FirstRand Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

FirstRand navigates a dynamic financial services landscape where buyer power, particularly from sophisticated corporate clients, exerts significant pressure. The threat of new entrants is moderate due to high capital requirements and regulatory hurdles, but disruptive fintech innovations pose a growing concern.

The full analysis reveals the real forces shaping FirstRand’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FirstRand's significant annual IT expenditure, amounting to R19.3 billion for the fiscal year ending June 2024, underscores its deep dependence on technology and infrastructure providers. This substantial investment highlights the considerable leverage held by specialized software developers, cloud service providers, and hardware manufacturers.

While these specialized vendors wield influence, FirstRand's position as a major financial institution likely allows for the negotiation of long-term agreements and volume discounts. These strategic purchasing practices can effectively temper the bargaining power of these critical technology suppliers.

The financial services industry, and by extension FirstRand, is fundamentally built on the expertise of its people. Highly specialized skills in areas such as advanced analytics, cybersecurity, and complex financial engineering are in high demand. For instance, in 2024, the global shortage of cybersecurity professionals was estimated to be around 4 million, a figure that directly impacts the cost and availability of talent for firms like FirstRand.

When critical skills are scarce, particularly in rapidly evolving technological domains, the bargaining power of employees with those skills naturally increases. This means that attracting and retaining top talent becomes a significant challenge, potentially driving up salary expectations and benefits packages. FirstRand's strategic focus on robust training programs and internal development initiatives, as evidenced by their significant investment in employee upskilling in 2023, is a direct response to mitigate this supplier power.

FirstRand's funding sources, particularly customer deposits, represent a largely fragmented supplier base where individual depositors hold minimal bargaining power. This broad base of small depositors provides a stable and cost-effective funding pillar for the bank.

However, institutional investors and capital markets, which supply wholesale funding and debt instruments, wield more significant bargaining power. These sophisticated suppliers can influence the terms and interest rates on large-scale funding, directly impacting FirstRand's cost of capital.

For instance, in 2024, South African banks, including FirstRand, have navigated a landscape where interest rates remained elevated, increasing the cost of wholesale funding. The bank's strong capital adequacy ratios, such as a Common Equity Tier 1 (CET1) ratio often exceeding regulatory minimums, and robust liquidity coverage ratios, are crucial in mitigating the bargaining power of these larger, more influential funding providers by demonstrating financial strength and stability.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers hold moderate bargaining power within the South African banking sector. The increasing complexity of regulations, such as the ongoing implementation of Basel IV, demands specialized expertise. In 2023, South African banks collectively spent billions on compliance-related activities, underscoring the essential nature of these services.

FirstRand, like its peers, navigates a landscape shaped by evolving anti-financial crime measures and data privacy laws. This reliance on external legal, audit, and compliance advisors grants these specialized firms leverage. For instance, the demand for cybersecurity and data protection services saw a significant uptick in 2024, increasing the cost of specialized talent and advisory fees.

- Increased Regulatory Scrutiny: The South African Reserve Bank (SARB) continues to enhance its oversight, leading to greater demand for specialized compliance consulting.

- Cost of Non-Compliance: Penalties for regulatory breaches can be substantial, making adherence to evolving standards a critical and costly necessity for banks like FirstRand.

- FirstRand's Mitigation Strategy: FirstRand's strategic investments in its internal risk management and governance functions aim to build in-house capabilities, thereby potentially moderating its reliance on external compliance providers and their associated bargaining power.

Data and Analytics Providers

The bargaining power of data and analytics providers for FirstRand is significant, as these firms often possess proprietary datasets and sophisticated analytical tools essential for competitive advantage in today's financial market. For instance, in 2024, the global big data and business analytics market was projected to reach over $300 billion, highlighting the value and scarcity of specialized expertise.

FirstRand's ongoing digital transformation, including its investment in cloud-native banking solutions, aims to bolster its internal data capabilities and reduce reliance on external providers. However, the unique nature of some specialized data, such as real-time market feeds or advanced AI-driven customer segmentation models, can still grant providers considerable leverage.

- Proprietary Data Access: Specialized providers control unique datasets crucial for FirstRand's market analysis and risk management.

- Advanced Analytical Capabilities: Firms offering cutting-edge AI and machine learning tools for insights command higher influence.

- Market Concentration: A limited number of high-quality data providers can lead to concentrated supplier power.

- Switching Costs: Integrating new data systems can be complex and costly, increasing dependence on existing providers.

FirstRand faces considerable supplier power from specialized technology providers, given its R19.3 billion IT expenditure in FY24. However, its status as a major financial institution allows for negotiation of favorable terms, mitigating some of this leverage.

The bargaining power of employees with scarce, specialized skills, particularly in cybersecurity where a global shortage of 4 million professionals existed in 2024, is significant. FirstRand's investment in internal training aims to counter this.

While individual depositors offer a stable funding base with low supplier power, institutional investors and capital markets have more influence, especially in a 2024 environment of elevated interest rates. Strong capital adequacy ratios help FirstRand manage this.

Regulatory and compliance service providers, including legal and audit firms, hold moderate bargaining power due to increasing regulatory complexity and demand for specialized expertise, as seen in the 2024 surge in cybersecurity advisory fees.

| Supplier Type | Bargaining Power | Key Factors | FirstRand Mitigation |

| Technology Providers | High | Specialized software, cloud services, hardware | Volume discounts, long-term agreements |

| Skilled Employees | High | Cybersecurity, advanced analytics expertise | Internal training and development |

| Institutional Investors | Moderate to High | Wholesale funding, debt instruments | Strong capital adequacy, liquidity ratios |

| Compliance Services | Moderate | Regulatory expertise, legal advice | In-house risk management and governance |

What is included in the product

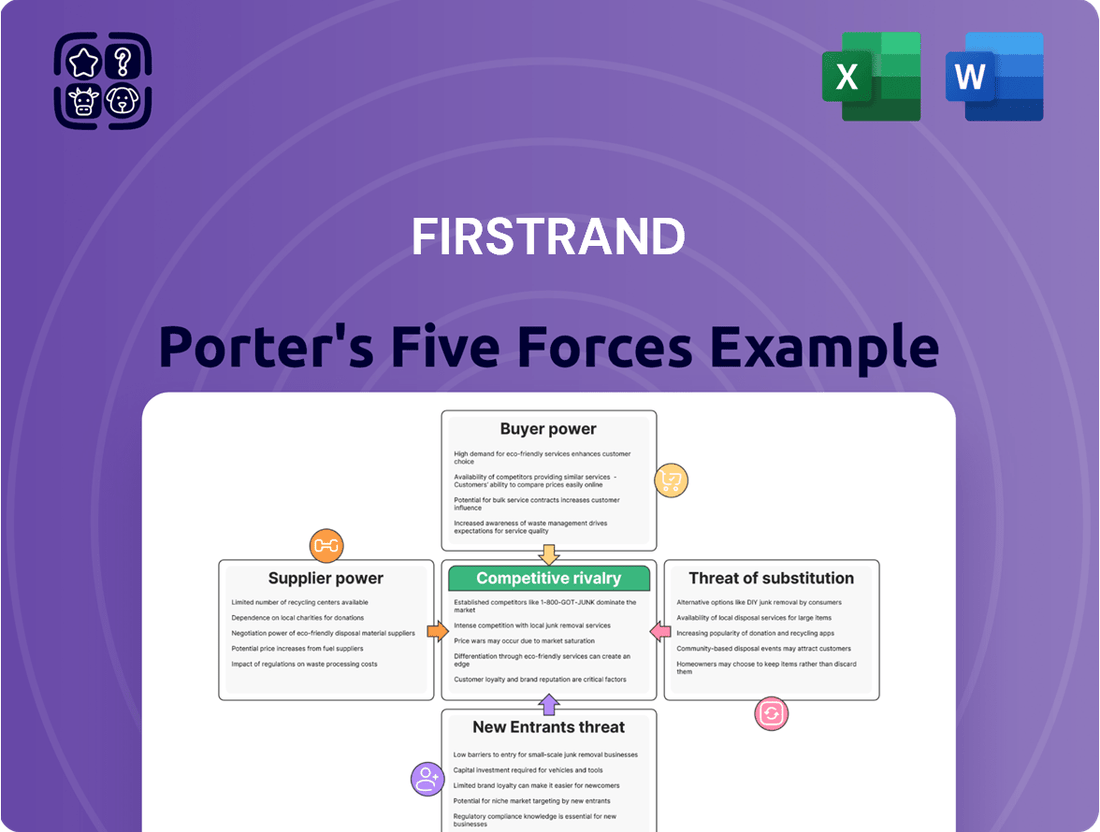

This analysis unpacks the competitive forces impacting FirstRand, detailing the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Effortlessly identify and prioritize competitive threats with a visual representation of FirstRand's Porter's Five Forces, allowing for proactive strategy adjustment.

Customers Bargaining Power

Retail and commercial banking clients, a key segment for FNB, exert moderate bargaining power. This is largely driven by the presence of numerous competitors offering similar services and the growing accessibility of digital banking platforms. In 2024, the financial sector continued to see increased competition, with digital-only banks gaining traction, further empowering customers.

The costs associated with switching banks for fundamental transactional needs remain relatively low, making customers more inclined to seek better deals. This, coupled with a heightened sensitivity to pricing and an expectation for highly personalized digital interactions, puts pressure on FNB to continuously innovate and offer competitive value propositions to retain its client base.

Corporate and investment banking clients, the core of RMB's business, wield significant bargaining power. Their large transaction volumes and sophisticated financial requirements mean they can often negotiate highly customized terms and pricing. For instance, in 2024, major South African corporations often leveraged their substantial deal flow to secure preferential rates, a trend observed across the global banking sector.

These influential clients frequently maintain relationships with several banking institutions, creating a highly competitive environment. This necessitates that RMB, and its peers, continuously demonstrate value through strong origination capabilities and robust market-making services to win and keep their business.

WesBank's vehicle and asset finance clients possess moderate bargaining power. This is driven by a competitive landscape featuring other established banks and nimble non-bank lenders, all vying for market share. In 2024, the South African vehicle finance market saw continued competition, with interest rates and flexible repayment structures being key differentiators for consumers.

While WesBank benefits from its strong brand, customers are highly sensitive to pricing and the overall attractiveness of financing terms. The ease with which clients can compare offers online and the availability of alternative financing solutions means WesBank must remain highly competitive. For instance, a slight increase in interest rates by WesBank could prompt a customer to explore options from a competitor offering a more favorable deal.

UK Specialist Lending Clients (Aldermore)

Aldermore's UK specialist lending clients, encompassing SMEs, homeowners, and landlords, exhibit a moderate degree of bargaining power. This is influenced by the availability of alternative lenders and the specific financial needs of each client segment. For instance, SMEs seeking specialized financing might have fewer readily available options compared to homeowners looking for standard mortgages, thus reducing their individual bargaining leverage.

The competitive landscape of the UK lending market, especially in specialist areas, means clients can often compare offerings. However, Aldermore’s strategic focus on niche markets and its commitment to providing tailored financial solutions can mitigate some of this power. By offering attractive returns and managing client expectations through clear communication and service, Aldermore aims to foster loyalty and maintain its profitability margins, even amidst client-driven price pressures.

- Client Segmentation: Aldermore serves diverse client groups like SMEs, homeowners, and landlords, each with varying bargaining power based on market alternatives.

- Market Competition: The UK's competitive lending environment allows clients to shop for better terms, influencing their negotiation strength.

- Aldermore's Strategy: The bank's niche focus and emphasis on client relationships help manage expectations and ensure profitability.

- Economic Influence: Evolving economic conditions in the UK can shift the balance of power between lenders and borrowers.

Public Sector Clients

Public sector clients often wield significant bargaining power, especially when their financial needs are substantial and procurement processes are open to competitive tenders. For instance, in 2023, South African government entities awarded billions in contracts across various financial services, highlighting the scale of these opportunities and the intense competition for them. FirstRand's strategy to counter this involves offering integrated financial solutions that span banking, insurance, and investment management, thereby demonstrating a broader value proposition beyond mere transactional services.

Securing and maintaining these large public sector mandates relies heavily on FirstRand's capacity to deliver specialized and adaptable financial packages. The group's diversified business model, encompassing brands like FNB, RMB, WesBank, and Ashburton, allows it to cater to the complex and varied requirements of government departments and state-owned enterprises. Building and nurturing strong relationships, coupled with a proven track record of expertise and reliable service delivery, are paramount for success in this segment.

- High Bargaining Power: Public sector clients often represent large-scale financial transactions, increasing their leverage.

- Transparent Procurement: Competitive bidding processes common in the public sector empower these clients.

- FirstRand's Strategy: Offering comprehensive, tailored solutions across its diverse brand portfolio is key.

- Relationship & Expertise: Demonstrating deep understanding and building trust are crucial for winning and retaining public sector business.

Customers of FirstRand, particularly in retail and commercial banking, hold moderate bargaining power due to a competitive market and the ease of digital banking adoption. In 2024, the rise of digital-only banks further amplified this, pushing FirstRand to continually innovate its offerings and pricing to retain its client base.

Corporate clients, especially those within RMB, possess significant bargaining power, leveraging large transaction volumes to negotiate favorable terms. This was evident in 2024 as major corporations secured preferential rates, a trend mirrored globally, necessitating strong origination and market-making services from banks like RMB.

WesBank's vehicle finance clients also experience moderate bargaining power, influenced by competition from banks and non-bank lenders. Pricing and flexible terms were key differentiators in the 2024 South African market, compelling WesBank to remain competitive.

| Customer Segment | Bargaining Power | Key Drivers | 2024 Trend/Observation |

| Retail & Commercial Banking (FNB) | Moderate | Competitor intensity, digital platforms, low switching costs | Increased digital bank competition empowering customers |

| Corporate & Investment Banking (RMB) | High | Large transaction volumes, sophisticated needs, multiple banking relationships | Corporates negotiated preferential rates on substantial deal flow |

| Vehicle & Asset Finance (WesBank) | Moderate | Competitive landscape, price sensitivity, ease of online comparison | Interest rates and flexible repayment structures were key differentiators |

Preview Before You Purchase

FirstRand Porter's Five Forces Analysis

This preview showcases the exact, comprehensive Porter's Five Forces Analysis of FirstRand that you will receive immediately after purchase. The document is fully formatted and ready for immediate use, providing an in-depth examination of competitive forces within the banking sector. You're looking at the actual document, ensuring no surprises or placeholders, just the complete, professionally written analysis you need.

Rivalry Among Competitors

The competitive rivalry among established major banks in South Africa is fierce, with FirstRand, Standard Bank, Absa, Nedbank, and Capitec dominating the landscape. These giants actively compete across retail, commercial, and corporate banking, driving innovation in products, aggressive pricing strategies, and a constant push for superior customer service.

In 2024, the South African banking sector continues to exhibit strong profitability, with aggregate profits for the top five banks reaching approximately R100 billion. However, this robust financial performance is coupled with increasing operational pressures and a palpable need for strategic reinvention, which in turn amplifies the intensity of competition as these institutions vie for market share and customer loyalty.

The rise of digital-only banks and fintechs is a major disruptor for FirstRand. These nimble competitors, like TymeBank in South Africa which reported over 9 million customers by early 2024, leverage lower overheads and tech-driven innovation to attract customers, especially younger demographics seeking seamless digital experiences and competitive pricing.

FirstRand is actively countering this by fast-tracking its digital capabilities. For instance, its FNB Connect service is continually enhancing its digital offerings, aiming to match the agility and customer focus of new entrants. This strategic push is crucial for retaining market share and appealing to evolving customer preferences in the digital age.

FirstRand's multi-brand approach, encompassing FNB, RMB, WesBank, and Aldermore, allows it to vie for customers across a broad spectrum of financial needs, from retail banking to corporate finance and vehicle asset finance. This diversification, while reducing pressure in any single market, necessitates direct competition with highly specialized firms in each of those sectors, intensifying overall rivalry.

International Competition and Global Players

FirstRand navigates a competitive landscape where global players, despite some divestments from Africa, remain significant rivals, especially in corporate and investment banking for substantial cross-border deals. For instance, in 2023, major international banks continued to facilitate significant African-related financing, demonstrating ongoing engagement. FirstRand's UK presence via Aldermore also means contending with a deeply entrenched and highly competitive banking sector, characterized by established institutions and innovative fintechs.

- Global Banks' African Footprint: While some international banks have scaled back, entities like Standard Chartered and Citi maintain substantial operations in Africa, competing directly with FirstRand on large-scale corporate finance and trade services.

- UK Market Saturation: Aldermore operates in the UK's mature banking market, facing intense competition from high-street banks, challenger banks, and specialized lenders, impacting pricing and market share acquisition.

- Strategic Advantage: FirstRand's deep understanding of African markets and its extensive regional network serve as a crucial differentiator against global competitors who may lack this localized expertise.

Regulatory and Economic Environment

The competitive rivalry within the banking sector is significantly shaped by South Africa's and the UK's evolving regulatory and economic climates. Fluctuations in interest rates, inflation rates, and the implementation of new regulations like Basel IV or open banking directly affect how banks operate and their ability to generate profits, thereby intensifying the competition for customers and market dominance.

For instance, in 2024, the South African Reserve Bank maintained its repo rate at 8.25% through much of the year, influencing lending costs and bank margins. Simultaneously, the Bank of England kept its base rate at 5.25% for extended periods in 2024, creating a similar dynamic in the UK market. These economic conditions force banks to innovate and compete more aggressively on pricing and service offerings.

- Regulatory Reforms: Basel IV implementation in both regions is expected to increase capital requirements for banks, potentially impacting their lending capacity and profitability, thus fueling competition.

- Economic Volatility: Persistent inflation and interest rate uncertainty in 2024 create a challenging operating environment, compelling banks to focus on efficiency and customer retention to maintain market share.

- Open Banking: Continued adoption of open banking initiatives in the UK and similar developments in South Africa are fostering new entrants and forcing traditional banks to enhance their digital offerings and customer experience to stay competitive.

- Profitability Pressures: The combined effect of these factors places significant pressure on bank profitability, leading to heightened competition for fee-based income and a more aggressive pursuit of market share.

Competitive rivalry within South Africa's banking sector is intense, with FirstRand, Standard Bank, Absa, Nedbank, and Capitec vying for market share. This competition is amplified by digital-only banks and fintechs, forcing established players like FirstRand to accelerate their digital transformation to retain customers. FirstRand's diversified brand portfolio, including FNB and RMB, allows it to compete across various financial segments but also pits it against specialized rivals in each area.

| Bank | 2024 Estimated Profit (R billion) | Key Competitive Area |

|---|---|---|

| FirstRand | ~20 | Retail, Corporate, Vehicle Finance |

| Standard Bank | ~22 | Retail, Corporate, Investment Banking |

| Absa | ~18 | Retail, Corporate, Wealth Management |

| Nedbank | ~15 | Corporate, Retail, Wealth Management |

| Capitec | ~10 | Retail, Digital Banking |

SSubstitutes Threaten

Fintech and digital payment solutions present a substantial threat of substitution for FirstRand's traditional banking services. Consumers are increasingly opting for non-bank apps and platforms for transactions, money management, and even credit, effectively bypassing conventional banking channels. For instance, by the end of 2023, South Africa saw a significant surge in mobile money transactions, with platforms like Ozow and PayFast processing billions of rand, demonstrating a clear shift in consumer behavior away from traditional bank-led payment systems.

Customers increasingly have options beyond traditional banks, turning to non-bank lenders and alternative finance platforms for loans. This trend, evident in the growth of peer-to-peer lending and specialized credit providers, offers potentially more flexible terms and quicker approvals.

For FirstRand, this poses a significant threat, especially impacting segments like WesBank's asset finance and Aldermore's specialist lending. The availability of these substitutes can divert business from FirstRand's core banking products, as seen in the projected 15% growth of the alternative lending market in South Africa by the end of 2024.

Self-service investment platforms and robo-advisors present a significant threat of substitutes for FirstRand's wealth management services. These digital solutions, often offering lower fees and greater accessibility, appeal to a growing segment of financially savvy clients. For instance, the global robo-advisor market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a clear shift in client preference.

Clients can directly access financial markets through online brokerage platforms, bypassing traditional banking channels for investment management. This disintermediation allows individuals to build and manage their portfolios with greater autonomy. FirstRand's own Ashburton Investments brand directly engages with this competitive landscape, highlighting the need for continuous innovation to retain market share against these evolving substitutes.

Embedded Finance and Ecosystems

Embedded finance, integrating financial services into non-financial platforms like e-commerce or ride-sharing apps, acts as a significant threat of substitutes. This seamless integration allows consumers to access financial products without directly interacting with traditional banks, potentially diverting business. For instance, a customer buying goods on an online marketplace might opt for integrated buy-now-pay-later services rather than a credit card from a bank.

FirstRand is actively exploring embedded finance, recognizing its potential to reach customers in new ways. By partnering with platforms, they can offer banking services at the point of need. This strategy aims to counter the threat by becoming part of the substitute offering itself.

The growth in digital ecosystems means more opportunities for non-financial companies to offer financial solutions. This trend is expected to continue, with projections indicating a substantial increase in the value of embedded finance transactions globally. For example, by 2025, the global embedded finance market is anticipated to reach trillions of dollars.

- Embedded finance directly integrates financial services into non-financial platforms, offering a convenient alternative to traditional banking.

- This trend reduces the need for direct customer engagement with banks, posing a competitive threat.

- FirstRand is strategically pursuing embedded finance opportunities to remain competitive and capture new market segments.

- The global embedded finance market is experiencing rapid growth, projected to reach significant valuations by mid-2020s.

Cryptocurrencies and Blockchain Technology

The rise of cryptocurrencies and blockchain presents a growing threat of substitutes for FirstRand. South Africa has seen increasing interest and adoption, with transaction volumes in crypto exchanges showing significant growth. While not yet a direct replacement for mainstream banking, these digital assets could fundamentally alter payment systems and international money transfers, impacting FirstRand's core revenue from these services.

Consider the potential impact on transactional income:

- Disruption of Payment Systems: Cryptocurrencies offer alternative payment rails that bypass traditional banking infrastructure.

- Cross-Border Remittances: Blockchain-based solutions can facilitate faster and cheaper international money transfers, directly competing with bank offerings.

- Emerging Asset Class: As cryptocurrencies gain acceptance, they could be used for a wider range of financial activities, further reducing reliance on traditional financial institutions.

The threat of substitutes for FirstRand is substantial, stemming from fintech, alternative lenders, and digital investment platforms. These substitutes offer convenience, lower costs, and specialized services, directly challenging traditional banking models. For instance, South Africa's digital payment landscape saw platforms like Ozow and PayFast processing billions by the end of 2023, indicating a clear shift in consumer preference away from traditional bank-led systems.

Customer behavior is evolving, with a growing preference for non-bank solutions. This includes opting for alternative finance providers for loans, which often provide more flexible terms and faster approvals. The alternative lending market in South Africa was projected to grow by 15% by the end of 2024, highlighting the increasing competition FirstRand faces.

Furthermore, self-service investment platforms and robo-advisors are eroding FirstRand's wealth management market share. These digital tools, characterized by lower fees and enhanced accessibility, are particularly attractive to a younger, tech-savvy demographic. The global robo-advisor market, valued at approximately $2.5 billion in 2023, is expected to see significant expansion, underscoring this trend.

| Substitute Area | Example | Impact on FirstRand | 2023/2024 Data Point |

|---|---|---|---|

| Digital Payments | Fintech Apps (Ozow, PayFast) | Reduced transaction fees and customer loyalty | Billions processed by non-bank payment platforms in South Africa |

| Lending | Peer-to-Peer Lending, Specialized Lenders | Loss of loan origination and interest income | 15% projected growth in South Africa's alternative lending market (2024) |

| Wealth Management | Robo-Advisors, Online Brokerages | Decreased assets under management and advisory fees | Global robo-advisor market valued at ~$2.5 billion (2023) |

Entrants Threaten

The banking industry, a core part of FirstRand's operations, faces substantial regulatory hurdles. For instance, in 2024, South Africa's Prudential Authority continues to enforce stringent capital adequacy ratios, with Tier 1 capital requirements often exceeding 10.5% of risk-weighted assets. These, alongside compliance with evolving frameworks like Basel IV, demand significant upfront investment and ongoing adherence, making it exceptionally difficult for new, undercapitalized entities to compete effectively.

The threat of new entrants from digital-only banks, or neo-banks, is a significant concern for established players like FirstRand. These nimble, tech-focused firms bypass the high infrastructure costs of traditional banks, allowing them to offer competitive pricing and user-friendly digital experiences, often focusing on underserved market segments. For instance, by mid-2024, several neo-banks in South Africa had already captured notable market share in specific digital payment and lending niches.

Fintech startups are a significant threat, often targeting lucrative segments like payments or lending, thereby siphoning off profitable business from established players like FirstRand. For example, in 2024, the global fintech market was valued at over $2 trillion, showcasing the scale of these disruptive forces.

These specialized entrants can erode market share by offering more agile and customer-centric solutions in specific niches. This mirrors the competitive landscape faced by institutions like Aldermore in the UK, which contends with numerous specialized lenders focusing on particular customer needs or asset classes.

Brand Loyalty and Customer Trust

Established financial institutions like FirstRand enjoy a substantial advantage due to deeply ingrained brand loyalty and customer trust, cultivated over decades of reliable service. This makes it incredibly difficult for new players to gain traction, as they must first invest heavily in building a comparable reputation and customer base. For instance, FirstRand's extensive network and customer relationships, evidenced by its significant market share in South Africa, present a formidable hurdle.

The threat of new entrants is further mitigated by FirstRand's diverse and well-recognized brands, each catering to specific market segments. This multi-brand strategy reinforces customer loyalty and creates a comprehensive offering that new competitors would struggle to replicate quickly. In 2024, FirstRand reported a strong customer base across its various divisions, underscoring the effectiveness of this approach in deterring new market entrants.

- Brand Recognition: FirstRand's established brands like FNB and RMB are household names, fostering immediate trust.

- Customer Loyalty: Long-standing customer relationships are a significant barrier to entry for new financial services providers.

- Reputation: Decades of operation have allowed FirstRand to build a reputation for stability and reliability, which new entrants lack.

- Market Share: FirstRand's substantial market share in key segments indicates a strong incumbent advantage against potential new competitors.

Access to Distribution Networks and Data

New entrants often struggle to establish the widespread distribution networks that established banks like FirstRand have cultivated over years. This includes physical branches, ATMs, and digital platforms, all of which are crucial for customer reach and service delivery.

Access to and the ability to leverage vast amounts of customer data is another significant barrier. Incumbents possess historical data that informs product development, risk assessment, and personalized marketing, giving them a competitive edge that new players find difficult to replicate quickly.

For instance, as of late 2024, major South African banks, including FirstRand, continue to invest heavily in expanding their digital capabilities and data analytics. This ongoing investment by incumbents makes it harder for newcomers to compete on the same level of customer insight and service efficiency.

- Distribution Network Challenge: New entrants must invest heavily to build a comparable physical and digital footprint to incumbents.

- Data Advantage: Existing players hold extensive customer data, enabling superior personalization and risk management.

- Customer Relationships: Established trust and long-standing relationships with customers are difficult for new entrants to overcome.

- Digital Evolution: While digital channels lower some barriers, the data and relationship advantages of incumbents persist.

The threat of new entrants for FirstRand remains moderate, primarily due to high capital requirements and stringent regulatory oversight in the banking sector. For instance, in 2024, South African banks must adhere to strict capital adequacy ratios, often exceeding 10.5% for Tier 1 capital, which presents a substantial financial barrier for new players. While fintechs and neo-banks are emerging, their ability to scale and gain significant market share is often hampered by the need for extensive licensing and compliance, a process FirstRand has navigated over decades.

Established brand loyalty and extensive distribution networks, including digital platforms and physical branches, further deter new entrants. FirstRand's strong customer relationships, built over many years, and its significant market share in South Africa, as reported in 2024, create a formidable competitive moat. Newcomers would need substantial investment not only in technology but also in building comparable trust and reach to effectively challenge incumbents.

| Factor | Impact on New Entrants | FirstRand's Position |

| Capital Requirements & Regulation | High Barrier | Established compliance infrastructure |

| Brand Recognition & Loyalty | Significant Challenge | Decades of trust and market presence |

| Distribution Networks (Digital & Physical) | Costly to Replicate | Extensive existing infrastructure |

| Data & Customer Insights | Difficult to Match | Vast historical customer data |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for FirstRand leverages a comprehensive suite of data sources, including FirstRand's annual reports, investor presentations, and regulatory filings. We also incorporate industry-specific research from reputable financial news outlets and market intelligence firms to provide a robust understanding of the competitive landscape.