Floor & Decor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Floor & Decor Bundle

Floor & Decor faces moderate buyer power due to the availability of alternatives, but their direct-to-consumer model and extensive product selection can mitigate this. Supplier power is also a key consideration, with the industry's reliance on manufacturers influencing pricing and availability. The threat of new entrants is present, though capital investment and established distribution channels create some barriers.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Floor & Decor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Floor & Decor sources a broad range of flooring materials, including tile, wood, laminate, vinyl, and natural stone. This diversity in product categories suggests that suppliers are likely spread across various specialized markets, rather than being concentrated in a few dominant entities. The hard surface flooring market itself is projected to grow from $5.0 billion in 2024 to $5.8 billion by 2030, indicating a healthy and expanding supplier ecosystem.

Floor & Decor demonstrates some ability to mitigate supplier bargaining power by diversifying its sourcing, reducing over-reliance on single regions like China. This strategic move offers flexibility when facing potential price hikes or supply disruptions from specific suppliers.

However, the sheer breadth of Floor & Decor's product assortment means that establishing and vetting new suppliers for specialized flooring and home improvement items can still involve significant switching costs. Ensuring consistent quality, reliable delivery schedules, and competitive pricing across a wide range of SKUs presents an ongoing challenge.

The uniqueness of supplier products for hard surface flooring, a key area for Floor & Decor, is generally low. While the company boasts a vast selection, the fundamental raw materials like wood and stone are largely commoditized. This means suppliers often offer similar basic materials, reducing their individual bargaining power based on product differentiation.

However, Floor & Decor does mention proprietary brands, which suggests that some suppliers might offer more unique or differentiated products. If these proprietary offerings are exclusive or significantly superior, it could grant those specific suppliers a degree of increased bargaining power. For instance, if a supplier develops a unique, eco-friendly wood treatment or a proprietary stone-cutting technique that is difficult to replicate, they could command better terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into retail operations, similar to Floor & Decor's model, is generally low. This is due to the significant capital investment and specialized expertise needed for large-scale, direct-to-consumer distribution and retail management. For instance, a basic flooring manufacturer would face immense challenges in replicating Floor & Decor's extensive warehouse infrastructure and customer service capabilities.

The specialized nature of the flooring retail business, with its emphasis on showroom experience, logistics, and customer support, presents a substantial barrier to entry for most suppliers. This dissuades them from undertaking the complex and costly endeavor of establishing their own retail chains. Floor & Decor's 2023 revenue reached $4.1 billion, showcasing the scale of operations that suppliers would need to match.

- Deterrent Investment: The substantial financial outlay required for retail infrastructure, inventory management, and marketing discourages supplier forward integration.

- Expertise Gap: Suppliers typically lack the specialized retail management, merchandising, and customer service expertise that Floor & Decor possesses.

- Focus on Core Competencies: Most suppliers prefer to concentrate on their manufacturing strengths rather than diverting resources to complex retail operations.

Importance of Floor & Decor to Suppliers

Floor & Decor's position as a major player in the hard surface flooring sector means it represents a substantial customer for many suppliers. Its significant purchasing power, driven by large order volumes and consistent demand, grants it considerable leverage. For example, in 2023, Floor & Decor reported net sales of $4.6 billion, indicating the scale of its operations and the potential revenue stream it offers to its suppliers.

However, the bargaining power of suppliers can be influenced by their own customer diversification. If a supplier serves a broad base of other large clients, Floor & Decor's individual importance to that supplier might be diminished, thereby reducing Floor & Decor's leverage in negotiations. This dynamic means that while Floor & Decor is a large buyer, the specific supplier's market position is a critical factor.

- Significant Customer Base: Floor & Decor's substantial revenue, reaching $4.6 billion in 2023, makes it a key client for many in the flooring supply chain.

- Leverage through Volume: The company's large order volumes and predictable demand provide it with considerable negotiating power.

- Supplier Diversification Impact: The bargaining power of suppliers is moderated if they have numerous other large customers, diluting Floor & Decor's individual importance.

Floor & Decor's bargaining power with suppliers is moderate, influenced by its large purchasing volume and the commoditized nature of many raw materials. However, the company's diversification of sourcing and the specialized retail expertise it possesses act as significant counterbalances to supplier leverage.

While the flooring market is growing, with the hard surface flooring segment projected to reach $5.8 billion by 2030, Floor & Decor's $4.6 billion in net sales for 2023 highlights its substantial influence as a buyer. This scale allows for negotiation leverage, especially given that many basic flooring materials are not highly differentiated.

The threat of suppliers integrating forward into retail is low due to the high capital and expertise required, a barrier reinforced by Floor & Decor's established infrastructure and $4.1 billion in 2023 revenue. This limits suppliers' ability to directly compete in the retail space.

| Factor | Impact on Supplier Bargaining Power | Floor & Decor's Position |

| Supplier Product Differentiation | Low for commoditized materials, higher for proprietary items | Generally low, but proprietary brands offer some supplier leverage |

| Switching Costs for Floor & Decor | Moderate due to breadth of SKUs and vetting new suppliers | Requires effort to maintain quality and reliability across diverse sourcing |

| Supplier Forward Integration Threat | Low due to capital and expertise requirements | Significant barrier due to Floor & Decor's scale and retail capabilities |

| Floor & Decor's Purchasing Volume | High leverage for Floor & Decor | $4.6 billion in 2023 net sales provides substantial negotiating power |

| Supplier Customer Diversification | Reduces Floor & Decor's leverage if suppliers have many large clients | Impact depends on individual supplier's client base |

What is included in the product

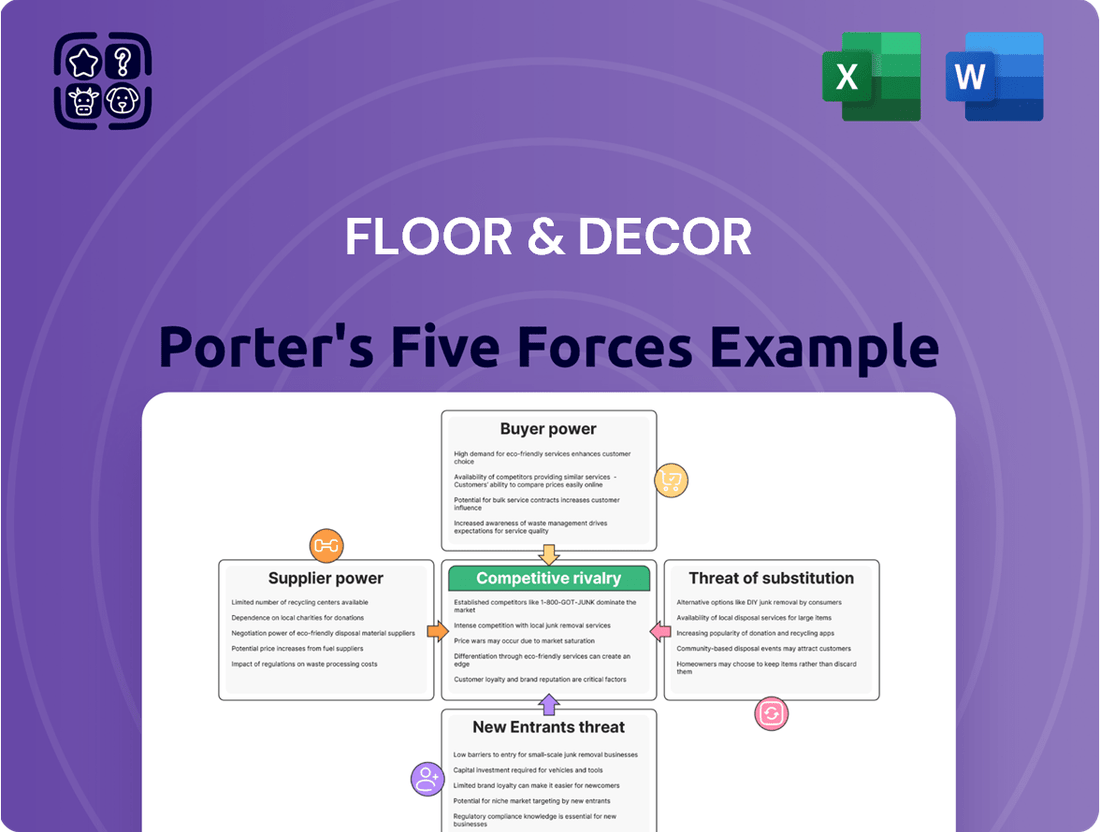

This analysis delves into the competitive forces impacting Floor & Decor, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the flooring industry.

Understand competitive intensity with a visual breakdown of rivalry, supplier power, buyer power, threat of new entrants, and substitutes, all in one place.

Customers Bargaining Power

Floor & Decor caters to a wide array of customers, from professional contractors and large commercial clients to individual homeowners undertaking DIY projects. This diversity significantly dilutes the bargaining power of any single customer or customer segment.

The company's business model, which emphasizes accessibility and a broad product selection, ensures that no single customer group holds a disproportionate amount of influence. For instance, in 2023, Floor & Decor reported net sales of $4.1 billion, indicating a substantial customer base that prevents any one buyer from dictating terms.

Customers might incur switching costs if they move away from Floor & Decor, particularly concerning product availability and the specialized services the company provides. Floor & Decor's strength lies in its extensive in-stock inventory and the immediate accessibility of products, which can make switching to a competitor less appealing.

The bargaining power of customers is significantly influenced by the availability of substitute products. For Floor & Decor, this means customers can choose from a wide array of flooring options beyond what Floor & Decor offers, such as carpet, laminate, or even other home improvement projects that don't involve new flooring. This broad selection gives customers considerable leverage.

The broader home improvement market dynamics also play a crucial role. Consumer spending patterns, economic uncertainties, and fluctuating interest rates directly impact a customer's willingness and ability to undertake new flooring projects. For instance, in 2024, with ongoing concerns about inflation and potential interest rate adjustments, consumers might delay discretionary purchases like flooring, thereby increasing their bargaining power as they become more price-sensitive.

Price Sensitivity of Customers

Home renovation spending has experienced some shifts, with a softening in median spending observed in 2024. This suggests that homeowners are becoming more price-sensitive, carefully evaluating their expenditures on home improvement projects.

While Floor & Decor positions itself as a low-price leader in the flooring and home improvement market, consumers are still likely to scrutinize significant purchases. This heightened price sensitivity directly impacts the bargaining power of customers, as they have more leverage when seeking the best value for their money.

- Price Sensitivity Impact: Consumers are increasingly comparing prices and seeking deals, putting pressure on retailers to maintain competitive pricing.

- Demand Elasticity: For flooring products, demand may become more elastic, meaning a small price increase could lead to a proportionally larger decrease in quantity demanded.

- Brand Loyalty vs. Price: While brand loyalty exists, a significant price difference can sway customers towards alternative suppliers, especially for commodity-like products.

- Economic Conditions: Broader economic conditions, such as inflation and interest rates, can amplify customer price sensitivity by reducing discretionary income for home renovations.

Threat of Backward Integration by Customers

The threat of backward integration by customers for a company like Floor & Decor is extremely low. The significant capital investment required for flooring manufacturing, along with the need for specialized machinery and expertise, makes it impractical for most customers, whether individual consumers or even commercial entities, to produce their own flooring materials.

Consider the scale of operations. A typical flooring manufacturer operates with millions of dollars in plant and equipment. For instance, a modern tile manufacturing facility can cost tens of millions to set up. This high barrier to entry effectively deters potential customers from attempting to manufacture their own products.

Furthermore, the complex supply chains and technological know-how involved in producing diverse flooring types, from luxury vinyl plank to ceramic tile, present substantial challenges. Customers typically prefer to focus on their core competencies rather than venturing into the highly technical and capital-intensive world of manufacturing.

- High Capital Investment: Setting up a flooring manufacturing plant requires substantial upfront capital, often in the tens of millions of dollars, making it prohibitive for most customers.

- Specialized Production Processes: Manufacturing flooring involves complex technologies and specialized machinery, requiring significant technical expertise that customers typically lack.

- Economies of Scale: Established flooring manufacturers benefit from economies of scale, allowing them to produce at a lower cost per unit than a new, smaller-scale entrant.

- Focus on Core Competencies: Customers, whether homeowners or businesses, generally prefer to concentrate on their primary activities rather than engaging in the complexities of manufacturing.

Floor & Decor's diverse customer base, ranging from individual homeowners to large contractors, dilutes the bargaining power of any single buyer. The company's extensive product selection and accessible inventory further limit individual customer leverage. In 2023, Floor & Decor's $4.1 billion in net sales reflects a broad customer reach, preventing any one entity from dictating terms.

While customers can find substitutes for flooring, Floor & Decor's focus on in-stock availability and specialized services can create switching costs. However, broader economic conditions in 2024, such as inflation, increase customer price sensitivity. This heightened awareness of value means customers have more power to negotiate or seek better deals, impacting the company's pricing strategies.

The threat of backward integration by customers is minimal due to the high capital investment and specialized expertise required for flooring manufacturing. Setting up a tile plant, for example, can cost tens of millions of dollars, a barrier that deters most customers from producing their own materials.

| Factor | Impact on Floor & Decor Customer Bargaining Power | Supporting Data/Rationale |

|---|---|---|

| Customer Base Diversity | Lowers individual customer power | Wide range of customers from DIY homeowners to large contractors |

| Product Availability & Switching Costs | Moderate impact; strong inventory reduces incentive to switch | Emphasis on immediate product accessibility |

| Availability of Substitutes | Increases customer power | Customers can choose from numerous flooring types and home improvement alternatives |

| Economic Conditions (2024) | Increases customer power | Inflation and interest rate concerns lead to greater price sensitivity and demand for value |

| Backward Integration Threat | Very low | High capital requirements and technical expertise for manufacturing |

Full Version Awaits

Floor & Decor Porter's Five Forces Analysis

This preview showcases the complete Floor & Decor Porter's Five Forces Analysis, offering a detailed examination of industry competition and profitability. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

Floor & Decor faces a competitive landscape characterized by a large number of players in the U.S. hard surface flooring market. This sector is quite fragmented, meaning there isn't one dominant company controlling a huge chunk of the market.

While Floor & Decor is a substantial specialty retailer, its competitive set includes giants like Home Depot and Lowe's, which have vast resources and broad customer reach. These big-box stores offer a wide variety of flooring options alongside other home improvement products.

Beyond these large players, Floor & Decor also contends with numerous smaller, independent specialty flooring retailers. These businesses often focus on specific niches or local markets, providing personalized service and unique product selections that can appeal to certain customer segments.

The global hard surface flooring market is anticipated to expand at a compound annual growth rate of 2.3% between 2024 and 2030. This growth is somewhat tempered by a recent slowdown in U.S. home renovation spending during 2024. Floor & Decor, for instance, experienced a 1.8% decline in comparable store sales in the first quarter of 2025, indicating a competitive environment where market expansion doesn't always translate to immediate gains for all players.

Floor & Decor stands out by offering an exceptionally broad range of flooring products, from tile and wood to laminate and vinyl, often exceeding 3,000 SKUs. This extensive selection, combined with their warehouse-style retail format, allows for immediate product availability, a key differentiator from competitors who may rely on special orders or smaller inventories. For instance, in 2023, their sales reached $4.1 billion, reflecting strong customer adoption of this model.

Switching Costs for Customers

While it's generally easy for most customers to switch between flooring retailers, Floor & Decor's business model can introduce subtle switching costs, particularly for professional installers. These costs aren't always monetary but stem from the convenience and efficiency gained by sticking with a familiar supplier.

The sheer volume of inventory Floor & Decor typically maintains is a significant factor. For contractors and professional installers, having immediate access to large quantities of specific flooring materials, such as porcelain tile or luxury vinyl plank, can be crucial for project timelines. Having to source materials from multiple smaller suppliers or wait for special orders from competitors could lead to costly project delays, making Floor & Decor's readily available stock a strong incentive to return.

Furthermore, Floor & Decor's specialized services, like design assistance and project planning for more complex installations, can also contribute to implicit switching costs. Professionals who rely on these services to streamline their work may find it less efficient to re-establish these relationships or find equivalent support elsewhere. In 2023, the company reported net sales of $4.1 billion, indicating a substantial customer base that likely benefits from these efficiencies.

- Large In-Stock Quantities: Floor & Decor's extensive inventory reduces project delays for professionals, a key convenience factor.

- Specialized Services: Project planning and design assistance offered by Floor & Decor can create reliance for complex jobs.

- Efficiency for Installers: The combination of availability and support saves professional installers valuable time and reduces potential project disruptions.

Exit Barriers

Floor & Decor faces substantial exit barriers, largely driven by the significant capital investment required for its expansive warehouse-style stores and substantial inventory levels. These high fixed costs make it economically challenging for a company to simply cease operations. For instance, in 2023, Floor & Decor operated over 200 warehouse stores, each representing a considerable sunk cost.

The specialized nature of the hard surface flooring business itself acts as another formidable exit barrier. Acquiring and liquidating specialized equipment, managing unique inventory, and navigating the specific supply chains within this sector can be complex and costly. This inherent difficulty in divesting specialized assets means that even when market conditions are unfavorable, companies like Floor & Decor are incentivized to continue competing rather than incur significant losses through an exit.

These combined factors create a situation where continued competition is often the more rational, albeit difficult, path for players in the hard surface flooring industry.

- High Fixed Costs: Significant investment in large warehouse stores and inventory.

- Specialized Business: Unique equipment, inventory, and supply chain complexities.

- Incentive to Continue: Encourages ongoing competition even in challenging markets.

The competitive rivalry within the hard surface flooring market is intense, with Floor & Decor facing strong competition from both large home improvement retailers and numerous smaller specialty stores. The market is fragmented, meaning no single entity dominates, leading to constant jockeying for market share. This dynamic is further fueled by the global hard surface flooring market's projected growth, even with a recent slowdown in U.S. renovation spending in 2024.

Floor & Decor differentiates itself through a vast product selection, often exceeding 3,000 SKUs, and a warehouse-style format that ensures immediate availability, a key advantage over competitors. For instance, in Q1 2025, comparable store sales saw a slight dip of 1.8%, underscoring the competitive pressures. The company's 2023 net sales of $4.1 billion highlight its significant presence despite these challenges.

While switching between flooring retailers is generally easy for consumers, Floor & Decor fosters loyalty among professional installers through its extensive in-stock inventory and specialized services like design assistance. This efficiency and reliability, crucial for project timelines, can create implicit switching costs, encouraging repeat business. The company's operational model, with over 200 warehouse stores in 2023, reinforces this customer retention strategy.

SSubstitutes Threaten

The threat of substitutes for Floor & Decor's products is moderate. While hard surface flooring, such as tile and wood, is a primary offering, soft surface flooring like carpets and rugs represent a viable alternative for consumers. Despite a general trend away from carpet, it remains a popular choice for specific applications within the home, impacting demand for hard surface options.

The price-performance trade-off for substitutes is a key consideration. While carpet might offer a lower upfront cost compared to some hard flooring options, the long-term value proposition often favors hard surfaces due to their superior durability and reduced maintenance needs. For instance, in 2024, the average cost of installing carpet can range from $1 to $5 per square foot, whereas luxury vinyl plank (LVP) or tile can start at $2 to $7 per square foot, but often lasts significantly longer.

Economic uncertainties and inflationary pressures in 2024 are directly impacting consumer decisions in the home improvement sector. This environment can lead consumers to prioritize more budget-friendly alternatives or to focus on the longevity and lower upkeep of materials, potentially shifting demand away from options that require more frequent replacement or costly maintenance, even if their initial price is lower.

Customer propensity to substitute for flooring products is shaped by several key factors. Budget constraints are a significant driver, pushing consumers to consider more economical alternatives when prices rise. For instance, while luxury vinyl plank (LVP) offers durability, its higher cost compared to laminate or even certain types of tile can encourage a switch. In 2023, the average cost of LVP installation ranged from $3 to $7 per square foot, whereas laminate could be installed for $2 to $5 per square foot, presenting a clear cost-based substitution opportunity.

The desire for comfort also plays a crucial role, particularly favoring carpet in certain living spaces. While hard surface flooring like that offered by Floor & Decor is popular for its durability and ease of cleaning, the plush feel of carpet remains a strong draw for bedrooms and family rooms. This preference for tactile comfort creates a direct substitution threat, especially if carpet manufacturers offer competitive pricing or innovative, stain-resistant technologies.

Evolving design trends and the surge in DIY projects further influence substitution. As homeowners become more adventurous with their design choices, they may explore a broader array of materials, sometimes bypassing traditional flooring categories altogether. The DIY movement, amplified by readily available online tutorials and more accessible tools, empowers consumers to undertake projects that might not involve standard flooring replacement, potentially opting for painted concrete, decorative epoxy coatings, or even simpler solutions like peel-and-stick tiles, thereby reducing reliance on established flooring suppliers.

Innovation in Substitute Products

The flooring industry is experiencing a surge of innovation, particularly in eco-friendly and sustainable materials, smart flooring technologies, and advanced waterproof solutions. These advancements are making alternative flooring options increasingly attractive to consumers and businesses alike.

This innovation directly impacts the threat of substitutes for traditional flooring products. For instance, the growing demand for resilient and low-maintenance materials like luxury vinyl plank (LVP) and waterproof laminate is challenging the market share of materials like hardwood and carpet. In 2023, the global LVP market was valued at approximately $17.5 billion and is projected to grow significantly, indicating a strong consumer preference for these innovative substitutes.

- Eco-friendly materials like bamboo and cork offer sustainable alternatives with growing consumer appeal.

- Smart flooring, incorporating features like heating or data collection, presents a novel substitute for conventional floor coverings.

- Waterproof technologies in LVP and rigid core flooring directly compete with traditional water-sensitive materials such as carpet and some engineered wood.

- The increasing availability and affordability of these innovative substitutes heighten the competitive pressure on established flooring products.

Indirect Substitution through Home Renovation Alternatives

Consumers seeking home improvements may divert spending away from flooring entirely. For instance, instead of new tile, a homeowner might invest in a kitchen countertop upgrade or a new patio. This shift in discretionary spending means that even if flooring demand remains stable, a larger portion of home renovation budgets could be allocated elsewhere.

The threat of indirect substitution is amplified when consumers prioritize other renovation areas. Consider that in 2024, the U.S. home improvement market was projected to reach over $480 billion, with significant portions allocated to kitchen and bath remodels. If consumers opt for these projects, it directly reduces the available capital for flooring purchases, acting as a substitute for the flooring category itself.

- Home Renovation Spending Shifts: Consumers can choose to upgrade kitchens, bathrooms, or outdoor living spaces instead of flooring.

- Indirect Substitution Impact: Projects like countertop replacements or patio additions can absorb home improvement budgets that might otherwise go to flooring.

- Market Data Context: With the U.S. home improvement market exceeding $480 billion in 2024 projections, shifts in allocation significantly impact specific categories like flooring.

The threat of substitutes for Floor & Decor is moderate, with carpet and other soft surfaces posing a direct challenge, especially given varying price points and comfort preferences. While hard flooring like LVP offers durability, its higher initial cost compared to laminate or carpet can drive substitution, particularly when budget constraints are a primary concern for consumers in 2024.

Innovation in flooring, such as advanced waterproof materials and eco-friendly options like bamboo, further strengthens the substitute threat. These alternatives cater to growing consumer demand for sustainability and low maintenance, directly competing with traditional offerings and impacting market share.

| Substitute Type | Example | 2024 Price Range (per sq ft) | Key Driver |

| Soft Flooring | Carpet | $1 - $5 (installed) | Comfort, lower upfront cost |

| Hard Flooring | Laminate | $2 - $5 (installed) | Cost-effectiveness, DIY friendly |

| Hard Flooring | Luxury Vinyl Plank (LVP) | $3 - $7 (installed) | Durability, waterproof features |

| Other | Painted Concrete | $1 - $3 (DIY) | Low cost, industrial aesthetic |

Entrants Threaten

Establishing a specialty retail chain like Floor & Decor, with its large warehouse-format stores and extensive in-stock inventory, demands substantial capital. The company's strategy involves significant capital expenditures for new store openings, which inherently creates a high barrier to entry for potential new competitors. For instance, in fiscal year 2023, Floor & Decor reported capital expenditures of $790.1 million, primarily for opening 30 new stores.

Floor & Decor leverages significant economies of scale derived from its extensive global sourcing network and substantial purchasing power. This allows them to negotiate favorable terms with suppliers, driving down per-unit costs. For instance, in 2023, Floor & Decor reported net sales of $4.17 billion, indicating the sheer volume of goods they handle, which is difficult for newcomers to replicate.

New entrants face a considerable hurdle in matching Floor & Decor's cost structure, as achieving similar purchasing volumes and establishing comparable supplier relationships takes considerable time and capital investment. This scale directly translates into their ability to offer competitive pricing, a key factor in attracting and retaining customers in the flooring industry.

Floor & Decor has cultivated a strong brand identity centered on its extensive product range, competitive pricing, and dedicated customer service, fostering significant customer loyalty. This established reputation makes it challenging for new entrants to quickly gain market traction and build comparable trust among consumers.

In 2024, Floor & Decor's commitment to value and selection continued to resonate, as evidenced by its consistent revenue growth. For instance, their fiscal year 2023 saw net sales reach $4.5 billion, indicating a strong customer base that new competitors would need to actively win over with compelling offers and a superior value proposition.

Access to Distribution Channels

Floor & Decor benefits from its extensive network of warehouse stores strategically located across numerous states. This established presence makes it difficult for new entrants to replicate the same level of accessibility and convenience for customers.

Securing prime retail locations and building an efficient supply chain capable of handling a wide variety of hard surface flooring products represents a substantial hurdle for emerging competitors. For instance, as of Q1 2024, Floor & Decor operated 201 warehouse format stores, a number that continues to grow, underscoring the capital investment required to achieve similar market penetration.

- Established Infrastructure: Floor & Decor's existing footprint of 201 warehouse stores as of Q1 2024 creates a significant barrier.

- Supply Chain Complexity: The logistical challenge of sourcing and distributing a diverse range of flooring materials is a deterrent.

- Capital Investment: New entrants need substantial capital to acquire prime real estate and develop comparable distribution networks.

Government Policy and Regulations

While the flooring retail sector isn't heavily regulated, new entrants must navigate building codes and material safety standards. For instance, in 2024, compliance with evolving energy efficiency standards for flooring materials could add upfront costs. Furthermore, import tariffs on goods, a factor Floor & Decor actively manages, can significantly impact the cost structure for newcomers sourcing international products, potentially raising their initial investment requirements.

Government policies can also influence market entry through zoning laws and licensing requirements, which vary by locality. These can create barriers to establishing physical retail locations. For example, securing permits for large retail spaces in desirable commercial areas often involves navigating complex and time-consuming bureaucratic processes.

- Building Codes and Material Standards: New entrants must comply with evolving safety and performance regulations for flooring.

- Import Tariffs: Fluctuations in tariffs on imported flooring materials can increase initial setup costs for new businesses.

- Zoning and Licensing: Local government regulations can create hurdles for establishing retail presence.

The threat of new entrants for Floor & Decor is moderate, primarily due to the significant capital investment required to establish a comparable retail footprint and supply chain. While the industry itself doesn't have overly burdensome regulations, the sheer scale of operations and established brand loyalty present considerable challenges for newcomers.

New entrants must overcome substantial capital requirements for store development and inventory, as well as replicate Floor & Decor's efficient sourcing and distribution network. For instance, Floor & Decor's 2023 capital expenditures of $790.1 million for new store openings highlight the investment needed.

Achieving economies of scale comparable to Floor & Decor's $4.5 billion in fiscal year 2023 net sales is a significant hurdle, impacting pricing power and cost structure. Replicating their 201 warehouse stores as of Q1 2024 also necessitates considerable real estate acquisition and development.

| Barrier to Entry | Description | Impact on New Entrants |

| Capital Requirements | High costs for store build-out, inventory, and distribution networks. | Significant financial barrier; requires substantial funding. |

| Economies of Scale | Floor & Decor's large purchasing volume leads to lower costs. | New entrants struggle to match pricing and cost efficiency. |

| Brand Loyalty & Reputation | Established customer trust and recognition. | Difficult for new players to quickly gain market share. |

| Supply Chain & Sourcing | Complex global sourcing and logistics infrastructure. | Challenging and time-consuming for newcomers to build. |

| Real Estate & Location | Strategic placement of large warehouse stores. | Requires significant investment and effort to secure prime locations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Floor & Decor is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports. We also incorporate data from trade publications and economic databases to provide a comprehensive view of the competitive landscape.