Floor & Decor Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Floor & Decor Bundle

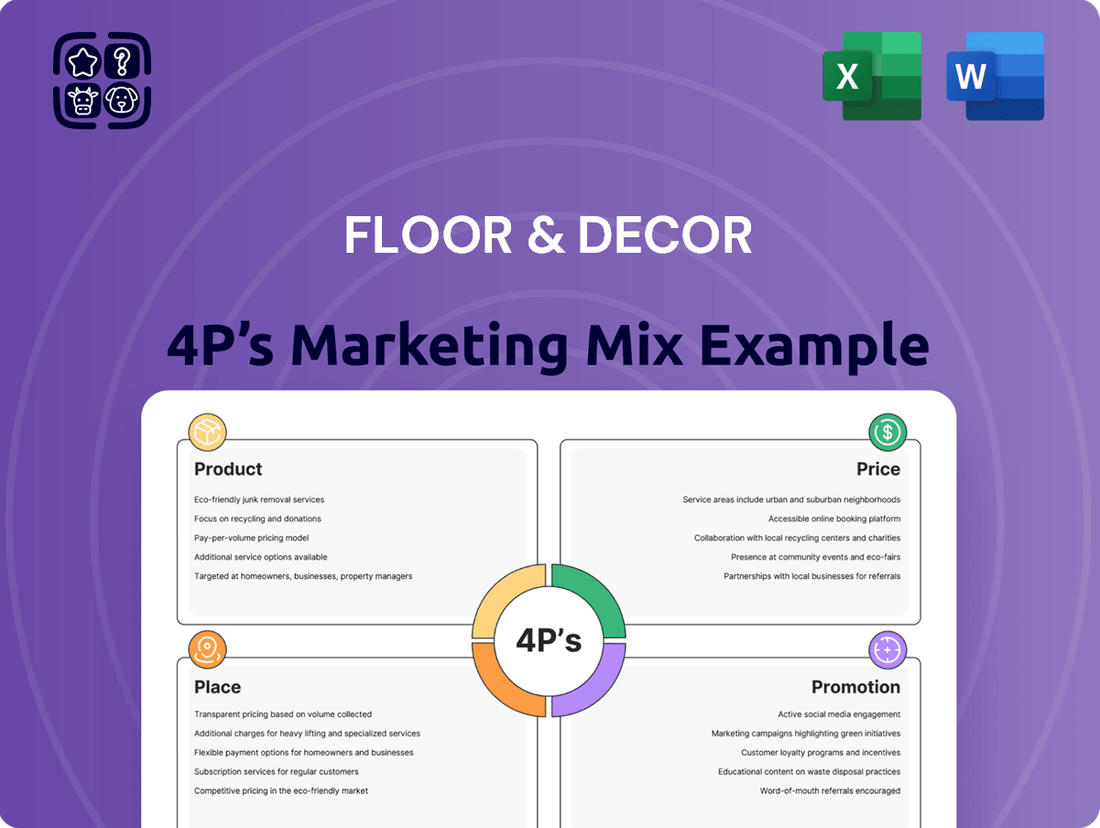

Discover how Floor & Decor masterfully blends its product assortment, competitive pricing, extensive distribution, and targeted promotions to capture market share. This analysis reveals the synergy between their 4Ps, offering a clear blueprint for success.

Ready to go beyond the surface? Get the complete 4Ps Marketing Mix Analysis for Floor & Decor, packed with strategic insights and actionable examples. Elevate your understanding of their market dominance and gain a competitive edge.

Product

Floor & Decor's extensive hard surface flooring selection is a cornerstone of its marketing strategy, featuring a wide variety of tile, wood, laminate, vinyl, and natural stone. This broad offering ensures a match for nearly any design or practical requirement, from durable kitchen tiles to elegant hardwood floors. In 2023, Floor & Decor reported net sales of $4.7 billion, reflecting strong customer demand for their diverse product lines.

Floor & Decor extends its product line beyond just flooring to include a wide array of complementary accessories and installation materials. This encompasses items like wall tile, grout, adhesive, and specialized tools, ensuring customers can find everything needed for a complete project. For instance, in 2023, the company's sales growth was bolstered by its extensive selection, catering to both DIY enthusiasts and professional contractors seeking convenience.

Floor & Decor strategically targets a broad customer spectrum, including professional contractors, large commercial clients, and individual homeowners undertaking DIY projects. This multi-faceted approach ensures their product selection resonates with distinct needs, from bulk materials for trade professionals to aesthetically pleasing, current designs for residential customers.

Proprietary Brands and Global Sourcing

Floor & Decor's proprietary brands and global sourcing strategy are central to its marketing mix. By directly sourcing from manufacturers across the globe, the company cultivates over 50 exclusive brands alongside established names, giving them a unique product offering.

This direct-to-manufacturer approach is a key driver of their competitive pricing, enabling them to maintain everyday low prices. For instance, in fiscal year 2023, Floor & Decor reported net sales of $4.1 billion, underscoring the success of their cost-control and value-driven model.

- Extensive Private Label: Over 50 proprietary brands offer unique value and differentiation.

- Global Manufacturer Relationships: Direct sourcing from worldwide manufacturers ensures cost control.

- Competitive Pricing: This model underpins the 'everyday low prices' strategy.

- Trend Responsiveness: Direct sourcing allows for rapid introduction of global flooring trends.

Free Design Services

Floor & Decor's commitment to enhancing the customer experience is evident in its free design services. These in-store consultations are designed to help customers visualize their projects and make confident product selections, ensuring a cohesive aesthetic for their flooring and accessory choices. This personalized approach simplifies the often overwhelming task of navigating a vast product catalog, guiding customers toward achieving their specific design aspirations.

These services directly address a key customer need by providing expert guidance. For instance, a customer planning a bathroom renovation might receive advice on tile patterns and grout colors, directly translating their vision into a tangible plan. This proactive support aims to reduce purchase friction and increase customer satisfaction.

- Customer Empowerment: Free design services allow customers to confidently select products that match their vision.

- Project Visualization: Customers can better see how flooring and accessories will look in their space before purchasing.

- Expert Guidance: Professional advice helps customers navigate complex design choices and product compatibility.

- Value Addition: This complimentary service adds significant value, differentiating Floor & Decor from competitors.

Floor & Decor's product strategy centers on an expansive selection of hard surface flooring, complemented by a comprehensive range of installation materials and accessories. This vast inventory, featuring over 50 proprietary brands sourced globally, allows for unique product offerings and competitive everyday low prices. In fiscal year 2023, the company achieved net sales of $4.7 billion, a testament to the broad appeal and value proposition of its product assortment.

| Product Category | Key Features | 2023 Sales Contribution (Implied) |

|---|---|---|

| Hard Surface Flooring | Tile, wood, laminate, vinyl, natural stone | Significant portion of $4.7 billion net sales |

| Installation Materials & Accessories | Grout, adhesive, tools, wall tile | Supports core flooring sales, enhances project completion |

| Proprietary Brands | Over 50 exclusive brands | Drives differentiation and cost control |

What is included in the product

This analysis provides a comprehensive breakdown of Floor & Decor's marketing mix, examining how their extensive product selection, value-driven pricing, accessible store locations, and targeted promotional efforts combine to create a dominant market position in the flooring industry.

Simplifies complex marketing strategy into actionable insights, alleviating the pain of overwhelming data for quick decision-making.

Provides a clear, concise overview of Floor & Decor's marketing approach, easing the burden of understanding their competitive positioning.

Place

Floor & Decor's product strategy hinges on its large warehouse-format stores, a key element of its marketing mix. These expansive retail spaces are intentionally designed to showcase a vast inventory of hard surface flooring and complementary products, ensuring customers have ample selection readily available. This physical presence is central to their customer experience, offering a tangible way to interact with merchandise.

The sheer scale of these stores is impressive, with over 1 million square feet dedicated to in-stock flooring. This allows for a hands-on shopping experience, where customers can directly see, touch, and compare various flooring options. As of the first quarter of 2025, Floor & Decor had expanded its footprint to 254 warehouse-format locations spanning 38 states, demonstrating a significant commitment to this retail model.

Floor & Decor’s expansion strategy centers on a consistent rollout of new warehouse stores to broaden its market reach. In fiscal year 2024, the company successfully launched 30 new locations, bringing its total store count to 251 by the end of the year.

Looking ahead to fiscal 2025, the initial projection for new store openings was 25. However, this target has been revised to 20 new stores, a recalibration influenced by prevailing macroeconomic uncertainties, with some planned openings now deferred to 2026.

Floor & Decor complements its expansive warehouse format with smaller, focused design studios. As of March 27, 2025, the company operates five of these dedicated studios. These locations are strategically positioned to offer a more personalized and curated customer experience, emphasizing design consultation and a carefully selected product range.

Multi-channel Retailer with Online Presence

Floor & Decor leverages a robust multi-channel strategy, integrating its extensive physical store network with a strong online platform. This approach ensures customers can engage with the brand across various touchpoints, from in-store browsing to online research and purchasing.

The company's website, flooranddecor.com, serves as a crucial hub for product discovery, offering detailed information, inspirational lookbooks, and e-commerce capabilities. This digital presence is instrumental in driving organic traffic and enriching the customer's journey by providing convenient access to product information and purchasing options.

- Website Functionality: flooranddecor.com enables product browsing, access to trend lookbooks, and online purchasing.

- Customer Engagement: The online platform enhances customer search experience and drives organic traffic.

- Omnichannel Sales Contribution: Connected customer sales accounted for approximately 19% of total net sales in fiscal 2023, highlighting the importance of their integrated sales approach.

Efficient Supply Chain and Distribution Network

Floor & Decor's efficient supply chain and distribution network is a cornerstone of its marketing strategy. By controlling the sourcing of products directly from manufacturers worldwide and operating its own distribution centers, the company achieves significant cost reductions and ensures consistent product availability for its customers. This vertical integration is key to maintaining competitive pricing and meeting demand.

A critical aspect of their strategy involves diversifying sourcing to mitigate geopolitical and economic risks. For instance, while China represented 18% of Floor & Decor's product sourcing in fiscal 2024, the company has a clear objective to reduce this reliance to mid-to-low single digits by the close of 2025. This proactive approach enhances supply chain resilience.

- Controlled Sourcing: Direct relationships with global manufacturers reduce intermediary costs.

- In-house Distribution: Own distribution centers optimize logistics and inventory management.

- Sourcing Diversification: Reducing dependence on single countries like China to 5-9% by end of 2025.

- Cost Efficiency: Vertical integration directly contributes to competitive product pricing.

Floor & Decor's place strategy is defined by its large, warehouse-style stores. These locations are designed to hold an extensive inventory of hard surface flooring and related items, offering customers a wide selection readily available. This physical footprint is central to their customer experience, allowing for direct interaction with the merchandise.

As of Q1 2025, Floor & Decor operated 254 warehouse stores across 38 states. This extensive network supports their strategy of making a broad product range accessible to a large customer base.

The company also utilizes smaller design studios to offer a more curated and personalized experience, complementing the broader reach of its warehouse format. This dual approach to physical retail ensures diverse customer needs are met.

Floor & Decor's place strategy is further enhanced by its integrated online presence, flooranddecor.com, which supports product discovery and online sales, creating a seamless omnichannel experience.

What You See Is What You Get

Floor & Decor 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Floor & Decor's 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know exactly what you're getting.

Promotion

Floor & Decor leverages targeted advertising and media campaigns to drive brand awareness and attract new customers, especially in expanding markets. Their messaging emphasizes a vast product selection, consistent low pricing, and immediate product availability, aiming to clearly communicate their value proposition.

In fiscal year 2023, Floor & Decor reported a 5.1% increase in net sales to $4.7 billion, demonstrating the effectiveness of their outreach efforts in reaching a broader customer base and reinforcing their market position.

Floor & Decor prioritizes driving organic traffic and enhancing its website's customer experience. This includes boosting site speed, refining search functionality, and incorporating inspirational content to attract and retain visitors. In 2023, their digital marketing efforts contributed to a significant portion of their overall sales growth, with online channels becoming increasingly vital for product discovery and engagement.

Floor & Decor's PRO Appreciation Month is a key part of their promotion strategy, specifically targeting professional clients like contractors and designers. This initiative provides free virtual education and engagement opportunities, fostering stronger ties with this crucial customer segment. For example, in 2024, the company continued to emphasize these programs, aiming to solidify their position as a go-to supplier for trade professionals.

In-Store Educational Events and Design Appointments

Floor & Decor is significantly investing in in-store educational events, with a target of 155 events planned for 2025. This initiative is designed to attract new customers and re-engage existing professional clients, such as contractors and designers. These events are crucial for building expertise and providing hands-on learning opportunities.

Complementing these events, the company offers free in-store design appointments. This service provides personalized guidance and support, helping customers visualize and plan their projects effectively. By offering this valuable, no-cost service, Floor & Decor aims to enhance the overall customer experience and build stronger relationships.

- 155 educational events planned for 2025.

- Focus on driving growth among **new and re-engaging active professionals**.

- **Free in-store design appointments** enhance customer support.

- These initiatives aim to foster **customer loyalty and project success**.

Seasonal Catalogs and Trend Lookbooks

Floor & Decor leverages seasonal catalogs, like their Spring and Summer 2024 editions, and annual Trend Lookbooks to highlight emerging flooring and tile styles. These visually rich publications act as crucial inspiration for both homeowners and trade professionals, showcasing how to achieve current design trends with their product offerings.

These lookbooks are more than just product showcases; they are strategic marketing tools that influence purchasing decisions by demonstrating aspirational design outcomes. For instance, their 2024 Trend Lookbook likely featured popular materials such as large-format porcelain tiles and natural wood-look vinyl planks, reflecting market demand.

- Inspiration Hub: Catalogs and lookbooks provide a curated view of design possibilities, driving customer engagement and product discovery.

- Trend Forecasting: Annual lookbooks position Floor & Decor as a leader in identifying and presenting the latest interior design trends.

- Sales Driver: By showcasing stylish applications, these publications directly encourage product selection and purchase, particularly for renovation projects.

Floor & Decor's promotional strategy centers on educating and engaging its customer base, particularly professionals. Their PRO Appreciation Month and planned 155 in-store educational events for 2025 are key to building loyalty and driving sales within this segment.

The company also uses visually appealing seasonal catalogs and Trend Lookbooks, such as those released for Spring and Summer 2024, to inspire customers and highlight current design trends, directly influencing purchasing decisions.

Digital marketing remains a significant focus, with efforts to enhance website experience and drive organic traffic contributing to overall sales growth, as seen in 2023's performance where online channels played a vital role.

| Promotional Tactic | Target Audience | Key Benefit | 2024/2025 Data Point |

|---|---|---|---|

| PRO Appreciation Month | Contractors, Designers | Builds loyalty, provides education | Continued emphasis in 2024 |

| In-store Educational Events | New & Existing Professionals | Enhances expertise, drives engagement | 155 events planned for 2025 |

| Free In-store Design Appointments | All Customers | Personalized guidance, project planning | Ongoing service offering |

| Seasonal Catalogs & Trend Lookbooks | Homeowners, Trade Professionals | Inspiration, showcases design trends | Spring/Summer 2024 catalogs released |

Price

Floor & Decor's pricing strategy centers on Everyday Low Prices (EDLP), a key differentiator that often places their hard surface flooring and accessories 20-30% below traditional retailers. This aggressive pricing is a cornerstone of their value proposition, making quality materials more accessible to a broad customer base.

Floor & Decor meticulously tracks competitor pricing, from major home improvement chains to niche flooring specialists, to sustain its price advantage. While comparisons are made with giants like Home Depot and Lowe's, the company's pricing strategy is most keenly focused on specialty flooring retailers. This ongoing market awareness reinforces their position as a low-price leader, a critical element in their market strategy.

Floor & Decor showcases adaptable pricing, a key element in navigating economic shifts like tariffs. For instance, in 2024, the company's strategy involved robust supplier negotiations and diversifying its supply chain away from regions facing import duties, such as China. This proactive stance helps mitigate potential cost increases.

When necessary, Floor & Decor has shown a willingness to adjust prices to protect its profit margins, aiming to balance competitive market positioning with the need to offset external cost pressures. This flexibility is crucial for maintaining consistent product availability and financial health.

Financing Options and Promotions

Floor & Decor enhances product accessibility through strategic financing and promotions. Their credit card offers 12-month special financing on purchases exceeding $500, making larger projects more manageable.

Promotional efforts are robust, with discounts and coupon codes frequently available. Customers can often find these deals via their newsletter subscriptions or third-party coupon websites, directly incentivizing purchases.

- Special Financing: 12-month special financing available on purchases of $500 or more with the Floor & Decor credit card.

- Promotional Codes: Discounts are regularly offered through newsletters and coupon aggregators.

- Customer Incentives: These financial tools and discounts are designed to lower purchase barriers and encourage sales volume.

Volume-Based Pricing and Pro Discounts

Floor & Decor's pricing strategy likely incorporates volume-based tiers and pro discounts to attract and retain professional customers. This approach aligns with their business model, which emphasizes selling materials in job lot quantities, making bulk purchases more economical for contractors and commercial clients.

This strategy is particularly effective given the industry's reliance on large-scale projects. For instance, in 2023, Floor & Decor reported a net sales increase of 6.6% to $4.5 billion, indicating strong demand from both DIY and professional segments, with professional sales being a key driver.

- Volume Discounts: Offering reduced per-unit costs for larger order sizes incentivizes professionals to consolidate their purchasing with Floor & Decor.

- Pro Accounts: Dedicated programs for trade professionals often include exclusive pricing, early access to new products, and dedicated support.

- Job Lot Quantities: The inherent nature of selling in bulk quantities naturally lends itself to cost efficiencies that can be passed on to high-volume buyers.

Floor & Decor's pricing strategy is built on Everyday Low Prices (EDLP), consistently positioning them 20-30% below traditional retailers for flooring and accessories. This aggressive approach, supported by meticulous competitor price tracking, particularly against specialty retailers, makes quality materials more accessible. Their 2023 net sales of $4.5 billion reflect the success of this value-driven model.

| Pricing Tactic | Description | Impact |

|---|---|---|

| Everyday Low Prices (EDLP) | 20-30% below traditional retailers | Increased accessibility and sales volume |

| Competitor Price Monitoring | Focus on specialty flooring retailers | Sustains price leadership |

| Supplier Negotiations & Diversification | Mitigates tariff impacts (e.g., 2024) | Protects profit margins |

| Special Financing (12-month on $500+) | Via Floor & Decor credit card | Lowers purchase barriers for large projects |

| Promotional Codes & Discounts | Via newsletters and third-party sites | Incentivizes immediate purchases |

| Volume-Based Tiers & Pro Discounts | For contractors and commercial clients | Drives professional segment growth |

4P's Marketing Mix Analysis Data Sources

Our Floor & Decor 4P's analysis leverages a blend of publicly available company data, including investor relations materials and official press releases, alongside proprietary retail and e-commerce intelligence. This ensures a comprehensive understanding of their product assortment, pricing strategies, distribution network, and promotional activities.