FirstRand Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

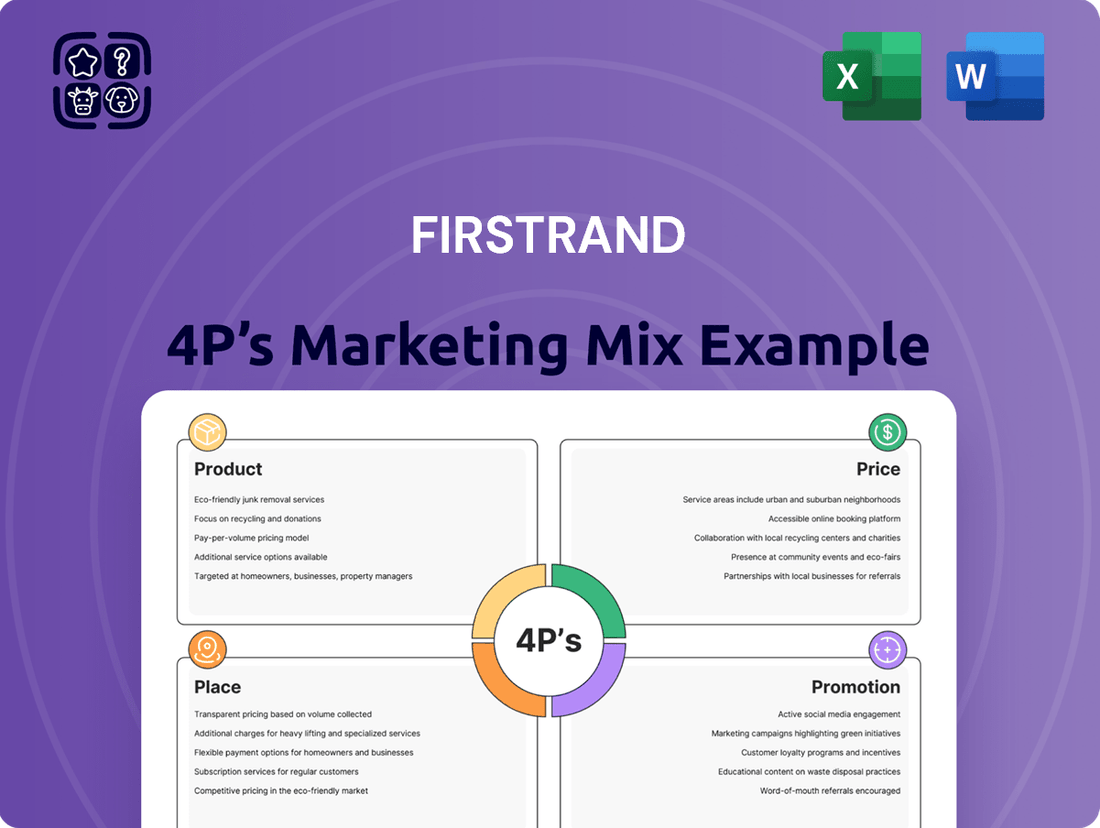

FirstRand's marketing success is built on a robust 4Ps strategy, from its diverse product offerings to its strategic pricing and extensive distribution. Understanding how these elements synergize is key to grasping their market dominance.

Dive deeper into FirstRand's product innovation, competitive pricing models, expansive place strategies, and impactful promotion campaigns. Get the full, editable analysis to unlock actionable insights for your own business.

Product

FirstRand, a financial powerhouse, leverages its strong brand portfolio including FNB, RMB, WesBank, and Aldermore to deliver a broad spectrum of financial solutions. This encompasses everything from everyday banking needs to sophisticated investment and insurance products.

Their product strategy is built on diversification, catering to a wide array of clients, from individual consumers to large corporations and even public sector entities. This ensures a comprehensive offering, meeting diverse financial requirements across the market.

In 2024, FirstRand reported a significant increase in its diversified product offerings, with lending and deposit growth contributing positively to its performance. For instance, FNB saw substantial uptake in its digital banking solutions, enhancing customer access to a variety of financial tools.

FirstRand's customer-centric offerings are designed to resonate deeply with specific market segments, differentiating them from rivals. This approach focuses on tailoring financial solutions to meet evolving customer needs and preferences.

FNB exemplifies this strategy with its innovative retail and commercial products, notably its robust digital platforms and the highly successful eBucks loyalty program. As of the first half of 2024, FNB reported a significant increase in digital transaction volumes, demonstrating the strong adoption of these customer-focused innovations.

WesBank, a key part of FirstRand's specialized lending, focuses on vehicle and asset finance, boasting strong partnerships with major motor manufacturers and dealer networks. This strategic approach, evident in its substantial market share in South Africa, allows WesBank to offer tailored solutions for both individual consumers and businesses, including comprehensive fleet management services.

In the UK, Aldermore, another FirstRand entity, targets niche markets with specialist lending. It serves small and medium-sized enterprises (SMEs), homeowners, landlords, and vehicle owners who may be overlooked by traditional banks. Aldermore's offerings extend to competitive savings products, demonstrating a diversified approach to specialist finance.

By focusing on these specialized segments, FirstRand, through WesBank and Aldermore, effectively addresses specific market needs. For instance, WesBank's 2023 financial results showed continued growth in its vehicle finance book, underscoring the demand for its specialized offerings in the automotive sector.

Corporate and Investment Banking Expertise

Rand Merchant Bank (RMB), FirstRand's corporate and investment banking arm, is a cornerstone of its offering, emphasizing a robust origination capability, market-making, and distribution networks. This expertise extends to private equity and a rapidly expanding transactional platform, providing clients with comprehensive financial solutions. In 2024, RMB reported a significant contribution to FirstRand's overall earnings, demonstrating its vital role in the group's success.

RMB's product suite is designed to meet the complex needs of its corporate clients, encompassing diverse financing options, sophisticated trade solutions, and strategic corporate finance advisory services. These offerings are crucial for businesses navigating global markets and seeking growth opportunities. For instance, RMB's deal pipeline in the infrastructure finance sector remained strong through early 2025, reflecting ongoing demand for its specialized expertise.

- Financing Products: Tailored debt solutions and capital raising for various corporate needs.

- Trade Solutions: Facilitating international trade through import/export finance and supply chain solutions.

- Corporate Finance Advisory: Strategic guidance on mergers, acquisitions, and capital structuring.

- Private Equity: Investment and partnership in growth-oriented businesses.

Insurance and Investment s

FirstRand is strategically expanding beyond core banking by cultivating capital-light revenue streams in insurance and investment management. This diversification aims to offer clients a more comprehensive financial toolkit.

Through its various insurance offerings and the dedicated asset management arm, Ashburton Investments, FirstRand is broadening its market reach. For instance, in the fiscal year ending June 30, 2024, the group reported significant growth in its wealth and investment management segments, reflecting the success of this strategy.

Key aspects of FirstRand's insurance and investments include:

- Diversified Product Suite: Offering a range of insurance products alongside investment solutions to meet varied client needs.

- Capital-Light Growth: Focusing on revenue generation that requires less capital commitment compared to traditional banking.

- Ashburton Investments: A dedicated asset management business enhancing the group's investment capabilities.

- Integrated Financial Services: Providing clients with a holistic approach to financial planning and wealth creation.

FirstRand's product strategy centers on a diversified portfolio catering to a broad client base, from retail to corporate. This includes offerings from FNB, RMB, WesBank, and Aldermore, covering everyday banking, specialized lending, and investment solutions.

The group's product innovation is evident in digital platforms and loyalty programs like FNB's eBucks, which saw increased digital transaction volumes in H1 2024. WesBank maintains a strong presence in vehicle finance, with its 2023 results showing continued book growth.

Furthermore, FirstRand is expanding into capital-light areas like insurance and wealth management, with Ashburton Investments bolstering its investment capabilities. These segments experienced significant growth in the fiscal year ending June 30, 2024.

| Brand | Key Product Areas | 2024/2025 Data Highlights |

|---|---|---|

| FNB | Retail & Commercial Banking, Digital Solutions, eBucks | Increased digital transaction volumes (H1 2024) |

| RMB | Corporate & Investment Banking, Trade Finance, Advisory | Strong deal pipeline in infrastructure finance (early 2025) |

| WesBank | Vehicle & Asset Finance | Continued growth in vehicle finance book (2023) |

| Aldermore | Specialist Lending (SMEs, Homeowners), Savings | Serves niche markets often overlooked by traditional banks |

| Ashburton Investments | Asset Management, Wealth Management | Significant growth in segments (FY ending June 30, 2024) |

What is included in the product

This analysis provides a comprehensive breakdown of FirstRand's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's designed for professionals seeking to understand FirstRand's marketing positioning, offering a deep dive into each element with examples and strategic implications.

Addresses the complexity of FirstRand's marketing strategy by providing a clear, concise overview of their 4Ps, simplifying understanding and decision-making.

Eliminates the need for extensive reading by distilling FirstRand's marketing mix into an easily digestible format, saving valuable time for busy executives.

Place

FirstRand, through its FNB brand, maintains a significant physical footprint in South Africa and across Africa, boasting a substantial branch and ATM network. This extensive physical presence is a cornerstone of its marketing mix, ensuring customers have convenient access for their banking needs. As of early 2024, FNB operates hundreds of branches and thousands of ATMs, facilitating essential services for a broad customer base.

FirstRand's digital and online platforms are central to its customer engagement and distribution strategy. The group's mobile and internet banking services provide convenient access to a wide range of financial products and services.

Significant investments in digital transformation are evident, with FNB and RMB adopting cloud-native solutions like Finxact. This move aims to enhance flexibility, personalize customer experiences, and broaden the group's digital reach, anticipating continued growth in digital channel adoption throughout 2024 and into 2025.

WesBank's strategic alliances with major automotive manufacturers, component suppliers, and extensive dealer networks are fundamental to its market leadership in vehicle and asset finance. These collaborations grant WesBank unparalleled access to customers precisely when they are making purchasing decisions, embedding its financial services directly into the sales process.

International Presence

FirstRand's international footprint is a key element of its growth strategy, extending beyond its South African stronghold. The group has strategically established a presence in several sub-Saharan African nations, including Botswana, Namibia, Eswatini, Lesotho, Zambia, Mozambique, Ghana, and Nigeria. This regional expansion allows FirstRand to leverage diverse economic opportunities and cater to a broader customer base across the continent.

Further diversifying its operations, FirstRand maintains a significant presence in the United Kingdom through its subsidiary Aldermore, a challenger bank focused on small and medium-sized enterprises. Additionally, the group has a presence in India via FirstRand Services, supporting its global operational needs. This multi-market approach mitigates risk and unlocks new revenue streams.

- Sub-Saharan Africa: Operations in Botswana, Namibia, Eswatini, Lesotho, Zambia, Mozambique, Ghana, and Nigeria.

- United Kingdom: Presence via Aldermore, focusing on SME lending.

- India: Operations through FirstRand Services, supporting global functions.

Direct Sales and Advisory Channels

FirstRand employs direct sales teams and dedicated financial advisors to cater to its corporate and high-net-worth clientele. This personalized strategy is crucial for delivering complex financial solutions and tailored investment advice, fostering robust client relationships. For instance, in the fiscal year ending June 30, 2023, FirstRand's wealth management segment, which heavily relies on these advisory channels, saw significant growth, with assets under management increasing by 15% to ZAR 850 billion.

These direct advisory channels allow for a deep understanding of client needs, enabling FirstRand to offer sophisticated products and services. This approach is particularly effective in navigating the intricate landscape of corporate finance and investment banking, where bespoke solutions are paramount. The group's commitment to personalized service is reflected in its client retention rates, which consistently outperform industry averages.

Key aspects of FirstRand's direct sales and advisory channels include:

- Dedicated Relationship Managers: Providing a single point of contact for all client needs.

- Expert Financial Advice: Offering specialized guidance on investments, wealth planning, and corporate finance.

- Tailored Product Solutions: Developing bespoke financial instruments to meet specific client objectives.

- Client-Centric Approach: Prioritizing long-term partnerships built on trust and performance.

FirstRand's physical presence is robust, with FNB operating a vast network of branches and ATMs across South Africa and other African nations, ensuring accessibility for a broad customer base. This physical infrastructure is complemented by a strong digital strategy, with significant investments in cloud-native solutions like Finxact enhancing online and mobile banking capabilities, anticipating continued digital adoption through 2024 and 2025.

The group's strategic alliances, particularly WesBank's partnerships with automotive manufacturers and dealers, embed financial services directly into the customer's purchasing journey. This multi-channel approach, combining physical touchpoints with sophisticated digital platforms and strategic partnerships, underpins FirstRand's market reach and customer engagement.

FirstRand's international expansion into markets like the UK (via Aldermore for SMEs) and India, alongside its Sub-Saharan African operations, diversifies revenue and mitigates risk. This global and regional presence, coupled with direct sales and advisory teams for high-net-worth and corporate clients, highlights a comprehensive place strategy that caters to diverse market needs and segments.

Same Document Delivered

FirstRand 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive FirstRand 4P's Marketing Mix analysis covers Product, Price, Place, and Promotion in detail. You get the complete, ready-to-use report without any alterations.

Promotion

FirstRand masterfully employs an integrated multi-brand marketing strategy, allowing each distinct entity like FNB, RMB, WesBank, and Aldermore to cultivate its own identity and connect with specific customer segments. This approach, as seen in their 2024 campaigns, highlights tailored value propositions while simultaneously reinforcing the robust reputation and financial stability of the parent FirstRand Group.

FirstRand leverages digital marketing extensively, utilizing social media platforms like Facebook, Instagram, and LinkedIn to connect with its tech-savvy customer base. This strategy allows for direct engagement, the dissemination of valuable content, and the execution of highly targeted advertising campaigns, particularly for its growing suite of digital banking solutions.

In 2024, FirstRand continued to emphasize its digital-first approach, with a significant portion of its marketing budget allocated to online channels. This focus is driven by the increasing adoption of digital banking services across its customer segments, aiming to foster deeper relationships and provide seamless user experiences.

FirstRand's Public Relations and Corporate Communications efforts are crucial for building and maintaining trust. They actively share news on financial performance, leadership shifts, and strategic moves via official announcements and media releases, ensuring transparency with stakeholders.

In the first half of fiscal year 2024, FirstRand reported a profit attributable to ordinary shareholders of R18.2 billion, a 12% increase compared to the previous year. This growth underscores the effectiveness of their communication in conveying positive financial health to the market.

The company's commitment to clear communication extends to its digital platforms, where investor relations sections provide timely updates and reports. This accessibility reinforces their credibility and fosters stronger relationships with investors and the broader public.

Customer Loyalty Programs

FirstRand leverages customer loyalty programs as a pivotal promotional strategy, most notably through FNB's eBucks. This program is engineered to enhance customer retention by rewarding consistent engagement and product usage. It effectively incentivizes customers to deepen their relationship with the bank, fostering a sense of loyalty and encouraging them to explore a wider array of FirstRand's offerings.

The eBucks program is more than just a reward system; it's a driver of cross-selling and customer lifetime value. By offering tangible benefits for banking activities, it encourages customers to consolidate their financial needs with FirstRand. This strategy is particularly effective in building long-term relationships and increasing the overall stickiness of their customer base.

Recent performance data underscores the impact of such loyalty initiatives. For instance, FNB reported that eBucks contributed significantly to customer engagement metrics in the 2024 financial year. The program saw millions of active members, with substantial amounts of eBucks earned and redeemed, demonstrating its tangible value in driving customer behavior and satisfaction.

- eBucks drives increased transaction volumes across FNB's product suite.

- The program fosters deeper customer relationships, leading to higher retention rates.

- Loyalty initiatives like eBucks are crucial for cross-selling opportunities within FirstRand.

- Customer participation in eBucks directly correlates with increased product adoption and engagement.

Sponsorships and Community Initiatives

Sponsorships and community initiatives are key to FirstRand's marketing efforts, aiming to build a positive brand image and showcase its commitment to corporate social responsibility. These activities align with the company's stated purpose of 'shared prosperity,' emphasizing its role in creating societal value.

While specific 2024 or 2025 data for FirstRand's community initiatives isn't readily available, similar large financial institutions typically invest significantly in these areas. For instance, in 2023, many major banks reported substantial contributions to education, health, and economic development programs. These investments often yield measurable social impact alongside brand benefits.

- Brand Enhancement: Sponsoring events and supporting community projects boosts brand visibility and positive perception.

- Corporate Social Responsibility (CSR): Demonstrates a commitment to societal well-being, aligning with stakeholder expectations.

- Shared Prosperity: These initiatives directly communicate FirstRand's purpose of contributing to broader economic and social upliftment.

- Stakeholder Engagement: Fosters stronger relationships with customers, employees, and the communities in which it operates.

FirstRand's promotional strategy is a multi-faceted approach, heavily leaning on digital engagement and loyalty programs. The FNB eBucks program, a standout initiative, demonstrably drives customer loyalty and cross-selling, as evidenced by millions of active members and significant eBucks earned and redeemed in fiscal year 2024. This focus on rewarding engagement is key to deepening customer relationships and increasing product adoption across the group's diverse brands.

Price

FirstRand strategically prices its extensive product suite to mirror perceived value and market position across retail, commercial, and corporate banking. This approach ensures offerings are competitive, considering prevailing market demand and competitor pricing structures.

For instance, in the competitive South African banking sector, FirstRand's pricing for transactional accounts and lending products in 2024 reflects a balance between attracting new customers and maintaining profitability, often aligning with or slightly above key competitor rates for similar services.

FirstRand, through its retail and commercial banking arm FNB, utilizes tiered fee structures and bundled account packages. These offerings are designed to align with diverse customer needs and varying transaction volumes, providing flexibility and potential cost savings for those with higher engagement levels.

FirstRand's pricing strategy heavily relies on interest rates for both lending products and customer deposits. The bank actively manages these rates, considering factors like market conditions and customer affordability, to optimize its net interest income, a crucial component of its revenue stream. For instance, in the first half of 2024, FirstRand reported a net interest income of R34.5 billion, highlighting the significance of this pricing element.

Adjustments to lending criteria and deposit rates are dynamic, reflecting the economic environment. During periods of rising inflation and interest rates, such as those experienced in 2023 and early 2024, FirstRand would likely adapt its pricing to maintain profitability while remaining competitive and considering the impact on borrower affordability.

Discounts, Incentives, and Promotions

FirstRand actively employs discounts, incentives, and promotions to attract and retain customers across its diverse financial product offerings. These strategies are crucial for driving adoption and deepening customer relationships within its banking and insurance segments.

FNB, a key subsidiary, has demonstrated this by adjusting its pricing for low-value real-time payments. For example, fee reductions were implemented to encourage greater utilization of these payment channels. This initiative aligns with the broader goal of making digital transactions more accessible and cost-effective for a wider customer base.

The group's approach often involves targeted campaigns and loyalty programs. These are designed to reward existing customers and attract new ones by offering competitive rates and exclusive benefits. Such promotions are vital in the highly competitive South African financial services landscape.

- Targeted Fee Reductions: FNB's initiative to lower fees on low-value real-time payments aims to boost transaction volumes and digital engagement.

- Customer Acquisition Incentives: FirstRand utilizes promotional offers and welcome bonuses to attract new clients to its banking and investment platforms.

- Loyalty Programs: Existing customers benefit from loyalty rewards and preferential rates, fostering long-term relationships and increasing customer lifetime value.

Consideration of External Factors and Regulatory Environment

FirstRand's pricing strategies are dynamic, continuously adapting to shifts in the broader economic landscape. Factors like inflation, interest rate movements, and evolving regulatory frameworks directly influence how the company prices its financial products and services. For instance, the ongoing UK motor finance commission matter has necessitated substantial provisions, directly impacting FirstRand's financial performance and, consequently, its pricing decisions for the foreseeable future.

These external pressures necessitate a flexible approach to pricing. FirstRand must remain agile in its strategies to account for:

- Economic Conditions: Fluctuations in GDP growth and consumer spending power affect demand for financial products, prompting price adjustments.

- Interest Rate Cycles: Changes in central bank rates directly impact the cost of funds and lending margins, requiring careful repricing.

- Regulatory Changes: New compliance requirements or investigations, like the UK motor finance commission issue, can lead to significant financial impacts and necessitate revised pricing models.

- Inflationary Pressures: Rising inflation erodes purchasing power and increases operational costs, compelling price increases to maintain profitability.

FirstRand's pricing strategy is multifaceted, aiming to balance competitiveness with profitability across its diverse financial offerings. This involves dynamic adjustments to interest rates on loans and deposits, reflecting market conditions and customer affordability. The bank also employs tiered fee structures and bundled packages, particularly through FNB, to cater to varied customer needs and encourage deeper engagement.

Incentives and promotional offers are key to customer acquisition and retention. For example, fee reductions on low-value real-time payments by FNB aim to boost digital transaction volumes. Furthermore, loyalty programs and preferential rates are utilized to foster long-term customer relationships and enhance lifetime value.

External factors significantly influence FirstRand's pricing decisions. Economic conditions, interest rate cycles, and regulatory changes, such as the provisions made for the UK motor finance commission matter, necessitate flexible and adaptive pricing models to maintain profitability and competitiveness.

| Metric | Value (H1 2024) | Significance |

|---|---|---|

| Net Interest Income | R34.5 billion | Highlights the importance of interest rate pricing on revenue. |

| Transaction Fee Income | Not explicitly detailed for H1 2024, but a key component influenced by pricing. | Reflects revenue from account fees and payment services. |

| Customer Deposits | R1.1 trillion (as of FY2023) | Indicates the scale of liabilities priced by deposit rates. |

4P's Marketing Mix Analysis Data Sources

Our FirstRand 4P's Marketing Mix Analysis leverages a robust blend of internal and external data sources. This includes official company reports, investor relations materials, and direct engagement with FirstRand's digital platforms, alongside reputable financial news outlets and industry-specific market research.