FirstRand Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

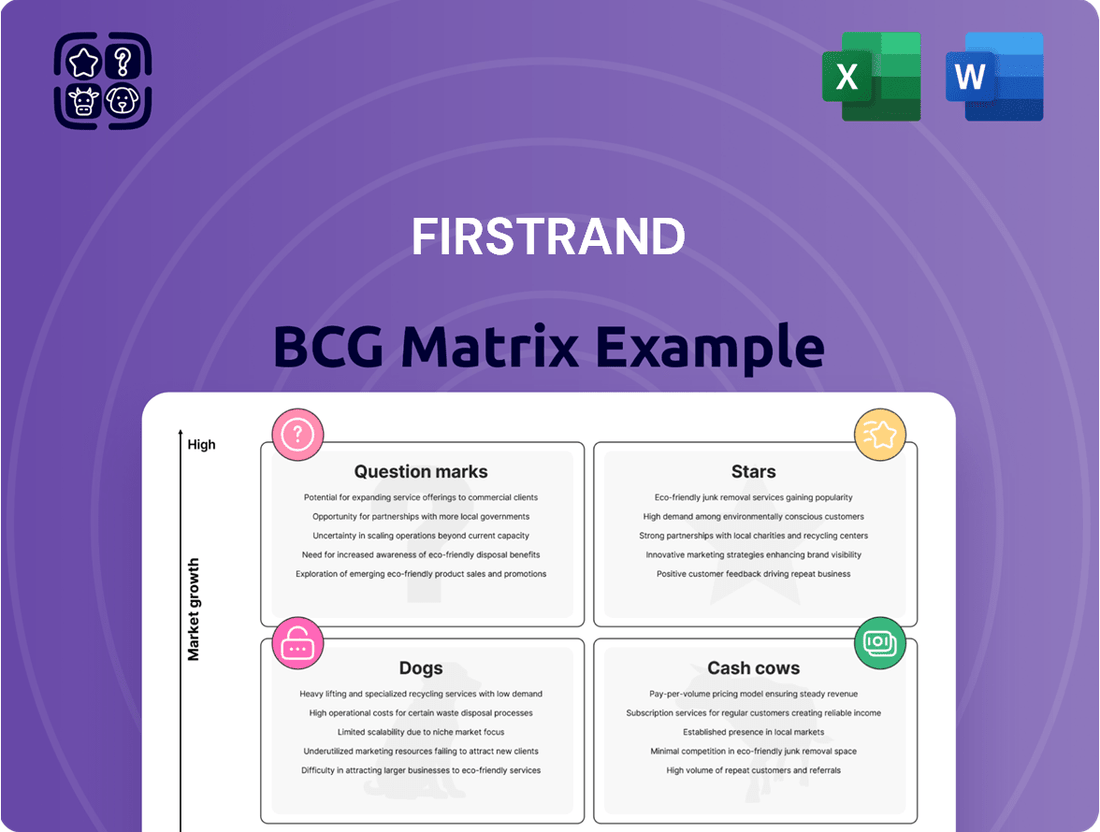

Unlock the strategic heart of FirstRand's product portfolio with a glimpse into its BCG Matrix. See which offerings are driving growth and which might be holding it back.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for FirstRand.

Stars

FNB, FirstRand's primary banking division, has solidified its position as a star within the group due to its robust digital platform and impressive customer engagement. The eBucks loyalty program, a cornerstone of their strategy, actively incentivizes digital interaction, contributing to significant customer stickiness. In 2024, FNB reported continued growth in digital transaction volumes, underscoring the success of these initiatives.

The integration of behavioural analytics further amplifies the platform's effectiveness, allowing FNB to identify opportunities for cross-selling and up-selling. This data-driven approach enhances profitability by deepening relationships with the existing customer base. Strategic investments, such as the partnership with Fiserv for Finxact, are bolstering FNB's cloud-native, real-time banking capabilities, paving the way for even more tailored and responsive digital services.

FirstRand's strategic expansion into other African nations, spearheaded by FNB and growing contributions from RMB, represents a significant high-growth segment. These international ventures are outperforming domestic operations, demonstrating a higher combined return on equity.

FNB's operations across the broader African continent achieved an impressive 20% growth in profit before tax during the fiscal year 2024. This robust performance underscores the success of FirstRand's diversification strategy into more dynamic and rapidly expanding economies.

This geographical diversification is not merely about expanding reach; it's a calculated move to tap into markets with substantial growth potential, positioning FirstRand for continued market share gains and elevated profitability in the coming years.

RMB, FirstRand's corporate and investment banking division, is a clear star in the South African market. It commands a significant market share within a sector that's experiencing growth, demonstrating its robust position.

Despite potential vulnerability to economic downturns, RMB's expertise in areas like corporate finance and M&A generates substantial knowledge-based fees. This was evident in the first half of 2025, highlighting its revenue-generating capabilities.

The recent regulatory green light for RMB to acquire HSBC South Africa's corporate banking operations further cements its leadership and bolsters its future growth trajectory in this competitive landscape.

Aldermore's Specialist Lending in the UK

Aldermore, a key player in the UK's specialist lending sector, is performing exceptionally well. It's concentrating on the more profitable parts of the specialist mortgage market, which is expected to see substantial growth.

The demand for these types of loans is projected to remain strong for the next five years. Aldermore has managed to grow its lending even when the overall market was a bit slow.

- Market Growth: The UK specialist mortgage market is forecast to expand significantly in the coming five years.

- Aldermore's Performance: Achieved positive lending growth despite a generally subdued lending environment.

- Market Share: Increased its share of completions in the specialist owner-occupied lending segment.

- Strategic Focus: Concentrates on higher-return niches within the specialist lending space.

Digital Transformation Initiatives Across the Group

FirstRand's commitment to digital transformation is a cornerstone of its group-wide star strategy, evident in its adoption of Finxact from Fiserv for both FNB and RMB. This significant investment in cutting-edge technologies, including AI and machine learning, is designed to elevate customer interactions, streamline operations, and accelerate the launch of new financial products. By embracing these advancements, the group is strategically positioning itself for continued robust growth within the evolving digital financial ecosystem.

The implementation of Finxact is a key enabler of this digital push. For instance, FNB, a major retail banking arm, has leveraged this platform to enhance its digital offerings, aiming to capture a larger share of the digitally-savvy customer base. Similarly, RMB, the corporate and investment banking division, is utilizing these digital capabilities to improve transaction processing and client service. In 2024, FirstRand reported that its digital channels were increasingly becoming the primary interaction points for a growing number of customers, reflecting the success of these initiatives.

Key aspects of FirstRand's digital transformation include:

- Enhanced Customer Experience: Utilizing AI for personalized banking solutions and improved customer support.

- Operational Efficiency: Automating processes through machine learning to reduce costs and increase speed.

- Product Innovation: Accelerating the development and deployment of new digital financial products and services.

- Data-driven Insights: Leveraging advanced analytics to understand customer behavior and market trends.

FNB and RMB, FirstRand's core banking and corporate divisions respectively, are positioned as stars due to their strong market presence and growth. FNB's digital strategy, including the eBucks program, has driven customer engagement and transaction volumes, with continued growth reported in 2024. RMB, a leader in corporate and investment banking, benefits from knowledge-based fees and recent strategic acquisitions, solidifying its revenue streams.

Aldermore, the UK specialist lender, also shines as a star. Its focus on profitable niches within the specialist mortgage market, which is projected for significant growth over the next five years, has allowed it to achieve positive lending growth even in a slower market. Aldermore has successfully increased its market share in the owner-occupied lending segment.

FirstRand's group-wide digital transformation, notably the adoption of Finxact for FNB and RMB, is a key driver for these star performers. This investment in AI and machine learning enhances customer experience and operational efficiency, with digital channels becoming primary interaction points for an increasing number of customers in 2024.

| Business Unit | Market Position | Growth Drivers | Key Performance Indicators (2024/H1 2025) |

|---|---|---|---|

| FNB | Star (Digital Banking) | Digital platform, eBucks, behavioural analytics, African expansion | 20% profit growth in Africa, increased digital transaction volumes |

| RMB | Star (Corporate & Investment Banking) | Market share, M&A expertise, regulatory approvals (HSBC SA acquisition) | Strong knowledge-based fees, leading market position |

| Aldermore | Star (UK Specialist Lending) | Niche market focus, projected market growth, increased market share | Positive lending growth, increased share in specialist owner-occupied lending |

What is included in the product

FirstRand's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

The FirstRand BCG Matrix provides a clear, one-page overview, alleviating the pain of complex portfolio analysis by instantly categorizing each business unit.

Cash Cows

FNB's retail and commercial banking in South Africa is a prime example of a cash cow within the FirstRand group. This segment holds a dominant position in a well-established market, consistently delivering robust profits.

Despite economic headwinds affecting consumer credit in fiscal year 2024, FNB’s financial performance remained strong. The bank saw healthy increases in both deposits and loans, which directly supported its substantial net interest income.

WesBank, a key player in FirstRand's portfolio, operates as a strong Cash Cow within the vehicle and asset finance sector in South Africa. It commands a significant market share in this mature industry.

Despite economic pressures impacting vehicle ownership costs and affordability, WesBank's established presence and expertise in navigating credit cycles make it a consistent revenue generator. For instance, FirstRand's 2023 integrated report highlighted WesBank's robust performance, contributing significantly to the group's overall earnings.

The company's commitment to careful lending practices and its agility in responding to market changes are crucial for maintaining its profitable status. This strategic approach solidifies its role as a reliable source of cash flow for FirstRand.

FirstRand's established deposit base across its brands, including FNB and Aldermore, represents a significant cash cow. This stable, low-cost funding is vital for its net interest income and lending operations.

FNB saw a robust 10% growth in customer deposits in H1 2025, while Aldermore achieved 8% growth in FY2024. These figures highlight the reliability and maturity of FirstRand's deposit-gathering capabilities, a key strength.

FirstRand's Overall Capital Adequacy

FirstRand's capital adequacy ratio consistently surpasses its internal targets, a strong indicator of its robust financial health and its capacity to generate surplus capital. This financial buffer is crucial in a mature banking sector, allowing the group to navigate economic volatility and effectively support its diverse business operations.

The excess capital generated from this strong capital adequacy can be strategically allocated. This includes funding growth opportunities through investments and acquisitions, as well as returning value to shareholders via dividends, demonstrating an efficient deployment of resources.

- Capital Adequacy: FirstRand's Common Equity Tier 1 (CET1) ratio stood at a healthy 13.5% as of December 31, 2023, comfortably exceeding its target range.

- Excess Capital Generation: This strong ratio translates to significant excess capital, providing ample room for strategic initiatives and shareholder returns.

- Strategic Flexibility: The group's financial strength enables it to pursue growth avenues and absorb potential economic shocks, underpinning its stable position.

Existing Customer Base and Cross-Selling

FirstRand's significant existing customer base, primarily through its FNB brand, is a key driver of its cash cow status. This broad reach enables effective cross-selling of a wide array of financial products and services, from transactional accounts and credit cards to investments and insurance.

Leveraging these established relationships significantly lowers the cost of acquiring new business for additional products. This efficiency directly translates into higher profit margins and a more consistent, predictable cash flow for the group.

FirstRand's strategy focuses on deepening customer engagement and maximizing the lifetime value of its mature customer segments through this cross-selling approach.

- Customer Acquisition Cost Reduction: By cross-selling to existing customers, FirstRand avoids the higher costs associated with acquiring entirely new clients.

- Increased Customer Lifetime Value: Offering a broader suite of products to a single customer enhances their overall value to the bank over time.

- Profit Margin Enhancement: Lower acquisition costs and increased product penetration naturally lead to improved profit margins on these mature customer relationships.

- Stable Cash Flow Generation: The consistent demand for diverse financial services from a large, loyal customer base provides a reliable source of cash flow.

FirstRand's established deposit base, particularly within FNB and Aldermore, acts as a significant cash cow. This provides a stable, low-cost funding source crucial for net interest income. FNB saw a robust 10% growth in customer deposits in H1 2025, while Aldermore achieved 8% growth in FY2024, underscoring the maturity and reliability of these operations.

The group's strong capital adequacy, with a CET1 ratio of 13.5% at the end of 2023, generates excess capital. This surplus allows for strategic investments and shareholder returns, reinforcing its stable market position and ability to navigate economic fluctuations.

The extensive existing customer base, primarily through FNB, is a core driver of cash cow status. This allows for efficient cross-selling of various financial products, reducing acquisition costs and enhancing customer lifetime value, leading to improved profit margins.

| Business Unit | BCG Category | Key Strengths | FY2024/H1 2025 Data Point |

|---|---|---|---|

| FNB Retail & Commercial Banking | Cash Cow | Dominant market position, strong profit generation | 10% growth in customer deposits (H1 2025) |

| WesBank | Cash Cow | Significant market share in vehicle finance, expertise in credit cycles | Robust performance contributing significantly to group earnings (FY2023) |

| Established Deposit Base (FNB & Aldermore) | Cash Cow | Stable, low-cost funding, vital for net interest income | Aldermore achieved 8% deposit growth (FY2024) |

| Existing Customer Base (FNB) | Cash Cow | Efficient cross-selling, reduced acquisition costs, enhanced lifetime value | Lower cost of acquiring new business for additional products |

Delivered as Shown

FirstRand BCG Matrix

The FirstRand BCG Matrix preview you're seeing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, detailing FirstRand's strategic positioning, is ready for your immediate use in decision-making and planning. You can be confident that the quality and content presented here are precisely what you'll download, ensuring no surprises and a seamless integration into your business strategy.

Dogs

Within FirstRand's diverse financial offerings, some specialized or older lending products might be struggling. These niche areas, perhaps not keeping pace with evolving market demands or facing new competition, could show both sluggish growth and a small slice of the overall market. They represent offerings that may have lost their appeal to customers and contribute very little to the company's bottom line, potentially costing more to maintain than they earn.

The UK motor finance investigation has cast a shadow over specific segments within FirstRand's portfolio, particularly those related to Aldermore's historical commission arrangements. These legacy issues, which have led to substantial provisions, are now viewed as a 'dog' within the BCG matrix framework.

A significant provision of R3 billion has been set aside, reflecting the financial impact of this regulatory scrutiny. The ongoing uncertainty surrounding potential redress schemes further exacerbates the situation, creating a drag on profitability and a dim outlook for growth in these particular legacy areas.

Non-core or divested business units within FirstRand's BCG Matrix would represent those segments that the group has identified for divestiture or has already exited. These are typically underperforming assets with limited market share and growth potential, which FirstRand aims to shed to enhance overall efficiency and concentrate on its core competencies.

These "dogs" are businesses that are not contributing significantly to the group's strategic objectives or financial performance. By divesting these units, FirstRand can reallocate capital and management attention to areas with higher potential for growth and profitability, thereby streamlining its operations.

Legacy IT Systems Without Modernization Plans

Legacy IT systems that FirstRand has not prioritized for modernization represent potential ‘dogs’ in its business portfolio. These systems, often expensive to maintain and offering little in terms of new functionality or competitive edge, drain valuable resources. For instance, in 2024, many financial institutions reported that maintaining outdated core banking systems could cost upwards of 70% of their total IT budget, significantly impacting innovation capacity.

These underperforming IT assets can hinder FirstRand's agility and efficiency, preventing it from fully capitalizing on market opportunities or responding swiftly to evolving customer demands. The group's strategic move towards platforms like Finxact aims to mitigate this risk, ensuring that its technological backbone supports, rather than obstructs, its growth objectives.

- Resource Drain: Legacy systems consume significant operational expenditure, diverting funds from strategic growth initiatives.

- Limited Functionality: These systems often lack the capabilities needed to support modern digital services and customer experiences.

- Competitive Disadvantage: Outdated technology can lead to slower product development and a less responsive customer interface compared to digitally native competitors.

- Maintenance Costs: In 2023, estimates suggested that maintaining legacy IT infrastructure could account for as much as 60-80% of an organization's IT budget, a figure that likely persisted into 2024 for many.

Certain Less Developed African Market Operations

Within FirstRand's extensive African footprint, certain less developed market operations could be classified as dogs in the BCG matrix. These are typically newer ventures or those in nascent economies where market penetration is slow and profitability is minimal.

These specific operations might be characterized by low market share and low growth potential, demanding significant investment without immediate returns. For instance, a new digital banking initiative in a country with limited internet access and a low smartphone penetration rate might fall into this category.

By the end of 2024, FirstRand's strategy likely involves either divesting from these underperforming units or injecting further capital to foster growth. The decision hinges on the long-term potential and the specific challenges encountered, such as regulatory hurdles or intense local competition.

- Low Market Share: Operations in countries like South Sudan or potentially smaller West African nations might exhibit market shares below 10% as of late 2024, reflecting early-stage challenges.

- Limited Growth Prospects: These markets often face macroeconomic instability or underdeveloped financial infrastructure, capping immediate growth potential.

- Resource Drain: Such operations can consume management attention and capital, acting as cash cows in reverse until a turnaround or exit strategy is implemented.

- Strategic Re-evaluation: FirstRand likely reviews these dog segments annually, potentially flagging them for restructuring or divestment if key performance indicators do not improve.

These "dogs" represent business units or products within FirstRand that exhibit low market share and low growth potential. They often require significant investment to maintain but generate minimal returns, essentially draining resources. Identifying and managing these segments is crucial for optimizing capital allocation and improving overall profitability.

The UK motor finance investigation, particularly concerning Aldermore's historical commission arrangements, has been explicitly identified as a "dog." This situation has led to a substantial R3 billion provision, highlighting the financial impact of regulatory scrutiny and legacy issues. The uncertainty surrounding potential redress schemes further dampens the outlook for these specific legacy areas.

Legacy IT systems are another clear example of "dogs" within FirstRand's portfolio. These systems are costly to maintain, offer limited functionality, and create a competitive disadvantage. In 2024, it was estimated that maintaining outdated core banking systems could consume over 70% of an IT budget, hindering innovation and agility.

Certain less developed market operations within FirstRand's African footprint can also be classified as dogs. These ventures in nascent economies face slow market penetration and minimal profitability, often characterized by low market share and limited growth prospects. By the end of 2024, FirstRand's strategy likely involves either divesting from these underperforming units or injecting further capital to foster growth.

| Business Segment Example | BCG Classification | Key Characteristics | Financial Impact/Consideration (2024 Data) | Strategic Implication |

|---|---|---|---|---|

| UK Motor Finance (Aldermore Legacy) | Dog | Low growth, low market share, regulatory issues | R3 billion provision for regulatory scrutiny; ongoing redress scheme uncertainty | Divestment or significant restructuring |

| Legacy IT Systems | Dog | High maintenance costs, limited functionality, competitive disadvantage | Maintenance costs potentially >70% of IT budget; hinders innovation | Modernization or replacement strategy |

| Underdeveloped African Market Operations | Dog | Low market share, slow penetration, minimal profitability | Low market share (<10% in some nascent markets); requires significant capital without immediate returns | Divestment, restructuring, or targeted investment for growth |

Question Marks

FirstRand's commitment to digital transformation is evident in its continuous development of new financial products and ventures. These emerging digital offerings, while poised for significant growth in the dynamic digital banking landscape, likely hold a low market share presently due to their early stage of adoption. For instance, as of late 2024, many neobanks and digital-first platforms are still building their customer base, with some reporting user acquisition rates that are growing but still represent a fraction of established players.

FirstRand's ambition to expand aggressively into new African markets, such as East Africa, places these ventures in the question mark category of the BCG Matrix. These regions offer substantial growth potential, but FirstRand currently holds minimal to no market share there.

For example, Kenya's banking sector, a potential target, saw its GDP grow by an estimated 5.0% in 2024, indicating a robust economic environment ripe for financial services expansion. However, entering these markets requires substantial capital investment and finely tuned strategic execution to build a significant presence.

Successfully navigating these new territories will be critical for FirstRand to transform these question marks into future star performers within its African portfolio. The bank's 2024 financial reports will likely detail the initial investments and strategic approaches being deployed in these nascent markets.

Aldermore's foray into emerging UK specialist lending segments, such as bespoke solutions for rapidly growing tech startups or financing for renewable energy projects, represents potential question marks. While these areas offer significant future growth, they demand considerable upfront investment and may take time to achieve substantial market share and profitability. For instance, the UK's green finance market is projected to grow significantly, with estimates suggesting the green bond market alone could reach £1 trillion by 2030, presenting both opportunity and risk for lenders entering this space.

Strategic Acquisitions in Non-Traditional Financial Services

FirstRand's exploration into non-traditional financial services, such as acquiring stakes in fintech startups or specialized lending platforms, represents a strategic question mark. These ventures, while potentially high-growth, typically begin with a small market footprint. For instance, in 2024, the global fintech market was valued at approximately $1.1 trillion, with significant growth projected, but individual players often start with a niche presence.

These acquisitions require substantial investment for integration and scaling. FirstRand would need to carefully assess the potential return on investment, considering the inherent risks of nascent markets. The success hinges on their ability to effectively integrate new technologies and business models into their existing framework, a process that can be complex and capital-intensive.

- New Market Entry: Targeting high-growth fintech sectors with initially low market share.

- Capital Intensity: Significant investment required for acquisition, integration, and scaling.

- Strategic Integration Risk: Potential challenges in merging new ventures with existing operations.

- Market Volatility: Non-traditional areas can be subject to rapid technological shifts and regulatory changes.

Targeted Lending Strategies in Challenging South African Retail Segments

FirstRand's approach to challenging South African retail segments, where consumer affordability is strained, positions these areas as potential question marks within its BCG matrix. While the bank targets growth, these segments may necessitate increased provisions for credit losses and dedicated management resources to secure market share and profitability.

These targeted lending strategies could become question marks if the expected returns do not materialize, potentially leading to higher non-performing loans. For instance, if consumer discretionary spending, which saw a moderate increase in early 2024, falters due to inflation, these segments could struggle to meet repayment obligations.

- Segment Performance: Retail segments facing affordability challenges, despite overall economic resilience, require careful monitoring for potential credit deterioration.

- Risk of Downgrade: Intensive management and potential higher credit impairment charges could signal a shift towards 'dog' status if profitability targets are consistently missed.

- Strategic Focus: The success of these targeted strategies hinges on FirstRand's ability to accurately assess and manage credit risk in a volatile consumer environment.

- Data Dependence: Continuous analysis of consumer spending patterns and macroeconomic indicators is crucial for adapting lending strategies in these sensitive retail areas.

FirstRand's ventures into new African markets and emerging digital financial services represent classic question marks. These areas offer high growth potential, but the bank currently holds a minimal market share, requiring significant investment and strategic focus to gain traction.

For instance, FirstRand's expansion into East Africa, a region with projected GDP growth of around 5.0% in key markets like Kenya during 2024, highlights this strategy. However, establishing a foothold in these diverse economies demands substantial capital and careful navigation of local regulatory and competitive landscapes.

Similarly, investments in fintech startups, a sector valued at over $1.1 trillion globally in 2024, are question marks. These ventures, while potentially disruptive, typically start with a small market presence and carry inherent integration and scaling risks.

The success of these question mark initiatives hinges on FirstRand's ability to effectively allocate capital, manage associated risks, and execute its growth strategies to convert potential into market leadership.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from FirstRand's annual reports, industry research on the South African banking sector, and official growth forecasts to ensure reliable insights.