FirstRand SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

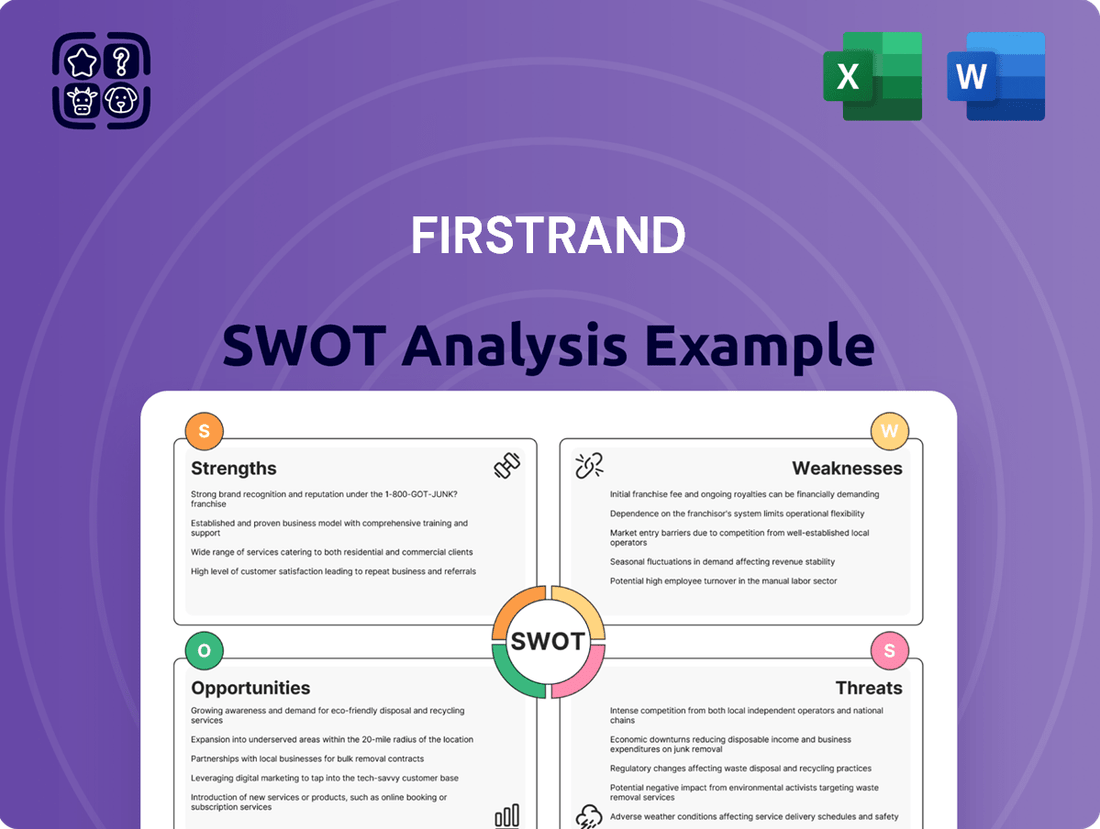

FirstRand leverages its strong brand and diversified financial services to navigate a dynamic African market, but faces intense competition and evolving regulatory landscapes. Our comprehensive SWOT analysis reveals the critical opportunities and threats shaping its future.

Want to understand the full strategic picture of FirstRand's market position, including its robust digital transformation efforts and potential economic headwinds? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment or strategic planning.

Strengths

FirstRand's strength lies in its deeply diversified business model, operating under a portfolio of robust and trusted brands such as FNB for retail banking, RMB for corporate and investment banking, WesBank for vehicle finance, and Aldermore for business and mortgage lending. This spread across various financial services and customer segments, from individual consumers to large corporations, significantly mitigates risk. For instance, in the first half of fiscal year 2024, FirstRand reported a headline earnings growth of 15%, demonstrating the resilience of its diverse operations.

FirstRand's financial performance remains a significant strength, evidenced by a 10% growth in normalized earnings and headline earnings for the six months ending December 31, 2024. This consistent growth highlights the group's ability to generate value across its operations.

The company boasts a strong capital foundation, with a total capital adequacy ratio of 16.1% reported for FY 2024. Furthermore, its Common Equity Tier 1 (CET1) ratio stood at a healthy 13.6% as of December 2024, comfortably surpassing regulatory minimums and providing a solid buffer against potential economic headwinds.

This robust capital position is not merely a static figure; it underpins FirstRand's capacity for sustained growth and its resilience in navigating varying economic landscapes. It allows the group to pursue strategic opportunities and maintain operational stability.

FirstRand, notably via its FNB division, has consistently demonstrated superior digital capabilities, setting a benchmark in South Africa's banking sector. This digital leadership fosters strong customer loyalty, or 'stickiness,' by offering integrated financial services and rewarding programs like eBucks, which saw over 1.2 million active members in 2024, encouraging deeper engagement.

The company leverages sophisticated behavioral analytics to personalize offerings, driving higher transactional volumes and creating substantial opportunities for cross-selling and up-selling. This focus on digital innovation is a key driver of profitability, allowing FirstRand to maximize value from its existing customer relationships.

Effective Risk Management and Credit Quality

FirstRand's robust risk management framework is a significant strength, consistently keeping its credit loss ratio within management's target range, even amidst economic headwinds. For the six months ending December 31, 2024, this ratio saw a welcome improvement.

This positive trend is attributed to a strategic focus on attracting and retaining high-quality credit customers, coupled with notably strong credit performance, especially within its UK operations. This disciplined lending approach is key to safeguarding the bank's financial health and its ability to generate sustainable returns.

- Improved Credit Performance: For H1 FY25, FirstRand's credit loss ratio demonstrated a favorable trend, indicating effective credit underwriting and collections.

- Focus on Quality Customers: The bank's strategy prioritizes lending to creditworthy individuals and businesses, minimizing potential defaults.

- Resilience in Challenging Markets: Despite economic uncertainties, FirstRand has maintained a strong credit quality, showcasing its proactive risk mitigation strategies.

Strategic Acquisitive Growth and International Diversification

FirstRand's strategic acquisitive growth is a significant strength, exemplified by its acquisition of HSBC South Africa assets. This move is poised to bolster its corporate banking segment and enhance its appeal to multinational corporations, aiming to capture a larger market share in this lucrative sector.

The group's international diversification, particularly through its UK entities Aldermore and MotoNovo, demonstrates a successful strategy to mitigate risks associated with over-reliance on its home market. These operations have consistently delivered resilient performance, contributing positively to FirstRand's overall earnings and providing valuable diversification benefits.

- Acquisition of HSBC South Africa: Expected to scale corporate banking and increase multinational client share.

- UK Operations (Aldermore & MotoNovo): Showed resilient performance in 2024, contributing to earnings diversification.

- Geographic Diversification: Reduces exposure to South African economic fluctuations, enhancing stability.

FirstRand's diversified business model, encompassing FNB, RMB, WesBank, and Aldermore, offers robust risk mitigation across various financial services and customer segments. This diversification was evident in the 15% headline earnings growth reported for the first half of fiscal year 2024.

The company's financial performance is a key strength, with normalized earnings and headline earnings growing by 10% in the six months ending December 31, 2024, underscoring its consistent value generation.

A strong capital foundation, featuring a total capital adequacy ratio of 16.1% and a CET1 ratio of 13.6% as of December 2024, provides resilience and capacity for strategic growth.

FirstRand's digital leadership, particularly through FNB and its eBucks rewards program with over 1.2 million active members in 2024, fosters customer loyalty and drives cross-selling opportunities through personalized offerings.

The group's sophisticated risk management framework, evidenced by a favorable credit loss ratio trend in H1 FY25 and a focus on quality customers, ensures financial health and sustainable returns.

Strategic acquisitions, like the HSBC South Africa assets, and international diversification through UK entities Aldermore and MotoNovo, enhance its corporate banking segment and mitigate reliance on the South African market, as demonstrated by resilient performance in 2024.

| Key Strength | Metric/Data Point | Period |

| Diversified Business Model | 15% Headline Earnings Growth | H1 FY24 |

| Financial Performance | 10% Normalized Earnings Growth | H1 FY25 (ending Dec 2024) |

| Capital Adequacy | 13.6% CET1 Ratio | December 2024 |

| Digital Engagement | 1.2M+ Active eBucks Members | 2024 |

| Credit Quality | Improved Credit Loss Ratio | H1 FY25 |

| International Operations | Resilient Performance (UK Entities) | 2024 |

What is included in the product

Delivers a strategic overview of FirstRand’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Highlights FirstRand's key competitive advantages and potential threats, enabling proactive risk mitigation and opportunity capitalization.

Weaknesses

FirstRand's significant reliance on the South African market exposes it to the nation's economic volatility. Challenges like persistent inflation and elevated interest rates, which have been a feature of the South African landscape through 2024 and into 2025, directly impact the group's earnings. For instance, the South African Reserve Bank's repo rate remained at 8.25% through early 2024, a factor that can dampen consumer spending and business investment.

The ongoing logistical issues and infrastructure constraints within South Africa also present a hurdle, potentially affecting business operations and customer access to services. Furthermore, high levels of personal debt among South African consumers, a trend that continued to be a concern in 2024, can lead to increased loan defaults, directly impacting FirstRand's asset quality and profitability, particularly within its retail and small business segments.

Lending and deposit margins in South Africa have been under continuous pressure. This trend is expected to persist, impacting the group's profitability.

FirstRand anticipates softer Net Interest Income (NII) growth for FY 2025. This is primarily due to anticipated lower average interest rates and intensified competition within the market.

The group's strategic shift towards a greater proportion of commercial lending compared to retail advances, while a sound move for risk management, also contributes to this margin compression.

FirstRand's cost-to-income ratio saw a slight deterioration in the full year FY 2024, ticking up to 51.9% from 51.5% in FY 2023. However, a positive trend emerged in the half-year ended December 31, 2024, where the ratio improved to 50.8%, indicating successful cost management initiatives in that period.

Despite these efforts, persistent increases in staff costs, driven by talent acquisition and retention strategies, alongside significant ongoing investments in digital transformation and technology infrastructure, are contributing to elevated operating expenses. This pressure on costs could potentially dampen profitability if revenue growth does not outpace these expense increases.

Regulatory and Legal Risks in International Markets

FirstRand faces considerable regulatory and legal headwinds, particularly in international markets. The company set aside a substantial R3 billion provision in response to the UK Financial Conduct Authority's investigation into motor finance dealer commissions. This significant financial commitment underscores the potential impact of regulatory actions.

Further legal and regulatory scrutiny in overseas operations presents ongoing challenges. Although FirstRand secured an appeal related to the UK matter, the persistent attention from international regulators creates both financial uncertainty and reputational risk. This environment necessitates careful navigation and robust compliance strategies.

- UK FCA Investigation: A R3 billion provision was made for motor finance dealer commission probes.

- Ongoing Scrutiny: Legal and regulatory oversight in international markets continues.

- Financial Impact: Provisions and potential fines pose a direct financial risk.

- Reputational Damage: Regulatory issues can negatively affect market perception and trust.

Muted Retail Advances Growth

FirstRand's retail advances growth, particularly in homeloans, has been muted. This is largely due to ongoing customer affordability challenges and weak demand within a difficult consumer landscape. For instance, in the first half of 2024, while overall group advances grew, the pace in certain retail segments lagged expectations, impacting potential expansion for FNB and WesBank.

This subdued performance in retail lending, especially home loans, presents a constraint on FirstRand's ability to capitalize on growth opportunities in a significant market segment.

- Subdued Retail Advances: Growth in retail lending, particularly mortgages, has been slower than anticipated.

- Affordability Pressures: Persistent challenges in customer affordability are dampening demand for new loans.

- Challenging Consumer Environment: The broader economic climate is contributing to lower consumer spending and borrowing.

- Limited Growth Segment: This weakness restricts expansion potential within key FNB and WesBank operations.

FirstRand's profitability is pressured by a challenging operating environment in South Africa, characterized by persistent inflation and high interest rates, which have impacted consumer spending and loan demand through 2024 and into 2025. Elevated operating expenses, driven by investments in digital transformation and staff costs, are also a concern, even with recent improvements in the cost-to-income ratio to 50.8% in H1 FY2025. Furthermore, significant regulatory headwinds, exemplified by a R3 billion provision for UK motor finance probes, introduce financial uncertainty and reputational risk.

What You See Is What You Get

FirstRand SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual FirstRand SWOT analysis, giving you a clear understanding of its depth and quality. Purchase unlocks the complete, in-depth report, providing you with all the insights you need.

Opportunities

FirstRand is actively pursuing expansion across key sub-Saharan African markets, aiming to leverage its competitive strengths and achieve significant scale. This strategic push is already showing positive results, with notable growth in customer bases and transactional services within various countries.

The company's focus on building strong in-country franchises is yielding tangible benefits, particularly in deposit gathering. For instance, as of the first half of 2024, FirstRand's African operations (excluding South Africa) saw customer deposits increase by 11%, highlighting the success of its localized growth strategies and presenting substantial avenues for further expansion.

FirstRand's robust digital ecosystem, exemplified by FNB's leading adoption rates, presents a significant opportunity to deepen customer relationships. By strategically utilizing these platforms, the group can effectively promote additional products and services to its existing customer base, thereby increasing transactional volumes and revenue per customer.

This digital-first approach allows for targeted cross-selling and up-selling initiatives, enhancing customer lifetime value. For instance, as of the first half of 2024, FNB reported a continued strong performance in its digital channels, with a significant portion of customer interactions occurring online, underscoring the potential for further digital-driven growth.

FirstRand is strategically positioned to benefit from an expected easing of the credit environment, particularly as fiscal year 2025 progresses. This optimism is fueled by a more positive economic outlook in South Africa, partly driven by the formation of the GNU and the implementation of the two-pot retirement system, which could stimulate consumer spending. Furthermore, anticipated interest rate reductions are likely to make borrowing more attractive.

The group's robust balance sheet and a sound existing credit portfolio provide the capacity to prudently relax lending standards. This allows FirstRand to actively support economic growth by making credit more accessible to businesses and individuals, thereby capturing a larger share of an expanding market.

Growth in Corporate and Commercial Lending

FirstRand can capitalize on the robust growth in corporate and commercial lending, a key opportunity. FNB Commercial and RMB Core Lending have demonstrated solid advances growth, driven by strategic focus on sectors experiencing above-cycle expansion. This momentum is a strong indicator of market demand and FirstRand's ability to meet it effectively.

The strategic acquisition of HSBC South Africa's corporate banking business is a game-changer for RMB. This move significantly bolsters RMB's capabilities in serving a crucial client base, including multinational corporations and large domestic enterprises. This integration is poised to unlock substantial growth and market share in the corporate lending segment.

- Solid Advances Growth: FNB Commercial and RMB Core Lending have seen strong expansion in their loan books.

- Sectoral Focus: Origination efforts are strategically targeting sectors with above-average growth potential.

- HSBC Acquisition: Integration of HSBC's corporate banking business enhances RMB's service offering to large corporates and multinationals.

- Market Position: The acquisition strengthens FirstRand's competitive standing in the corporate banking landscape.

Diversification into Insurance and Investment Management

FirstRand's strategic push into insurance and investment management is a key opportunity to deepen customer ties and generate more stable, capital-light income. This diversification aims to leverage existing customer bases for cross-selling opportunities, thereby enhancing overall customer lifetime value.

The group has already seen encouraging results from its insurance ventures, with strong performance contributing positively to its non-interest revenue. This success signals significant potential for scaling these operations further, building on the established trust and transactional relationships with its clientele.

- Broadening Service Offerings: FirstRand aims to become a more comprehensive financial partner by integrating insurance and asset management services, moving beyond traditional banking.

- Capital-Light Growth: These ventures offer a pathway to earnings growth with a lower capital requirement compared to traditional lending activities.

- Enhanced Customer Relationships: By offering a wider suite of products, FirstRand can strengthen its bond with existing customers, fostering loyalty and increasing share of wallet.

- Non-Interest Revenue Contribution: The insurance segment, in particular, has demonstrated its ability to boost non-interest revenue, a crucial element for diversified and resilient financial performance.

FirstRand is well-positioned to capitalize on an improving credit environment, particularly as fiscal year 2025 unfolds. This optimism is bolstered by a more favorable economic outlook in South Africa, with potential stimulus from the GNU and the two-pot retirement system, alongside anticipated interest rate reductions that could spur borrowing.

The group’s strong balance sheet and quality loan book allow for prudent easing of lending standards, enabling FirstRand to support economic expansion by increasing credit accessibility. This strategic move is expected to capture a larger market share as the economy grows.

FirstRand is also leveraging its digital platforms to deepen customer relationships and drive cross-selling. As of the first half of 2024, FNB's digital channels saw continued strong engagement, highlighting the potential for further growth through targeted product promotion and enhanced customer lifetime value.

The acquisition of HSBC South Africa's corporate banking business significantly strengthens RMB's position in serving large domestic and multinational corporations, a key growth area. This move is expected to unlock substantial opportunities in the corporate lending segment.

| Opportunity Area | Key Driver | 2024/2025 Data Point |

|---|---|---|

| African Expansion | Growing customer bases and transactional services | 11% increase in customer deposits in African operations (ex-SA) H1 2024 |

| Digital Ecosystem | Deepening customer relationships and cross-selling | Strong continued performance in FNB digital channels H1 2024 |

| Credit Environment Easing | Improved economic outlook and anticipated rate cuts | Positive impact on consumer spending and borrowing attractiveness |

| Corporate & Commercial Lending | Robust advances growth and strategic sector focus | Solid advances growth in FNB Commercial and RMB Core Lending |

| HSBC Acquisition | Enhanced capabilities for large corporates | Strengthened RMB's service offering to key client segments |

Threats

The South African banking landscape is intensely competitive, consistently squeezing lending and deposit margins. This intensified rivalry is projected to further compress these margins in FY 2025, potentially dampening net interest income even with an increase in core lending volumes.

Despite anticipated economic improvements, consumers are still feeling the pinch from higher interest rates and persistent inflation. This ongoing affordability challenge directly impacts customers' ability to manage their finances, which could translate into more defaults on loans, especially within retail banking segments.

For FirstRand, this means a continued risk of increased non-performing loans and a subsequent rise in credit impairment charges. For instance, in the first half of 2024, South Africa’s household debt-to-disposable income ratio remained a concern, indicating that consumers have less discretionary income to absorb unexpected costs or loan repayments.

Global economic uncertainties, including persistent inflation and ongoing geopolitical tensions, pose a significant threat to FirstRand's international operations. These factors can disrupt cross-border transactions and dampen investor confidence, impacting capital flows into and out of the markets where FirstRand operates.

For instance, the International Monetary Fund (IMF) projected in its October 2024 World Economic Outlook that global growth would slow to 2.9% in 2024, down from 3.0% in 2023, citing persistent inflation and geopolitical fragmentation. This slowdown can directly affect demand for financial services and increase the cost of doing business internationally for FirstRand.

Technological Disruption and Cybersecurity Risks

Technological disruption, particularly from agile fintechs, presents a significant challenge to FirstRand's established banking models. The need for continuous, substantial investment in digital transformation and robust cybersecurity measures to safeguard customer data and operations becomes paramount. This ongoing investment, while necessary for competitiveness, directly impacts operational costs and introduces inherent risks associated with potential data breaches or critical system failures. For instance, the global banking sector faced an estimated USD 30 billion in losses due to cyberattacks in 2023, highlighting the financial implications of these threats.

Key considerations for FirstRand regarding technological disruption and cybersecurity risks include:

- Keeping pace with fintech innovation: The rapid evolution of financial technology requires constant adaptation and investment to avoid being outmaneuvered by more agile competitors.

- Cybersecurity investment: Protecting sensitive customer data and maintaining system integrity necessitates significant and ongoing expenditure on advanced security protocols and infrastructure.

- Operational cost impact: The financial burden of technological upgrades and cybersecurity defenses directly affects profitability and requires careful budget allocation.

- Risk of breaches and failures: Despite investments, the inherent risk of cyberattacks or system malfunctions remains, potentially leading to financial losses and reputational damage.

Regulatory Changes and Compliance Costs

FirstRand, like all financial institutions, faces the persistent threat of regulatory changes. The evolving landscape, both domestically in South Africa and internationally, can necessitate significant compliance costs and operational adjustments. For instance, new regulations concerning climate stress testing, a growing area of focus for financial regulators globally, could require substantial investment in data collection, modeling, and reporting infrastructure.

The potential for further investigations into past practices, such as the ongoing scrutiny of motor finance commission structures in South Africa, presents a direct financial liability risk. These investigations can lead to significant fines, remediation costs, and reputational damage, impacting profitability and requiring management to divert resources towards compliance and legal defense.

- Increased Compliance Burden: New regulations, such as those impacting data privacy or capital adequacy, can lead to higher operational expenses for FirstRand as it adapts its systems and processes.

- Financial Penalties: Non-compliance with evolving regulations can result in substantial fines, as seen in past industry-wide investigations, directly impacting the bottom line.

- Strategic Adjustments: Regulatory shifts may force FirstRand to alter its product offerings or market strategies to align with new requirements, potentially limiting growth opportunities in certain areas.

Intensified competition in South Africa will likely compress lending margins, impacting net interest income in FY 2025. Persistent inflation and high interest rates continue to strain consumer affordability, increasing the risk of loan defaults and credit impairment charges, with South Africa's household debt-to-disposable income ratio remaining a concern in early 2024. Global economic uncertainties, including geopolitical tensions, could disrupt international operations and investor confidence, as indicated by the IMF's projected slowdown in global growth for 2024.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including FirstRand's official financial filings, comprehensive market research reports, and expert industry analysis, ensuring an accurate and insightful assessment.