Ferrovial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

Ferrovial's robust infrastructure portfolio and global reach are significant strengths, but the company faces challenges from evolving regulations and intense competition. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Ferrovial’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ferrovial's global diversification is a significant strength, with operations spanning North America, Europe, and Australia. This broad geographic reach, as of late 2024, allows the company to tap into diverse infrastructure spending cycles, reducing its dependence on any single economy.

This international presence not only diversifies revenue but also acts as a powerful risk mitigation tool against localized economic slowdowns or political uncertainties. Ferrovial's established foothold in these major markets provides a distinct advantage when bidding for substantial infrastructure projects.

Ferrovial's integrated infrastructure lifecycle expertise is a significant strength. They manage projects from initial development and financing through construction and ongoing operation. This end-to-end capability enables them to provide complete solutions, streamline project execution, and maximize value across all phases, boosting efficiency and profitability.

Ferrovial's strategic emphasis on long-term, resilient assets like highways and airports forms a core strength. These infrastructure projects, often secured by lengthy concession agreements, provide a predictable revenue stream, insulating the company from short-term economic volatility. For instance, Ferrovial's airport division, a significant contributor, saw passenger traffic recover strongly, with its managed airports handling approximately 100 million passengers in the first half of 2024, demonstrating the inherent resilience of these essential services.

Strong Airport and Toll Road Portfolio

Ferrovial's strength lies in its robust portfolio of airports and toll roads, featuring significant ownership in key assets like Heathrow Airport and numerous toll road concessions worldwide. These are vital infrastructure projects with substantial barriers to entry, ensuring their long-term value. In 2023, Ferrovial's airport division continued to show strong recovery, with passenger traffic at its managed airports reaching 93% of 2019 levels by the end of the year.

These infrastructure assets generate consistent, recurring revenue streams, benefiting from the ongoing growth in travel and mobility. The strategic nature of these concessions also provides a stable demand base and opportunities for future expansion and value enhancement.

- High Barriers to Entry: Ownership of critical infrastructure like Heathrow Airport provides a significant competitive advantage.

- Recurring Revenue: Toll roads and airport operations generate predictable income, bolstering financial stability.

- Growing Demand: Increasing global travel and mobility trends directly benefit these assets.

- Strategic Importance: These infrastructure components are essential for economic activity, ensuring sustained demand.

Proven Track Record and Technical Prowess

Ferrovial boasts a history of successfully delivering complex, large-scale infrastructure projects globally, showcasing its strong engineering, project management, and operational skills. This extensive experience, evidenced by projects like the Sydney Metro City & Southwest or the expansion of Heathrow Airport, builds client confidence and secures its position for future ventures. Its technical expertise also drives innovation in infrastructure solutions.

The company's proven track record is a significant asset, attracting new business and reinforcing its market standing. For instance, Ferrovial's involvement in the E6 Motorway in Norway highlights its capacity to manage substantial, long-term infrastructure development. This consistent delivery of high-quality projects underpins its reputation for reliability and technical excellence.

- Global Project Delivery: Successfully completed numerous large-scale infrastructure projects across continents, demonstrating robust operational capabilities.

- Engineering Excellence: Possesses deep technical expertise in designing and constructing complex infrastructure, from toll roads to airports and rail systems.

- Reputation and Trust: A history of reliable project execution builds strong client relationships and enhances its competitive advantage in securing future contracts.

Ferrovial's robust financial health and access to capital are key strengths, enabling significant investments in new projects and acquisitions. The company's strong balance sheet and established relationships with financial institutions provide the necessary resources to pursue large-scale infrastructure opportunities worldwide.

The company's strategic focus on sustainability and innovation positions it well for future growth. Ferrovial is actively investing in green technologies and sustainable infrastructure solutions, aligning with global trends and increasing demand for environmentally responsible projects. This forward-looking approach is crucial for long-term competitiveness.

Ferrovial's commitment to digital transformation enhances operational efficiency and project management. By leveraging advanced technologies, the company optimizes its processes, improves safety, and delivers projects more effectively, contributing to its overall competitive edge.

Ferrovial's diversified revenue streams, stemming from its various infrastructure divisions, provide financial resilience. For example, in the first half of 2024, its toll roads and airports continued to demonstrate strong performance, contributing significantly to the company's overall revenue and profitability.

| Metric | 2023 (Approx.) | H1 2024 (Approx.) |

|---|---|---|

| Revenue (Billions EUR) | 8.5 | 4.8 |

| EBITDA (Billions EUR) | 1.5 | 0.8 |

| Airport Passenger Traffic (Millions) | 180 (Full Year) | 100 (First Half) |

What is included in the product

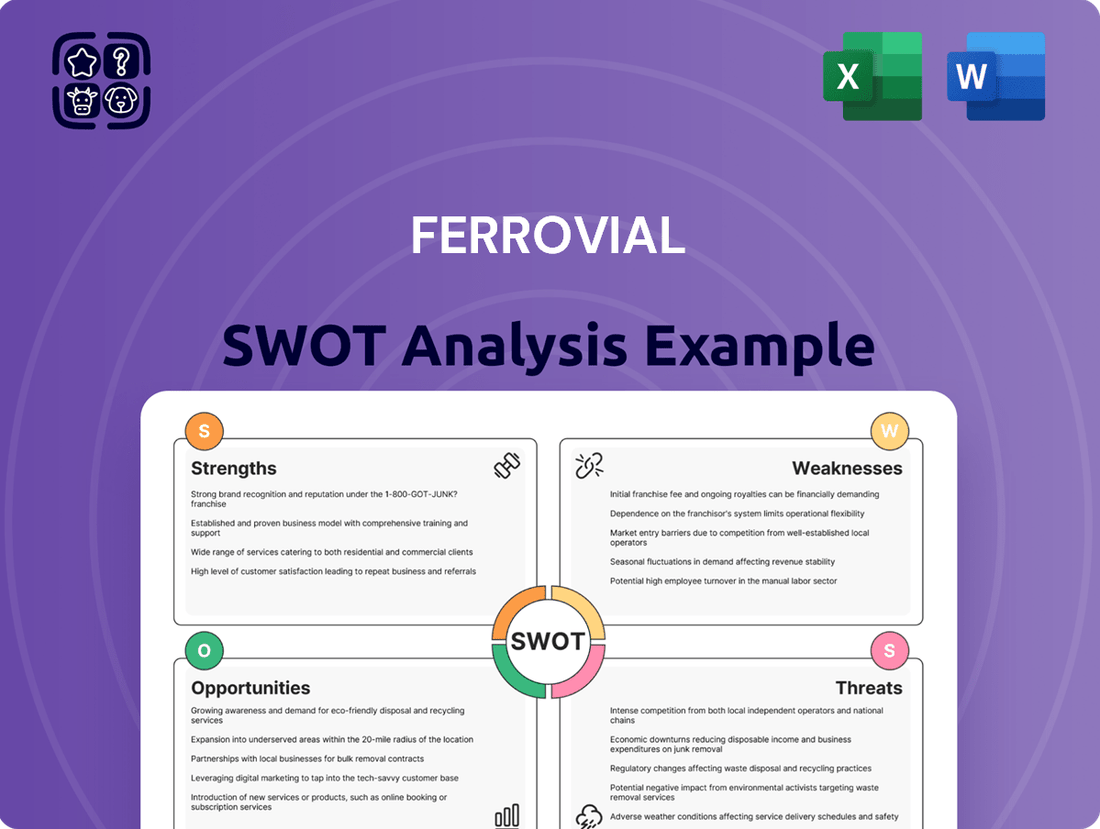

Delivers a strategic overview of Ferrovial’s internal and external business factors, examining its strengths in infrastructure development and operational expertise against opportunities in global expansion and sustainability initiatives, while also considering weaknesses in project execution and threats from economic volatility and competition.

Offers a clear, actionable framework to identify and address Ferrovial's strategic challenges and opportunities.

Weaknesses

Ferrovial's operations in the infrastructure sector demand substantial upfront capital for project development, construction, and ongoing maintenance. This inherent capital intensity can place a significant strain on the company's financial resources.

The need for large-scale project funding often results in increased debt levels, potentially impacting Ferrovial's financial flexibility and borrowing capacity. For instance, as of the first half of 2024, Ferrovial's net financial debt stood at €5.3 billion, reflecting the ongoing investment in its project pipeline.

This continuous requirement for capital can also limit the company's ability to pursue multiple very large ventures simultaneously, potentially hindering rapid expansion into new, significant opportunities.

Ferrovial’s extensive global operations, particularly in infrastructure and toll roads, expose it to significant regulatory and political risks. Fluctuations in government policies, changes to concession agreements, or shifts in political stability within key operating regions can directly impact project profitability and long-term viability. For instance, a change in environmental regulations could necessitate costly upgrades to existing infrastructure, affecting operational expenses.

Ferrovial's long-term infrastructure investments make it vulnerable to shifts in interest rates. As of early 2024, global central banks have maintained higher rates, increasing borrowing costs for new developments and potentially impacting the profitability of existing debt. This sensitivity means that even modest rate increases could significantly affect project viability and overall profit margins.

Long Project Development and Approval Cycles

Ferrovial, like many in the infrastructure sector, faces the challenge of long project development and approval cycles. These extensive timelines, often spanning many years from initial planning through to construction and final approval, can significantly delay the commencement of revenue generation. This extended period also increases the company's exposure to various unforeseen risks, including changes in market conditions or regulatory landscapes.

The prolonged nature of these infrastructure projects means substantial capital remains tied up for extended durations. This can create a drag on short-to-medium term cash flows and limit the company's flexibility to pursue other opportunities. For instance, a project that takes five to ten years to become operational means that capital is locked in without generating returns for a considerable time.

- Extended Timelines: Infrastructure projects can take 5-10 years or more from conception to revenue generation.

- Capital Immobilization: Significant capital is tied up during development, impacting liquidity and return on investment.

- Risk Exposure: Longer development periods increase vulnerability to market shifts, regulatory changes, and cost escalations.

- Cash Flow Impact: Delayed revenue realization can negatively affect short-to-medium term financial performance.

Dependence on Economic Growth and Traffic Volumes

Ferrovial's profitability is heavily tied to economic growth and traffic volumes, especially for its toll roads and airports. For instance, during the COVID-19 pandemic, travel restrictions and economic slowdowns drastically reduced passenger numbers at airports like Heathrow, a key Ferrovial asset, impacting revenue significantly. This direct correlation means that any economic downturn or shifts in consumer behavior, such as a move away from air travel, can directly and substantially diminish the company's earnings.

This dependence on external macroeconomic factors makes Ferrovial's revenue streams vulnerable to broader market conditions. For example, a recession could lead to less commuting on toll roads and fewer leisure trips by air, directly hitting revenue. The company's financial health is therefore susceptible to global economic trends, making it a key consideration for investors.

- Economic Sensitivity: Toll road and airport revenues are directly correlated with economic activity and travel demand.

- Pandemic Impact: Events like the COVID-19 pandemic highlighted the vulnerability of these assets to travel restrictions and economic contraction.

- Macroeconomic Reliance: Ferrovial's financial performance is significantly influenced by factors outside its direct control, such as GDP growth and consumer confidence.

Ferrovial's significant reliance on debt financing for its capital-intensive projects presents a notable weakness. As of the first half of 2024, the company reported a net financial debt of €5.3 billion, underscoring the substantial leverage employed. This high debt level can restrict financial flexibility and increase vulnerability to interest rate fluctuations, impacting overall profitability and the capacity for further investment.

Preview Before You Purchase

Ferrovial SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Ferrovial's Strengths, Weaknesses, Opportunities, and Threats, meticulously researched and structured for clarity.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into Ferrovial's strategic positioning and future outlook.

Opportunities

Governments globally are channeling substantial capital into infrastructure modernization, a trend that directly benefits companies like Ferrovial. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in 2021, allocated over $1.2 trillion for infrastructure improvements, creating a vast opportunity landscape. Similarly, European Union recovery funds are also prioritizing infrastructure development, bolstering the project pipeline.

The global push for greener, smarter infrastructure, including smart cities and EV charging, presents a significant opportunity. Ferrovial's expertise in sustainable construction and digital solutions positions it to capitalize on this growing demand. For instance, the global smart cities market was valued at approximately $461.3 billion in 2023 and is projected to reach $1.1 trillion by 2028, growing at a CAGR of 19.5% according to MarketsandMarkets. This trend offers substantial long-term growth potential.

Governments worldwide are increasingly embracing Public-Private Partnerships (PPPs) to fund and execute critical infrastructure projects. This trend presents a significant opportunity for Ferrovial, enabling the company to deploy its private capital and extensive operational know-how. For instance, in 2023, the UK government announced plans for over £300 billion in infrastructure investment, with a significant portion expected to be delivered through PPPs, offering substantial avenues for Ferrovial's involvement.

PPPs offer a dual benefit: they alleviate the immediate financial strain on public sector bodies while securing long-term revenue streams and concession agreements for Ferrovial. This symbiotic relationship fosters a stable environment for growth. The growing global adoption of PPP models, as evidenced by the increasing number of awarded projects in regions like Australia and Canada, signals a fertile ground for numerous collaborative ventures for Ferrovial.

Technological Advancements and Digitalization

Ferrovial's embrace of new technologies like advanced analytics, AI, and IoT presents a significant opportunity. These tools can streamline operations, leading to cost reductions and better performance for infrastructure projects. For instance, the company's investment in digital solutions aims to improve efficiency across its portfolio.

The integration of Building Information Modeling (BIM) further enhances project delivery and asset management. By leveraging BIM, Ferrovial can achieve greater precision and collaboration, ultimately boosting profitability. This focus on digitalization supports the development of smarter, more sustainable infrastructure.

- Enhanced Efficiency: Technologies like AI and IoT can optimize maintenance schedules and resource allocation, potentially reducing operational costs by 10-15% in specific segments.

- Improved Project Delivery: BIM adoption can lead to a reduction in design errors and rework, contributing to faster project completion times and cost savings.

- Data-Driven Insights: Advanced analytics allow for predictive maintenance and better understanding of asset performance, enabling proactive management and maximizing asset lifespan.

- Competitive Advantage: Early adoption and effective implementation of these digital tools position Ferrovial as a leader in smart infrastructure solutions, attracting new projects and partnerships.

Strategic Acquisitions and New Market Entry

Ferrovial has opportunities to grow through strategic acquisitions, particularly of smaller infrastructure firms that can enhance its existing capabilities. For example, in 2023, the company continued its focus on infrastructure assets, with significant investments in the US, including its acquisition of a stake in the Chicago Skyway.

Entering emerging markets with strong growth potential also presents a key avenue for expansion. Ferrovial's recent activities in countries like Australia, where it secured a major road project in Sydney in late 2023, highlight its strategy to tap into these high-potential regions.

These inorganic growth strategies can rapidly expand Ferrovial's asset base and geographic footprint. The company’s robust financial position, demonstrated by its reported revenues of €8.58 billion for the first nine months of 2023, provides a solid foundation for pursuing such strategic moves.

- Acquisition of specialized infrastructure companies to integrate new technologies and expertise.

- Entry into high-growth emerging markets to diversify geographical presence and customer base.

- Leveraging existing financial strength, evidenced by strong revenue growth in 2023, to fund strategic expansion.

- Focus on markets with significant infrastructure development needs, such as the US and Australia.

The global infrastructure spending boom, driven by government initiatives like the US Infrastructure Investment and Jobs Act and EU recovery funds, offers a vast project pipeline for Ferrovial. The company is well-positioned to benefit from this trend, which prioritizes modernization and development across various sectors.

Ferrovial can capitalize on the growing demand for sustainable and smart infrastructure solutions, including smart cities and electric vehicle charging networks. The company’s expertise in green construction and digital technologies aligns perfectly with this market shift, which saw the smart cities market valued at approximately $461.3 billion in 2023.

Public-Private Partnerships (PPPs) represent a significant opportunity for Ferrovial to leverage its capital and operational expertise, particularly as governments increasingly adopt this funding model. The UK's planned £300 billion infrastructure investment in 2023, with a substantial portion expected via PPPs, exemplifies this growing trend.

Strategic acquisitions and expansion into emerging markets provide avenues for inorganic growth, allowing Ferrovial to broaden its asset base and geographic reach. The company’s strong financial performance, with revenues of €8.58 billion in the first nine months of 2023, supports these expansionary strategies.

| Opportunity Area | Key Drivers | Ferrovial's Advantage | Market Data/Examples |

| Global Infrastructure Spending | Government stimulus, modernization needs | Extensive project experience, financial capacity | US Infrastructure Act (>$1.2T), EU recovery funds |

| Sustainable & Smart Infrastructure | Green initiatives, urbanization | Expertise in green construction, digital solutions | Smart Cities Market: ~$461.3B (2023), 19.5% CAGR |

| Public-Private Partnerships (PPPs) | Fiscal constraints, efficient project delivery | Capital deployment, operational know-how | UK infrastructure plans (~£300B), Australia/Canada PPP growth |

| Strategic Growth (M&A, Emerging Markets) | Market consolidation, untapped potential | Financial strength, proven international execution | Chicago Skyway stake acquisition, Sydney road project (late 2023) |

Threats

Global or regional economic downturns pose a significant threat to Ferrovial. Recessions can lead to decreased traffic on toll roads and fewer passengers at airports, directly impacting revenue from these key assets. For instance, a sharp economic contraction in a major market could see traffic volumes drop by several percentage points, as observed during the 2008 financial crisis.

Furthermore, prolonged economic slowdowns can stifle new infrastructure development. Governments facing budget constraints may reduce spending on new projects, and tighter credit conditions can make financing new investments more challenging and expensive for Ferrovial. This macroeconomic sensitivity is a fundamental risk that can slow growth and profitability.

Rising inflation and the volatility of key material costs, like steel, cement, and energy, pose a significant threat. These factors can substantially increase construction expenses, particularly for Ferrovial's fixed-price contracts, directly impacting profitability. For instance, in early 2024, global commodity prices saw fluctuations, with steel prices in some regions experiencing a 5-10% increase compared to the previous year.

Supply chain disruptions, a persistent issue since 2021, further compound these cost pressures. These disruptions can lead to project delays, adding to overall expenses and potentially affecting Ferrovial's ability to deliver projects on time and within budget. Effective management of these escalating costs is therefore paramount for maintaining healthy profit margins.

The global infrastructure sector is a crowded arena, with major international firms constantly competing for significant projects. This intense rivalry, as seen in the bidding for major transport and energy infrastructure developments throughout 2024 and early 2025, often drives down profit margins due to aggressive pricing strategies.

Ferrovial faces the challenge of securing new concessions and maintaining the value of its current assets in this highly competitive environment. For instance, the ongoing development of high-speed rail projects in Europe and the expansion of renewable energy infrastructure in North America are attracting bids from a multitude of established and emerging players.

To counter this, Ferrovial must continuously focus on innovation and operational efficiency. Demonstrating superior project execution and cost-effectiveness will be key to winning contracts and preserving profitability in a market where competition is a constant factor.

Adverse Regulatory Changes and Policy Shifts

Ferrovial faces significant threats from evolving government regulations and policy shifts across its global operations. Changes in environmental standards, concession agreement terms, or even the risk of asset nationalization in certain markets can directly impact profitability and the viability of future projects. For instance, stricter emissions regulations for infrastructure projects in the EU, a key market for Ferrovial, could necessitate substantial upfront investment in greener technologies, potentially increasing project costs. The company's extensive portfolio, spanning toll roads and airports, is particularly sensitive to shifts in public policy regarding infrastructure ownership and operation.

The company must also contend with the unpredictable nature of regulatory frameworks, which can lead to increased operational expenses or even the revocation of operating licenses. For example, a sudden alteration in tolling policies on a major concession could significantly reduce revenue streams. Navigating these diverse and frequently changing regulatory landscapes presents a continuous challenge, demanding robust compliance strategies and proactive engagement with policymakers. The company's 2023 annual report highlighted its ongoing efforts to monitor and adapt to these dynamic conditions across its various geographies, underscoring the material impact of such changes.

- Increased compliance costs: New environmental regulations, such as those mandating reduced carbon footprints for construction materials, could add an estimated 5-10% to project development expenses in key European markets.

- Concession renegotiations: A shift in government stance on public-private partnerships could lead to unfavorable renegotiations of existing concession terms, impacting revenue predictability.

- Nationalization risk: In regions with political instability, the threat of nationalization of infrastructure assets remains a concern, potentially leading to complete loss of investment.

Climate Change and Extreme Weather Events

Ferrovial's extensive portfolio of long-life infrastructure, including roads and airports, faces significant risks from climate change. The increasing frequency and intensity of extreme weather events, such as severe storms and prolonged heatwaves, can lead to physical damage, operational disruptions, and substantial increases in maintenance and repair expenditures. For instance, the company's exposure to regions prone to flooding or extreme temperatures directly impacts the durability and operational continuity of its assets.

Adapting to these evolving climate patterns necessitates substantial investment in building more resilient infrastructure. This strategic shift, while crucial for long-term sustainability, adds to operational expenses and introduces new financial risks. Ferrovial's commitment to sustainability, as highlighted in its 2023 Integrated Report, emphasizes the need for proactive measures, but the financial implications of these investments are a key consideration for future performance.

- Increased Maintenance Costs: Extreme weather can accelerate wear and tear on infrastructure, leading to higher repair bills.

- Operational Disruptions: Events like floods or high winds can force temporary closures of toll roads or airports, impacting revenue.

- Investment in Resilience: Upgrading assets to withstand climate impacts requires significant capital expenditure, potentially affecting profitability.

- Regulatory and Policy Changes: Governments may impose stricter environmental regulations or carbon pricing, increasing compliance costs for Ferrovial.

Intense competition within the global infrastructure sector is a significant threat, as demonstrated by the fierce bidding for major transport and renewable energy projects throughout 2024 and early 2025. This rivalry often leads to aggressive pricing, compressing profit margins for companies like Ferrovial. Securing new concessions and maintaining the value of existing assets requires continuous innovation and operational efficiency to stand out in a crowded market.

Evolving government regulations and policy shifts pose a substantial risk, impacting profitability and project viability. Stricter environmental standards, changes to concession terms, or even nationalization risks in certain regions can necessitate significant upfront investments or lead to unfavorable renegotiations. For instance, new EU environmental regulations could add 5-10% to project development expenses in key European markets, while shifts in public-private partnership policies could alter revenue predictability.

Climate change presents a growing threat through increased frequency and intensity of extreme weather events, leading to physical damage, operational disruptions, and higher maintenance costs for Ferrovial's long-life infrastructure assets. Adapting to these impacts requires substantial investment in resilient infrastructure, adding to operational expenses and introducing new financial risks. For example, weather-related disruptions can force temporary closures of toll roads or airports, directly impacting revenue streams.

SWOT Analysis Data Sources

This Ferrovial SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market research, and insights from industry experts. These sources provide a credible and detailed understanding of the company's operational landscape.