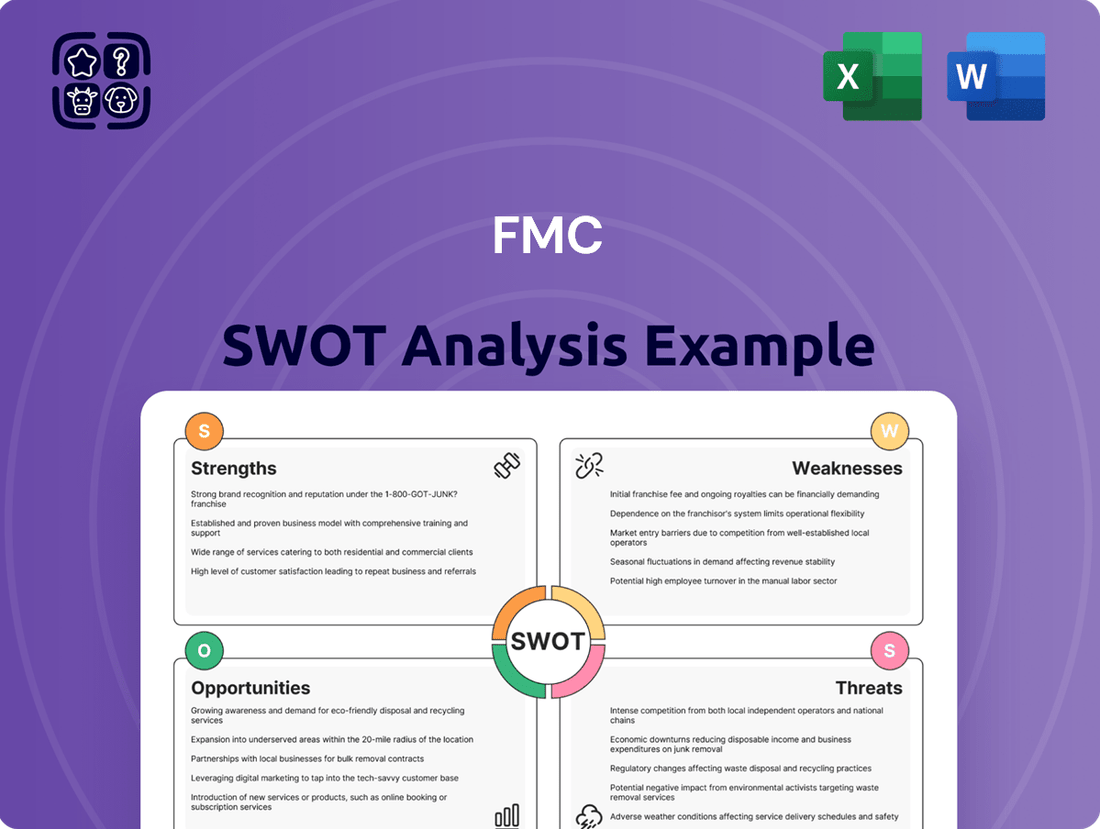

FMC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FMC Bundle

FMC's strengths lie in its robust product portfolio and global reach, but its reliance on agricultural cycles presents a key weakness. Understanding these dynamics is crucial for navigating the competitive landscape. Discover the complete picture behind FMC's market position with our full SWOT analysis, revealing actionable insights and strategic takeaways ideal for investors and analysts.

Strengths

FMC Corporation commands a significant presence in the global crop protection market, a testament to its robust brand recognition and a deeply entrenched customer loyalty. This strong market standing is further amplified by its expansive distribution network, which guarantees widespread product availability for farmers across the globe, bolstering both its market share and revenue streams.

The company's resilience in maintaining a stable market share throughout 2024 underscores the enduring strength of its competitive advantages. FMC's strategic focus on innovation and customer relationships continues to solidify its leadership in an increasingly competitive agricultural landscape.

FMC's commitment to research and development is a significant strength, evidenced by its substantial investment in creating new active ingredients and advanced formulations. The company boasts a pipeline featuring over 35 active ingredients, with more than 20 representing novel modes of action, positioning it to tackle emerging agricultural issues effectively.

This dedication to innovation is further underscored by FMC's progress in areas like new fungicides and microbial solutions, as detailed in their 2024 sustainability report. Such advancements are crucial for providing farmers with next-generation tools to enhance crop protection and yield.

FMC boasts a diverse and patented product portfolio, a key strength in the competitive agricultural sector. This includes a robust range of crop protection solutions, with insecticides, particularly its highly successful diamides franchise, forming a core component. The company's commitment to innovation is further evidenced by its expansion into biologicals, crop nutrition, and digital agriculture, offering a more holistic approach to farming.

The proprietary technologies and patented active ingredients underpinning FMC's offerings create a substantial competitive advantage. This innovation pipeline is difficult for rivals to replicate, ensuring FMC maintains a leading edge in product development and market positioning. For instance, the success of its diamide insecticides, like Rynaxypyr and Cyazypyr, demonstrates the market's demand for its patented solutions, contributing significantly to its revenue streams.

Commitment to Sustainability

FMC's dedication to sustainability is a significant strength, woven into its core business strategies to foster value and growth. The company has made tangible progress, achieving a notable 27% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2021 baseline.

Furthermore, FMC reported a 6% decrease in waste generation during 2024. These achievements not only position FMC favorably against international environmental benchmarks but also contribute to operational efficiencies and attract investors focused on environmental, social, and governance (ESG) principles.

- Reduced Emissions: Achieved a 27% reduction in Scope 1 and 2 greenhouse gas emissions (2021 baseline).

- Waste Reduction: Saw a 6% decrease in waste generated in 2024.

- Investor Appeal: Enhanced attractiveness to environmentally conscious investors.

- Cost Savings: Realized operational cost benefits from sustainability initiatives.

Strategic Cost Management and Efficiency

FMC's strategic cost management has been a significant strength, with robust cost-reduction plans yielding substantial savings. These efforts, including restructuring and manufacturing footprint optimization, are vital for navigating market challenges and boosting profits.

The company's financial discipline was evident in 2024, where it maintained strong profitability despite sales dips. This resilience is highlighted by an impressive 21% Adjusted EBITDA margin, underscoring the effectiveness of its cost-control measures.

- Cost Reduction Initiatives: FMC has successfully implemented comprehensive cost-reduction strategies.

- Manufacturing Optimization: Restructuring and optimizing the manufacturing footprint have driven efficiency.

- Profitability Resilience: Achieved a 21% Adjusted EBITDA margin in 2024 despite sales pressures.

- Disciplined Financial Management: Demonstrates a strong ability to control expenses and maintain profitability.

FMC's market leadership is built on a foundation of strong brand recognition and deep customer loyalty, amplified by an extensive global distribution network. This ensures consistent product availability for farmers, solidifying its market share and revenue. The company's resilience in 2024, maintaining a stable market presence amidst challenges, highlights the sustained power of these competitive advantages, further bolstered by a strategic focus on innovation and customer relationships.

What is included in the product

Analyzes FMC’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic thinking by clearly identifying key internal and external factors.

Weaknesses

FMC faces significant vulnerability as patents for its high-performing products, particularly its diamide franchise, begin to expire. This expiration opens the door for generic competitors, which can exert considerable downward pressure on pricing and potentially erode FMC's market share. The company has explicitly stated that generic versions of its key product, Rynaxypyr, are already impacting both price and volume in several international markets, highlighting the immediate financial implications of this weakness.

FMC faced a notable revenue downturn, with a 14% drop in Q1 2025 compared to the prior year's first quarter. This decline was largely attributed to falling prices and adverse currency movements.

Sales were particularly weak in North America and Asia, impacted by reduced sales volumes and strategic price adjustments. These regional performance issues contributed significantly to the overall revenue decrease.

The company's financial results were also hampered by broader market headwinds. These included distributors reducing their inventory levels (destocking) and customers adopting a more conservative approach to their purchasing decisions.

FMC experienced a notable weakness in its Q1 2025 performance, reporting negative free cash flow of $596 million. This figure represents a significant downturn when compared to the same period in the previous year.

The primary drivers behind this negative free cash flow were a decrease in cash generated from operations and a less substantial reduction in inventory levels compared to Q1 2024. These factors combined to strain the company's immediate cash position.

Although FMC projects a return to positive free cash flow for the entirety of 2025, the Q1 results highlight a short-term liquidity challenge that warrants attention.

Exposure to Foreign Exchange Headwinds

Foreign currency fluctuations have demonstrably impacted FMC's financial results. For instance, in the first quarter of 2024, FMC reported that currency headwinds reduced net sales by approximately $50 million.

The continued strength of the U.S. dollar, anticipated through late 2024 and into early 2025, is poised to exacerbate these challenges. This trend directly diminishes the reported value of FMC's international revenue when translated back into U.S. dollars, creating a persistent drag on top-line growth and profitability metrics like adjusted EBITDA.

- Currency Impact: Foreign exchange movements reduced FMC's Q1 2024 net sales by roughly $50 million.

- Dollar Strength: The U.S. dollar's appreciation is expected to persist through late 2024 and early 2025.

- Revenue Translation: International sales are worth less in U.S. dollar terms due to currency translation.

- Profitability Pressure: This currency effect directly impacts reported revenue and adjusted EBITDA.

High Payout Ratio and Dividend Sustainability Concerns

FMC's dividend payout ratio stood at a notable 88.2% by the end of December 2024. This figure is considerably higher when compared to the typical payout ratios seen within the Basic Materials sector. Such a substantial payout ratio can signal potential concerns regarding the long-term sustainability of its dividend payments, especially if the company experiences a downturn in its earnings. This leaves limited financial flexibility for reinvestment or weathering economic headwinds.

The company has a track record of consistent dividend increases. However, the elevated payout ratio of 88.2% in December 2024, surpassing the sector average, raises questions about its ability to maintain this growth trajectory. A high payout ratio can restrict a company's capacity to reinvest earnings back into the business for research and development or capital expenditures, which are crucial for future growth in the competitive agricultural sciences industry. This could potentially impact FMC's ability to adapt to evolving market demands and technological advancements.

- High Payout Ratio: FMC's dividend payout ratio reached 88.2% as of December 2024, exceeding the Basic Materials sector average.

- Sustainability Concerns: This elevated ratio raises questions about the company's ability to sustain dividend payments if earnings falter.

- Limited Reinvestment: A high payout leaves less capital for crucial business reinvestment, potentially hindering future growth and innovation.

FMC's reliance on a few key products makes it vulnerable to patent expirations, as seen with its diamide franchise. The introduction of generic versions of its flagship product, Rynaxypyr, is already impacting pricing and volume in international markets, directly affecting revenue. This patent cliff represents a significant challenge to maintaining market share and profitability in the coming years.

The company's Q1 2025 performance was marked by a 14% revenue decline year-over-year, driven by lower prices and unfavorable currency movements, particularly impacting North America and Asia. Furthermore, FMC reported a negative free cash flow of $596 million in Q1 2025, a stark contrast to the prior year, largely due to reduced operating cash generation and slower inventory adjustments. While positive free cash flow is projected for the full year 2025, the initial quarterly results highlight short-term liquidity pressures.

Persistent U.S. dollar strength is expected to continue impacting FMC through late 2024 and early 2025, diminishing the reported value of its international sales and pressuring adjusted EBITDA. Additionally, FMC's dividend payout ratio reached 88.2% by the end of December 2024, significantly higher than the Basic Materials sector average, raising concerns about dividend sustainability and limiting the company's financial flexibility for reinvestment in growth initiatives.

| Financial Metric | Q1 2025 (vs. Q1 2024) | Key Drivers |

|---|---|---|

| Revenue Change | -14% | Lower prices, adverse currency movements, destocking |

| Free Cash Flow | -$596 million | Decreased operating cash flow, slower inventory reduction |

| Dividend Payout Ratio (Dec 2024) | 88.2% | High payout relative to sector average, potential sustainability concern |

Preview Before You Purchase

FMC SWOT Analysis

You’re viewing a live preview of the actual FMC SWOT analysis document. The complete version, offering comprehensive insights, becomes available immediately after your purchase.

Opportunities

The world's population is projected to reach nearly 10 billion by 2050, creating a substantial increase in food demand. This surge necessitates agricultural advancements that boost yields while minimizing environmental impact. FMC is strategically positioned to address this by offering solutions that support sustainable farming, such as their biological crop protection products.

FMC's dedication to innovation in sustainable agriculture is evident in their R&D investments. In 2023, the company allocated a significant portion of its research budget towards developing environmentally sound solutions, including biologicals and precision agriculture technologies. This focus directly caters to the growing market demand for greener farming methods.

Emerging markets offer substantial growth potential for FMC, providing avenues to access untapped revenue. For instance, the company saw a notable increase in sales in Latin America during 2024, even amidst broader market headwinds.

FMC is actively pursuing new distribution channels and strengthening its footprint in these developing regions. This strategic push into markets like Latin America is designed to broaden its revenue base and lessen dependence on more saturated, established markets.

Technological leaps in precision agriculture and digital farming present significant opportunities for FMC. By integrating artificial intelligence, FMC can refine its product development and operational efficiencies, offering growers more sophisticated crop protection advice through platforms like Arc farm intelligence. This data-driven approach is poised to drive greater adoption of FMC's innovative solutions.

New Product Launches and R&D Pipeline Commercialization

FMC's commitment to innovation is evident in its strong research and development pipeline. Key new active ingredients such as Fluindapyr, Isoflex, and Dodhylex are poised to be significant growth drivers. The strategic commercialization of these advancements, especially in the fungicide and biologicals segments, is crucial for offsetting revenue impacts from upcoming patent expirations and reinforcing FMC's market standing.

These upcoming product launches are projected to make a considerable impact on FMC's financial performance. For instance, the company has indicated that its R&D pipeline is expected to contribute approximately $1 billion in incremental revenue by 2033, with a significant portion of this coming from the aforementioned new active ingredients. This pipeline represents a vital strategy to maintain and expand market share in a competitive agricultural solutions landscape.

- Fluindapyr: Expected to be a key fungicide with broad-spectrum applications.

- Isoflex: A novel insecticide targeting key pest challenges.

- Dodhylex: A new herbicide designed for enhanced weed control efficacy.

- Biologicals: FMC is also investing in biological crop protection solutions, aligning with market trends towards sustainable agriculture.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships represent a significant avenue for FMC to bolster its product offerings and expand its global footprint. These moves can accelerate growth by integrating new technologies or accessing untapped markets.

FMC's dedicated venture capital arm, FMC Ventures, actively scouts and invests in promising early-stage agricultural technology firms. This strategy allows FMC to gain exposure to cutting-edge innovations and potentially integrate them into its existing business model. For instance, in 2023, FMC Ventures announced investments in companies focused on biologicals and digital agriculture solutions, aligning with the industry's shift towards sustainable and precision farming practices.

- Accelerated Innovation: Partnerships can bring novel technologies to market faster than internal R&D alone.

- Market Expansion: Acquisitions can provide immediate access to new geographic regions or customer segments.

- Portfolio Enhancement: Integrating acquired or partnered products can broaden FMC's crop protection and biological solutions.

- Synergistic Growth: Combining resources and expertise can unlock new revenue streams and operational efficiencies.

FMC's robust R&D pipeline, featuring new active ingredients like Fluindapyr and Isoflex, is set to drive significant growth, with an estimated $1 billion in incremental revenue by 2033. The company's strategic investments in biologicals and precision agriculture, exemplified by its venture capital arm, FMC Ventures, position it to capitalize on the increasing demand for sustainable farming solutions.

The expansion into emerging markets, particularly in Latin America where FMC saw notable sales increases in 2024, offers substantial untapped revenue potential. Furthermore, technological advancements in digital farming and AI integration, as seen with their Arc farm intelligence platform, enhance operational efficiencies and provide growers with advanced crop protection advice.

| Opportunity Area | Key Initiatives/Products | Projected Impact |

|---|---|---|

| R&D Pipeline | Fluindapyr, Isoflex, Dodhylex, Biologicals | ~$1 billion incremental revenue by 2033 |

| Market Expansion | Latin America focus, new distribution channels | Increased sales and diversified revenue base |

| Technology Integration | Precision agriculture, AI, Arc farm intelligence | Enhanced product development and grower advisory |

| Strategic Partnerships | FMC Ventures investments in AgTech | Accelerated innovation and portfolio enhancement |

Threats

The expiration of patents for FMC's key products, particularly within the diamides franchise, is a significant threat. This opens the door for intensified generic competition, which is already evident in markets like India, China, Argentina, and Mexico. This influx of lower-cost alternatives directly pressures pricing and can erode sales volume for FMC's established offerings.

Fluctuations in agricultural commodity prices significantly impact farmer income, directly affecting their purchasing power for crop protection products. For instance, a sharp decline in corn prices, a key crop for many farmers, could lead them to postpone or reduce spending on essential inputs like FMC's insecticides and herbicides.

Higher interest rates, as seen with the Federal Reserve's continued monetary tightening through 2024, further strain farmer finances by increasing the cost of borrowing for operational expenses. This dual pressure of lower commodity prices and elevated interest rates can curb farmer spending, creating unpredictable sales volumes and revenue for companies like FMC.

The agricultural chemicals sector faces intense regulatory and environmental pressure, impacting companies like FMC. For instance, the loss of product registrations, such as triflusulfuron in the EMEA region, can directly affect revenue streams and necessitate costly reformulation or replacement strategies. This highlights the significant risk posed by evolving compliance landscapes.

New tariffs or trade disputes can also introduce substantial uncertainty and inflate operational expenses for FMC. For example, changes in import/export duties on key raw materials or finished goods can erode profit margins and disrupt supply chains. Adapting to these shifting trade policies is crucial for maintaining cost competitiveness.

FMC must continually invest in research and development to meet increasingly stringent environmental standards and sustainability mandates. Failure to adapt to evolving regulations regarding chemical usage, residue limits, or ecological impact can lead to product bans or market access restrictions, directly impacting sales volumes and market share.

Supply Chain Disruptions and Input Cost Volatility

Supply chain disruptions remain a significant concern for FMC. While the company experienced some relief with lower input costs in Q1 2025, this favorable trend is not guaranteed. A resurgence in raw material prices or renewed supply constraints could quickly erode profitability and hinder manufacturing operations.

The volatility of input costs presents an ongoing threat. For instance, fluctuations in the price of key agricultural inputs, which are crucial for FMC's product formulations, can directly impact production expenses. If these costs escalate unexpectedly, it could squeeze margins, especially if the company cannot fully pass these increases onto customers.

- Global supply chain fragility: Events like geopolitical tensions or natural disasters can still trigger shortages and price hikes for essential raw materials.

- Input cost sensitivity: FMC's profitability is closely tied to the cost of its primary ingredients, making it vulnerable to market price swings.

- Q1 2025 cost favorability: Although a positive development, the sustainability of lower input costs is uncertain, leaving room for future cost pressures.

Climate Change Impacts on Agriculture

Climate change presents a significant long-term threat to agriculture, with increasingly erratic weather patterns, rising sea levels, and heightened pest and disease outbreaks impacting crop production globally. For instance, the U.S. experienced an average temperature increase of 1.9°F (1.1°C) between 1900 and 2020, contributing to more frequent extreme weather events.

While FMC's advanced crop protection solutions are designed to help farmers mitigate these challenges, severe weather events or substantial shifts in arable land zones could still lead to reduced crop yields. This, in turn, might dampen the overall demand for crop protection products, affecting FMC's market penetration and revenue streams. The FAO reported in 2024 that climate-related disasters caused an estimated $100 billion in agricultural losses annually in recent years.

- Unpredictable Weather: Increased frequency of droughts, floods, and extreme temperatures directly impacts crop health and yield potential.

- Pest and Disease Pressure: Warmer climates can expand the range and activity of agricultural pests and diseases, requiring more robust and potentially costly management solutions.

- Shifting Agricultural Zones: Changes in temperature and rainfall patterns may render traditional farming regions less productive, forcing adaptation or migration of crop cultivation.

The expiration of patents for FMC's key products, particularly within the diamides franchise, is a significant threat, opening the door for intensified generic competition. This influx of lower-cost alternatives directly pressures pricing and can erode sales volume for FMC's established offerings. For example, the agrochemical market in India has seen a notable increase in generic pesticide availability, impacting established players.

Intensified regulatory scrutiny and evolving environmental standards present ongoing challenges. For instance, the European Union's Farm to Fork strategy aims to reduce pesticide use by 50% by 2030, which could impact the market for certain crop protection chemicals. This necessitates continuous investment in R&D for more sustainable solutions.

Climate change, with its increasing frequency of extreme weather events, poses a substantial risk. The UN reported in 2024 that climate-related disasters caused an estimated $100 billion in agricultural losses annually in recent years, impacting farmer income and their ability to invest in crop protection products.

Fluctuations in agricultural commodity prices and rising interest rates, as seen with the Federal Reserve's monetary tightening through 2024, strain farmer finances. This dual pressure can curb farmer spending on essential inputs like FMC's products.

SWOT Analysis Data Sources

This FMC SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate assessment.