Ferrovial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

Explore the strategic core of Ferrovial's operations with its comprehensive Business Model Canvas. This document unpacks how they leverage key resources and partnerships to deliver innovative infrastructure and mobility solutions. Understand their revenue streams and cost drivers to gain a competitive edge.

Unlock the full strategic blueprint behind Ferrovial's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Ferrovial's relationship with government entities and public authorities is foundational, enabling the company to secure long-term concessions and participate in Public-Private Partnerships (PPPs). These collaborations are vital for the development, financing, and operation of large-scale transportation infrastructure.

These partnerships are critical for major undertakings such as toll roads and airports, allowing Ferrovial to deploy its engineering and operational capabilities while governments maintain regulatory oversight and benefit from private sector efficiencies. For example, Ferrovial's significant presence in North America involves extensive engagement with state and local transportation departments for highway development projects.

Ferrovial relies on strategic alliances with construction and engineering firms worldwide to tackle its vast and intricate infrastructure projects. These collaborations are crucial for pooling specialized expertise, sharing project risks, and accessing necessary resources, which has bolstered the construction division's impressive order book.

These joint ventures allow Ferrovial to leverage the unique strengths of its partners, ensuring efficient project execution and high-quality outcomes. For instance, significant projects like the New Terminal One at New York's JFK International Airport and numerous road projects in Texas and Florida underscore the success of these key partnerships.

Ferrovial's business model hinges on robust connections with financial institutions, banks, and institutional investors. These partnerships are crucial for securing the substantial financing needed for new infrastructure projects and for managing its debt effectively. For instance, in 2024, Ferrovial continued to leverage its strong credit standing to access capital markets for its diverse portfolio.

These financial relationships also enable Ferrovial to execute its asset rotation strategies, providing liquidity by divesting mature assets. This strategic capital allocation allows the company to maintain a healthy financial position and fund its growth ambitions, as seen in its ongoing infrastructure development pipelines throughout 2024.

Technology and Innovation Providers

Ferrovial actively collaborates with technology and innovation providers to drive advancements in smart infrastructure and mobility solutions. These partnerships are crucial for integrating cutting-edge technologies like AI for asset management and predictive maintenance, ensuring operational efficiency.

A key aspect of these collaborations involves developing and implementing digital platforms. For instance, NextMove, a digital platform, enhances user experience and operational capabilities within Ferrovial's mobility services. These strategic alliances keep Ferrovial at the vanguard of industry progress, delivering infrastructure designed for the future.

- AI Integration: Partnering with tech firms to embed AI in asset management for predictive maintenance, reducing downtime and costs.

- Digital Platforms: Collaborating on digital solutions like NextMove to improve user experience and operational efficiency in mobility.

- Research Institutions: Engaging with academic bodies to foster innovation and explore new technological frontiers in infrastructure development.

- Industry Leadership: These partnerships ensure Ferrovial remains at the forefront of technological advancements, offering future-ready infrastructure.

Local Communities and Stakeholders

Ferrovial actively cultivates relationships with local communities and environmental groups to secure its social license to operate. This engagement ensures projects meet local needs and sustainability objectives, a crucial element in infrastructure development. For instance, in 2024, Ferrovial continued its focus on community benefit initiatives across its global projects, aiming to enhance local economies and improve quality of life.

Transparent communication and addressing stakeholder concerns are paramount. Ferrovial prioritizes open dialogue to build trust and ensure project alignment with community expectations. This proactive approach helps mitigate potential conflicts and fosters collaborative problem-solving.

The company's commitment to Environmental, Social, and Governance (ESG) principles guides these partnerships. Ferrovial adheres to international sustainability standards, such as those promoted by the Global Reporting Initiative (GRI), and complies with relevant regulatory frameworks. In 2024, Ferrovial reported significant progress in its ESG targets, underscoring its dedication to responsible business practices.

Key aspects of these partnerships include:

- Fostering social license to operate through proactive community engagement.

- Ensuring project alignment with local needs and sustainability goals.

- Contributing to local economic development and improving quality of life.

- Adherence to ESG principles and international sustainability standards.

Ferrovial's key partnerships are crucial for its infrastructure development and operational success, spanning government bodies, construction firms, financial institutions, technology providers, and local communities.

These collaborations are essential for securing project concessions, accessing capital, leveraging expertise, and ensuring social acceptance, all vital for Ferrovial's global operations and growth strategy.

In 2024, Ferrovial's strategic alliances were evident in its continued participation in major PPPs and its commitment to innovation through technology partnerships.

| Partnership Type | Key Role | 2024 Impact/Focus |

|---|---|---|

| Government & Public Authorities | Concessions, PPPs, Regulatory Frameworks | Securing long-term infrastructure development contracts, e.g., highway projects in North America. |

| Construction & Engineering Firms | Specialized Expertise, Risk Sharing, Resource Access | Successful execution of complex projects like New Terminal One at JFK, leveraging joint ventures. |

| Financial Institutions & Investors | Project Financing, Debt Management, Asset Rotation | Accessing capital markets for growth pipelines and maintaining financial health. |

| Technology & Innovation Providers | AI Integration, Digital Platforms, Smart Infrastructure | Enhancing operational efficiency and user experience via solutions like NextMove. |

| Local Communities & Environmental Groups | Social License, ESG Compliance, Local Benefit | Ensuring project alignment with sustainability goals and community needs, fostering trust. |

What is included in the product

A strategic, detailed overview of Ferrovial's operations, covering key customer segments, value propositions, and revenue streams within its infrastructure and mobility sectors.

This model offers a clear, concise representation of Ferrovial's business, ideal for understanding its market positioning and operational framework.

The Ferrovial Business Model Canvas provides a structured approach to identifying and addressing operational inefficiencies, acting as a pain point reliever by clearly mapping key activities and resources.

By offering a clear, visual representation of Ferrovial's operations, the Business Model Canvas simplifies complex strategies, relieving the pain of understanding and communicating core business drivers.

Activities

Ferrovial's core activity revolves around identifying, developing, and securing financing for significant transportation infrastructure projects, such as highways and airports. This crucial stage involves conducting thorough feasibility studies, obtaining necessary concessions, and meticulously structuring complex financial arrangements to bring these ventures to fruition.

The company strategically targets investments in projects demonstrating high growth potential, with a particular emphasis on North America. This focus is designed to ensure the creation of sustained long-term value and capitalize on emerging infrastructure needs in key economic regions.

Ferrovial's core operations revolve around the physical construction and sophisticated engineering of vital infrastructure. This includes major civil works such as roads, railways, and airport facilities, executed by its construction divisions like Budimex and Webber.

These construction and engineering services are fundamental to Ferrovial's business, consistently fueling a strong order book. In 2023, Ferrovial's Construction division reported revenues of €10.5 billion, showcasing the significant scale of its project execution capabilities.

Ferrovial's core strength lies in the long-term operation and maintenance of its transportation infrastructure. This includes managing key assets like the 407 ETR toll road in Canada and various Express Lanes in the US, alongside airports. These activities are crucial for ensuring smooth traffic flow, efficient facility management, and leveraging advanced systems for peak performance and user experience.

These operational activities generate consistent and predictable revenue streams, which are fundamental to Ferrovial's financial resilience. For instance, in 2023, Ferrovial's toll road segment reported revenues of €1,340 million, highlighting the significant contribution of these long-term concessions to its overall financial health.

Strategic Asset Rotation and Investment Management

Ferrovial's strategic asset rotation is a cornerstone of its investment management. This involves actively selling mature assets to fund new growth areas. For instance, in 2023, Ferrovial completed the sale of its entire stake in Heathrow Airport, a significant divestment that generated substantial capital. This strategic move allows for optimized capital allocation and fuels reinvestment in higher-potential projects.

This disciplined approach to asset rotation is crucial for driving profitability and supporting Ferrovial's long-term expansion strategy. By strategically divesting from established assets, the company can unlock capital for investments in emerging sectors and geographies, ensuring a dynamic and forward-looking portfolio. This active management generates capital gains and enhances overall financial performance.

- Strategic Divestment: Sale of mature assets to free up capital.

- Reinvestment in Growth: Funding new, high-potential opportunities.

- Capital Optimization: Efficient allocation of financial resources.

- Profitability Enhancement: Generating capital gains through asset rotation.

Innovation in Mobility and Energy Solutions

Ferrovial is actively innovating in mobility and energy, developing AI-driven smart roads and digital payment systems like NextPass to enhance urban transit efficiency. These advancements reflect a strategic push towards smart infrastructure solutions.

The company is also expanding its footprint in the energy sector, with significant investments in renewable energy projects. For instance, by the end of 2024, Ferrovial aims to have a substantial portfolio of renewable energy assets contributing to a cleaner energy future.

- Smart Mobility: Development of AI-powered traffic management systems and digital payment platforms like NextPass.

- Energy Infrastructure: Increased investment in renewable energy projects, including solar and wind power generation.

- Sustainability Focus: Positioning Ferrovial to address future challenges in sustainable infrastructure through technological integration.

Ferrovial's key activities center on the entire lifecycle of major infrastructure, from initial development and financing to construction and long-term operation. The company actively manages and maintains assets like toll roads and airports, generating stable revenue streams. Strategic asset rotation, such as the 2023 sale of its Heathrow Airport stake, is crucial for reinvesting capital into new, high-growth opportunities, demonstrating a dynamic approach to portfolio management and capital optimization.

Preview Before You Purchase

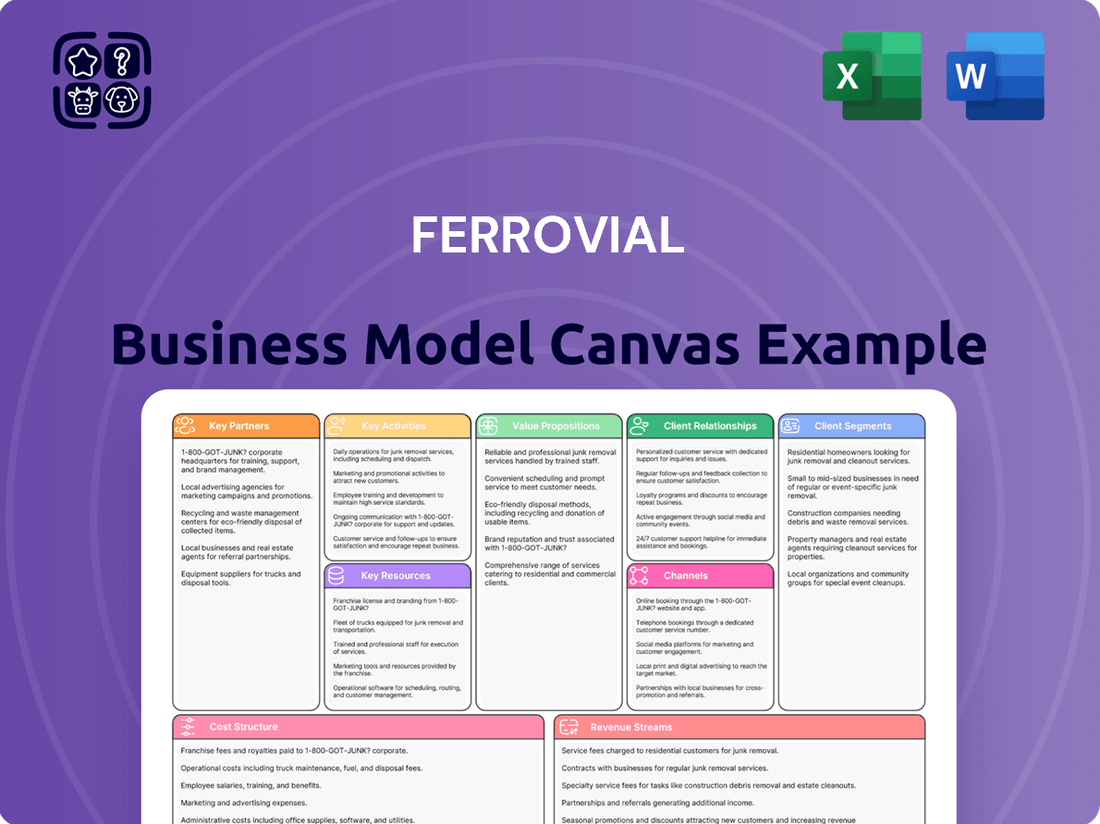

Business Model Canvas

The Ferrovial Business Model Canvas preview you are seeing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, providing you with a transparent and accurate representation of what you're buying. You can be confident that upon completing your order, you will gain full access to this same professionally prepared Business Model Canvas, ready for your immediate use and adaptation.

Resources

Ferrovial's financial capital is a cornerstone of its business model, providing the capacity to pursue ambitious infrastructure development. In 2024, the company demonstrated this by securing a €1.1 billion sustainability-linked revolving credit facility, underscoring its access to significant funding for growth initiatives.

This robust financial position allows Ferrovial to make substantial equity contributions to major projects, such as its significant investment in JFK International Airport's New Terminal One. Such financial muscle is crucial for undertaking complex, long-term infrastructure ventures and solidifying its market leadership.

Ferrovial's expertise and intellectual capital are foundational to its business model, particularly evident in its deep understanding of developing, financing, building, and operating complex transportation infrastructure. This specialized knowledge is a significant competitive advantage.

This intellectual capital is embodied in Ferrovial's highly skilled workforce, including engineers, project managers, and strategic leaders. Their collective experience enables the company to effectively manage intricate projects and navigate diverse regulatory landscapes across its global operations. For instance, Ferrovial's involvement in major projects like the expansion of Heathrow Airport showcases this capability.

This accumulated expertise allows Ferrovial to differentiate itself in the highly competitive global infrastructure market. The company's ability to consistently deliver on large-scale, complex projects, often under challenging conditions, underscores the value of its intellectual capital and extensive experience.

Ferrovial's key resources include its extensive portfolio of long-term infrastructure concessions, such as those for highways and airports. These agreements, often spanning many decades, are crucial for generating stable and predictable revenue. For instance, the 99-year concession for the 407 ETR highway in Canada exemplifies the long-term nature of these valuable assets.

Physical Infrastructure Assets

Ferrovial's physical infrastructure assets are the bedrock of its business, encompassing vital transportation networks. These include extensive highway concessions, such as the US Express Lanes, and sophisticated airport terminals. The company's substantial fleet of construction equipment further solidifies its operational capacity.

The value of these tangible assets is directly tied to their strategic positioning and how efficiently they are managed. For instance, Ferrovial's involvement in the 407 ETR highway in Ontario, Canada, a highly successful toll road, highlights the revenue-generating potential of well-placed infrastructure.

- Highway Networks: Ferrovial operates and maintains significant toll road concessions globally, contributing substantially to its revenue streams.

- Airport Operations: The company manages and develops airport terminals, enhancing passenger experience and operational efficiency.

- Construction Equipment: A vast inventory of specialized construction machinery supports its project execution capabilities.

Advanced Technology and Digital Platforms

Ferrovial leverages advanced technology and digital platforms as a core resource, focusing on smart roads, sophisticated traffic management, and enhanced operational efficiency. This commitment is evident in systems designed for dynamic tolling, intelligent transport solutions, and user-friendly digital tools like the NextPass application, which streamlines access and payments.

Investment in cutting-edge technology directly boosts the value and performance of Ferrovial's extensive infrastructure portfolio. For example, in 2023, Ferrovial's digital transformation initiatives contributed to improved asset management and a more seamless user experience across its operations.

- Digital Platforms: Development and deployment of integrated digital solutions for managing and optimizing infrastructure assets.

- Intelligent Transport Systems (ITS): Implementation of advanced technologies for real-time traffic monitoring, control, and information dissemination.

- User Convenience Apps: Creation of mobile applications like NextPass to enhance customer experience through easy access and payment functionalities.

- Data Analytics: Utilization of data generated by digital platforms to inform decision-making and drive operational improvements.

Ferrovial's key resources are a blend of tangible and intangible assets that drive its infrastructure development and management capabilities. These include substantial financial backing, deep technical expertise, a vast portfolio of concession agreements, physical infrastructure assets, and a strong commitment to technological innovation.

| Resource Category | Key Components | Significance | 2024 Data/Example |

|---|---|---|---|

| Financial Capital | Access to credit, equity investments | Enables large-scale project financing and growth | €1.1 billion sustainability-linked revolving credit facility secured |

| Intellectual Capital | Engineering expertise, project management, strategic leadership | Drives successful execution of complex infrastructure | Experience in Heathrow Airport expansion |

| Concession Portfolio | Long-term rights to operate infrastructure | Generates stable, predictable revenue streams | 99-year concession for 407 ETR highway in Canada |

| Physical Assets | Highway networks, airport terminals, construction equipment | Forms the operational backbone of the business | Involvement in US Express Lanes and airport terminals |

| Technology & Digital Platforms | Smart road systems, ITS, user apps | Enhances efficiency, user experience, and asset management | NextPass application for streamlined payments |

Value Propositions

Ferrovial's core value lies in its ability to connect communities and significantly improve the quality of life for millions. By developing and managing vital transportation networks, the company directly addresses the challenges of urban congestion, making travel smoother and more efficient. This focus on infrastructure directly translates to tangible benefits for citizens, fostering economic opportunities and enhancing overall mobility.

In 2024, Ferrovial's commitment to this value proposition is evident in its ongoing projects. For instance, its management of toll roads in Texas, like the LBJ Express and the North Tarrant Express, demonstrably reduced average commute times by up to 24% during peak hours in recent years, a trend expected to continue. This directly contributes to a better quality of life by giving people back valuable time.

Ferrovial provides infrastructure solutions designed for enduring resilience and sustainability, tackling today's and tomorrow's societal and environmental needs. This is demonstrated by their commitment to ambitious decarbonization goals, aligning with stringent sustainability standards, and actively developing projects that can withstand climate change impacts.

The company's dedication to sustainability not only strengthens its attractiveness to investors and partners but also underpins the long-term viability and value of its infrastructure assets. For instance, in 2023, Ferrovial's sustainability-linked financing reached €3.1 billion, underscoring its strategic integration of environmental, social, and governance (ESG) principles into its core business model.

Ferrovial's commitment to modern transportation networks delivers efficient and reliable mobility. For instance, their management of toll roads, like the 407 ETR in Canada, consistently shows high levels of traffic flow and user satisfaction, demonstrating reduced congestion. This operational focus directly benefits millions of daily commuters and travelers.

Innovation in Mobility and Digital Infrastructure

Ferrovial's innovation in mobility and digital infrastructure delivers enhanced user experiences and operational efficiency. They integrate advanced technologies such as AI for intelligent asset management, improving maintenance and performance.

These digital solutions foster seamless interaction and create smarter, more responsive infrastructure. For example, in 2024, Ferrovial continued to expand its digital services, aiming to streamline traffic management and improve passenger journeys across its concessions.

- AI-driven asset management enhances infrastructure longevity and reduces operational costs.

- Digital platforms offer users real-time information and seamless access to mobility services.

- Focus on smart city integration positions Ferrovial at the forefront of future urban development.

- Investment in R&D fuels the creation of next-generation mobility solutions.

Value Creation for Shareholders through Strategic Asset Management

Ferrovial creates substantial shareholder value by actively managing its asset portfolio, focusing on strategic growth opportunities, and consistently returning capital. This disciplined approach is evident in its asset rotation strategy, which optimizes the company's holdings and capital allocation. For instance, in 2024, Ferrovial continued to divest non-core assets while investing in high-growth infrastructure projects, demonstrating a clear commitment to enhancing shareholder returns.

The company's strong financial performance underpins its ability to deliver value. In 2024, Ferrovial reported robust earnings, driven by its diversified business segments and efficient operations. This financial strength allows for increased dividends and a focus on share value appreciation, making it an attractive proposition for investors seeking reliable returns.

- Disciplined Asset Management: Ferrovial's strategic asset rotation in 2024, including the sale of certain infrastructure assets, aimed to unlock capital for reinvestment in higher-return opportunities.

- Strategic Growth Focus: The company continued to invest in key projects, such as those in the renewable energy and digital infrastructure sectors, anticipating strong future revenue streams.

- Shareholder Remuneration: Ferrovial's commitment to consistent dividends, supported by its solid financial results in 2024, directly benefits its shareholders.

Ferrovial's value proposition centers on building and managing essential infrastructure that enhances daily life and fosters economic growth. They connect communities by improving transportation networks, making travel more efficient and less congested.

This commitment is reflected in their 2024 operations, where projects like the managed toll roads in Texas demonstrably reduced commute times, giving people back valuable time and improving their quality of life.

Ferrovial offers sustainable and resilient infrastructure solutions designed for the future. Their focus on decarbonization and climate-resilient projects aligns with global sustainability goals, making their assets more attractive and viable long-term.

The company's dedication to innovation in mobility and digital infrastructure provides users with better experiences and operational efficiency. By integrating technologies like AI for asset management, Ferrovial ensures smarter, more responsive infrastructure, as seen in their 2024 expansion of digital services for traffic management.

| Value Proposition | Description | 2024 Example/Data |

|---|---|---|

| Connecting Communities & Improving Quality of Life | Developing and managing vital transportation networks to reduce congestion and enhance mobility. | Managed toll roads in Texas (e.g., LBJ Express) continued to show reduced commute times. |

| Sustainable & Resilient Infrastructure | Providing infrastructure solutions that address environmental needs and climate change impacts. | Continued investment in ESG principles, with sustainability-linked financing a key strategy. |

| Efficient & Reliable Mobility | Ensuring smooth traffic flow and user satisfaction through effective infrastructure management. | High traffic volumes and user satisfaction maintained on key concessions like the 407 ETR. |

| Innovative Mobility & Digital Infrastructure | Integrating advanced technologies for enhanced user experiences and operational efficiency. | Expansion of digital services for streamlined traffic management and passenger journeys. |

| Shareholder Value Creation | Actively managing assets, pursuing strategic growth, and returning capital to shareholders. | Disciplined asset rotation and continued investment in high-growth sectors like digital infrastructure. |

Customer Relationships

Ferrovial cultivates deep, strategic alliances with public sector entities, essential for winning and managing large-scale infrastructure projects. These partnerships are founded on mutual trust and a dedication to public service, often spanning decades. For example, in 2024, Ferrovial secured a significant contract extension for a major toll road concession in Texas, a testament to its long-standing relationship with the state’s transportation authority.

Ferrovial solidifies customer relationships through performance-based contracts and robust Service Level Agreements (SLAs). These agreements are crucial for ensuring the delivery of top-tier infrastructure and operational efficiency, directly linking payment and continued business to achieved metrics.

By consistently meeting or surpassing these performance benchmarks, Ferrovial demonstrates its reliability and commitment to excellence. This focus on measurable outcomes, such as on-time project completion or specific operational uptime percentages, builds significant client confidence and reinforces its standing as a trusted partner.

Ferrovial actively engages with communities surrounding its projects, fostering positive relationships through open dialogue and addressing local concerns. In 2024, the company continued its commitment to social responsibility by investing in initiatives that enhance local well-being and environmental protection, such as supporting community development programs and implementing sustainable practices on its construction sites.

Investor Relations and Transparent Communication

Ferrovial cultivates robust investor relations by prioritizing transparent and consistent communication. This involves providing a wealth of information through comprehensive annual reports, detailed financial results presentations, and direct investor calls. For instance, in 2023, Ferrovial’s revenue reached €15,156 million, a 13% increase compared to the previous year, demonstrating the company's financial trajectory which is crucial for investor understanding.

This commitment ensures that its diverse investor base, including individual investors and financial professionals, receives accurate and timely data on the company's performance, strategic direction, and future outlook. Maintaining this open dialogue is paramount for fostering and sustaining market confidence in Ferrovial's operations and growth potential.

- Annual Reports: Detailed financial and operational reviews.

- Financial Results Presentations: Regular updates on company performance.

- Investor Calls: Direct engagement with the investment community.

- Transparency: Key to building and maintaining market confidence.

User-Centric Solutions for End-Users

Ferrovial prioritizes the end-user experience across its infrastructure. For instance, at its airports, like Heathrow, the company focuses on enhancing passenger journeys through initiatives such as streamlined check-in processes and improved retail offerings, aiming to boost customer satisfaction and repeat usage. This user-centric approach is crucial for public acceptance and the long-term viability of its projects.

The company implements technologically advanced solutions to facilitate smoother interactions. On its toll roads, such as the 407 ETR in Canada, Ferrovial has invested in advanced electronic toll collection systems, reducing wait times and improving traffic flow for millions of commuters annually. By making these daily experiences more convenient, Ferrovial builds goodwill and reinforces the value of its infrastructure.

- Seamless Technology Integration: Implementing advanced payment systems like those on the 407 ETR, which saw over 200 million transactions in 2023, directly benefits commuters by reducing friction.

- Enhanced Passenger Experience: Investments in airport services, contributing to Heathrow's position as a leading global hub, focus on passenger comfort and efficiency.

- Data-Driven Improvements: Utilizing user feedback and operational data to continuously refine services, ensuring infrastructure meets evolving consumer needs.

- Public Acceptance and Loyalty: A strong focus on user satisfaction fosters positive public perception and encourages continued use of Ferrovial's assets.

Ferrovial's customer relationships are built on a foundation of reliability and performance, particularly with public sector clients. These partnerships are often long-term, cemented by successful project delivery and adherence to stringent Service Level Agreements. For example, in 2024, Ferrovial's continued management of a major toll road in Texas highlights the trust placed in its operational capabilities.

The company also prioritizes the end-user experience, integrating technology to enhance convenience and efficiency. Initiatives like advanced electronic tolling systems on assets such as the 407 ETR, which processed over 200 million transactions in 2023, directly improve daily commutes. Similarly, investments in airport services at hubs like Heathrow aim to elevate passenger satisfaction.

Transparent communication with investors is also a cornerstone, with detailed financial reporting and regular updates. Ferrovial's 2023 revenue of €15,156 million, a 13% increase, underscores its financial health and commitment to stakeholder confidence.

Community engagement is another key aspect, with Ferrovial investing in local well-being and environmental initiatives, as seen in its 2024 support for community development programs.

Channels

Ferrovial secures new projects and grows its portfolio by directly participating in competitive bidding for public-private partnerships (PPPs) and concessions. This direct engagement with government bodies and transportation agencies is crucial for winning major infrastructure deals. For instance, in 2024, Ferrovial was awarded the contract for the expansion of the I-77 highway in North Carolina, a significant PPP project in a key growth market.

Ferrovial frequently expands its global reach and strengthens its market position through strategic acquisitions of established infrastructure assets and companies. This approach allows for rapid market entry and immediate access to operational expertise and revenue streams. For instance, in 2023, Ferrovial completed the acquisition of a 15% stake in IRB Infrastructure Trust, a leading Indian toll road operator, further solidifying its presence in a key growth market.

Joint ventures are another cornerstone of Ferrovial's strategy, enabling the company to share risks and resources on large-scale projects. These collaborations are vital for undertaking complex infrastructure development, such as major highway construction or airport expansions. In 2024, Ferrovial continued to engage in various joint ventures for significant projects globally, leveraging the specialized skills and financial capacity of its partners to deliver critical infrastructure.

Ferrovial leverages its dedicated investor relations website, annual reports, and quarterly financial statements as primary channels to disseminate crucial information. These platforms offer detailed financial data and strategic updates, fostering transparency for shareholders and analysts. In 2023, Ferrovial reported revenues of €8,144 million, underscoring the importance of these reports in communicating financial performance.

Digital Platforms for Mobility Solutions

Ferrovial leverages digital platforms and mobile applications to deliver its innovative mobility solutions and connect with customers. These channels are crucial for enhancing user experience and streamlining service delivery.

A prime example is NextMove by Cintra, which offers digital solutions like the NextPass toll payment app. This app simplifies toll transactions, making them more convenient for users.

These digital channels not only boost user convenience and efficiency but also serve as a vital source for collecting data. This data is instrumental in driving operational improvements and refining future service offerings.

- Digital Engagement: Ferrovial utilizes mobile apps and online portals to interact directly with users of its mobility services.

- Streamlined Transactions: Platforms like NextMove's NextPass app simplify toll payments, reducing friction for drivers.

- Data-Driven Improvement: The data collected through these digital channels provides insights for optimizing operations and enhancing customer satisfaction.

- Future Mobility: These digital touchpoints are foundational for developing and scaling new mobility solutions.

Industry Conferences and Professional Networks

Ferrovial actively participates in key industry conferences and professional networks. These engagements are vital for showcasing its expertise in areas like sustainable infrastructure and digital transformation. For instance, in 2024, Ferrovial was a prominent participant at events such as the International Road Federation World Meeting and various European infrastructure forums, facilitating direct interaction with industry peers and potential clients.

These gatherings are instrumental in identifying emerging market trends and potential business development avenues. By connecting with other industry leaders and stakeholders, Ferrovial gains insights into new technologies and project opportunities, especially in sectors like renewable energy integration into transportation networks. Such participation helps in forging strategic partnerships and securing future contracts.

- Showcasing Capabilities: Ferrovial uses these platforms to highlight its advanced engineering and construction techniques, particularly in large-scale projects.

- Opportunity Identification: Conferences provide a direct channel to discover new project tenders and market demands, especially in sustainable infrastructure.

- Networking and Partnerships: Building relationships with potential clients, suppliers, and technology partners is a core objective.

- Industry Trend Awareness: Staying updated on technological advancements and regulatory changes is crucial for maintaining a competitive edge.

Ferrovial's channels for customer interaction and service delivery are increasingly digital, focusing on user convenience and data collection. This includes mobile applications and online portals that facilitate transactions and enhance the customer experience. For example, the NextPass app by Cintra streamlines toll payments, making them more efficient for drivers.

These digital platforms are not just about convenience; they are vital for gathering data that helps Ferrovial improve its operations and develop new mobility solutions. This data-driven approach is key to staying competitive in the evolving infrastructure sector.

Ferrovial also maintains direct communication with its stakeholders through investor relations websites and official reports, ensuring transparency regarding financial performance and strategic direction. In 2023, the company reported revenues of €8,144 million, a figure communicated through these channels.

The company actively engages in industry conferences and professional networks to showcase its expertise and identify new opportunities. In 2024, Ferrovial's participation in events like the International Road Federation World Meeting highlighted its commitment to sustainable infrastructure and digital transformation, fostering valuable industry connections.

Customer Segments

Government agencies and public authorities represent Ferrovial's core customer base. These national, regional, and local entities are tasked with the crucial functions of infrastructure planning, development, and procurement. They actively seek out private sector partners like Ferrovial to leverage specialized expertise and secure the necessary capital for ambitious, large-scale transportation projects such as highways, railways, and airports.

Ferrovial's strategic approach heavily emphasizes securing long-term concessions and Public-Private Partnership (PPP) contracts with these governmental clients. For instance, in 2023, Ferrovial's Infrastructure division, which largely serves this segment, reported revenues of €5,785 million, highlighting the significant reliance on government infrastructure spending.

Transportation authorities and municipalities are crucial clients for Ferrovial, seeking to enhance urban mobility and manage complex transit systems. These entities, responsible for everything from city bus routes to regional toll roads, rely on Ferrovial's expertise to optimize traffic flow and maintain vital infrastructure. For instance, in 2024, many cities are investing heavily in smart traffic management systems, with global spending projected to reach over $10 billion.

Ferrovial's solutions address the pressing need for efficient urban connectivity and infrastructure upkeep. They offer services that help municipalities tackle congestion, improve public transportation efficiency, and ensure the longevity of roads and bridges. This focus aligns with a growing global trend; by the end of 2023, over 50 major cities had implemented or were piloting advanced public transport ticketing systems, a key area where Ferrovial provides value.

Ferrovial actively collaborates with private developers, often entering into joint ventures for specific infrastructure and construction projects. These partnerships leverage combined expertise and risk-sharing, as seen in numerous public-private partnerships (PPPs) where private developers bring specialized skills and capital.

Institutional investors, such as pension funds and sovereign wealth funds, are key partners for Ferrovial, particularly in financing large-scale projects and acquiring stakes in completed, revenue-generating assets. For instance, in 2023, Ferrovial continued to attract significant investment from these entities for its portfolio of concessions, demonstrating their confidence in long-term infrastructure returns.

These relationships are vital for Ferrovial’s capital recycling strategy, allowing the company to free up capital from mature assets to reinvest in new development opportunities. In 2024, Ferrovial's asset rotation activities are expected to continue, with institutional investors being primary targets for the acquisition of operational assets, thereby fueling further growth and expansion.

Commuters and Commercial Transport Users (indirectly)

While not directly paying Ferrovial for services in many instances, the vast number of people using Ferrovial's infrastructure, like highways and airports, are a crucial customer segment. Their daily travel needs directly influence how Ferrovial designs and operates its services. This includes individual drivers looking for smooth commutes and businesses that depend on efficient transport for their goods.

The satisfaction of these users, the sheer volume of traffic, and the resulting toll revenues are intrinsically tied to this segment. For example, Ferrovial's airport operations, such as those at Glasgow and Aberdeen airports, serve millions of passengers annually. In 2023, Ferrovial's airport division reported a significant increase in passenger traffic, with numbers approaching pre-pandemic levels, underscoring the importance of this user base.

- Millions of daily users: Commuters and travelers are the lifeblood of Ferrovial's infrastructure assets.

- Efficiency and reliability: These users expect seamless and dependable journeys, impacting toll revenue and user satisfaction.

- Commercial impact: Businesses rely on Ferrovial's network for timely logistics, making infrastructure performance critical.

- Revenue linkage: Traffic volume and user experience directly translate into financial performance for Ferrovial.

Airlines and Airport Service Providers

Ferrovial's airport business caters to airlines, which are essential for passenger and cargo traffic, and various airport service providers such as ground handlers and retailers. These entities rely on Ferrovial's infrastructure to conduct their operations efficiently.

The company's commitment to developing and maintaining state-of-the-art facilities, exemplified by projects like the New Terminal One at JFK Airport, is a core strategy for attracting and securing long-term relationships with these crucial customers. High-quality infrastructure directly impacts airline operational costs and passenger experience.

In 2024, major airlines continued to focus on network expansion and operational efficiency, making airport infrastructure a key consideration in their route planning. For instance, airlines operating out of Ferrovial-managed airports benefit from modern check-in systems and streamlined baggage handling, which can reduce turnaround times.

- Airlines: Key customers requiring efficient passenger and cargo handling facilities.

- Airport Service Providers: Including ground handlers, retailers, and catering companies that operate within the airport ecosystem.

- Infrastructure Quality: Modern, well-maintained airports are critical for attracting and retaining these customer segments.

- JFK New Terminal One: A significant investment showcasing Ferrovial's commitment to high-quality airport development.

Ferrovial's customer base is diverse, primarily encompassing government entities and public authorities that commission large-scale infrastructure projects. These clients, responsible for national and regional development, partner with Ferrovial for its specialized expertise and capital. In 2023, Ferrovial's infrastructure division generated €5,785 million in revenue, underscoring the significant demand from this sector.

Additionally, transportation authorities and municipalities represent a key segment, seeking improvements in urban mobility and transit systems. Ferrovial provides solutions for congestion management and public transport efficiency, aligning with global trends where cities are investing in smart traffic systems, with projected spending exceeding $10 billion in 2024.

The company also engages with private developers through joint ventures and collaborates with institutional investors like pension funds and sovereign wealth funds for project financing and asset acquisition. This capital recycling strategy is crucial for Ferrovial's growth, with continued investor interest in operational assets anticipated in 2024.

Finally, the millions of daily users of Ferrovial's infrastructure, such as commuters and travelers, are an indirect but vital customer segment. Their experience directly impacts revenue through traffic volume and satisfaction, as evidenced by the recovery in passenger traffic at Ferrovial-managed airports in 2023, nearing pre-pandemic levels.

| Customer Segment | Key Needs | Ferrovial's Offering | 2023/2024 Relevance |

|---|---|---|---|

| Government Agencies & Public Authorities | Infrastructure development, specialized expertise, capital | Concessions, PPP contracts, large-scale project execution | €5,785M revenue for Infrastructure division (2023) |

| Transportation Authorities & Municipalities | Urban mobility enhancement, transit system management | Smart traffic solutions, public transport efficiency | Cities investing in smart traffic systems (>$10B projected spend 2024) |

| Private Developers | Expertise, risk-sharing, capital | Joint ventures, project collaboration | Ongoing partnerships for infrastructure projects |

| Institutional Investors | Long-term returns, portfolio diversification | Acquisition of operational assets, project financing | Continued interest in asset rotation and concessions (2024) |

| End Users (Commuters, Travelers) | Efficient, reliable transport, seamless journeys | Well-maintained highways, airports, and transit networks | Airport passenger traffic recovery (2023), impacting revenue |

Cost Structure

Ferrovial's cost structure is heavily influenced by significant capital expenditures for infrastructure development. These are the substantial investments needed to build new highways, airports, and other mobility assets, forming the core of its long-term value.

For instance, in 2023, Ferrovial reported capital expenditure of €1,721 million, with a significant portion allocated to ongoing projects like the expansion of Heathrow Airport and the development of the NTE35W highway in Texas. These are inherently capital-intensive ventures.

The financing for these massive undertakings typically involves a strategic mix of equity and debt. This approach allows Ferrovial to manage the financial burden and maintain a robust balance sheet while pursuing growth opportunities in essential infrastructure.

Ferrovial's cost structure is significantly shaped by the ongoing operating and maintenance expenses for its vast transportation infrastructure, including toll roads and airports. These costs encompass everything from routine road repairs and airport facility upkeep to the essential technology systems and personnel required for smooth, safe operations. For instance, in 2023, Ferrovial reported significant investments in maintaining its infrastructure assets, reflecting the substantial nature of these recurring expenditures.

Ferrovial's capital-intensive projects mean substantial financing costs, primarily interest on debt. In 2023, the company reported financial expenses of €422 million, reflecting the ongoing cost of servicing its debt obligations. Effectively managing these costs through strategic capital structuring and securing competitive borrowing rates is crucial for profitability.

Personnel Costs and Administrative Expenses

Ferrovial's cost structure is significantly shaped by its global workforce, encompassing salaries, benefits, and development programs. In 2023, the company reported personnel expenses of €2,280 million, reflecting its substantial investment in human capital across its diverse operations. This figure underscores the importance of managing its extensive team efficiently.

Beyond direct employee compensation, administrative expenses for corporate functions and business units represent another key cost area. These overheads are crucial for supporting Ferrovial's global infrastructure and service delivery. The company's commitment to an agile and efficient operating model aims to optimize these administrative outlays, contributing to overall profitability.

- Personnel Costs: €2,280 million in 2023, covering salaries, benefits, and training for a global workforce.

- Administrative Expenses: Essential for supporting corporate functions and business unit operations worldwide.

- Operational Efficiency: Effective management of human capital and administrative overhead is a strategic priority.

Research and Development for Innovation

Ferrovial's commitment to innovation is a significant component of its cost structure, with substantial investments directed towards research and development. These expenditures are primarily focused on pioneering new mobility solutions, driving digital transformation across its operations, and advancing sustainable infrastructure technologies. For instance, in 2023, Ferrovial continued to allocate resources to areas like AI-driven asset management and decarbonization initiatives, essential for future competitiveness.

These forward-looking investments, while impacting current costs, are critical for building future revenue streams and maintaining a competitive advantage in the evolving infrastructure and mobility sectors. The company’s R&D efforts are geared towards creating more efficient, sustainable, and technologically advanced solutions.

- Investment in R&D for innovative mobility solutions and digital transformation.

- Focus on sustainable infrastructure technologies, including AI for asset management and decarbonization.

- These are strategic, forward-looking costs essential for competitive edge and future revenue growth.

Ferrovial's cost structure is dominated by substantial capital expenditures for infrastructure development, such as highways and airports. These investments are crucial for long-term value creation.

Ongoing operating and maintenance expenses for its existing infrastructure also represent a significant cost. This includes routine upkeep, technology, and personnel necessary for safe and efficient operations.

Personnel costs, including salaries and benefits for its global workforce, are a major outlay. In 2023, these amounted to €2,280 million, highlighting the investment in human capital.

Financing costs, primarily interest on debt used to fund its capital-intensive projects, are another key element. Financial expenses were €422 million in 2023.

| Cost Category | 2023 Data (€ million) | Key Components |

|---|---|---|

| Capital Expenditures | 1,721 | New infrastructure development (e.g., highways, airports) |

| Personnel Costs | 2,280 | Salaries, benefits, training for global workforce |

| Financial Expenses | 422 | Interest on debt financing |

| Operating & Maintenance | Significant ongoing investments | Infrastructure upkeep, technology, operational personnel |

Revenue Streams

Ferrovial's primary revenue engine is toll collection from its extensive highway network, especially in North America. These user fees, influenced by traffic volume and dynamic pricing, offer a dependable income. For instance, the 407 ETR in Canada and various US Express Lanes are key contributors to this vital revenue stream.

Ferrovial's airport operations generate revenue through airline charges like landing and parking fees, alongside passenger-related fees. Concessions, which include retail and service outlets within the airport, also contribute significantly to this revenue stream.

A prime example of a revenue driver is the New Terminal One at JFK International Airport, a project expected to substantially boost Ferrovial's airport fee and concession income. In 2023, Ferrovial's airport division reported a revenue of €1,266 million, showcasing the importance of these income sources.

Ferrovial's construction arm is a major revenue engine, securing income by executing significant infrastructure projects for both external customers and its own concession developments. This encompasses the building of vital transportation networks like roads and railways, alongside other critical civil engineering endeavors.

The company's construction order book stands as a strong indicator of its future revenue-generating capacity within this division. As of the first quarter of 2024, Ferrovial reported a construction order book of €17.5 billion, showcasing a robust pipeline of upcoming work.

Dividends from Infrastructure Assets

Ferrovial generates substantial revenue through dividends derived from its ownership in various infrastructure assets. These investments, particularly in mature toll roads, offer a reliable and expanding stream of cash flow, significantly contributing to the company's overall financial health and its ability to reward shareholders.

In 2024, Ferrovial's strategic holdings in infrastructure assets yielded a notable €947 million in dividend income. This figure underscores the importance of these equity stakes as a core revenue driver.

- Dividend Income: Key revenue stream from equity stakes in infrastructure.

- Asset Maturity: Focus on established assets like toll roads for consistent cash flow.

- 2024 Performance: Received €947 million in dividends from infrastructure holdings.

- Shareholder Value: Dividends are a crucial element of shareholder returns.

Proceeds from Asset Divestments

Proceeds from asset divestments represent a significant, albeit less consistent, revenue source for Ferrovial. This involves selling off infrastructure assets that are considered mature or no longer central to the company's long-term strategy. These transactions can unlock substantial capital, which is then strategically redeployed into new ventures and growth initiatives.

In 2023, Ferrovial completed the sale of its 25% stake in the UK's Heathrow Airport for approximately €2.4 billion. This move aligns with the company's strategy to focus on its core activities and invest in new development projects.

- Strategic Asset Rotation: Ferrovial actively manages its portfolio by divesting non-core or mature infrastructure assets.

- Capital Generation: These divestments are designed to generate substantial capital for reinvestment.

- Example: Heathrow Sale: The sale of its Heathrow Airport stake in 2023 for around €2.4 billion exemplifies this revenue stream.

- Focus on Growth: The capital raised is crucial for funding new projects and expanding into emerging markets.

Ferrovial's revenue streams are diverse, encompassing toll road operations, airport management, construction services, and income from strategic investments. The company also generates capital through the divestment of certain assets.

Toll roads remain a cornerstone, with significant contributions from North American networks like the 407 ETR and US Express Lanes. Airport operations benefit from airline and passenger fees, as well as concessions, with the New Terminal One at JFK being a key growth driver. The construction division, bolstered by a €17.5 billion order book as of Q1 2024, executes major infrastructure projects.

Furthermore, Ferrovial's portfolio of infrastructure assets, particularly mature toll roads, provides substantial dividend income, amounting to €947 million in 2024. Strategic divestments, such as the 2023 sale of its Heathrow Airport stake for €2.4 billion, also contribute significant capital for reinvestment.

| Revenue Stream | Key Activities | 2024 Data/Notes |

| Toll Roads | Operation of highway networks, user fees | Major contributor, e.g., 407 ETR (Canada) |

| Airport Operations | Airline/passenger fees, concessions | €1,266 million revenue in 2023; JFK New Terminal One |

| Construction | Infrastructure project execution | €17.5 billion order book (Q1 2024) |

| Dividend Income | Income from infrastructure asset holdings | €947 million in 2024 |

| Asset Divestments | Sale of mature or non-core assets | €2.4 billion from Heathrow sale (2023) |

Business Model Canvas Data Sources

The Ferrovial Business Model Canvas is built upon a foundation of comprehensive financial reports, detailed market research, and internal operational data. These diverse sources ensure each component of the canvas is informed by accurate and relevant information.