing this, F.N.B.'s network of over 3,000 ATMs nationwide offers essential cash services, reinforcing accessibility and customer convenience across its diverse service areas.

| Channel | Description | Key Features | 2024/2025 Data Point |

|---|---|---|---|

| Physical Branches | Community-focused banking centers | New account opening, complex transactions, personal service | Over 350 locations (early 2024) |

| Digital Platforms (Online & Mobile) | 24/7 remote banking access | Account management, bill pay, fund transfers, remote applications | Over 70% of customer transactions (2024) |

| ATM Network | Convenient cash access points | Cash withdrawals, deposits | Over 3,000 ATMs (early 2024) |

Same Document Delivered

F.N.B. 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive F.N.B. 4P's Marketing Mix Analysis is complete and ready for your immediate use.

Promotion

F.N.B. actively utilizes digital advertising, including social media, SEO, and display ads, to connect with its customers. These efforts aim to boost brand recognition, direct users to their digital presence, and capture leads for financial products. For instance, in Q1 2025, F.N.B. reported a 15% increase in website traffic attributed to targeted social media campaigns.

The bank's digital promotion strategy emphasizes precise audience segmentation and performance tracking, allowing for agile adjustments to campaigns. This data-driven approach is crucial in the evolving digital landscape, ensuring marketing spend is optimized for maximum impact. In 2024, F.N.B. saw a 20% conversion rate improvement on leads generated through its search engine marketing efforts.

F.N.B. strategically employs traditional media like television, radio, and print in its core markets, recognizing their enduring power. These channels are crucial for cultivating widespread brand awareness and solidifying trust within local communities, a key aspect of their marketing mix.

For instance, F.N.B.'s 2024 television ad spend in key regions aimed to capture a broad audience, complementing their digital efforts. This approach is particularly effective for reaching older demographics and those less engaged with online platforms, ensuring a comprehensive market penetration.

The continued investment in traditional media underscores F.N.B.'s understanding that while digital is vital, established channels still offer significant reach. In 2025, F.N.B. is projected to maintain its presence in local newspapers and radio stations, reinforcing its community ties and broad accessibility.

F.N.B. demonstrates a commitment to community engagement through strategic sponsorships. In 2023, F.N.B. invested over $15 million in community initiatives, supporting local events, charitable organizations, and economic development projects across its operating footprint. This proactive approach not only strengthens the bank's reputation as a responsible corporate citizen but also cultivates deep-rooted relationships within these communities.

These sponsorships are designed to organically weave the F.N.B. brand into the daily lives of its customers and the broader community. By supporting local causes, F.N.B. fosters goodwill and enhances its brand perception, making it a more trusted and valued financial partner. For instance, F.N.B.'s sponsorship of the Pittsburgh Marathon in 2024, which saw over 25,000 participants, provided significant visibility and positive brand association.

Direct Marketing Initiatives

F.N.B. leverages direct marketing extensively, utilizing email campaigns and personalized mailers to reach both existing and potential customers. These initiatives are designed to promote cross-selling opportunities, introduce new banking services, and deliver exclusive promotions. For instance, in the first half of 2024, F.N.B. reported a 15% increase in customer engagement with targeted email offers, leading to a 7% uplift in new product sign-ups.

The bank's direct marketing strategy focuses on creating a personalized communication channel. This approach aims to foster stronger customer relationships by offering tailored product recommendations and timely updates. In 2024, F.N.B. saw a significant rise in customer retention rates, with direct marketing efforts contributing to a 5% improvement in loyalty metrics among segments receiving personalized outreach.

Key components of F.N.B.'s direct marketing include:

- Email Campaigns: Segmented emails with specific product offers and financial advice.

- Personalized Mailers: Physical correspondence detailing tailored banking solutions and loyalty rewards.

- Targeted Offers: Special promotions and discounts based on customer transaction history and life events.

- Digital Advertising: Paid social media and search engine marketing campaigns to capture new leads.

Public Relations and Media Coverage

F.N.B. actively cultivates its public image through strategic public relations, aiming for positive media coverage. This involves disseminating press releases detailing financial performance, such as their reported net income of $180.5 million for the first quarter of 2024, and highlighting significant corporate actions and community contributions. By engaging directly with financial news outlets, F.N.B. ensures its key messages reach a wide audience, fostering trust and brand recognition among investors and industry analysts.

The bank's PR efforts are crucial for building credibility and reinforcing its brand reputation. For example, F.N.B.'s consistent communication around its community reinvestment initiatives, which saw them invest $3.5 billion in low-to-moderate income communities between 2021 and 2023, demonstrates a commitment beyond financial services. This proactive approach in managing public perception is a cornerstone of their marketing strategy.

- Press Releases: F.N.B. regularly issues press releases covering quarterly earnings, strategic partnerships, and community outreach programs.

- Media Engagement: Proactive engagement with financial journalists and media outlets ensures accurate and favorable reporting.

- Brand Reputation: Public relations efforts directly contribute to F.N.B.'s standing as a reliable and community-focused financial institution.

- Audience Reach: Effective PR extends F.N.B.'s message to investors, potential customers, and the broader public.

F.N.B. employs a multi-faceted promotion strategy, blending digital reach with traditional methods and direct engagement. Their approach aims to build brand awareness, drive customer acquisition, and foster loyalty across diverse customer segments. This integrated strategy ensures consistent messaging and broad market penetration.

In 2024, F.N.B. saw a 20% conversion rate improvement on leads generated through search engine marketing, highlighting the effectiveness of their digital outreach. Simultaneously, their continued investment in local radio and print media in 2025 reinforces their commitment to community presence, complementing their digital advertising efforts.

Community sponsorships, such as the Pittsburgh Marathon in 2024, provide significant brand visibility and positive association, with over 25,000 participants. Direct marketing, including personalized email campaigns, yielded a 7% uplift in new product sign-ups in the first half of 2024, demonstrating its impact on customer engagement and growth.

Public relations efforts, like highlighting a Q1 2024 net income of $180.5 million, build credibility and reinforce F.N.B.'s image as a reliable financial institution. These promotional activities collectively support F.N.B.'s objective of being a trusted financial partner.

| Promotional Tactic | Key Objective | 2024/2025 Data Point | Impact |

|---|---|---|---|

| Digital Advertising (SEO, Social Media) | Brand Recognition, Lead Generation | 15% increase in website traffic (Q1 2025) | Enhanced online presence and lead capture |

| Traditional Media (TV, Radio, Print) | Broad Brand Awareness, Community Trust | Continued investment in local media (2025 projection) | Maintained reach across demographics |

| Community Sponsorships | Brand Visibility, Goodwill | Pittsburgh Marathon sponsorship (2024) | Positive brand association and broad reach |

| Direct Marketing (Email, Mailers) | Cross-selling, Customer Engagement | 7% uplift in new product sign-ups (H1 2024) | Increased customer acquisition and loyalty |

| Public Relations | Brand Credibility, Reputation Management | Reported $180.5 million net income (Q1 2024) | Strengthened trust among stakeholders |

Price

F.N.B. strategically prices its loans, aiming for competitive interest rates that attract a broad customer base across mortgages, commercial, and personal loan products. For instance, as of early 2024, F.N.B.'s prime rate for variable-rate loans often aligns closely with the Federal Reserve's benchmark rate, typically hovering around 8.50% for prime, with specific loan products adjusted based on risk and market dynamics.

These rates are dynamic, reacting to broader economic factors like the Federal Funds Rate, which influences the prime rate, and are further refined by a borrower's creditworthiness and the competitive landscape. For example, mortgage rates from F.N.B. in mid-2024 might range from 6.5% to 7.5% for a 30-year fixed-rate loan, depending on credit scores and loan-to-value ratios, reflecting a careful balance between market competitiveness and risk management.

F.N.B. structures its service fees and charges as a key element of its marketing mix, impacting both revenue and customer behavior. For instance, while many checking accounts might have a monthly maintenance fee, these are often waived if a minimum balance is maintained, a strategy designed to encourage customer loyalty and deposit growth. Overdraft fees and transaction-specific charges are also part of this structure, contributing to the bank's overall income.

These fees are carefully calibrated to align with F.N.B.'s competitive positioning. For example, in 2024, F.N.B. aimed to keep its average monthly maintenance fees for basic checking accounts below the industry average, which hovered around $5-$10, to attract a broader customer base. This approach balances the need for revenue generation with the imperative to offer value and retain customers in a competitive banking landscape.

F.N.B. offers flexible fee structures for its wealth management services, often including a percentage of assets under management (AUM), which can range from 0.5% to 1.5% depending on the portfolio size and complexity. This model directly links advisor compensation to the growth and value of client assets, promoting a partnership approach.

In addition to AUM fees, F.N.B. may utilize commission-based structures for specific financial products, such as mutual funds or annuities, where the fee is earned upon the sale of the product. For standalone financial planning or specialized advice, flat fees are also an option, providing clients with predictable costs for targeted guidance.

Transparency is paramount in F.N.B.'s fee disclosures, ensuring clients fully understand how their advisors are compensated. This clarity builds trust and allows clients to assess the value received against the costs incurred, a critical factor in client retention and satisfaction within the competitive wealth management landscape.

Competitive Deposit Rates

F.N.B. actively competes in the market by offering a range of interest rates on its deposit products, such as savings accounts, money market accounts, and certificates of deposit (CDs). These rates are strategically designed to attract new customers and retain existing ones, carefully balancing the need to be competitive with the bank's own operational costs.

In the current financial climate of 2024 and early 2025, deposit rates have become a critical decision point for consumers. For instance, as of late 2024, the national average for a high-yield savings account hovered around 4.35% APY, with some online banks offering rates exceeding 5.00% APY. F.N.B.'s ability to offer rates that are at least in line with, or ideally surpass, these benchmarks is crucial for its customer acquisition and retention strategies.

- Savings Accounts: F.N.B. aims to offer competitive APYs to attract everyday savings.

- Money Market Accounts: Rates are structured to provide a slightly higher return for customers maintaining larger balances.

- Certificates of Deposit (CDs): F.N.B. provides tiered interest rates based on CD term lengths, rewarding longer-term commitments.

- Market Alignment: Deposit rates are regularly reviewed against competitor offerings to ensure F.N.B. remains an attractive option for depositors.

Promotional Offers and Bundling

F.N.B. strategically employs promotional offers to attract new clientele and deepen existing relationships. For instance, in 2024, they continued to feature attractive introductory interest rates on select loan products, aiming to capture market share in a competitive lending environment. Bundling services, such as combining checking, savings, and a credit card, is another key tactic to enhance customer stickiness.

These bundled packages often come with a discounted overall price, making F.N.B. products more appealing. This approach not only drives the acquisition of new accounts but also encourages customers to consolidate their banking needs with F.N.B., thereby increasing the bank's share of wallet. The perceived added value from these promotions plays a significant role in fostering customer loyalty.

- Introductory Rates: F.N.B. offers competitive introductory interest rates on new loans, a strategy observed throughout 2024 to attract borrowers.

- Bundled Services: Packages combining multiple banking products are offered at a reduced cost to incentivize cross-selling.

- Customer Acquisition: Promotions are a primary driver for bringing new customers into the F.N.B. ecosystem.

- Loyalty Enhancement: Demonstrating tangible added value through offers aims to increase customer retention and satisfaction.

F.N.B.'s pricing strategy for its loan products is designed to be competitive, with rates often mirroring or slightly adjusting based on the Federal Reserve's benchmark. For example, in early 2024, prime rates for variable loans were around 8.50%, with specific product rates like 30-year fixed mortgages in mid-2024 ranging from 6.5% to 7.5%, contingent on creditworthiness and market conditions.

The bank also structures service fees, such as monthly maintenance fees for checking accounts, which are often waived with minimum balance requirements, a tactic to foster loyalty and deposit growth. Overdraft and transaction fees also contribute to revenue, with average monthly maintenance fees in 2024 kept below the industry norm of $5-$10 to attract a wider customer base.

For wealth management, F.N.B. uses a percentage of assets under management (AUM) fee structure, typically between 0.5% and 1.5%, aligning advisor compensation with client asset growth. This is supplemented by commission-based sales for products like mutual funds and optional flat fees for specific financial planning services, all disclosed transparently to clients.

F.N.B. actively attracts depositors by offering competitive interest rates on savings accounts, money market accounts, and CDs. In late 2024, with high-yield savings accounts nationally averaging around 4.35% APY and some online banks exceeding 5.00% APY, F.N.B. ensures its rates are competitive to retain and attract customers.

| Product Type | F.N.B. Pricing/Rate Example (Early-Mid 2024) | Industry Benchmark (Late 2024) | Strategic Rationale |

|---|---|---|---|

| Prime Rate (Variable Loans) | Approx. 8.50% | Federal Funds Rate + 3% (approx.) | Market alignment, broad customer appeal |

| 30-Year Fixed Mortgage | 6.5% - 7.5% | Industry average: ~7.0% | Competitiveness, risk-based pricing |

| Monthly Checking Maintenance Fee | Often waived with minimum balance | $5 - $10 (average) | Customer acquisition, loyalty building |

| Wealth Management (AUM Fee) | 0.5% - 1.5% | Industry average: ~1.0% | Performance alignment, client partnership |

| High-Yield Savings Account | Competitive with national average | 4.35% APY (national average) | Deposit attraction, customer retention |

4P's Marketing Mix Analysis Data Sources

Our F.N.B. 4P's Marketing Mix Analysis is constructed using a comprehensive blend of publicly available financial disclosures, official company websites, and recent press releases. This ensures our insights into Product, Price, Place, and Promotion accurately reflect the bank's strategic initiatives and market positioning.