Floor & Decor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Floor & Decor Bundle

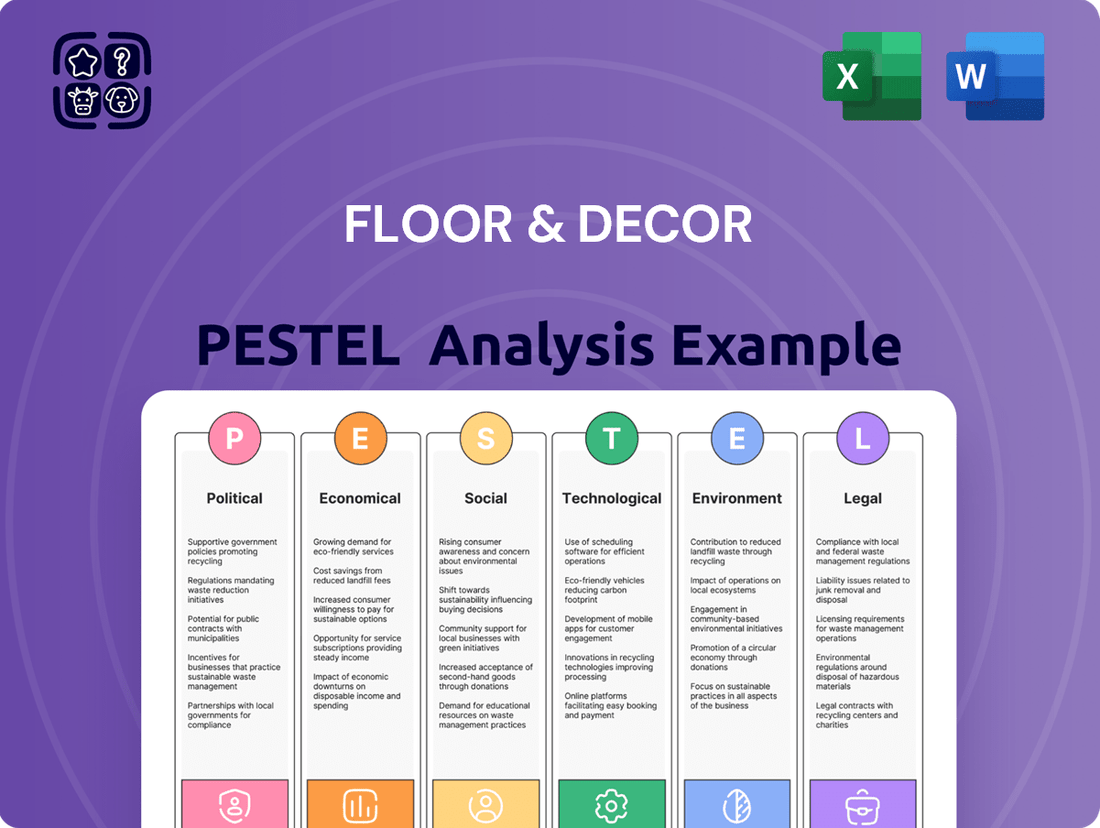

Navigate the ever-changing market landscape with our comprehensive PESTLE analysis of Floor & Decor. Understand how political shifts, economic fluctuations, and technological advancements are directly impacting their operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions.

Unlock a deeper understanding of the external forces shaping Floor & Decor's success. Our PESTLE analysis provides critical insights into social trends, environmental considerations, and legal frameworks affecting the company. Download the full report now and gain a competitive edge.

Political factors

Potential increases in tariffs on imported flooring materials, especially Luxury Vinyl Tile (LVT) and Stone Plastic Composite (SPC) from Asia, represent a significant political risk for Floor & Decor. With over 70% of LVT/SPC supply originating from Asia, proposed tariff hikes, potentially reaching 65%, could drastically escalate direct costs for the company and the broader industry.

These tariff adjustments necessitate proactive strategic shifts in sourcing locations and pricing models to mitigate the impact on profitability and competitiveness. The company must anticipate these policy changes and adapt its supply chain to buffer against such economic pressures.

Global trade policies and international relations significantly impact the availability and cost of construction materials, a core component for Floor & Decor. For instance, changes in tariffs or import/export regulations can directly affect the landed cost of flooring products imported from overseas. In 2024, ongoing trade discussions between major economies could introduce new cost pressures or opportunities for sourcing.

Geopolitical tensions and evolving trade agreements present potential disruptions to Floor & Decor's supply chains. A shift in trade relations with key manufacturing countries could lead to increased lead times or necessitate finding alternative suppliers, impacting inventory levels and pricing strategies. The company's reliance on international sourcing means it is sensitive to these global dynamics.

Changes in labor laws, such as minimum wage increases, directly affect Floor & Decor's labor expenses. For instance, states like California and New York have seen phased minimum wage hikes, with California aiming for $16 per hour statewide by 2024. These adjustments necessitate that Floor & Decor adapt its compensation strategies and potentially review staffing levels to manage increased payroll costs across its retail operations.

Building Material Standards and 'Buy American' Initiatives

New federal standards could mandate domestic manufacturing for construction materials, potentially impacting Floor & Decor's product sourcing and supply chain. These regulations, while primarily targeting infrastructure, might also encourage a broader market shift towards domestically produced goods, influencing consumer choices and competitive landscapes.

The implications for Floor & Decor include adapting product lines to meet potential 'Buy American' requirements, which could affect material costs and availability. For instance, the Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, includes provisions encouraging the use of American-made materials in federally funded projects, setting a precedent for future policy and market trends.

- Potential increased costs for imported materials if 'Buy American' provisions are expanded.

- Opportunities to partner with or source from domestic manufacturers.

- Shifts in consumer preference towards products perceived as domestically sourced.

- Need for supply chain flexibility to adapt to evolving trade and manufacturing policies.

Government Support for Housing and Infrastructure

Government support for housing and infrastructure projects directly impacts demand for building materials like those Floor & Decor offers. Initiatives aimed at boosting new construction or significant renovation projects can lead to increased sales. For instance, in 2024, the U.S. Department of Housing and Urban Development (HUD) continued programs like the HOME Investment Partnerships Program, which funds affordable housing development, indirectly benefiting flooring suppliers.

Furthermore, infrastructure spending, such as investments in public buildings, transportation hubs, and community facilities, creates opportunities for commercial flooring solutions. The Infrastructure Investment and Jobs Act, enacted in late 2021 and continuing its implementation through 2024 and beyond, allocates substantial funds towards modernizing infrastructure. This can translate into demand for durable and aesthetically pleasing flooring in a wide range of public spaces.

Key government support mechanisms include:

- Tax incentives for new home buyers and developers: These can encourage residential construction, increasing the need for flooring.

- Federal and state grants for affordable housing: These programs directly fund projects that require building materials.

- Infrastructure spending bills: Investments in public works create demand for commercial-grade flooring solutions.

- Permitting and zoning reforms: Streamlining approval processes can accelerate construction timelines, boosting material demand.

Government policies on trade, particularly tariffs on imported goods like LVT and SPC from Asia, directly impact Floor & Decor's cost structure. Potential tariff increases, as high as 65% on certain materials, could significantly raise expenses. The company's reliance on Asian suppliers for over 70% of its LVT/SPC necessitates strategic adjustments to sourcing and pricing to maintain competitiveness.

Federal and state initiatives supporting housing and infrastructure development create demand for Floor & Decor's products. For example, the continuation of HUD's HOME Investment Partnerships Program in 2024, alongside substantial infrastructure investments from the Infrastructure Investment and Jobs Act, stimulates both residential and commercial flooring sales.

Labor laws, such as minimum wage increases, affect operational costs. With states like California aiming for a $16 per hour minimum wage by 2024, Floor & Decor must manage increased payroll expenses across its retail network.

Government regulations promoting domestic manufacturing could influence sourcing strategies. The Infrastructure Investment and Jobs Act's encouragement of American-made materials sets a precedent, potentially shifting market preferences and requiring adaptation to 'Buy American' provisions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Floor & Decor, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and capitalize on emerging market opportunities.

Floor & Decor's PESTLE analysis offers a clear, summarized version of external factors, relieving the pain point of wading through extensive research during meetings and presentations.

Economic factors

Elevated interest rates, with the Federal Reserve maintaining its benchmark rate in the 5.25%-5.50% range through mid-2024, directly impact mortgage rates. This can lead to a slowdown in new home sales and large-scale renovation projects as financing becomes more expensive.

However, this environment also presents an opportunity for home improvement retailers like Floor & Decor. Homeowners who secured lower mortgage rates in previous years may be less inclined to move, instead opting to invest in renovating and upgrading their current residences to improve living spaces.

This 'locked-in' effect on mortgages can foster sustained demand for home improvement products, as consumers focus on enhancing their existing homes rather than undertaking the costly process of moving in a high-interest-rate climate.

Consumer confidence remains a key indicator for the home improvement sector. Despite persistent inflation concerns impacting personal finances, a significant portion of homeowners are still prioritizing DIY projects, particularly for essential maintenance and upgrades aimed at improving comfort and livability. This resilient demand for home enhancements directly benefits companies like Floor & Decor.

In the first quarter of 2024, the U.S. Personal Consumption Expenditures (PCE) price index, a closely watched inflation gauge, saw a moderate increase, yet consumer spending on goods, including home improvement items, demonstrated continued, albeit slower, growth. This suggests that while consumers are mindful of costs, they are still allocating funds towards their homes.

The U.S. housing market in late 2024 and early 2025 is characterized by a noticeable slowdown in existing home sales, with data from the National Association of Realtors indicating a continued dip in transactions compared to previous years. Despite this, home prices have remained resilient, even showing modest increases in many regions. This dynamic often encourages homeowners to focus on improving their current residences rather than moving, directly benefiting companies like Floor & Decor.

New home construction, while not booming, continues at a steady, albeit slower, pace through 2024 and into 2025. This ongoing development, even at reduced rates, still generates consistent demand for flooring and other home improvement products. For example, housing starts in the single-family sector, though fluctuating, are projected to maintain a baseline level, providing a predictable stream of business for material suppliers.

Furthermore, home equity levels have generally remained robust, providing homeowners with a valuable financial resource. As of mid-2024, average home equity in the U.S. stands at a significant percentage, giving many homeowners the confidence and capital to undertake renovation projects. This increased home equity translates directly into greater spending power for upgrades, including flooring, as individuals leverage their property's value.

Inflation and Material Costs

Inflationary pressures and increased costs for building materials and labor continue to present challenges for the home improvement sector. Floor & Decor, like its peers, must manage these rising input expenses, which directly influence product pricing, profit margins, and the discretionary spending capacity of consumers. For instance, the Producer Price Index for construction materials saw a notable increase in early 2024, indicating ongoing cost pressures.

Adapting pricing strategies and optimizing supply chain management are therefore critical for Floor & Decor to maintain competitiveness and profitability. The company's ability to absorb or pass on these increased costs will be a key determinant of its financial performance in the coming periods.

- Rising Material Costs: Lumber prices, a key indicator, experienced volatility throughout 2023 and into 2024, impacting overall construction expenses.

- Labor Cost Increases: Wage growth in skilled trades and construction sectors has also contributed to higher operational costs.

- Consumer Purchasing Power: Persistent inflation can erode consumer confidence and reduce spending on discretionary home improvement projects.

- Strategic Pricing: Floor & Decor will need to carefully balance competitive pricing with the need to cover elevated input costs.

Market Consolidation and Competition

The flooring industry is experiencing a notable trend of consolidation, with projections indicating that by 2027, a smaller number of dominant companies will command a significant portion of the market. This evolving competitive environment presents both challenges and opportunities for Floor & Decor.

Floor & Decor must effectively utilize its established multi-channel approach and extensive product offerings to defend and expand its market position. This strategy is crucial for competing against established large-scale retailers as well as niche, specialized competitors who are also vying for market share.

- Market Share Dynamics: Industry analysts anticipate a shift towards fewer, larger entities dominating the flooring sector by 2027, intensifying competitive pressures.

- Competitive Landscape: Floor & Decor faces robust competition from both broad-line retailers and specialized flooring providers, necessitating strategic differentiation.

- Strategic Imperatives: Maintaining and growing market share requires Floor & Decor to consistently leverage its multi-channel strategy and diverse product catalog.

Elevated interest rates, with the Federal Reserve maintaining its benchmark rate in the 5.25%-5.50% range through mid-2024, directly impact mortgage rates, potentially slowing new home sales and large renovations. However, this also encourages homeowners to invest in upgrading existing residences, fostering sustained demand for home improvement products like flooring.

Despite inflation concerns, consumer spending on home improvement items showed continued growth in early 2024, indicating resilience. Home equity levels remained robust as of mid-2024, providing homeowners with capital for renovation projects.

Rising material and labor costs, exemplified by increased Producer Price Index for construction materials in early 2024, present challenges. Floor & Decor must manage these input expenses to maintain profitability and competitiveness.

The flooring industry is consolidating, with projections of fewer dominant companies by 2027, intensifying competition for Floor & Decor.

What You See Is What You Get

Floor & Decor PESTLE Analysis

The preview shown here is the exact Floor & Decor PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers all key external factors influencing Floor & Decor's business operations, providing valuable strategic insights.

Sociological factors

The do-it-yourself (DIY) movement continues to be a significant driver in the home improvement market. In 2024, a substantial portion of homeowners are actively engaged in self-directed renovation projects, motivated by the potential for cost savings and the personal fulfillment derived from completing tasks themselves. This trend is further amplified by the widespread availability of online tutorials and resources, making even complex projects more approachable.

Floor & Decor is well-positioned to capitalize on this DIY enthusiasm. The company offers an extensive product range, from flooring materials to installation tools, all presented in a format that is easy for consumers to navigate. This accessibility directly supports homeowners looking to tackle projects independently, reinforcing Floor & Decor's appeal to this growing customer base.

The United States housing stock is aging, with the median age of owner-occupied homes reaching approximately 40 years in 2023. This persistent need for renovations and upgrades directly fuels demand for flooring and home improvement products, creating a stable market for companies like Floor & Decor.

Millennials, now a significant force in the housing market, are increasingly prioritizing homeownership and renovation. In 2024, this generation is expected to account for a substantial portion of new homebuyers, bringing their unique design preferences and digital-first purchasing habits, which Floor & Decor must cater to for continued growth.

These evolving demographic trends, particularly the aging population and the rise of millennial homeowners, necessitate strategic adjustments in product offerings and marketing approaches. Floor & Decor's success hinges on its ability to adapt to these shifts, ensuring its product development and outreach align with the changing needs and tastes of its core customer base.

Homeowners are increasingly investing in their living spaces, with a growing emphasis on comfort, functionality, and aesthetics. This trend, evident in rising spending on home improvement, fuels demand for products that elevate the quality of life at home. For instance, the U.S. home improvement market was valued at approximately $480 billion in 2023, with a significant portion dedicated to interior upgrades.

This shift means consumers are looking beyond basic needs to projects that enhance enjoyment and livability. They seek decorative and high-quality flooring solutions that contribute to a more pleasant and personalized home environment. Floor & Decor's extensive product range, featuring everything from luxury vinyl plank to natural stone, directly addresses this evolving homeowner motivation.

Rising Demand for Sustainable and Eco-Friendly Products

A significant shift in consumer and commercial preferences is driving demand for sustainable and eco-friendly flooring. This includes a growing interest in materials such as bamboo, cork, and reclaimed wood, as well as products with low volatile organic compound (VOC) emissions, which contribute to better indoor air quality. As of early 2024, reports indicate that the global green building materials market, encompassing flooring, is projected to reach substantial figures, reflecting this burgeoning demand.

Floor & Decor is well-positioned to leverage this trend by broadening its selection of environmentally conscious flooring solutions. Highlighting these options and communicating the company's commitment to sustainability can attract a key demographic of environmentally aware customers. For instance, expanding the range of recycled content flooring or showcasing products with certifications like GREENGUARD can resonate strongly with this market segment.

- Growing Consumer Preference: Consumers are increasingly seeking flooring that aligns with their environmental values, impacting purchasing decisions.

- Commercial Sector Adoption: Businesses are also prioritizing sustainable materials for LEED certifications and corporate social responsibility initiatives.

- Product Innovation: The demand encourages manufacturers to develop and offer more eco-friendly flooring options, including those made from recycled or rapidly renewable resources.

- Market Growth: The market for sustainable building materials, including flooring, is experiencing robust growth, presenting a significant opportunity for retailers like Floor & Decor.

Influence of Digital Platforms and Online Research

Today's homeowners are increasingly digital natives, leveraging online platforms for every stage of their home improvement journey. A significant majority, often over 70% in recent surveys, begin their research online, seeking inspiration, product reviews, and price comparisons before ever stepping into a store. This reliance on digital channels means Floor & Decor's robust online presence, including its website, social media engagement, and virtual design tools, is paramount for capturing customer attention and influencing purchasing decisions.

The company's multi-channel strategy is designed to meet these informed consumers where they are, providing detailed product information and project inspiration online to guide them toward a purchase, whether it's completed digitally or in-store. For instance, Floor & Decor's website likely sees millions of unique visitors annually, with a substantial portion of these visitors engaging with product pages and design galleries. This digital engagement directly translates into in-store traffic and sales, highlighting the symbiotic relationship between online research and physical retail for home improvement purchases.

- Digital research is the primary starting point for over 70% of homeowners undertaking renovation projects.

- Floor & Decor's online presence is critical for attracting and guiding tech-savvy consumers.

- Millions of annual website visitors indicate strong digital engagement influencing purchasing decisions.

- A multi-channel approach bridges online research with in-store sales for home improvement products.

Sociological factors significantly influence the home improvement sector, with the DIY movement remaining a powerful trend. In 2024, a substantial number of homeowners are undertaking their own renovation projects, driven by cost savings and personal satisfaction, further enabled by readily available online tutorials.

The aging U.S. housing stock, with a median home age around 40 years in 2023, consistently fuels demand for renovations. Furthermore, millennials, now a dominant force in homeownership, are actively renovating, bringing their distinct design preferences and digital-first shopping habits to the market.

Consumers are increasingly investing in home aesthetics and comfort, with U.S. home improvement spending reaching approximately $480 billion in 2023. This focus on enhancing livability directly boosts demand for quality flooring solutions that contribute to a more pleasant living environment.

There's a growing preference for sustainable and eco-friendly flooring options, including bamboo, cork, and low-VOC products, as consumers prioritize indoor air quality and environmental responsibility. The global green building materials market, encompassing flooring, is projected for substantial growth, indicating a strong market opportunity.

Technological factors

The home improvement sector is witnessing robust e-commerce growth, with online sales of building materials climbing due to enhanced convenience and broader product selection. This trend is projected to continue, with the U.S. home improvement e-commerce market expected to reach approximately $165 billion by 2025, a significant increase from previous years.

Floor & Decor, operating as a multi-channel retailer, must prioritize ongoing investment in its digital infrastructure. This includes optimizing its online platforms and ensuring smooth transitions between online and in-store experiences to align with shifting consumer preferences and maintain a competitive edge in the evolving retail landscape.

The integration of smart home technology into flooring is a burgeoning technological advancement. Innovations such as temperature-regulating floors, enhanced sound absorption, and even self-healing materials are becoming more prevalent. For instance, by 2025, the global smart flooring market is projected to reach over $1.5 billion, indicating substantial growth.

Floor & Decor can capitalize on this trend by offering or incorporating smart flooring solutions that seamlessly connect with existing smart home ecosystems. This strategy would appeal to a growing segment of consumers seeking connected living experiences, aligning with the increasing adoption of smart home devices, which saw a 15% year-over-year increase in household penetration in 2024.

The integration of Augmented Reality (AR) and Artificial Intelligence (AI) is fundamentally reshaping the retail landscape. AR allows customers to virtually preview products, such as visualizing new flooring in their own homes, a feature increasingly expected by consumers. For instance, a 2024 report indicated that 60% of consumers are more likely to purchase a product after using AR to visualize it.

Floor & Decor can capitalize on these advancements by implementing AR for enhanced design visualization, enabling customers to see how different flooring options would look in their spaces. AI-powered tools can further revolutionize operations by providing sophisticated customer support, streamlining project planning for DIY customers, and optimizing inventory management through predictive analytics. These technological adoptions are projected to boost customer engagement and operational efficiency, offering a significant competitive advantage in the home improvement sector.

Advancements in Manufacturing and Supply Chain Automation

Automation is significantly transforming flooring manufacturing. In 2024, companies are investing heavily in robotic systems for tasks like tile cutting and material handling, boosting precision and output. This isn't just about speed; it's about a measurable reduction in waste, with some facilities reporting up to a 15% decrease in material scrap due to automated quality control.

Logistics are also seeing a technological uplift. The adoption of lightweight, durable materials in transport equipment, coupled with AI-powered route optimization, is making deliveries more efficient. For instance, by optimizing delivery routes, companies can achieve an estimated 10% reduction in fuel consumption and associated emissions.

Floor & Decor's supply chain is positioned to capitalize on these trends. By integrating advanced automation in its distribution centers and leveraging smart logistics solutions, the company can expect to see improved inventory management and faster order fulfillment. This translates to better product availability and potentially lower operational costs, which are crucial in a competitive retail environment.

Key benefits for Floor & Decor include:

- Enhanced Production Accuracy: Automated systems minimize human error in manufacturing, leading to more consistent product quality.

- Cost Efficiencies: Reduced waste and optimized labor utilization through automation contribute to lower production costs.

- Improved Transportation Logistics: Smart routing and lighter equipment decrease delivery times and environmental impact.

- Supply Chain Resilience: Greater automation can lead to more predictable and reliable supply chain operations.

Innovation in Flooring Product Materials and Performance

Technological advancements are significantly reshaping the flooring industry. Continuous innovation in materials is yielding products with superior durability, enhanced water resistance, and better acoustic properties. For instance, Luxury Vinyl Plank (LVP) and Luxury Vinyl Tile (LVT) have seen widespread adoption due to their practical benefits and aesthetic versatility.

Floor & Decor's success hinges on its capacity to integrate these cutting-edge materials into its product offerings. By providing flooring solutions that blend advanced performance with appealing design, the company can effectively cater to evolving consumer preferences and maintain a competitive edge in the market.

- LVP/LVT Market Growth: The global LVT market was valued at approximately $16.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, driven by demand for water-resistant and durable flooring.

- Sustainability Focus: Manufacturers are increasingly investing in R&D for eco-friendly materials, with a growing segment of consumers prioritizing sustainable flooring options.

- Smart Flooring Integration: Emerging technologies include self-healing surfaces and integrated heating or cooling systems, though these are still niche applications.

Technological factors are profoundly influencing the home improvement sector, with e-commerce growth in building materials expected to reach $165 billion by 2025. Floor & Decor must bolster its digital infrastructure to cater to this shift, ensuring seamless online-to-in-store experiences.

Innovations like smart flooring, projected to exceed $1.5 billion globally by 2025, and AR visualization, which boosts purchase likelihood by 60% according to 2024 data, offer significant opportunities. Integrating these technologies enhances customer engagement and operational efficiency.

Automation in manufacturing, seeing investment in robotics for precision tasks, reduces waste by up to 15% in some facilities. AI-powered logistics and route optimization further improve delivery efficiency, potentially cutting fuel consumption by 10%.

The company can leverage advanced materials like LVP/LVT, a market valued at $16.5 billion in 2023, known for durability and water resistance. A growing consumer preference for sustainability also drives R&D in eco-friendly flooring options.

Legal factors

Trade tariffs and import regulations significantly affect Floor & Decor's operational costs and pricing. For instance, the U.S. imposed tariffs on certain goods from China, which could impact the cost of imported flooring materials, influencing Floor & Decor's cost of goods sold. Navigating these evolving trade policies is crucial for maintaining competitive pricing and avoiding costly penalties, ensuring a stable supply chain for their diverse product lines.

Floor & Decor operates in a landscape shaped by diverse and frequently updated labor and employment laws. This includes navigating varying state minimum wage requirements, which saw an average of 3.7% increase across states in 2024, and adhering to overtime regulations, such as the Fair Labor Standards Act (FLSA). Proper worker classification is also paramount to avoid penalties.

Ensuring compliance across its numerous operating states is a significant undertaking for Floor & Decor. For instance, states like California and New York often have stricter rules regarding overtime and worker classification than federal mandates. Failure to comply can lead to substantial legal fees and damage to the company's reputation.

New legislation, like New York's Retail Worker Safety Act, is imposing stricter workplace violence prevention policies and safety measures in retail settings. Floor & Decor must adapt by implementing comprehensive safety protocols and training to comply with these evolving regulations and protect its employees.

Compliance with these mandates could involve investments in enhanced security infrastructure and updated operational procedures. For instance, the Occupational Safety and Health Administration (OSHA) reported over 100,000 workplace injuries in the retail sector in 2023 alone, highlighting the critical need for robust safety measures.

Consumer Protection and Product Liability Laws

Floor & Decor operates under a framework of consumer protection laws that govern product quality, safety, and advertising. These regulations ensure that customers receive accurate information about products and are protected from deceptive practices. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on ensuring truthfulness in advertising, impacting how Floor & Decor communicates product benefits and origins to consumers.

Product liability laws hold companies responsible for damages caused by defective products. This means Floor & Decor must ensure the safety and integrity of its flooring materials, from manufacturing to installation advice. Failure to comply can result in costly lawsuits and damage to brand reputation. The company's commitment to quality control directly mitigates these risks.

- Product Safety Standards: Adherence to national and international safety certifications for materials like tile, laminate, and vinyl is paramount.

- Warranty Regulations: Floor & Decor must comply with laws dictating the terms and conditions of product warranties offered to customers.

- Advertising Accuracy: Consumer protection agencies scrutinize marketing claims to prevent misleading information about product performance or durability.

- Recall Procedures: Robust processes for handling product recalls are essential to protect consumers and manage liability.

Building Codes and Environmental Certifications

Floor & Decor must adhere to a complex web of building codes and environmental regulations across its operating regions. These legal frameworks dictate everything from material safety standards to energy efficiency requirements for retail spaces and the products sold. For instance, in 2024, the U.S. Green Building Council’s LEED (Leadership in Energy and Environmental Design) certification continues to influence construction and renovation projects, potentially impacting demand for materials that meet these sustainability benchmarks.

Non-compliance can lead to significant penalties, project delays, and restricted market access. Obtaining certifications like GREENGUARD for low chemical emissions, crucial for indoor air quality, is becoming increasingly important for flooring manufacturers and retailers like Floor & Decor. As of early 2025, there's a growing trend in state-level legislation focusing on embodied carbon in building materials, which could necessitate greater transparency and sourcing adjustments for Floor & Decor.

- Building Code Adherence: Floor & Decor's operations and product offerings must comply with local, state, and federal building codes, ensuring safety and suitability for intended use.

- Environmental Certifications: Obtaining and promoting products with environmental certifications (e.g., GREENGUARD, FSC) is vital for market acceptance and appealing to environmentally conscious consumers.

- Regulatory Impact: Evolving regulations around material safety, VOC emissions, and embodied carbon directly influence product development, sourcing, and sales strategies.

- Market Access: Failure to meet these legal and certification standards can restrict access to certain markets or project types, impacting overall revenue potential.

Floor & Decor must navigate a complex legal environment, including trade regulations that impact import costs and product sourcing. For example, ongoing trade tensions can affect the price of imported flooring materials, influencing their cost of goods sold and competitive pricing strategies. Adherence to evolving labor laws, such as state-specific minimum wage increases, which saw an average of 3.7% in 2024, is also critical for operational compliance and avoiding penalties.

Consumer protection laws are paramount, requiring accurate advertising and product quality assurances. The Federal Trade Commission's continued focus in 2024 on truthfulness in advertising directly influences how Floor & Decor communicates product benefits. Furthermore, product liability laws necessitate rigorous quality control to prevent costly lawsuits and protect brand reputation, especially as workplace injuries in retail, exceeding 100,000 in 2023 per OSHA, underscore safety's importance.

Building codes and environmental regulations, including LEED certifications and emerging state legislation on embodied carbon as of early 2025, shape product development and market access. Compliance with standards like GREENGUARD for indoor air quality is increasingly vital, as non-compliance can result in penalties and restricted market entry.

| Legal Factor | Impact on Floor & Decor | 2024/2025 Relevance |

| Trade Tariffs | Increased import costs, pricing adjustments | Ongoing trade policy shifts affect sourcing |

| Labor Laws | Compliance with minimum wage, overtime rules | State minimum wage increases (avg. 3.7% in 2024) |

| Consumer Protection | Advertising accuracy, product quality | FTC focus on truthful marketing in 2024 |

| Product Liability | Ensuring product safety and integrity | Mitigating risks from potential workplace injuries (100k+ in retail 2023) |

| Building Codes & Environmental Regs | Material sourcing, operational standards | LEED influence, embodied carbon legislation (early 2025) |

Environmental factors

Consumer preference is shifting towards sustainable flooring options, driving demand for products with recycled content, rapidly renewable resources like bamboo and cork, and low VOC emissions. This trend is particularly strong among younger demographics and those prioritizing health and environmental impact in their purchasing decisions.

By 2025, the global green building materials market, which includes flooring, is projected to reach over $400 billion, indicating a substantial opportunity for companies like Floor & Decor that can cater to this growing segment. For instance, the demand for LVT (Luxury Vinyl Tile) with recycled content has seen a significant uptick.

Floor & Decor is actively working to lessen its environmental impact by focusing on energy conservation and waste reduction. A key part of this strategy involves managing its carbon footprint throughout its store and distribution center network. For example, the company has been upgrading to LED lighting and more efficient HVAC systems, aiming to reduce energy consumption. These upgrades are not just good for the planet; they also contribute to lower operating expenses.

Floor & Decor's commitment to waste reduction and recycling is increasingly vital, especially as circular economy principles gain traction in the flooring sector. This involves actively exploring and adopting modular flooring options designed for easier recycling and component replacement. For instance, in 2023, the company reported progress in its sustainability efforts, though specific figures on waste diversion rates for that year are not yet publicly detailed.

Implementing robust take-back programs for used flooring materials is a key strategy to foster a more circular model. This not only diverts waste from landfills but also provides valuable raw materials for new products. The company's operational efficiency is also being scrutinized to minimize waste generation throughout the supply chain, from sourcing to installation.

Responsible Sourcing and Supply Chain Management

Floor & Decor places a strong emphasis on responsible sourcing and managing its supply chain to ensure product quality and ethical practices. This commitment extends to working with global suppliers who are expected to operate responsibly and respect natural resources, aligning with sustainable business goals.

Transparency in their logistics, such as their participation as a SmartWay Transport Partner, directly contributes to reducing the environmental footprint associated with freight transportation. This initiative highlights their dedication to minimizing the ecological impact of their operations.

- Ethical Sourcing: Floor & Decor partners with suppliers who adhere to responsible operational standards and environmental stewardship.

- Supply Chain Transparency: Initiatives like being a SmartWay Transport Partner demonstrate a commitment to visible and accountable logistics.

- Environmental Impact Reduction: Focus on sustainable practices within the supply chain aims to lessen the overall environmental burden of freight.

Concerns Regarding Indoor Air Quality and Chemical Emissions

Consumers are increasingly focused on health, making indoor air quality a significant factor in flooring choices. This trend boosts demand for materials that emit fewer volatile organic compounds (VOCs) and are free from polyvinyl chloride (PVC). Floor & Decor needs to ensure its product selection aligns with these health-conscious preferences, as evidenced by the growing market for low-emission flooring solutions.

For instance, the global low-VOC flooring market was valued at approximately $20.5 billion in 2023 and is projected to reach over $35 billion by 2030, indicating a strong consumer shift. Floor & Decor's commitment to offering products that meet stringent indoor air quality standards, such as GREENGUARD certification, will be crucial for capturing this expanding segment of the market.

- Growing Demand for Healthy Homes: Consumer awareness of the link between building materials and health is rising, prioritizing products that improve indoor environments.

- Low-VOC and PVC-Free Preferences: This translates into a clear market preference for flooring options that minimize harmful chemical off-gassing.

- Regulatory and Certification Importance: Meeting or exceeding certifications like GREENGUARD or FloorScore® becomes a competitive advantage for retailers like Floor & Decor.

- Market Growth Projections: The market for sustainable and healthy building materials, including flooring, is expected to see continued robust growth in the coming years.

Environmental concerns are increasingly shaping consumer choices, with a notable shift towards sustainable flooring. This includes demand for materials with recycled content, rapidly renewable resources, and low VOC emissions, particularly among environmentally conscious demographics. The global green building materials market, encompassing flooring, is projected to exceed $400 billion by 2025, highlighting a significant growth area for companies like Floor & Decor.

Floor & Decor is actively reducing its environmental footprint through energy conservation and waste reduction initiatives, such as upgrading to LED lighting and more efficient HVAC systems in its stores and distribution centers to lower energy consumption. The company's focus on circular economy principles involves exploring modular flooring options designed for easier recycling and component replacement, aiming to divert waste from landfills and provide raw materials for new products.

Consumer health awareness is also driving demand for flooring with improved indoor air quality, leading to increased preference for low-VOC and PVC-free materials. The global low-VOC flooring market was valued at approximately $20.5 billion in 2023 and is anticipated to grow to over $35 billion by 2030, underscoring the importance of certifications like GREENGUARD for competitive advantage.

| Environmental Factor | Impact on Floor & Decor | Market Trend/Data (2023-2025) |

|---|---|---|

| Sustainable Materials Demand | Drives product assortment and sourcing strategies. | Global green building materials market > $400 billion by 2025. |

| Energy Efficiency & Waste Reduction | Reduces operational costs and enhances brand image. | Upgrades to LED lighting and efficient HVAC systems. |

| Indoor Air Quality (Low-VOC) | Influences product selection and marketing. | Global low-VOC flooring market ~$20.5 billion in 2023, projected growth. |

| Circular Economy Practices | Requires innovation in product design and take-back programs. | Increased adoption of modular and recyclable flooring solutions. |

PESTLE Analysis Data Sources

Our Floor & Decor PESTLE analysis is built on a foundation of credible data, drawing from government economic reports, industry-specific market research, and environmental impact assessments. We also incorporate insights from legal databases and technological trend analyses to ensure comprehensive coverage.