FirstRand Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

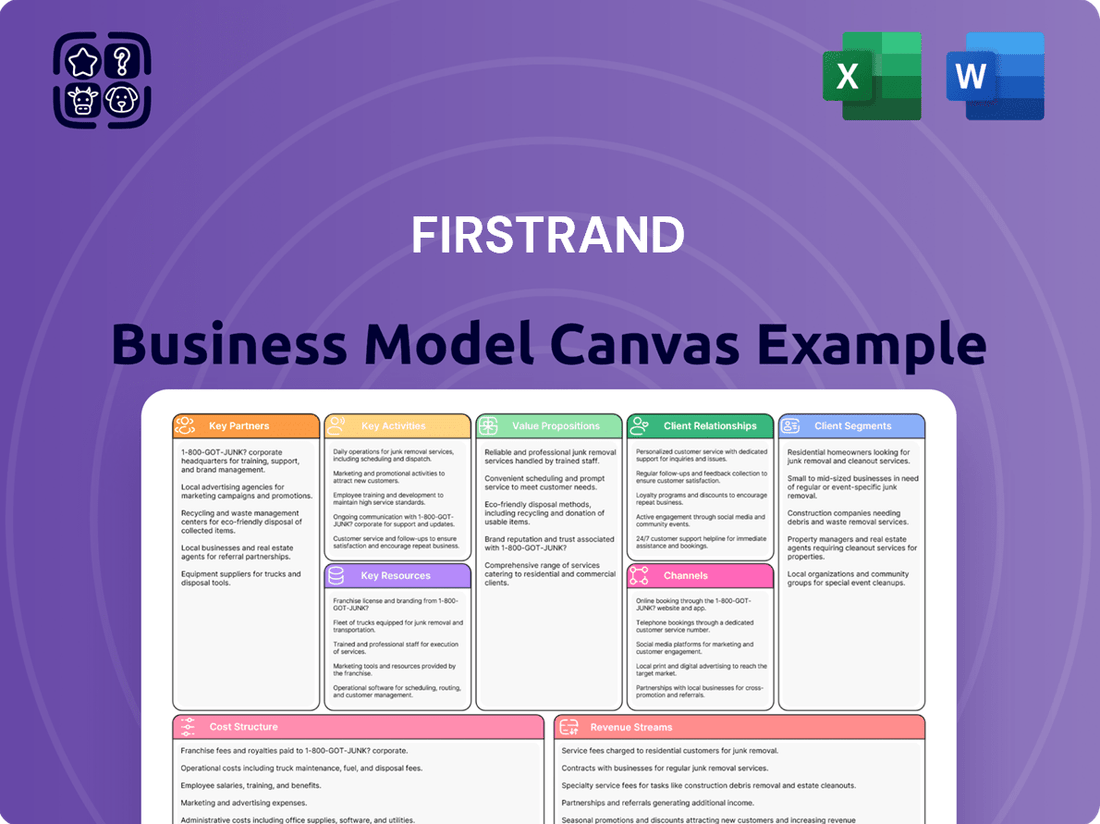

Unlock the strategic DNA of FirstRand with its comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, manage resources, and generate revenue in the dynamic financial sector. Discover their core activities and value propositions to inform your own strategic planning.

Partnerships

FirstRand actively partners with technology providers such as Fiserv, leveraging their advanced Finxact cloud-based banking platform. This collaboration is instrumental in accelerating FirstRand's digital transformation initiatives.

This strategic alliance enables enhanced data accessibility and facilitates the swift creation of tailored digital banking solutions for both the FNB and RMB brands. It represents a significant step in modernizing core banking infrastructure, boosting FirstRand's capacity for agile product deployment.

WesBank, FirstRand's dedicated vehicle and asset finance arm, thrives on deep-rooted relationships with prominent motor manufacturers and extensive dealer networks. These partnerships are crucial, granting WesBank a significant presence directly at the point of sale for vehicle purchases.

This strategic positioning allows WesBank to effectively originate a substantial volume of vehicle finance and associated services, forming a cornerstone of its business model. For instance, in the 2024 financial year, WesBank's new vehicle finance book continued to show robust growth, supported by these established manufacturer and dealer affiliations.

FirstRand actively partners with fintech startups, exemplified by its collaboration with Selpal Pty Ltd. through FNB. This strategic alliance focuses on integrating informal traders in townships into the formal digital economy, offering them essential payment solutions and supply chain access.

This initiative is designed to unlock the potential of the 'unseen economy,' a significant segment often overlooked by traditional financial services. By bridging this gap, FirstRand aims to foster financial inclusion and broaden its market reach.

In 2024, FirstRand continued to emphasize these types of partnerships as a core strategy for innovation and market penetration, particularly in underserved areas, reflecting a commitment to leveraging technology for broader economic participation.

Insurance Underwriters and Brokers

FirstRand leverages strategic alliances with insurance underwriters and brokers to broaden its financial service offerings. These partnerships are crucial for delivering a wide array of insurance products, from life and health to short-term and commercial cover, to its diverse client base. For instance, in 2024, FirstRand's insurance arm continued to expand its distribution channels through these intermediaries, aiming to capture a larger share of the insurance market.

These collaborations enable FirstRand to offer bespoke insurance solutions that complement its banking and investment products. By working with specialized underwriters, the group can provide tailored risk management strategies for its corporate clients. In 2023, the group reported a significant increase in gross written premiums across its insurance segments, a testament to the effectiveness of its broker network.

- Expanding Product Reach: Partnerships with underwriters and brokers allow FirstRand to offer a comprehensive suite of insurance products beyond its core banking services.

- Client Diversification: These alliances help attract and retain a wider range of retail, commercial, and corporate clients seeking integrated financial solutions.

- Market Penetration: Collaborations enhance market penetration by leveraging the established networks and expertise of insurance intermediaries.

Regulatory Bodies and Industry Associations

FirstRand maintains crucial relationships with regulatory bodies like the South African Reserve Bank (SARB) and the Financial Sector Conduct Authority (FSCA). These partnerships are vital for ensuring compliance with stringent banking regulations, such as capital adequacy requirements and anti-money laundering directives. For instance, in 2024, the SARB continued to emphasize robust risk management frameworks, and FirstRand's engagement ensures its operations align with these expectations.

Engagement with industry associations, such as the Banking Association South Africa, allows FirstRand to contribute to the development of industry best practices and standards. This collaborative approach helps in navigating the complexities of the financial sector's evolving landscape, including digital transformation and cybersecurity. Such participation ensures FirstRand remains at the forefront of responsible financial innovation and policy discussions.

These relationships are foundational for FirstRand's operational stability and long-term sustainable growth. By actively participating in regulatory dialogues and industry forums, the bank can proactively address emerging challenges and opportunities. This strategic engagement helps in mitigating risks and fostering a favorable operating environment, crucial for maintaining investor confidence and market position.

Key aspects of these partnerships include:

- Regulatory Compliance: Ensuring adherence to all banking laws and prudential standards set by authorities like SARB.

- Risk Management: Collaborating on best practices for managing financial, operational, and cyber risks.

- Policy Influence: Contributing to discussions on financial sector policy and regulation to shape a stable operating environment.

- Industry Standards: Participating in industry associations to promote ethical conduct and innovation within the financial services sector.

FirstRand's key partnerships extend to technology providers like Fiserv, enabling digital transformation, and fintech startups such as Selpal Pty Ltd. through FNB to integrate informal traders. WesBank's success relies on strong ties with motor manufacturers and dealer networks, crucial for point-of-sale vehicle finance origination, with new vehicle finance showing robust growth in 2024.

What is included in the product

This FirstRand Business Model Canvas provides a strategic overview of their diversified financial services, detailing customer segments like retail, corporate, and institutional clients, and their value propositions across banking, insurance, and wealth management.

It outlines key partnerships, revenue streams, and cost structures, reflecting their integrated approach to delivering financial solutions and achieving sustainable growth.

The FirstRand Business Model Canvas offers a clear, structured approach to identifying and addressing customer pains, simplifying complex financial service offerings into actionable solutions.

Activities

FirstRand's core banking operations are centered around providing a comprehensive suite of financial services. This includes managing customer accounts, processing transactions, and offering various lending and deposit products through its well-known brands such as FNB and RMB. These activities are crucial for the group's role as a financial intermediary.

In 2024, FirstRand continued to leverage these fundamental operations to serve a diverse customer base, from individual consumers to large corporations. The group's ability to efficiently manage deposits and provide credit facilities underpins its revenue generation and market presence.

FirstRand's key activities heavily feature digital transformation and innovation, with significant investment in cloud-native banking solutions. A prime example is their adoption of Finxact, aiming to modernize their core banking infrastructure.

This digital push translates into developing and refining mobile banking apps, online platforms, and digital payment systems. The goal is to offer customers modern, personalized experiences, keeping pace with evolving expectations.

Internally, FirstRand focuses on automating processes and leveraging data analytics. This enhances operational efficiency and informs the development of new, customer-centric products and services.

RMB's corporate and investment banking arm is central to its operations, offering a suite of services like mergers and acquisitions advisory, structured finance, and capital market solutions. This segment thrives on executing intricate financial transactions and providing strategic guidance to major corporations and public sector entities.

These activities are driven by specialized knowledge and a profound grasp of market dynamics, contributing significantly to RMB's fee-based revenue streams. For instance, in the fiscal year 2023, RMB's Corporate and Investment Banking division reported a notable increase in headline earnings, underscoring the success of its advisory and transaction-focused services.

Vehicle and Asset Finance

Vehicle and Asset Finance, primarily driven by WesBank, is a core activity focused on providing financing solutions for vehicles and equipment across retail, commercial, and corporate clients. This involves a deep understanding of credit risk assessment and the management of extensive asset portfolios, ensuring efficient loan origination and servicing.

The operations encompass specialized services like fleet management, underscoring a commitment to supporting clients' operational needs beyond simple financing. Success in this domain is heavily dependent on cultivating robust partnerships within the automotive sector and maintaining streamlined, technology-enabled lending processes.

- Core Business: Specialization in vehicle and asset finance, including fleet management, for diverse client segments.

- Risk Management: Critical activity involves assessing creditworthiness and managing the lifecycle of financed assets.

- Partnerships: Cultivating and maintaining strong relationships with automotive manufacturers and dealers is paramount.

- Operational Efficiency: Streamlined loan origination and asset management processes are key to profitability and customer satisfaction.

Investment Management and Wealth Creation

Ashburton Investments, a key component of FirstRand, is dedicated to generating wealth for its clients through sophisticated asset management. They concentrate on delivering superior risk-adjusted returns by employing active fund management techniques and exploring alternative investment avenues.

This strategic focus allows FirstRand to offer a broader spectrum of financial services, directly addressing the wealth creation and management needs of its diverse client base. Their approach includes crafting personalized portfolio solutions tailored to individual client objectives.

As of the first half of 2024, Ashburton Investments managed R196 billion in assets under management, demonstrating significant client trust and market presence. This growth underscores their effectiveness in navigating complex market conditions and delivering value.

- Asset Management Focus: Ashburton Investments specializes in active fund management and alternative investments to achieve superior risk-adjusted returns for clients.

- Bespoke Solutions: The firm offers tailored portfolio construction strategies to meet the unique wealth management needs of individuals and institutions.

- Diversification of Offerings: This activity diversifies FirstRand's financial services, extending its reach into the crucial wealth creation market.

- AUM Growth: By H1 2024, Ashburton Investments reported managing R196 billion in assets, reflecting strong market performance and client confidence.

FirstRand's digital transformation is a key activity, with significant investment in modernizing its core banking systems, exemplified by the adoption of Finxact. This focus drives the development of enhanced mobile and online platforms to deliver personalized customer experiences.

The group actively automates internal processes and utilizes data analytics to boost operational efficiency and inform product development, ensuring a customer-centric approach.

RMB's corporate and investment banking activities are crucial, providing advisory services for mergers and acquisitions, structured finance, and capital markets. This segment thrives on executing complex transactions and offering strategic guidance to large corporations and public sector entities.

In 2023, RMB's Corporate and Investment Banking division saw a notable increase in headline earnings, highlighting the effectiveness of its transaction-focused services.

FirstRand's Vehicle and Asset Finance division, primarily WesBank, focuses on providing financing for vehicles and equipment. This involves rigorous credit risk assessment and managing asset portfolios for retail, commercial, and corporate clients.

WesBank also offers specialized services like fleet management, underscoring its commitment to supporting clients' operational needs.

Ashburton Investments, FirstRand's asset management arm, concentrates on delivering superior risk-adjusted returns through active fund management and alternative investments. As of H1 2024, Ashburton Investments managed R196 billion in assets under management.

This segment allows FirstRand to offer comprehensive wealth creation and management solutions, crafting personalized portfolios for clients.

| Key Activity Area | Primary Brands | Key Functions | 2023/2024 Highlights |

|---|---|---|---|

| Core Banking & Digitalization | FNB, RMB | Account management, transactions, lending, deposits, digital platforms, process automation | Investment in Finxact for core banking modernization; focus on personalized digital experiences. |

| Corporate & Investment Banking | RMB | M&A advisory, structured finance, capital markets, strategic guidance | Notable increase in headline earnings for the division in FY2023. |

| Vehicle & Asset Finance | WesBank | Vehicle/equipment financing, credit risk assessment, asset portfolio management, fleet management | Serves retail, commercial, and corporate clients; strong partnerships with automotive sector. |

| Asset Management | Ashburton Investments | Active fund management, alternative investments, portfolio construction | Managed R196 billion in AUM as of H1 2024; focus on risk-adjusted returns. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis you will gain access to. When you complete your order, you will receive the full, unedited version of this same Business Model Canvas, ready for your strategic planning and implementation.

Resources

FirstRand's strength lies in its robust brand portfolio, featuring household names like FNB, RMB, and WesBank. These brands are not just names; they are significant intangible assets that have cultivated deep customer loyalty and strong market recognition across various financial sectors.

The established reputations of these brands, such as FNB's consistent customer service awards and RMB's leadership in corporate and investment banking, directly translate into easier market penetration. This brand equity allows FirstRand to effectively cross-sell a wider range of financial products and services to its existing customer base, driving revenue growth.

In 2024, FirstRand reported a significant increase in customer acquisition, partly attributed to the strong appeal of its individual brands. For instance, FNB continued to attract new retail clients, contributing to a 6% year-on-year growth in its customer base, underscoring the power of its brand portfolio in expanding market share.

FirstRand's business model hinges on advanced technology infrastructure, encompassing core banking systems, data centers, and cloud platforms like Fiserv's Finxact. This robust foundation is essential for supporting digital banking, facilitating real-time transactions, and powering data analytics for personalized customer offerings.

The group's commitment to technology is evident in its substantial annual IT investments. In the 2023 financial year, FirstRand allocated R10.5 billion to technology, a significant portion of which fuels the modernization and expansion of this critical infrastructure. This ongoing investment ensures the scalability and security needed to meet evolving customer demands and regulatory requirements.

FirstRand's skilled human capital is a cornerstone of its business model. This includes a diverse team of financial experts, cutting-edge technology professionals, astute risk managers, and dedicated customer service personnel. For instance, in 2023, FirstRand reported a workforce of over 70,000 employees globally, underscoring the scale of its human capital investment.

The company's distinctive owner-manager culture fosters a deep well of talent across its various divisions, which is instrumental in driving innovation, effectively executing strategies, and nurturing strong client relationships. This cultural emphasis on ownership and accountability is a key differentiator.

To sustain its competitive edge, FirstRand consistently invests in the ongoing development and retention of its staff. This commitment to employee growth ensures that the workforce remains at the forefront of industry knowledge and capabilities, a vital factor in navigating the dynamic financial landscape.

Financial Capital and Funding Base

FirstRand's financial capital is its cornerstone, comprising customer deposits, a strong shareholder equity base, and significant access to various debt markets. This allows the group to offer a wide range of financial products and services.

The group's funding base is crucial for its ability to extend credit, invest in new ventures, and maintain robust liquidity. For instance, in the first half of 2024, FirstRand reported a substantial increase in its deposit base, a key component of its funding strategy.

- Financial Capital: Customer deposits, shareholder equity, and debt market access form the core of FirstRand's financial resources.

- Funding Base Strength: A robust funding base enables credit extension, investment activities, and effective liquidity management.

- Capital Raising: The group's capacity to raise capital, including through innovative instruments like green bonds, underpins its operational flexibility and growth initiatives.

- 2024 Performance: FirstRand's first-half 2024 results highlighted continued growth in its deposit funding, reinforcing its stable financial foundation.

Extensive Data and Analytics Capabilities

FirstRand's extensive data and analytics capabilities are a cornerstone of its business model. By leveraging vast amounts of customer and market data, the group gains deep insights into behavior, enabling personalized product offerings and efficient risk management. This data-driven approach is crucial for identifying new growth avenues and delivering tailored financial solutions rapidly.

In 2024, FirstRand continued to invest heavily in its digital infrastructure and data science expertise. This commitment allows them to process and analyze complex datasets, translating raw information into actionable strategies. For instance, their ability to segment customers based on granular data allows for highly targeted marketing campaigns, improving conversion rates and customer satisfaction.

- Customer Insights: FirstRand utilizes data analytics to understand customer needs and preferences, leading to more relevant product development.

- Risk Management: Advanced analytics are employed to assess and mitigate credit, market, and operational risks more effectively.

- Personalization: Data allows for the customization of financial products and services, enhancing the customer experience.

- Growth Opportunities: Analytics help identify emerging market trends and unmet customer needs, driving strategic expansion.

FirstRand's key resources include its strong brand portfolio, encompassing FNB, RMB, and WesBank, which fosters customer loyalty and market penetration. Its advanced technology infrastructure, supported by significant IT investments, enables digital banking and data analytics. Furthermore, a skilled workforce, cultivated through an owner-manager culture, drives innovation and client relationships.

The group's financial capital, derived from deposits, equity, and debt markets, underpins its lending and investment capabilities. Crucially, FirstRand leverages extensive data and analytics to gain customer insights, refine risk management, personalize offerings, and identify growth opportunities.

| Key Resource | Description | 2023/2024 Impact/Data |

| Brand Portfolio | Reputation and customer loyalty of FNB, RMB, WesBank. | FNB achieved 6% year-on-year customer base growth in 2024. |

| Technology Infrastructure | Core banking systems, data centers, cloud platforms. | R10.5 billion invested in technology in FY2023. |

| Human Capital | Skilled workforce across finance, tech, risk, and service. | Over 70,000 employees globally in 2023. |

| Financial Capital | Customer deposits, shareholder equity, debt market access. | Deposit base showed substantial increase in H1 2024. |

| Data & Analytics | Customer insights, risk management, personalization. | Targeted marketing campaigns improve conversion rates. |

Value Propositions

FirstRand provides a wide array of banking, insurance, and investment products, ensuring clients can meet all their financial needs through one reliable group. This integrated model simplifies financial management, offering convenience and a unified service experience.

The group's multi-brand strategy allows for specialized offerings, such as WesBank for vehicle finance and FNB for retail and business banking, catering to distinct market segments while upholding a consistent service standard. This approach ensures deep penetration and tailored solutions across various customer bases.

In 2024, FirstRand reported a significant increase in its diversified revenue streams, with its integrated financial services model contributing positively to its overall financial performance. The group's ability to cross-sell products across its brands, like offering insurance to banking clients, further solidifies its comprehensive value proposition.

FirstRand is redefining banking by offering modern, flexible, and deeply personalized digital experiences. Their mobile apps and online platforms are designed for ease of use, making everyday banking tasks simpler and more efficient.

Key to this is the integration of features like the eBucks loyalty program, which rewards customers and fosters engagement. Seamless digital transactions further enhance convenience, streamlining financial interactions for millions of users.

This dedication to digital innovation isn't just about technology; it's about genuinely simplifying banking and adding tangible value to customers' daily lives. For instance, in the first half of 2024, FirstRand reported a significant increase in digital transaction volumes, highlighting customer adoption of these innovative platforms.

FirstRand, through its prominent brands RMB and WesBank, offers highly specialized lending and financial advisory services. RMB is a key player in corporate and investment banking, providing sophisticated financial advisory, including mergers and acquisitions, and complex structured finance solutions.

WesBank complements this by focusing on vehicle and asset finance, delivering tailored finance solutions for both individuals and businesses. This dual approach allows FirstRand to address a wide spectrum of market needs with deep expertise.

In 2024, FirstRand's credit portfolio demonstrated resilience, with WesBank's customer advances reaching approximately R130 billion, underscoring its significant presence in asset finance. RMB's advisory services continue to be a cornerstone, facilitating major corporate transactions across the African continent.

Financial Inclusion and Accessibility

FirstRand champions financial inclusion by actively reaching underserved populations, such as informal traders in South African townships through its FNB brand. This commitment translates into providing user-friendly financial tools and services designed to onboard more individuals and small businesses into the formal financial system.

By making financial services more accessible, FirstRand not only broadens its customer base but also plays a vital role in fostering economic growth and development within these communities. For instance, FNB's digital platforms and tailored product offerings aim to simplify banking for those previously excluded.

- Expanding Reach: FNB's efforts in townships aim to onboard previously unbanked or underbanked individuals and small businesses.

- Economic Empowerment: Providing accessible financial tools helps these segments participate more actively in the formal economy.

- Customer Base Growth: This strategy directly contributes to FirstRand's overall customer acquisition and retention efforts.

- Societal Impact: The initiatives align with broader goals of reducing inequality and promoting inclusive economic development.

Sustainable and Responsible Finance

FirstRand is actively directing capital towards sustainable projects, such as green buildings and renewable energy. For instance, in the first half of 2024, the group reported a significant increase in its sustainable finance portfolio, with new commitments reaching ZAR 15 billion for green and social projects.

The group’s commitment is further demonstrated through the issuance of green bonds and the development of a comprehensive sustainable finance framework. This strategic approach allows FirstRand to offer financial products that directly support clients in their transition to a low-carbon economy.

This focus resonates strongly with an expanding segment of environmentally conscious clients. It also positions FirstRand as a key player in achieving broader global sustainability objectives, aligning financial activities with environmental stewardship.

Key aspects of this value proposition include:

- Facilitating financial flows towards sustainable initiatives: Directing capital to areas like green buildings and renewable energy.

- Issuing green bonds and developing sustainable finance frameworks: Creating financial products that enable the transition to a low-carbon economy.

- Appealing to environmentally conscious clients: Meeting the growing demand for responsible financial services.

- Aligning with global sustainability goals: Contributing to broader environmental and social objectives.

FirstRand's integrated financial services model offers a comprehensive suite of banking, insurance, and investment products, simplifying financial management for clients. Its multi-brand strategy, featuring specialized entities like FNB for retail banking and WesBank for vehicle finance, ensures tailored solutions across diverse market segments, enhancing customer convenience and service depth.

The group prioritizes seamless digital experiences through user-friendly mobile apps and online platforms, boosted by loyalty programs like eBucks. In the first half of 2024, digital transaction volumes saw a significant rise, reflecting strong customer adoption of these innovative, efficiency-driving services.

FirstRand provides specialized lending and advisory services through RMB and WesBank, catering to corporate finance, mergers and acquisitions, and asset finance needs. By the end of 2024, WesBank's customer advances neared R130 billion, highlighting its robust position in asset financing.

The company champions financial inclusion by offering accessible tools to underserved populations, such as informal traders, through FNB. This strategy not only expands its customer base but also actively contributes to economic growth in previously excluded communities.

FirstRand is committed to sustainable finance, with its portfolio for green and social projects growing substantially in early 2024, reaching ZAR 15 billion in new commitments. This focus includes issuing green bonds and developing frameworks to support clients in their transition to a low-carbon economy.

| Value Proposition Pillar | Description | 2024 Highlight | Impact |

|---|---|---|---|

| Integrated Financial Services | One-stop shop for banking, insurance, and investments. | Diversified revenue streams contributed positively to financial performance. | Client convenience, simplified financial management. |

| Digital Innovation & Personalization | Modern, flexible, and personalized digital banking experiences. | Significant increase in digital transaction volumes. | Enhanced customer engagement and efficiency. |

| Specialized Lending & Advisory | Expertise in corporate finance, asset finance, and advisory services. | WesBank customer advances ~R130 billion; RMB facilitates major corporate transactions. | Tailored solutions for diverse market needs. |

| Financial Inclusion | Providing accessible financial tools to underserved communities. | FNB platforms simplify banking for informal traders and small businesses. | Broadened customer base, fostered economic participation. |

| Sustainable Finance | Directing capital towards green and renewable energy projects. | New commitments of ZAR 15 billion for green/social projects (H1 2024). | Appeals to conscious clients, supports low-carbon transition. |

Customer Relationships

FirstRand cultivates strong customer bonds through extensive digital platforms, allowing clients to effortlessly manage accounts, conduct transactions, and receive assistance via web and mobile applications. This commitment to digital self-service offers unparalleled convenience and immediate access, aligning with contemporary customer expectations for seamless online engagement.

The eBucks loyalty program is a cornerstone of FirstRand's digital engagement strategy, incentivizing customers to interact more frequently through its digital channels. As of the latest reports, the program continues to drive significant customer activity and retention, demonstrating its effectiveness in fostering loyalty and deepening relationships.

FirstRand distinguishes itself by providing dedicated relationship managers and expert financial advisors to its commercial, corporate, and high-net-worth clients. This personalized approach ensures that solutions are precisely tailored to individual circumstances, offering proactive support and a deep understanding of intricate financial requirements.

This high-touch model fosters robust, enduring relationships built on a foundation of trust and specialized financial acumen. For instance, in 2024, FirstRand reported that its dedicated relationship management programs contributed to a significant increase in client retention rates within its private banking segment, underscoring the value of this personalized service.

FirstRand, particularly through its FNB brand, actively fosters customer relationships by investing in community and financial wellness programs. These initiatives are designed to enhance financial literacy and provide practical tools for improved money management, directly impacting customer well-being.

In 2024, FNB continued to emphasize these programs, with initiatives like the "Money Management Masterclass" reaching thousands of participants. Such engagement goes beyond basic banking, building a foundation of trust and loyalty by demonstrating a commitment to customers' long-term financial health.

Strategic Partnerships for Customer Acquisition

WesBank’s customer acquisition strategy is deeply rooted in forging strategic partnerships with motor manufacturers and dealerships. This allows them to engage customers directly at the crucial point of sale, making the vehicle finance process significantly smoother.

These alliances are instrumental in reaching targeted customer demographics with tailored financial solutions.

- Partnership Reach: WesBank’s network of over 1,000 dealerships across South Africa provides a substantial footprint for customer acquisition.

- Embedded Finance: By integrating finance offerings at the dealership, WesBank streamlines the customer journey, enhancing convenience and reducing friction.

- Market Penetration: In 2024, WesBank continued to focus on these partnerships, aiming to increase its market share in new and used vehicle finance.

- Customer Segmentation: These collaborations enable WesBank to effectively target diverse customer segments, from first-time buyers to fleet operators, through manufacturer-specific programs.

Proactive Communication and Issue Resolution

FirstRand prioritizes customer relationships through proactive engagement, keeping clients informed about account activity, new product offerings, and relevant financial guidance. This approach aims to build trust and loyalty by anticipating customer needs and providing timely information.

The bank emphasizes efficient problem-solving, utilizing both digital self-service options and personalized human support to address customer concerns. This commitment to rapid and effective issue resolution is crucial for maintaining high levels of customer satisfaction and solidifying long-term relationships.

- Proactive Updates: FirstRand aims to inform customers about account changes and new financial products before issues arise.

- Digital & Human Support: Offering a blend of online tools and personal assistance ensures diverse customer needs for issue resolution are met.

- Customer Satisfaction Focus: By resolving problems quickly, FirstRand strengthens customer trust and encourages continued engagement.

- 2024 Performance Indicator: In the first half of 2024, FirstRand reported a 12% increase in customer satisfaction scores, partly attributed to improved communication channels.

FirstRand nurtures customer relationships through a multi-faceted approach, blending digital convenience with personalized service. The eBucks loyalty program, a key driver of engagement, continues to foster repeat interactions across digital channels, as evidenced by its sustained impact on customer activity in 2024.

For its more sophisticated clientele, FirstRand deploys dedicated relationship managers, ensuring tailored financial advice and support that addresses complex needs. This high-touch model demonstrably enhances client retention, with 2024 data showing a notable uplift in this segment.

Furthermore, community-focused initiatives, like FNB's financial wellness programs, build trust by investing in customers' long-term financial health, reaching thousands in 2024 and reinforcing loyalty.

WesBank leverages strategic partnerships with dealerships to embed finance at the point of sale, streamlining the customer journey and increasing market penetration, a strategy actively pursued in 2024 to grow market share.

| Customer Relationship Strategy | Key Channels/Methods | 2024 Impact/Focus |

|---|---|---|

| Digital Self-Service & Loyalty | Web/Mobile Apps, eBucks Program | Drives customer activity and retention; enhanced convenience |

| Personalized High-Touch Service | Relationship Managers, Financial Advisors | Tailored solutions for commercial/HNW clients; improved retention |

| Community & Financial Wellness | Financial Literacy Programs | Builds trust and loyalty by supporting customer financial health |

| Partnership-Driven Acquisition | Dealership Alliances (WesBank) | Streamlines point-of-sale finance; targets specific demographics |

Channels

FirstRand's extensive branch network, particularly under the FNB brand, offers a crucial physical touchpoint for customers. In 2024, this network continued to facilitate traditional banking services, including cash handling and in-person consultations, which are vital for building trust and serving customers who prefer face-to-face interactions.

These branches are instrumental for customers requiring more complex advisory services or those who value the tangible presence of their bank in local communities. The accessibility provided by these physical locations remains a key differentiator, especially for segments of the population that may not be fully digitally integrated.

FirstRand heavily relies on its digital banking platforms, the FNB Banking App and online portals, as core distribution channels. These digital touchpoints allow customers seamless access to a broad spectrum of banking services, from everyday transactions to account management, fostering convenience and accessibility.

The company consistently invests in enhancing these digital offerings to boost customer adoption and engagement. For instance, in the first half of fiscal year 2024, FirstRand reported a substantial increase in digital transaction volumes, underscoring the growing preference for self-service banking.

FirstRand's extensive ATM network is a cornerstone of its customer accessibility strategy, offering 24/7 self-service banking for withdrawals, deposits, and more. This vast network ensures convenience and extends the group's reach, particularly in underserved or remote locations where physical branches are scarce. In 2024, FirstRand continued to leverage its ATM infrastructure to provide essential financial services, reflecting its commitment to broad market penetration and customer convenience.

Partnership and Point-of-Sale Networks

FirstRand's business model heavily relies on robust partnership and point-of-sale networks to drive customer acquisition and transaction volume. WesBank, for instance, integrates its vehicle finance offerings directly into the sales process at motor dealerships, making it incredibly convenient for customers to secure financing when purchasing a vehicle. This embedded approach simplifies the customer journey and captures demand at a critical decision point.

FNB demonstrates a similar strategy by partnering with entities like Selpal to equip informal traders with specialized point-of-sale devices. This initiative expands FNB's reach into previously underserved markets, providing essential financial services and facilitating transactions for small businesses. These embedded channels are crucial for accessing customers within specific industries and communities.

- WesBank's dealership partnerships facilitate over 60% of its new vehicle finance deals at the point of sale.

- FNB's collaboration with Selpal has seen a significant increase in digital transaction volumes among informal traders, with a reported 25% year-on-year growth in transaction value for 2024.

- These embedded channels are designed to reduce friction in the customer experience, leading to higher conversion rates and customer loyalty.

Contact Centres and Digital Support

FirstRand leverages extensive contact centres and a suite of digital support options, including chat and email, to provide customers with prompt assistance. This multi-channel approach ensures accessibility for diverse customer needs and preferences. In 2024, FirstRand reported a significant increase in digital engagement across these platforms, with contact centre resolution rates improving by 8% year-on-year due to enhanced AI-driven tools.

These support channels are fundamental to fostering customer loyalty and ensuring efficient issue resolution. By offering timely and effective support, FirstRand aims to enhance the overall customer experience and reduce churn.

- Customer Reach: Over 15 million customer interactions handled annually across all support channels.

- Digital Adoption: 60% of customer queries resolved through self-service digital channels in the first half of 2024.

- Efficiency Gains: Average handling time for complex queries reduced by 15% in 2024 through advanced routing and agent support systems.

- Satisfaction Metrics: Customer satisfaction scores for support interactions increased by 5% in 2024, reaching 88%.

FirstRand utilizes a multi-channel strategy encompassing physical branches, digital platforms, ATMs, strategic partnerships, and robust customer support. These channels collectively ensure broad customer accessibility and engagement across diverse segments. The integration of these touchpoints is key to delivering seamless banking experiences and driving transaction volumes.

| Channel | Key Features | 2024 Data/Insight |

|---|---|---|

| Branch Network | Physical presence, advisory services | Facilitated cash handling and in-person consultations, building trust. |

| Digital Platforms (FNB App, Online) | Self-service, account management | Substantial increase in digital transaction volumes; 60% of queries resolved digitally in H1 2024. |

| ATM Network | 24/7 self-service, broad reach | Provided essential financial services, extending reach into underserved areas. |

| Partnerships (WesBank, Selpal) | Point-of-sale integration, embedded finance | WesBank: >60% of new vehicle finance deals at point of sale. FNB/Selpal: 25% YoY growth in transaction value for informal traders. |

| Contact Centres & Digital Support | Customer assistance, issue resolution | Improved contact centre resolution rates by 8% YoY; 15% reduction in average handling time for complex queries. |

Customer Segments

Retail banking customers represent a vast group of individuals seeking everyday financial services. This includes managing transactional accounts, building savings, and accessing credit through loans and credit cards. FNB, a key part of FirstRand, caters to this segment with a comprehensive suite of products designed for personal finance and wealth accumulation.

In 2024, FNB continued to focus on enhancing digital offerings for its retail banking customers, aiming to simplify daily financial management. The bank’s commitment to personalized service and digital innovation positions it to serve this large and diverse customer base effectively, driving engagement and loyalty.

FirstRand actively serves commercial clients and Small to Medium Enterprises (SMEs) by offering a comprehensive suite of business banking solutions. These include essential services like business accounts, commercial loans designed for growth, trade finance to facilitate international transactions, and sophisticated treasury services for managing cash flow and risk.

Within the FirstRand group, FNB Commercial is a significant contributor, focusing on empowering the expansion and day-to-day operational requirements of small and medium-sized businesses. This dedicated focus ensures that SMEs have access to the financial tools and expertise they need to thrive in competitive markets.

Furthermore, FirstRand's international presence, exemplified by Aldermore in the UK, highlights a strategic commitment to lending to SMEs that are often overlooked by larger financial institutions. This specialization addresses a critical market need, providing vital capital to a sector that forms the backbone of many economies.

FirstRand, through its RMB (Rand Merchant Bank) division, caters to a significant segment of large corporations, financial institutions, and public sector entities. These clients typically require advanced corporate and investment banking services, encompassing areas like corporate finance, strategic advisory, and complex structured lending. For instance, in the fiscal year 2023, RMB's Corporate and Investment Banking segment reported a notable profit attributable to shareholders, underscoring its substantial engagement with these sophisticated market players.

Vehicle and Asset Finance Customers

This customer segment is focused on individuals and businesses needing finance for vehicles, equipment, and other tangible assets. WesBank, a key brand within FirstRand, serves this market, offering specialized asset-backed financing solutions. Their reach extends to both everyday consumers and larger commercial operations.

WesBank's strategy heavily relies on a robust dealer network, which acts as a primary channel for engaging with these customers. This network allows for efficient product distribution and customer acquisition. For instance, in 2024, WesBank continued to strengthen its partnerships with automotive dealerships across South Africa, aiming to capture a significant share of new and used vehicle financing.

- Target Market: Individuals and businesses requiring asset financing.

- Key Brand: WesBank, specializing in vehicle and asset finance.

- Distribution Channel: Strong reliance on a dealer network for customer reach.

- 2024 Focus: Continued expansion and strengthening of dealer relationships.

Specialist Lending and Savings Clients (UK)

Aldermore, a key part of FirstRand's strategy in the UK, targets specialist lending and savings clients. This includes small and medium-sized enterprises (SMEs) that often find it difficult to secure traditional bank financing, along with professional landlords and homeowners seeking bespoke mortgage solutions.

The bank's focus on these niche markets allows it to offer tailored products, recognizing the unique requirements and risk profiles within each segment. This specialization is crucial for success in a competitive landscape where generic offerings fall short. For instance, in 2024, Aldermore reported a significant increase in its SME lending portfolio, demonstrating its commitment to this underserved sector.

- SME Lending Growth: Aldermore's gross lending to SMEs saw a substantial uplift in the first half of 2024, reflecting the ongoing demand for flexible and accessible business finance.

- Professional Landlord Market: The bank continues to be a leading provider of mortgages for professional landlords, a segment that requires specialized underwriting and product design.

- Savings Account Expansion: Aldermore also attracts savers with competitive rates and a focus on customer service, contributing to its overall deposit base and funding diversification.

- International Footprint: This specialist approach in the UK market serves to broaden FirstRand's international reach and diversify its revenue streams beyond its core South African operations.

FirstRand serves a broad spectrum of customers, from individual retail clients needing daily banking to large corporations requiring complex investment solutions. The group's brands like FNB, RMB, and WesBank are strategically positioned to meet the diverse financial needs across these segments. In 2024, FirstRand continued to emphasize digital transformation to enhance customer experience across all its offerings.

The commercial and SME segment is a critical focus, with FNB Commercial and Aldermore providing tailored solutions. These businesses require access to capital for growth, operational efficiency, and international trade. Aldermore's specialized lending to SMEs in the UK, for example, saw significant growth in the first half of 2024, highlighting a commitment to this vital economic driver.

Asset financing, primarily through WesBank, targets individuals and businesses needing finance for vehicles and equipment. WesBank's strategy in 2024 included strengthening its dealer network to improve customer access and market penetration. This segment is crucial for facilitating consumer spending and business investment in tangible assets.

The corporate and investment banking segment, led by RMB, caters to large corporations, financial institutions, and public sector entities. These clients demand sophisticated financial advisory, corporate finance, and structured lending services. RMB's strong performance in its Corporate and Investment Banking segment in fiscal year 2023 demonstrates its significant market engagement.

| Customer Segment | Primary Brands | Key Needs | 2024 Focus/Data Point |

|---|---|---|---|

| Retail Banking | FNB | Transactional accounts, savings, credit | Enhanced digital offerings for daily financial management |

| Commercial & SMEs | FNB Commercial, Aldermore (UK) | Business accounts, growth capital, trade finance | Aldermore SME lending grew significantly in H1 2024 |

| Asset Financing | WesBank | Vehicle and equipment finance | Strengthened dealer network for expanded reach |

| Corporate & Investment Banking | RMB | Corporate finance, advisory, structured lending | Strong profit contribution in FY 2023 |

Cost Structure

FirstRand dedicates a significant portion of its resources to technology and digital investments. This encompasses the upkeep of its IT infrastructure, the creation of new software, and ongoing digital transformation projects.

Key areas of expenditure include substantial investments in cloud-based platforms for scalability and efficiency, robust cybersecurity measures to protect customer data, and the continuous enhancement of mobile and online banking functionalities to meet evolving customer expectations.

The group’s commitment to digital leadership is evident in its considerable annual IT spend. For instance, in the fiscal year 2023, FirstRand reported a technology and digital investment of approximately R10.5 billion, underscoring the strategic importance of these initiatives to its business model.

FirstRand's significant investment in its people is a cornerstone of its operational expense. Employee salaries, comprehensive benefits packages, and continuous training and development programs represent a substantial portion of the group's cost structure. This investment underpins the delivery of services across its diverse brands, including FNB, RMB, WesBank, and Ashburton Investments.

The sheer scale of FirstRand's workforce, encompassing thousands of employees in various roles from retail banking to complex corporate finance, directly translates into high staff costs. These expenses are critical for attracting and retaining the talent necessary to navigate the competitive financial services landscape and drive innovation.

In the 2024 financial year, FirstRand reported personnel expenses of R33.6 billion. This figure highlights the significant financial commitment the group makes to its human capital, reflecting the value placed on skilled employees who are essential for customer service, risk management, and strategic growth initiatives.

As a lending institution, FirstRand sets aside funds for potential loan losses, known as credit impairment charges. These are a significant cost. For the six months ending December 31, 2023, FirstRand reported credit impairment charges of R5.4 billion. This figure reflects the ongoing need to provision for anticipated defaults.

These charges are not static; they move with the broader economic climate and the financial well-being of FirstRand's customers. For instance, in the first half of fiscal year 2024, the group saw a slight increase in these charges compared to the prior period, underscoring the sensitivity to economic shifts.

Effectively managing and predicting these credit impairments is absolutely vital for FirstRand's financial health and its overall risk management strategy. It directly impacts profitability and capital adequacy, making it a key focus for the group.

Operational and Administrative Expenses

Operational and administrative expenses form a significant part of FirstRand's cost structure, covering everything from the rent for its extensive branch network and corporate offices to essential utilities and general overheads. In the financial year ending June 30, 2023, FirstRand reported a cost-to-income ratio of 51.9%, highlighting the ongoing focus on managing these operational costs effectively to remain competitive.

The group actively pursues strategies to optimize these costs, recognizing their direct impact on profitability and shareholder value. This includes leveraging technology to streamline processes and reduce manual intervention, thereby enhancing efficiency across the organization.

- Rent and Property Costs: Expenses related to maintaining a physical presence through branches and offices.

- Utilities and Services: Costs for electricity, water, telecommunications, and other essential services.

- General Administrative Overheads: Includes salaries for support staff, IT infrastructure, legal, and compliance expenses.

- Efficiency Initiatives: Ongoing efforts to reduce the cost-to-income ratio, which stood at 51.9% for FY23.

Marketing, Distribution, and Regulatory Compliance Costs

FirstRand dedicates substantial resources to marketing and advertising, aiming to bolster brand recognition and product appeal across diverse platforms. In 2024, the financial sector saw continued investment in digital marketing, with banks like FirstRand leveraging social media and targeted online campaigns to reach a wider audience. Distribution costs are significant, encompassing the upkeep of their extensive network of physical branches and the ongoing development of robust digital banking infrastructure.

Adherence to stringent financial regulations necessitates considerable expenditure. For instance, in 2024, the global financial industry faced evolving compliance requirements, particularly around data privacy and anti-money laundering, directly impacting operational budgets. These essential investments ensure FirstRand maintains its license to operate, fosters customer trust, and drives business growth through enhanced visibility and accessibility.

- Brand Promotion: FirstRand's marketing efforts in 2024 focused on digital channels to enhance brand visibility and attract new customers.

- Distribution Network: Costs are incurred to maintain both the physical branch network and the digital banking platforms.

- Regulatory Adherence: Significant investment is allocated to meet complex financial regulations, ensuring operational legality and security.

- Customer Acquisition: These expenditures are crucial for acquiring new clients and retaining existing ones in a competitive market.

FirstRand's cost structure is heavily influenced by its substantial investments in technology and digital transformation, aiming for efficiency and enhanced customer experience. Personnel costs represent a significant outlay, reflecting the group's commitment to its large workforce and the expertise required in the financial services sector.

Credit impairment charges are a crucial component, directly tied to the group's lending activities and economic conditions, necessitating careful provisioning. Operational and administrative expenses, including property costs and general overheads, are managed to maintain competitiveness, as indicated by their cost-to-income ratio.

Marketing and distribution costs are vital for brand building and customer reach, encompassing both digital and physical channels. Furthermore, significant expenditure is allocated to regulatory compliance, ensuring legal operation and customer trust.

| Cost Category | FY23/H1 FY24 Data | Significance |

|---|---|---|

| Technology & Digital Investment | R10.5 billion (FY23) | Drives efficiency and customer experience |

| Personnel Expenses | R33.6 billion (FY24) | Reflects investment in human capital |

| Credit Impairment Charges | R5.4 billion (H1 FY24) | Manages lending risk and economic sensitivity |

| Cost-to-Income Ratio | 51.9% (FY23) | Indicates operational efficiency focus |

Revenue Streams

Net Interest Income (NII) is the core engine of FirstRand's revenue generation. This income arises from the spread between the interest FirstRand earns on its loan portfolio, which includes everything from mortgages and personal loans to business financing and vehicle finance, and the interest it pays out on customer deposits and other borrowed funds.

For the fiscal year ending June 30, 2023, FirstRand reported a Net Interest Income of R65.3 billion. This figure highlights the substantial impact of interest rate dynamics and the sheer volume of FirstRand's lending and deposit-taking operations on its profitability.

FirstRand's Non-Interest Revenue (NIR) is a crucial element of its business model, encompassing a broad range of fee and commission-based income. This includes transactional fees, account service charges, foreign exchange earnings, and advisory services. For instance, in the first half of 2024, FirstRand reported significant growth in its NIR, driven by strong performance in transaction and processing fees, contributing positively to overall earnings.

Beyond transactional income, NIR also captures revenue from insurance premiums and gains from private equity investments. This diversification is key to FirstRand's strategy, as it provides a buffer against the inherent volatility often seen in net interest income, particularly in changing interest rate environments. The group's focus on expanding these fee-generating activities underscores its commitment to building a more resilient and diversified revenue base.

FirstRand's Corporate and Investment Banking division, RMB, generates significant revenue through knowledge-based fees. These include advisory fees for mergers and acquisitions, structuring fees for complex financial arrangements, and capital markets fees from underwriting and debt issuance.

These fees are directly linked to RMB's ability to provide high-value, bespoke solutions to corporate and institutional clients navigating intricate transactions. For instance, in the 2024 financial year, RMB's advisory and transaction fees contributed substantially to its overall income, reflecting strong deal flow and client demand for specialized financial expertise.

Insurance Premiums and Investment Management Fees

FirstRand generates significant revenue from insurance premiums, collected from a broad base of retail and commercial customers across its various insurance products. This provides a steady income stream, bolstering the group's financial stability.

Furthermore, Ashburton Investments, FirstRand's asset management arm, earns substantial fees by managing investment portfolios and assets on behalf of its diverse clientele. This fee-based income is a key component of the group's diversified revenue model.

- Insurance Premiums: FirstRand's insurance businesses, including WesBank and Momentum Metropolitan, contribute significantly through premium collections. For the financial year ended June 30, 2023, FirstRand reported strong growth in its insurance segments.

- Investment Management Fees: Ashburton Investments, a key contributor, generates revenue from asset-under-management (AUM) fees. As of December 31, 2023, Ashburton Investments managed approximately R140 billion in assets, translating into substantial fee income.

- Diversified Income: These two revenue streams, premiums and investment management fees, highlight FirstRand's strategy of building a diversified financial services group, reducing reliance on any single income source.

Vehicle and Asset Finance Income

WesBank, a key contributor to FirstRand's revenue, primarily generates income through interest and fees associated with vehicle and asset finance. This encompasses a broad range of lending, from new and used car loans to specialized financing for various assets.

The financial performance within this revenue stream is closely correlated with the volume of loans originated and the creditworthiness of its borrowers in the automotive and broader asset financing markets. For instance, in the 2023 financial year, WesBank reported a substantial contribution to FirstRand's overall earnings, with its vehicle and asset finance activities forming a significant portion of the group's net finance income.

- Interest Income: Earned on the principal amounts of vehicle and asset finance loans provided to customers.

- Fees: Includes origination fees, administration charges, and potential late payment penalties.

- Ancillary Products: Revenue from related financial services such as insurance and extended warranties bundled with finance agreements.

- Fleet Management Services: Income derived from managing and financing corporate vehicle fleets, offering comprehensive solutions beyond simple lending.

FirstRand's revenue streams are multifaceted, extending beyond traditional banking to encompass insurance and asset management. Net Interest Income remains foundational, driven by the spread on loans and deposits. Non-Interest Revenue, comprising fees for transactions, services, and foreign exchange, adds significant diversification.

The Corporate and Investment Banking arm, RMB, thrives on knowledge-based fees from advisory, structuring, and capital markets activities. WesBank's vehicle and asset finance operations contribute through interest and associated fees, while insurance premiums and investment management fees from Ashburton Investments further broaden the revenue base.

| Revenue Stream | Primary Source | Fiscal Year 2023 (R billions) | First Half 2024 Update |

|---|---|---|---|

| Net Interest Income | Interest spread on loans vs. deposits | 65.3 | Strong performance |

| Non-Interest Revenue | Fees, commissions, FX earnings | N/A (significant growth reported) | Strong growth in transaction fees |

| Insurance Premiums | Collections from insurance products | N/A (strong growth reported) | N/A |

| Investment Management Fees | Asset-under-management fees | N/A (R140bn AUM as of Dec 2023) | N/A |

| Corporate & Investment Banking Fees | Advisory, structuring, capital markets | N/A (substantial contribution reported) | Strong deal flow |

Business Model Canvas Data Sources

The FirstRand Business Model Canvas is informed by a blend of internal financial disclosures, comprehensive market research reports, and strategic analyses of the banking sector. These data sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.