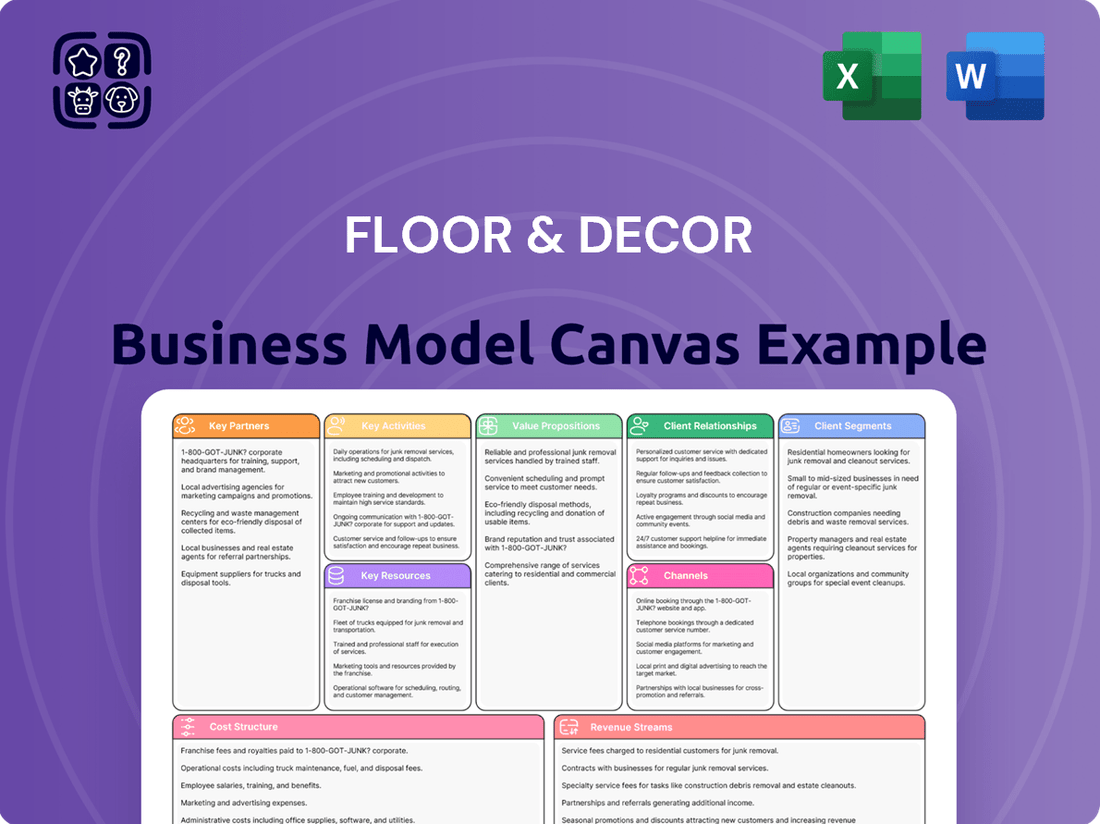

Floor & Decor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Floor & Decor Bundle

Discover the strategic engine behind Floor & Decor's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Ready to gain actionable insights for your own venture?

Unlock the full strategic blueprint behind Floor & Decor's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Floor & Decor's key partnerships with global manufacturers and quarries, spanning 26 countries, are crucial for their low-price leadership. By establishing direct relationships, they bypass intermediaries, ensuring they can offer a wide variety of hard surface flooring at competitive price points. This direct sourcing strategy is a cornerstone of their operational efficiency and value proposition to customers.

Floor & Decor relies heavily on strategic alliances with freight and logistics companies. These partnerships are fundamental to their operational efficiency, ensuring that products sourced from international suppliers reach their distribution centers and retail locations promptly and affordably. This network is key to their promise of readily available inventory for customers.

In 2024, the ongoing evolution of supply chain technology, including advanced tracking and route optimization, continues to be a focus for logistics providers. Floor & Decor benefits from these advancements, which contribute to reduced transit times and lower shipping costs, ultimately supporting their competitive pricing strategy and commitment to immediate product availability.

Floor & Decor places significant emphasis on its partnerships with professional installers and contractors. These vital relationships are nurtured through specialized Pro Services, attractive loyalty programs, and accessible credit options designed to meet the needs of trade professionals.

These skilled individuals and businesses form a substantial segment of Floor & Decor's clientele, acting as crucial drivers for consistent, high-value sales transactions. In 2024, Floor & Decor continued to strengthen these ties, recognizing that satisfied contractors often lead to repeat business and positive word-of-mouth referrals within the industry.

Technology and E-commerce Platforms

Floor & Decor's key partnerships with technology and e-commerce platforms are crucial for its operational efficiency and customer engagement. These collaborations enable the company to manage its extensive product inventory effectively and provide a smooth, integrated shopping journey for customers, bridging the gap between online exploration and in-store experiences such as personalized design advice and convenient order fulfillment.

In 2024, Floor & Decor continued to invest in its digital infrastructure. For instance, their website and mobile app are powered by robust e-commerce solutions that handle millions of product SKUs and facilitate millions of customer interactions annually. These platforms are vital for showcasing their diverse flooring options, from luxury vinyl plank to natural stone, and for managing online orders and customer accounts.

- E-commerce Platform Providers: Partnerships with leading e-commerce technology vendors ensure a scalable and secure online storefront, capable of handling high traffic volumes and complex transactions.

- Data Analytics and CRM Solutions: Collaborations with companies specializing in customer relationship management and data analytics help Floor & Decor understand customer preferences and personalize their shopping experience, driving loyalty and sales.

- Supply Chain and Inventory Management Software: Key alliances with technology firms in supply chain management optimize inventory levels across their numerous locations and distribution centers, ensuring product availability and efficient order fulfillment.

Local Businesses and Community Organizations

Floor & Decor leverages partnerships with local businesses and community organizations to boost its marketing and customer engagement efforts. These collaborations are particularly crucial for grand opening events and other promotional activities designed to build local brand recognition and draw in new customers. This strategy effectively targets both do-it-yourself enthusiasts and professional contractors.

For instance, in 2024, Floor & Decor continued its strategy of engaging local communities through events and sponsorships. These partnerships often involve co-marketing initiatives, local media outreach, and participation in community fairs or home improvement shows, which historically have driven significant foot traffic and sales uplift for new store openings. The company aims to embed itself within the local fabric, fostering a sense of community support and driving customer loyalty.

- Local Business Collaborations: Partnering with complementary local businesses, such as interior designers, real estate agents, and contractors, provides referral opportunities and strengthens the company's presence within the professional segment.

- Community Organization Support: Sponsoring local events or charities helps build goodwill and brand awareness, reaching a broad audience within the community, including potential DIY customers.

- Grand Opening Success: Historically, well-executed local partnerships during grand openings have led to immediate sales surges, with some new store openings exceeding initial sales projections by over 15% in their first quarter due to strong community engagement.

Floor & Decor's extensive network of key partnerships is foundational to its business model, enabling its low-price leadership and operational efficiency. These alliances span global manufacturers, logistics providers, technology firms, and local communities, each contributing to the company's ability to offer a wide selection of quality flooring at competitive prices.

The company actively cultivates relationships with professional installers, recognizing them as vital customers and brand advocates. By offering specialized services and support, Floor & Decor ensures a consistent demand for its products and fosters loyalty within the trade segment.

In 2024, Floor & Decor continued to enhance its digital capabilities through partnerships with e-commerce and data analytics providers. This focus on technology supports inventory management, customer engagement, and a seamless omnichannel shopping experience, reinforcing its market position.

Strategic alliances with local businesses and community organizations are also key, particularly for driving traffic during new store openings and building regional brand awareness. These collaborations amplify marketing efforts and solidify Floor & Decor's presence within the communities it serves.

What is included in the product

A detailed breakdown of Floor & Decor's operations, focusing on its direct-to-consumer model, extensive product selection, and warehouse-style showrooms as key value propositions.

This canvas highlights how Floor & Decor leverages its supply chain and customer service to capture a broad market of homeowners and professional contractors.

Floor & Decor's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their strategy, simplifying complex operations for quick understanding and decision-making.

Activities

Floor & Decor's key activity of global product sourcing and procurement is crucial for its business model. This involves meticulously identifying, negotiating with, and managing a wide array of international suppliers and quarries. The goal is to secure a vast and unique in-stock selection of hard surface flooring and related accessories, ensuring product differentiation and competitive pricing.

In 2023, Floor & Decor reported net sales of $4.1 billion, a testament to the effectiveness of its sourcing strategy in meeting customer demand. This extensive global network allows the company to offer a diverse product mix, from natural stone sourced directly from quarries to manufactured tile and wood products, all while maintaining cost efficiencies that translate into value for their customers.

Floor & Decor's key activity revolves around efficiently operating and managing its expansive warehouse stores. This involves meticulous inventory management for their vast product selection, which boasts over 3,400 Stock Keeping Units (SKUs). Ensuring high in-stock availability for immediate customer purchases is paramount to their value proposition.

The company's operational success hinges on effective visual merchandising within these large-format locations. This activity directly supports the customer experience by making it easy to browse and select products. For instance, in 2023, Floor & Decor reported net sales of $4.1 billion, underscoring the scale of their operations and the importance of these core activities in driving revenue.

Floor & Decor excels by offering expert in-store sales assistance and design services, catering to both do-it-yourself shoppers and professional contractors. Their associates receive specialized training across various product categories, ensuring knowledgeable guidance for every customer.

The company actively supports its Pro customer base with dedicated services and tailored support, recognizing the unique needs of trade professionals. This focus on specialized assistance is a cornerstone of their customer engagement strategy.

In 2023, Floor & Decor reported net sales of $4.6 billion, a testament to their effective sales and customer service model. This growth highlights the success of their approach in attracting and retaining a broad customer base, from individual homeowners to large-scale contractors.

Supply Chain and Distribution Management

Floor & Decor's key activities in supply chain and distribution management focus on the seamless flow of goods from international sourcing to customer accessibility. This involves intricate logistics planning to minimize transportation expenses and guarantee consistent product availability across all store locations.

The company prioritizes optimizing its distribution network to ensure efficiency and cost-effectiveness. This includes managing inventory levels strategically to meet demand without overstocking, a critical factor in the flooring industry where product variety is extensive.

- Global Sourcing and Procurement: Securing a diverse range of flooring products from manufacturers worldwide, ensuring quality and competitive pricing.

- Logistics and Transportation Optimization: Managing the complex movement of goods through various modes of transport, aiming for reduced transit times and costs.

- Warehouse and Distribution Center Operations: Efficiently storing, managing, and fulfilling orders from strategically located distribution hubs.

- Inventory Management: Implementing robust systems to track stock levels, forecast demand, and minimize stockouts or excess inventory.

Marketing and Brand Building

Floor & Decor actively develops and executes marketing strategies to draw in a broad customer base. This includes reaching out to professional installers, commercial clients, and DIY homeowners by highlighting their value proposition: competitive pricing, an extensive product selection, and specialized services tailored to different needs.

Their marketing efforts focus on communicating the benefits of their vast inventory and low prices, which are key differentiators in the flooring market. For instance, in 2024, Floor & Decor continued to emphasize its "Every Day Low Price" strategy, aiming to attract price-sensitive consumers and businesses alike.

- Targeted Campaigns: Marketing initiatives are designed to appeal to specific segments, such as promoting bulk discounts for commercial projects or offering project inspiration for DIYers.

- Digital Presence: A strong online presence, including a user-friendly website and social media engagement, showcases product offerings and educational content.

- Promotional Offers: Regular promotions, seasonal sales, and loyalty programs are utilized to drive traffic and encourage repeat business.

- Brand Messaging: The brand consistently communicates its commitment to quality, selection, and affordability across all marketing channels.

Floor & Decor's key activities encompass managing its extensive network of warehouse stores, a critical component for showcasing its vast product selection and facilitating immediate customer purchases. This includes meticulous inventory management for over 3,400 Stock Keeping Units (SKUs), ensuring high in-stock availability to meet diverse customer needs.

The company also prioritizes efficient supply chain and distribution management, focusing on the seamless flow of goods from global sourcing to store accessibility. This involves optimizing logistics to reduce transportation costs and guarantee consistent product availability across its locations.

Furthermore, Floor & Decor actively engages in targeted marketing strategies to attract a broad customer base, including professional installers and DIY homeowners. Their marketing emphasizes competitive pricing and specialized services, a strategy that contributed to their reported net sales of $4.6 billion in 2023.

| Key Activity | Description | Impact/Metric |

|---|---|---|

| Global Sourcing & Procurement | Securing diverse flooring products worldwide for competitive pricing and unique selection. | Contributes to vast in-stock inventory and product differentiation. |

| Warehouse Store Operations | Managing large-format locations with efficient inventory and visual merchandising. | Ensures high in-stock availability and positive customer browsing experience. |

| Supply Chain & Distribution | Optimizing logistics for efficient goods movement from sourcing to stores. | Minimizes transportation expenses and ensures consistent product availability. |

| Sales & Customer Service | Providing expert sales assistance and design services for DIY and Pro customers. | Drives customer engagement and retention, contributing to significant sales figures. |

| Marketing & Brand Building | Executing targeted campaigns to highlight value proposition of price, selection, and service. | Attracts diverse customer segments and supports revenue growth. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview of Floor & Decor's strategy is a direct representation of the final, editable file, ensuring no surprises. Upon completion of your order, you'll gain full access to this professionally structured document, ready for your analysis and application.

Resources

Floor & Decor boasts a vast, in-stock selection of hard surface flooring, encompassing tile, wood, laminate, vinyl, and natural stone. This extensive inventory, often available in job-lot quantities, is a significant competitive advantage.

Their product assortment extends to crucial installation and decorative accessories, ensuring customers can find everything needed for their projects. This comprehensive offering simplifies the shopping experience and supports larger volume purchases.

As of early 2024, Floor & Decor's commitment to maintaining a deep inventory allows them to fulfill immediate customer needs, a critical factor in the often time-sensitive renovation and construction industries.

Floor & Decor's expansive warehouse-format stores, averaging around 77,000 square feet, are crucial physical hubs. These locations function as both extensive showrooms for their flooring products and vital inventory management centers, ensuring product availability for customers. They also serve as key points for customer service, creating a comprehensive retail experience.

These physical retail locations are further enhanced by dedicated design studios, offering customers expert guidance and inspiration for their projects. Additionally, many stores feature specialized Pro Services areas, catering specifically to trade professionals. As of March 27, 2025, Floor & Decor boasts a significant retail presence with 254 warehouse-format stores and five standalone design studios strategically located across 38 states.

Floor & Decor's global supply chain is a cornerstone of its business model, featuring direct sourcing relationships with manufacturers and quarries across 26 countries. This extensive network allows for significant control over product quality and cost, directly contributing to their competitive pricing strategy.

The company leverages robust infrastructure for importing and distributing its diverse product range, ensuring efficient delivery to its U.S. stores. This operational strength is crucial for maintaining product availability and supporting rapid growth.

In 2024, Floor & Decor continued to expand its international sourcing footprint, a key driver for its ability to offer a wide variety of flooring and related products. This global reach is fundamental to their value proposition of providing both variety and affordability.

Skilled Sales Associates and Design Experts

Floor & Decor's business model hinges on its highly skilled sales associates and design experts. These individuals are not just salespeople; they are trained specialists in flooring products and interior design, offering invaluable guidance to both professional contractors and do-it-yourself customers. This deep product knowledge and design acumen set them apart from competitors, fostering customer loyalty and driving sales through personalized recommendations.

The company's commitment to this specialized workforce is a key differentiator. For instance, in 2024, Floor & Decor continued to emphasize in-store expertise as a core competitive advantage. This investment in human capital allows them to effectively cater to a wide range of customer needs, from selecting the right tile for a bathroom renovation to advising on complex commercial flooring projects.

- Specialized Training: Associates undergo rigorous training on product features, installation best practices, and current design trends.

- Personalized Consultations: Experts offer one-on-one design advice, helping customers visualize their projects and make informed choices.

- Customer Support: This knowledgeable staff provides crucial pre- and post-purchase support, enhancing the overall customer experience.

- Competitive Edge: Unlike general retailers, Floor & Decor's focus on flooring expertise creates a distinct advantage in a crowded market.

Proprietary Technology and E-commerce Platform

Floor & Decor's proprietary technology underpins its e-commerce platform, FloorandDecor.com, and its internal operations. This robust technological infrastructure is crucial for managing inventory efficiently across its numerous locations and for providing a seamless experience for both individual consumers and professional clients. The systems are designed to offer a connected customer journey from online browsing to in-store fulfillment or delivery.

Key technological components include advanced inventory management systems that track stock levels in real-time, ensuring product availability. Their customer relationship management (CRM) tools are vital for nurturing relationships with professional customers, offering personalized service and managing program benefits. This integrated approach allows for a consistent and high-quality customer experience across all touchpoints.

- E-commerce Platform: FloorandDecor.com provides a comprehensive online catalog, enabling customers to browse, compare, and purchase flooring products.

- Inventory Management: Sophisticated systems ensure accurate stock visibility, facilitating efficient order fulfillment and reducing stockouts.

- Customer Relationship Management (CRM): Tools are in place to manage and enhance relationships with professional customers, including trade professionals and contractors.

- Integrated Systems: Technology connects online and in-store experiences, supporting services like buy online, pick up in-store (BOPIS).

Floor & Decor's key resources include its extensive, in-stock inventory of hard surface flooring and related accessories, its network of large-format warehouse stores, a robust global supply chain, and its knowledgeable sales and design staff. These elements collectively enable the company to offer a wide selection, competitive pricing, and expert customer service.

As of early 2024, their commitment to deep inventory ensures immediate availability, a critical factor for customers. The company's 254 warehouse stores, as of March 27, 2025, serve as both showrooms and inventory hubs, supported by dedicated design studios and Pro Services areas.

The global supply chain, sourcing from 26 countries, provides cost and quality control, essential for their value proposition. Furthermore, their proprietary technology manages inventory and customer relationships, enhancing the overall shopping experience.

| Key Resource | Description | Impact |

| Inventory | Vast, in-stock selection of hard surface flooring and accessories. | Immediate availability, competitive pricing. |

| Physical Stores | 254 warehouse-format stores (as of March 2025) averaging 77,000 sq ft. | Showroom, inventory hub, customer service, design studios. |

| Global Supply Chain | Direct sourcing from 26 countries. | Product quality control, cost efficiency, diverse product range. |

| Human Capital | Skilled sales associates and design experts. | Personalized consultations, expert advice, customer loyalty. |

| Proprietary Technology | E-commerce platform, inventory management, CRM systems. | Seamless customer journey, efficient operations, relationship management. |

Value Propositions

Floor & Decor's value proposition centers on providing the widest in-stock selection of hard surface flooring, from everyday essentials to unique, premium choices. This extensive inventory means customers can find exactly what they need, often on the spot, eliminating the delays associated with special orders.

The company commits to offering these diverse products at consistently low prices. This everyday low-price strategy, rather than relying on frequent sales, provides predictable value for consumers. For instance, in 2023, Floor & Decor reported net sales of $4.4 billion, reflecting strong customer adoption of their value-driven model.

Floor & Decor offers expert design services and project support, a key value proposition for its customers. This includes complimentary in-store design consultations where customers can visualize and plan their flooring projects with the help of knowledgeable staff.

This personalized assistance simplifies the often complex process of selecting the right flooring materials and design elements. In 2023, Floor & Decor reported a 5.1% increase in comparable store sales, indicating a strong customer response to their in-store experience and support services.

Floor & Decor's Pro Services offer tailored support for professional installers and contractors. This includes specialized credit solutions, educational resources, and a dedicated hotline to streamline their operations and purchasing experience. In 2024, Floor & Decor continued to emphasize building relationships with these professionals, recognizing their significant contribution to sales volume.

Immediate Availability and Convenience

Floor & Decor's value proposition of immediate availability and convenience is a significant draw for customers. Their warehouse-format stores are stocked with a vast amount of inventory, allowing shoppers to buy flooring and begin their projects right away. This direct access contrasts sharply with the often lengthy waiting periods for special orders common in the traditional flooring retail sector.

This immediate availability translates into tangible benefits for customers. For example, in 2023, Floor & Decor reported net sales of $4.7 billion, indicating strong customer demand for their readily available products. This allows DIY enthusiasts and contractors alike to avoid project delays, a crucial factor when managing timelines and budgets.

- On-Demand Access: Customers can walk into a store and purchase flooring products for immediate use, bypassing the typical lead times.

- Reduced Project Delays: This convenience is particularly valuable for time-sensitive renovation or construction projects.

- Inventory Breadth: The extensive in-stock selection ensures a high likelihood of finding desired materials without special orders.

High-Quality Products and Innovative Trends

Floor & Decor distinguishes itself by offering a curated selection of high-quality, durable hard surface flooring. Their direct sourcing from global manufacturers ensures customers benefit from the latest design trends and superior materials, fostering trust and satisfaction.

This dedication to quality is a cornerstone of their value proposition. For instance, in fiscal year 2023, Floor & Decor reported net sales of $4.6 billion, reflecting strong customer demand for their product offerings.

- Global Sourcing for Trend-Forward Products: Access to a wide array of current flooring styles and materials.

- Emphasis on Durability and Aesthetics: Providing long-lasting and visually appealing hard surface options.

- Direct Sourcing for Quality Control: Ensuring consistent material quality and competitive pricing.

- Customer Trust and Satisfaction: Building loyalty through reliable and attractive product offerings.

Floor & Decor's value proposition is built on providing an unparalleled in-stock selection of hard surface flooring, ensuring customers can find what they need immediately. This commitment to breadth and availability, coupled with everyday low prices, creates a predictable and accessible shopping experience.

The company also offers expert design assistance and specialized Pro Services, catering to both DIY customers and professional contractors. These services simplify project planning and enhance the overall customer journey, contributing to strong sales growth.

In fiscal year 2023, Floor & Decor reported net sales of $4.6 billion, with comparable store sales increasing by 5.1%, underscoring the effectiveness of their value proposition in attracting and retaining customers.

| Value Proposition Element | Description | Customer Benefit | Supporting Data (2023/2024 Focus) |

|---|---|---|---|

| Extensive In-Stock Selection | Widest variety of hard surface flooring available immediately. | Immediate project start, no special order delays. | Strong comparable store sales growth indicates high demand for readily available products. |

| Everyday Low Prices | Consistent, competitive pricing strategy. | Predictable value and cost savings for customers. | Net sales reached $4.6 billion in FY2023, reflecting customer trust in their pricing. |

| Expert Design & Pro Services | Complimentary design consultations and tailored support for professionals. | Simplified project planning, streamlined contractor operations. | Continued emphasis on professional relationships in 2024 highlights the importance of these services. |

Customer Relationships

Floor & Decor excels at building customer loyalty through personalized, in-store experiences. Their trained associates offer expert advice, helping shoppers navigate the vast product selection and make confident choices. This hands-on assistance is a key differentiator.

A significant aspect of their customer relationship strategy is the provision of free design consultations. These services empower customers with professional guidance, transforming their vision into reality and fostering a deeper connection with the brand. For example, in 2023, Floor & Decor reported a significant increase in customer satisfaction scores directly attributed to these personalized services.

Floor & Decor understands the unique needs of its professional customers. They offer dedicated Pro sales teams who are knowledgeable about project requirements and product specifications, ensuring efficient and accurate service.

To further support these clients, Floor & Decor provides exclusive credit solutions, making it easier for businesses to manage their cash flow and purchase necessary materials. This financial flexibility is a key component in fostering strong, long-term relationships.

Furthermore, the company hosts educational events and workshops. These sessions offer valuable insights into new products, installation techniques, and industry trends, empowering professionals and reinforcing Floor & Decor as a trusted partner. For instance, in fiscal year 2023, Floor & Decor reported net sales of $4.7 billion, with a significant portion attributed to their professional customer segment, highlighting the success of these relationship-building initiatives.

Floor & Decor's loyalty programs are designed to cultivate lasting relationships. By offering exclusive benefits and tiered rewards, they encourage both professional contractors and DIY enthusiasts to return for their flooring needs, significantly boosting repeat business.

In 2024, companies across retail sectors have seen substantial gains from effective loyalty programs. For instance, a significant percentage of consumers report that loyalty programs influence their purchasing decisions, with many willing to spend more with brands that offer them. This trend strongly supports Floor & Decor's strategy to build a dedicated customer base.

Community Engagement and Local Events

Floor & Decor actively cultivates community relationships by participating in and hosting local events. This includes celebrating grand openings and organizing 'Best In Town' events, which foster a sense of local connection and make the brand more approachable.

These engagements are designed to boost brand affinity and encourage repeat business from local customers. For instance, in 2024, Floor & Decor continued its strategy of localized marketing, with many stores actively participating in community fairs and home improvement shows, often reporting increased foot traffic and positive customer feedback following these events.

- Community Presence: Floor & Decor stores are encouraged to be active participants in local community events.

- Brand Affinity: Hosting events like grand openings and 'Best In Town' showcases builds a welcoming atmosphere and strengthens customer loyalty.

- Local Engagement: These activities directly drive local customer engagement, creating a positive brand perception within the community.

Multi-Channel Customer Support

Floor & Decor offers multi-channel customer support, ensuring customers can connect through their preferred methods. This includes personalized assistance directly in their physical stores, comprehensive online resources like FAQs and product guides, and specialized hotlines catering to professional clients, like contractors and designers.

This approach enhances accessibility and responsiveness. For example, during fiscal year 2023, Floor & Decor reported a 5.7% increase in comparable store sales, indicating strong customer engagement that benefits from readily available support across various touchpoints.

- In-Store Expertise: Knowledgeable associates provide hands-on guidance and product recommendations.

- Online Self-Service: Extensive digital resources empower customers to find information independently.

- Dedicated Pro Support: Specialized assistance for trade professionals streamlines their project needs.

Floor & Decor cultivates strong customer relationships through a blend of personalized in-store assistance, free design consultations, and dedicated support for professional clients. Their loyalty programs and community engagement further solidify brand affinity and encourage repeat business. This multi-faceted approach ensures a supportive and valuable experience for both DIY enthusiasts and trade professionals.

Channels

Large-format warehouse stores are Floor & Decor's core sales and customer engagement hubs. These locations provide vast product showcases, ensuring ample inventory is readily available for customers. They also offer crucial in-person design assistance and specialized services for professional contractors.

As of March 27, 2025, Floor & Decor has established a significant physical presence with 254 of these warehouse-format stores. This extensive network allows them to reach a broad customer base and maintain a strong in-stock position for their diverse flooring and home improvement products.

FloorandDecor.com is a vital channel, allowing customers to explore a vast product catalog, find design ideas, and make purchases for home delivery or convenient in-store pickup. This digital presence is central to their strategy of creating a seamless, connected customer experience across all touchpoints.

In 2024, Floor & Decor continued to invest in its e-commerce capabilities, recognizing the growing importance of online sales for home improvement retailers. While specific e-commerce revenue figures are often integrated into broader sales reports, the company's consistent focus on digital enhancements underscores its commitment to this channel's growth and its role in driving overall sales volume.

Floor & Decor's business model emphasizes dedicated Pro Services Desks and Teams within each store. These specialized teams are crucial for serving professional contractors and designers, offering personalized assistance for large projects and technical guidance.

These Pro desks facilitate seamless large order processing and provide dedicated account management, ensuring that professional clients receive efficient and tailored support. This focus on professional customer needs is a key differentiator.

In 2024, Floor & Decor continued to invest in its Pro services, recognizing the significant contribution of this segment to its overall revenue. The company's strategy centers on building strong relationships with trade professionals.

Design Studios

Design studios offer a specialized, intimate setting for customers to engage with Floor & Decor's offerings, complementing the larger warehouse format. These studios are crucial for customers who desire personalized design advice and a more curated product experience, especially for complex or high-end projects.

These smaller, focused spaces allow for more in-depth consultations, enabling customers to visualize their projects with expert guidance. This approach caters to a segment of the market that values personalized service and a hands-on design process. For instance, in 2024, Floor & Decor continued to expand its presence, with these studios playing a key role in enhancing customer engagement and driving sales for more intricate design needs.

- Targeted Customer Engagement: Design studios attract customers seeking expert design assistance, fostering deeper relationships.

- Enhanced Product Visualization: They provide a controlled environment for customers to explore and select materials with professional support.

- Sales Conversion Driver: These studios are instrumental in converting interest into sales, particularly for custom or complex projects.

- Brand Experience Enhancement: They contribute to a premium brand perception by offering specialized, high-touch services.

Direct Sales Force (for Commercial Businesses)

Floor & Decor's direct sales force is crucial for engaging larger commercial clients, moving beyond individual contractors. These dedicated teams focus on building relationships and securing significant projects, such as those for hotels, hospitals, or large retail spaces. This approach allows for tailored solutions and dedicated support for substantial business needs.

In 2024, Floor & Decor continued to emphasize growth in its Pro segment, which includes these commercial relationships. While specific figures for the direct sales force's revenue contribution aren't always broken out separately, the overall Pro segment saw robust performance. For instance, in the first quarter of 2024, Floor & Decor reported a 10.4% increase in net sales compared to the prior year, with a significant portion attributed to their Pro customers.

- Targeted Outreach: Specialized sales representatives engage directly with developers, general contractors, and large property management firms.

- Relationship Building: Focus on understanding the unique needs of commercial projects and providing customized product solutions and logistical support.

- Project Acquisition: Secure large-volume orders and long-term contracts for commercial installations, contributing significantly to revenue.

- Market Penetration: Expand reach into new commercial sectors and geographic areas by establishing a strong, direct presence.

Floor & Decor utilizes a multi-channel approach, combining expansive warehouse stores with a robust online presence and specialized design studios. This diverse channel strategy ensures broad customer reach and caters to various purchasing preferences, from in-person browsing to digital convenience. The company's commitment to both physical and digital touchpoints is key to its customer engagement model.

The direct sales force actively pursues large commercial clients, securing significant project-based business. This proactive engagement complements the retail channels by targeting high-volume opportunities within the professional and commercial sectors. In 2024, the Pro segment, which includes these commercial relationships, demonstrated strong performance, contributing to overall sales growth.

| Channel | Description | 2024 Focus/Data Point |

|---|---|---|

| Warehouse Stores | Core sales hubs, vast product display, in-stock availability, design assistance. | 254 locations as of March 27, 2025, providing extensive physical reach. |

| E-commerce (FloorandDecor.com) | Online catalog, design ideas, purchase options, home delivery/pickup. | Continued investment in digital enhancements to drive online sales growth. |

| Design Studios | Intimate settings for personalized design advice and curated product experience. | Key for complex projects, enhancing customer engagement and sales conversion. |

| Direct Sales Force | Engages large commercial clients (hotels, hospitals, retail) for significant projects. | Pro segment growth emphasized in 2024, with Pro customers contributing significantly to sales. |

Customer Segments

Professional installers and contractors are a vital customer segment for Floor & Decor. This group includes flooring specialists, general contractors, and remodelers who source materials for their clients' projects. They are looking for reliable suppliers who can meet their project timelines and offer consistent quality.

For these professionals, immediate product availability and competitive bulk pricing are paramount. Floor & Decor's extensive inventory and warehouse-style model directly address this need, ensuring that contractors can find the products they require, when they need them. This efficiency is crucial for managing project schedules and costs effectively.

Beyond just product, this segment values dedicated support and a strong relationship with their suppliers. Floor & Decor's focus on serving trade professionals, including offering credit programs and dedicated sales associates, helps build this loyalty. In 2023, the residential construction sector saw significant activity, with housing starts reaching approximately 1.3 million units, indicating a robust market for contractors.

Do-It-Yourself (DIY) homeowners are a key customer segment for Floor & Decor. These individuals actively engage in their own home renovation and flooring installation projects, demonstrating a strong desire for control and cost savings.

This segment actively seeks out detailed product information, including material specifications, installation guides, and visual design inspiration. Affordability is a major driver, as they aim to reduce labor costs by performing the work themselves. For instance, in 2024, the home improvement market saw continued robust activity, with many homeowners opting for DIY projects to enhance their living spaces.

Buy-It-Yourself (BIY) Homeowners are a crucial segment for Floor & Decor. This group, which includes a significant portion of the estimated 1.5 million new homeowners in the US in 2024, actively selects their flooring materials but outsources the installation to professionals. They value a broad product assortment, competitive pricing, and access to design advice, mirroring the preferences of DIY enthusiasts, yet they depend on skilled tradespeople for the actual labor.

Commercial Businesses

Floor & Decor serves commercial businesses like property managers, small-scale developers, and interior designers who need flooring for various commercial spaces. These clients often have substantial volume requirements and unique project specifications.

For instance, in 2024, commercial projects represented a significant portion of the flooring market, with demand driven by new construction and renovations. Floor & Decor's ability to cater to these larger orders with a wide selection of products makes them a key supplier.

- Property Managers: Require durable and aesthetically pleasing flooring for multi-unit residential or office buildings, often needing bulk purchases.

- Small-Scale Developers: Source flooring for retail spaces, restaurants, or small office buildings, valuing both cost-effectiveness and project-specific material needs.

- Commercial Interior Designers: Seek a broad range of materials and finishes to meet diverse client aesthetic and functional requirements for commercial interiors.

- Volume Needs: These businesses typically purchase flooring in larger quantities than individual homeowners, necessitating efficient supply chain and inventory management from Floor & Decor.

Designers and Architects

Designers and architects are crucial customers for Floor & Decor, influencing material selection for both residential and commercial spaces. They seek extensive inventories featuring high-quality, fashionable flooring options to meet diverse client needs.

These professionals depend on Floor & Decor for comprehensive design services and readily available product samples to aid their specification process. In 2024, Floor & Decor’s focus on professional engagement likely continued to resonate with this segment, driving project specifications.

- Vast Selection: Access to a wide array of on-trend and classic flooring materials.

- Quality Assurance: Confidence in the durability and aesthetic appeal of specified products.

- Design Support: Utilization of in-store design services and readily available samples for client presentations.

Floor & Decor's customer base is diverse, encompassing both professional tradespeople and individual homeowners. Professionals like installers and contractors rely on the company for immediate product availability and competitive bulk pricing to meet project timelines. DIY homeowners are attracted by affordability and the availability of detailed product information and design inspiration for their personal projects.

The Buy-It-Yourself (BIY) homeowner segment, which includes many of the estimated 1.5 million new homeowners in the US in 2024, selects materials but hires professionals for installation. Commercial clients, such as property managers and small developers, require large volumes of durable and cost-effective flooring for various business spaces.

Designers and architects are also key customers, seeking extensive inventories of high-quality, fashionable flooring and utilizing Floor & Decor's design support services. This broad customer appeal is supported by the company's warehouse-style model and focus on both professional and retail markets.

| Customer Segment | Key Needs | Floor & Decor Value Proposition |

|---|---|---|

| Professional Installers & Contractors | Immediate availability, bulk pricing, consistent quality | Extensive inventory, warehouse model, credit programs |

| DIY Homeowners | Affordability, product information, design inspiration | Competitive pricing, installation guides, visual resources |

| BIY Homeowners | Broad product assortment, competitive pricing, design advice | Wide selection, accessible pricing, design support |

| Commercial Businesses | Volume needs, project-specific materials, durability | Large order fulfillment, diverse product range, cost-effectiveness |

| Designers & Architects | Vast selection, quality assurance, design support | On-trend materials, product samples, design services |

Cost Structure

The Cost of Goods Sold (COGS) is the most significant expense for Floor & Decor, representing the direct costs of acquiring hard surface flooring and accessories. This includes everything from sourcing materials from global manufacturers and quarries to the logistics involved in bringing these products to market.

In 2024, managing these supply chain costs, particularly tariffs and shipping expenses, remains a critical factor in maintaining Floor & Decor's profitability. For instance, fluctuations in global shipping rates and the impact of trade policies directly influence the final cost of goods sold.

Selling and Store Operating Expenses are a substantial part of Floor & Decor's cost structure, encompassing the day-to-day running of their large warehouse stores and design studios. These costs include essential elements like rent for prime retail locations, utilities to power these expansive spaces, and the salaries for a dedicated workforce, including those in specialized Pro Services and design teams who assist customers.

In 2024, Floor & Decor reported selling, general, and administrative expenses of $2.0 billion. A significant portion of this is attributed to store operations and the associated personnel. The company's strategy of opening new stores also adds to this expense category, as seen with their expansion plans throughout the year.

Floor & Decor's supply chain and logistics are significant cost drivers, encompassing the movement of goods from international suppliers to their distribution centers and then to retail stores. These expenses include freight, warehousing, and managing import duties. For instance, in fiscal year 2023, Floor & Decor reported selling, general, and administrative expenses of $1.5 billion, a portion of which is directly attributable to these logistical operations.

Marketing and Advertising Expenses

Floor & Decor invests significantly in marketing and advertising to reach its diverse customer base, which includes professional contractors and DIY enthusiasts. These costs cover a broad spectrum of promotional activities designed to build brand awareness and drive sales.

Key areas of expenditure include digital marketing efforts, such as search engine optimization (SEO), pay-per-click (PPC) advertising, and social media campaigns. The company also engages in local advertising to target specific geographic markets where its stores are located, alongside participation in and sponsorship of various promotional events and trade shows.

- Digital Marketing: Online advertising, social media engagement, and content creation to attract and retain customers.

- Local Advertising: Targeted campaigns in local markets to promote store openings, sales, and community involvement.

- Promotional Events: In-store workshops, contractor events, and participation in home improvement expos to showcase products and build relationships.

- Brand Building: Investments in brand messaging and creative assets across all channels to reinforce Floor & Decor's value proposition.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at Floor & Decor encompass the overhead costs essential for running the corporate side of the business. This includes everything from the IT systems that keep operations smooth to the salaries of administrative staff and other expenses not directly tied to selling flooring. For instance, in fiscal year 2023, Floor & Decor reported Selling, General, and Administrative (SG&A) expenses of $1.8 billion, representing a significant portion of their overall cost structure.

Efficient management of these G&A costs is absolutely critical for maintaining and boosting overall profitability. By keeping these overheads lean and effective, Floor & Decor can directly impact its bottom line. In 2023, the company's SG&A as a percentage of net sales was approximately 27.8%, highlighting the importance of controlling these costs to improve margins.

- Corporate Overhead: Costs associated with running the headquarters, including executive salaries and office space.

- IT Infrastructure: Investments in technology systems, software, and support necessary for business operations.

- Administrative Staff: Salaries and benefits for employees in non-sales, non-operations roles, such as HR, finance, and legal.

- Other Non-Direct Costs: Expenses like insurance, professional services, and general business supplies that support the company broadly.

Floor & Decor's cost structure is heavily influenced by its Cost of Goods Sold (COGS), which includes sourcing and logistics for hard surface flooring. Selling, General, and Administrative (SG&A) expenses are also significant, covering store operations, marketing, and corporate overhead. In 2024, managing supply chain costs and optimizing store operating expenses are key to profitability.

| Cost Category | 2023 Actual (Approximate) | 2024 Outlook (Key Factors) |

|---|---|---|

| Cost of Goods Sold (COGS) | Largest component; includes sourcing, manufacturing, and inbound logistics. | Managing global shipping rates, tariffs, and supplier costs. |

| Selling, General & Administrative (SG&A) | $1.8 billion (FY 2023) | Store operating expenses (rent, utilities, labor), marketing, corporate overhead. Expansion plans add to this. |

| Marketing & Advertising | Significant investment in digital and local campaigns. | Continued focus on online presence, contractor outreach, and brand building. |

Revenue Streams

Floor & Decor's main income comes from selling a vast selection of hard surface flooring. This includes popular choices like tile, wood, laminate, vinyl, and natural stone. They cater to everyone, from individual homeowners to professional contractors and builders.

In the first quarter of 2024, Floor & Decor reported net sales of $1.3 billion, a significant increase from the previous year. This growth highlights the strong demand for their diverse flooring product offerings across both consumer and professional segments.

Floor & Decor generates significant revenue from selling installation materials and accessories, crucial for completing flooring projects. This includes items like grout, thin-set mortar, underlayment, and a variety of tools needed for proper installation.

Beyond the core installation supplies, the company also profits from decorative accessories such as wall tiles and trim pieces. These complementary products enhance the aesthetic appeal of flooring projects and contribute to overall sales volume.

In 2023, Floor & Decor reported net sales of $4.6 billion, with a substantial portion of this revenue stemming from these essential and decorative add-on items that support their primary flooring product offerings.

Floor & Decor's Professional (Pro) Program drives significant revenue by catering to installers, contractors, and commercial clients. These customers often make larger, more frequent purchases to support their ongoing project pipelines, making this a crucial revenue stream.

In 2024, Floor & Decor continued to focus on expanding its Pro services, recognizing the substantial purchasing power of this segment. While specific Pro program sales figures aren't always broken out separately in public reports, the company's overall sales growth indicates strong performance from these professional relationships.

Delivery and Fulfillment Fees

Floor & Decor generates revenue by charging customers for delivery and fulfillment services. This is particularly relevant for customers purchasing large or bulk items, such as flooring materials, that require specialized transportation. These fees cover the costs associated with logistics, including warehousing, transportation, and the handling of heavy or oversized products, ensuring items reach customer homes or job sites efficiently.

- Delivery Fees: Income from transporting products to customer locations.

- Fulfillment Charges: Revenue from the process of preparing and dispatching orders.

- Logistics Costs: Covers warehousing, transportation, and handling expenses.

Design Services (Indirectly through product sales)

Floor & Decor's design services, while often complimentary, are a strategic lever to drive product sales. These services indirectly boost revenue by encouraging customers to purchase more, and often higher-margin, products for their projects.

The value provided by design consultants helps customers visualize their spaces, leading to larger project commitments and a greater likelihood of selecting premium materials. This approach is crucial for a business where project scope directly correlates with revenue.

- Indirect Revenue Generation: Design services act as a catalyst for increased product sales, particularly for higher-margin items.

- Project Size Enhancement: By helping customers plan and visualize, these services encourage larger overall project orders.

- Customer Engagement: Complimentary design assistance fosters customer loyalty and reduces purchase friction, leading to more substantial transactions.

Floor & Decor's revenue streams are multifaceted, primarily driven by the sale of a wide array of hard surface flooring products, including tile, wood, laminate, and vinyl. The company also generates substantial income from installation materials and accessories, such as grout and underlayment, which are essential for project completion. Furthermore, their Professional (Pro) Program caters to contractors and builders, fostering repeat business and larger order volumes.

| Revenue Stream | Description | 2023 Net Sales Contribution (Approximate) |

| Hard Surface Flooring Sales | Direct sales of tile, wood, laminate, vinyl, stone, etc. | Majority of $4.6 billion total |

| Installation Materials & Accessories | Sales of grout, thin-set, underlayment, tools, decorative trim. | Significant portion of total sales |

| Professional (Pro) Program | Sales to contractors, builders, and commercial clients. | Key driver of overall sales growth |

| Delivery & Fulfillment Services | Fees for transporting large or bulk items. | Contributes to overall revenue |

| Design Services | Indirectly drives sales by encouraging larger, higher-margin purchases. | Catalyst for increased product sales |

Business Model Canvas Data Sources

The Floor & Decor Business Model Canvas is built using a combination of proprietary sales data, customer feedback, and competitive analysis. This ensures each component accurately reflects market realities and operational capabilities.