FMC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FMC Bundle

Uncover the strategic potential hidden within this company's product portfolio using the BCG Matrix. See which offerings are driving growth and which might be holding it back. Purchase the full BCG Matrix to unlock actionable insights and a clear path for optimizing your investments and product strategy.

Stars

FMC's strategic focus on innovation is evident in its pipeline of new active ingredients (AIs). Products like fluindapyr and Isoflex are poised to become significant growth drivers, offering farmers advanced solutions with novel modes of action for enhanced pest and disease management.

The company projects these new AIs to achieve $600 million in sales by 2027. This forecast highlights FMC's ambition to secure a leading position in a high-growth market segment, leveraging these cutting-edge products to expand its market share and revenue streams.

FMC's Plant Health business, a significant part of its portfolio, is showing robust expansion. In the first quarter of 2025, sales in this segment saw a 1% increase, with projections for mid-20% growth for the entire Plant Health segment by the end of the year.

The global agricultural biologicals market itself is on a strong upward trajectory. This growth is fueled by the increasing consumer and regulatory demand for sustainable farming practices, which directly benefits FMC's biological products like biopesticides, biofertilizers, and biostimulants.

These eco-friendly alternatives are becoming increasingly popular among farmers seeking to reduce their environmental impact and comply with evolving agricultural standards. This trend positions FMC's biologicals portfolio as a key player, or a 'star', within the broader agricultural inputs market.

FMC's investment in precision agriculture technologies, such as its Arc™ farm intelligence platform, positions these offerings as potential Stars within the BCG Matrix. This segment leverages data-driven tools to enhance pest management, a critical area for optimizing crop yields and resource efficiency. The market for these digital farming solutions is experiencing significant growth, with projections indicating continued expansion as more farmers embrace technological advancements to improve their operations.

Pheromone-based Pest Control

FMC is actively developing pheromone-based pest control products, a key component of its biologicals platform. These are anticipated to significantly boost Plant Health growth after 2027, aligning with a strong market trend towards sustainable agriculture.

These innovative, eco-friendly solutions directly address the increasing consumer and regulatory demand for reduced chemical pesticide use. The market for advanced biological controls, including pheromones, is experiencing robust expansion, with projections indicating substantial growth in the coming years.

FMC's investment in this area positions them to capture a leading market share in this high-growth segment. The global biopesticides market, which includes pheromones, was valued at approximately USD 5.1 billion in 2023 and is projected to reach USD 14.7 billion by 2030, growing at a CAGR of over 16% during that period.

- Market Growth: The global biopesticides market is projected for significant expansion, driven by demand for sustainable solutions.

- FMC's Strategy: Pheromone-based products are a strategic focus for FMC's Plant Health division, targeting post-2027 growth acceleration.

- Environmental Benefits: These products offer an environmentally friendly alternative to traditional chemical pest control methods.

- Investment Rationale: FMC's development aligns with a growing market segment poised for high growth and leadership opportunities.

New Diamide Formulations

FMC is actively developing new diamide formulations, building upon the success of established products like Rynaxypyr and Cyazypyr. This strategic move aims to extend the lifecycle and value of these key insecticides. By introducing these innovations, FMC is not only reinforcing its market position in a vital product segment but also proactively addressing the growing need for effective insect resistance management strategies in agriculture.

These advanced formulations are crucial for FMC's sustained competitiveness. They allow the company to adapt to the dynamic landscape of agricultural challenges and evolving farmer needs. The ongoing investment in research and development for these diamide technologies underscores FMC's commitment to providing cutting-edge solutions that ensure product relevance and the potential for continued high market share in the insecticide category.

- Rynaxypyr and Cyazypyr: Core diamide active ingredients with established market presence.

- New Formulations: Focus on enhanced efficacy, broader spectrum, and improved resistance management.

- Market Share Maintenance: Innovations designed to retain FMC's leadership in the insecticide market.

- Agricultural Adaptability: Addressing evolving pest pressures and sustainable farming practices.

FMC's investment in precision agriculture technologies, such as its Arc™ farm intelligence platform, positions these offerings as potential Stars within the BCG Matrix. This segment leverages data-driven tools to enhance pest management, a critical area for optimizing crop yields and resource efficiency. The market for these digital farming solutions is experiencing significant growth, with projections indicating continued expansion as more farmers embrace technological advancements to improve their operations.

The company's pheromone-based pest control products, a key component of its biologicals platform, are anticipated to significantly boost Plant Health growth after 2027. This aligns with a strong market trend towards sustainable agriculture, with the global biopesticides market projected to reach USD 14.7 billion by 2030, growing at a CAGR of over 16%.

FMC's new diamide formulations, building on Rynaxypyr and Cyazypyr, are also strong candidates for Stars. These innovations aim to extend product lifecycles and address insect resistance, reinforcing FMC's leadership in the insecticide market.

These innovative and eco-friendly solutions directly address the increasing consumer and regulatory demand for reduced chemical pesticide use. The market for advanced biological controls, including pheromones, is experiencing robust expansion, with projections indicating substantial growth in the coming years.

| FMC Product Category | BCG Matrix Classification | Key Growth Drivers | Market Outlook |

|---|---|---|---|

| Precision Agriculture (Arc™ platform) | Star | Data-driven pest management, enhanced crop yields, resource efficiency | Significant growth, continued expansion |

| Pheromone-based Pest Control | Star | Sustainable agriculture demand, reduced chemical use, environmental benefits | Global biopesticides market to reach USD 14.7 billion by 2030 (16%+ CAGR) |

| New Diamide Formulations (Rynaxypyr/Cyazypyr) | Star | Insect resistance management, extended product lifecycle, enhanced efficacy | Reinforcing leadership in insecticide market |

What is included in the product

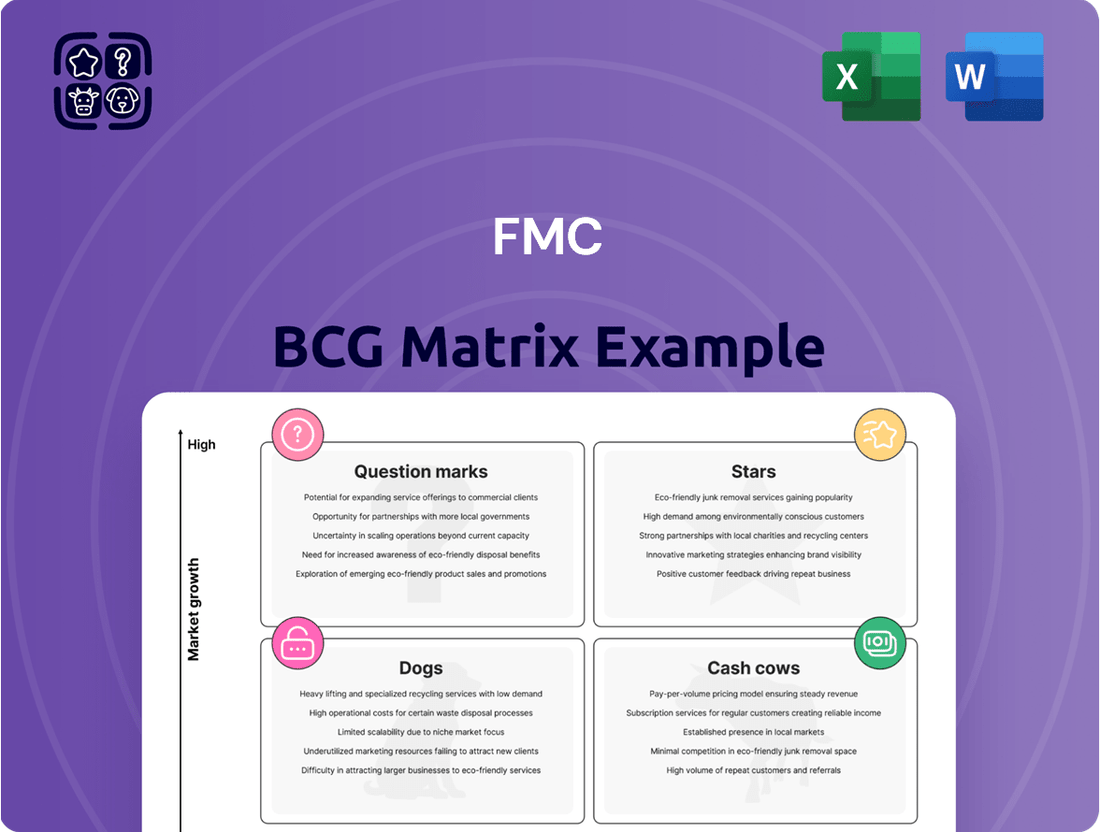

The FMC BCG Matrix analyzes product portfolio performance based on market share and growth.

It guides strategic decisions on investing in Stars and Question Marks, milking Cash Cows, and divesting Dogs.

The FMC BCG Matrix provides clarity on resource allocation, easing the pain of strategic uncertainty.

Cash Cows

Rynaxypyr and Cyazypyr, FMC's proprietary diamide insecticides, are the company's cash cows, contributing approximately 35% of FMC's total revenue in 2024. These molecules are central to FMC's portfolio, demonstrating strong market penetration and high customer loyalty. Their established brand recognition and efficacy ensure consistent sales performance.

Despite projections of flat gross profit dollars for Rynaxypyr between 2025 and 2027, the branded formulations of these diamides are expected to continue generating substantial cash flow. This sustained profitability is attributed to their significant market share and the enduring demand for effective pest control solutions in agriculture.

FMC's established insecticide portfolio, generating $2.28 billion in revenue over the last twelve months, represents a significant Cash Cow. These products, while operating in mature markets with modest growth, command a high market share.

Their widespread adoption and strong brand recognition mean they require less investment in promotion and placement, allowing them to consistently produce substantial cash flow for FMC.

FMC's mature herbicide products are true cash cows, operating in established markets with lower growth potential but significant market share. These products, like Authority® and Bicep II Magnum®, consistently generate substantial profits due to their strong competitive advantages and optimized cost structures. For instance, FMC reported agricultural solutions revenue of $1,255 million in the first quarter of 2024, with herbicides forming a significant portion of this, demonstrating their ongoing financial strength.

These mature herbicides have achieved a dominant position, allowing FMC to command high profit margins and predictable cash flows. By continuing to invest strategically in supporting infrastructure, such as efficient manufacturing and distribution networks, FMC can further enhance the profitability and cash-generating capacity of these vital product lines. This focus ensures these dependable assets continue to fund innovation and growth in other areas of the business.

Fungicide Portfolio (excluding new AIs)

FMC's fungicide portfolio, excluding new active ingredients, represents a significant cash cow. These established products operate in a mature market, meaning growth may be slower, but they consistently generate substantial profits. This stability allows FMC to fund investments in more innovative areas without needing to heavily reinvest in the existing fungicide lines themselves.

The company's strategy here is to maintain market share and optimize profitability. For instance, in 2024, FMC's crop protection segment, which includes these mature fungicides, continued to be a strong revenue driver. While specific figures for the "cash cow" fungicides aren't broken out separately, the overall segment performance reflects their reliable contribution to the company's financial health.

- Mature Market Dominance: The existing fungicide offerings hold strong positions in established crop protection segments.

- Consistent Cash Generation: These products are reliable contributors to FMC's overall cash flow.

- Lower Reinvestment Needs: Capital allocation focuses on maintenance rather than aggressive expansion or R&D for these mature assets.

- Strategic Financial Support: The cash generated supports investments in FMC's growth-oriented segments and pipeline innovations.

Professional Pest and Turf Management (Pre-Divestiture)

Before FMC divested its Global Specialty Solutions (GSS) business in November 2024, the Professional Pest and Turf Management segment likely operated as a cash cow. This segment generated consistent revenue from established offerings in mature markets, such as golf course maintenance and pest control services.

The stable cash flow from this business allowed FMC to strategically reallocate resources towards its core agricultural operations. For instance, in 2023, FMC reported total revenue of $5.2 billion, with its agricultural solutions segment being the primary driver.

- Cash Generation: The mature nature of the pest and turf management market typically yields predictable and substantial cash flows.

- Stable Demand: Essential services like pest control ensure consistent demand, even during economic fluctuations.

- Resource Allocation: Cash generated here supported FMC's investment in R&D and market expansion for its core agricultural products.

- Divestiture Impact: The November 2024 divestiture aimed to sharpen FMC's focus on its high-growth agricultural business.

FMC's established insecticide portfolio, generating $2.28 billion in revenue over the last twelve months, represents a significant Cash Cow. Rynaxypyr and Cyazypyr, FMC's proprietary diamide insecticides, are key contributors, making up approximately 35% of FMC's total revenue in 2024. These products benefit from strong market penetration and high customer loyalty.

Despite projections of flat gross profit dollars for Rynaxypyr between 2025 and 2027, the branded formulations of these diamides are expected to continue generating substantial cash flow due to their significant market share and enduring demand.

FMC's mature herbicide products, such as Authority® and Bicep II Magnum®, are also cash cows. These operate in established markets with lower growth potential but command significant market share, consistently generating substantial profits. FMC reported agricultural solutions revenue of $1,255 million in the first quarter of 2024, with herbicides forming a substantial part of this, underscoring their financial strength.

These mature products have achieved dominant market positions, enabling FMC to achieve high profit margins and predictable cash flows, which in turn support investments in more innovative product lines.

| Product Category | Approximate 2024 Revenue Contribution | Market Characteristic | Cash Flow Contribution |

| Diamide Insecticides (Rynaxypyr, Cyazypyr) | ~35% of total revenue | Mature, high market share | Substantial and consistent |

| Established Herbicides | Significant portion of $1,255M Q1 2024 Ag Solutions Revenue | Mature, dominant market position | High profit margins, predictable |

| Mature Fungicides (excluding new active ingredients) | Not separately broken out, but strong segment contributor | Mature, stable demand | Reliable, supports innovation |

Full Transparency, Always

FMC BCG Matrix

The FMC BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive, ready-to-implement strategic analysis for your business units. You can confidently assess its value knowing that the final product will be exactly as presented, allowing for immediate integration into your planning processes. This ensures a seamless transition from preview to actionable strategy.

Dogs

FMC faced a significant sales drop in the EMEA region, directly linked to the anticipated loss of registration for its triflusulfuron herbicide. This regulatory setback effectively moved triflusulfuron into the 'dog' category within the BCG matrix.

Products that lose their registration can no longer be legally marketed, leading to a zero market share and no potential for future growth. Such products are prime candidates for divestment or outright discontinuation, as they represent a drain on resources with no return.

Certain cost-plus contract sales to diamide partners represent a segment within FMC's portfolio that, while maintaining volume, exhibits characteristics of a 'dog' in the BCG matrix due to diminished profitability. In 2024, these specific contracts experienced a 9% price decrease, with a significant portion of this reduction stemming from passed-through manufacturing cost savings.

While the underlying diamide products are not inherently weak, the contractual structure limits their cash-generating potential. This scenario, where sales volume persists but profit margins are compressed, suggests a low return on investment, a key indicator for classifying an offering as a 'dog' from a strategic cash flow perspective.

Underperforming older formulations in FMC's portfolio, if they exist, would fall into the Dogs category of the BCG Matrix. These are products in low-growth markets that have seen their market share decline due to newer, more effective competitors or the development of resistance in target pests. Such products often struggle to generate profits and may even drain resources, necessitating a careful evaluation of their future within the company's strategy.

Products in Highly Competitive, Commoditized Segments

In highly competitive, commoditized segments of the crop protection market, FMC's products could be classified as dogs if they face intense price competition and minimal product differentiation. These markets typically offer low growth prospects and struggle to secure substantial market share for any single company, hindering profitability. While specific product names were not disclosed, such a scenario implies that any FMC offerings in these areas would likely be mature products with limited innovation potential.

These commoditized segments are characterized by:

- Low Market Growth: Mature markets often see growth rates below the overall industry average, limiting expansion opportunities. For instance, some older herbicide categories might only grow at 1-2% annually.

- Intense Price Competition: With little to distinguish products, pricing becomes the primary competitive lever, squeezing margins for all participants. Generic product pricing can be significantly lower than branded alternatives.

- Low Differentiation: Products in these segments offer similar efficacy and application, making it difficult for companies to command premium pricing or build strong brand loyalty.

- Limited Investment Returns: The combination of low growth and price pressure makes it challenging to generate attractive returns on investment, potentially leading to divestment or minimal resource allocation.

Divested Global Specialty Solutions (GSS) Business

The divestiture of FMC's Global Specialty Solutions (GSS) business, completed in 2023 for $1.8 billion, illustrates a strategic move away from a segment that, while potentially profitable, did not align with the company's core agricultural focus. This decision to sell the GSS business, which primarily served non-agricultural markets like pest control and turf management, positions FMC to concentrate resources and capital on its high-growth agricultural solutions.

While GSS may have generated consistent revenue, its classification as a 'dog' within FMC's portfolio, according to the BCG matrix framework, stems from its lower growth prospects and lack of synergy with the company's primary objective of being a leader in global crop protection. FMC's strategic pivot emphasizes investing in innovation and market expansion within its agricultural segment, where it sees greater potential for long-term, high-margin growth.

- Divestiture Value: FMC sold its GSS business for $1.8 billion in 2023.

- Strategic Rationale: The sale aimed to sharpen FMC's focus on the global crop protection market.

- 'Dog' Classification: GSS was likely considered a 'dog' due to its non-core nature and limited alignment with FMC's agricultural growth strategy.

- Resource Reallocation: Proceeds from the sale are intended to fuel investments in FMC's core agricultural business.

Products classified as 'dogs' in the BCG matrix represent offerings with low market share in low-growth markets. These products typically generate minimal profits and may even consume more resources than they produce, often requiring careful management or divestment.

FMC's triflusulfuron herbicide, following its registration loss, is a prime example of a product that has transitioned into the 'dog' category, effectively ceasing to contribute to revenue or growth.

Similarly, certain cost-plus contracts for diamide partners, despite maintaining volume, exhibit 'dog' characteristics due to compressed profitability, as seen in the 9% price decrease observed in 2024.

The divestiture of FMC's Global Specialty Solutions (GSS) business in 2023 for $1.8 billion also aligns with the strategic management of 'dogs,' allowing the company to reallocate resources to core, higher-growth agricultural segments.

| Product/Segment | BCG Category | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Triflusulfuron Herbicide | Dog | Negligible (post-registration loss) | Zero | Divestment/Discontinuation |

| Cost-Plus Diamide Contracts | Dog | Low (contractually limited) | Low Profitability | Evaluate contractual terms/profitability |

| Global Specialty Solutions (GSS) | Dog (strategic fit) | Lower Growth | Non-core | Divested (2023) |

Question Marks

Newly launched active ingredients, while showing promise in high-growth segments like specific emerging markets or niche crop applications, are classified as question marks in the FMC BCG Matrix. These products, such as potential new fungicides or insecticides targeting resistant pests, demand substantial investment in research, development, marketing, and distribution to establish a market presence.

For instance, a hypothetical new herbicide introduced in Southeast Asia in late 2023, targeting a prevalent weed impacting rice cultivation, would fit this category. Despite a projected market growth rate of 8% annually for this specific segment, its initial market share might be less than 1% as of early 2024, necessitating significant promotional efforts and farmer education to drive adoption and upward mobility in the matrix.

FMC's emerging digital and precision agriculture offerings, such as its Arc™ farm intelligence platform, represent potential question marks in the BCG matrix. These technologies are positioned in a rapidly expanding market driven by the demand for increased efficiency and sustainability in farming.

While the market for precision agriculture is projected to reach over $15 billion by 2025, many of these advanced digital tools are still in their early adoption phases. This means they may currently hold a relatively low market share for FMC, despite the high growth potential of the sector.

Significant investment is typically required to scale these nascent technologies, develop user-friendly interfaces, and educate farmers on their benefits, which is characteristic of question mark assets. Success will depend on FMC's ability to gain traction and transition these offerings into stars.

FMC's strategic move to establish a direct route to market in Brazil for large corn and soybean growers is a significant play in a region boasting substantial agricultural output. Brazil's agricultural sector is a powerhouse, with corn production alone projected to reach over 120 million metric tons in the 2023-2024 marketing year, and soybeans exceeding 150 million metric tons. This expansion taps into a high-growth potential, aiming to capture a larger share of this vital market.

However, this venture into Brazil's complex agricultural landscape positions it as a question mark within the FMC BCG Matrix. The initiative demands considerable upfront investment in infrastructure, distribution networks, and local market penetration strategies. While the long-term rewards could be substantial, the initial phase involves inherent risks and uncertainty regarding market acceptance and the speed of return on investment, typical of question mark products or strategies.

Pheromone Products (Pre-2027 Acceleration)

Pheromone products within FMC's portfolio are currently positioned as question marks in the BCG matrix. While the market for these innovative plant health solutions is experiencing significant growth, their current market share is likely still developing. This suggests they are in a high-growth industry but haven't yet captured a dominant position.

The expectation is that these products will become stars, driving substantial growth for FMC's Plant Health segment post-2027. To achieve this potential, they require ongoing investment in research, development, and market penetration strategies. For instance, the global biopesticides market, which includes pheromones, was projected to reach approximately $10 billion by 2025, indicating a robust growth trajectory.

- Market Growth: Pheromone products operate in a rapidly expanding biopesticides market, with significant future growth anticipated.

- Current Share: Despite market growth, their current market share is likely low, characteristic of a question mark.

- Investment Needs: Continued investment is crucial for these products to transition from question marks to stars.

- Future Potential: They are strategically important for FMC's Plant Health growth, especially beyond 2027.

Dodhylex™ (Based on Launch Calendar)

Dodhylex™, a novel active ingredient, is positioned as a question mark within the FMC BCG Matrix. Its launch calendar suggests a projected contribution to growth by 2027, though initially modest. This classification stems from its presence in a high-growth market, likely related to new AI applications, where its current market share is inherently low due to its recent or anticipated market entry.

The strategic implication for Dodhylex™ is the need for significant investment to capitalize on its growth potential.

- Market Position: High market growth, low market share.

- Strategic Implication: Requires substantial investment to increase market share and achieve market leadership.

- Projected Contribution: Expected to contribute to growth by 2027, but with a small initial impact.

- Industry Context: Operates within a nascent, high-potential market, such as emerging AI technologies.

Question marks represent products or business units in high-growth markets but with low market share. They require significant investment to gain traction and could potentially become stars. FMC's strategic initiatives, like its expansion into Brazil and the development of digital agriculture platforms, exemplify this category, demanding substantial resources to navigate complex markets and drive adoption.

These nascent offerings, including pheromone products and new active ingredients like Dodhylex™, are crucial for future growth but currently represent a gamble. Their success hinges on FMC's ability to execute effectively, overcome market entry barriers, and convert potential into market leadership.

| FMC Offering | Market Growth | Current Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| New Active Ingredients (e.g., Dodhylex™) | High (e.g., specific emerging markets, niche crops) | Low (early market entry) | High (R&D, marketing, distribution) | Star or Dog |

| Digital/Precision Agriculture (e.g., Arc™) | Very High (projected >$15B by 2025) | Low (early adoption phase) | High (scaling, user interface, education) | Star or Dog |

| Brazil Market Expansion | High (significant agricultural output) | Low (new direct route to market) | High (infrastructure, distribution, penetration) | Star or Dog |

| Pheromone Products | High (biopesticides market, ~$10B by 2025) | Low (developing position) | High (R&D, market penetration) | Star (post-2027 potential) |

BCG Matrix Data Sources

Our FMC BCG Matrix leverages comprehensive data, including company financial statements, industry market share reports, and economic growth forecasts, to accurately position each business unit.