FMC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FMC Bundle

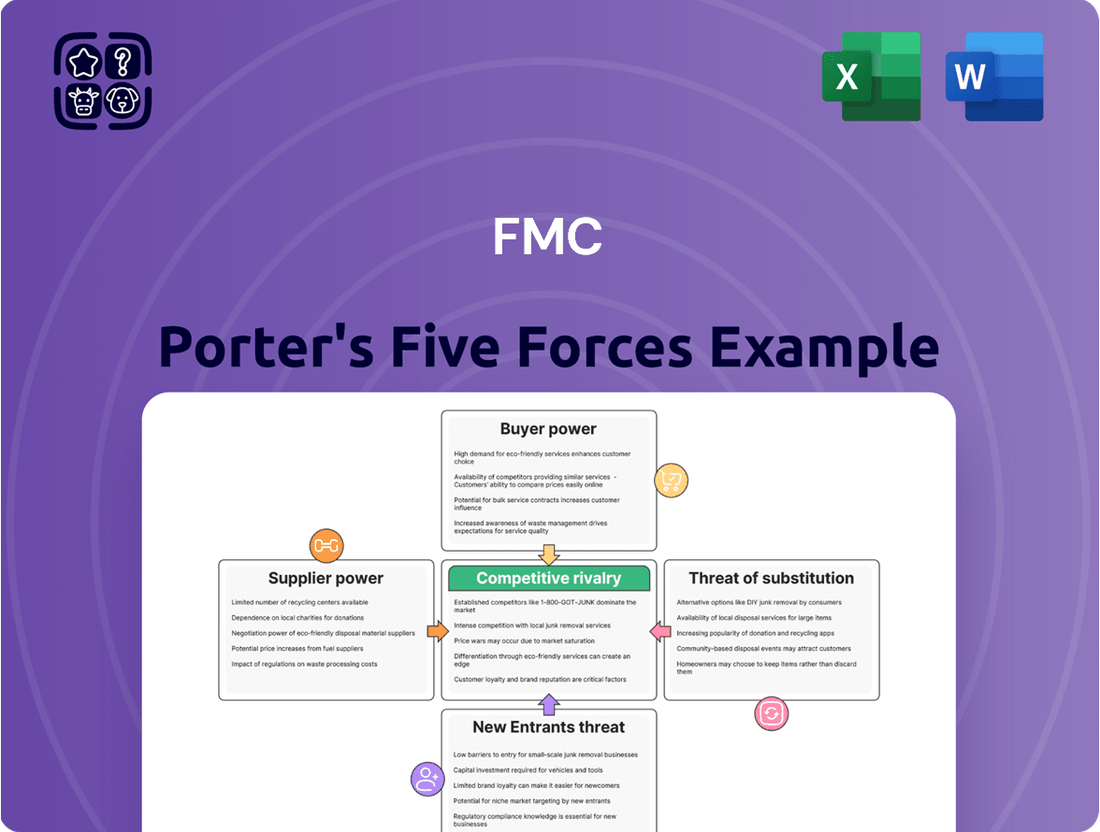

Understanding the competitive landscape is crucial for any business, and FMC is no exception. Our Porter's Five Forces Analysis delves into the core elements that shape FMC's industry, revealing the intensity of rivalry, the power of buyers and suppliers, and the ever-present threats of new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FMC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for essential raw materials significantly shapes FMC Corporation's bargaining power. For instance, key inputs like petrochemicals, phosphates, and potash are often sourced from a limited number of global producers. If a large portion of these critical materials comes from just a handful of companies, those suppliers gain substantial leverage.

This concentration can lead to increased pricing power for suppliers, particularly when demand is high or supply chains face disruptions. In 2023, global potash prices experienced volatility due to geopolitical events, demonstrating how supplier concentration can directly impact input costs for companies like FMC.

The uniqueness of inputs FMC requires significantly impacts supplier bargaining power. If FMC relies on highly specialized or patented raw materials with limited alternative suppliers, those suppliers gain considerable leverage. This is especially true for advanced chemical compounds or proprietary biological agents integral to FMC's crop protection and plant health product lines.

Switching costs play a significant role in the bargaining power of suppliers for FMC. If changing a supplier for essential raw materials or components requires substantial investment in new machinery, re-training staff, or navigating complex regulatory re-certifications, FMC may find it prohibitive to switch. For instance, in 2024, the average cost for a manufacturing company to switch to a new critical component supplier was estimated to be around 15% of the annual component cost, factoring in R&D, testing, and integration.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into an FMC's industry, such as by developing their own crop protection products, significantly bolsters their bargaining power. This scenario, while less frequent for basic raw material providers, becomes a more pertinent concern when dealing with specialized ingredient or technology suppliers who possess unique capabilities. For instance, a key agrochemical ingredient supplier might consider launching its own branded finished products, directly competing with its current FMC customers.

This forward integration threat can manifest in several ways:

- Increased Leverage: Suppliers capable of forward integration can leverage this potential to negotiate better terms, higher prices, or more favorable contract conditions with FMC companies.

- Market Disruption: If a supplier successfully integrates forward, it can disrupt existing market dynamics, potentially reducing the market share and profitability of its former FMC clients.

- Strategic Consideration: FMC companies must constantly assess the capabilities and strategic intentions of their key suppliers to anticipate and mitigate this potential threat.

Importance of FMC to Suppliers

The significance of a company's business to its suppliers directly impacts the suppliers' bargaining power. If a company like FMC constitutes a substantial portion of a supplier's total revenue, that supplier may be more inclined to offer competitive pricing and favorable contract terms to retain such a valuable client. For instance, if FMC accounts for 20% of a key ingredient supplier's sales, that supplier has a strong incentive to keep FMC satisfied.

Conversely, if FMC represents a minor customer for a large supplier, its individual purchasing volume might not grant it significant leverage. In such scenarios, the supplier, serving many larger clients, may have less reason to concede to FMC's demands. This dynamic is crucial in understanding the supplier-customer relationship within the FMCG sector.

- Supplier Dependence: A supplier heavily reliant on FMC's orders has less power.

- Customer Concentration: If FMC is a small client to a large supplier, its bargaining power diminishes.

- Revenue Impact: For example, if a packaging supplier derives 30% of its income from FMC, its willingness to negotiate increases.

- Market Share: The percentage of a supplier's total market share that FMC represents is a key indicator of its influence.

The bargaining power of suppliers for FMC Corporation is influenced by several factors, including supplier concentration, input uniqueness, and switching costs. When a few suppliers dominate the market for essential raw materials, they gain significant pricing leverage, as seen with global potash price volatility in 2023. Similarly, if FMC relies on specialized or patented inputs, suppliers of these unique materials hold more sway.

High switching costs for FMC, whether due to new machinery investments or regulatory hurdles, further empower suppliers. For example, in 2024, switching critical component suppliers cost manufacturers an average of 15% of annual component costs. The threat of suppliers integrating forward into FMC's industry also increases their bargaining power, potentially disrupting market dynamics.

Finally, the proportion of a supplier's revenue that FMC represents is a critical determinant of its bargaining power. If FMC is a major client, suppliers are more incentivized to offer favorable terms. Conversely, if FMC is a minor customer, its influence diminishes significantly.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases power for few dominant suppliers | Global potash price volatility in 2023 |

| Uniqueness of Inputs | Increases power for suppliers of specialized/patented materials | Proprietary biological agents for crop protection |

| Switching Costs | Increases power for suppliers when switching is costly for FMC | Average 15% cost to switch critical component suppliers (2024) |

| Forward Integration Threat | Increases power as suppliers can become competitors | Agrochemical ingredient supplier launching own branded products |

| FMC's Importance to Supplier | Decreases power if FMC is a small customer; Increases if FMC is a major client | 20% of supplier sales from FMC incentivizes satisfaction |

What is included in the product

This analysis examines the five competitive forces impacting FMC's industry: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

FMC's customer base primarily consists of farmers, agricultural businesses, and professional pest and turf management companies. While there's a trend towards larger farms, the sheer number of individual farmers means the customer base remains somewhat fragmented.

This fragmentation typically weakens the bargaining power of individual customers. For instance, in 2024, the average farm size in the U.S. continued to grow, but the total number of farms, though declining, still represents a vast number of independent purchasing decisions, limiting any single farmer's leverage against a major supplier like FMC.

Farmers' price sensitivity is a major driver of their bargaining power. Since crop protection chemicals can be a substantial part of their operating expenses, and their own income fluctuates with commodity prices, farmers are often on the lookout for ways to reduce costs.

This sensitivity means farmers are quite willing to switch to cheaper, generic agrochemical products if the price difference is significant. For instance, in 2024, the global agrochemical market saw continued interest in off-patent products as farmers sought to manage input costs amidst fluctuating agricultural commodity prices.

The growing availability of generic crop protection products, alongside the rise of biopesticides and integrated pest management (IPM) strategies, significantly bolsters customer bargaining power. This means farmers and agricultural businesses have more options if FMC's pricing or product offerings become less competitive.

When customers can easily access effective substitutes, they gain leverage to negotiate better prices with FMC. For instance, the global biopesticides market was valued at approximately USD 5.2 billion in 2023 and is projected to grow substantially, indicating a strong shift towards alternative solutions that can challenge traditional chemical providers.

This increasing array of choices puts direct pressure on FMC to maintain competitive pricing and demonstrate superior product value. If a competitor offers a similar level of efficacy at a lower cost, customers are more likely to switch, impacting FMC's market share and profitability.

Customer Information and Transparency

The increasing availability of information regarding product pricing, effectiveness, and available alternatives significantly bolsters customer bargaining power. For instance, in the agricultural sector, digital platforms and advisory services in 2024 provided farmers with unprecedented data access. This empowers them to make more informed purchasing decisions, which can translate into negotiating more favorable terms with suppliers.

- Enhanced Information Access: Farmers can now easily compare prices and performance metrics for inputs like fertilizers and seeds across multiple suppliers.

- Digital AgTech Growth: The agritech market saw substantial investment in 2024, with companies offering data analytics and farm management software, directly contributing to farmer transparency.

- Negotiating Leverage: With better information, farmers are less reliant on single suppliers and can leverage competitive offers, potentially securing discounts or improved credit terms.

- Impact on Input Costs: This transparency can drive down input costs for farmers, directly affecting the profitability of agricultural businesses.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while less prevalent for individual farmers, can be a significant factor for larger entities like agricultural cooperatives or major agribusinesses. These groups might possess the resources to develop their own basic crop protection solutions or establish powerful purchasing consortia. This collective strength enhances their negotiation leverage against suppliers like FMC.

For instance, a large cooperative could invest in R&D for generic pesticide formulations, thereby reducing their reliance on specialized providers. In 2024, the global agrochemical market saw significant consolidation, with larger players often acquiring smaller innovative firms, potentially enabling these larger entities to offer more integrated solutions to their farmer members, thereby increasing their bargaining power.

- Cooperative Investment: Large agricultural cooperatives may allocate capital towards internal R&D for crop protection chemicals, reducing their dependence on external suppliers.

- Buying Power Leverage: Forming strong buying groups allows customers to negotiate better prices and terms by presenting a united front to suppliers like FMC.

- Market Dynamics: Increased consolidation in the agrochemical sector in 2024 means larger agribusinesses may have greater capacity for backward integration.

The bargaining power of FMC's customers, primarily farmers, is influenced by their price sensitivity and the availability of substitutes. In 2024, farmers continued to seek cost reductions due to fluctuating commodity prices, making them receptive to competitive pricing and generic alternatives. The growing biopesticides market, valued around USD 5.2 billion in 2023, highlights the increasing options available to farmers, thereby strengthening their negotiating position.

Enhanced information access through digital platforms in 2024 empowers farmers to compare products and prices, reducing reliance on single suppliers and enabling them to negotiate better terms. Large agricultural cooperatives also exert influence through potential backward integration or by forming purchasing consortia, further amplifying their collective bargaining power against major agrochemical providers like FMC.

| Factor | Impact on FMC | 2024 Data/Trend |

|---|---|---|

| Customer Fragmentation | Weakens individual customer power | Continued growth in average farm size, but still numerous independent buyers |

| Price Sensitivity | Increases demand for lower-cost options | Farmers actively seeking cost-effective solutions amid commodity price volatility |

| Availability of Substitutes | Provides leverage for negotiation | Growing biopesticides market (USD 5.2B in 2023) and generic products offer alternatives |

| Information Access | Enhances customer negotiation power | Digital platforms provide easy price and performance comparisons |

| Backward Integration/Consortia | Increases collective customer leverage | Consolidation in agrochemicals may enable larger entities to integrate or form buying groups |

Preview Before You Purchase

FMC Porter's Five Forces Analysis

This preview shows the exact FMC Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive breakdown of competitive forces within the FMC industry. You'll gain insights into buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry. This document is fully formatted and ready for your immediate use, offering a complete strategic overview.

Rivalry Among Competitors

The global crop protection market is a battleground with many significant players. FMC faces stiff competition from giants like Bayer CropScience, Syngenta Group, BASF, Corteva Agriscience, and ADAMA Agricultural Solutions. These established companies possess substantial resources and market share.

This competitive landscape is further intensified by the presence of numerous smaller and medium-sized enterprises, creating a fragmented market. This means FMC must constantly innovate and adapt to maintain its position against a wide array of rivals.

The growth rate within the crop protection chemicals sector directly impacts the intensity of competitive rivalry. When the market expands at a slower pace, companies often find themselves competing more fiercely for existing market share, leading to heightened competitive pressures.

Looking at the projections, the global market for crop protection chemicals is anticipated to expand at a compound annual growth rate (CAGR) of 5.5% between 2023 and 2028. This indicates a moderately growing market, suggesting that while opportunities exist, the drive to capture and maintain market share will continue to be a significant factor in competitive dynamics among industry players.

FMC Corporation heavily relies on its commitment to advanced technology, superior product quality, and unwavering reliability, all fueled by continuous innovation and robust research and development. This focus allows them to stand out in a competitive landscape.

Companies boasting strong R&D pipelines, capable of developing novel active ingredients, advanced formulations like new-mode-of-action fungicides, or sustainable options such as pheromone- and microbial-based products, can significantly differentiate themselves. For instance, FMC's investment in diamide formulations has been a key differentiator. However, the inherent ease with which competitors can imitate these innovations, or the increasing prevalence of generic alternatives, can significantly escalate competitive rivalry within the agricultural solutions sector.

Exit Barriers

High exit barriers significantly influence competitive rivalry in agricultural sciences. Specialized manufacturing assets, often requiring substantial capital investment and tailored for specific product lines, make it difficult for companies to divest or repurpose them. For instance, a facility designed for a particular type of seed treatment or biopesticide might have limited alternative uses, trapping capital and forcing continued operation even in a downturn.

Regulatory hurdles also contribute to these barriers. Obtaining approvals for agricultural products, especially those involving biotechnology or novel chemical compounds, is a lengthy and costly process. Companies that have invested heavily in these approvals are reluctant to abandon their market position, even if current profitability is low, as they have already sunk considerable resources. This persistence can prolong intense competition.

Furthermore, the long research and development cycles inherent in agricultural sciences mean that companies often have substantial ongoing investments in product pipelines. Abandoning these projects would mean writing off years of R&D expenditure. Consequently, even unprofitable or struggling competitors may remain in the market, fighting to recoup their investments and avoid complete write-offs, thereby intensifying the competitive landscape.

- Specialized Assets: Many agricultural science firms operate highly specialized manufacturing facilities, making asset liquidation challenging and expensive.

- Regulatory Compliance: Significant costs and time are associated with gaining and maintaining regulatory approvals for agricultural products, discouraging exits.

- R&D Investment: Long development timelines for new seeds, crop protection chemicals, and biologicals create substantial sunk costs, incentivizing continued market presence.

- Brand Reputation: Established brands in agriculture often have long-standing customer relationships that companies are hesitant to abandon, even during periods of lower profitability.

Market Concentration and Consolidation

While the FMCG market remains somewhat fragmented, significant consolidation has occurred, particularly among global players. For instance, in 2023, the value of mergers and acquisitions in the consumer staples sector reached hundreds of billions of dollars, indicating a clear trend towards fewer, larger entities wielding more market power. This shift is reshaping the competitive landscape into a more oligopolistic structure.

This consolidation means that the remaining major players, such as Nestlé, Procter & Gamble, and Unilever, are increasingly engaging in strategic competition. Their rivalry often centers on sophisticated pricing strategies, accelerated product innovation cycles, and the formation of strategic alliances to gain market share and operational efficiencies. These actions directly impact the intensity of rivalry within the sector.

- Market Concentration: Key global FMCG companies continue to grow through acquisitions, leading to increased market share for a select few.

- Oligopolistic Tendencies: The sector is leaning towards an oligopoly, where a small number of large firms dominate, influencing market dynamics.

- Strategic Competition: Major players are locked in intense competition through pricing, new product introductions, and strategic partnerships to capture market share.

- Impact on Rivalry: Consolidation intensifies rivalry among the remaining large firms, often leading to price wars or aggressive marketing campaigns.

Competitive rivalry within the crop protection sector is intense, driven by the presence of large, well-resourced global players like Bayer, Syngenta, and BASF, alongside numerous smaller firms. This dynamic is amplified by a moderately growing market, projected to expand at a 5.5% CAGR from 2023 to 2028, which encourages companies to vie aggressively for market share. FMC's strategy of focusing on innovation, advanced formulations, and product quality helps it differentiate, though the imitation of these advancements and the rise of generics can escalate competition.

High exit barriers, stemming from specialized assets, extensive regulatory approval processes, and significant R&D investments, keep even struggling competitors engaged, thus prolonging intense rivalry. The FMCG sector, meanwhile, is experiencing consolidation, leading to an oligopolistic structure where major players like Nestlé and Procter & Gamble engage in fierce strategic competition through pricing, innovation, and partnerships.

| Competitor | 2023 Revenue (USD Billions) | Key Product Areas | Market Share (Est.) |

|---|---|---|---|

| Bayer CropScience | ~20.3 | Herbicides, Insecticides, Seeds | ~20% |

| Syngenta Group | ~17.4 | Crop Protection, Seeds, Digital Agriculture | ~15% |

| BASF Agricultural Solutions | ~10.5 | Crop Protection, Seeds, Digital Farming | ~10% |

| Corteva Agriscience | ~14.3 | Seeds, Crop Protection | ~12% |

| FMC Corporation | ~5.4 | Crop Protection (Insecticides, Herbicides, Fungicides) | ~5% |

SSubstitutes Threaten

The increasing adoption of biological solutions and biopesticides presents a significant threat to traditional synthetic pesticide markets. Consumers and regulators are increasingly favoring environmentally friendly options, driven by concerns over chemical residues and ecological impact. This shift is evident in market growth figures, with the global biopesticides market projected to reach approximately $10.4 billion by 2025, demonstrating a compound annual growth rate of around 12.9%.

FMC Corporation is actively responding to this trend by investing in and developing its own biological product portfolio. This strategic move aims to capture market share in the growing biologicals segment and mitigate the threat posed by these substitutes to its core synthetic pesticide business. For instance, FMC has launched products like `Treciga` and is exploring further innovations in this space.

Integrated Pest Management (IPM) techniques represent a significant threat of substitutes for traditional chemical pesticides. By combining biological controls, cultural practices, and less harmful chemical options, IPM offers an alternative that reduces reliance on conventional products. This approach is increasingly favored due to growing environmental concerns and regulatory pressures. For instance, the global IPM market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a clear shift in demand away from solely chemical-based solutions.

Advances in precision agriculture technologies, like AI sensors and GPS systems, offer targeted pest management. This reduces the need for broad-spectrum chemicals, acting as a substitute for traditional spraying methods. For instance, drone technology allows for highly localized application of treatments, minimizing waste and environmental impact.

Genetically Engineered Crops

The threat of substitutes for FMC's crop protection chemicals is influenced by advancements in genetically engineered crops. These engineered varieties, designed for insect or disease resistance, can directly reduce the demand for traditional chemical treatments. For instance, the widespread adoption of Bt corn, which produces its own insecticide, has significantly lowered the need for sprayed insecticides in corn production.

This trend presents a challenge to FMC's core business. As more farmers adopt these resistant crop traits, the market for certain insecticides and fungicides may shrink. Companies developing these biotech traits, often seed providers, act as indirect competitors, offering an alternative solution to pest and disease management.

Consider the impact on insecticide demand:

- Genetically engineered crops can reduce the need for chemical insecticides by up to 50% in some applications.

- The global market for genetically modified seeds was valued at approximately $18.9 billion in 2023, indicating substantial investment and adoption.

- This shift necessitates FMC's focus on developing integrated solutions that combine chemical and biological approaches, or those targeting traits not addressed by current genetic engineering.

Alternative Pest Control Methods

Beyond traditional agriculture, the professional pest and turf management sectors are seeing a rise in alternative control methods. These substitutes can significantly impact the demand for conventional chemical solutions.

Smart pest monitoring systems and automated pest control devices offer precision and reduced chemical usage. Nanotechnology in pest control is also emerging as a viable alternative, promising more targeted and efficient solutions.

These innovations represent a growing threat of substitutes for companies heavily reliant on chemical-based pest control products.

- Smart Pest Monitoring Systems: These systems use sensors and data analytics to track pest activity, allowing for targeted interventions rather than broad-spectrum chemical applications.

- Automated Pest Control Devices: Technologies like robotic traps and targeted sprayers reduce the need for manual labor and chemical dispersion.

- Nanotechnology in Pest Control: This field explores the use of nanoparticles for delivering pesticides more effectively and with potentially lower environmental impact.

The threat of substitutes for FMC's traditional crop protection chemicals is multifaceted. Biologicals and integrated pest management (IPM) offer environmentally friendlier alternatives, with the global biopesticides market projected to reach $10.4 billion by 2025 and the IPM market valued at $50 billion in 2023. Precision agriculture and genetically engineered crops, such as Bt corn, further reduce the need for chemical applications, with GM seeds valued at $18.9 billion in 2023.

| Substitute Category | Market Size/Projection (USD) | Key Drivers |

|---|---|---|

| Biopesticides | $10.4 billion by 2025 | Environmental concerns, regulatory favor |

| Integrated Pest Management (IPM) | $50 billion (2023) | Reduced chemical reliance, sustainability |

| Genetically Modified Seeds | $18.9 billion (2023) | Inherent pest/disease resistance |

Entrants Threaten

The agricultural sciences sector, especially when it comes to creating new crop protection chemicals, demands massive upfront investment in research and development. This high cost acts as a significant hurdle for any new player looking to enter the market.

Bringing a novel active ingredient from initial discovery through to commercialization can easily cost hundreds of millions of dollars, with development timelines often spanning a decade or more. For example, the cost to develop a new pesticide can range from $250 million to over $300 million. This financial commitment makes it incredibly difficult for smaller companies or startups to compete with established giants.

The agrochemicals market is characterized by significant regulatory hurdles, demanding rigorous adherence to safety and environmental standards. These stringent requirements, including lengthy testing and approval processes, act as a substantial barrier for potential new entrants. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, implemented in 2007, imposes extensive data submission requirements for chemicals, including agrochemicals, making market entry costly and time-consuming.

FMC Corporation, a leader in agricultural sciences, possesses a robust portfolio of intellectual property and patents covering its innovative active ingredients and proprietary formulations. This strong patent protection, a key barrier to entry, makes it challenging for potential new competitors to replicate FMC's offerings without substantial research and development expenditure or costly licensing agreements. For instance, FMC's significant investments in R&D, which often exceed billions of dollars annually across the industry, are critical for developing and patenting new crop protection solutions.

Economies of Scale in Manufacturing and Distribution

The threat of new entrants in the Fast-Moving Consumer Goods (FMCG) sector is significantly shaped by the immense cost advantages enjoyed by established players due to economies of scale in manufacturing and distribution. Building a global manufacturing footprint and an extensive distribution network demands substantial upfront capital, making it a formidable barrier for newcomers. For instance, in 2024, major FMCG conglomerates often operate with production facilities that produce millions of units daily, a scale that allows them to negotiate lower raw material prices and optimize production processes, thereby driving down per-unit costs.

New entrants often find it incredibly challenging to match the pricing strategies of incumbents who benefit from these scaled operations. Without the ability to achieve similar cost efficiencies, any new player would struggle to compete on price, a critical factor in the price-sensitive FMCG market. Established companies have also invested heavily in logistics and supply chain management, creating efficient global networks that are difficult and expensive to replicate.

- Significant Capital Investment: Establishing large-scale manufacturing plants and global distribution channels requires billions of dollars in investment, deterring many potential entrants.

- Cost Disadvantage for Newcomers: Without achieving comparable production volumes, new entrants cannot leverage bulk purchasing power for raw materials or spread fixed costs as effectively, leading to higher per-unit costs.

- Established Supply Chains: Incumbents possess optimized and often proprietary logistics networks, providing faster delivery and lower transportation costs compared to what a new entrant could initially establish.

- Brand Loyalty and Market Penetration: While not directly scale-related, the established market presence and brand recognition built through years of scaled operations further solidify the barriers for new entrants.

Brand Recognition and Customer Loyalty

The threat of new entrants is significantly influenced by brand recognition and customer loyalty. FMC, with its extensive history and deep-rooted relationships with farmers and distributors worldwide, has cultivated a strong brand presence. This established trust and familiarity make it difficult for newcomers to penetrate the market. For instance, in 2024, agricultural input markets often see established players maintaining a significant market share due to these long-standing connections.

Developing comparable brand recognition and loyalty in the agricultural sector is a resource-intensive and time-consuming endeavor. New companies must invest heavily in marketing, sales, and building trust with a diverse customer base. This barrier is particularly high in segments where product efficacy is closely tied to farmer experience and historical performance data, which FMC can readily provide.

- Established Brand Equity: FMC's long operational history, dating back to 1883, has allowed it to build substantial brand equity.

- Farmer Relationships: Decades of engagement have fostered strong, often generational, relationships with farmers globally.

- Distribution Network Strength: FMC's established distribution channels are a significant hurdle for new entrants to replicate.

- Customer Loyalty Factors: Reliability, proven product performance, and accessible support contribute to high customer retention for FMC.

The threat of new entrants into the agricultural sciences sector is considerably low due to the immense capital required for research, development, and regulatory approval. For example, the cost to bring a new crop protection product to market can easily exceed $300 million, with development timelines stretching over a decade. This financial and temporal commitment creates a substantial barrier, making it difficult for new companies to challenge established players like FMC.

Porter's Five Forces Analysis Data Sources

Our analysis leverages a comprehensive array of data, including industry-specific market research reports, company annual reports, and economic indicators from reputable sources like the World Bank and Bloomberg.