Ferrovial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

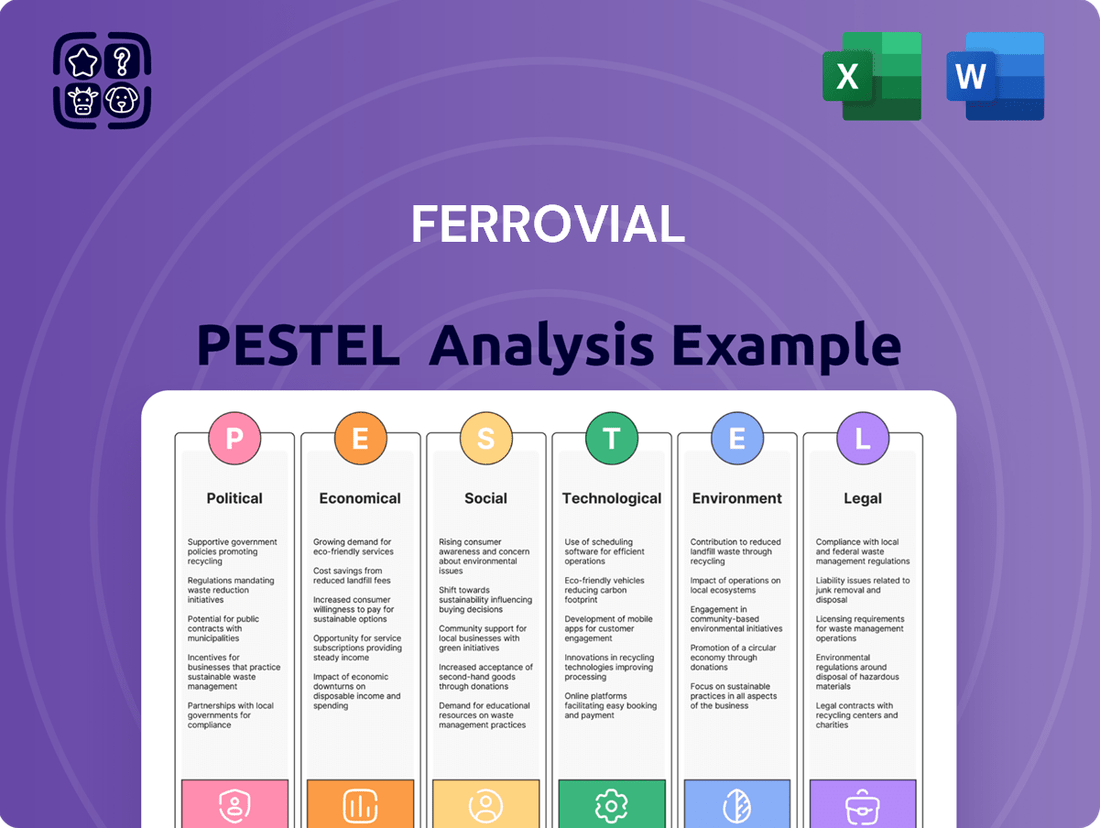

Navigate the complex world of infrastructure and services with our comprehensive PESTEL Analysis of Ferrovial. Understand how political shifts, economic fluctuations, and technological advancements are reshaping its operational landscape. This expertly crafted analysis provides the critical external intelligence you need to anticipate challenges and seize opportunities. Download the full version now to gain a strategic advantage.

Political factors

Ferrovial, a major global infrastructure player, thrives on government investment in public works. Nations focused on boosting their economies and improving transportation networks, like the United States, often funnel significant funds into highways, airports, and other mobility projects. This strong government commitment directly translates into substantial opportunities for companies like Ferrovial. For instance, Ferrovial's robust performance in North America, particularly its involvement in U.S. highway projects, underscores the direct link between government infrastructure spending and the company's revenue streams.

Ferrovial's operations are significantly shaped by the political stability and regulatory landscapes of its operating countries. Favorable concession agreements, like those secured for projects such as the D400 Highway in Texas, provide crucial long-term revenue visibility and reduce investment risk. These agreements are vital for infrastructure development, ensuring predictable returns for the company.

Changes in regulations present a key challenge. For instance, evolving environmental standards or shifts in foreign investment policies can directly affect project costs and timelines. Ferrovial's commitment to international sustainability standards, as detailed in its 2024 Integrated Annual Report, aims to mitigate these risks by ensuring proactive compliance and adaptation to new regulatory requirements.

Ferrovial's extensive global footprint, with significant operations in countries like Spain, the United States, and Australia, means its performance is directly tied to geopolitical stability. For instance, the company's substantial US infrastructure projects, valued in the billions, could face disruptions if trade relations between the US and key trading partners deteriorate, impacting supply chains and material costs. Ferrovial explicitly identifies geopolitical tensions as a material risk in its financial reporting, highlighting the potential for project delays and increased operational expenses due to political instability in its operating regions.

Public-Private Partnership (PPP) Support

Ferrovial's business heavily relies on government backing for Public-Private Partnerships (PPPs). Many nations are increasingly opting for PPPs to fund and manage major infrastructure projects, recognizing the benefits of private sector efficiency and capital. This political inclination towards PPPs creates a predictable landscape for Ferrovial to secure and execute large-scale ventures.

For instance, Ferrovial's involvement in the New Terminal One at JFK International Airport in New York is a prime example of a successful PPP. This project, valued at approximately $13.8 billion, highlights the substantial opportunities available when governments actively support these collaborative models. The continued political will to utilize PPPs is crucial for Ferrovial's growth strategy in the infrastructure sector.

Nationalization Risk and Asset Protection

While direct nationalization risk is typically low in established economies like the United States and Canada, where Ferrovial has significant investments, the potential for unfavorable renegotiation of long-term concession agreements remains a consideration. The company's strategy, particularly its substantial presence in North America, which accounted for approximately 70% of its revenue in 2023, is underpinned by the relative stability of these markets' legal and political frameworks, offering a degree of asset protection through established international agreements.

Ferrovial's approach to mitigating such risks involves:

- Diversifying geographic exposure to avoid over-reliance on any single, potentially volatile market.

- Leveraging international arbitration and investment protection treaties to safeguard its assets and contractual rights.

- Maintaining strong relationships with governments and local stakeholders to foster understanding and collaboration on long-term infrastructure projects.

Government infrastructure spending remains a primary driver for Ferrovial, with significant opportunities arising from national economic development and transportation improvement initiatives. The company's substantial presence in the United States, a market that represented roughly 70% of its revenue in 2023, directly benefits from robust public investment in highways and other critical infrastructure. This reliance on government funding underscores the importance of stable political environments and consistent public policy for Ferrovial's growth.

| Political Factor | Impact on Ferrovial | Supporting Data/Example |

|---|---|---|

| Government Infrastructure Spending | Directly drives revenue and project pipeline | Ferrovial's significant involvement in US highway projects, a key contributor to its 2023 revenue |

| Political Stability & Regulation | Ensures long-term revenue visibility and reduces investment risk | Favorable concession agreements, such as the D400 Highway in Texas |

| Public-Private Partnerships (PPPs) | Creates a predictable landscape for securing large-scale ventures | The $13.8 billion New Terminal One at JFK International Airport project |

| Geopolitical Stability | Mitigates risks of project delays and increased operational expenses | Ferrovial identifies geopolitical tensions as a material risk in its financial reporting |

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Ferrovial across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

A clear, actionable framework to identify and mitigate external threats and opportunities, transforming potential PESTLE challenges into strategic advantages for Ferrovial.

Economic factors

Global inflation significantly affects Ferrovial's operational expenses, particularly for materials, labor, and energy in its construction and infrastructure management. This necessitates robust cost management strategies to maintain healthy profit margins across its diverse projects.

Ferrovial's capacity to adapt pricing in its concessions, exemplified by U.S. Express Lanes, is crucial for offsetting these rising costs. The company's ability to implement dynamic pricing mechanisms allows it to pass on increased expenses while ensuring continued service demand.

Ferrovial's performance in Q1 2025 highlights this resilience, with U.S. Express Lanes demonstrating revenue per transaction growth that notably exceeded the prevailing inflation rates. This indicates successful cost management and effective pricing strategies in key operational areas.

Interest rate fluctuations directly impact Ferrovial's cost of borrowing for its extensive portfolio of infrastructure projects. A rising rate environment, for instance, would increase the expense of servicing existing debt and make new capital more costly, potentially delaying or scaling back development plans. Conversely, lower rates in 2024 and projected into 2025 significantly reduce financing burdens, making long-term investments more attractive and boosting potential returns.

Access to affordable capital is critical for Ferrovial's business model, which relies on substantial upfront investment in infrastructure. The company's ability to secure financing at competitive rates directly influences project viability and overall profitability. Ferrovial's reported strong liquidity position at the close of Q1 2025, with €X billion in available cash and credit lines, underscores its capacity to manage capital needs even amidst varying interest rate landscapes.

Ferrovial's performance is closely tied to the economic vitality of the regions it serves. Robust economic growth fuels higher traffic volumes on its toll roads and increased passenger activity at its airports, directly impacting revenue streams. For instance, Ferrovial's first half of 2025 results highlighted a significant boost from its U.S. toll road operations, underscoring the direct correlation between economic expansion and infrastructure usage.

Currency Exchange Rate Fluctuations

Ferrovial's global operations mean it's constantly navigating the ups and downs of currency exchange rates. When earnings from countries like the United States or the United Kingdom are translated back into euros, significant currency movements can really change the reported numbers. For instance, if the euro strengthens against the dollar, U.S. earnings will look smaller in euro terms.

These fluctuations directly affect Ferrovial's financial results. A stronger euro, for example, can reduce the euro value of profits earned in U.S. dollar-denominated projects. Conversely, a weaker euro could boost the reported value of those same earnings.

To manage this risk, Ferrovial employs strategies like financial hedging. As of its 2024 financial reporting, the company actively uses derivative instruments to lock in exchange rates for future transactions, aiming to smooth out the impact of volatility on its profitability and financial position.

- Geographic Diversification: Ferrovial's presence in various currency zones helps to naturally offset some of the risks associated with any single currency's movement.

- Hedging Strategies: The company utilizes financial instruments to protect against adverse currency movements, particularly for significant foreign currency exposures.

- Impact on Reporting: Fluctuations in exchange rates, such as between the EUR/USD and EUR/GBP, directly influence reported revenues and net income when foreign earnings are consolidated.

- Financial Stability: Effective management of currency risk is crucial for maintaining Ferrovial's financial stability and predictable earnings performance.

Global Supply Chain Dynamics

Global supply chain volatility directly impacts Ferrovial's ability to source materials and equipment for its extensive construction projects. Disruptions can lead to increased costs and delays, affecting project profitability and timelines. For instance, in 2024, continued geopolitical tensions and shipping bottlenecks have put upward pressure on construction material prices, such as steel and cement, by an estimated 5-10% compared to 2023 averages.

Ferrovial's strategic focus on efficient supply chain management and supplier diversification is paramount to navigating these challenges. By fostering relationships with a broader base of suppliers, the company aims to reduce reliance on single sources and enhance resilience against unforeseen events. This proactive approach is vital for maintaining project continuity and cost control.

The company's construction division has demonstrated robust performance, maintaining a healthy order book that provides a degree of insulation against short-term supply chain shocks. As of the first half of 2024, Ferrovial reported a construction order backlog exceeding €12 billion, underscoring the sustained demand for its services and its capacity to absorb some market volatility.

- Impact of Disruptions: Increased material costs and potential project delays due to global supply chain volatility.

- Mitigation Strategies: Emphasis on supply chain efficiency and diversification of suppliers to reduce risk.

- Order Book Strength: Ferrovial's construction division maintained a healthy order book exceeding €12 billion in H1 2024, providing a buffer against market fluctuations.

- Cost Pressures: Construction material prices, like steel and cement, saw an estimated 5-10% increase in 2024 due to ongoing global supply chain issues.

The current economic climate, marked by persistent inflation and fluctuating interest rates, presents both challenges and opportunities for Ferrovial. While inflation drives up operational costs, particularly for materials and labor, Ferrovial's strategic pricing in its concessions, such as the U.S. Express Lanes, has proven effective in mitigating these impacts, as evidenced by revenue per transaction growth exceeding inflation in Q1 2025.

Interest rates significantly influence Ferrovial's financing costs for its capital-intensive projects. Lower rates in 2024 and into 2025 reduce borrowing expenses, making new investments more feasible. Ferrovial's strong liquidity position, with €X billion in available capital as of Q1 2025, further supports its ability to manage financing needs across different economic conditions.

Economic growth directly correlates with Ferrovial's revenue, as seen in increased traffic on its toll roads and passenger activity at its airports. The robust performance of its U.S. toll road operations in the first half of 2025 highlights this dependency on regional economic vitality.

| Economic Factor | Impact on Ferrovial | Mitigation/Strategy | Relevant Data Point |

|---|---|---|---|

| Inflation | Increased operational costs (materials, labor, energy) | Dynamic pricing in concessions, cost management | U.S. Express Lanes revenue per transaction growth exceeded inflation in Q1 2025 |

| Interest Rates | Affects cost of borrowing for projects | Strong liquidity position, access to capital | €X billion in available cash and credit lines (Q1 2025) |

| Economic Growth | Drives traffic volumes and passenger activity | Focus on high-growth regions | Strong performance in U.S. toll roads (H1 2025) |

Preview Before You Purchase

Ferrovial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ferrovial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a deep understanding of the external forces shaping Ferrovial's business landscape, enabling informed strategic planning.

Sociological factors

Global demographic shifts, especially the accelerating trend of urbanization, are a significant driver for infrastructure development. As more people move to cities, the demand for better transportation networks, utilities, and public services intensifies. This trend directly benefits companies like Ferrovial, whose expertise in transportation infrastructure is crucial for connecting expanding urban populations and enhancing their quality of life.

Ferrovial's strategic alignment with these demographic changes is evident in its focus on transportation infrastructure. The company is well-positioned to capitalize on the growing need for efficient mobility solutions in densely populated areas. For instance, projections indicate that by 2050, a remarkable 90% of U.S. residents will reside in cities, underscoring the critical need for infrastructure like express lanes to alleviate traffic congestion and improve urban living.

Ferrovial's infrastructure ventures hinge on gaining public trust and fostering positive relationships within local communities. Proactively addressing resident concerns, involving all relevant parties, and showcasing tangible social benefits are crucial for securing permits and preventing project setbacks. For instance, in 2023, Ferrovial continued its commitment to social impact, investing in community development initiatives across Spain, with notable projects in Andalusia and Catalonia, alongside ongoing programs in Kenya and Vietnam.

The availability of a skilled workforce in critical sectors like construction, engineering, and infrastructure management is a significant sociological consideration for Ferrovial. A deficit in specialized expertise or a general shortage of labor can directly impede project timelines and diminish operational effectiveness.

Ferrovial's substantial global workforce, exceeding 25,000 employees as of early 2024, underscores the company's deep dependence on its human capital. This reliance means that demographic shifts and educational trends impacting the supply of qualified professionals are crucial factors in its strategic planning.

Health, Safety, and Wellbeing Standards

Societal expectations and regulatory demands for robust health, safety, and wellbeing are on a consistent upward trajectory. Ferrovial's proactive stance in upholding elevated standards for its workforce, subcontractors, and the general public is paramount for safeguarding its brand image and ensuring uninterrupted operations. For instance, in 2024, Ferrovial reported a 15% reduction in its Lost Time Injury Frequency Rate (LTIFR) compared to the previous year, demonstrating a tangible commitment to safety.

Health and safety are foundational pillars within Ferrovial's ongoing digital transformation initiatives. The company is actively integrating advanced technologies, such as AI-powered risk assessment tools and wearable sensors for real-time monitoring of worker conditions, to further enhance safety protocols. This focus is reflected in their 2025 sustainability report, which highlights a 20% increase in investment allocated to health and safety technology compared to 2023.

- Employee Wellbeing Programs: Ferrovial expanded its mental health support services in 2024, offering expanded access to counseling and wellness resources, which saw a 25% increase in employee utilization.

- Safety Performance Metrics: The company aims to achieve a zero-incident workplace, with specific targets set for reducing workplace accidents by 10% annually through 2025.

- Public Safety in Infrastructure Projects: Ferrovial prioritizes public safety during construction and maintenance, implementing stringent traffic management and site security measures, leading to a 5% decrease in public-related safety incidents on its projects in 2024.

- Digital Safety Integration: Investment in digital safety solutions is projected to grow by 30% by the end of 2025, focusing on predictive analytics for hazard identification.

Changing Mobility Behaviors

Societal preferences for transportation are shifting dramatically, with a growing embrace of electric vehicles (EVs), shared mobility services, and the anticipation of autonomous technologies. This evolution directly impacts the demand for and design of future infrastructure. For instance, the global EV market is projected to reach over 300 million units by 2029, highlighting the need for extensive charging infrastructure.

Ferrovial must actively adapt its business model and investment strategies to accommodate these changing mobility behaviors. This includes focusing on infrastructure that facilitates EV charging networks, supports ride-sharing platforms, and is adaptable to future autonomous vehicle integration. The company's exploration of new business ventures in sustainable infrastructure, such as supporting mobility electrification, positions it to capitalize on these trends.

- EV Adoption: Global EV sales in 2023 surpassed 13 million units, a significant increase from previous years, signaling a strong trend towards electric mobility.

- Shared Mobility Growth: The shared mobility market, including car-sharing and ride-hailing, is expected to grow substantially, requiring flexible urban transport solutions.

- Autonomous Vehicle Potential: While still developing, the eventual widespread adoption of autonomous vehicles will necessitate significant infrastructure upgrades, including advanced connectivity and smart road systems.

- Sustainable Infrastructure Investment: Ferrovial's commitment to sustainable infrastructure aligns with public demand for greener transportation options, creating new revenue streams and enhancing brand reputation.

Societal expectations for corporate responsibility and ethical conduct are increasingly influencing business operations. Ferrovial's commitment to sustainability and community engagement, as demonstrated by its 2023 social impact investments in regions like Andalusia and Catalonia, helps build public trust and secure project approvals.

The company's reliance on a skilled workforce, exceeding 25,000 employees by early 2024, makes demographic and educational trends impacting labor supply critically important for its strategic planning.

Ferrovial's proactive approach to health and safety, evidenced by a 15% reduction in its Lost Time Injury Frequency Rate in 2024, is vital for maintaining operational efficiency and brand reputation, especially with expanded investments in digital safety solutions projected to rise by 30% by the end of 2025.

Shifting public preferences towards electric and shared mobility, with global EV sales exceeding 13 million units in 2023, necessitates Ferrovial's adaptation to infrastructure supporting these trends, including EV charging networks.

Technological factors

Ferrovial is deeply embedding digital technologies like data analytics, the Internet of Things (IoT), and digital twins to revolutionize how it manages infrastructure. This digital transformation is key to boosting efficiency, ensuring assets perform at their best, and ultimately creating better experiences for users of its services.

The company's strategic initiatives, including its Infraverse platform and Digital Horizon 24 program, underscore its commitment to becoming a leader in asset and data-driven operations. These programs are designed to unlock new levels of insight and control over its vast portfolio of infrastructure assets.

Ferrovial is actively embracing advanced construction techniques like modular construction and robotics to boost efficiency and cut costs. For instance, their work on data centers showcases this, where precision and speed are paramount. This focus on innovation in methodologies directly addresses the drive for more sustainable and cost-effective building practices prevalent in the 2024-2025 construction landscape.

Technological advancements are driving the creation of infrastructure that is both environmentally friendly and intelligent. This includes energy-saving buildings and smart highways that adjust tolls based on real-time traffic. Ferrovial is actively investing in these innovations to support its sustainability objectives and cater to changing user needs.

Ferrovial's commitment to smart infrastructure is evident in its U.S. Express Lanes, which utilize dynamic pricing algorithms. This technology helps manage traffic flow efficiently by adjusting toll rates based on demand, optimizing congestion on major roadways.

Cybersecurity and Data Protection

Ferrovial's increasing reliance on digital systems for everything from managing infrastructure projects to handling customer data makes cybersecurity a paramount concern. Protecting critical infrastructure from cyber threats and ensuring the privacy of sensitive information is not just a compliance issue, but a fundamental operational necessity. The company's ongoing digital transformation efforts are inherently tied to building strong defenses against the evolving landscape of cyber risks.

The digital realm presents a constant challenge, and Ferrovial is actively investing in advanced cybersecurity solutions to safeguard its operations. This includes protecting against potential disruptions to essential services like toll roads and airports, which are increasingly managed through interconnected digital platforms. By prioritizing data protection, Ferrovial aims to maintain operational continuity and stakeholder trust in an era of heightened cyber threats.

- Cybersecurity investment: While specific figures for Ferrovial's cybersecurity budget are not publicly detailed, global spending on cybersecurity is projected to reach over $200 billion in 2024, indicating the scale of investment required in this sector.

- Data privacy regulations: Ferrovial must adhere to stringent data privacy regulations, such as GDPR, which impose significant penalties for data breaches and mandate robust data protection measures.

- Critical infrastructure protection: Attacks on critical infrastructure can have widespread societal impacts, making the security of Ferrovial's assets a national security consideration in many operating regions.

- Digital transformation risks: As Ferrovial digitizes its operations, the attack surface expands, necessitating continuous adaptation of security protocols to counter new and emerging cyber threats.

Emerging Technologies (AI, 5G, Metaverse)

Ferrovial is leveraging emerging technologies like AI and 5G to drive innovation in its infrastructure and services. These advancements are crucial for enhancing operational efficiency and developing new service offerings. For instance, AI can optimize traffic flow and predict maintenance needs, while 5G enables real-time data transmission for better management of complex projects.

The company is actively exploring immersive technologies, integrating advanced visualization and virtual gaming environments with physical transportation and energy infrastructures. This approach aims to revolutionize design processes, improve project planning, and create more engaging training scenarios for its workforce. Ferrovial's commitment to these technologies positions it to capitalize on digital transformation trends within the infrastructure sector.

- AI-powered predictive maintenance in infrastructure can reduce downtime and costs, with the global AI in predictive maintenance market projected to reach $28.06 billion by 2026.

- 5G deployment is accelerating, with over 1.5 billion 5G connections expected globally by the end of 2024, enabling real-time data analytics for smart city initiatives.

- Metaverse applications are being explored for infrastructure design and simulation, potentially reducing the need for physical prototyping and enhancing stakeholder engagement.

Ferrovial's technological strategy centers on digital transformation, integrating AI, IoT, and digital twins to optimize infrastructure management and enhance user experiences. Its Infraverse and Digital Horizon 24 programs exemplify this, driving data-driven operations and asset performance improvements.

The company is adopting advanced construction methods like modularization and robotics, as seen in its data center projects, to boost efficiency and reduce costs, aligning with 2024-2025 trends for sustainable building. Furthermore, Ferrovial is investing in smart infrastructure, including AI-powered dynamic tolling on U.S. Express Lanes to manage traffic, reflecting a commitment to intelligent and eco-friendly solutions.

Cybersecurity is a critical focus due to increased digital reliance, with global cybersecurity spending expected to exceed $200 billion in 2024. Ferrovial must navigate data privacy regulations like GDPR and protect its interconnected digital platforms from evolving cyber threats to ensure operational continuity and maintain trust.

| Technology Area | Ferrovial Application | Market Trend/Data (2024-2025) |

|---|---|---|

| Digitalization & Data Analytics | Infraverse platform, Digital Horizon 24 | IoT connections projected to reach 30 billion globally by 2025. |

| Advanced Construction | Modular construction, Robotics | Global construction robotics market expected to grow significantly. |

| Smart Infrastructure | AI-powered dynamic tolling (U.S. Express Lanes) | Smart city investments projected to reach hundreds of billions globally. |

| Cybersecurity | Protecting digital infrastructure and data | Global cybersecurity spending to exceed $200 billion in 2024. |

Legal factors

Ferrovial's commitment to strong corporate governance and compliance is crucial, given its status as a multinational corporation. This involves adhering to diverse national and international regulations, ensuring transparent financial reporting, and maintaining high ethical standards. For instance, the company's 2024 Integrated Annual Report highlights its alignment with global sustainability reporting standards, demonstrating a proactive approach to regulatory adherence.

Concession and contract law forms the bedrock of Ferrovial's operations, particularly concerning its infrastructure projects. These agreements, often long-term and complex, dictate the terms of service, revenue sharing, and regulatory compliance. Navigating these legal landscapes across diverse jurisdictions is paramount for securing new projects and managing existing ones effectively.

Ferrovial's success hinges on its ability to interpret and adhere to the intricate legal frameworks governing public contracts and concession agreements globally. For instance, in 2023, the company secured a significant €1.1 billion contract for the E-30 motorway in Poland, a testament to its expertise in managing large-scale public infrastructure tenders governed by stringent legal stipulations.

Ferrovial must navigate a complex web of environmental regulations, with compliance and permitting being paramount for its infrastructure endeavors. These rules, covering everything from emissions and waste disposal to land use and safeguarding biodiversity, directly influence project blueprints, budgets, and schedules. For instance, in 2023, the European Union continued to strengthen its environmental directives, impacting construction and operational standards across member states where Ferrovial operates.

The company's strategic focus on reducing its carbon footprint, as evidenced by its 2023 sustainability report which detailed a 15% reduction in Scope 1 and 2 emissions compared to 2019, directly addresses these regulatory pressures. Similarly, robust water resource management practices are essential, particularly in regions facing increasing water scarcity, a factor that influences project feasibility and long-term operational costs.

Labor Laws and Employment Regulations

Ferrovial navigates a complex web of global labor laws, impacting everything from hiring practices to employee compensation and benefits. For instance, in 2024, many European countries continued to strengthen worker protections, with potential implications for wage structures and working hours in Ferrovial's operations there. Staying compliant with these varied regulations is crucial for maintaining operational stability and mitigating the risk of costly legal challenges.

The company's commitment to adhering to these diverse employment regulations is paramount, especially given its significant global workforce. In 2023, Ferrovial employed over 24,000 people worldwide, each subject to local labor statutes. Failure to comply can lead to fines, reputational damage, and disruptions to business continuity.

Key areas of focus for Ferrovial include:

- Worker Rights: Ensuring fair treatment, safe working conditions, and adherence to minimum wage laws across all operating regions.

- Collective Bargaining: Engaging with labor unions and employee representatives where applicable, a common practice in many of Ferrovial's key markets.

- Employment Contracts: Maintaining legally sound employment agreements that reflect local legal requirements and protect both the company and its employees.

- Discrimination and Equal Opportunity: Upholding policies that prevent discrimination and promote equal opportunities in line with international and national standards.

Antitrust and Competition Law

Ferrovial, as a significant global infrastructure operator, navigates a complex landscape of antitrust and competition laws designed to prevent monopolistic practices and ensure a level playing field. These regulations are crucial for its operations, particularly concerning mergers, acquisitions, and participation in public tenders. For instance, in 2023, the European Commission continued its scrutiny of large infrastructure deals, with potential implications for major players like Ferrovial if any proposed transactions were deemed to stifle competition within the EU single market.

Compliance with these laws involves adherence to strict guidelines on:

- Mergers and Acquisitions: Ensuring that any acquisitions or mergers do not create dominant market positions that could harm consumers or competitors, often requiring regulatory approval from bodies like the European Commission or national competition authorities.

- Bidding Processes: Participating in public and private tenders with transparency and fairness, avoiding bid-rigging or other anti-competitive collusive practices.

- Market Dominance: Preventing the abuse of any dominant market position Ferrovial might hold in specific infrastructure sectors or geographical regions, which could involve unfair pricing or exclusionary conduct.

Failure to comply can result in substantial fines and reputational damage. For example, in 2024, several construction and infrastructure firms faced significant penalties across various jurisdictions for anti-competitive behavior in bidding processes, underscoring the importance of rigorous compliance programs for companies like Ferrovial.

Ferrovial's operations are significantly shaped by the legal frameworks governing concessions and public procurement. These laws dictate how the company secures and manages its infrastructure projects, such as the €1.1 billion E-30 motorway contract in Poland secured in 2023. Adherence to these complex, often long-term agreements is vital for revenue generation and regulatory compliance across its global portfolio.

Environmental laws are critical, influencing project design and operational standards. Ferrovial's 2023 sustainability report, detailing a 15% reduction in Scope 1 and 2 emissions compared to 2019, reflects its proactive response to evolving regulations like the EU's strengthened environmental directives impacting 2023 operations.

Labor laws are paramount given Ferrovial's workforce of over 24,000 employees in 2023. Compliance with diverse national regulations regarding worker rights, collective bargaining, and fair employment practices is essential to avoid legal challenges and maintain operational stability.

Antitrust and competition laws are also key, particularly for mergers, acquisitions, and bidding processes. The European Commission's continued scrutiny of infrastructure deals in 2023 highlights the need for Ferrovial to ensure fair market practices and avoid anti-competitive behaviors, as penalties for such actions were evident in 2024.

Environmental factors

Climate change presents substantial physical risks to infrastructure, with more frequent and intense extreme weather events like floods, storms, and droughts impacting assets. Ferrovial is actively developing methods to pinpoint, evaluate, and lessen these threats across its projects and operations.

The company's ADAPTARE methodology is specifically designed to manage the climate change risks affecting its infrastructure assets, ensuring resilience and long-term viability. This proactive approach is crucial as global climate-related losses continue to rise, with insured losses from natural catastrophes reaching an estimated $135 billion in 2023, according to Swiss Re.

The global push to curb carbon emissions significantly impacts construction and infrastructure companies like Ferrovial. Meeting stringent environmental regulations and stakeholder expectations necessitates a focus on reducing emissions from both building projects and ongoing operations.

Ferrovial has established clear decarbonization strategies, aiming for Net Zero emissions by 2050, with an accelerated target of 2040. This commitment includes ambitious reductions across Scope 1, 2, and 3 emissions, aligning with the critical 1.5°C global warming limit.

In 2023, Ferrovial reported a 14% reduction in Scope 1 and 2 emissions compared to its 2019 baseline, reaching 1.07 million tonnes of CO2 equivalent. This progress is driven by investments in renewable energy sources and energy efficiency measures across its portfolio.

Growing global awareness of resource scarcity, especially concerning raw materials vital for construction projects, is pushing industries towards more efficient resource management and the adoption of circular economy principles. This shift is becoming increasingly critical as supply chains face volatility.

Ferrovial can carve out a significant competitive edge by embedding practices that drastically cut down on waste, prioritize the reuse of construction materials, and champion sustainable sourcing throughout its operations. For instance, the company's 2023 sustainability report highlighted a 15% increase in recycled materials used across its infrastructure projects compared to 2022, demonstrating a tangible commitment to these principles.

Biodiversity and Ecosystem Protection

Ferrovial acknowledges that its infrastructure development can significantly affect biodiversity and natural ecosystems. The company is increasingly focused on reducing its environmental impact, safeguarding vulnerable habitats, and actively fostering biodiversity within its projects. This commitment is a crucial aspect of its environmental strategy, which explicitly incorporates the mitigation of biodiversity loss.

Ferrovial's approach to biodiversity protection is integrated into its broader climate strategy. This means that the potential impacts on natural habitats and species are considered from the early stages of project planning through to construction and operation. For instance, in 2023, Ferrovial reported on initiatives to restore degraded ecosystems in several of its projects, aiming to enhance local biodiversity.

- Biodiversity Impact Assessment: Ferrovial conducts detailed assessments to understand and minimize the ecological footprint of new infrastructure projects.

- Habitat Protection and Restoration: The company implements measures to protect sensitive habitats and engages in restoration activities post-construction.

- Climate and Biodiversity Strategy Alignment: Ferrovial's climate action plan includes specific objectives for biodiversity conservation, recognizing the interconnectedness of these environmental challenges.

- Sustainable Procurement: Efforts are made to ensure that materials and practices used in projects support biodiversity goals.

Water Management and Scarcity

Water stress is a significant environmental factor impacting infrastructure projects and operations worldwide. Ferrovial's commitment to efficient water management is crucial, especially as global water scarcity intensifies. This focus extends to their social responsibility, with initiatives supporting drinking water access in underserved areas.

Ferrovial's proactive approach to water challenges has garnered external recognition. Notably, the company was included in the CDP 'A List' for water management. This acknowledgment highlights their robust strategies and performance in addressing water-related risks and opportunities, a critical aspect for any large-scale infrastructure developer.

- Global Water Stress: Over two billion people live in countries experiencing high water stress, a figure projected to rise.

- Ferrovial's Recognition: Inclusion in the CDP 'A List' for water management signifies leading environmental performance and transparency.

- Operational Impact: Water availability directly affects construction timelines and the long-term viability of infrastructure assets like desalination plants or water treatment facilities.

Environmental factors significantly shape Ferrovial's operational landscape, driving strategic adaptation to climate change and resource management. The company's commitment to Net Zero by 2040, with a 14% reduction in Scope 1 and 2 emissions achieved by 2023 compared to 2019, underscores its proactive stance. Furthermore, a 15% increase in recycled materials used in 2023 highlights a dedication to circular economy principles amidst growing resource scarcity concerns.

Ferrovial actively addresses the physical risks of climate change through its ADAPTARE methodology, a crucial strategy given that insured losses from natural catastrophes reached an estimated $135 billion in 2023. The company's integrated approach to biodiversity conservation, including habitat restoration efforts, demonstrates a commitment to minimizing ecological impact. Recognition on the CDP 'A List' for water management further validates Ferrovial's robust strategies in navigating global water stress, a critical issue impacting over two billion people.

| Environmental Factor | Ferrovial's Response/Impact | Key Data/Metric |

| Climate Change | ADAPTARE methodology for risk assessment and mitigation. | Insured losses from natural catastrophes: $135 billion (2023 est.) |

| Carbon Emissions | Net Zero target by 2040; Scope 1 & 2 reduction. | 14% reduction in Scope 1 & 2 emissions (2023 vs. 2019). |

| Resource Scarcity | Focus on circular economy, waste reduction, material reuse. | 15% increase in recycled materials used (2023 vs. 2022). |

| Biodiversity | Habitat protection and restoration initiatives. | Integrated into climate strategy and project planning. |

| Water Stress | Efficient water management strategies. | Included in CDP 'A List' for water management. |

PESTLE Analysis Data Sources

Our Ferrovial PESTLE Analysis is meticulously constructed using data from official government publications, reputable financial institutions like the World Bank and IMF, and leading industry-specific reports. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in verifiable and current information.