FMC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FMC Bundle

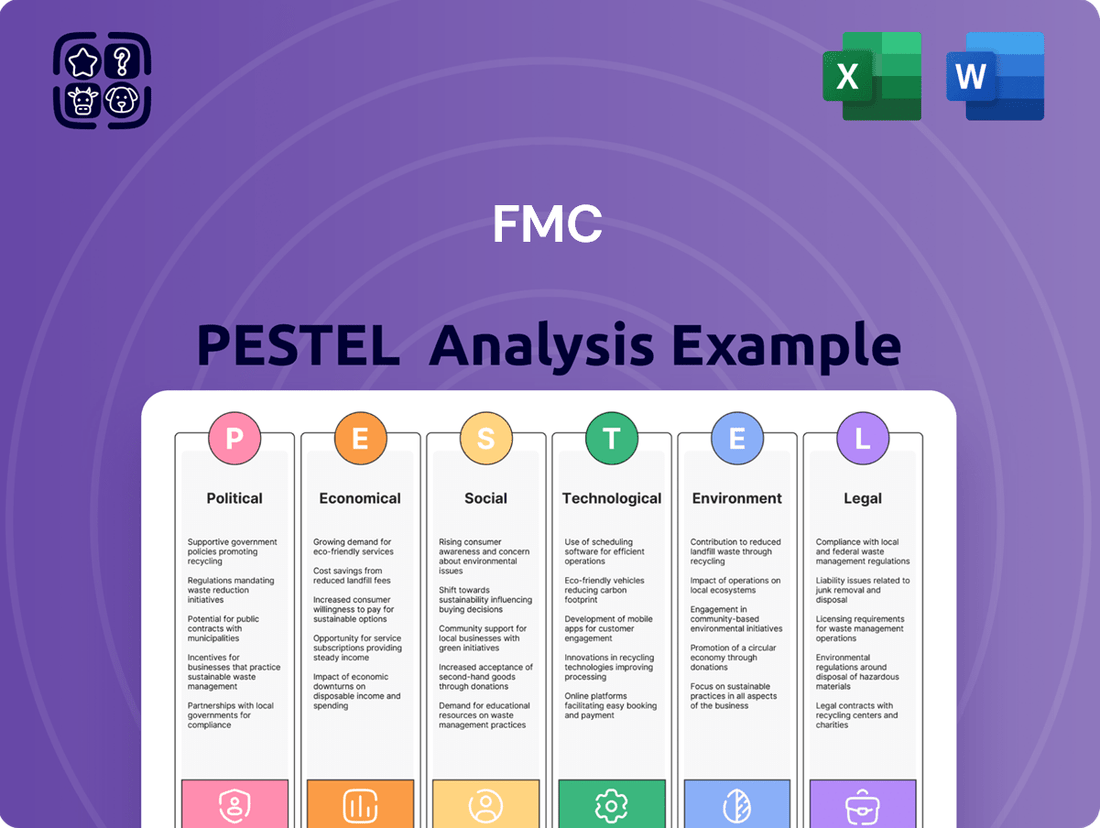

Navigate the complex external forces shaping FMC's future with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic direction. Gain a competitive edge by leveraging these critical insights. Download the full, comprehensive report now to unlock actionable intelligence for smarter decision-making.

Political factors

Government policies, particularly agricultural subsidies and support programs, play a crucial role in shaping farmer purchasing power and influencing crop selection, which directly impacts the demand for FMC's crop protection and plant health products. For instance, the U.S. Farm Bill, a significant piece of legislation, often dictates which crops receive the most support, indirectly guiding farmer investment and thus FMC's market opportunities. The 2023 Farm Bill discussions and subsequent legislation will continue to define these support structures.

Global trade agreements and tariffs significantly influence the cost of raw materials and the competitiveness of FMCG products. For instance, the US-China trade tensions saw tariffs impacting various goods, potentially increasing input costs for multinational FMCG companies. These agreements also shape market access, with changes in agricultural trade policies directly affecting the availability and price of key ingredients for food and beverage manufacturers.

Political stability in regions crucial for agriculture directly impacts FMC's ability to source raw materials and distribute its products. For instance, disruptions in major grain-producing areas due to political unrest can affect the availability and price of key ingredients for FMC's crop protection solutions. In 2024, ongoing geopolitical tensions in Eastern Europe, a significant agricultural hub, have led to supply chain challenges for various agricultural inputs, a factor FMC closely monitors.

Geopolitical instability can severely disrupt farming operations, leading to reduced crop yields and hindering the timely delivery of essential agricultural inputs like seeds and crop protection chemicals. This instability directly translates into risks for FMC's revenue, as it can impede market access and increase operational costs. For example, civil unrest in parts of Africa in late 2024 impacted local planting seasons, affecting demand for agricultural inputs in those specific markets.

Regulatory Environment for Pesticides

The regulatory environment for pesticides is a critical political factor for FMC, influencing everything from product development to market access. This landscape is a patchwork of varying rules across different nations regarding registration, application, and acceptable residue levels, and it's always changing. For instance, the European Union's stringent regulations, including its ongoing review of glyphosate, often set a high bar, potentially impacting FMC's global product strategy and requiring substantial investment in research and development for compliant alternatives. Conversely, more efficient regulatory processes in emerging markets can expedite the introduction of FMC's innovative solutions.

FMC must navigate this complex web of global regulations, which presents significant operational challenges. In 2024, the cost of bringing a new pesticide to market in developed economies can easily exceed $250 million, with a significant portion dedicated to meeting regulatory requirements. This necessitates careful planning and resource allocation to ensure compliance and maintain market presence.

- Global Regulatory Divergence: FMC faces varying pesticide registration, use, and residue limit regulations across different countries, impacting market access and product portfolio decisions.

- R&D Investment Driver: Stricter regulations often compel FMC to invest more in developing new formulations or entirely new, compliant pest control solutions.

- Market Entry Accelerator: Streamlined regulatory processes can significantly speed up the time-to-market for FMC's innovative agricultural technologies.

- Operational Complexity: Ensuring compliance with diverse and evolving international regulatory frameworks is a major ongoing consideration for FMC's global operations.

Government Support for Sustainable Agriculture Initiatives

Governments globally are increasingly prioritizing sustainable agriculture, a trend that directly benefits companies like FMC. This focus translates into policies encouraging reduced reliance on chemical inputs and a greater adoption of biological solutions. For instance, the United States Department of Agriculture (USDA) has been expanding its support for organic and sustainable farming practices, with significant funding allocated to research and development in these areas.

These policy shifts create a favorable market environment for FMC's portfolio of environmentally conscious crop protection products and biologicals. For example, the European Union's Farm to Fork strategy aims to reduce pesticide use by 50% by 2030, a target that necessitates the adoption of alternative solutions, which FMC is well-positioned to provide.

Policy incentives, such as tax credits or subsidies for adopting sustainable farming technologies, can further accelerate the market penetration of FMC's innovative offerings. These incentives encourage farmers to invest in new products and practices that align with governmental environmental goals, thereby boosting demand.

FMC's commitment to innovation in developing solutions that support these governmental initiatives provides a distinct competitive edge. By aligning its product development pipeline with sustainability mandates, FMC can capture market share and build stronger relationships with farmers seeking to comply with evolving regulations and consumer preferences.

Government policies significantly shape agricultural markets, influencing farmer purchasing power and crop choices, which directly impacts demand for FMC's products. For instance, evolving agricultural subsidies and support programs, like those seen in the U.S. Farm Bill, guide farmer investments and create market opportunities for crop protection and plant health solutions. The ongoing implementation and potential revisions of such legislation in 2024 and 2025 will continue to be critical for FMC's strategic planning.

What is included in the product

This FMC PESTLE analysis dissects how external macro-environmental factors impact the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying external threats and opportunities relevant to the FMC's market and industry.

Provides a clear, actionable framework for identifying and mitigating external threats, transforming potential roadblocks into strategic opportunities.

Economic factors

Global commodity prices, including those for corn, soybeans, and wheat, significantly influence farmer profitability. For instance, the USDA reported that average net farm income in the U.S. was projected to be $177.1 billion in 2024, a decrease from $183.9 billion in 2023, reflecting price pressures.

When commodity prices are high, farmers experience increased income, which often translates to greater investment in agricultural inputs like crop protection products from companies such as FMC. Conversely, lower commodity prices can squeeze profit margins, leading farmers to scale back on spending for these essential inputs.

FMC's sales performance is therefore closely tied to the economic vitality of the agricultural sector. A strong agricultural economy, driven by favorable commodity prices, typically boosts FMC's revenue as farmers are more willing and able to purchase their products to enhance crop yields and protect their investments.

Rising inflation significantly impacts FMC, increasing expenses for crucial elements like raw materials, energy, and labor. For instance, the US Producer Price Index for finished goods saw a notable increase in early 2024, reflecting broader inflationary pressures that directly affect manufacturing input costs.

FMC must navigate these escalating input costs by optimizing operational efficiency, employing hedging strategies to lock in prices, or strategically passing these increases to consumers. Failure to manage these costs effectively, such as through price adjustments that alienate customers, could diminish product competitiveness and squeeze profit margins.

Persistent inflation poses a substantial risk to FMC's profitability if proactive cost management measures are not consistently implemented. For example, if FMC's key raw material costs, like those for agricultural chemicals, rise faster than its ability to adjust prices, its net income could be negatively impacted.

As a global player, FMC's financial performance is significantly influenced by currency exchange rate fluctuations. For instance, if the US Dollar strengthens against currencies where FMC has substantial sales, like the Euro or Brazilian Real, its reported revenues from those regions will translate into fewer dollars, impacting overall profitability. In 2023, FMC reported that foreign currency translation negatively impacted its sales by approximately 1% compared to the prior year, highlighting this sensitivity.

These currency shifts also affect FMC's competitive positioning. A stronger dollar makes FMC's products more expensive for customers in countries with weaker currencies, potentially leading to reduced sales volume. Conversely, a weaker dollar can make imported raw materials, which FMC relies on for its manufacturing processes, more costly, thereby squeezing profit margins.

Managing these currency risks is therefore a critical component of FMC's financial strategy. The company actively employs hedging strategies, such as forward contracts and options, to mitigate the impact of adverse currency movements. For example, in early 2024, FMC likely hedged a portion of its expected Euro-denominated revenues to protect against potential dollar appreciation.

Global Economic Growth and Consumer Demand

Global economic growth is a key driver for consumer demand, impacting FMC's business indirectly. As economies expand, so does consumer spending on food and agricultural products, often with a greater emphasis on quality and safety. This trend translates to a need for higher crop yields, which in turn boosts demand for crop protection solutions.

The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, but expected to remain steady at 3.2% in 2025. This sustained growth indicates a generally favorable environment for consumer demand, although regional variations exist.

- Global GDP Growth: IMF forecasts 3.2% in 2024 and 3.2% in 2025, signaling continued but moderate expansion.

- Consumer Spending: Stronger economies typically lead to increased discretionary spending, including on higher-quality food products.

- Agricultural Demand: Economic upswings often correlate with higher demand for agricultural commodities and inputs like crop protection.

- Economic Downturn Impact: Recessions can suppress demand for agricultural products and reduce farmer investment in inputs.

Interest Rates and Access to Capital

Changes in interest rates directly impact the cost of capital for FMC. For instance, if the Federal Reserve raises the federal funds rate, as it has done periodically throughout 2023 and early 2024 to combat inflation, FMC's borrowing costs for new projects or refinancing existing debt will likely increase. This can make significant capital expenditures, such as building new manufacturing facilities or acquiring new technologies, more expensive, potentially slowing down expansion plans or R&D investments.

Conversely, a period of lower interest rates, such as those seen in earlier years, can make expansion and innovation more affordable. For example, if FMC were to issue bonds in a low-interest-rate environment, the coupon payments would be lower, freeing up capital for other strategic initiatives. This accessibility to cheaper capital is crucial for maintaining competitiveness in the dynamic agricultural sector.

Furthermore, interest rates significantly influence farmers' ability to access credit for purchasing essential agricultural inputs like seeds, fertilizers, and crop protection products. Higher interest rates can increase the cost of loans for farmers, potentially leading them to reduce their spending on these inputs. This reduced demand for agricultural products directly affects FMC's sales volumes and overall revenue.

- Interest Rate Impact: The US central bank's monetary policy decisions, including adjustments to the federal funds rate, directly influence borrowing costs for companies like FMC.

- Capital Expenditure: Higher interest rates (e.g., a 1% increase) can add millions to the cost of financing large capital projects over their lifespan.

- Farmer Affordability: Increased interest rates on agricultural loans can reduce farmers' purchasing power for crucial inputs, potentially impacting FMC's sales by 2-5% in affected regions.

Global economic conditions directly influence agricultural markets, affecting farmer profitability and their capacity to invest in crop protection solutions. For instance, the USDA projected U.S. net farm income to decrease to $177.1 billion in 2024, down from $183.9 billion in 2023, indicating potential headwinds for input spending.

Inflationary pressures increase FMC's operational costs, from raw materials to energy, impacting profit margins if not effectively managed through pricing or efficiency gains. The Producer Price Index for finished goods in the U.S. saw increases in early 2024, highlighting these cost pressures.

Currency exchange rate volatility affects FMC's reported earnings and international competitiveness. A stronger U.S. dollar, for example, can reduce the value of foreign sales when translated back into dollars, as seen when foreign currency translation negatively impacted FMC's sales by approximately 1% in 2023.

Interest rate changes influence FMC's cost of capital and farmers' access to credit, potentially impacting investment decisions and demand for agricultural inputs. Higher rates can make expansion projects more costly and reduce farmers' purchasing power.

| Economic Factor | 2024 Projection/Trend | Impact on FMC | Supporting Data |

|---|---|---|---|

| Global GDP Growth | Projected at 3.2% (IMF) | Supports demand for agricultural products and inputs. | IMF forecasts 3.2% for 2024 and 2025. |

| Commodity Prices | Mixed, with some price pressures | Affects farmer profitability and input spending. | U.S. Net Farm Income projected down in 2024. |

| Inflation | Persistent | Increases FMC's operating costs. | Rising U.S. Producer Price Index. |

| Interest Rates | Elevated | Increases borrowing costs and impacts farmer credit. | Federal Reserve rate adjustments in 2023-2024. |

| Currency Exchange Rates | Volatile | Impacts reported sales and international competitiveness. | 1% negative impact on FMC sales in 2023 due to currency. |

Preview Before You Purchase

FMC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FMC PESTLE Analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights to inform strategic decision-making.

Sociological factors

The world's population is projected to reach approximately 9.7 billion by 2050, a significant increase that directly fuels the demand for agricultural output. This escalating need for food security puts immense pressure on farming practices to become more productive and efficient. FMC, as a leading agricultural sciences company, is positioned to benefit from this trend by providing solutions that enhance crop yields and minimize losses.

Effective crop protection is paramount in meeting these growing food demands, as it helps farmers safeguard their harvests from pests and diseases. Minimizing post-harvest losses, which can account for substantial portions of food production, is also critical. FMC's innovative product portfolio addresses these challenges, contributing to a more resilient and productive global food supply chain.

Consumers are increasingly prioritizing health and environmental impact, driving a significant demand for sustainably produced, organic, and pesticide-residue-free food. This trend directly influences agricultural practices, pushing for innovation in crop protection. For instance, the global organic food market was valued at approximately $250 billion in 2023 and is projected to grow substantially in the coming years.

FMC needs to strategically adapt its offerings to align with these evolving consumer preferences. This means expanding its portfolio to include biologicals, biopesticides, and integrated pest management (IPM) solutions. The market for biopesticides alone is expected to reach over $10 billion by 2028, indicating a strong growth opportunity.

While this shift presents a challenge to established chemical product sales, it simultaneously opens avenues for new product development and market penetration. Companies that successfully integrate these sustainable solutions can capture a larger share of this expanding market segment.

Public sentiment towards agricultural chemicals significantly shapes the market for FMC's offerings. Concerns about health and environmental effects can trigger stricter regulations and consumer demand for 'cleaner' alternatives. For instance, a 2024 survey indicated that 65% of consumers are more likely to purchase produce they believe was grown with fewer synthetic pesticides.

This perception directly impacts regulatory bodies' decisions, potentially leading to bans or limitations on certain chemical classes. FMC's strategy must therefore include robust communication about product safety and a commitment to developing and promoting more sustainable crop protection solutions to maintain market access and consumer trust.

Labor Availability and Rural-Urban Migration

The ongoing shift of populations from rural areas to cities is a significant sociological factor impacting agriculture, and by extension, companies like FMC. This trend can create labor shortages in the agricultural sector, pushing farmers to seek out more efficient, less labor-intensive methods. For instance, in many developed nations, the agricultural workforce is aging, with fewer young people entering the field. In the US, the average age of a farmer is around 57.5 years old, and a significant portion of farmworkers are immigrants, whose availability can be affected by policy changes.

This demographic movement directly fuels the demand for automation and advanced crop protection solutions. FMC's portfolio, which includes technologies designed to reduce manual labor requirements and enhance operational efficiency, becomes increasingly attractive to farmers facing these challenges. The adoption of precision agriculture, for example, which uses data to optimize resource application, directly addresses the need for less labor and more targeted interventions.

The impact of rural-urban migration on farming models is profound. It necessitates a re-evaluation of traditional practices and accelerates the integration of technology. This demographic shift influences not only how crops are grown but also the types of products and services agricultural companies need to offer to remain competitive and relevant in the evolving landscape.

- Labor Shortages: Rural-urban migration exacerbates labor scarcity in agriculture, with countries like India seeing millions move to urban centers annually, impacting the availability of farmhands.

- Demand for Automation: This demographic trend drives demand for automated farming equipment and digital solutions, a market projected to grow significantly, with the global agricultural robotics market expected to reach billions by 2027.

- FMC's Strategic Position: FMC's focus on innovative crop protection and digital farming tools aligns with the industry's need for solutions that reduce reliance on manual labor and improve overall farm productivity.

- Shifting Farming Models: The sociological pressure encourages a transition towards more technologically advanced and capital-intensive farming, impacting investment decisions and operational strategies.

Health and Safety Concerns of Farm Workers

Heightened awareness and stricter regulations surrounding farm worker health and safety, particularly concerning agricultural chemicals, are pushing for innovations in safer product formulations and application techniques. FMC's commitment to research and development is crucial here, focusing on products with reduced toxicity and providing thorough training and safety protocols for their application.

Compliance with these worker safety standards is not just a legal requirement but also vital for maintaining FMC's reputation and ensuring operational continuity. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stricter guidelines for pesticide applicators, impacting product labeling and training mandates.

- Regulatory Scrutiny: Increased government oversight on chemical handling, as seen with ongoing reviews of pesticide safety data by agencies like the EPA, directly influences FMC's product development pipeline.

- Worker Well-being: A focus on reducing exposure risks for farm laborers, a demographic often facing occupational health challenges, necessitates investment in lower-hazard active ingredients and improved personal protective equipment (PPE) recommendations.

- Reputational Risk: Incidents involving worker exposure can lead to significant fines, lawsuits, and damage to brand image, making proactive safety measures a core business imperative for FMC.

The increasing global population, projected to exceed 9.7 billion by 2050, directly drives demand for enhanced agricultural productivity, a key area for FMC. This demographic shift, coupled with a growing consumer preference for sustainably sourced food, pushes for innovation in crop protection and yield enhancement solutions, areas where FMC is strategically positioned.

Sociological factors like the rural-urban migration trend create labor shortages in agriculture, increasing demand for automation and efficient farming practices. FMC's focus on digital farming tools and advanced crop protection technologies directly addresses this need, aligning with the industry's move towards more technologically driven and less labor-intensive models.

Heightened awareness and stricter regulations concerning farm worker health and safety are prompting a demand for safer product formulations and application methods. FMC's commitment to developing lower-toxicity products and providing robust safety protocols is essential for compliance and maintaining its market reputation amidst evolving standards.

| Sociological Factor | Impact on Agriculture | FMC's Strategic Response | Relevant Data (2024/2025) |

|---|---|---|---|

| Population Growth | Increased demand for food security and higher crop yields | Developing advanced crop protection and yield-enhancing solutions | Global population projected to reach 9.7 billion by 2050 |

| Consumer Preferences | Demand for organic, sustainable, and pesticide-residue-free food | Expanding portfolio to include biologicals and biopesticides | Global organic food market valued at ~$250 billion in 2023; Biopesticide market projected to exceed $10 billion by 2028 |

| Rural-Urban Migration | Agricultural labor shortages and increased demand for automation | Focus on digital farming tools and labor-reducing technologies | Average age of US farmer ~57.5 years; Agricultural robotics market growth |

| Worker Health & Safety | Stricter regulations and demand for safer chemical handling | Developing lower-toxicity products and promoting safety protocols | EPA's continued emphasis on stricter pesticide applicator guidelines (2024) |

Technological factors

Technological advancements in precision agriculture are revolutionizing farming. GPS-guided tractors, soil sensors, and drone imagery enable hyper-localized application of inputs, significantly boosting efficiency. For instance, the global precision agriculture market was valued at approximately $8.5 billion in 2023 and is projected to reach over $20 billion by 2030, indicating robust growth.

FMC can leverage these trends by integrating its crop protection solutions with digital farming platforms. This synergy allows for optimized product usage, minimizing waste and maximizing effectiveness for farmers. By aligning with these digital ecosystems, FMC can enhance its value proposition and drive adoption of its products in a data-driven agricultural landscape.

This evolving technological environment necessitates FMC's proactive development of digital tools and strategic partnerships. Collaborating with ag-tech companies and data analytics providers will be crucial for FMC to offer integrated solutions that meet the sophisticated needs of modern, digitally-enabled agriculture. This strategic focus will ensure FMC remains competitive and relevant in the rapidly advancing ag-tech sector.

Breakthroughs in biotechnology, like CRISPR gene editing, are revolutionizing crop development. These advancements can boost plant resilience against pests and diseases, potentially shifting demand for traditional chemical crop protection solutions. For instance, by 2024, genetically modified crops with enhanced pest resistance are projected to cover over 200 million hectares globally, impacting the market for insecticides.

While some biotechnological progress may lessen the reliance on specific pesticides, it can also introduce novel challenges that necessitate innovative responses from FMC. The company needs to stay abreast of these dynamic crop trait developments to ensure its product portfolio remains relevant and effective in the evolving agricultural landscape.

FMC Corporation consistently channels significant resources into research and development, focusing on discovering novel active ingredients and crafting advanced formulations. This commitment is vital for creating products that are not only more effective but also safer for users and the environment. For instance, in 2023, FMC reported R&D expenses of $345 million, underscoring their dedication to innovation.

The development of active ingredients with new modes of action is particularly crucial for addressing the growing challenge of pest resistance. Simultaneously, advancements in formulation technology allow FMC to enhance product efficacy, improve application efficiency, and minimize off-target environmental effects. This continuous innovation pipeline is a cornerstone of FMC's strategy to maintain its competitive edge in the agricultural chemical market.

Emerging Technologies in Pest Detection and Monitoring

The integration of artificial intelligence (AI), machine learning (ML), drones, and remote sensing is revolutionizing pest detection and monitoring, presenting significant opportunities for FMC. These advanced technologies allow for real-time identification and tracking of pests and diseases, enabling more targeted and efficient interventions. For instance, AI-powered image analysis from drones can detect early signs of infestation with remarkable accuracy, potentially reducing crop losses by up to 20% according to industry estimates for 2024.

These innovations facilitate proactive and precise pest management strategies, which in turn can lead to a reduction in overall chemical usage. By pinpointing affected areas with greater precision, FMC can optimize the application of its crop protection products, enhancing their effectiveness while minimizing environmental impact. This approach aligns with the growing demand for sustainable agricultural practices, a trend expected to continue shaping the market through 2025.

FMC can strategically leverage or partner with leading developers in these technological fields to bolster its service offerings and refine its product recommendations. Such collaborations could lead to integrated solutions that provide growers with actionable insights, thereby strengthening FMC's competitive position in the agricultural technology landscape. The global market for agricultural drones, a key component of this technological shift, was valued at over $2.5 billion in 2023 and is projected to grow substantially in the coming years.

- AI and ML for early pest identification: Enabling predictive analytics for pest outbreaks.

- Drone-based surveillance: Providing high-resolution imagery for precise monitoring.

- Remote sensing integration: Offering broad-scale data for regional pest management.

- Reduced chemical application: Leading to cost savings and environmental benefits for farmers.

Development of Biological and Bio-control Solutions

The agricultural sector's increasing emphasis on sustainability is fueling rapid technological progress in biological and bio-control solutions. This includes advancements in biopesticides, pheromones, and beneficial microorganisms, offering alternatives to conventional chemical treatments.

FMC Corporation is actively investing in and expanding its biological product lines to cater to this growing market demand for environmentally friendly agricultural inputs. This strategic move is vital for meeting consumer and regulatory preferences for greener farming practices and broadening FMC's product portfolio beyond synthetic chemicals.

- Market Growth: The global biopesticides market was valued at approximately $6.5 billion in 2023 and is projected to reach over $15 billion by 2030, indicating substantial growth driven by sustainability trends.

- FMC's Strategy: FMC has been strategically acquiring and developing biological solutions, aiming to derive a significant portion of its revenue from these offerings in the coming years.

- Innovation Focus: Key areas of innovation include microbial inoculants, plant health enhancers, and targeted bio-insecticides, all designed to improve crop yield and resilience with reduced environmental impact.

Technological advancements in precision agriculture, including AI-driven pest detection and drone surveillance, are enabling more targeted and efficient crop protection. These innovations, projected to significantly reduce chemical usage, are reshaping how farmers manage their fields, with the agricultural drone market alone exceeding $2.5 billion in 2023.

Biotechnology, particularly gene editing like CRISPR, is revolutionizing crop development by enhancing resilience to pests and diseases, potentially altering the demand for traditional chemical solutions. By 2024, genetically modified crops with improved pest resistance are expected to cover over 200 million hectares globally, impacting the insecticide market.

FMC's substantial R&D investment, totaling $345 million in 2023, focuses on novel active ingredients and advanced formulations to address pest resistance and improve product efficacy. This commitment to innovation is crucial for maintaining competitiveness in a rapidly evolving ag-tech landscape, especially with the growing market for biologicals, valued at $6.5 billion in 2023.

Legal factors

FMC Corporation faces significant hurdles with product registration and approval processes, which are often lengthy and country-specific for agricultural chemicals. This directly impacts their ability to bring new products to market globally, with varying timelines across different regions.

Navigating these complex legal landscapes demands considerable investment in regulatory expertise and the generation of extensive data to meet diverse national requirements. For instance, the European Union's stringent REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, which came into full effect in 2018, represent a substantial undertaking for any chemical company seeking market access.

Any delays or outright rejections in these approval processes can have a material impact on FMC's revenue forecasts and their competitive standing in key markets. In 2023, FMC reported that regulatory approvals were a key factor in their product launch timelines, underscoring the financial implications of these legal frameworks.

Environmental regulations are tightening worldwide, impacting FMC's operations. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to influence chemical usage, requiring extensive data submission and potentially restricting certain substances vital for agricultural solutions.

These evolving rules mean FMC must invest in research and development for safer, more sustainable product alternatives and adapt manufacturing processes to meet stricter water quality and waste disposal standards. Failure to comply can result in significant penalties, as seen with past fines levied against chemical companies for environmental violations, impacting profitability and brand image.

Strong intellectual property rights and patent protection are paramount for FMC, a leader in agricultural sciences, to secure its substantial investments in research and development for innovative active ingredients and advanced crop protection formulations. The company's ability to innovate hinges on robust legal safeguards that allow it to recoup its R&D expenditures.

The duration and scope of patent exclusivity directly shape FMC's market entry strategies and long-term profitability for its groundbreaking products. For instance, patent expirations can lead to significant revenue declines as generic competitors enter the market, making patent lifecycle management a critical business function.

FMC continually navigates the legal complexities of protecting its innovations against counterfeiting and unauthorized use, a persistent challenge in the global agrochemical sector. In 2023, the global market for counterfeit pesticides was estimated to be worth billions, highlighting the significant financial and reputational risks FMC faces.

Product Liability and Safety Regulations

FMC Corporation operates within a legal landscape heavily influenced by product liability and stringent safety regulations. The company must ensure its agricultural chemicals and solutions meet rigorous standards throughout their entire lifecycle, from development and manufacturing to their ultimate application by end-users. Failure to comply can lead to significant legal challenges.

Litigation stemming from claims of product-related harm to humans, animals, or the environment represents a substantial legal risk for FMC. Such legal battles can result in severe financial penalties, including damages and settlements, and can also inflict considerable damage to the company's reputation. For instance, in 2023, the agricultural sector saw ongoing legal scrutiny over pesticide impacts, underscoring the need for proactive risk management.

To mitigate these legal exposures, FMC is legally obligated to maintain robust quality control systems. This includes implementing comprehensive testing protocols and ensuring the highest standards in manufacturing processes. Furthermore, providing clear, accurate labeling on all products, detailing proper usage, potential hazards, and emergency procedures, is a critical legal requirement. Adherence to user safety guidelines is paramount in preventing incidents and demonstrating due diligence.

- Product Lifecycle Compliance: FMC must adhere to regulations covering research, manufacturing, distribution, and end-use of its products.

- Litigation Risks: Potential for lawsuits due to alleged product harm or environmental damage, leading to financial and reputational costs.

- Regulatory Adherence: Strict compliance with safety standards and government oversight bodies is essential.

- Quality Control & Labeling: Imperative to have strong quality assurance and transparent, informative product labeling for user safety.

International Trade Laws and Compliance

FMC Corporation navigates a complex web of international trade laws, impacting its global operations. This includes adhering to import/export regulations, sanctions lists, and anti-dumping duties, which directly influence its supply chain and market access. For instance, in 2023, the U.S. Department of Commerce continued to enforce trade restrictions on certain agricultural inputs from specific countries, potentially affecting FMC's sourcing strategies.

Geopolitical shifts and evolving trade policies can create significant disruptions. Changes in tariffs or the imposition of new sanctions can impede the cross-border movement of essential raw materials and finished products, as well as the protection of intellectual property. FMC's ability to adapt to these dynamic legal landscapes is crucial for maintaining seamless international business.

Compliance with these intricate legal frameworks is non-negotiable for FMC's sustained global presence. Failure to comply can result in substantial fines, reputational damage, and operational halts. Ensuring adherence to international trade laws underpins FMC's capacity for uninterrupted global business activities and market participation.

- Import/Export Regulations: FMC must comply with varying customs duties and documentation requirements across different nations.

- Sanctions Compliance: Adherence to international sanctions regimes, such as those imposed by the UN or individual countries, is critical to avoid penalties.

- Anti-Dumping Measures: FMC needs to monitor and comply with anti-dumping duties that may be levied on its products or those of its competitors in certain markets.

- Intellectual Property Protection: Safeguarding patents and other IP across jurisdictions is vital, with international trade laws playing a role in cross-border enforcement.

FMC Corporation's legal and regulatory environment is a critical factor shaping its operations and market strategy. Navigating complex product registration, intellectual property protection, and stringent environmental and safety standards requires significant investment and ongoing adaptation. The company's ability to successfully manage these legal obligations directly impacts its financial performance and global competitiveness.

In 2024, FMC continues to face evolving legal landscapes, particularly concerning chemical safety and environmental impact, with regulations like REACH in Europe demanding continuous data generation and compliance efforts. The company's robust patent portfolio, a key asset, is constantly under pressure from potential infringements and the natural expiration of exclusivity periods, necessitating proactive legal strategies for IP defense and lifecycle management.

Furthermore, product liability and litigation risks remain a significant concern, as highlighted by ongoing scrutiny in the agricultural sector regarding pesticide impacts. FMC's commitment to rigorous quality control and transparent product labeling is not only a best practice but a legal imperative to mitigate these risks and ensure user safety, with potential fines for non-compliance remaining a substantial deterrent.

International trade laws and sanctions also present ongoing challenges, requiring FMC to meticulously manage its global supply chains and market access to avoid penalties and operational disruptions. Adapting to shifts in trade policies, tariffs, and anti-dumping measures is essential for maintaining seamless international business operations and protecting its global market share.

Environmental factors

Climate change is significantly reshaping agriculture. Altered weather patterns, more frequent extreme events like droughts and floods, and changing pest and disease landscapes directly affect crop yields. For FMC, this means an increasing demand for products that bolster crop resilience and help farmers manage climate-related risks, driving innovation in sustainable solutions.

Global water scarcity is intensifying, with projections indicating that by 2050, over 5 billion people could experience water stress. This reality directly impacts agriculture, a core market for FMC. The need for crops to be grown with less water means FMC's product development must prioritize water-efficient solutions. For instance, innovations in seed treatments and crop protection that require less irrigation are becoming critical.

Water quality concerns are equally pressing, as agricultural run-off containing pesticides and fertilizers can contaminate freshwater sources. Regulatory bodies are increasingly scrutinizing the environmental persistence and impact of agrochemicals. This regulatory pressure, coupled with growing public awareness, pushes FMC to innovate towards formulations with reduced environmental impact and greater biodegradability, aligning with a global trend where water stewardship is a key business imperative.

Growing concerns over biodiversity loss, especially the impact on vital pollinators like bees, are intensifying regulatory pressure on pesticide use. FMC faces increasing demands to develop and promote products that safeguard non-target organisms and bolster overall ecosystem resilience.

In response, FMC is investing in R&D for more targeted pesticide formulations and biological control agents. For instance, the company's focus on precision agriculture solutions aims to reduce the overall volume of chemicals applied, thereby minimizing off-target effects. This aligns with a broader industry trend, as global investment in biologicals for crop protection is projected to reach billions by 2025.

Soil Health and Sustainable Land Management

The agricultural industry's growing emphasis on soil health and sustainable land management, including techniques like no-till farming and minimizing soil disturbance, directly impacts the demand for specific crop protection products and their application methods. FMC can capitalize on this trend by innovating products that align with these environmentally conscious practices, thereby fostering soil fertility and ensuring sustained agricultural output. For instance, the global soil health market was valued at approximately USD 10 billion in 2023 and is projected to grow significantly in the coming years, driven by increasing awareness of soil degradation and the need for regenerative agriculture.

FMC's strategic response could involve developing and promoting crop protection solutions that actively support soil microbiome health, a critical component of robust soil ecosystems. As farmers increasingly adopt practices that preserve and enhance soil biology, products that are compatible with or even beneficial to beneficial soil organisms will see greater adoption. This shift is evidenced by the rising investment in biologicals and biostimulants, which are often integrated into soil health management programs. In 2024, the global biopesticides market alone was estimated to be worth over USD 25 billion, showcasing a strong market appetite for these nature-derived solutions.

Key considerations for FMC in this environmental factor include:

- Product Development: Creating crop protection agents that are less disruptive to soil structure and beneficial microbial communities.

- Application Technology: Innovating application methods that reduce soil compaction and chemical runoff, such as precision application systems.

- Market Positioning: Highlighting products that contribute to soil health and sustainability in marketing efforts, aligning with farmer priorities.

- Research & Development: Investing in R&D for biological control agents and integrated pest management (IPM) solutions that complement soil health initiatives.

Waste Management and Product Life Cycle Assessment

FMC faces significant environmental scrutiny regarding waste generated throughout its operations, from chemical manufacturing byproducts to consumer packaging and the disposal of unused agricultural chemicals. In 2024, the agricultural sector, a key market for FMC, saw increased focus on reducing chemical waste, with some regions implementing stricter regulations on pesticide container disposal. For instance, the European Union's Farm to Fork strategy continues to push for reduced chemical usage and better waste management in agriculture.

To mitigate its environmental impact, FMC is investing in robust waste management systems and conducting thorough product life cycle assessments. These assessments help identify environmental hotspots from raw material extraction to end-of-life disposal. By 2025, the company aims to have completed LCAs for its major product lines, providing data to guide sustainability improvements.

Key strategies for FMC include developing more sustainable packaging solutions and promoting responsible product use and disposal among its customers. This involves initiatives like:

- Enhancing recycling rates for product packaging: FMC is exploring biodegradable and easily recyclable materials for its product containers.

- Implementing take-back programs: Facilitating the return and safe disposal of unused or expired chemicals.

- Educating farmers on best practices: Providing guidance on proper application and disposal to minimize environmental contamination.

- Investing in circular economy principles: Seeking ways to repurpose waste streams into valuable resources.

Climate change necessitates agricultural adaptation, driving demand for FMC's resilience-focused products. Water scarcity and quality concerns are pushing for water-efficient solutions and reduced environmental impact formulations. Biodiversity loss, particularly concerning pollinators, is leading to stricter regulations on pesticide use, prompting FMC to invest in targeted solutions and biologicals, with the biopesticides market projected to exceed USD 25 billion in 2024.

PESTLE Analysis Data Sources

Our FMC PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable market research firms, and leading economic indicators. This ensures that every facet of the political, economic, social, technological, legal, and environmental landscape is grounded in current and verifiable data.