Ferrovial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

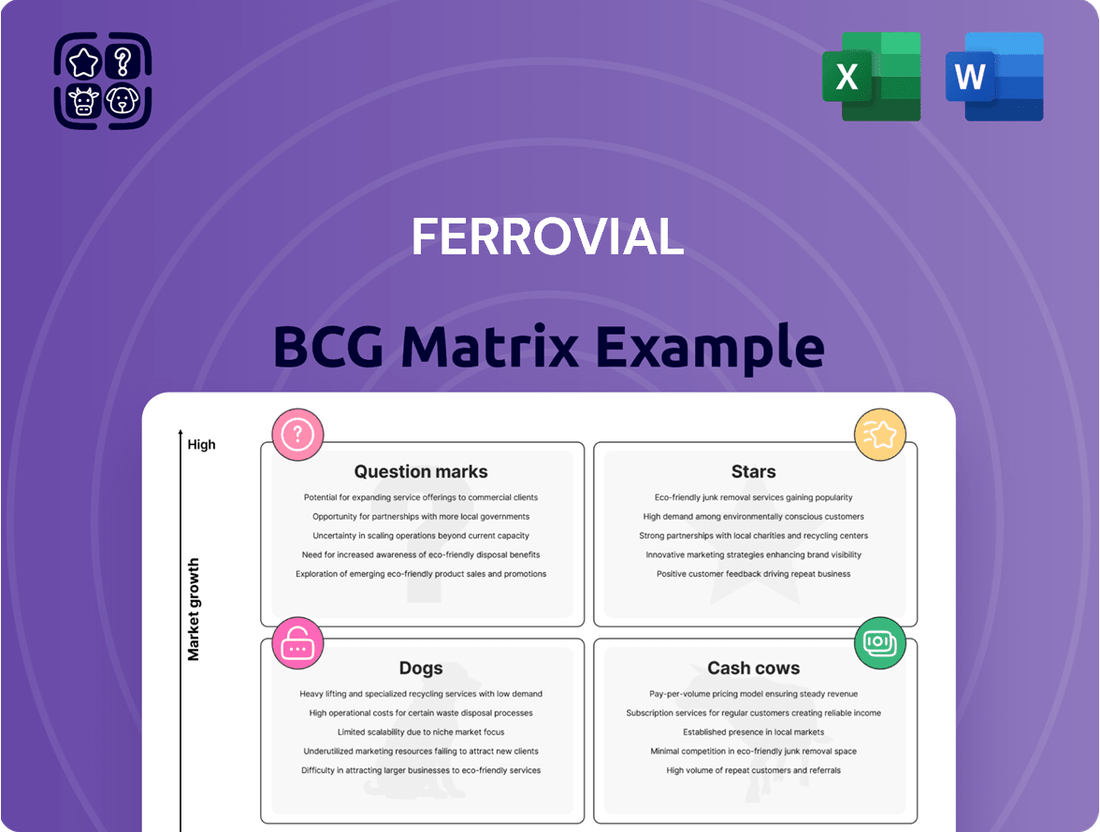

Curious about Ferrovial's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio is segmented into Stars, Cash Cows, Dogs, and Question Marks. Understand which ventures are driving growth and which require careful consideration.

Unlock the full potential of this analysis by purchasing the complete Ferrovial BCG Matrix. Gain a comprehensive understanding of their market share and growth rates, empowering you with data-driven insights for optimized resource allocation and future investment decisions.

Stars

Ferrovial's North American managed lanes and highways, especially its U.S. Express Lanes, are showing impressive revenue growth, consistently beating inflation and attracting more drivers. This strong performance is a cornerstone of Ferrovial's strategy, generating significant returns and solidifying its position as a major player in the expanding infrastructure sector. For instance, in 2024, the company reported continued traffic increases across its managed lane portfolio, contributing to a healthy financial outlook.

The New Terminal One (NTO) at JFK Airport stands as a star in Ferrovial's portfolio, characterized by its substantial capital investment and impressive construction momentum, reaching nearly 72% completion by mid-2025.

This project is firmly positioned as a high-growth asset within the vital U.S. aviation sector, evidenced by its extensive airline agreements and its strategic importance for Ferrovial's future market leadership.

Furthermore, the successful green bond refinancing of the NTO project underscores its alignment with prevailing sustainable finance trends, enhancing its appeal and long-term viability.

Ferrovial's Construction division shines as a Star in the BCG matrix, driven by its substantial North American presence. Roughly 45% of its impressive order book is situated in this dynamic region, reflecting significant growth potential.

The division's profitability has seen consistent improvement, reaching an adjusted EBIT margin of 3.5%. This financial strength is further bolstered by the strategic adoption of advanced technologies, including AI, to optimize operational efficiency and project delivery.

IRB Infrastructure Trust (India) Investment

Ferrovial's strategic acquisition of a 24% stake in IRB Infrastructure Trust in India is a significant move, aiming to capitalize on India's burgeoning toll road market. This investment offers a robust platform to engage with a diverse portfolio of operational and developing toll road concessions across the nation.

India's infrastructure landscape presents a compelling growth opportunity, driven by increasing urbanization and economic expansion. By securing this stake, Ferrovial is well-positioned to benefit from the country's substantial infrastructure development requirements, marking it as a key contributor to the company's global growth strategy.

- Strategic Entry: Ferrovial's 24% stake in IRB Infrastructure Trust provides direct access to India's rapidly growing toll road sector.

- Portfolio Diversification: The investment includes participation in a mix of operational and under-construction toll road concessions, offering a balanced risk-reward profile.

- Growth Market: India's infrastructure needs and economic trajectory make it a prime market for long-term infrastructure investment, with toll road revenue expected to rise.

- Market Potential: By 2024, India's road infrastructure sector was projected to see significant investment, with toll revenue expected to grow substantially due to increased vehicle volumes and economic activity.

Renewable Energy & Digital Infrastructure Ventures

Ferrovial is strategically expanding into dynamic sectors like renewable energy and digital infrastructure, signaling a commitment to future growth and innovation. A prime example is its investment in a €72 million solar plant located in Texas, demonstrating a tangible step into the renewable energy market. These ventures are positioned to capitalize on global sustainability trends and technological advancements.

The company's foray into digital infrastructure is highlighted by its 'AIVIA Smart Roads' initiative, which aims to integrate advanced digital solutions into transportation networks. This aligns with the increasing demand for connected and intelligent infrastructure. These forward-thinking investments underscore Ferrovial's adaptability and its pursuit of long-term value creation in evolving markets.

- Renewable Energy Investment: €72 million invested in a solar plant in Texas.

- Digital Infrastructure Initiative: Development of 'AIVIA Smart Roads'.

- Strategic Focus: Diversification into high-growth sectors.

- Market Alignment: Capitalizing on global sustainability and digital trends.

Ferrovial's U.S. Express Lanes and managed highways are performing exceptionally well, with traffic and revenue consistently rising, outpacing inflation. The New Terminal One at JFK Airport is a significant star, nearing 72% completion by mid-2025 and securing strong airline agreements. Ferrovial's Construction division, with 45% of its order book in North America and an adjusted EBIT margin of 3.5%, is also a star, boosted by technology adoption.

| Asset/Division | Growth Driver | Key Metric | Status |

|---|---|---|---|

| U.S. Managed Lanes | Increased traffic, revenue growth | Revenue beating inflation | Star |

| New Terminal One (JFK) | Aviation sector growth, strategic importance | ~72% completion (mid-2025) | Star |

| Construction Division | North American expansion, operational efficiency | 45% order book in NA, 3.5% adj. EBIT margin | Star |

What is included in the product

The Ferrovial BCG Matrix offers strategic insights by classifying its business units as Stars, Cash Cows, Question Marks, or Dogs, guiding investment and divestment decisions.

The Ferrovial BCG Matrix provides a clear, one-page overview, relieving the pain of scattered business unit performance data.

Cash Cows

The 407 ETR, a Canadian toll highway, stands as a prime example of a Cash Cow for Ferrovial. Its mature status and impressive profitability translate into consistent, substantial dividends for the company. In 2023, the 407 ETR reported revenues of CAD 1.28 billion, demonstrating its robust financial performance.

The road's fully electronic tolling system, coupled with an exceptionally high revenue capture rate, guarantees predictable and reliable cash flows. This operational efficiency minimizes overhead and maximizes profitability, solidifying its position as a stable income generator for Ferrovial's portfolio.

Established US toll road concessions, like the I-77 and I-66 express lanes, are now consistently paying dividends. This indicates their maturity and transition into reliable cash-generating assets for Ferrovial. These mature concessions are crucial for Ferrovial's North American operations, providing stable income streams.

Ferrovial's mature infrastructure assets, such as toll roads and airports, consistently generate robust dividends. For instance, in 2023, its infrastructure division contributed significantly to its overall financial performance, providing a stable revenue stream. These assets are in a mature phase, meaning they require minimal reinvestment for expansion, allowing their substantial cash flows to be utilized effectively.

This reliable cash generation from its infrastructure holdings is crucial for Ferrovial's financial strategy. It provides the necessary liquidity to fund new growth opportunities, manage its debt obligations, and distribute returns to its shareholders. The predictable nature of these dividends underpins the company's financial stability and its capacity for strategic capital allocation.

Efficient Core Construction Operations

Ferrovial's core construction operations are a prime example of a Cash Cow within its BCG Matrix. These established activities consistently deliver strong adjusted EBIT margins, reflecting high operational efficiency and disciplined cost management. For instance, in 2024, the construction division demonstrated its reliability by maintaining a robust backlog, underpinning its role as a steady cash generator for the broader group.

The division's ability to selectively pursue profitable projects further solidifies its Cash Cow status. This strategic approach ensures that capital is deployed effectively, maximizing returns from its mature business lines. The consistent cash flow generated from these operations is crucial for funding Ferrovial's investments in higher-growth areas.

- High Operational Efficiency: Ferrovial's construction business consistently achieves strong adjusted EBIT margins, indicating effective project execution and cost control.

- Robust Backlog: The division maintains a substantial and reliable project backlog, ensuring a predictable stream of revenue and cash flow.

- Selective Bidding Strategy: By focusing on profitable opportunities, the construction segment maximizes its cash contribution to the group.

- Steady Cash Contributor: This mature business unit serves as a vital source of stable cash flow, supporting Ferrovial's overall financial health and growth initiatives.

Strategic Asset Divestment Proceeds

Ferrovial's strategic divestment of mature assets, including significant stakes in Heathrow Airport and AGS Airports, has been a key driver of its cash cow strategy. These sales have not only yielded substantial capital gains but also generated considerable cash inflows, allowing the company to effectively 'milk' value from its established, lower-growth holdings.

This asset rotation is crucial for funding future growth. The capital generated from these divestments is strategically reinvested into higher-growth opportunities, transforming mature assets into the financial fuel for Ferrovial's expansion. For instance, in 2023, Ferrovial completed the sale of its 25% stake in Heathrow Airport to Ardian and the Saudi Public Investment Fund for approximately €2.4 billion, a move that significantly bolstered its financial flexibility.

- Heathrow Airport Divestment: Sale of a 25% stake in 2023 generated approximately €2.4 billion in proceeds.

- AGS Airports Sale: Ferrovial also divested its stake in AGS Airports, further contributing to cash generation.

- Strategic Reinvestment: Proceeds are earmarked for reinvestment in high-growth sectors like renewable energy and sustainable infrastructure.

Ferrovial's mature infrastructure assets, such as toll roads and airports, consistently generate robust dividends, acting as its primary cash cows. These established operations require minimal reinvestment for expansion, allowing their substantial cash flows to be utilized effectively. The predictable nature of these dividends underpins the company's financial stability and its capacity for strategic capital allocation.

| Asset | 2023 Revenue (Approx.) | Status | Cash Flow Contribution |

| 407 ETR (Canada) | CAD 1.28 billion | Mature | Consistent Dividends |

| US Toll Roads (e.g., I-77, I-66) | N/A (Dividends Paid) | Mature | Stable Income Streams |

| Infrastructure Division | Significant Contribution | Mature | Stable Revenue Stream |

What You’re Viewing Is Included

Ferrovial BCG Matrix

The Ferrovial BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This professionally designed report offers a clear strategic overview of Ferrovial's business units, categorized into Stars, Cash Cows, Question Marks, and Dogs, enabling informed decision-making. You can confidently use this preview as an exact representation of the analysis-ready file that will be yours to edit, print, or present. This is not a demo; it's the final, actionable BCG Matrix report ready for your strategic planning.

Dogs

Ferrovial's divestment of its Heathrow Airport stake, a move completed in 2023 for £2.37 billion, signifies a strategic shift. This mature, regulated asset, while a significant holding for years, no longer fit Ferrovial's forward-looking strategy focused on greenfield projects offering greater growth and return potential. The sale effectively recategorized Heathrow from a potential 'Cash Cow' or even a 'Dog' in a BCG matrix context, given its limited growth prospects compared to Ferrovial's new investment focus.

Ferrovial's divestment of its 50% stake in AGS Airports, encompassing Glasgow, Aberdeen, and Southampton, signals a strategic pivot away from mature, non-core infrastructure assets. This move, completed in 2023, aligns with Ferrovial's focus on high-growth opportunities and its ongoing portfolio optimization.

These regional airports, while contributing to operations, likely presented fewer avenues for significant expansion compared to Ferrovial's other infrastructure holdings. The sale, which reportedly generated substantial capital, allows for reinvestment into areas with greater strategic alignment and higher return potential, underscoring a commitment to future-oriented growth.

Ferrovial's strategic portfolio management in 2024 included the divestment of its remaining stake in Serveo and its mining services operations in Chile. These actions are consistent with a broader strategy to concentrate on core, high-growth infrastructure assets.

Serveo, a services business, and the Chilean mining services segment were identified as non-core assets. Their divestment allows Ferrovial to reallocate capital towards its primary focus: transportation infrastructure, where it holds stronger market positions and sees greater growth potential.

The disposal of these lower-growth service segments, which had limited market share and strategic alignment, underscores Ferrovial's commitment to optimizing its business portfolio for enhanced shareholder value and a more focused operational strategy.

IRB Infrastructure Developers (Divested Stake)

Ferrovial's decision to divest a 5% stake in IRB Infrastructure Developers, despite its prior investment in IRB Infrastructure Trust, signals a strategic re-evaluation of its Indian market presence. This move suggests a focus on optimizing its portfolio by potentially offloading assets that may not align with its current strategic objectives or are perceived as less promising. For instance, in the fiscal year ending March 31, 2024, IRB Infrastructure Developers reported a consolidated revenue of INR 8,151 crore, a slight decrease from INR 8,242 crore in the previous year, which could have influenced Ferrovial's decision.

This divestment can be interpreted as an effort to avoid capital being tied up in assets that are not yielding the desired returns or are facing challenges. Ferrovial's approach indicates a proactive stance in managing its investments, ensuring capital is allocated to areas with higher growth potential or strategic importance. The company's ongoing assessment of its global infrastructure assets is crucial for maintaining a healthy and dynamic investment portfolio.

- Strategic Portfolio Refinement: Ferrovial's sale of a 5% stake in IRB Infrastructure Developers highlights a targeted adjustment to its investment strategy in India.

- Asset Performance Assessment: The divestment likely stems from an ongoing evaluation of IRB Infrastructure Developers' performance relative to Ferrovial's investment criteria.

- Capital Allocation Optimization: By divesting, Ferrovial aims to prevent capital from being locked into underperforming or less strategically aligned assets, ensuring efficient use of resources.

- Market Dynamics: Understanding the financial performance of IRB Infrastructure Developers, such as its reported revenue of INR 8,151 crore for FY24, provides context for Ferrovial's strategic decisions.

Non-Strategic, Mature Concessions with Limited Expansion

Ferrovial's strategic approach involves actively managing its portfolio, which means older, mature concessions with limited potential for expansion or significant value addition are prime candidates for divestment. These assets, while potentially generating steady revenue, do not fit the company's forward-looking strategy focused on growth opportunities.

For example, a concession for an older toll road with fixed tariffs and no planned upgrades would fall into this category. Such assets might be considered "cash cows" in a different context, but within Ferrovial's growth-oriented framework, they represent opportunities for capital recycling into more promising ventures.

- Mature Concessions: Assets with established operations and limited future growth prospects.

- Limited Expansion Potential: These concessions offer minimal opportunities for increasing revenue or market share.

- Active Asset Rotation: Ferrovial's strategy includes divesting such assets to reinvest in higher-growth areas.

- Focus on Greenfield Projects: The company prioritizes new developments with greater potential for value creation.

Within the context of the BCG Matrix, Ferrovial's divestment of certain assets can be seen as moving them from potentially problematic categories. Assets that are mature with limited growth prospects, like older concessions or non-core service businesses, align with the characteristics of "Dogs."

These "Dogs" typically have low market share and low market growth, meaning they don't offer significant opportunities for expansion or high returns. Ferrovial's strategy of selling these types of assets, such as its stake in AGS Airports or its mining services in Chile, is about freeing up capital.

This capital is then redeployed into "Stars" or "Question Marks" – areas where Ferrovial sees higher growth potential and can invest to drive future value. The divestment of Serveo in 2024, for instance, was a move to shed a lower-growth segment.

The company's active portfolio management means it's not afraid to exit segments that no longer fit its strategic vision, effectively cleaning out potential "Dogs" to focus on more promising ventures.

Question Marks

The Lima Peripheral Ring Road project, awarded to Ferrovial, is a prime example of a "Question Mark" in the BCG matrix. This new venture in a high-growth market demands significant initial investment for construction and development.

Currently, the project has no established market share and is not generating substantial returns, fitting the profile of a question mark that requires careful consideration and strategic decisions regarding future investment.

Ferrovial's commitment to this project, valued at approximately €200 million for the first phase, underscores its potential, but its future success hinges on effective execution and market acceptance to transition into a star or cash cow.

Ferrovial is aggressively pursuing new express lane projects in North America, notably being shortlisted for significant undertakings like the I-285 East in Atlanta and the I-24 Southeast Choice Lanes in Tennessee. These strategic bids target high-growth corridors where the company seeks to substantially increase its footprint.

These ventures represent substantial capital investments during the bidding and initial development stages, positioning them as potential Stars in Ferrovial's portfolio. Success hinges on securing these complex projects and demonstrating strong execution capabilities.

Ferrovial actively seeks out new airport projects worldwide, with a keen eye on sustainability. These greenfield developments represent significant long-term growth opportunities but demand considerable initial investment.

Currently, these early-stage projects lack any market share, making them speculative. Their ultimate success depends on future passenger demand and efficient operational setup.

Advanced Digital Infrastructure & AI Integration Initiatives

Ferrovial's commitment to advanced digital infrastructure and AI integration, exemplified by initiatives beyond its 'AIVIA Smart Roads' project, positions it in high-growth technological areas. These ventures, focusing on automation and data analytics, are characterized by significant innovation and early-stage development.

While these AI integration efforts are pioneering, they are currently in a phase that demands substantial research and development investment, with a less defined trajectory towards immediate, large-scale market penetration or profitability. For instance, Ferrovial's digital transformation strategy, which includes AI, saw a notable increase in digital investment in 2024.

- Innovation Focus: Investments in AI and automation represent Ferrovial's push into cutting-edge technological frontiers.

- Early Stage Investment: These projects require significant upfront capital for R&D and pilot programs.

- Market Uncertainty: The path to substantial market share and profitability for these nascent AI applications is still being established.

- Strategic Importance: Despite current uncertainties, these initiatives are crucial for future competitiveness and operational efficiency.

Potential New Ventures in Emerging Geographies

Ferrovial is actively pursuing complex greenfield projects in emerging markets such as Australia and Colombia. These regions offer substantial growth prospects, although Ferrovial's current market share in specific new ventures there is minimal or nonexistent.

These ventures are considered speculative investments, demanding considerable capital outlay to establish a presence and validate the business model's scalability. For instance, Australia's infrastructure spending is projected to reach AUD 120 billion in 2024, presenting a significant opportunity for new entrants to capture market share.

- Australia's infrastructure investment: Expected to exceed AUD 120 billion in 2024.

- Colombia's infrastructure development: Significant government focus on modernization projects, creating new entry points.

- High-risk, high-reward profile: Initial investments are speculative, aiming to build market share in nascent ventures.

- Capital intensive: Establishing operations in these new geographies requires substantial upfront investment.

Ferrovial's investments in early-stage digital infrastructure and AI integration, such as its 'AIVIA Smart Roads' project, are classic examples of Question Marks. These ventures are in high-growth technological sectors, demanding significant R&D capital with an uncertain path to market dominance.

The company's strategic focus on AI in 2024, with increased digital investment, highlights this commitment to innovation. However, these pioneering efforts currently lack established market share and profitability, necessitating careful evaluation of future resource allocation to determine their potential to become Stars.

| Project Type | Market Growth | Current Market Share | Investment Required | Potential |

|---|---|---|---|---|

| Lima Peripheral Ring Road | High | Low/None | High | Star/Dog |

| New Express Lane Projects (e.g., Atlanta, Tennessee) | High | Low/None | High | Star |

| Greenfield Airport Projects | High | Low/None | High | Star/Dog |

| AI Integration & Digital Infrastructure | Very High | Low/None | Very High | Star |

| Emerging Market Greenfield Projects (Australia, Colombia) | High | Low/None | High | Star/Dog |

BCG Matrix Data Sources

Our Ferrovial BCG Matrix is constructed using a blend of public financial disclosures, comprehensive market research reports, and internal performance data to provide a clear strategic overview.