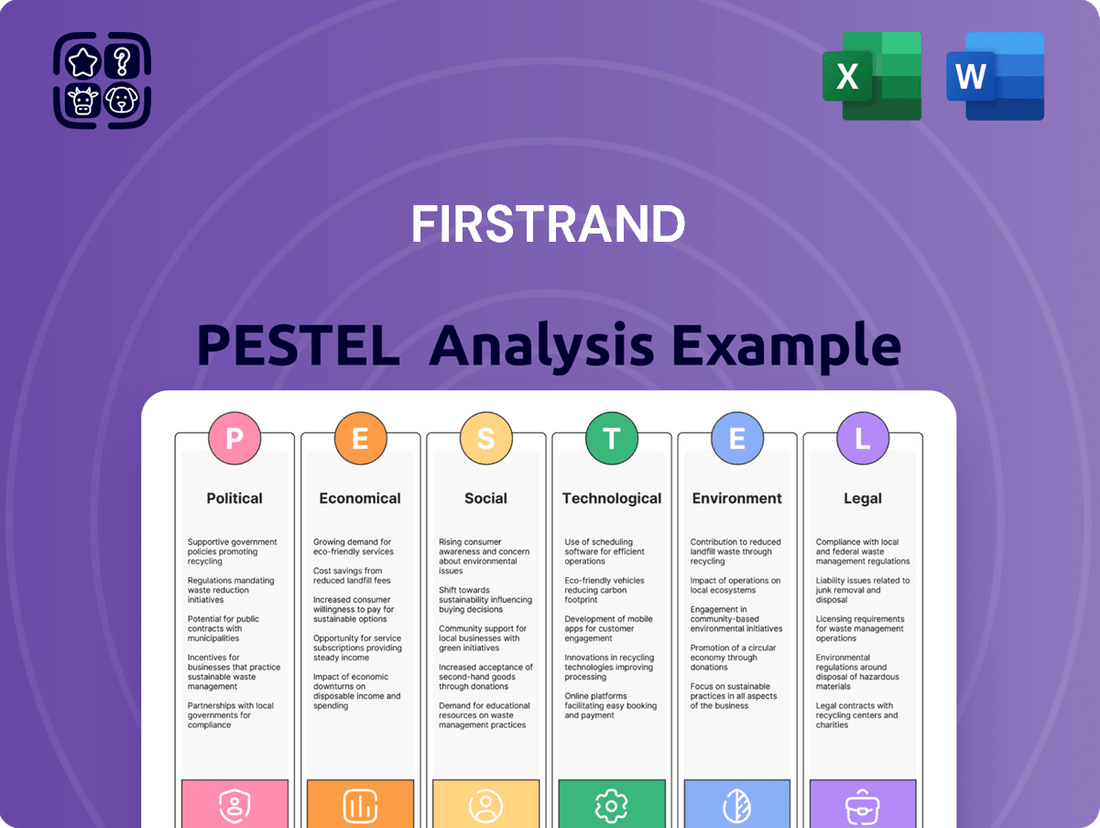

FirstRand PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping FirstRand's trajectory. Our comprehensive PESTLE analysis provides the deep-dive intelligence you need to anticipate market shifts and capitalize on opportunities. Download the full report now to gain a strategic advantage.

Political factors

South Africa's political landscape has seen a significant shift with the formation of a Government of National Unity following the 2024 general elections. This development has been broadly welcomed by financial markets, leading to a notable strengthening of the rand, which traded around R18.00 to the US dollar in early July 2024, a considerable improvement from earlier in the year. This enhanced political stability is a vital positive for FirstRand, given that the vast majority of its revenue is generated within South Africa.

The expectation is that this new political arrangement will foster policy continuity and a dedicated effort towards implementing critical structural reforms. Areas such as resolving the energy crisis and improving logistics infrastructure are particularly important for the broader economic environment, which in turn directly benefits the banking sector and FirstRand's operations. A stable policy environment reduces uncertainty, encouraging investment and supporting economic growth.

Global geopolitical tensions and evolving trade dynamics present significant macroeconomic challenges. These external forces can sway investor sentiment and impact economic expansion across FirstRand's key markets, such as South Africa and the United Kingdom.

For instance, the ongoing Russia-Ukraine conflict, which began in February 2022, continues to disrupt global supply chains and energy markets, contributing to inflationary pressures that central banks worldwide, including the South African Reserve Bank and the Bank of England, are working to manage. The International Monetary Fund's (IMF) World Economic Outlook for April 2024 projected global growth at 3.2%, a slight increase from 2023, but warned of persistent risks from geopolitical fragmentation and trade protectionism.

While FirstRand's diversified business model offers some resilience, prolonged geopolitical uncertainty can dampen both business and consumer confidence, potentially affecting loan demand and credit quality across its operations.

Governmental regulatory oversight is a significant political factor for FirstRand. The South African banking sector is under the watchful eye of the Prudential Authority (PA), which is dedicated to maintaining financial stability. Any shifts in legal or regulatory demands, particularly concerning capital adequacy and liquidity requirements, can directly influence how FirstRand operates and its overall financial results. This continuous regulatory attention fosters a strong and resilient banking landscape.

Policy reforms and economic initiatives

South Africa's commitment to structural reforms, particularly in critical areas like energy and logistics, is showing early signs of positive impact on the broader economic landscape. These initiatives are designed to unlock greater economic potential and create a more favorable operating environment for businesses, including major financial institutions like FirstRand.

While fixed investment has lagged expectations, these policy shifts are intended to invigorate economic activity. For FirstRand, this translates into an improved outlook, with the group anticipating a stronger performance for the year ending June 2025 than previously forecast, partly attributed to the anticipated benefits of these ongoing reforms.

- Energy Reforms: Progress in addressing the energy crisis is crucial for reducing operational costs and improving business confidence across sectors.

- Logistics Improvements: Enhancements in port and rail efficiency are expected to lower supply chain costs, benefiting businesses and consumers alike.

- Investment Stimulation: Government initiatives are targeting increased fixed investment to drive job creation and economic growth.

- FirstRand Outlook: The financial services sector stands to gain from a more stable and growing economy, with FirstRand's performance projections reflecting this positive sentiment for FY2025.

International political relations affecting UK operations

FirstRand's UK presence, largely via Aldermore, navigates the UK's political landscape. Regulatory shifts, like the Financial Conduct Authority's (FCA) focus on motor finance commission probes, directly influence Aldermore's financial health, necessitating substantial provisions. For instance, in the first half of 2024, FirstRand allocated R2.1 billion in provisions related to these investigations, impacting its reported earnings.

The ongoing nature of these regulatory reviews and potential litigation poses a significant risk, capable of materially altering FirstRand's consolidated financial outcomes. The ultimate resolution of these matters, including any fines or compensation, remains a key political and economic factor for the group's UK operations.

- Regulatory Scrutiny: The FCA's ongoing investigations into motor finance commission practices create uncertainty and potential financial liabilities for Aldermore.

- Provisioning Impact: FirstRand's R2.1 billion provision in H1 2024 highlights the direct financial consequences of these political and regulatory developments.

- Legal Proceedings: The outcome of legal challenges stemming from these investigations could further impact FirstRand's profitability and operational stability in the UK.

- Political Stability: Broader political stability within the UK influences investor confidence and the predictability of the regulatory environment for financial institutions like Aldermore.

The formation of South Africa's Government of National Unity following the 2024 elections has positively impacted the rand, trading around R18.00 to the US dollar in early July 2024. This political stability is crucial for FirstRand, as most of its revenue originates domestically, and it fosters expectations of policy continuity and structural reforms, particularly in energy and logistics. These improvements are vital for reducing operational costs and enhancing business confidence across sectors.

Global geopolitical tensions, such as the ongoing Russia-Ukraine conflict, continue to influence economic expansion and contribute to inflationary pressures, with the IMF projecting global growth at 3.2% for 2024, though risks from fragmentation persist. FirstRand's UK operations, specifically Aldermore, face regulatory scrutiny from the FCA regarding motor finance commissions, leading to significant provisioning. FirstRand allocated R2.1 billion in provisions in H1 2024 due to these investigations, highlighting the direct financial impact of regulatory developments.

What is included in the product

This FirstRand PESTLE analysis delves into the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers a comprehensive view of how these global and regional trends present both challenges and strategic opportunities for FirstRand.

A clear, actionable summary of FirstRand's PESTLE factors, providing immediate insights to navigate external challenges and inform strategic decisions.

Economic factors

Global inflation has eased, prompting central banks to hint at future interest rate reductions. However, South Africa's rate-cutting cycle is proving to be more gradual and delayed than initially anticipated. This environment presents a mixed outlook for financial institutions.

Lower interest rates generally offer relief to consumers and could boost borrowing, but they also tend to squeeze banks' net interest margins. Despite these macroeconomic pressures, FirstRand has reported an improvement in its credit performance, indicating resilience in its loan portfolio.

South Africa's economic activity showed a modest improvement, with real GDP growth projected at 1.5% for 2025 by the IMF, a step up from the 0.6% recorded in the financial year ended June 2024. This gradual recovery is a key factor for FirstRand, directly impacting the demand for credit and the overall health of its domestic banking operations.

Consumer credit demand has softened due to persistent inflation and higher interest rates, impacting disposable income. This slowdown is evident as retail credit demand moderates, with consumers becoming more cautious with borrowing.

In contrast, corporate and commercial lending has demonstrated robust growth, indicating a stronger appetite for investment among businesses. FirstRand's strategic focus on Small and Medium-sized Enterprises (SMEs) is a key driver of this positive momentum in business credit.

Looking ahead, FirstRand anticipates a rebound in consumer lending towards the end of 2025. This projected increase is contingent on further interest rate reductions, which are expected to ease borrowing costs and stimulate consumer spending.

Currency volatility and exchange rates

The South African Rand's performance against major currencies is a key economic factor. In early 2025, the Rand demonstrated appreciation against the US dollar, which is beneficial as it can lower the cost of imported goods, potentially easing inflationary pressures within South Africa.

However, this positive trend is not without risk. The Rand continues to be susceptible to external economic shocks and domestic fiscal policy challenges, meaning this stability might be short-lived. For FirstRand, this currency movement directly affects its financial reporting.

When the company translates the earnings from its international operations back into South African Rand (ZAR), fluctuations in the exchange rate can significantly alter the reported financial performance. For example, a stronger Rand means that foreign earnings, when converted, will appear lower in ZAR terms.

- Rand appreciation against USD in early 2025 eased import costs.

- Vulnerability to external shocks and domestic fiscal issues persists for the Rand.

- Currency translation impacts the reported ZAR value of FirstRand's international earnings.

Competitive landscape in the banking sector

The South African banking sector is intensely competitive, with FirstRand operating alongside four other major players that collectively hold a significant market share. This concentration means that innovation and customer acquisition are key battlegrounds.

Emerging digital-only banks and sophisticated embedded finance solutions are disrupting traditional banking models. These new entrants are forcing established institutions like FirstRand to rethink their service offerings and digital strategies to remain relevant and competitive.

The heightened competition is likely to exert downward pressure on interest margins for loans and deposit rates. This dynamic directly impacts the profitability of banks, necessitating efficient operations and diversified revenue streams.

- Market Dominance: Five major banks control a substantial portion of the South African banking market.

- Digital Disruption: New digital banks and embedded finance platforms are challenging incumbents.

- Profitability Pressures: Increased competition may lead to lower lending rates and deposit costs.

- Strategic Imperative: Banks like FirstRand must adapt their strategies to counter competitive threats.

South Africa's economic growth is projected at 1.5% for 2025, a slight increase from 0.6% in the prior year, according to the IMF, influencing credit demand. While consumer lending has slowed due to inflation and high rates, corporate and SME lending shows robust growth, a positive for FirstRand's strategy. The Rand's appreciation against the USD in early 2025 has helped ease import costs, though its stability remains vulnerable to external and domestic fiscal factors, impacting FirstRand's international earnings translation.

| Economic Factor | 2024 Projection (IMF) | 2025 Projection (IMF) | Impact on FirstRand | Key Data Point |

|---|---|---|---|---|

| GDP Growth (South Africa) | 0.6% (FY ended June 2024) | 1.5% | Influences credit demand and loan portfolio health. | IMF projection for 2025 is a positive sign. |

| Interest Rate Cycle | Gradual and delayed rate cuts anticipated. | Continued gradual cuts expected. | Affects net interest margins and borrowing costs. | Higher rates currently squeeze margins. |

| Rand Performance (vs USD) | Appreciated in early 2025. | Vulnerable to shocks. | Impacts translation of foreign earnings. | Stronger Rand can lower reported foreign profits. |

What You See Is What You Get

FirstRand PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FirstRand PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape shaping FirstRand's operations and future growth.

Sociological factors

Consumer expectations are evolving at an unprecedented pace, with a pronounced move towards digital banking solutions. This trend is particularly evident in South Africa, where customers increasingly prioritize convenience and accessibility offered by online and mobile platforms.

FirstRand's FNB has been at the forefront of this digital transformation within the South African banking sector. By investing heavily in its digital infrastructure, FNB has successfully fostered strong customer loyalty, often referred to as 'stickiness,' through the integration of various financial services and rewarding loyalty programs like eBucks.

The strategy centers on utilizing these robust digital channels not only to increase transaction volumes but also to effectively promote a wider array of financial products and services to its existing customer base, thereby driving cross-selling opportunities.

FirstRand is actively promoting financial inclusion, focusing on streamlining social grant distribution and digitizing cash transactions within communities. By offering electronic wallet solutions to unbanked individuals and training unemployed youth as financial advisors, the group not only meets critical societal needs but also broadens its customer reach. This strategy is particularly relevant as South Africa's financial inclusion rate saw a notable increase, with approximately 70% of adults having a formal bank account by 2023, according to reports from the South African Reserve Bank.

FirstRand's diverse client base, spanning retail, corporate, and public sectors, necessitates a keen understanding of shifting demographic trends. For instance, the increasing wealth among certain segments, particularly high-net-worth individuals, drives demand for specialized services like offshore wealth management solutions, with jurisdictions like Guernsey being a notable focus for such structures.

Impact of high unemployment on credit quality

High unemployment in South Africa, persistently impacting economic activity, directly affects consumer disposable income. This strain on household finances makes it harder for individuals to manage their debts, potentially leading to increased defaults and impacting the credit quality of financial institutions.

For a major financial services group like FirstRand, this translates to a heightened risk of credit losses. While FirstRand has demonstrated resilience, maintaining its credit loss ratio within target parameters even amidst economic headwinds, the ongoing consumer financial pressure remains a significant challenge that requires careful management.

For instance, South Africa's unemployment rate stood at approximately 32.9% in the fourth quarter of 2023, a figure that underscores the widespread economic vulnerability. This environment directly influences FirstRand's credit portfolio, as a larger pool of unemployed individuals means fewer people are able to service their loans.

Key impacts on FirstRand's credit quality due to high unemployment include:

- Increased Probability of Default: Higher unemployment directly correlates with a greater likelihood of individuals being unable to meet their loan obligations.

- Higher Credit Loss Ratios: As more loans become non-performing, banks like FirstRand face elevated credit loss ratios, impacting profitability.

- Reduced Demand for Credit: Economic uncertainty and job insecurity often lead to a decrease in consumer and business demand for new credit products.

- Strain on Affordability: Even employed individuals may face reduced disposable income due to inflation and economic slowdowns, impacting their ability to afford new or existing credit.

Public trust and brand reputation

Maintaining public trust is absolutely critical for a financial services group like FirstRand. Their success hinges on the confidence customers place in their brands. This trust is built through consistent ethical behavior and transparent dealings.

FirstRand's multi-brand approach, featuring well-recognized names such as FNB, RMB, and WesBank, directly benefits from strong brand reputations. A positive public perception across these diverse offerings is key to their market position. For instance, in 2024, FNB was recognized as South Africa's best retail bank for the 14th consecutive year by Global Finance, underscoring its strong brand equity.

Ethical conduct, responsible lending practices, and clear communication are vital for preserving this trust. Recent challenges, such as the ongoing UK motor finance commission review, highlight the importance of proactive and transparent engagement to mitigate reputational damage and maintain public confidence in their operations.

- Brand Strength: FirstRand's portfolio of brands, including FNB, RMB, and WesBank, are cornerstones of its public image and customer loyalty.

- Customer Confidence: Public trust is directly linked to the perceived integrity and reliability of financial institutions.

- Reputational Risk: Events like the UK motor finance commission review demonstrate how ethical lapses or transparency issues can erode public trust.

- Award Recognition: FNB's consistent accolades, such as being named South Africa's best retail bank in 2024, validate and reinforce public trust in FirstRand's retail operations.

Societal attitudes towards financial institutions are evolving, with a growing emphasis on corporate social responsibility and ethical practices. Consumers increasingly expect transparency and a commitment to community well-being from the companies they engage with.

FirstRand's commitment to financial inclusion, such as digitizing social grant distribution and training unemployed youth, directly addresses societal needs and enhances its public image. This focus on broader societal impact is becoming a key differentiator in the financial services sector.

The group's strong brand equity, exemplified by FNB's consistent recognition as South Africa's best retail bank, demonstrates how positive public perception, built on trust and ethical operations, translates into tangible business success.

However, challenges like the UK motor finance commission review highlight the critical need for proactive management of reputational risks to maintain public confidence.

Technological factors

FirstRand is actively pursuing digital transformation, pouring resources into modernizing its platforms to better serve clients and streamline operations. This strategic shift is crucial for staying competitive in the rapidly evolving financial landscape.

A key component of this strategy is the adoption of Finxact from Fiserv, a cutting-edge, cloud-native banking solution. This platform is designed to enable real-time processing and foster innovation across FirstRand’s banking arms, FNB and RMB.

The investment in Finxact is expected to significantly enhance FirstRand’s digital capabilities, allowing for faster product development and improved customer experiences. This move underscores the group's commitment to leveraging technology for future growth and efficiency.

The South African Reserve Bank (SARB) and Financial Sector Conduct Authority (FSCA) are actively exploring AI governance, with public consultations anticipated in the second half of 2025. This regulatory focus highlights the increasing importance of responsible AI deployment within the financial sector.

FirstRand, through its retail arm FNB, is already leveraging behavioral analytics. This allows them to gain deeper insights into customer preferences and behaviors, which directly translates into more targeted product offerings and improved profitability. For instance, FNB's use of data analytics has been instrumental in personalizing customer journeys.

The strategic adoption of AI and advanced data analytics is non-negotiable for financial institutions like FirstRand. These technologies are fundamental to developing hyper-personalized financial solutions, strengthening risk management frameworks, and significantly boosting operational efficiency across all business units.

As financial services increasingly migrate to digital platforms, cybersecurity threats and the imperative for robust data protection have become paramount for FirstRand. The growing sophistication of cyberattacks poses a significant risk to customer data and the integrity of financial transactions, making cybersecurity a critical operational focus.

Protecting sensitive customer information and securing financial transactions against evolving cyber threats is a non-negotiable operational requirement for FirstRand. The company must invest heavily in advanced security measures to safeguard its digital infrastructure.

Maintaining customer trust and ensuring compliance with stringent data privacy regulations, such as the Protection of Personal Information Act (POPIA) in South Africa, necessitates the implementation of comprehensive and continuously updated security protocols. Failure to do so can result in substantial reputational damage and financial penalties, impacting FirstRand's market standing.

Innovation in payment systems and digital offerings

FirstRand's FNB is heavily invested in enhancing its digital capabilities, particularly through its mobile app and internet banking platforms. This focus on innovation in payment systems and digital offerings allows for the rapid deployment of new, personalized financial products. For instance, FNB has seen significant growth in its digital channels, with mobile banking transactions increasing by 15% year-on-year as of the first half of 2024, reflecting customer adoption of these advanced payment solutions.

The bank's strategy hinges on its ability to quickly scale its merchant-acquiring infrastructure and expand e-wallet functionalities. This technological advancement is crucial for reaching a broader market and solidifying its customer-centric approach. In 2024, FNB's e-wallet service processed over 50 million transactions, demonstrating the success of its digital payment innovation.

- Digital Growth: FNB's mobile app usage saw a 20% increase in active users in the first half of 2024 compared to the same period in 2023.

- Payment System Expansion: The bank has expanded its merchant-acquiring network by 25% in 2024, enabling more businesses to accept digital payments.

- E-wallet Adoption: FNB's e-wallet has become a primary payment method for over 2 million customers, with transaction volumes up 18% in the last fiscal year.

Investment in IT infrastructure and emerging technologies

FirstRand is actively investing in its technology infrastructure, including its UK-based Aldermore operation, even with persistent inflation impacting costs. This commitment to scaling technology platforms is crucial for future growth.

These investments are designed to bolster operational resilience and ensure the group maintains its competitive standing in an increasingly digital financial sector. This focus on emerging technologies is a strategic imperative.

- IT Infrastructure Scaling: Continued investment in technology platforms across all group operations.

- Operational Resilience: Enhancing the robustness of systems to withstand disruptions.

- Competitive Edge: Leveraging new technologies to stay ahead in the evolving digital landscape.

Technological advancements are reshaping FirstRand's operations, driving a significant digital transformation. The adoption of cloud-native solutions like Finxact from Fiserv is central to this strategy, aiming for real-time processing and enhanced innovation across FNB and RMB. This focus on modernizing platforms is critical for maintaining competitiveness in the fast-evolving financial services sector.

FirstRand, particularly through FNB, is leveraging advanced data analytics and AI for hyper-personalization and improved risk management. FNB's mobile app saw a 20% increase in active users in H1 2024, and its e-wallet processed over 50 million transactions in 2024, highlighting strong digital adoption. The bank also expanded its merchant-acquiring network by 25% in 2024.

Cybersecurity is a paramount concern, with FirstRand investing in robust data protection measures to safeguard customer information and transactions against sophisticated threats. This is essential for maintaining customer trust and adhering to regulations like POPIA. The group continues to invest in scaling its technology infrastructure, even amidst inflationary pressures, to ensure operational resilience and a competitive edge.

| Technology Initiative | Key Metric | Period | Impact | |

|---|---|---|---|---|

| Finxact Adoption | Cloud-native banking solution | Ongoing | Enables real-time processing and innovation | |

| FNB Mobile App Growth | Active users | +20% | H1 2024 vs H1 2023 | Increased digital engagement |

| FNB E-wallet Transactions | Volume | 50M+ | 2024 | Primary payment method for millions |

| Merchant Acquiring Network | Expansion | +25% | 2024 | Broader digital payment acceptance |

Legal factors

FirstRand operates within a constantly shifting regulatory landscape, particularly concerning Basel reforms in South Africa. The group must navigate the complexities of these reforms, with a significant mid-year deadline approaching in 2025 for the remaining elements.

Meeting these evolving compliance demands, especially those related to capital adequacy and liquidity, remains a paramount and ongoing concern for FirstRand. Failure to adapt can impact financial stability and operational capacity.

The banking sector, including FirstRand, operates under intense scrutiny regarding consumer protection, a trend exemplified by the UK Financial Conduct Authority's (FCA) extensive review of historical motor finance discretionary commission arrangements. In response to potential liabilities stemming from such reviews, FirstRand has established a significant provision, indicating the financial impact of these regulatory actions.

Maintaining strict adherence to fair lending practices and robust consumer protection laws is not merely a compliance requirement but a critical imperative for FirstRand to safeguard its reputation and avoid costly financial penalties. Failure to do so can lead to substantial fines and a loss of customer trust, impacting long-term profitability.

South Africa's ongoing presence on the Financial Action Task Force (FATF) grey list highlights the critical need for robust Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) measures within its banking sector. FirstRand, like its peers, faces significant reputational and operational risks if compliance falters.

The country's financial institutions are under intense scrutiny to strengthen their AML/CFT frameworks, a move that directly impacts operational costs and strategic decision-making for entities like FirstRand. Failure to meet these evolving international standards could lead to increased regulatory penalties and restricted access to global financial markets.

Legal investigations and litigation risks

FirstRand is exposed to legal investigations and litigation risks, which could significantly affect its financial performance. A notable instance involves the UK motor finance commission review, with a UK Supreme Court hearing slated for April 2025 and an update from the Financial Conduct Authority (FCA) anticipated in May 2025. The potential for substantial provisions arising from these legal challenges underscores the importance of monitoring regulatory developments.

The group's financial results are directly susceptible to the outcomes of such legal proceedings. For example, if the FCA review or court rulings are unfavorable, FirstRand could be compelled to make significant financial provisions, impacting profitability and potentially requiring adjustments to its capital reserves. This highlights the inherent uncertainty and financial exposure associated with ongoing legal matters.

- UK Motor Finance Review: A critical legal challenge with a UK Supreme Court hearing in April 2025 and FCA update in May 2025.

- Financial Impact: Potential for substantial provisions and negative effects on FirstRand's financial results.

- Regulatory Scrutiny: Ongoing investigations create an environment of uncertainty and require careful management of legal risks.

Data privacy laws and cybersecurity governance

With the rapid growth of digital transactions, FirstRand must navigate a complex web of data privacy laws. Compliance with South Africa's Protection of Personal Information Act (POPIA) and the European Union's General Data Protection Regulation (GDPR) is paramount, impacting how customer data is collected, processed, and stored. Failure to comply can result in significant fines and reputational damage.

The South African Reserve Bank (SARB) and the Financial Sector Conduct Authority (FSCA) are actively developing AI governance principles. These principles will likely extend to data usage within AI systems, requiring FirstRand to ensure ethical and secure data handling. This regulatory focus underscores the importance of robust data governance.

FirstRand's commitment to strong data governance frameworks is therefore not just a legal necessity but a critical component of maintaining customer trust. These frameworks are essential for safeguarding sensitive customer information against cyber threats and ensuring compliance with evolving regulations. As of late 2024, data breaches continue to be a significant concern across the financial sector globally.

- POPIA Compliance: Adherence to South Africa's POPIA mandates strict rules on personal information processing.

- GDPR Alignment: For operations involving EU residents, GDPR compliance is a significant legal and operational consideration.

- AI Governance Focus: Anticipated SARB and FSCA guidelines on AI will directly influence data usage practices.

- Cybersecurity Investment: Ongoing investment in cybersecurity measures is crucial to protect against data breaches and maintain customer confidence.

FirstRand is navigating complex regulatory shifts, including the finalization of Basel reforms in South Africa, with key deadlines in 2025. The group must also contend with evolving consumer protection laws, as seen with the UK motor finance review, which has led to significant provisioning. Furthermore, South Africa's FATF grey list status necessitates robust Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) measures, impacting operational costs and reputational risk.

The group faces considerable legal exposure from ongoing investigations, notably the UK motor finance commission review, with a UK Supreme Court hearing in April 2025 and an FCA update expected in May 2025. These proceedings could necessitate substantial financial provisions, directly impacting FirstRand's profitability and capital reserves. Data privacy laws, including South Africa's POPIA and the EU's GDPR, also demand strict adherence, particularly with the increasing focus on AI governance principles from the SARB and FSCA.

| Legal Factor | Key Developments/Impact | FirstRand Relevance |

| Basel Reforms | Finalization of reforms with 2025 deadlines | Capital adequacy and liquidity compliance |

| Consumer Protection | UK Motor Finance Review; FCA update May 2025 | Potential for significant provisions; reputational risk |

| AML/CFT | South Africa on FATF Grey List | Enhanced compliance costs; operational scrutiny |

| Data Privacy | POPIA, GDPR; AI Governance (SARB/FSCA) | Data handling practices; cybersecurity investment |

Environmental factors

FirstRand acknowledges climate change as a significant global threat, capable of fundamentally altering business operations and affecting communities. The company is actively contributing to solutions by fostering climate resilience and supporting the shift towards a low-carbon economy. This commitment involves evaluating how climate-related risks might influence its investment portfolios and actively seeking out new business avenues aligned with sustainability goals.

FirstRand is actively weaving Environmental, Social, and Governance (ESG) factors into its core business strategy and daily operations. Climate change, in particular, is a significant focus, with it being a dedicated performance metric for senior leadership. This commitment is reflected in their robust climate risk management framework, which is integrated across all business units and adheres to the Task Force on Climate-related Financial Disclosures (TCFD) recommendations for transparent reporting.

FirstRand is increasingly focused on climate-related disclosures, aligning with the Task Force on Climate-related Financial Disclosures (TCFD) framework. These disclosures are integrated across various group reports, reflecting a growing demand from regulators and stakeholders for greater transparency regarding climate risks and opportunities within financial institutions.

Transition to a low-carbon economy and financed emissions

FirstRand is actively supporting the shift to a low-carbon economy by directing financial resources towards eight critical sectors. This strategic focus aims to channel capital effectively into areas that will drive sustainable growth and reduce environmental impact.

The group has set ambitious targets, committing to achieve net-zero emissions for its own South African operations by 2030. Furthermore, FirstRand's commitment extends to its financed emissions, with a goal of reaching net-zero by 2050, taking into account the specific country contexts in which it operates.

- Sector Focus: Prioritizing eight key sectors for low-carbon transition financing.

- Operational Net-Zero: Aiming for net-zero by 2030 for own SA operations.

- Financed Emissions Target: Targeting net-zero for financed emissions by 2050.

- Contextual Approach: Considering country-specific factors in emission reduction strategies.

Green and sustainable finance initiatives

FirstRand is actively engaging in green and sustainable finance, demonstrating a commitment to environmental responsibility. In October 2023, the bank issued green bonds, followed by another issuance in March 2024. These bonds specifically fund projects in green buildings and renewable energy, aligning with global sustainability goals.

Further solidifying its position, FirstRand updated its sustainability bond framework in October 2024. This enhancement broadens the scope to a comprehensive sustainable finance framework. This strategic move allows for the issuance of a wider range of thematic financial instruments, including green, social, and sustainability bonds.

- Green Bond Issuance: FirstRand issued green bonds in October 2023 and March 2024.

- Proceeds Allocation: Funds are directed towards green buildings and renewable energy financing.

- Framework Update: In October 2024, the sustainability bond framework was updated to a broader sustainable finance framework.

- Instrument Diversification: This update enables the issuance of thematic instruments like green, social, and sustainability financial instruments.

FirstRand recognizes the substantial impact of environmental factors on its operations and stakeholders, particularly concerning climate change. The group is strategically channeling finance into eight key sectors to support the transition to a low-carbon economy.

The bank has set clear targets, aiming for net-zero emissions in its own South African operations by 2030 and for financed emissions by 2050, considering country-specific contexts. FirstRand's commitment is further evidenced by its issuance of green bonds in October 2023 and March 2024, with proceeds supporting green buildings and renewable energy projects.

| Environmental Target | Year | Status |

|---|---|---|

| Net-zero emissions (own SA operations) | 2030 | Targeted |

| Net-zero emissions (financed emissions) | 2050 | Targeted |

| Green Bond Issuance | Oct 2023, Mar 2024 | Completed |

PESTLE Analysis Data Sources

Our FirstRand PESTLE Analysis draws from a robust blend of official government publications, reputable financial news outlets, and leading economic research bodies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the group.