Floor & Decor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Floor & Decor Bundle

Curious about Floor & Decor's product portfolio? Our BCG Matrix preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their strategic positioning and unlock actionable insights for growth, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Luxury Vinyl Plank (LVP) and Luxury Vinyl Tile (LVT) are currently stars for Floor & Decor, reflecting their rapid expansion and high market popularity in 2025. This strong performance is fueled by their inherent durability, superior water resistance, and realistic aesthetic appeal, closely mimicking natural wood and stone. The broad acceptance by homeowners, interior designers, and construction professionals solidifies their position as frontrunners in the expanding flooring market.

Floor & Decor is aggressively pursuing market penetration with a goal of reaching 500 warehouse-format stores across the United States. This ambitious expansion strategy, evidenced by plans to open 20-25 new locations in 2025, is designed to capture substantial share in the fragmented hard surface flooring sector.

These new store openings are crucial drivers of overall sales growth, providing a vital boost even when comparable store sales experience challenges. For instance, in the first quarter of 2024, Floor & Decor reported a 7.7% increase in total sales, reaching $1.3 billion, partly fueled by new store contributions.

Floor & Decor's strong emphasis on professional installers and commercial businesses is a key driver of its expansion, capturing a growing share of this lucrative market. The company achieved a significant milestone in Q1 2025, with revenue from professional customers mirroring that of homeowners, a clear sign of successful market penetration and robust growth within this vital segment.

By offering specialized services, tools, and materials specifically designed for pros, Floor & Decor has cemented its reputation as a go-to supplier. This strategic focus allows them to cater to the unique needs of this customer base, fostering loyalty and repeat business.

Wood Flooring Category

The wood flooring category at Floor & Decor is a clear star performer. The company saw a remarkable 20.5% growth in this segment during the first quarter of 2025. This robust expansion points to a substantial market share within a growing and attractive product space.

Floor & Decor's success in wood flooring is likely fueled by its extensive product offerings and efficient direct sourcing strategies. These advantages position the company for continued leadership and strong performance in this category.

- Category Growth: 20.5% increase in Q1 2025.

- Market Position: High market share in an expanding segment.

- Competitive Advantage: Comprehensive selection and direct sourcing.

- Future Outlook: Strong potential for continued leadership.

Installation Materials and Tools

Installation materials and tools are a vital part of Floor & Decor's offerings, directly supporting flooring sales. This segment experienced a significant 9.8% growth in Q1 2025, reflecting strong demand. Its high market share is a testament to its necessity for project completion, benefiting from the overall popularity of hard surface flooring.

Floor & Decor's strategy of being a comprehensive provider for both professional installers and DIY enthusiasts further bolsters this category's performance. Customers rely on the company for a complete solution, from the flooring itself to all the necessary accompanying items. This convenience factor is a key driver for the robust performance of installation materials and tools.

- Category Growth: Installation materials and tools saw a 9.8% increase in sales in Q1 2025.

- Market Share: This segment holds a high market share within Floor & Decor due to its essential nature for flooring projects.

- Demand Drivers: Growth is fueled by the strong demand for hard surface flooring and Floor & Decor's one-stop-shop model.

- Customer Base: The category serves both professional contractors and do-it-yourself customers, broadening its appeal.

Luxury Vinyl Plank (LVP) and Luxury Vinyl Tile (LVT) are stars for Floor & Decor, showing rapid expansion and high market popularity. Their durability, water resistance, and realistic aesthetics fuel this growth, making them favorites among homeowners and professionals alike.

Wood flooring also shines as a star, with a significant 20.5% growth in Q1 2025. Floor & Decor's extensive selection and efficient sourcing strategies contribute to its strong market position in this expanding category.

Installation materials and tools are another star, experiencing 9.8% growth in Q1 2025. Their essential nature for flooring projects and Floor & Decor's one-stop-shop approach drive demand from both professionals and DIY customers.

| Product Category | Q1 2025 Growth | Market Position | Key Drivers |

| LVP/LVT | High popularity | Leading | Durability, water resistance, aesthetics |

| Wood Flooring | 20.5% | High market share | Extensive selection, direct sourcing |

| Installation Materials & Tools | 9.8% | High | Essential for projects, one-stop-shop |

What is included in the product

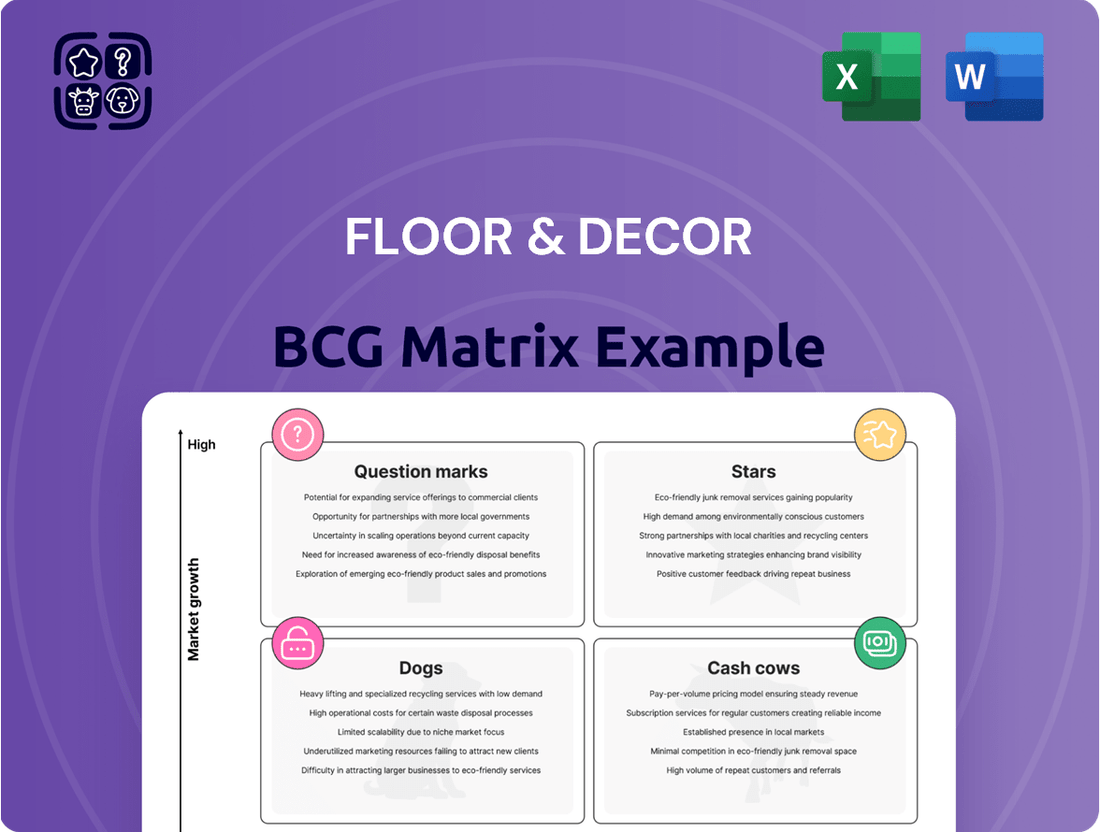

Highlights which units to invest in, hold, or divest, providing strategic direction for Floor & Decor's product portfolio.

A clear visual of Floor & Decor's business units, identifying Stars, Cash Cows, Question Marks, and Dogs, simplifies strategic decision-making.

Cash Cows

Floor & Decor's robust network of 254 warehouse-format stores, spread across 38 states, functions as a powerful cash cow. These well-established locations are the bedrock of the company's financial stability, consistently delivering significant total sales and a reliable revenue stream.

Even with occasional shifts in comparable store sales, the sheer scale and efficient operations of this store base guarantee a steady and predictable inflow of cash for Floor & Decor.

Floor & Decor's direct sourcing model is a significant cash cow, allowing them to bypass intermediaries and acquire products at more favorable prices. This directly contributes to their ability to offer competitive pricing while simultaneously boosting gross profit margins. For instance, in 2023, their gross profit margin was 42.6%, a testament to this efficient sourcing strategy.

This streamlined supply chain is a highly optimized and mature segment of their operations, generating substantial cash flow from their established product offerings. The company's commitment to supply chain efficiency is evident in their consistent revenue growth, reaching $4.7 billion in 2023.

Floor & Decor's commitment to offering the broadest in-stock selection of hard surface flooring, encompassing tile, wood, and natural stone, positions it as a strong cash cow. This strategy, coupled with everyday low prices, consistently generates revenue by attracting a wide customer base, from professionals to DIY enthusiasts.

The immediate availability of such a vast inventory reduces the need for significant marketing spend to drive sales, as customers can purchase what they need, when they need it. This operational efficiency contributes to its stable cash flow generation.

For instance, in the first quarter of 2024, Floor & Decor reported net sales of $1.3 billion, a testament to the consistent demand for its product assortment. This strong performance underscores the cash-generating power of its extensive in-stock strategy.

Tile Products (Core Offerings)

Tile products, Floor & Decor's foundational offerings, represent a significant Cash Cow within their business portfolio.

Despite potential moderation in highly decorative tile segments, the core tile category maintains a commanding market share for Floor & Decor. This enduring popularity translates into a consistent and reliable revenue source, bolstered by the company's established strength as a specialized retailer in this niche.

These established products necessitate less intensive marketing efforts compared to emerging trends, allowing for efficient resource allocation and predictable profitability.

- Market Share Dominance: Floor & Decor holds a substantial share in the core tile market.

- Stable Revenue Generation: Traditional tile products provide a predictable and consistent income stream.

- Lower Promotional Costs: Core offerings require less aggressive marketing than newer, trend-driven products.

- Enduring Demand: The consistent popularity of foundational tile options ensures sustained sales.

Mature Customer Base (DIY and Professional)

Floor & Decor has nurtured a substantial and loyal customer base for over twenty years, attracting both DIY homeowners and professional contractors. This deep-rooted loyalty translates into consistent, predictable revenue streams, as these customers frequently return for ongoing projects and supplies.

The company effectively capitalizes on this established customer loyalty by consistently offering a wide range of products and reliable services. For instance, in 2024, Floor & Decor reported a 5.1% increase in comparable store sales, a testament to the sustained engagement of its customer segments.

- Consistent Revenue: A mature customer base provides predictable, recurring revenue, a hallmark of a cash cow.

- Low Acquisition Costs: Retaining existing customers is typically less expensive than acquiring new ones, boosting profitability.

- Brand Loyalty: Over two decades, Floor & Decor has built strong brand recognition and trust, encouraging repeat purchases.

- Diverse Clientele: Serving both DIYers and professionals diversifies revenue sources and mitigates risk.

Floor & Decor's extensive network of 254 stores across 38 states forms a significant cash cow. These established locations consistently deliver substantial sales and a reliable revenue stream, ensuring a predictable inflow of cash despite minor fluctuations in comparable store sales.

Their direct sourcing model, bypassing intermediaries, allows for more favorable pricing and higher gross profit margins, exemplified by a 42.6% gross profit margin in 2023. This efficient supply chain, contributing to $4.7 billion in revenue in 2023, generates substantial cash flow from mature product offerings.

The company's strategy of maintaining the broadest in-stock selection of hard surface flooring, including tile, wood, and natural stone, at everyday low prices, further solidifies its cash cow status. This approach, evident in $1.3 billion in net sales for Q1 2024, reduces marketing spend and ensures consistent demand.

Floor & Decor's foundational tile products are a prime example of a cash cow, maintaining a strong market share and providing a consistent, reliable revenue source. These core offerings require less marketing investment than trend-driven products, leading to predictable profitability.

| Category | Key Cash Cow Attributes | Supporting Data (2023/2024) |

|---|---|---|

| Store Network | Scale, efficient operations, predictable revenue | 254 stores in 38 states, $4.7 billion total revenue (2023) |

| Direct Sourcing | Higher margins, competitive pricing, supply chain efficiency | 42.6% gross profit margin (2023) |

| In-Stock Selection | Broad availability, reduced marketing needs, consistent demand | $1.3 billion net sales (Q1 2024) |

| Core Tile Products | Market share dominance, stable revenue, lower promotional costs | Established strength in specialized tile retail |

Delivered as Shown

Floor & Decor BCG Matrix

The preview you are currently viewing is the identical, fully-formatted Floor & Decor BCG Matrix report you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally crafted strategic analysis ready for immediate application. The insights and structure you see here are exactly what you'll download, enabling you to seamlessly integrate this valuable business intelligence into your planning and decision-making processes without any further editing or preparation.

Dogs

Floor & Decor's strategic evaluation includes underperforming or closed store locations, a critical component of its business portfolio analysis, akin to the Dogs quadrant in the BCG Matrix. The company's proactive approach to store portfolio management was evident with the closure of one warehouse store in Q1 2025. This action signals a commitment to optimizing operational efficiency and resource allocation.

These underperforming units, often characterized by a low market share within their specific geographic regions and experiencing stagnant or declining sales growth, represent potential drains on company resources. For instance, if a store consistently fails to meet profitability targets, it can become a significant cash trap, diverting capital that could be better invested in high-growth areas of the business.

The identification of such locations is crucial for strategic decision-making. Floor & Decor likely employs rigorous performance metrics to pinpoint these underperformers. Once identified, these stores are candidates for strategic divestiture, allowing the company to exit unprofitable markets, or for intensive turnaround initiatives aimed at revitalizing sales and profitability.

Certain flooring styles, while once popular, now represent the 'dogs' in Floor & Decor's portfolio. Think of outdated laminate patterns or highly specific, niche tile designs that have seen a sharp decline in consumer interest. These items tie up capital and shelf space, offering minimal return.

In 2024, for instance, sales data for certain 1990s-era linoleum patterns might show a near-zero growth rate, indicating they are largely being phased out. Such products contribute little to overall revenue and can even incur carrying costs without generating significant profit, making them prime candidates for divestment or discontinuation.

In the first quarter of 2025, Floor & Decor observed that its decorative segments experienced a more subdued growth trajectory when contrasted with other product categories. This slowdown suggests a potential shift in consumer preferences or increased competition within these specific niches.

Should particular decorative accessories or wall tile collections consistently exhibit underperformance and maintain a low market share, they would likely be categorized as 'dogs' within the BCG matrix framework. For instance, if a specific line of ornate wallpaper, which represented only 1.5% of total sales in Q1 2025, failed to gain traction, it could be a prime candidate for this classification.

These underperforming decorative items might not resonate with prevailing market trends, potentially leading to stagnant inventory and inefficient capital allocation. For example, if a particular style of mosaic tile, introduced in late 2023, accounted for just 0.8% of Q1 2025 revenue and saw no significant sales increase, it could be tying up valuable resources that could be better deployed elsewhere.

Products Heavily Reliant on High-Tariff Imports with Weak Demand

Products heavily reliant on high-tariff imports with weak demand represent a significant concern for Floor & Decor. Despite initiatives to diversify sourcing, a substantial portion of their product mix, approximately 18% in FY24, still originates from China. Furthermore, a considerable 73% of their overall inventory is sourced internationally, highlighting a broad exposure to global trade dynamics.

When these internationally sourced products face the dual challenge of high import tariffs and subdued consumer demand, the situation becomes precarious. The inability to pass on increased costs to consumers due to weak demand means these product lines can quickly become unprofitable. This scenario can transform potentially valuable inventory into what are effectively 'cash traps' – assets that tie up capital without generating adequate returns.

- High Tariff Exposure: Certain product categories within Floor & Decor’s assortment are subject to elevated import tariffs, increasing their cost basis.

- Weak Consumer Demand: Concurrently, these specific product lines are experiencing a downturn in consumer purchasing interest.

- Inability to Pass Costs: The combination of high tariffs and weak demand prevents the company from raising prices to offset the increased import costs.

- Profitability Erosion: This leads to reduced profit margins or outright losses on these items, potentially impacting overall financial performance.

Non-Strategic Inventory Overstock

Non-strategic inventory overstock at Floor & Decor can be categorized as a 'dog' in the BCG matrix. This occurs when the company holds too much inventory that isn't selling quickly or isn't in high demand. For instance, an inventory turnover ratio decline from 2.31 in FY23 to 2.26 in FY24, coupled with increasing ending inventory, signals potential overstocking.

When this excess inventory consists of products with low demand, it represents capital that is tied up and not generating adequate returns. This situation negatively impacts cash flow and profitability, as storage costs continue to accrue on unsold goods.

- Declining Inventory Turnover: Floor & Decor's inventory turnover ratio fell from 2.31 in FY23 to 2.26 in FY24.

- Increasing Ending Inventory: This decline in turnover occurred alongside an increase in the company's ending inventory balance.

- Low Demand Products: If the overstocked items are those with historically slow sales or declining consumer interest, they fit the 'dog' profile.

- Capital Tied Up: This scenario means capital is immobilized in slow-moving or obsolete inventory, hindering potential investment in more profitable areas.

Within Floor & Decor's portfolio, products with declining consumer interest and high inventory levels are considered 'dogs'. These items tie up capital and shelf space without contributing significantly to revenue. For example, specific outdated flooring styles or niche decorative items that fail to resonate with current market trends exemplify this category.

These 'dogs' often exhibit stagnant or negative sales growth and a low market share, making them candidates for divestment or discontinuation to optimize resource allocation. The company's proactive management of underperforming store locations, such as the closure of one warehouse store in Q1 2025, reflects a broader strategy to prune less profitable assets across the business.

In 2024, certain product lines might show minimal growth, indicating they are becoming obsolete. For instance, a particular line of 1990s-era linoleum patterns could have a near-zero growth rate, signifying their phase-out and minimal contribution to overall revenue, while still incurring carrying costs.

Floor & Decor's Q1 2025 results indicated subdued growth in decorative segments, suggesting a potential shift in consumer preferences. If specific decorative accessories or wall tile collections, like a particular ornate wallpaper accounting for only 1.5% of Q1 2025 sales, consistently underperform, they are prime candidates for the 'dog' classification.

Question Marks

Floor & Decor's expansion into new geographic markets is a classic question mark in the BCG matrix. These ventures, while holding promise for future growth, currently represent low market share in unfamiliar territories. For instance, in 2023, Floor & Decor continued its strategic store rollout, opening 34 new locations, many of which were in markets where the company had a nascent presence.

The company's strategy here involves significant investment in marketing and operations to establish brand recognition and capture market share. This is crucial because success in these new areas is not guaranteed, and the initial outlay can be substantial. The potential upside, however, is considerable if these new markets can be cultivated into strong performers, mirroring the success seen in more established regions.

The market for eco-friendly and sustainable flooring is experiencing robust growth, with projections indicating an annual increase of over 7%. This presents a significant opportunity for companies like Floor & Decor to tap into a rapidly expanding consumer segment increasingly prioritizing environmental responsibility in their purchasing decisions.

While Floor & Decor may offer products like cork, bamboo, or those made from recycled materials, these likely represent a smaller portion of their overall sales compared to their more established, traditional flooring lines. This positions them as potential question marks within a BCG matrix framework, showing promise but not yet dominant market share.

To effectively leverage the burgeoning demand for sustainable options, substantial investment in product development, marketing, and supply chain optimization will be crucial. This strategic allocation of resources can help Floor & Decor solidify its position and capture a larger share of this high-growth market segment.

Smart flooring, featuring embedded sensors for heating and lighting, represents a rapidly expanding segment within the overall flooring market. This innovative technology is poised for significant growth, driven by increasing consumer demand for integrated home automation and energy efficiency.

If Floor & Decor were to enter this nascent market, their initial market share would likely be minimal. The smart flooring sector is still developing, with established players and emerging innovators vying for position, meaning any new entrant would face a competitive landscape.

Significant investment in research and development, alongside robust marketing campaigns, would be essential for Floor & Decor to establish a foothold and cultivate this category into a meaningful contributor to their revenue. For instance, the global smart flooring market was valued at approximately $2.5 billion in 2023 and is projected to reach over $7 billion by 2030, indicating substantial investment potential and growth opportunities.

Further Vertical Integration into Installation Services

Floor & Decor might consider acquiring a large installation company to establish a nationwide service network. This move represents a significant growth avenue, allowing them to capture more of the project's overall value.

However, this strategic direction is a question mark due to the substantial initial capital required and the company's current negligible share in the direct installation service market.

- Potential for Increased Project Value Capture: Acquiring an installation service could allow Floor & Decor to capture a larger percentage of the total project spend, moving beyond just material sales.

- High Upfront Investment: Establishing or acquiring a nationwide installation network would demand considerable capital outlay, impacting immediate profitability and cash flow.

- Low Initial Market Share in Installation Services: Entering the installation market directly would mean starting with a very small market share, typical of a question mark in the BCG matrix, requiring time and resources to build presence.

- 2024 Market Context: In 2024, the home improvement sector continued to see demand for renovation services, but also faced labor shortages and rising labor costs, which would be critical factors in assessing the viability of such an acquisition.

Enhanced Digital/Connected Customer Sales Penetration

Floor & Decor's digital sales penetration, while growing, still presents a significant untapped opportunity within the expanding online flooring market. This suggests a potential for substantial growth if the company can effectively leverage its connected customer base.

Investing in enhanced e-commerce capabilities, such as advanced augmented reality visualization tools and a more integrated online-to-offline customer journey, could be key to capturing a larger share of this high-growth segment. For instance, by early 2024, online retail sales in the US were projected to continue their upward trend, with home improvement sectors seeing increased digital adoption.

- High-Growth Opportunity: Low online sales penetration relative to market potential indicates a prime area for expansion.

- Strategic Investment Areas: Focus on e-commerce platforms, AR tools, and seamless O2O experiences.

- Market Context: The broader digital retail landscape, particularly in home improvement, shows increasing online engagement.

- Potential Impact: These investments can significantly increase market share in the digital flooring space.

Floor & Decor's foray into new geographic markets and the development of its sustainable product lines are prime examples of question marks within the BCG matrix. These areas require substantial investment to build market share, with success not yet guaranteed. For instance, the company's 2023 store expansion, with 34 new locations, often targeted less penetrated markets, highlighting this question mark status.

Similarly, the growing demand for eco-friendly flooring, projected to grow over 7% annually, represents a significant opportunity. While Floor & Decor offers such products, their market share in this niche is likely still developing, necessitating further investment in product development and marketing to capitalize on this trend.

The smart flooring segment, valued at approximately $2.5 billion in 2023 and projected to reach over $7 billion by 2030, also falls into the question mark category. Entering this nascent market would require significant R&D and marketing to gain traction against emerging innovators and established players.

Acquiring a national installation service is another strategic question mark. While it could increase project value capture, it demands high upfront capital and starts with negligible market share in installation services. The 2024 market context of rising labor costs and shortages further complicates this venture.

Floor & Decor's digital sales penetration, though growing, remains a question mark. Enhancing e-commerce capabilities, including AR visualization, is crucial to capture a larger share of the expanding online flooring market, which saw continued digital adoption in early 2024.

| Business Area | BCG Category | Strategic Focus | 2023/2024 Data Points |

|---|---|---|---|

| New Geographic Markets | Question Mark | Market penetration, brand building | 34 new stores opened in 2023, many in new territories. |

| Sustainable Flooring | Question Mark | Product development, marketing, supply chain | Market projected to grow over 7% annually. |

| Smart Flooring | Question Mark | R&D, marketing, market entry | 2023 market value ~$2.5B, projected to reach ~$7B by 2030. |

| National Installation Service | Question Mark | Acquisition/development, capital investment | High upfront costs, low initial market share in services; 2024 saw rising labor costs. |

| Digital Sales Penetration | Question Mark | E-commerce enhancement, AR tools | Continued upward trend in US online retail sales in early 2024. |

BCG Matrix Data Sources

Our Floor & Decor BCG Matrix is built on comprehensive data, including company financial reports, market share analysis, and industry growth forecasts to provide strategic insights.