Floor & Decor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Floor & Decor Bundle

Floor & Decor leverages its strong brand recognition and extensive product selection to attract a broad customer base, but faces intense competition and potential supply chain disruptions. What you've seen is just the beginning of understanding their strategic landscape.

Want the full story behind Floor & Decor's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Floor & Decor boasts an extensive product assortment, covering a wide spectrum of hard surface flooring like tile, wood, laminate, vinyl, and natural stone, alongside necessary accessories. This broad selection caters to diverse project needs, from professional installations to DIY endeavors.

A key strength is its commitment to in-stock availability across its warehouse-style stores. This ensures customers, including contractors and homeowners, can find and purchase products immediately, bypassing the delays often associated with special orders. For instance, in Q1 2024, Floor & Decor reported a 10.5% increase in comparable store sales, partly driven by its ability to meet immediate customer demand.

Floor & Decor excels with a strong multi-channel retail strategy, seamlessly blending its expansive warehouse-format stores with accessible design studios and a comprehensive online presence. This integrated approach significantly boosts customer convenience and product accessibility, allowing shoppers to engage with the brand and make purchases through whichever channel suits them best.

The company's physical locations are more than just showrooms; they offer complimentary design services and specialized support from dedicated pro sales teams, effectively serving both individual homeowners and professional contractors. This dual focus ensures a tailored experience for a broad customer spectrum.

For fiscal year 2023, Floor & Decor reported a 10.2% increase in net sales, reaching $4.4 billion, underscoring the effectiveness of their customer-centric, multi-channel approach in driving growth and market penetration.

Floor & Decor is on a significant growth path, evidenced by its consistent store openings. The company has a clear vision for the future, targeting over 500 locations long-term. This ambitious expansion includes plans for roughly 20-25 new warehouse stores in fiscal year 2025, aiming to capture more market share.

Focus on Professional and DIY Customers

Floor & Decor's strength lies in its dual focus, effectively serving both professional contractors and individual homeowners undertaking DIY projects. This broad appeal is a significant advantage in the competitive home improvement sector.

The company provides specialized services like dedicated pro sales representatives and convenient in-store pickup options, which are crucial for busy contractors. For DIY customers, they offer extensive product selection and resources that simplify the renovation process.

- Broad Customer Appeal: Caters to professional installers, commercial clients, and DIY homeowners.

- Tailored Services: Offers dedicated pro service managers and educational events for different customer needs.

- Market Share Capture: This dual focus helps secure a larger portion of the home improvement market.

Resilience Amidst Economic Headwinds

Floor & Decor has demonstrated notable resilience against prevailing economic headwinds, including elevated interest rates and a fluctuating housing market. This strength is underscored by its consistent performance and strategic adaptability.

The company has effectively managed costs and implemented strategic initiatives that have supported its profitability and market share preservation. For instance, in the first quarter of 2024, Floor & Decor reported a comparable store sales increase of 1.1%, indicating steady customer traffic despite economic pressures.

Key to this resilience are its operational flexibilities. The company has shown an ability to adjust its store expansion plans strategically, ensuring efficient capital deployment. This adaptability, coupled with a focus on gross margin improvement, which reached 33.0% in Q1 2024, highlights its robust operational management.

- Consistent Comparable Store Sales: Achieved a 1.1% increase in comparable store sales in Q1 2024, showcasing demand resilience.

- Gross Margin Improvement: Maintained a strong gross margin of 33.0% in Q1 2024, reflecting effective pricing and cost control.

- Strategic Store Rollout: Demonstrated flexibility in store opening plans to optimize capital allocation amidst market uncertainties.

Floor & Decor's extensive product selection, encompassing a wide variety of hard surface flooring and accessories, directly addresses diverse customer needs. Its commitment to having products readily available in its warehouse-style stores minimizes customer wait times, a significant advantage in a market where immediate availability is key. This focus on in-stock inventory contributed to a 10.5% increase in comparable store sales in Q1 2024.

The company's integrated multi-channel strategy, combining large format stores, design studios, and online presence, enhances customer accessibility and convenience. Furthermore, Floor & Decor's ability to cater to both professional contractors and DIY homeowners, offering specialized services like dedicated pro sales teams, broadens its market appeal and solidifies its customer base. This dual focus supported a 10.2% net sales increase to $4.4 billion in fiscal year 2023.

Floor & Decor demonstrates resilience against economic pressures, maintaining consistent comparable store sales, with a 1.1% increase in Q1 2024. Its operational flexibility, including strategic store rollout plans and a focus on gross margin improvement, which reached 33.0% in Q1 2024, further strengthens its market position and ability to navigate economic fluctuations.

The company's aggressive growth strategy, targeting 20-25 new warehouse stores in fiscal year 2025, positions it to capture significant market share. This expansion, coupled with a strong emphasis on customer service and product availability, underpins its sustained performance.

| Metric | Q1 2024 | FY 2023 |

|---|---|---|

| Comparable Store Sales Growth | 1.1% | 10.5% (reported Q1 2024 for prior year) |

| Net Sales | N/A | $4.4 billion |

| Gross Margin | 33.0% | N/A |

| New Stores Planned (FY 2025) | 20-25 | N/A |

What is included in the product

This analysis maps out Floor & Decor's market strengths, operational gaps, and external risks. It provides a comprehensive understanding of the company's competitive landscape and strategic positioning.

Offers a clear breakdown of Floor & Decor's competitive landscape, highlighting areas for improvement and growth to alleviate strategic uncertainty.

Weaknesses

Floor & Decor's fortunes are significantly linked to the housing market's ups and downs. When fewer homes are sold or people spend less on renovations, demand for flooring naturally dips. For instance, in early 2024, rising mortgage rates contributed to a slowdown in existing home sales, which can directly translate to slower growth for Floor & Decor.

Floor & Decor operates in a highly competitive landscape, facing formidable rivals such as Home Depot and Lowe's. These larger players benefit from significant economies of scale and established brand recognition across a wider spectrum of home improvement goods, not just flooring.

The sheer market presence and purchasing power of these giants allow them to negotiate more favorable terms with suppliers and potentially offer more aggressive pricing, posing a direct challenge to Floor & Decor's ability to compete solely on price in certain segments.

Furthermore, the extensive product assortments offered by these larger retailers, encompassing everything from lumber to appliances, can draw customers seeking a one-stop shopping experience, potentially diverting foot traffic and sales opportunities away from Floor & Decor's specialized model.

Floor & Decor's stock has often commanded a premium valuation, reflected in its historically high price-to-earnings (P/E) ratio. For instance, as of early 2024, its P/E ratio has been notably higher than many retail peers, suggesting investor optimism about its future growth.

This premium valuation, however, can be challenged by profitability pressures. While the company has demonstrated strong revenue growth, its operating margins have sometimes lagged behind historical averages. This can be attributed to the significant investments required for new store openings and the expansion of its distribution network, which can temporarily weigh on profitability.

Exposure to Tariff Concerns and Supply Chain Risks

Floor & Decor faces significant headwinds due to its heavy reliance on China for product sourcing. This exposes the company to the volatile landscape of international trade, particularly tariff adjustments and broader geopolitical tensions. For instance, the ongoing trade disputes between the US and China could directly impact the cost of goods sold.

While Floor & Decor has been proactive in diversifying its supplier base and working to mitigate cost increases, the persistence of tariffs remains a considerable risk. These tariffs can inflate inventory expenses, which might force the company to either absorb these costs, thereby reducing profit margins, or pass them on to consumers through higher prices. Such price hikes could potentially deter customers, especially in a price-sensitive market, and erode the company's competitive edge.

- Sourcing Concentration: A substantial portion of Floor & Decor's product portfolio originates from China, creating vulnerability to trade policy shifts.

- Tariff Impact: Potential increases in inventory costs due to tariffs could pressure profit margins or necessitate price adjustments.

- Competitive Pressure: Price increases stemming from tariffs may impact Floor & Decor's ability to compete effectively with rivals who may have more diversified supply chains.

- Supply Chain Disruptions: Geopolitical events or trade disputes can lead to unexpected disruptions in the flow of goods, impacting product availability and lead times.

Inventory Management Challenges

Floor & Decor faces significant inventory management challenges, with reports highlighting a growing disconnect between available stock and customer demand. This mismatch has resulted in an increase in overall inventory levels.

The company's inventory turnover ratio has also been on the rise. For instance, in the first quarter of 2024, Floor & Decor reported a 1.7% increase in inventory compared to the previous year, reaching $1.77 billion. This upward trend in the turnover ratio can signal overstocking or a slowdown in demand, both of which can negatively impact financial health by tying up valuable capital and increasing the risk of markdowns or obsolescence.

- Increased Inventory Levels: Reports indicate a widening gap between Floor & Decor's stock and actual demand, leading to higher inventory holdings.

- Rising Inventory Turnover Ratio: An increasing inventory turnover ratio suggests potential overstocking or weakening sales, which can strain cash flow.

- Capital Tie-up and Write-down Risk: Holding excess inventory ties up capital and increases the likelihood of needing to discount products or write off unsold goods, impacting profitability.

Floor & Decor's reliance on a single country for a significant portion of its products makes it susceptible to geopolitical risks and trade policy changes, like tariffs. This concentration in China, for example, could lead to increased costs for goods sold, potentially forcing price hikes that might alienate price-sensitive customers and diminish its competitive edge against rivals with more diversified sourcing.

What You See Is What You Get

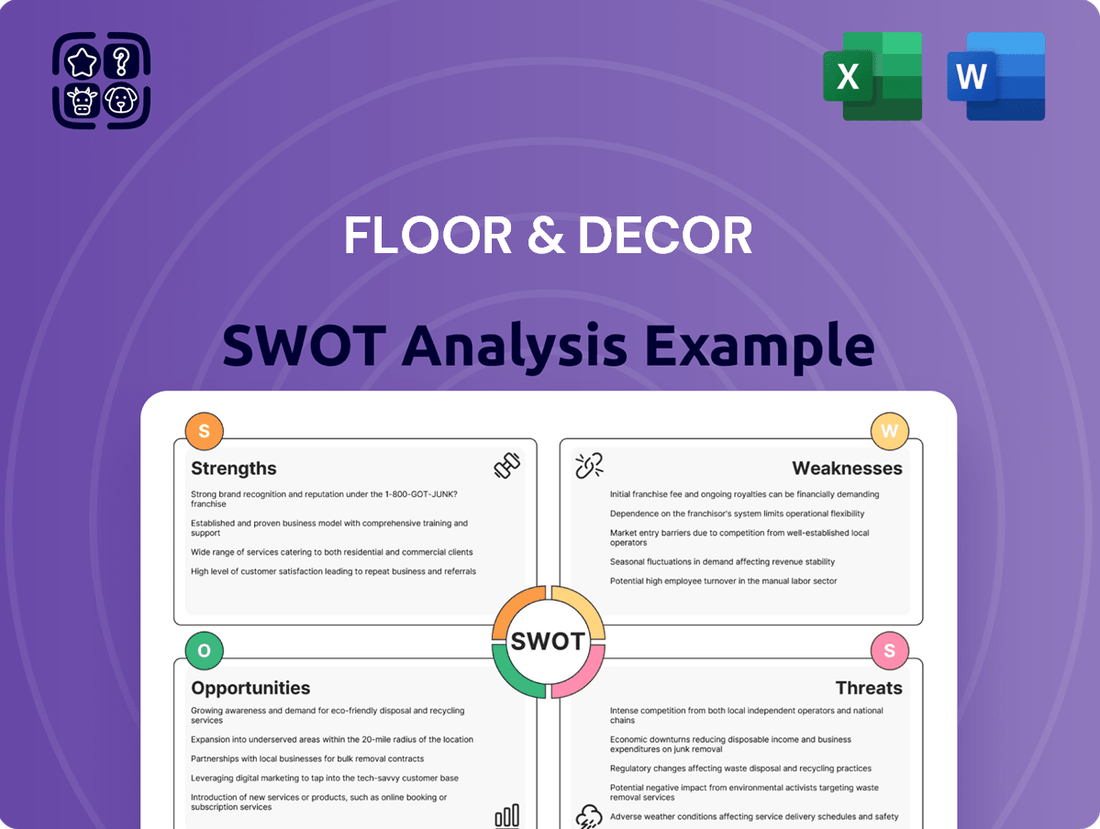

Floor & Decor SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This document offers a comprehensive look at Floor & Decor's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning.

The preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Floor & Decor has an ambitious long-term vision to operate more than 500 warehouse-format stores across the United States. This represents a significant doubling of its current store count, which stood at over 250 locations as of early 2024. This aggressive expansion plan, with new store openings slated for 2025, offers a prime opportunity to capture greater market share and tap into previously underserved customer bases.

The flooring industry is experiencing a significant shift towards sustainable and eco-friendly materials, driven by consumer demand for products with a reduced environmental footprint. Floor & Decor is well-positioned to leverage this trend by broadening its selection of cork, bamboo, recycled wood, and other environmentally conscious flooring solutions. This strategic move directly addresses the growing market preference for greener alternatives.

The do-it-yourself and home renovation sector shows resilience, even with economic uncertainties. This trend is fueled by older homes needing updates and a growing desire among homeowners to customize and improve their living spaces.

Floor & Decor is strategically positioned to capitalize on this sustained interest in renovation. The company serves both individual DIYers and professional contractors, allowing it to capture a broad segment of this expanding market.

In 2023, U.S. home improvement spending reached an estimated $485 billion, demonstrating a strong underlying demand. Projections for 2024 suggest continued growth, with the market expected to see a 2-3% increase, further supporting Floor & Decor's opportunity.

Technological Advancements and Digital Innovation

The home improvement sector is seeing significant technological integration, with smart home devices and online platforms transforming how customers design and select products. Floor & Decor can capitalize on this by expanding its digital offerings.

Enhancing its digital presence, including user-friendly online design tools and virtual product visualization, presents a key growth avenue. For instance, by late 2024, the company could aim to integrate AI-powered design assistants, mirroring trends seen in other retail sectors where personalized digital experiences are driving customer engagement.

Floor & Decor can also invest in in-store technology to create a more seamless and engaging customer journey. This might include interactive displays or augmented reality tools that allow customers to visualize flooring in their own homes. Such advancements cater directly to the growing segment of tech-savvy consumers actively seeking digital solutions in their purchasing decisions.

- Digital Integration: Expanding online design tools and virtual visualization capabilities to cater to tech-savvy customers.

- In-Store Technology: Implementing interactive displays and augmented reality for enhanced customer experience.

- AI-Powered Assistance: Exploring AI for personalized design recommendations and streamlined product selection processes.

Potential for Easing Interest Rates and Housing Market Recovery

A projected easing of interest rates, anticipated from late 2024 into 2025, presents a significant tailwind for the housing market. Lower borrowing costs can invigorate home sales, encourage refinancing activities, and spur renovation projects, all of which directly translate to increased demand for flooring and related home improvement products.

This potential market recovery is a key opportunity for Floor & Decor. As housing starts and existing home sales pick up, driven by more accessible mortgage rates, the company is well-positioned to capitalize on this resurgence. For instance, if mortgage rates were to decline by 0.5% to 1% in 2025, it could unlock millions of potential buyers and homeowners looking to invest in their properties.

- Interest Rate Outlook: Federal Reserve signals potential rate cuts in 2025, aiming for a more stable economic environment.

- Housing Market Impact: Lower rates are expected to boost housing affordability, potentially increasing home sales by 5-10% in 2025.

- Renovation Spending: Homeowners with lower mortgage rates may have more disposable income for renovations, including flooring upgrades.

- Floor & Decor's Position: The company's broad product selection and focus on DIY and professional customers align with increased home improvement activity.

Floor & Decor’s aggressive store expansion plan, aiming for over 500 U.S. locations by 2025, presents a substantial opportunity to capture increased market share. The growing consumer preference for sustainable products also positions the company favorably, allowing it to expand its offerings of eco-friendly flooring materials like cork and bamboo. Furthermore, the resilient DIY and home renovation market, fueled by a desire for home improvements, provides a consistent demand base for Floor & Decor's products and services.

| Opportunity Area | Description | 2024/2025 Data/Projections |

|---|---|---|

| Store Expansion | Aggressive growth to over 500 warehouse-format stores. | Targeting over 500 stores by 2025, doubling current count. |

| Sustainable Products | Expanding selection of eco-friendly flooring. | Increased consumer demand for cork, bamboo, recycled materials. |

| Home Renovation Market | Capitalizing on DIY and professional contractor demand. | U.S. home improvement spending projected to grow 2-3% in 2024. |

| Digital Integration | Enhancing online tools and virtual visualization. | Potential integration of AI-powered design assistants by late 2024. |

| Interest Rate Environment | Benefiting from potential interest rate easing. | Anticipated rate cuts in late 2024 into 2025 to boost housing market. |

Threats

Persistent high interest rates remain a significant challenge for the flooring sector, potentially dampening consumer appetite for discretionary spending on home renovations and new builds. This economic environment can translate to fewer customers walking through the doors and a decline in sales, particularly for higher-priced flooring options.

The Federal Reserve's monetary policy, including its benchmark interest rate which stood at 5.25%-5.50% as of early 2024, directly impacts mortgage affordability and consumer borrowing power, both crucial for major home improvement projects. This sustained period of elevated borrowing costs creates an ongoing headwind for companies like Floor & Decor, affecting sales volumes and potentially impacting profitability.

The flooring industry is notably fragmented, meaning Floor & Decor contends with a wide array of competitors, from large home improvement chains to smaller, specialized local businesses. This intense competition means that securing market share often involves aggressive pricing strategies. For instance, in the first quarter of 2024, the overall retail sector experienced a slowdown, which can exacerbate price wars as companies vie for customer spending.

This heightened competition, particularly when market demand softens, directly translates into significant pricing pressures. Retailers may be forced to lower prices to attract customers, which can eat into profit margins. Floor & Decor's gross margin, which stood at approximately 37.4% in Q1 2024, could be vulnerable to erosion if it needs to match competitor pricing to maintain sales volume.

Floor & Decor's extensive reliance on global sourcing, despite diversification efforts, leaves it vulnerable to supply chain disruptions. For instance, the ongoing trade tensions between major manufacturing nations and the potential for new tariffs in 2024-2025 could significantly impact import costs. This exposure directly translates to risks of increased expenses and challenges in maintaining steady product availability for customers.

Labor Shortages, Particularly for Installers

A significant hurdle for Floor & Decor, like much of the home improvement sector, is the ongoing scarcity of skilled labor, especially for flooring installers. This shortage directly impacts the ability to meet customer demand for installation services, potentially dampening sales of products reliant on professional fitting. For instance, a 2024 survey by the Associated General Contractors of America indicated that over 70% of construction firms reported difficulty finding qualified workers, a trend that directly affects the flooring installation pipeline.

This labor constraint can translate into longer wait times for customers, impacting their overall satisfaction and potentially leading them to delay or abandon projects. Furthermore, the limited supply of installers often drives up labor costs, which can increase the total project expenses for consumers and may affect Floor & Decor's competitive pricing advantage for installation-inclusive offerings. The Bureau of Labor Statistics projected a 4% growth in flooring installer jobs from 2022 to 2032, which, while positive, may not outpace demand in a robust housing market.

- Installer Shortage Impact: Reduced capacity to fulfill installation service demand.

- Cost Implications: Increased labor expenses for consumers, potentially affecting project affordability.

- Customer Experience: Longer lead times for installations can lead to dissatisfaction.

- Industry Trend: Over 70% of construction firms reported hiring difficulties in 2024.

Shift in Consumer Spending Priorities

Consumers might prioritize essential home repairs over new flooring projects if economic uncertainty rises. For instance, if inflation continues to be a concern into 2024-2025, homeowners may defer non-essential renovations. This could lead to a decrease in demand for Floor & Decor's more decorative and higher-margin items, impacting overall revenue growth.

This shift could be particularly noticeable in discretionary spending categories. A report from the U.S. Bureau of Labor Statistics in late 2024 indicated a slight uptick in consumer spending on home maintenance, but a plateau in spending on home furnishings and improvements that are not strictly necessary. This suggests consumers are becoming more selective.

- Consumer spending can pivot towards essential maintenance, reducing demand for aesthetic upgrades.

- Economic caution may lead homeowners to delay discretionary flooring purchases.

- Floor & Decor's higher-margin decorative products are particularly vulnerable to this trend.

Intensified competition and persistent high interest rates present significant threats to Floor & Decor. The fragmented nature of the flooring market means the company faces pressure from various players, potentially leading to price wars that could erode profit margins, as evidenced by the company's Q1 2024 gross margin of approximately 37.4%. Furthermore, elevated interest rates, with the Federal Reserve's benchmark rate at 5.25%-5.50% in early 2024, dampen consumer spending on discretionary home improvements.

Supply chain vulnerabilities and a shortage of skilled labor are also critical threats. Global sourcing exposes Floor & Decor to potential cost increases from trade tensions and tariffs expected in 2024-2025. Simultaneously, a scarcity of qualified flooring installers, with over 70% of construction firms reporting hiring difficulties in 2024, limits installation capacity and increases labor costs for consumers, potentially impacting project affordability and customer satisfaction.

Consumer spending patterns may shift towards essential home maintenance over discretionary upgrades, particularly if economic uncertainty persists into 2024-2025. This could reduce demand for Floor & Decor's higher-margin, decorative flooring options, as consumers become more selective with their renovation budgets. Data from late 2024 suggested a plateau in spending on non-essential home improvements.

SWOT Analysis Data Sources

This analysis draws from comprehensive data, including Floor & Decor's financial reports, detailed market research on the home improvement sector, and expert commentary on retail trends to ensure a robust understanding of the company's position.