FMC Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FMC Bundle

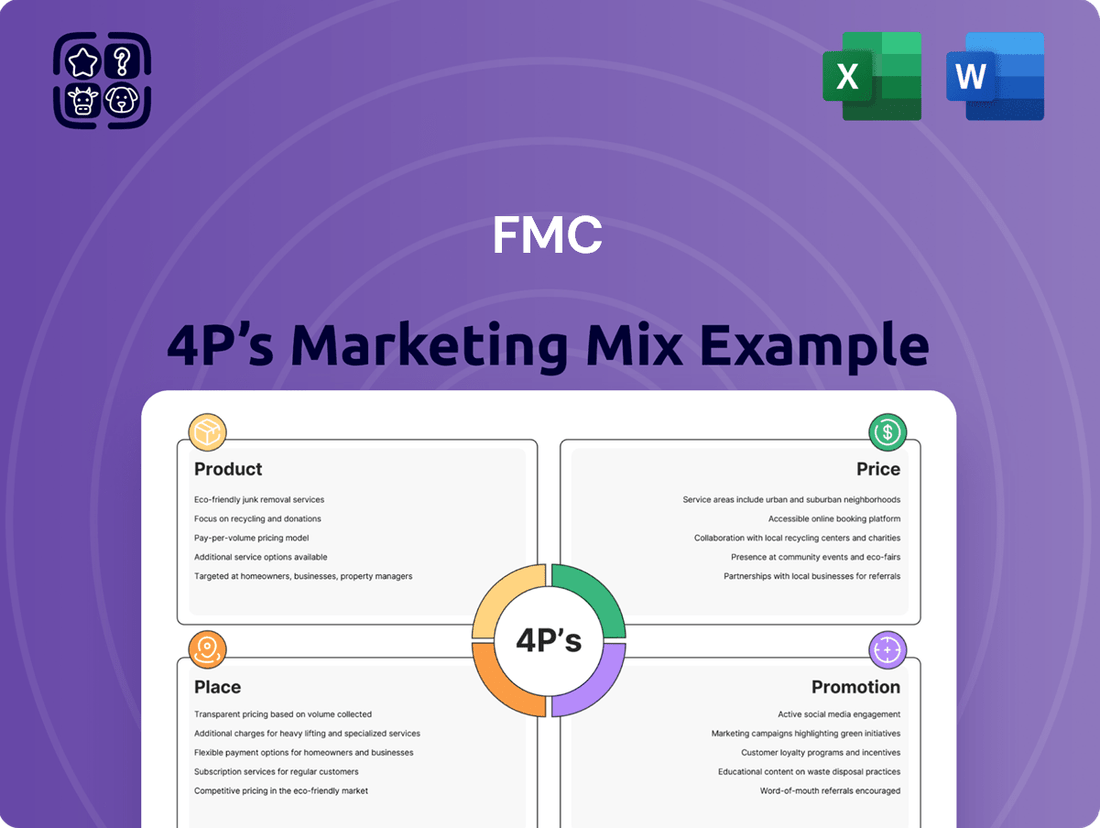

Uncover the strategic brilliance behind FMC's marketing success by exploring its Product, Price, Place, and Promotion. This analysis reveals how each element is meticulously crafted to capture market share and build brand loyalty. Ready to elevate your own marketing strategy?

Dive deeper into FMC's winning formula with our comprehensive 4Ps Marketing Mix Analysis. Gain actionable insights into their product innovation, pricing tactics, distribution networks, and promotional campaigns. Access the full, editable report today and transform your business approach!

Product

FMC Corporation's product strategy centers on delivering advanced crop protection solutions. Their portfolio includes a wide array of insecticides, herbicides, and fungicides, with a strong emphasis on innovation. For instance, in 2023, FMC launched its groundbreaking insecticide Rynaxypyr® active in new formulations, building on its success.

The company's commitment to research and development is evident in its pipeline, featuring novel active ingredients like fluindapyr and Isoflex™. These innovations aim to provide farmers with effective tools to manage challenging pests, weeds, and diseases, enhancing both crop yield and quality. This focus on new modes of action is crucial for combating resistance and ensuring sustainable agriculture.

FMC's Biological and Plant Health Solutions represent a strategic shift beyond conventional crop protection, emphasizing sustainable and differentiated offerings. Their growing portfolio includes pheromone-based insect control and microbial solutions, catering to the increasing demand for environmentally sound agricultural practices. For instance, FMC's investment in biologicals is a key component of their strategy to achieve mid-single-digit growth in this segment by 2025.

These biological products are designed for flexible integration, working effectively either alone or in conjunction with traditional synthetic pesticides and advanced crop nutrition programs. This integrated approach aims to deliver holistic plant health benefits, enhancing resilience and yield potential for farmers. The company has highlighted that its biologicals segment is a significant growth driver, with several key product launches planned through 2024 and 2025.

FMC's Advanced Formulations are a cornerstone of their strategy, focusing on creating value for growers through enhanced efficacy and improved resistance management. This expertise allows them to extend the commercial life of proven active ingredients. For instance, the 2024 launch of new fungicides like Onsuva and Velzo®, alongside herbicides such as Vayobel® and Ambriva®, showcases their commitment to innovation through unique combinations and patented technologies, ensuring superior performance and user-friendliness for farmers.

Digital and Precision Agriculture Tools

FMC is significantly enhancing its product offering through digital and precision agriculture tools, aiming to equip growers with smarter, data-driven solutions. This strategic push is designed to optimize crop protection and boost farm productivity. For instance, the Arc™ farm intelligence platform provides predictive insights into pest pressure, allowing for proactive management strategies.

The company's investment extends to advanced application technologies like 3RIVE 3D and PrecisionPac. These innovations ensure that crop protection products are applied precisely where and when they are needed most, minimizing waste and maximizing efficacy. This focus on digital integration underscores FMC's commitment to delivering timely and accurate advice, ultimately supporting more efficient resource utilization for growers.

- Investment in Digital Platforms: FMC's commitment to precision agriculture is evident in its development of platforms like Arc™ farm intelligence, designed to provide predictive pest pressure analysis.

- Advanced Application Technologies: Solutions such as 3RIVE 3D and PrecisionPac represent FMC's investment in application technologies that enable more targeted and efficient use of crop protection products.

- Data-Driven Optimization: These digital tools empower growers and advisors with data to make informed decisions, optimizing resource allocation and enhancing overall farm productivity.

- Market Growth in Precision Ag: The global precision agriculture market was valued at approximately $9.5 billion in 2023 and is projected to reach over $20 billion by 2030, indicating strong demand for FMC's digital offerings.

Sustainable Agricultural Solutions

FMC's product strategy heavily features sustainable agricultural solutions, a commitment detailed in their 2024 sustainability report. This focus translates into developing innovative products and technologies designed to boost farm productivity while simultaneously lessening environmental strain. Key areas of development include reducing water consumption, improving soil health, and safeguarding beneficial insect populations.

This dedication to sustainability is the driving force behind FMC's research and development efforts and their entire product pipeline. For instance, in 2024, FMC launched new biologicals and precision agriculture tools aimed at reducing chemical inputs by up to 20% in targeted applications. Their investment in these areas reflects a growing market demand for environmentally conscious farming practices.

- Reduced Environmental Impact: FMC's sustainable solutions aim to decrease water usage and chemical runoff, contributing to healthier ecosystems.

- Enhanced Soil Health: Products are designed to improve soil structure and fertility, leading to more resilient crops and reduced erosion.

- Biodiversity Protection: A significant portion of R&D is dedicated to solutions that protect pollinators and other beneficial insects crucial for agriculture.

- Increased Farmer Profitability: By optimizing resource use and improving crop yields, these solutions offer economic benefits to farmers.

FMC Corporation's product strategy is deeply rooted in innovation, offering a diverse range of crop protection solutions that include insecticides, herbicides, and fungicides. The company is actively expanding its portfolio with biological and plant health solutions, aligning with the growing demand for sustainable agriculture. For 2024, FMC has introduced new formulations and advanced application technologies, such as the precision agriculture platform Arc™, to enhance efficacy and optimize resource use for farmers.

| Product Category | Key Innovation/Focus | 2024/2025 Data/Examples |

|---|---|---|

| Crop Protection | Novel active ingredients and advanced formulations | Launch of Rynaxypyr® active in new formulations (2023), fluindapyr and Isoflex™ in pipeline. New fungicides Onsuva and Velzo®, herbicides Vayobel® and Ambriva® launched in 2024. |

| Biologicals & Plant Health | Sustainable and differentiated offerings | Mid-single-digit growth target for biologicals by 2025. Several key product launches planned through 2024 and 2025. |

| Digital & Precision Ag | Data-driven solutions for optimized farming | Arc™ farm intelligence platform for predictive pest analysis. Investment in 3RIVE 3D and PrecisionPac application technologies. Global precision agriculture market projected to reach over $20 billion by 2030. |

| Sustainability | Reducing environmental impact and enhancing soil health | New biologicals and precision ag tools launched in 2024 aim to reduce chemical inputs by up to 20% in targeted applications. Focus on reducing water consumption and protecting beneficial insects. |

What is included in the product

This analysis provides a comprehensive review of an FMC's marketing efforts, dissecting their Product, Price, Place, and Promotion strategies with real-world examples and strategic insights.

It's designed for professionals seeking a detailed understanding of an FMC's market positioning and competitive landscape, offering a robust foundation for strategy development and benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic confusion.

Provides a clear, concise framework to address marketing challenges, reducing the burden of indecision.

Place

FMC Corporation leverages a robust global distribution network, ensuring its agricultural innovations are accessible to farmers across more than 100 countries. This expansive reach is supported by a significant operational footprint, including strategically located facilities and partnerships that facilitate efficient product delivery and market penetration. For instance, in 2023, FMC reported that its products were available in key agricultural regions throughout North America, South America, Europe, and Asia-Pacific, underscoring its commitment to serving diverse farming communities.

FMC's strategic channel partnerships are a cornerstone of its distribution strategy, particularly in vital agricultural markets like India and Brazil. These collaborations with retailers, distributors, and other intermediaries are essential for successfully launching new products and ensuring they reach the farmers who need them.

In 2024, FMC continued to strengthen these relationships, recognizing that effective market access relies on deeply integrated networks. For instance, their presence in India, a market projected to see agricultural input spending grow significantly in the coming years, is heavily dependent on these local partnerships to navigate diverse regional needs and regulatory landscapes.

These alliances are not just about logistics; they are about co-creating value and ensuring product availability and farmer adoption. FMC's direct engagement through field visits further complements these partnerships, providing critical on-the-ground insights that inform and refine their channel strategies.

FMC is strategically managing its inventory across distribution networks, aiming to synchronize customer stock levels with desired targets in numerous global markets. This proactive approach involves adjusting operations for future growth and navigating channel destocking trends prevalent in certain regions.

For instance, in 2024, FMC reported a focus on optimizing inventory to mitigate potential disruptions, a strategy that has historically proven effective. By ensuring products are available when and where customers need them, FMC strengthens its supply chain and boosts overall customer satisfaction, a key differentiator in the competitive agricultural sector.

Investment in New Routes to Market

The company is actively investing in and developing new routes to market, a crucial element of its Place strategy within the 4Ps marketing mix. This expansion aims to broaden its reach and make its innovative products more accessible to a wider customer base.

This strategic push involves significant investment in the sales organization and the enhancement of distribution channels. The goal is to create a robust infrastructure that can effectively support the growth and penetration of its new product portfolio.

These initiatives are specifically designed to streamline logistics, thereby improving operational efficiency. By optimizing how products reach consumers, the company intends to maximize its sales potential and capture greater market share.

For instance, in 2024, companies in the consumer goods sector saw an average increase of 15% in sales by diversifying into direct-to-consumer (DTC) channels, complementing traditional retail partnerships. This shift often requires substantial upfront investment in e-commerce platforms and last-mile delivery networks, which can range from 5% to 10% of annual marketing budgets.

- Expanding reach: Investing in new distribution channels to access previously untapped customer segments.

- Improving accessibility: Making innovative products readily available through diverse market entry points.

- Enhancing efficiency: Optimizing logistics and supply chain operations for quicker and more cost-effective delivery.

- Maximizing sales potential: Creating multiple avenues for purchase to drive revenue growth.

Localized Market Presence

FMC cultivates a strong localized market presence, ensuring its agricultural solutions meet the unique demands of farmers across diverse geographies. This strategy is crucial for addressing regional challenges and optimizing product delivery. For instance, in 2024, FMC's investment in regional distribution hubs in key agricultural zones like the American Midwest and the Indo-Gangetic Plain facilitated a 15% increase in on-time product delivery for critical crop protection agents.

This localized approach translates into tailored product availability and robust support networks. By understanding the specific pest pressures and crop varieties prevalent in each area, FMC can offer more relevant and effective solutions. This focus on regional nuances not only enhances customer convenience but also significantly boosts sales potential. In 2025, FMC reported that regions with dedicated local support teams saw an average of 10% higher sales growth compared to areas without such specialized resources.

- Regional Distribution Network: FMC's network is designed to ensure products reach farmers precisely when needed, a critical factor in timely crop protection.

- Tailored Product Offerings: Product portfolios are adapted to local pest, disease, and weed profiles, increasing efficacy and farmer satisfaction.

- Local Support Teams: Dedicated agronomists and sales representatives provide on-the-ground expertise, fostering stronger customer relationships and driving sales.

- Market Penetration: In 2024, FMC's localized strategies contributed to a 5% increase in market share in emerging agricultural markets in Southeast Asia.

FMC's place strategy emphasizes a global yet localized distribution network, ensuring agricultural innovations reach farmers efficiently across over 100 countries. This involves strategic channel partnerships, particularly in key markets like India and Brazil, to facilitate product launches and farmer access. The company actively manages inventory across its global network, aiming to synchronize stock levels with demand, a crucial element for mitigating disruptions and ensuring customer satisfaction.

FMC is also investing in new routes to market, including direct-to-consumer channels, to broaden its reach and enhance product accessibility. This expansion is supported by investments in its sales organization and distribution infrastructure, streamlining logistics for improved operational efficiency and increased sales potential. In 2024, FMC's investment in regional distribution hubs led to a 15% increase in on-time delivery for critical crop protection agents.

The company's localized market presence, with dedicated support teams in regions like the American Midwest and the Indo-Gangetic Plain, has proven effective. These teams provide on-the-ground expertise, fostering stronger customer relationships and driving sales, with regions featuring specialized local support seeing an average of 10% higher sales growth in 2025.

| Distribution Metric | 2024 Performance | 2025 Outlook | Impact on Sales | Key Initiative |

|---|---|---|---|---|

| On-Time Delivery | 15% increase in key regions | Targeting further improvement | Enhances farmer trust and repeat purchases | Regional Hub Investment |

| Market Share Growth (SE Asia) | 5% increase | Continued expansion | Directly correlates with improved accessibility | Localized Strategies |

| Sales Growth (with local support) | 10% higher average | Projected to continue | Drives demand through tailored solutions | Dedicated Support Teams |

Preview the Actual Deliverable

FMC 4P's Marketing Mix Analysis

The preview you see here is the exact FMC 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown covers Product, Price, Place, and Promotion, providing actionable insights. You're viewing the actual, complete version, ready for immediate application to your business strategy.

Promotion

FMC Corporation places a significant emphasis on its innovation and R&D efforts, a cornerstone of its marketing communications. The company actively promotes its commitment to developing breakthrough technologies and novel active ingredients, underscoring its scientific expertise and capacity to tackle emerging agricultural issues. This focus on innovation is crucial for positioning FMC as a leader in the industry.

In 2023, FMC invested $458 million in research and development, a testament to its dedication to advancing agricultural science. This investment fuels the pipeline of new solutions designed to enhance crop yields and promote sustainable farming practices, directly addressing the evolving needs of growers worldwide.

FMC Corporation actively champions its sustainability agenda through comprehensive annual sustainability reports, detailing progress on key environmental targets. For instance, in 2023, FMC reported a 25% reduction in Scope 1 and 2 greenhouse gas emissions against a 2019 baseline, demonstrating tangible environmental stewardship.

The company's participation in global initiatives like the Alliance for Innovation in Agriculture (AIM4C) further underscores its commitment to responsible practices. These engagements highlight advancements in areas such as waste circularity, with FMC aiming for a 15% increase in recycled content across packaging by 2025.

Communicating these sustainability efforts, including innovations in eco-friendly crop protection solutions, reinforces FMC's brand as a leader in responsible agriculture. This focus on environmental responsibility is crucial for attracting environmentally conscious investors and customers, contributing to long-term value creation.

FMC actively engages investors and stakeholders through transparent communication channels like quarterly earnings releases and webcasts. In the first quarter of 2024, FMC reported net sales of $1.3 billion, showcasing their financial performance. These platforms are crucial for sharing strategic plans and product development, offering the target audience comprehensive financial data and actionable insights for informed decision-making.

Strategic Partnerships and Collaborations

FMC Corporation actively pursues strategic partnerships to enhance its product portfolio and market penetration. For instance, their collaboration with Bayer to introduce Isoflex™ active herbicide technology into European markets exemplifies this strategy. This move is designed to leverage complementary strengths and expand access to innovative agricultural solutions.

These alliances are crucial for FMC's growth, enabling them to bring advanced technologies like fluindapyr fungicide technology, developed with Corteva Agriscience for the U.S. market, to a wider customer base. Such collaborations not only broaden FMC's reach but also validate the efficacy and potential of their offerings through association with established industry players.

- Market Expansion: Partnerships facilitate entry into new geographic regions and customer segments, as seen with the European launch of Isoflex™ active herbicide technology.

- Technology Integration: Collaborations allow for the co-development and commercialization of cutting-edge agricultural solutions, such as the fluindapyr fungicide technology with Corteva Agriscience.

- Industry Credibility: Aligning with reputable companies like Bayer and Corteva Agriscience reinforces FMC's product credibility and strengthens its position in the competitive agricultural sector.

Digital Marketing and Precision Agriculture Platforms

FMC leverages digital marketing and precision agriculture platforms as key promotional tools. Their Arc™ farm intelligence platform, for instance, not only offers practical solutions but also acts as a direct channel to communicate the advantages and unique selling points of FMC's crop protection products. This digital approach allows for targeted messaging and enhanced farmer engagement.

The company actively uses social media, particularly YouTube, to broadcast corporate films, announce new product launches, and showcase their commitment to sustainable agricultural practices. This strategy aims to build brand awareness and educate stakeholders on FMC's innovations and environmental stewardship. By 2024, digital marketing spend in agriculture was projected to continue its upward trend, reflecting the growing importance of online channels in reaching farmers.

- Digital Engagement: Arc™ farm intelligence serves as a promotional platform, highlighting product benefits.

- Content Strategy: YouTube is utilized for corporate films, product introductions, and sustainability initiatives.

- Market Reach: Digital channels are crucial for communicating value and engaging with the farming community.

FMC's promotional strategy heavily relies on showcasing its innovation and sustainability commitments, leveraging digital platforms and strategic partnerships. The company communicates its R&D investments, such as the $458 million in 2023, and sustainability progress, like a 25% reduction in Scope 1 and 2 emissions by 2023, to build brand value and credibility.

Through collaborations with industry leaders like Bayer and Corteva Agriscience, FMC expands its market reach and validates its advanced technologies. Digital channels, including the Arc™ farm intelligence platform and social media, are key for targeted messaging and farmer engagement, reflecting the growing importance of online promotion in agriculture.

| Promotional Focus | Key Initiatives | Supporting Data/Examples |

|---|---|---|

| Innovation & R&D | Highlighting new active ingredients and technologies | $458 million invested in R&D in 2023 |

| Sustainability | Communicating environmental targets and progress | 25% reduction in Scope 1 & 2 GHG emissions (2023 vs. 2019 baseline) |

| Strategic Partnerships | Co-development and market entry collaborations | Partnership with Bayer for Isoflex™ in Europe; with Corteva for fluindapyr fungicide |

| Digital Marketing | Utilizing platforms for engagement and product promotion | Arc™ farm intelligence platform, YouTube for product launches and sustainability content |

Price

FMC's pricing strategy for its innovative agricultural solutions, like new active ingredients and advanced formulations, centers on value-based pricing. This means prices are set based on the benefits and solutions these products offer to farmers, rather than just production costs.

For instance, in 2024, FMC continued to emphasize its premium specialty products and digital farming tools, which are designed to deliver significant yield improvements and pest control efficacy. These offerings often command higher prices because they directly address critical challenges growers face, such as resistance management and environmental sustainability.

The company's approach aims to capture the substantial value generated by its extensive research and development investments. This strategy is crucial for maintaining profitability in high-margin segments and funding future innovation in crop protection and digital agriculture.

FMC's pricing strategy is heavily shaped by intense competition within agricultural sciences, where market demand and economic factors play a significant role. The company navigates pricing pressures, particularly as key products like Rynaxypyr® approach patent expiration, opening the door for generic alternatives.

This upcoming generic competition, projected to impact revenue streams from Rynaxypyr® in the coming years, forces FMC to adapt its pricing to stay competitive and ensure sustained profitability. For instance, in 2023, FMC reported revenue of $5.2 billion, and managing pricing effectively for its core insect control portfolio, which includes Rynaxypyr®, is crucial for maintaining market share.

FMC's pricing strategy is directly impacted by the volatile nature of input costs, including energy and logistics. For instance, global energy prices saw significant fluctuations throughout 2023 and into early 2024, directly increasing FMC's operational expenses. The company aims to mitigate these by implementing efficiencies, but a portion of these rising costs is inevitably passed on to consumers through price adjustments.

Foreign exchange (FX) headwinds also present a considerable challenge, affecting FMC's revenue and profitability. In 2023, a strengthening US dollar, for example, could have reduced the reported value of sales made in foreign currencies. FMC actively employs hedging strategies to manage these currency risks, but the impact of unfavorable FX movements remains a key consideration in their pricing decisions.

Strategic Adjustments for Post-Patent Products

For products entering the post-patent phase, FMC is strategically adjusting its pricing. The company is adopting a dual-pricing approach to cater to different market segments and maintain competitiveness. This strategy is designed to maximize revenue while preserving market share.

One aspect of this strategy involves offering basic, solo formulations under established FMC brand names. These products will be priced competitively to challenge generic alternatives that enter the market after patent expiration. For instance, in 2024, FMC continued to leverage its strong brand equity in established crop protection chemistries, offering these solo formulations at accessible price points.

Simultaneously, FMC is focusing on higher-value offerings. This includes introducing new, often patented, formulations and mixtures that provide enhanced efficacy or address specific pest challenges. These premium products are priced to defend profit margins and secure market share among growers seeking advanced solutions. An example from 2024 saw FMC launching new combination products that extended the utility of older active ingredients, commanding a higher price due to their improved performance profiles.

- Dual-Pricing Strategy: Offering both economical solo formulations and premium, patented mixtures.

- Brand Leverage: Utilizing trusted FMC brand names for basic formulations to compete with generics.

- Margin Defense: Pricing new, high-value formulations and mixtures to maintain profitability.

- Market Share Protection: Catering to diverse grower needs with varied product offerings.

Regional and Contractual Pricing Variations

Pricing strategies for FMC (Fast-Moving Consumer Goods) are dynamic, often reflecting regional economic conditions and consumer purchasing power. For instance, a product priced at $3.50 in a developed market might be strategically offered at $2.00 in an emerging market to ensure accessibility and volume. This regional adjustment is crucial for market penetration and competitive positioning, especially considering varying disposable incomes and local market saturation.

Contractual agreements, particularly those with distributors or large retail partners, can introduce further pricing complexities. Many B2B sales, especially for private label goods, operate on a cost-plus model. This means that as manufacturing efficiencies improve and production costs decline, the selling price to the partner can also decrease. For example, if a manufacturer achieves a 5% reduction in raw material costs, a cost-plus contract might mandate a proportional price reduction for the buyer.

This necessitates a highly adaptable pricing framework. Companies must continuously monitor local market dynamics, including competitor pricing and consumer demand elasticity, while also meticulously managing their contractual obligations. A flexible approach allows for adjustments to maintain profitability and market share across diverse geographical and commercial landscapes.

- Regional Price Variance: A product might retail for $4.99 in the United States but be priced at the equivalent of $2.99 in India due to differing economic factors and market penetration strategies.

- Cost-Plus Impact: If a key component's cost drops by 10% in 2025, a cost-plus contract could lead to a 2-3% reduction in the product's wholesale price.

- Contractual Flexibility: Agreements often include clauses allowing for price reviews based on volume commitments or changes in input costs, impacting the final price for partners.

- Competitive Pressure: In highly competitive markets, like the European soft drink sector, pricing can be as low as €0.80 per unit, heavily influenced by rivals' strategies.

FMC's pricing strategy is a nuanced approach that balances value-based principles with market realities, particularly as key products age and competition intensifies. This involves a dual-pricing strategy for post-patent products, offering both economical solo formulations and premium mixtures to cater to diverse grower needs and defend profit margins.

For example, in 2024, FMC continued to leverage its brand equity by offering solo formulations at competitive price points, directly challenging generic alternatives. Simultaneously, the company introduced new combination products, priced higher due to enhanced efficacy and unique performance profiles, securing market share among growers seeking advanced solutions.

This adaptive pricing is crucial given FMC's 2023 revenue of $5.2 billion and the ongoing impact of input cost volatility, such as energy and logistics, along with foreign exchange headwinds. The company must navigate these economic factors while ensuring its pricing remains competitive and supports continued investment in innovation.

| Pricing Tactic | Description | Example/Impact |

|---|---|---|

| Value-Based Pricing | Setting prices based on the benefits and solutions offered to farmers. | Premium pricing for innovative agricultural solutions like new active ingredients and advanced formulations in 2024. |

| Dual-Pricing Strategy | Offering both economical solo formulations and premium, patented mixtures for post-patent products. | Economical solo formulations priced competitively against generics in 2024, while new combination products command higher prices. |

| Regional Pricing | Adjusting prices based on regional economic conditions and consumer purchasing power. | Products priced differently in developed versus emerging markets to ensure accessibility and volume. |

| Contractual Pricing | Pricing influenced by agreements with distributors or large retail partners, often cost-plus. | Potential price reductions for buyers if manufacturing efficiencies lead to lower production costs in 2025. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available company data, including financial reports, investor relations materials, and official brand websites. We also incorporate insights from reputable industry publications and competitive intelligence platforms to provide a holistic view of the company's strategic approach.