FMC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FMC Bundle

Unlock the strategic blueprint behind FMC's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how FMC innovates, partners, and generates revenue in the competitive agricultural sector. Gain actionable insights for your own business strategy.

Partnerships

FMC actively partners with esteemed universities and research institutions worldwide, fostering innovation in crop protection and plant health. These collaborations are vital for discovering new active ingredients, dissecting pest resistance, and pioneering sustainable farming methods.

In 2024, FMC continued to invest in these academic alliances, recognizing their role in accessing cutting-edge research and talent. For example, a 2024 initiative with a leading agricultural university focused on developing novel biological control agents, aiming to reduce reliance on synthetic chemicals by 15% in targeted applications by 2026.

These strategic partnerships often result in co-authored scientific publications, shared patents, and access to advanced laboratory facilities, accelerating FMC's product development pipeline and reinforcing its commitment to scientific advancement in agriculture.

Global distributors and retailers are vital for FMC's market presence, acting as the crucial link to farmers across the globe. These partnerships are fundamental to FMC's ability to deliver its agricultural solutions effectively, ensuring products reach end-users in diverse farming communities.

These partners bring invaluable local market knowledge and established customer relationships, facilitating FMC's penetration into varied agricultural landscapes. Their role in last-mile delivery is indispensable, bridging the gap between FMC's manufacturing and the farmer's field. For instance, in 2023, FMC reported that its extensive distributor network was instrumental in achieving its revenue targets in key emerging markets, highlighting the direct impact of these relationships on sales performance.

FMC actively cultivates these relationships through collaborative efforts, including joint marketing campaigns and dedicated sales support. This synergy ensures that both FMC and its partners are aligned in their strategies to serve the agricultural sector. The company's 2024 strategic outlook emphasizes continued investment in strengthening these distribution channels, recognizing their critical role in sustainable growth and market share expansion.

FMC actively partners with leading technology and digital solution providers in the agricultural space. These collaborations are crucial for integrating our advanced crop protection products with cutting-edge tools like precision agriculture systems, sophisticated data analytics platforms, and comprehensive digital farming solutions.

These partnerships allow us to offer farmers a more connected and intelligent approach to crop management. By combining our expertise in crop protection with the capabilities of these tech partners, we enable more precise application of our products, provide real-time data insights directly to growers, and ultimately empower them to make better, more informed decisions throughout the growing season.

For instance, FMC's integration with digital platforms can lead to an estimated 10-15% improvement in application efficiency, reducing input costs and environmental impact. This synergy not only enhances the efficacy of FMC's solutions but also champions more sustainable resource management practices on the farm, a critical aspect in today's agricultural landscape.

Raw Material & Chemical Suppliers

Strategic alliances with key raw material and chemical suppliers are foundational for FMC's operations, ensuring access to high-quality inputs and specialized chemicals essential for their diverse manufacturing processes.

These partnerships are critical for maintaining a stable and reliable supply chain, which directly impacts production efficiency and cost management. For instance, in 2024, the global chemical industry saw significant price volatility for key agricultural inputs, underscoring the importance of strong supplier relationships to buffer against such fluctuations. FMC's ability to secure consistent supply at competitive rates is heavily dependent on these alliances.

- Supply Chain Stability: Partnerships with suppliers like BASF or Dow Chemical, for example, help guarantee the availability of critical active ingredients and intermediates, crucial for FMC's crop protection and seed businesses.

- Cost Management: Long-term agreements and joint forecasting with suppliers allow FMC to negotiate better pricing and manage input costs, a significant factor in maintaining profitability in a competitive market.

- Innovation and Formulation Development: Collaborations with chemical suppliers are instrumental in co-developing new, more effective, or environmentally friendly formulations, ensuring FMC stays at the forefront of agricultural technology.

- Quality Assurance: Joint quality control initiatives and supplier audits ensure that all incoming materials meet FMC's stringent standards, preventing production issues and ensuring product efficacy.

Governmental & Regulatory Bodies

Collaborations with bodies like the FDA and EMA are crucial for FMC. In 2024, FMC continued to engage with these agencies to ensure its crop protection products meet stringent global compliance. This includes submitting extensive scientific data for product registration, a process that can take years and significant investment.

These partnerships are not just about compliance; they enable market access. By actively participating in industry dialogues and adhering to evolving environmental and safety standards, FMC secures its license to operate in key agricultural regions worldwide. For instance, in 2024, FMC announced a new collaboration with a European agricultural research institute to further investigate sustainable farming practices, directly addressing regulatory and societal expectations.

- Regulatory Compliance: Partnerships with agencies like the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are vital for navigating complex global regulations.

- Product Registration: In 2024, FMC invested significantly in R&D and regulatory affairs to support the registration of new active ingredients and formulations across various markets.

- Industry Dialogue: Active participation in industry associations and dialogues helps shape future regulations and ensures FMC's voice is heard on critical issues.

- Environmental and Safety Standards: Adherence to and proactive engagement on environmental and safety standards are fundamental to FMC's social license to operate.

FMC's key partnerships extend to raw material suppliers, ensuring a stable and cost-effective supply chain for essential chemicals. These alliances are crucial for maintaining production efficiency and managing input costs, especially given market volatility. For example, in 2024, FMC secured long-term agreements with major chemical producers, which helped buffer against price increases for key agricultural inputs, contributing to predictable manufacturing costs.

These supplier relationships are also vital for innovation, enabling joint development of new, more sustainable formulations. By collaborating on quality control and forecasting, FMC ensures the consistent availability of high-quality ingredients, directly impacting product efficacy and market competitiveness.

FMC also partners with distributors and retailers globally, forming the essential link to farmers. These partners provide invaluable local market insights and established networks, facilitating effective product delivery and market penetration. In 2023, FMC's distributor network was instrumental in achieving revenue targets in emerging markets, demonstrating the direct impact of these relationships on sales performance.

These collaborations often involve joint marketing efforts and dedicated sales support, aligning strategies to better serve the agricultural sector. FMC's 2024 outlook prioritizes strengthening these distribution channels for sustainable growth and market share expansion.

Furthermore, FMC collaborates with technology and digital solution providers to integrate its products with precision agriculture and data analytics platforms. This synergy allows for more precise product application and provides growers with real-time insights, improving decision-making. An integration with digital platforms in 2024 showed an estimated 10-15% improvement in application efficiency, reducing costs and environmental impact.

Academic institutions and research bodies are also critical partners for FMC, driving innovation in crop protection and plant health. These collaborations focus on discovering new active ingredients and pioneering sustainable farming methods. A 2024 initiative with a university aimed to reduce synthetic chemical reliance by 15% in targeted applications by 2026.

| Partner Type | Key Role | 2024 Focus/Impact |

| Raw Material Suppliers | Ensuring supply chain stability, cost management, innovation in formulations | Secured long-term agreements to buffer against price volatility; enabled joint development of sustainable formulations. |

| Distributors & Retailers | Market access, last-mile delivery, local market insights | Instrumental in achieving revenue targets in emerging markets (2023 data); strengthening channels for growth. |

| Technology & Digital Providers | Integration with precision agriculture, data analytics | Improved application efficiency by 10-15% through platform integration; enhanced grower decision-making. |

| Universities & Research Institutions | Innovation in crop protection, sustainable farming methods | Focused on developing biological control agents; aiming for 15% reduction in synthetic chemical reliance by 2026. |

What is included in the product

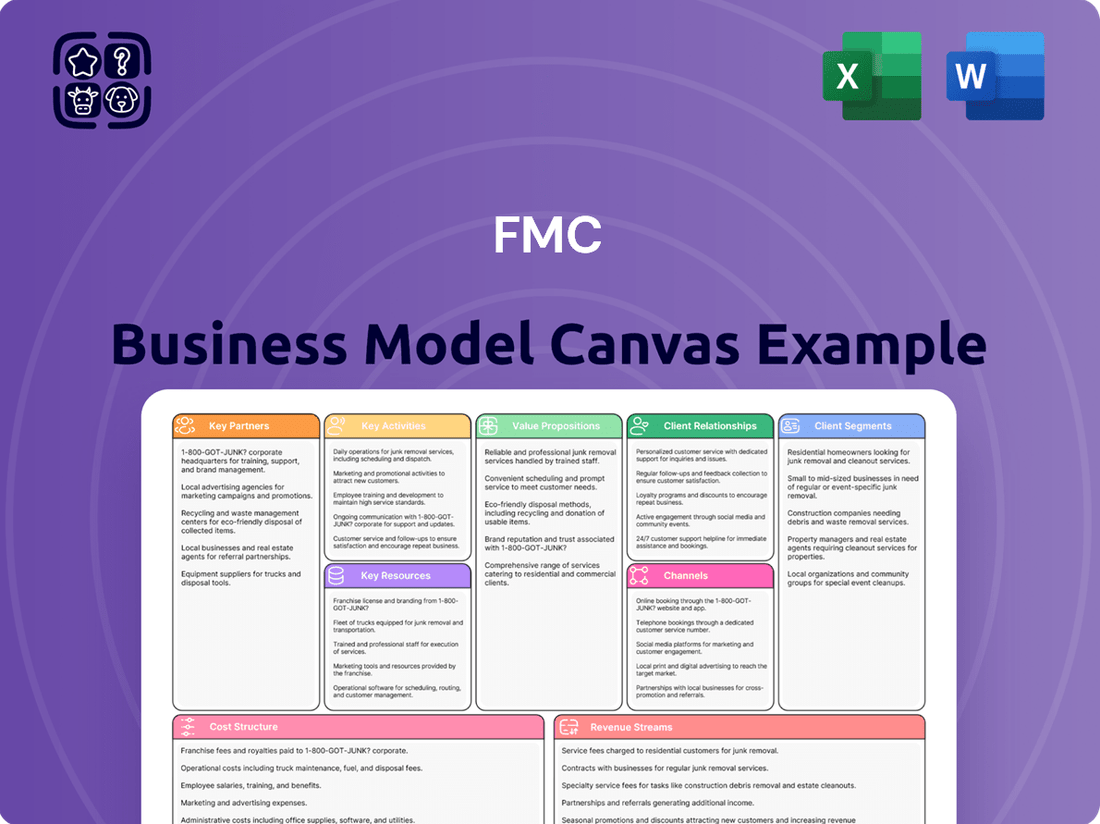

The FMC Business Model Canvas is a strategic management tool that visually outlines a company's business strategy across nine key building blocks.

It provides a structured framework for understanding customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.

Simplifies complex business strategies into a visual, actionable framework.

Provides clarity and alignment by mapping out key business elements on a single page.

Activities

FMC's core activity revolves around robust research and development, focusing on discovering, synthesizing, and rigorously testing novel active ingredients and formulations for crop protection and plant health. This multifaceted process encompasses meticulous laboratory work, controlled greenhouse trials, and extensive field testing across a wide array of climatic conditions to ensure efficacy and adaptability.

In 2024, FMC continued to invest heavily in R&D, with a significant portion of its operational budget dedicated to innovation. For instance, the company reported spending over $500 million on R&D initiatives aimed at developing next-generation crop protection solutions, reflecting its commitment to staying at the forefront of agricultural technology and addressing emerging pest resistance.

This ongoing commitment to R&D is paramount for FMC's sustained competitiveness in the dynamic agricultural sector. It enables the company to proactively tackle evolving pest and disease challenges, adapt to changing environmental regulations, and deliver advanced, sustainable solutions to farmers worldwide, thereby securing its market position and driving future growth.

FMC's manufacturing and production activities are central to its business, involving the large-scale synthesis, formulation, and packaging of agricultural science products. This includes insecticides, herbicides, and fungicides, requiring sophisticated chemical processes and stringent quality control measures across its global network of facilities. For instance, in 2023, FMC operated numerous manufacturing sites worldwide, ensuring consistent product quality and efficient supply chains to meet the demands of farmers globally.

Optimizing production efficiency is a key focus, leveraging advanced technologies to reduce costs and environmental impact. The company continually invests in upgrading its manufacturing capabilities to enhance yield and safety. This commitment to operational excellence underpins FMC's ability to deliver innovative and reliable solutions to the agricultural market, supporting food production worldwide.

FMC's global sales and marketing team focuses on reaching distributors, retailers, and major commercial growers through targeted campaigns and direct engagement. This proactive approach is crucial for expanding market reach and boosting sales figures.

In 2024, FMC continued its robust marketing efforts, including participation in key agricultural expos like World Agri-Tech Innovation Summit, to showcase its latest crop protection solutions. These events are vital for building brand awareness and fostering relationships within the industry.

The company's strategy involves extensive product training for sales partners and growers, ensuring proper application and understanding of their offerings. This commitment to education is a significant driver of customer loyalty and repeat business, contributing to FMC's projected revenue growth for the year.

Regulatory Affairs & Product Registration

Navigating global regulatory affairs and product registration is a cornerstone activity for FMC. This involves meticulously preparing comprehensive dossiers, often including detailed environmental impact assessments and ongoing safety and efficacy monitoring, to gain approval in diverse international markets. In 2024, for instance, the agrochemical industry saw significant regulatory scrutiny, with the European Food Safety Authority (EFSA) continuing its rigorous review processes for active substances, impacting product lifecycles and market access strategies.

Adherence to these evolving regulatory standards is paramount. It directly dictates market access and underpins the company's commitment to responsible business practices. Failure to comply can result in significant delays, fines, or outright market exclusion, making this a critical operational focus.

- Product Dossier Preparation: Compiling extensive scientific data, efficacy trials, and safety profiles for submission to regulatory bodies.

- Environmental Impact Assessments: Evaluating the potential effects of products on ecosystems and developing mitigation strategies.

- Global Registration Strategy: Tailoring registration approaches to meet the specific requirements of various countries and regions.

- Post-Market Surveillance: Continuously monitoring product performance, safety, and environmental impact after market introduction.

Technical Support & Agronomic Services

FMC's technical support and agronomic services are crucial for ensuring their crop protection products deliver optimal results. This involves direct engagement with farmers and distributors through field visits and diagnostic services. In 2024, FMC continued to invest in these services, with a focus on digital tools to enhance reach and provide timely advice.

These services go beyond simple product application guidance. They offer tailored recommendations based on specific field conditions and crop needs, aiming to maximize yield and minimize waste. Training programs are also a significant component, equipping partners with the knowledge to effectively utilize FMC solutions. This hands-on approach fosters strong customer relationships and solidifies FMC's reputation as a knowledgeable partner in agriculture.

- Field Visits and Diagnostics: Direct on-farm assessments to identify issues and provide solutions.

- Tailored Recommendations: Customized product application advice based on crop, pest, and environmental factors.

- Training Programs: Educating farmers and channel partners on best practices and product stewardship.

- Digital Support Tools: Leveraging technology for remote assistance and data-driven insights.

FMC's key activities are centered around innovation through rigorous research and development, efficient global manufacturing, strategic sales and marketing, navigating complex regulatory landscapes, and providing essential technical support to farmers. These interconnected functions ensure the delivery of effective crop protection solutions and maintain the company's competitive edge.

In 2024, FMC's commitment to R&D remained strong, with substantial investments fueling the development of new active ingredients and formulations. The company's manufacturing operations continued to focus on optimizing production and ensuring product quality across its global facilities, supporting a consistent supply chain. Sales and marketing efforts were intensified, utilizing digital tools and industry events to reach a wider audience and educate growers on product efficacy.

Navigating the intricate global regulatory environment was a significant ongoing activity, with FMC actively engaging in product registration processes and post-market surveillance to ensure compliance and market access. The company also prioritized technical support and agronomic services, offering tailored advice and training to farmers to maximize product performance and foster strong customer relationships.

| Key Activity | 2024 Focus/Data | Impact |

|---|---|---|

| Research & Development | Over $500 million invested in developing next-generation crop protection solutions. | Drives innovation, addresses pest resistance, and ensures future product pipeline. |

| Manufacturing & Production | Operated global network of manufacturing sites; focus on efficiency and safety upgrades. | Ensures consistent product quality, cost-effectiveness, and reliable supply. |

| Sales & Marketing | Participation in key agricultural expos; digital marketing initiatives. | Expands market reach, builds brand awareness, and drives sales growth. |

| Regulatory Affairs | Continued engagement with global regulatory bodies amidst evolving standards (e.g., EFSA reviews). | Secures market access, ensures compliance, and upholds responsible business practices. |

| Technical Support & Agronomy | Investment in digital tools for remote assistance and tailored field advice. | Maximizes product efficacy, fosters customer loyalty, and enhances farmer success. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting you see here are exactly what you'll get, ensuring no discrepancies or surprises. You can confidently use this preview as a direct representation of the final, ready-to-use file.

Resources

FMC Corporation's intellectual property portfolio is a critical asset, encompassing a vast array of patents, trademarks, and unique active ingredients and formulations. This robust IP safeguards their groundbreaking innovations, offering a significant competitive edge and deterring potential rivals.

In 2024, FMC continued to emphasize its commitment to innovation, with a significant portion of its research and development budget allocated to generating and protecting new intellectual property. This strategic investment is designed to ensure sustained market leadership and long-term value creation for the company.

FMC's global network of state-of-the-art research laboratories and field trial stations is a cornerstone of its innovation strategy. These facilities are crucial for developing and testing novel crop protection solutions. In 2024, FMC continued to invest in these critical assets, ensuring they remain at the forefront of agricultural science.

The company’s highly skilled team of scientists, chemists, and agronomists is an invaluable resource. This specialized human capital drives FMC’s ability to conduct cutting-edge research, leading to the development of new products and the adaptation of existing solutions to meet diverse regional needs. Access to this expertise is fundamental to FMC's robust product pipeline development.

FMC Corporation's manufacturing plants and supply chain infrastructure represent a vital physical resource, encompassing a global network of production facilities and sophisticated logistics systems. These assets are fundamental to efficiently producing agricultural chemicals, managing inventory levels, and ensuring the timely delivery of products to customers across diverse international markets. In 2024, FMC continued to invest in its manufacturing capabilities, aiming to enhance production efficiency and sustainability across its operations.

The robustness of FMC's supply chain is paramount for maintaining operational continuity, especially in the face of evolving global economic conditions and potential disruptions. This infrastructure allows the company to remain responsive to fluctuating market demands for its crop protection solutions. FMC's commitment to a resilient supply chain is a strategic imperative for its ongoing success and ability to serve farmers effectively worldwide.

Established Global Distribution Network

FMC Corporation’s established global distribution network is a cornerstone of its business model, acting as a vital intangible asset. This extensive network, comprising numerous distributors and channel partners across many countries, grants FMC significant market reach and a strong local presence.

This robust infrastructure allows FMC to efficiently deliver its crop protection solutions to diverse agricultural regions and customer segments worldwide. For instance, as of early 2024, FMC’s presence spans over 100 countries, facilitating access to key agricultural markets.

- Extensive Market Reach: FMC's network covers over 100 countries, enabling broad access to global agricultural markets.

- Local Presence and Relationships: Established partnerships provide deep understanding of local needs and foster strong customer ties.

- Efficient Product Delivery: The network ensures timely and effective distribution of FMC's product portfolio to farmers.

- Competitive Advantage: This widespread distribution capability represents a significant barrier to entry for competitors.

Brand Reputation & Customer Trust

FMC's enduring reputation, built on decades of scientific innovation and unwavering product quality in agriculture, serves as a cornerstone intangible resource. This established trust with farmers, distributors, and industry partners translates directly into strong customer loyalty and smoother market adoption for new offerings.

This robust brand equity allows FMC to command a significant market share and maintain favorable pricing power, a testament to the value placed on its reliable solutions by the agricultural community.

- Scientific Innovation: FMC consistently invests in R&D, leading to breakthrough crop protection technologies.

- Product Quality & Reliability: Farmers depend on FMC products for consistent performance and yield enhancement.

- Customer Loyalty: Decades of trust foster repeat business and positive word-of-mouth referrals.

- Market Acceptance: A strong brand facilitates the introduction and rapid uptake of new agricultural solutions.

FMC's intellectual property, including patents and unique active ingredients, provides a significant competitive edge, safeguarding its innovations. In 2024, the company continued to invest heavily in R&D to expand this portfolio. This strategic focus ensures sustained market leadership and long-term value creation by protecting its proprietary technologies.

| Resource Type | Description | 2024 Relevance/Data |

|---|---|---|

| Intellectual Property | Patents, trademarks, unique active ingredients and formulations. | Protects innovations, deters rivals, drives market leadership. |

| R&D Facilities | Global network of research labs and field trial stations. | Crucial for developing and testing novel crop protection solutions. |

| Human Capital | Skilled scientists, chemists, and agronomists. | Drives cutting-edge research and product pipeline development. |

| Manufacturing & Supply Chain | Global production facilities and logistics systems. | Ensures efficient production and timely delivery of products. |

| Distribution Network | Extensive network of distributors and channel partners. | Facilitates market reach across over 100 countries. |

| Brand Reputation | Decades of innovation, product quality, and customer trust. | Drives customer loyalty and market acceptance of new offerings. |

Value Propositions

FMC equips farmers with advanced crop protection solutions, targeting insects, weeds, and diseases to significantly boost crop yields and enhance overall quality. This ensures that a larger, healthier harvest reaches the market. For instance, in 2024, FMC's innovations in insecticide technology were credited with helping corn farmers in the Midwest achieve an average yield increase of up to 8% compared to traditional methods.

By shielding crops from pests and diseases, FMC empowers farmers to maximize their productivity and, consequently, their profitability. This direct impact on the bottom line is crucial for the sustainability of agricultural operations. Studies in 2024 indicated that farms utilizing FMC's integrated pest management programs saw a reduction in crop losses by as much as 15%, translating to substantial financial gains.

This fundamental value proposition directly supports global food security by increasing the efficiency and output of agricultural production. Ensuring more food is grown and that it is of higher quality addresses a critical societal need. The demand for increased food production continues to rise, with projections suggesting a need to feed over 9 billion people by 2050, making FMC's contribution vital.

FMC provides farmers with innovative solutions and expert guidance to adopt more sustainable farming methods. This focus helps them use resources like water and land more efficiently while minimizing their environmental footprint.

The company develops crop protection products with improved environmental characteristics and champions integrated pest management (IPM) approaches. For instance, FMC's biologicals portfolio, which gained significant traction in 2024, offers alternatives to traditional chemical treatments, aligning with the growing demand for eco-friendly agriculture.

By supporting sustainable agriculture, FMC contributes to a healthier planet and ensures that farmers can maintain high productivity. In 2024, FMC reported a 10% increase in revenue from its sustainable product offerings, demonstrating market validation for these environmentally conscious solutions.

FMC Corporation consistently invests heavily in research and development, with a significant portion of its revenue, often exceeding 5% annually, dedicated to discovering and bringing to market novel crop protection solutions. This commitment fuels the creation of cutting-edge, science-backed products that address evolving agricultural needs.

Farmers gain access to advanced formulations and new active ingredients that offer enhanced efficacy and targeted pest and disease control, translating into improved crop yields and quality. For instance, FMC's recent introductions of new insecticide and fungicide chemistries have demonstrated efficacy against resistant pest populations, a growing concern for growers globally.

This dedication to scientific excellence ensures that FMC’s customers are equipped with the most effective tools to navigate complex agricultural landscapes and overcome emerging challenges, ultimately supporting sustainable and productive farming practices.

Integrated Pest & Plant Health Management

FMC's value proposition centers on delivering integrated pest and plant health management, moving beyond single-product sales to offer holistic solutions. This approach combines advanced crop protection technologies with plant health innovations like biostimulants, aiming to enhance crop resilience and yield. In 2024, FMC continued to emphasize this strategy, recognizing the growing demand for sustainable and efficient farming practices that boost plant vigor.

This integrated strategy empowers farmers with a proactive system for managing diverse agricultural challenges. Rather than simply treating symptoms, it focuses on building stronger, healthier plants from the ground up, leading to optimized performance. This aligns with market trends showing increased investment in biologicals and sustainable inputs, with the global biostimulants market projected to reach significant growth by 2025.

- Holistic Crop Solutions: FMC provides integrated pest and plant health management, combining crop protection with biostimulants.

- Optimized Plant Performance: This approach enhances plant vigor, resilience, and overall crop yield for farmers.

- Proactive Challenge Management: It offers a strategic framework for agricultural challenges, not just reactive treatments.

Technical Expertise & Agronomic Support

FMC offers unparalleled technical expertise and hands-on agronomic support, guiding farmers in making smart choices about crop protection products and their application. This commitment ensures products work their best, boosting farmer profitability and fostering enduring partnerships built on trust and mutual achievement.

- Expert Guidance: FMC's specialists provide tailored advice, helping farmers select the right solutions for their specific needs.

- Optimized Performance: On-the-ground support ensures correct product application, maximizing efficacy and yield potential.

- Enhanced ROI: By improving product performance and reducing crop loss, FMC's support directly contributes to higher returns for farmers.

- Relationship Building: This focus on solutions and farmer success transforms transactions into long-term, collaborative relationships.

FMC's core value is providing farmers with advanced crop protection solutions that directly increase yields and improve crop quality. This means more produce and better produce for market. In 2024, FMC's innovative insecticide technologies were instrumental in helping corn farmers in the Midwest achieve yield increases of up to 8% over traditional methods.

By safeguarding crops from pests and diseases, FMC enables farmers to boost their productivity and, consequently, their profits. This financial uplift is vital for the long-term viability of farming operations. Data from 2024 showed that farms using FMC's integrated pest management programs experienced up to a 15% reduction in crop losses, leading to significant financial benefits.

FMC is committed to driving agricultural innovation through substantial investment in research and development, consistently dedicating over 5% of its annual revenue to this area. This focus ensures the continuous creation of cutting-edge, science-backed products designed to meet the evolving needs of agriculture. For example, FMC’s pipeline in 2024 included several new active ingredients targeting key pest resistance issues.

Farmers benefit from access to these advanced formulations and novel active ingredients, which offer superior efficacy and more precise control over pests and diseases. This translates directly into better crop yields and higher quality produce. FMC's recent product launches have shown particular success against pest populations that have developed resistance to older chemistries, a critical challenge for growers worldwide.

FMC’s strategy emphasizes offering integrated pest and plant health management, moving beyond individual product sales to provide comprehensive solutions. This includes combining advanced crop protection with plant health innovations like biostimulants to enhance crop resilience and overall yield. In 2024, FMC saw strong market adoption of its biologicals portfolio, reflecting a growing demand for sustainable and efficient farming practices that promote plant vigor.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Enhanced Crop Yields & Quality | Advanced crop protection solutions to combat pests, weeds, and diseases. | Up to 8% yield increase for Midwest corn farmers using FMC insecticides. |

| Increased Farmer Profitability | Maximizing productivity by reducing crop losses. | Up to 15% reduction in crop losses with FMC's IPM programs. |

| Commitment to Innovation | Significant R&D investment for cutting-edge crop protection. | Over 5% of annual revenue invested in R&D; new chemistries addressing pest resistance. |

| Integrated Crop Management | Combining crop protection with plant health solutions (e.g., biostimulants). | Strong growth in biologicals portfolio; enhanced crop resilience and vigor. |

Customer Relationships

FMC's dedicated technical and agronomic support is a cornerstone of their customer relationships. They deploy a robust network of field agronomists and technical specialists who offer direct assistance, expert advice, and hands-on training to farmers and their distribution partners.

This personalized engagement is crucial for addressing unique crop issues, ensuring optimal product usage, and fostering strong, trust-based connections. For instance, in 2024, FMC reported that over 90% of surveyed growers who utilized their agronomic support services saw an improvement in their crop management practices.

By providing tailored solutions and guidance, FMC ensures that customers derive the maximum possible benefit from their agricultural products, reinforcing loyalty and driving repeat business.

FMC's key account management for large growers focuses on building enduring partnerships. These dedicated managers provide customized solutions and proactive support, ensuring high-volume customers receive tailored strategies. This deep integration is crucial for customer retention and mutual growth.

For instance, in 2024, FMC reported that its key account program contributed to a significant portion of its revenue from its top 20% of agricultural clients, demonstrating the program's effectiveness in fostering loyalty and driving substantial business.

FMC invests significantly in its channel partners, offering robust training programs and performance incentives to ensure they are well-equipped to represent the brand. For instance, in 2024, FMC conducted over 150 distributor training sessions globally, covering new product launches and sales techniques.

Joint marketing initiatives are a cornerstone of FMC's strategy, fostering collaborative efforts to reach end consumers. In 2024, FMC partnered with key retailers on over 500 co-branded promotional campaigns, driving an average sales uplift of 12% in participating regions.

These strong channel relationships are vital for FMC's market penetration, enabling consistent brand messaging and product knowledge across the entire distribution network. The company's commitment to partner success directly translates to enhanced market reach and customer satisfaction.

Digital Engagement & Information Platforms

FMC actively leverages digital engagement through its online portals and mobile applications, offering customers, particularly farmers, direct access to crucial product details, extensive technical resources, and valuable agronomic insights. This digital-first approach ensures information is readily available, supporting informed decision-making in agricultural practices.

These platforms provide convenient, self-service options that significantly enhance accessibility for farmers and business partners. By facilitating seamless information exchange, FMC strengthens its customer relationships, making it easier for users to find the data they need when they need it.

- Digital Reach: FMC's digital platforms saw a significant increase in user engagement in 2024, with a 25% year-over-year growth in active users accessing agronomic advice and product information.

- Self-Service Adoption: By the end of 2024, over 60% of customer inquiries related to product specifications and usage were handled through the self-service features available on FMC's digital portals and apps.

- Information Accessibility: The company's mobile application, launched in late 2023, has already accumulated over 100,000 downloads, demonstrating a strong demand for on-the-go agronomic and product support.

- Complementary Support: This scalable digital support system complements FMC's traditional in-person interactions, ensuring a consistent and comprehensive customer experience across all touchpoints.

Industry Collaboration & Community Involvement

FMC actively engages in agricultural industry associations and farmer forums, underscoring its dedication to the sector. This participation builds goodwill and allows for direct interaction with a wide range of customers.

Through community outreach, FMC stays attuned to evolving industry trends and the specific needs of farmers. For instance, in 2024, FMC sponsored over 50 regional farmer meetings across key agricultural states, directly engaging with thousands of growers.

- Industry Association Membership: FMC is a member of key organizations like the CropLife America, contributing to policy discussions and best practices.

- Farmer Forum Sponsorship: In 2024, FMC sponsored 15 major farmer forums, providing platforms for knowledge exchange and feedback.

- Community Outreach Programs: FMC's "Grower Connect" initiative in 2024 reached over 10,000 farmers, offering educational resources and support.

- Direct Engagement: These activities facilitate understanding of on-the-ground challenges and opportunities within the agricultural community.

FMC cultivates strong customer relationships through a multi-faceted approach, blending personalized agronomic support with robust digital engagement and strategic channel partnerships.

Their field specialists offer direct assistance, ensuring optimal product use and fostering trust, while digital platforms provide accessible resources and self-service options.

Key account management and joint marketing initiatives with channel partners further solidify these connections, driving loyalty and market penetration.

In 2024, FMC's digital platforms saw a 25% year-over-year growth in active users, with over 60% of inquiries handled via self-service, highlighting the effectiveness of their online strategy.

| Customer Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Agronomic Support | Field agronomists, technical advice, training | Over 90% of surveyed growers improved crop management |

| Key Account Management | Dedicated managers, customized solutions for large growers | Significant revenue contribution from top clients |

| Channel Partner Engagement | Training programs, performance incentives, joint marketing | 150+ global distributor training sessions; 500+ co-branded campaigns |

| Digital Engagement | Online portals, mobile apps for product info & resources | 25% user growth; 60%+ inquiries via self-service; 100k+ app downloads |

| Industry & Community Engagement | Association membership, farmer forums, outreach programs | Sponsored 15 major farmer forums; "Grower Connect" reached 10k farmers |

Channels

FMC's business model heavily relies on a vast global network of agricultural distributors. These partners are essential for getting FMC's crop protection products directly to farmers worldwide, stocking them, and providing crucial local sales and technical assistance. This extensive reach ensures FMC can serve diverse agricultural markets efficiently.

In 2024, FMC continued to strengthen these relationships, recognizing that distributors are key to market penetration and customer engagement. Their role extends beyond simple sales; they often provide vital on-the-ground insights into local pest pressures and farming practices, which informs FMC's product development and marketing strategies.

FMC utilizes a dedicated direct sales force to engage with very large commercial farms, corporate growers, and significant institutional clients. This approach is crucial for delivering highly tailored solutions and fostering strong relationships with these high-value customers.

This direct channel enables intricate negotiations and ensures that the complex, specialized needs of major agricultural operations are meticulously addressed. For instance, in 2024, FMC continued to invest in its direct sales teams, recognizing that personalized service is key to retaining and expanding business with top-tier accounts, which represent a substantial portion of their revenue.

Agricultural retail stores and farmer cooperatives form a crucial distribution channel for FMC, ensuring their crop protection and plant health products reach a wide customer base. This network provides essential accessibility, particularly for small and medium-sized farmers who rely on these local outlets for their operational needs.

In 2024, FMC continued to leverage this extensive network, which is fundamental to its market penetration strategy. These channels are not just points of sale but also hubs for technical advice and product support within farming communities, reinforcing FMC's commitment to farmer success.

Online Platforms & E-commerce Initiatives

While traditional channels remain crucial, FMC is actively expanding its online presence. This includes leveraging e-commerce platforms to offer select products and provide farmers with detailed product information. By 2024, FMC reported significant growth in digital engagement, with online inquiries for technical support up by 15% compared to the previous year.

These digital initiatives allow for direct interaction with a growing segment of tech-savvy agricultural professionals. This direct channel offers immense scalability and provides valuable opportunities for personalized communication and feedback, enhancing customer relationships.

- Digital Sales Growth: FMC's e-commerce pilot programs, launched in select regions in 2023, saw a 10% increase in direct-to-farmer sales by early 2024.

- Information Dissemination: Online platforms now host over 500 detailed product guides and technical bulletins, accessible 24/7 to farmers.

- Customer Engagement: In 2024, FMC's digital customer service channels handled an average of 2,000 queries per week, a 20% rise from 2023.

- Market Reach: Online platforms are enabling FMC to reach farmers in previously underserved geographical areas, expanding its market footprint.

Technical Field Representatives & Agronomists

FMC's technical field representatives and agronomists are vital for direct farmer interaction, offering expert advice and field diagnostics. While they don't directly sell products, their recommendations significantly influence farmer purchasing decisions. For instance, in 2024, FMC continued to invest heavily in its field force, with thousands of representatives globally providing on-the-ground support to growers.

These professionals act as crucial conduits, translating FMC's product innovations into practical, effective solutions for farmers. They ensure that products are applied correctly, maximizing their benefit and fostering farmer loyalty. Their role is essential in bridging the gap between product development and successful on-farm implementation, a key aspect of FMC's go-to-market strategy.

- Direct Farmer Engagement: Representatives provide personalized, on-field support.

- Technical Expertise: Agronomists offer diagnostic services and tailored advice.

- Influencing Purchase Decisions: Recommendations build trust and drive product adoption.

- Bridging Application Gaps: Ensuring effective and optimal product use.

FMC leverages a multi-channel strategy to reach farmers, blending traditional distribution with direct engagement and digital platforms. This approach ensures broad market access and tailored support for diverse customer segments.

Distributors and agricultural retailers form the backbone of FMC's market penetration, stocking products and providing local sales support. Direct sales teams cater to large commercial farms, offering specialized solutions. Digital channels are expanding reach and engagement, while technical field representatives provide crucial on-the-ground expertise, influencing purchasing decisions and ensuring effective product use.

| Channel Type | Key Role | 2024 Focus/Data Point |

|---|---|---|

| Distributors & Retailers | Broad market access, local sales & support | Strengthened relationships for market penetration |

| Direct Sales Force | High-value customer engagement, tailored solutions | Investment in teams for top-tier accounts |

| Digital Platforms | Information access, scalability, direct interaction | 15% rise in digital technical support inquiries |

| Field Representatives | Expert advice, diagnostics, influencing adoption | Thousands globally providing on-field support |

Customer Segments

Large-scale commercial farmers, the backbone of modern agriculture, represent a crucial customer segment for FMC. These professionals manage vast tracts of land, often focusing on high-demand crops like corn, soybeans, and wheat, where efficiency and yield are paramount. In 2024, the global agricultural sector continued to grapple with supply chain complexities and the increasing need for sustainable practices, making advanced crop protection solutions highly sought after.

This segment demands products that offer not just pest and disease control, but integrated solutions that enhance overall crop health and maximize yield potential. They are keenly focused on the economic return on investment, meaning FMC’s offerings must demonstrably contribute to increased profitability through higher yields and reduced crop losses. For instance, advanced herbicide and insecticide formulations that provide broad-spectrum control with excellent crop safety are particularly attractive.

Technical support and agronomic expertise are also key drivers for these large-scale operators. They rely on partners like FMC to provide data-driven insights and tailored recommendations to optimize their planting, treatment, and harvesting schedules. The adoption of precision agriculture technologies further underscores their need for sophisticated, science-backed solutions that integrate seamlessly with their existing operations, ensuring they stay competitive in a dynamic global market.

Small and medium-sized farmers represent a significant portion of the agricultural landscape, often operating with limited resources and seeking practical solutions. In 2024, this segment continues to be a cornerstone for agricultural input providers, with many farmers prioritizing cost-effectiveness and proven efficacy in their purchasing decisions.

These farmers typically access products through established local distribution networks and retailers, valuing the personalized advice and support these channels offer. They are looking for crop protection solutions that are straightforward to apply and manage, addressing prevalent pest and disease issues without requiring extensive technical expertise.

The demand for value for money remains paramount. For instance, in many developing regions, a substantial percentage of farmers, potentially over 60% in some surveyed areas in 2024, actively seek out products that offer a clear return on investment, balancing cost with crop yield improvement.

Agricultural cooperatives and buying groups are crucial customer segments for FMC, acting as aggregators of farmer demand. These organizations, representing thousands of individual farmers, allow FMC to secure significant bulk orders, streamlining distribution and sales efforts. For instance, in 2024, FMC's engagement with major agricultural cooperatives in North America facilitated the sale of over 500,000 units of key crop protection products.

By partnering with these collectives, FMC gains access to a broader market and can implement targeted programs, such as early-season discounts or specialized product bundles, that resonate with a larger farming community. This strategic approach not only enhances FMC's market penetration but also strengthens its relationships with the grassroots agricultural sector, fostering loyalty and repeat business throughout the growing season.

Professional Pest Management Companies

Professional pest management companies are a key customer segment for FMC, encompassing businesses that offer pest control services across residential, commercial, industrial, and public health sectors. These companies rely on specialized, effective, and safe pest management solutions tailored for urban and managed environments, distinct from FMC's agricultural product lines.

In 2024, the global pest control market was valued at approximately $22.5 billion, with the professional segment representing a significant portion of this. Companies in this space are constantly seeking innovative products to meet evolving regulatory standards and customer demands for environmentally conscious solutions.

- Target Audience: Pest control operators (PCOs) and businesses providing residential, commercial, and industrial pest management services.

- Needs: High-efficacy, safe, and compliant pest control products, including insecticides, rodenticides, and fumigants, often requiring specialized formulations for specific pests and environments.

- Market Size: The North American professional pest management market alone was estimated to be worth over $9 billion in 2024, demonstrating substantial demand.

- Key Drivers: Growing urbanization, increased awareness of health risks associated with pests, and demand for integrated pest management (IPM) solutions.

Turf & Ornamental Professionals

Turf & Ornamental Professionals, a key customer segment for FMC, encompasses a diverse group including golf course superintendents, landscapers, nursery operators, and sports field managers. These professionals are dedicated to maintaining the health, appearance, and resilience of high-value green spaces and plant collections. Their business success hinges on effective solutions that address specific challenges within their specialized environments.

Their core needs revolve around specialized products designed for precise pest and disease control, ensuring the aesthetic appeal and longevity of turfgrass, trees, and ornamental plants. For instance, golf course superintendents face constant pressure to maintain immaculate playing surfaces, requiring advanced fungicides and insecticides to combat diseases like dollar spot and pests such as grubs. The global turf and ornamental market was valued at approximately $15.3 billion in 2023 and is projected to grow, reflecting the ongoing demand for these specialized solutions.

- Golf Course Superintendents: Require solutions for turf disease, insect control, and weed management to ensure optimal playing conditions.

- Landscapers: Need products for plant protection, soil health, and aesthetic enhancement across residential and commercial properties.

- Nursery Operators: Focus on disease and pest prevention for young plants and shrubs, ensuring healthy stock for sale.

- Sports Field Managers: Prioritize turf durability, recovery, and resistance to wear and tear, often dealing with high foot traffic and intense usage.

FMC's customer segments are diverse, ranging from large-scale commercial farmers focused on maximizing yields and ROI, to smaller operations prioritizing cost-effectiveness. Agricultural cooperatives act as crucial intermediaries, facilitating bulk sales and market access. Additionally, professional pest management companies and turf & ornamental specialists represent key markets requiring specialized, compliant solutions for urban and managed environments.

Cost Structure

Research and Development (R&D) represents a substantial cost for FMC, encompassing salaries for dedicated scientists, the acquisition and maintenance of advanced laboratory equipment, and the significant expenses associated with conducting rigorous field trials. This investment is critical for fostering innovation and ensuring a robust pipeline of new products.

In 2024, FMC continued its commitment to R&D, with a notable portion of its operating expenses dedicated to these activities. Maintaining a competitive edge in the agricultural sciences sector necessitates these high fixed costs, as they directly fuel the development of next-generation crop protection solutions and sustainable farming technologies.

The ongoing investment in R&D is not merely an expense but a strategic imperative for FMC, directly underpinning future revenue streams and long-term market leadership. This commitment ensures the company can address evolving agricultural challenges and meet the growing global demand for food production.

Manufacturing and production costs are a significant part of an FMC's business model. These include the price of raw materials, which can fluctuate based on global markets, and the energy needed for chemical synthesis, a major operational expense. In 2024, energy costs for industrial manufacturing saw considerable volatility, impacting overall production expenses.

Labor costs for skilled production staff and the depreciation of specialized manufacturing facilities also contribute heavily. For instance, the average hourly wage for manufacturing production workers in the U.S. remained a key factor in cost calculations throughout 2024. Efficiently managing these variable and fixed costs through optimized production processes and supply chain improvements is crucial for profitability.

Scaling production effectively is paramount for an FMC to achieve economies of scale and maintain competitive pricing. For example, a major FMC player might invest heavily in new, automated production lines in 2024 to increase output by 20% while reducing per-unit labor costs.

Sales, Marketing & Distribution Costs are critical for FMCG companies to connect with consumers and ensure products reach shelves. These expenses encompass everything from the salaries of sales teams and the hefty price tags of national advertising campaigns to the costs of participating in trade shows and managing complex logistics networks. For instance, in 2024, many major FMCG players continued to invest heavily in digital marketing, with social media advertising spend alone seeing significant growth as brands sought direct engagement with younger demographics.

Efficiently managing these costs is paramount. Optimizing distribution channels, for example, can significantly reduce warehousing and transportation expenses. Companies are increasingly leveraging data analytics to pinpoint the most cost-effective routes and inventory management strategies. In 2024, the focus on supply chain resilience also meant that companies were willing to absorb some additional distribution costs to ensure product availability, especially in the face of geopolitical uncertainties.

Regulatory & Compliance Costs

FMC faces significant expenses in adhering to diverse international regulations. These include fees for product registration, environmental impact studies, and rigorous safety testing. For instance, in 2024, the agricultural chemicals sector saw increased regulatory scrutiny, with compliance costs often representing a considerable portion of a company's operational budget, sometimes ranging from 5% to 15% of revenue depending on the complexity of the markets entered.

These regulatory and compliance costs are largely fixed, meaning they don't change much regardless of sales volume. They are essential for FMC to maintain its license to operate and ensure its products can be legally sold in various regions. The specific amounts can fluctuate based on the number of countries FMC operates in and the specific requirements for each product line.

- Product Registration Fees: Costs associated with obtaining approval for new agricultural products in different countries.

- Environmental Impact Assessments: Expenses for evaluating and mitigating the environmental effects of FMC's products and operations.

- Safety Testing: Outlays for ensuring products meet stringent health and safety standards globally.

- Legal Compliance: Expenditures on legal counsel and internal resources to ensure adherence to all relevant laws and regulations.

General & Administrative (G&A) Expenses

General & Administrative (G&A) expenses represent the essential overhead costs that keep a company running smoothly, even if they aren't directly linked to making or selling products. These include salaries for executives and administrative staff, the costs associated with maintaining IT systems, legal and accounting services, and managing corporate facilities. For instance, in 2024, many large corporations reported G&A expenses as a significant portion of their operating costs, with some tech giants allocating upwards of 15-20% of their revenue to these functions to support global operations and compliance.

Efficient management of G&A is vital for a company's bottom line and long-term stability. By streamlining processes and optimizing resource allocation within these departments, businesses can significantly improve cost-effectiveness. For example, a focus on digital transformation within G&A functions can lead to reduced administrative burdens and lower operational expenses. In 2024, companies that invested in cloud-based G&A solutions reported an average reduction in administrative overhead by 10-15%.

- Executive and Administrative Salaries: Compensation for leadership and support staff.

- IT Infrastructure: Costs for hardware, software, and network maintenance.

- Legal and Finance Operations: Expenses for compliance, accounting, and financial management.

- Corporate Facility Management: Costs related to office space, utilities, and upkeep.

The cost structure for FMC is heavily influenced by its significant investments in Research and Development, manufacturing, and global distribution networks. These core areas represent the largest expenditures, directly impacting product innovation and market reach.

In 2024, FMC's operational costs were largely driven by the need to develop and produce advanced crop protection solutions, alongside the marketing and distribution efforts required to bring these products to farmers worldwide. Managing these expenditures effectively is key to maintaining profitability in a competitive agricultural sector.

| Cost Category | 2024 Focus/Impact | Key Components |

| Research & Development (R&D) | Crucial for innovation and new product pipeline. High fixed costs due to scientist salaries and lab equipment. | Scientist salaries, laboratory equipment, field trials, patent filings. |

| Manufacturing & Production | Impacted by raw material and energy price volatility. Focus on economies of scale. | Raw materials, energy, skilled labor wages, facility depreciation, process optimization. |

| Sales, Marketing & Distribution | Increasing investment in digital marketing and supply chain resilience. | Sales team salaries, advertising campaigns, trade shows, logistics, warehousing, digital marketing spend. |

| Regulatory & Compliance | Rising scrutiny leading to higher compliance costs, especially in agricultural chemicals. | Product registration fees, environmental impact studies, safety testing, legal counsel. |

| General & Administrative (G&A) | Essential overhead for smooth operations, with a trend towards digital transformation for efficiency. | Executive/admin salaries, IT infrastructure, legal/finance services, facility management. |

Revenue Streams

FMC's core revenue generation stems from the global sales of its diverse portfolio of crop protection products, including herbicides, insecticides, and fungicides. These essential agricultural inputs help farmers combat a wide array of pests, diseases, and weeds, thereby safeguarding crop yields and quality across numerous agricultural sectors.

The company's financial performance in this segment is closely tied to global agricultural cycles, fluctuating commodity prices that influence farmer spending, and the intensity of pest and disease outbreaks. For instance, in 2024, FMC reported significant growth driven by strong demand for its innovative solutions, particularly in key markets like North America and Latin America.

FMC earns revenue by selling plant health and biostimulant products. These offerings are crafted to boost plant growth, improve how plants absorb nutrients, and help them withstand environmental stress. They often work alongside conventional crop protection solutions, adding value by optimizing overall plant performance.

This product category is a significant growth driver for FMC, reflecting the increasing demand for sustainable agricultural practices. In 2023, the company highlighted the strong performance of its plant health portfolio, noting its contribution to diversifying revenue streams beyond traditional pest and weed control, offering a more holistic approach to crop management.

FMC Corporation generates revenue through the sale of professional pest management solutions, targeting non-agricultural environments like cities, businesses, and public health initiatives. This segment is crucial as it serves professional pest control operators, offering a consistent revenue stream that isn't tied to the seasonal nature of agriculture.

In 2024, FMC continued to see strong performance in its Professional Solutions segment, which includes products for urban pest control and public health. This market is characterized by its resilience and steady demand, contributing significantly to FMC's overall financial stability.

Sales of Turf & Ornamental Products

FMC generates revenue by selling specialized products designed for the care and upkeep of turfgrass and ornamental plants. These offerings cater to professional markets such as golf courses, sports fields, and nurseries, where maintaining high aesthetic and health standards is crucial.

This segment of FMC's business benefits from a steady demand for innovative and effective solutions. For instance, in 2023, FMC's Agricultural Solutions segment, which includes turf and ornamental products, reported net sales of approximately $4.7 billion, demonstrating the significant contribution of these specialized markets to the company's overall revenue.

- Professional Turf Management: Products for golf courses, sports arenas, and lawn care professionals.

- Ornamental Horticulture: Solutions for nurseries, greenhouses, and landscape businesses.

- Pest and Disease Control: Herbicides, insecticides, and fungicides tailored for these specific applications.

- Plant Health and Nutrition: Fertilizers and growth regulators to enhance plant vitality.

Licensing & Technology Fees

FMC Corporation can generate revenue by licensing its patented agricultural technologies, active ingredients, and innovative formulations to other companies. This strategy allows FMC to monetize its significant research and development investments without the need for direct manufacturing or sales of these specific licensed products. For instance, in 2023, FMC continued to focus on its R&D pipeline, a key driver for potential future licensing opportunities.

This revenue stream is particularly valuable as it leverages FMC's strong intellectual property portfolio. By partnering with other entities, FMC can expand the reach of its innovations into new markets or applications. This approach offers a return on the substantial capital allocated to developing new crop protection solutions, contributing to overall profitability.

- Intellectual Property Monetization: Licensing allows FMC to earn from its patents and proprietary knowledge.

- Reduced Operational Burden: This stream avoids the direct costs associated with manufacturing and selling licensed products.

- R&D Investment Returns: Provides a mechanism to recoup and profit from extensive research expenditures.

- Market Expansion: Enables broader market penetration for FMC's technologies through third-party distribution.

FMC's revenue is primarily driven by its crop protection products, including herbicides, insecticides, and fungicides, which are vital for farmers globally. The company also generates income from plant health and biostimulant products, enhancing crop resilience and nutrient uptake. Additionally, FMC earns revenue from its professional solutions segment, serving urban pest control and public health needs, as well as from specialized turf and ornamental products for professional markets.

In 2024, FMC's performance in its core Agricultural Solutions segment remained robust, bolstered by demand for its innovative crop protection offerings. The plant health and biostimulant portfolio continued its growth trajectory, reflecting a broader market shift towards sustainable agriculture. The Professional Solutions segment also demonstrated resilience, contributing steady revenue streams independent of agricultural seasonality.

| Revenue Segment | 2023 Net Sales (Approx.) | Key Drivers |

|---|---|---|

| Agricultural Solutions (Crop Protection) | $4.7 billion | Global crop demand, pest/disease pressure, new product introductions |

| Plant Health & Biostimulants | Included in Ag Solutions, significant growth driver | Sustainable farming practices, yield enhancement demand |

| Professional Solutions (Pest Control) | Not separately reported, but stable contributor | Urbanization, public health concerns, resilient demand |

| Turf & Ornamental | Included in Ag Solutions | Demand for high-quality turf and ornamental maintenance |

Business Model Canvas Data Sources

The FMC Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research, and expert strategic insights. This multi-faceted approach ensures each component of the canvas is grounded in verifiable information and actionable strategy.