Ferrovial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

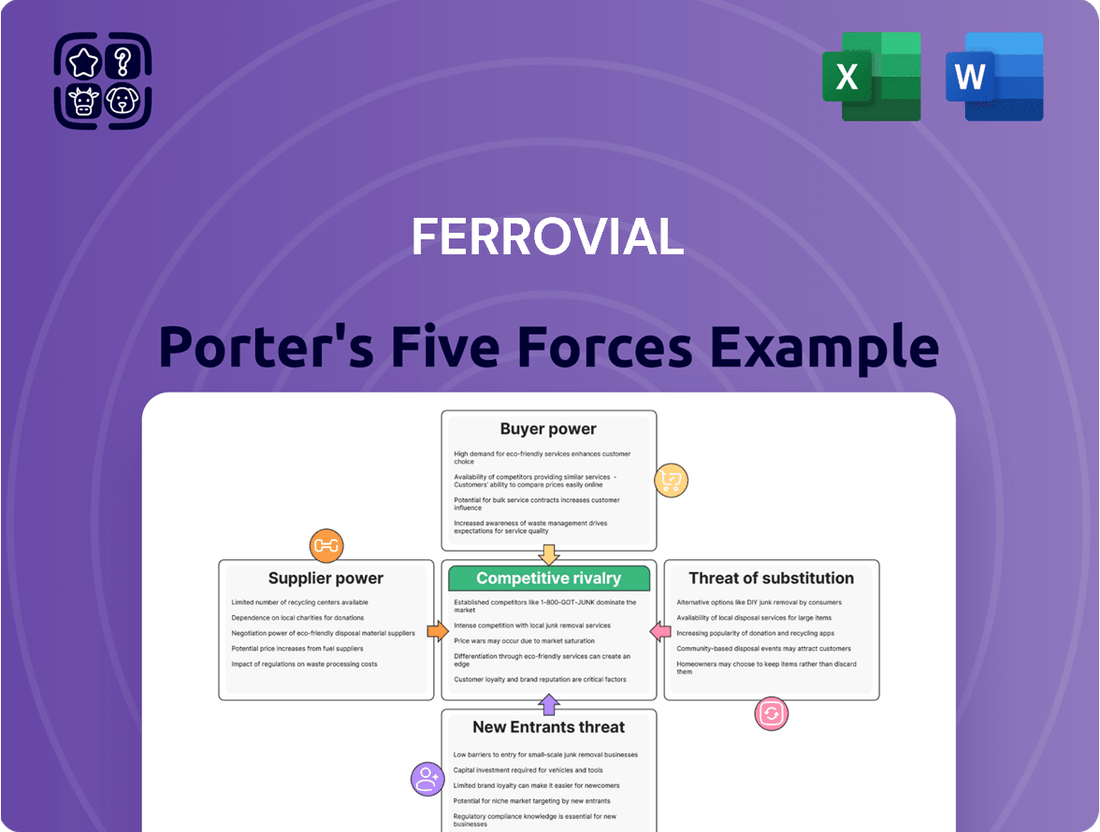

Ferrovial navigates a landscape shaped by intense rivalry and significant buyer power, with the threat of substitutes also posing a considerable challenge. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis dives deep into each of these pressures, offering a comprehensive strategic overview of Ferrovial’s competitive environment.

Ready to move beyond the basics? Get a full strategic breakdown of Ferrovial’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Ferrovial's reliance on essential construction materials like concrete, steel, and asphalt means suppliers hold significant sway. The availability and cost of these commodities are key determinants of their bargaining power. For instance, in early 2024, global steel prices saw volatility due to production adjustments and demand shifts, directly impacting Ferrovial's material procurement costs.

Suppliers of specialized heavy machinery and construction equipment, along with their maintenance services, wield considerable bargaining power over Ferrovial. These are typically high-value, long-term investments, and the scarcity of specific technologies or patented equipment can restrict Ferrovial's options, potentially driving up costs or resulting in less advantageous contract terms.

The availability of highly skilled labor, such as specialized engineers and project managers, significantly influences supplier power for companies like Ferrovial. A scarcity of this expertise, especially in crucial markets, can lead to increased labor costs and potential delays in project execution, particularly for large-scale infrastructure projects. For instance, in 2024, the global shortage of skilled construction workers was a prominent concern, impacting project bids and the overall cost of capital for major developments.

Supplier Power 4

Financial institutions are key suppliers for Ferrovial, offering vital project financing, bonds, and capital market services. The substantial capital required for infrastructure projects amplifies their influence. For instance, in 2023, global infrastructure investment reached an estimated $1.5 trillion, highlighting the sheer scale of funding needs.

Ferrovial's dependence on external funding means that the terms set by these financial institutions, including interest rates and lending criteria, directly impact project feasibility and profitability. Access to a diverse range of funding sources can mitigate this supplier power.

- Capital Intensity: Infrastructure projects demand significant upfront capital, making financial institutions indispensable partners.

- Funding Reliance: Ferrovial's business model necessitates substantial reliance on debt and equity markets for project execution.

- Interest Rate Sensitivity: Fluctuations in interest rates, a key pricing element from financial suppliers, directly affect the cost of capital.

- Market Access: The ability of financial institutions to provide access to diverse and competitive funding sources is a critical factor in their bargaining power.

Supplier Power 5

The bargaining power of suppliers for Ferrovial is growing, particularly concerning technology and software providers. Companies offering advanced solutions for project management, digital twins, and smart infrastructure are becoming crucial partners. As Ferrovial increasingly relies on these specialized technologies, the unique and proprietary nature of their offerings can significantly enhance their leverage in negotiations.

This trend is evident as infrastructure projects become more complex and data-driven. For instance, the global market for digital twins in construction was projected to reach $10.5 billion in 2024, indicating the substantial value and demand for such advanced solutions. Suppliers of these critical technologies can command higher prices or more favorable contract terms due to their indispensable role in optimizing Ferrovial's operations and project delivery.

- Increasing reliance on specialized technology: Ferrovial's adoption of digital twins and AI for project management elevates the importance of tech suppliers.

- Proprietary solutions create leverage: Unique software and advanced platforms give these suppliers a distinct advantage in negotiations.

- Market growth in construction tech: The digital twin market in construction is expanding rapidly, underscoring the value of these providers.

- Potential for higher costs: As technology becomes more integrated, the cost of acquiring and maintaining these advanced solutions could increase.

Suppliers of essential construction materials like steel and asphalt can exert considerable influence due to market price volatility. For example, in early 2024, global steel prices fluctuated, directly impacting Ferrovial's procurement costs. Similarly, specialized machinery providers, particularly those with proprietary technology, hold significant leverage, as acquiring and maintaining such equipment represents a substantial investment for Ferrovial.

The bargaining power of suppliers is amplified by the capital-intensive nature of infrastructure projects, making financial institutions crucial partners. Ferrovial's reliance on debt and equity markets means that interest rates and lending criteria set by these institutions directly influence project feasibility. The global infrastructure investment market, estimated at $1.5 trillion in 2023, highlights the scale of capital needs and the power of financial suppliers.

Technology and software providers are increasingly influential suppliers for Ferrovial, offering advanced solutions for project management and smart infrastructure. The growing complexity and data-driven nature of projects, exemplified by the projected $10.5 billion global market for digital twins in construction in 2024, mean these suppliers' unique offerings can command higher prices and more favorable terms.

| Supplier Type | Key Influence Factor | Example/Data Point (2024 Focus) |

|---|---|---|

| Material Suppliers (Steel, Asphalt) | Market Price Volatility | Global steel price fluctuations in early 2024 impacted procurement costs. |

| Specialized Equipment Providers | Proprietary Technology, High Capital Cost | Scarcity of specific patented construction machinery limits options. |

| Financial Institutions | Capital Intensity, Interest Rate Sensitivity | Global infrastructure investment reached $1.5 trillion in 2023; interest rates affect cost of capital. |

| Technology/Software Providers | Unique Solutions, Data-Driven Project Needs | Digital twin market in construction projected at $10.5 billion in 2024; critical for project optimization. |

What is included in the product

This analysis delves into the competitive forces impacting Ferrovial, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its operational sectors.

Instantly identify and mitigate competitive threats by visualizing the interplay of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Ferrovial's primary customers, including government bodies and large private developers, wield significant bargaining power. This stems from the immense scale of infrastructure projects, often involving multi-billion euro contracts, and the rigorous competitive bidding processes that characterize these sectors.

These powerful buyers can dictate project terms, exact specifications, and stringent regulatory compliance, effectively shaping the value chain. For instance, in 2023, Ferrovial secured a €1.1 billion ($1.2 billion) contract for the High-Speed Rail Link in Spain, where the public authority set the precise technical and operational requirements.

For Ferrovial's airport operations, airlines and cargo carriers hold considerable bargaining power. This is primarily driven by the sheer volume of traffic they generate, which is a critical revenue source. For instance, in 2023, major carriers at airports managed by Ferrovial, such as Heathrow or Glasgow, represent a substantial portion of passenger and cargo throughput.

The availability of alternative airports also significantly influences their leverage. If airlines have viable competing airports within a reasonable distance, they can more effectively negotiate terms like landing fees and gate allocation with Ferrovial. This competitive landscape forces Ferrovial to remain price-sensitive and service-oriented to retain these key customers.

Furthermore, the ability of airlines to negotiate favorable terms on service charges, including passenger fees and infrastructure usage, directly impacts Ferrovial's profitability. In 2024, ongoing discussions around airport charges at several European hubs highlight the persistent nature of this buyer power, as airlines seek to optimize their operational costs.

While Ferrovial's direct customers are often governments or public entities, the ultimate end-users of its infrastructure, like drivers on toll roads or travelers at airports, hold indirect bargaining power. Widespread public dissatisfaction with toll hikes or service fees can pressure governments, influencing the terms of concessions and Ferrovial's ability to set prices. For instance, in 2024, public outcry over proposed toll increases on certain highways in Spain led to renegotiations, demonstrating this consumer influence.

Buyer Power 4

In public-private partnerships (PPPs), the contracting public entity wields significant buyer power. This is because they dictate the project's scope, establish performance benchmarks, and typically retain ownership of the underlying asset, giving them substantial leverage over companies like Ferrovial.

Ferrovial's financial and operational results are directly influenced by the public entity's capacity to enforce contractual stipulations and levy penalties for any deviations from agreed-upon terms. This dynamic underscores the critical importance of meticulously structured contracts in managing the risks associated with PPPs.

- Public Entity Control: Contracting governments define project scope and performance, retaining asset ownership.

- Contractual Enforcement: The ability to impose penalties for non-compliance directly impacts Ferrovial's outcomes.

- Asset Ownership: Retaining ownership provides public entities with inherent leverage in negotiations.

- Risk Mitigation: Clear contract terms are essential for managing the risks posed by strong buyer power.

Buyer Power 5

Ferrovial's large corporate clients, particularly those seeking custom mobility or infrastructure solutions for their facilities, wield significant bargaining power. Their ability to negotiate for bespoke services and the sheer volume of their contracts mean they can significantly influence pricing and terms. This is amplified by the availability of alternative infrastructure providers, fostering competitive bidding processes.

The power of these corporate buyers is evident in their capacity to demand tailored solutions, which often involves intricate project specifications and service level agreements. For instance, a major industrial park developer might require integrated logistics, smart traffic management, and sustainable energy infrastructure, all designed to their unique operational needs. This level of customization inherently gives them leverage in negotiations.

- Large contract values: Corporate clients often commit to multi-year, high-value contracts, giving them substantial negotiating weight.

- Choice of providers: The presence of multiple infrastructure and mobility service providers allows these clients to solicit competitive bids, driving down costs.

- Bespoke solution requirements: The need for highly customized solutions means clients can dictate specific features and performance metrics, further enhancing their bargaining position.

- Potential for backward integration: In some cases, very large clients might explore developing certain infrastructure capabilities in-house, creating a credible threat to outsourcing providers.

Ferrovial's customers, particularly governments and large private developers, possess considerable bargaining power due to the massive scale of infrastructure projects and competitive bidding. This allows them to dictate terms, specifications, and regulatory compliance, as seen in the €1.1 billion High-Speed Rail Link contract awarded in Spain in 2023, where the public authority set precise requirements.

Airlines and cargo carriers at Ferrovial-managed airports also exert significant influence, driven by their substantial traffic volumes. For example, major carriers at Heathrow and Glasgow airports in 2023 represent a large portion of passenger and cargo throughput. The availability of alternative airports further strengthens their negotiating position on fees and gate allocations, compelling Ferrovial to prioritize competitive pricing and service quality.

In 2024, ongoing negotiations over airport charges at European hubs highlight the persistent buyer power of airlines aiming to optimize operational costs. Indirectly, end-users like drivers and travelers can influence pricing through public sentiment, which can pressure governments to renegotiate concession terms, as evidenced by public opposition to proposed toll increases on Spanish highways in 2024 leading to renegotiations.

Corporate clients seeking tailored mobility and infrastructure solutions also wield strong bargaining power through large contract values and the availability of alternative providers. Their demand for bespoke services, including integrated logistics and smart traffic management, allows them to negotiate specific features and performance metrics, enhancing their leverage.

| Customer Segment | Key Bargaining Power Factors | Examples/Data Points |

| Government Bodies/Public Entities | Scale of projects, competitive bidding, asset ownership, contractual enforcement | €1.1 billion HSR contract (2023), PPP concessions |

| Airlines & Cargo Carriers | Traffic volume, alternative airport availability, cost optimization needs | Major carriers at Heathrow/Glasgow (2023), airport charges negotiations (2024) |

| Large Corporate Clients | Large contract values, choice of providers, bespoke solution requirements | Demand for integrated logistics, smart traffic management |

| End-Users (Indirect) | Public sentiment, potential for consumer backlash | Public opposition to toll increases (Spain, 2024) |

Preview the Actual Deliverable

Ferrovial Porter's Five Forces Analysis

This preview shows the exact Ferrovial Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed analysis is fully formatted and ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

Competitive rivalry in the global infrastructure sector is notably intense, with a concentrated group of major players frequently vying for significant projects. Companies like Vinci, ACS, Bouygues, and Bechtel are direct competitors to Ferrovial, particularly in securing high-value, long-term concessions. This concentrated competition means that bidding processes for lucrative projects are often highly contested, driving down margins and demanding exceptional execution capabilities from all involved parties.

Competitive rivalry within the infrastructure sector, particularly for large-scale projects like those Ferrovial engages in, extends far beyond simple price competition. Companies differentiate themselves through a blend of technical expertise, robust financial capacity, a proven track record of successful project delivery, and a sophisticated ability to manage the inherent complexities and risks of major infrastructure development. For instance, in 2024, major global construction firms are increasingly emphasizing their ESG credentials and digital transformation capabilities as key differentiators.

The competitive rivalry within the infrastructure sector, particularly for new concessions, is fierce. Ferrovial, like its peers, faces numerous international consortia bidding for the same lucrative projects. This intense competition, a hallmark of the industry, naturally compresses profit margins.

The sheer volume of investment required for bid preparation further intensifies this rivalry. For instance, major infrastructure projects often see dozens of consortia submitting proposals, each incurring substantial costs for engineering studies, financial modeling, and legal expertise, all before a single contract is awarded.

Competitive Rivalry 4

Competitive rivalry within the infrastructure sector is intensifying, particularly as developed economies show signs of market saturation. This prompts companies like Ferrovial to actively pursue growth in emerging markets, where the competitive landscape, while different, remains robust. Success hinges on a firm's capacity to skillfully manage a variety of regulatory frameworks and cultivate strong local partnerships.

The ability to adapt to diverse operating environments is paramount. For instance, in 2024, infrastructure development in Southeast Asia, a key growth region, saw significant investment, but also presented challenges related to differing legal structures and local content requirements. Companies that can effectively navigate these complexities gain a distinct advantage.

- Geographic Diversification Strategy: Companies are increasingly looking beyond mature markets to emerging economies for new projects and revenue streams.

- Regulatory Navigation: Expertise in understanding and complying with varied international regulations is a critical differentiator.

- Local Partnerships: Building strong relationships with local entities is essential for market entry and operational success.

- Emerging Market Competition: While offering growth, emerging markets also present substantial competition from both established global players and emerging local champions.

Competitive Rivalry 5

The infrastructure sector, where Ferrovial operates, is characterized by intense competition for new projects. While long project cycles and high asset specificity can reduce rivalry once a contract is secured, the initial bidding process is fierce. Companies like ACS Group, Vinci, and Bouygues are significant global competitors, constantly vying for lucrative infrastructure development and concessions.

This rivalry is driven by the substantial capital investment required and the limited number of large-scale projects available at any given time. For instance, major projects like airport expansions or high-speed rail lines attract numerous international bidders, increasing the pressure on pricing and efficiency during the tender phase. Ferrovial's ability to secure these contracts often depends on its technological innovation, financial strength, and proven track record.

The competition extends beyond mere project acquisition to operational efficiency and innovation. Companies are constantly seeking ways to optimize construction processes, reduce costs, and improve the long-term performance of infrastructure assets. This includes adopting new technologies for project management and maintenance, aiming to gain a competitive edge in future bidding rounds.

- Intense Bidding Wars: Major infrastructure tenders, such as the recent expansion projects for airports like London Heathrow or major highway developments in North America, often see multiple global players submitting bids, leading to significant price competition.

- Focus on Execution: Once a project is awarded, the competitive landscape shifts to efficient project delivery and operational excellence, where firms like Ferrovial are judged on their ability to complete projects on time and within budget.

- Technological Advancement: Competitors are investing heavily in digital technologies and sustainable construction methods to differentiate themselves and improve profitability in a sector with historically tight margins.

- Global Market Presence: Companies like Ferrovial, ACS, Vinci, and Hochtief maintain a significant global presence, meaning competition is not confined to domestic markets but extends across continents for major infrastructure opportunities.

Competitive rivalry in the infrastructure sector is intense, with global giants like Vinci, ACS, and Bouygues frequently competing with Ferrovial for major projects. This high level of competition, especially for large concessions, drives down profit margins and necessitates exceptional project execution. For instance, in 2024, the bidding for significant airport and rail projects across Europe and North America saw numerous consortia, each incurring substantial pre-award costs.

Companies differentiate themselves through technical expertise, financial strength, and a strong track record, with ESG and digital transformation becoming key competitive factors in 2024. This rivalry extends to operational efficiency and technological innovation, as firms aim to gain an edge in future tenders.

| Competitor | Key Strengths | 2023 Revenue (Approx.) |

|---|---|---|

| Vinci | Diversified operations, strong concessions | €68.7 billion |

| ACS Group | Global presence, strong construction | €36.1 billion |

| Bouygues | Diversified construction and media | €56.2 billion |

SSubstitutes Threaten

For highway infrastructure, the primary substitutes are alternative modes of transportation like rail, public transit, and air travel for longer distances. Government investments in these alternatives can decrease reliance on road networks, potentially affecting toll road revenues.

The increasing adoption of remote work and virtual conferencing presents a significant threat of substitution for traditional transportation infrastructure. As more companies embrace flexible work arrangements, the demand for business travel, and consequently, air and road infrastructure, could diminish. For instance, by the end of 2024, it's estimated that over 30% of the workforce will be working remotely at least part-time, a substantial increase from pre-pandemic levels.

Similarly, the continued growth of e-commerce directly substitutes for physical retail and the associated logistics networks. This shift impacts not only the need for new roads and distribution centers but also potentially reduces the demand for passenger transport as people opt for online shopping. Global e-commerce sales are projected to reach trillions of dollars in 2024, underscoring the scale of this behavioral change.

Advances in smart city technologies offer a significant threat of substitution for traditional infrastructure development. For instance, intelligent traffic management systems implemented in cities like Singapore have demonstrated the ability to optimize existing road networks, potentially delaying or negating the need for costly new construction. This focus on efficiency can act as a substitute for expanding physical capacity.

Congestion pricing models, like those in London or Stockholm, also present a substitute by managing demand for infrastructure. By charging drivers to enter busy areas, these systems encourage shifts to public transport or off-peak travel, thereby reducing strain on roads without requiring new builds. In 2023, London's Ultra Low Emission Zone expansion, a form of demand management, generated over £300 million in revenue, highlighting the financial impact of such strategies.

Threat of Substitution 4

For airports, the threat of substitutes is generally low for long-haul travel, as few alternatives offer comparable speed and reach. However, for regional travel, high-speed rail networks present a growing substitute. For instance, in Europe, the expansion of high-speed rail lines, such as France's TGV or Germany's ICE, directly competes with short-haul flights, offering comparable or even faster journey times door-to-door for many city pairs.

The emergence of advanced air mobility, like electric Vertical Take-Off and Landing (eVTOL) aircraft, could also introduce new substitute options for short-distance air travel. While still in development, these could eventually offer alternatives to traditional short-haul flights or even ground transportation for specific routes, potentially impacting airport passenger volumes on shorter legs.

- High-Speed Rail Competition: Major European high-speed rail networks, such as the Eurostar connecting London and Paris, offer competitive travel times and convenience, directly substituting for short-haul air travel on these popular routes.

- Advancements in Ground Transport: Continued investment in and improvement of high-speed rail infrastructure globally is likely to increase its attractiveness as a substitute for air travel, especially for journeys under 500 miles.

- Emerging Air Mobility: The development and eventual deployment of eVTOLs for urban air mobility could create new substitute options for regional and inter-city travel, potentially diverting passengers from traditional airport services on shorter routes.

Threat of Substitution 5

The threat of substitutes for Ferrovial is evolving, particularly within the broader mobility infrastructure landscape. As shared mobility services gain traction, and autonomous and micro-mobility solutions emerge, the demand for traditional private vehicle infrastructure could decrease. This shift might favor different urban infrastructure designs or reduce the necessity for extensive parking facilities.

For example, ride-sharing platforms like Uber and Lyft, which saw significant growth in 2024, offer an alternative to private car ownership and the infrastructure that supports it. Similarly, the increasing adoption of electric scooters and bikes in urban centers, often facilitated by companies like Bolt, provides a substitute for short-distance car travel and the associated road and parking needs.

- Shared Mobility: Services like car-sharing and ride-hailing offer alternatives to private vehicle ownership, potentially reducing demand for traditional road infrastructure.

- Autonomous Vehicles: While still developing, the eventual widespread adoption of AVs could alter traffic patterns and parking requirements.

- Micro-mobility: The rise of e-scooters and e-bikes provides convenient substitutes for short urban trips, impacting the need for extensive car parking.

- Public Transportation Enhancements: Investments in efficient and accessible public transport systems also serve as a substitute for private car usage.

The threat of substitutes for Ferrovial is multifaceted, encompassing shifts in transportation modes and evolving urban mobility solutions. Alternative transport, like high-speed rail for regional travel and virtual conferencing for business, directly competes with infrastructure investments. Furthermore, the rise of shared mobility and micro-mobility services offers alternatives to private vehicle ownership, potentially altering the demand for traditional road and parking infrastructure.

| Substitute Type | Example | Impact on Ferrovial |

|---|---|---|

| Alternative Transportation Modes | High-speed rail (e.g., Eurostar) | Reduces demand for short-haul flights, affecting airport services. |

| Virtualization | Remote work, video conferencing | Decreases business travel, impacting road and air infrastructure usage. Over 30% of the workforce expected to work remotely part-time by end of 2024. |

| Shared & Micro-mobility | Ride-sharing (Uber, Lyft), e-scooters | Reduces reliance on private vehicles, potentially impacting road construction and parking demand. Global ride-sharing market projected to grow significantly in 2024. |

| Smart City Technologies | Intelligent traffic management | Optimizes existing infrastructure, potentially delaying or negating new construction needs. |

Entrants Threaten

The infrastructure sector, where Ferrovial operates, presents a formidable barrier to new entrants due to its exceptionally high capital requirements. Undertaking large-scale projects necessitates substantial upfront investment for bidding processes, construction, and securing long-term financing, effectively deterring smaller or less capitalized firms from entering the market.

The threat of new entrants in the infrastructure sector, particularly for companies like Ferrovial, is significantly mitigated by extensive regulatory hurdles. These include complex permitting processes and the absolute necessity for government approvals at various stages of project development and operation. For instance, securing the necessary environmental impact assessments and construction permits can take years and involve substantial legal and consulting fees, effectively deterring smaller or less experienced players.

Navigating these intricate legal and environmental frameworks presents a formidable challenge for any new entrant. The sheer volume of compliance requirements, from safety standards to land-use regulations, demands specialized expertise and considerable financial resources. This complexity means that potential new competitors must invest heavily in understanding and adhering to these rules, a cost and time commitment that acts as a powerful barrier to entry.

The threat of new entrants for Ferrovial remains moderate. Established players like Ferrovial have cultivated deep industry expertise and a strong reputation over many years. For instance, Ferrovial's long history in infrastructure development, including significant projects like the M-30 ring road in Madrid, demonstrates this accumulated knowledge and operational capability. This experience translates into proven track records and robust relationships with government bodies and financial institutions, which are crucial for securing large-scale concessions.

Newcomers often struggle to replicate this level of trust and established network. Building the necessary credibility and access to financing for major infrastructure projects, which can run into billions of euros, presents a significant barrier. For example, the bidding process for large public-private partnerships often favors entities with a demonstrated history of successful project delivery and strong financial backing, areas where incumbents like Ferrovial typically hold an advantage.

Threat of New Entrants 4

The threat of new entrants in the infrastructure sector, particularly for companies like Ferrovial, is generally considered moderate to low. This is largely due to the significant capital requirements and established economies of scale that benefit existing players. For instance, in 2024, major infrastructure projects often involve billions of dollars in upfront investment, creating a substantial barrier for newcomers. Incumbents can leverage their size to negotiate better terms with suppliers and spread fixed costs across a larger operational base, giving them a distinct cost advantage.

Economies of scope also play a vital role, allowing large companies to manage diverse projects and share resources efficiently. This integrated approach makes it difficult for new entrants to compete on price and operational effectiveness. Ferrovial, for example, benefits from its experience in various infrastructure segments, from toll roads to airports and construction, allowing for cross-project synergies.

Furthermore, regulatory hurdles and the need for specialized expertise and certifications act as additional deterrents. Obtaining permits and navigating complex legal frameworks can be time-consuming and costly.

- High Capital Investment: Infrastructure projects demand substantial upfront capital, often in the billions, deterring new entrants.

- Economies of Scale: Large incumbents like Ferrovial benefit from lower per-unit costs due to their size and volume of operations.

- Economies of Scope: Diversified infrastructure portfolios allow established firms to share resources and expertise across different project types.

- Regulatory and Expertise Barriers: Navigating permits, licenses, and possessing specialized knowledge are significant challenges for new players.

Threat of New Entrants 5

The threat of new entrants in the infrastructure sector, particularly for companies like Ferrovial, is significantly mitigated by the industry's inherent characteristics. Long project lifecycles, often spanning decades, coupled with the highly specialized and unique nature of infrastructure assets, demand more than just initial construction prowess. Newcomers must demonstrate robust long-term operational and maintenance capabilities, a significant barrier to entry.

This comprehensive lifecycle requirement necessitates substantial upfront investment in specialized equipment, skilled labor, and sophisticated management systems. For instance, in 2024, major infrastructure projects globally continued to require substantial capital, with the World Economic Forum highlighting the ongoing need for trillions in investment. This deep financial commitment and the need for proven expertise in managing assets over their entire lifespan deter less experienced or undercapitalized entities from entering.

Furthermore, regulatory hurdles and the need for extensive experience in navigating complex permitting processes and securing financing for large-scale projects add further layers of difficulty. Companies that have a track record of successfully delivering and maintaining similar infrastructure projects, like Ferrovial, possess an established reputation and operational know-how that is difficult for new entrants to replicate quickly.

- High Capital Requirements: Infrastructure projects demand massive upfront investment, making it difficult for new players to compete.

- Long Project Lifecycles: The extended duration of projects requires sustained operational and maintenance expertise, a significant barrier.

- Specialized Expertise: Successful entry necessitates not only construction skills but also deep knowledge in managing and maintaining unique infrastructure assets.

- Regulatory and Permitting Complexity: Navigating intricate regulatory landscapes and securing necessary approvals is a substantial challenge for new entrants.

The threat of new entrants for Ferrovial is generally low due to substantial barriers. High capital requirements, often in the billions for major projects, are a primary deterrent. For example, in 2024, the cost of developing large-scale infrastructure like high-speed rail or major airport expansions continues to necessitate significant upfront investment, making it prohibitive for smaller firms.

Established players benefit from economies of scale and scope, spreading fixed costs and leveraging expertise across diverse projects. This allows them to offer more competitive pricing. Furthermore, navigating complex regulatory environments, including obtaining permits and licenses, demands specialized knowledge and considerable time, acting as a significant hurdle for newcomers seeking to enter the infrastructure sector.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions of dollars needed for bidding, construction, and financing. | Very High Deterrent |

| Regulatory Hurdles | Complex permitting, environmental assessments, and government approvals. | High Deterrent |

| Economies of Scale/Scope | Established players have lower costs and shared resources. | Moderate Deterrent |

| Industry Experience & Reputation | Proven track records and established relationships are crucial. | High Deterrent |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ferrovial leverages data from company annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.