Ferrovial Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

Ferrovial's marketing mix is a strategic powerhouse, finely tuning its product offerings, competitive pricing, expansive distribution, and impactful promotion to dominate the infrastructure and services sector. This analysis reveals how these elements create a cohesive and powerful market presence.

Dive deeper into Ferrovial's sophisticated approach to Product, Price, Place, and Promotion. Gain actionable insights and a ready-to-use framework to elevate your own marketing strategies.

Product

Ferrovial's highways and toll roads are a core product, offering essential infrastructure for global mobility. These projects involve the full spectrum of development, from financing and construction to long-term operation and maintenance. The company managed approximately 2,500 kilometers of toll roads globally as of its 2023 annual report, generating significant revenue through user fees.

The emphasis is on creating efficient and user-friendly transportation networks. This includes investing in technology for smoother traffic flow and improved customer experiences. For instance, Ferrovial's commitment to innovation was evident in its 2024 plans to further integrate smart technologies across its highway portfolio, aiming to enhance safety and reduce congestion.

Ferrovial is a significant force in airport management and aviation infrastructure, actively developing, owning, and managing key global hubs. This focus directly addresses the Product element of their marketing mix by providing essential services that enhance air travel connectivity and optimize passenger and cargo movement.

The company's commitment extends to expanding capacity and improving operational efficiency, crucial for meeting the projected 4.3 billion global air passengers in 2024. Ferrovial's expertise encompasses critical components like terminals, runways, and both airside and landside facilities, ensuring a smooth travel experience.

In 2023, Ferrovial Airports reported a substantial 17.2% increase in passenger traffic across its portfolio, reaching 154.4 million passengers. This growth underscores the demand for their airport management services and their ability to cater to a recovering and expanding aviation market.

Ferrovial's product offering in urban mobility and smart infrastructure is expanding significantly, moving beyond traditional road construction. This encompasses investments in public transport systems, like bus rapid transit (BRT) and light rail, alongside the development of smart city technologies. For instance, Ferrovial's participation in the $1.1 billion expansion of the Sydney Metro in Australia highlights its commitment to large-scale public transit projects.

The company is actively developing solutions for efficient urban connectivity, focusing on sustainability and the integration of advanced technologies. This includes smart traffic management systems and digital platforms designed to optimize the flow of people and goods within cities. Ferrovial's acquisition of Canadian infrastructure firm WSP's P3 business in 2023, which included smart city consulting, further solidifies this strategic direction.

Integrated Infrastructure Lifecycle Services

Ferrovial's Integrated Infrastructure Lifecycle Services represent its product offering, covering the full spectrum of infrastructure development and management. This means they're involved from the initial idea stage right through to the eventual removal or repurposing of an asset.

This comprehensive approach includes crucial stages like design, actual construction, securing the necessary financing, and the ongoing operation and maintenance of the infrastructure. By managing all these phases, Ferrovial aims to deliver a seamless experience for its clients.

The benefit of this end-to-end service is significant. It helps ensure that infrastructure assets are built to last, perform at their best throughout their operational life, and generate reliable revenue for clients and partners. For instance, Ferrovial's involvement in projects like the Sydney Gateway in Australia, which commenced construction in 2021 and is projected to open in 2024, showcases their commitment to delivering complex infrastructure from inception to completion, contributing to long-term economic benefits.

- End-to-End Service: Covers design, construction, financing, operation, and maintenance.

- Asset Longevity: Focuses on maximizing the lifespan and performance of infrastructure.

- Revenue Predictability: Aims to provide stable income streams for clients through managed assets.

- Project Scope: Exemplified by large-scale projects like the Sydney Gateway, demonstrating integrated management capabilities.

Sustainable and Resilient Infrastructure Development

Ferrovial's product strategy centers on sustainable and resilient infrastructure development, integrating Environmental, Social, and Governance (ESG) principles throughout project lifecycles. This commitment ensures assets are not only functional but also beneficial to communities and capable of enduring future environmental and social shifts. For instance, Ferrovial's 2023 sustainability report highlighted a 20% reduction in Scope 1 and 2 emissions compared to 2018, demonstrating tangible progress in their environmental stewardship.

The company actively incorporates climate adaptation and mitigation measures into its designs. This includes utilizing low-carbon materials and implementing circular economy principles to minimize waste and resource consumption. Ferrovial's ongoing projects, such as the E63 motorway upgrade in Finland, are designed with enhanced drainage systems and biodiversity corridors to improve resilience against extreme weather events and protect local ecosystems.

- ESG Integration: Ferrovial embeds ESG criteria from initial design through to operational phases, focusing on long-term value creation.

- Resilience Focus: Projects are engineered to withstand climate change impacts and natural disasters, ensuring operational continuity.

- Environmental Performance: A key objective is reducing the carbon footprint of infrastructure, evidenced by their 2023 emission reduction targets.

- Community Benefit: Infrastructure development aims to deliver positive social outcomes and enhance quality of life for local populations.

Ferrovial's product portfolio is anchored by its extensive network of toll roads, representing a critical component of global transportation infrastructure. These assets are managed throughout their lifecycle, from initial financing and construction to ongoing operation and maintenance, generating revenue through user fees. As of the 2023 annual report, Ferrovial operated approximately 2,500 kilometers of toll roads worldwide, demonstrating a significant market presence.

The company's airport division offers comprehensive management of aviation hubs, enhancing air travel connectivity and optimizing passenger and cargo flows. This commitment to airport development and operation is crucial for meeting projected global air travel demand, with Ferrovial's portfolio serving 154.4 million passengers in 2023, a notable 17.2% increase from the previous year.

Ferrovial is also expanding its product offerings in urban mobility and smart infrastructure, moving beyond traditional road projects. This includes significant investments in public transport systems and smart city technologies, exemplified by its participation in the $1.1 billion Sydney Metro expansion, showcasing its capability in large-scale transit development.

| Product Segment | Key Offerings | 2023/2024 Data Points | Strategic Focus |

|---|---|---|---|

| Toll Roads | Development, financing, construction, operation, maintenance | ~2,500 km operated; Significant revenue from user fees | Efficiency, user experience, smart technology integration |

| Airports | Airport management, terminal development, runway operations | 154.4 million passengers served; 17.2% passenger traffic increase | Capacity expansion, operational efficiency, passenger satisfaction |

| Urban Mobility & Smart Infrastructure | Public transport systems (BRT, light rail), smart city solutions | Participation in Sydney Metro expansion ($1.1 billion); Acquisition of WSP's P3 business | Sustainable connectivity, advanced technology integration, smart traffic management |

What is included in the product

This analysis offers a comprehensive breakdown of Ferrovial's marketing strategies, examining its Product offerings, Pricing structures, Place (distribution) of services, and Promotion tactics.

Simplifies Ferrovial's marketing strategy by clearly outlining the 4Ps, alleviating the pain of complex, scattered information.

Provides a clear, actionable framework for understanding and executing Ferrovial's marketing efforts, easing the burden of strategic planning.

Place

Ferrovial's strategic market presence spans North America, Europe, and other key international regions, demonstrating a substantial global footprint. This broad operational base, as of early 2025, allows the company to tap into diverse infrastructure development pipelines and effectively diversify its exposure to regional economic fluctuations. For instance, Ferrovial's significant investments in the US, particularly in toll road concessions, complement its strong European base, providing a balanced growth profile.

Ferrovial's 'place' strategy heavily relies on securing long-term concessions and forging public-private partnerships (PPPs) directly with governments. This approach allows them to gain rights to develop and operate crucial infrastructure, like toll roads or airports, for decades. For instance, in 2024, Ferrovial continued to expand its portfolio of concessions, including its significant presence in the Texas toll road network, which generates substantial, predictable revenue streams.

Ferrovial frequently engages in strategic joint ventures and alliances with local entities, including construction firms and investors. This collaborative strategy aids in market penetration, risk diversification, and capitalizing on local knowledge and connections. For instance, in 2023, Ferrovial's involvement in the A30 highway concession in Spain, alongside local partners, exemplifies leveraging established networks for large infrastructure projects.

Decentralized Operational Hubs and Subsidiaries

Ferrovial's strategy of establishing decentralized operational hubs and local subsidiaries is a cornerstone of its global presence. These regional outposts, such as its presence in Australia for major infrastructure projects, allow for direct engagement with local markets and regulatory bodies. This approach is critical for navigating diverse legal frameworks and fostering positive community relations, as evidenced by their work on projects like the Sydney Metro West, where local integration is paramount.

This decentralized model enhances operational agility, enabling Ferrovial to adapt quickly to the unique demands of each market. By having dedicated teams on the ground, the company can ensure compliance with local standards and regulations, a crucial factor in sectors like construction and infrastructure. For instance, their Australian subsidiaries are deeply familiar with local environmental and labor laws, facilitating smoother project execution.

- Global Reach with Local Expertise: Ferrovial operates in over 15 countries, with a significant emphasis on localized operational hubs.

- Regulatory Adherence: Dedicated subsidiaries ensure strict compliance with diverse international and local regulations.

- Community Engagement: Local presences facilitate stronger relationships with communities impacted by infrastructure projects.

- Operational Agility: Decentralized structures allow for tailored project management and rapid response to market needs.

Digital Platforms for Project Management and Operations

Ferrovial's commitment to operational excellence extends beyond its physical infrastructure to sophisticated digital platforms. These tools are crucial for managing complex projects and optimizing day-to-day operations across its worldwide operations. For instance, in 2023, the company highlighted its use of digital twins and advanced analytics to improve asset management, leading to an estimated 15% reduction in maintenance costs for certain infrastructure assets.

The integration of these digital solutions allows for real-time monitoring of assets, from toll roads to airports, enabling proactive maintenance and enhanced service delivery. Ferrovial's investment in digital collaboration tools also facilitates seamless communication and data sharing among geographically dispersed teams, accelerating project timelines and improving overall efficiency. This digital backbone is key to maintaining Ferrovial's competitive edge.

- Remote Asset Monitoring: Enables proactive maintenance and performance optimization.

- Digital Collaboration Tools: Facilitate efficient communication and data sharing among global teams.

- Data Analytics: Drives informed decision-making for operational efficiency and cost reduction.

- Digital Twins: Used for simulating and optimizing asset performance and maintenance strategies.

Ferrovial's 'place' strategy is characterized by a deliberate global footprint, focusing on regions with robust infrastructure development opportunities. As of early 2025, the company's presence in North America, particularly the United States, and its continued strong base in Europe are key operational theaters. This strategic placement allows Ferrovial to leverage its expertise in managing large-scale infrastructure projects, such as toll roads and airports, through long-term concessions and public-private partnerships.

The company's approach to 'place' also involves establishing local subsidiaries and operational hubs, enabling direct engagement with markets and regulatory bodies. This decentralized model, exemplified by its operations in Australia for major infrastructure projects, ensures compliance with diverse legal frameworks and fosters positive community relations. By securing rights to develop and operate essential infrastructure, Ferrovial builds predictable revenue streams, as seen with its significant involvement in the Texas toll road network.

Furthermore, Ferrovial actively pursues strategic joint ventures and alliances with local partners. This collaborative strategy, demonstrated by its participation in the A30 highway concession in Spain with established local firms, aids in market penetration and risk diversification. These partnerships leverage local knowledge and networks, crucial for navigating the complexities of large infrastructure projects and ensuring efficient execution.

| Region | Key Activities | Notable Projects (2023-2024) | Strategic Rationale |

|---|---|---|---|

| North America (USA) | Toll Road Concessions, Airport Operations | Texas Toll Road Network Expansion | Access to large infrastructure pipelines, diversified revenue |

| Europe (Spain) | Highway Concessions, Airport Management | A30 Highway Concession (with partners) | Leveraging established networks, strong domestic base |

| Australia | Major Infrastructure Development | Sydney Metro West involvement | Local market penetration, regulatory navigation |

Preview the Actual Deliverable

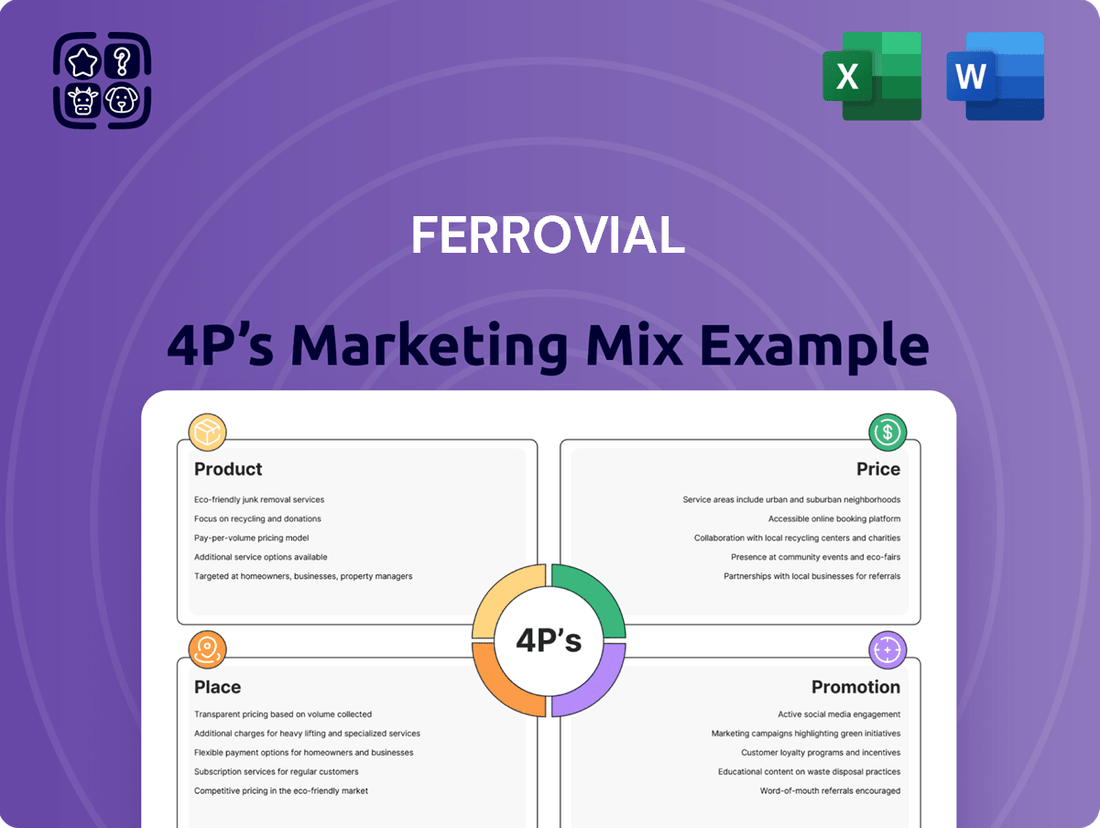

Ferrovial 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Ferrovial 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You can be confident that the detailed insights into Product, Price, Place, and Promotion for Ferrovial are exactly what you'll download.

Promotion

Ferrovial actively cultivates relationships with the global financial community through detailed investor presentations, comprehensive annual reports, and consistent earnings calls. This strategic engagement aims to inform and attract institutional investors, financial analysts, and existing shareholders.

The company focuses on showcasing its robust financial performance, clear strategic vision, and promising future growth opportunities. For instance, in its 2024 first-quarter results, Ferrovial reported a net profit of €181 million, a significant increase from the previous year, underscoring its financial health.

This transparent and proactive communication approach is crucial for building investor confidence and securing the necessary capital to fund its ambitious infrastructure development pipeline, including major projects in North America and Europe.

Ferrovial actively cultivates its image through strategic public relations, particularly for major infrastructure projects. For instance, their involvement in the expansion of the Port of Miami, a significant undertaking, necessitated extensive media outreach to highlight economic benefits and community advantages. This proactive approach ensures transparency and builds public trust.

By engaging with top-tier media, Ferrovial aims to shape narratives around its corporate milestones and development projects. This includes communicating the positive impact of initiatives like the expansion of the Sydney Gateway, which is projected to boost local employment. Such communication is crucial for managing public perception and gaining support for large-scale endeavors.

Positive media coverage acts as a powerful reputational amplifier for Ferrovial. For example, favorable reporting on their sustainable construction practices for the new terminal at Aberdeen Airport reinforces their commitment to environmental responsibility, fostering broader acceptance and stakeholder confidence in their operations.

Ferrovial executives frequently speak at major global conferences focusing on infrastructure, transportation, and sustainability. For example, in 2024, Ferrovial's CEO, Ignacio Madridejos, was a keynote speaker at the World Economic Forum's Annual Meeting, discussing the future of sustainable urban development. This active participation positions Ferrovial as a key influencer and innovator in the industry.

These engagements are vital for building relationships and demonstrating Ferrovial's technical capabilities. In 2025, the company is scheduled to present at the International Transport Forum in Leipzig, Germany, highlighting its advancements in smart mobility solutions. Such platforms allow Ferrovial to shape industry dialogue and showcase its commitment to future-forward infrastructure development.

Comprehensive Sustainability and ESG Reporting

Ferrovial actively promotes its dedication to sustainability through detailed Environmental, Social, and Governance (ESG) reports, readily accessible via its website and investor relations platforms. This proactive communication showcases its commitment to environmental protection, social responsibility, and strong corporate governance. For instance, in its 2023 Sustainability Report, Ferrovial detailed a 20% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating tangible progress towards its climate goals.

This emphasis on transparent ESG reporting is crucial for attracting and retaining investors increasingly focused on sustainable practices. Ferrovial's 2024 investor presentations consistently highlight its ESG performance, noting that over 60% of its financing in the past year was linked to sustainability targets. This approach not only builds trust but also enhances brand reputation among environmentally and socially conscious stakeholders, including customers and the wider public.

- ESG Reporting: Ferrovial publishes comprehensive annual sustainability reports detailing its performance across environmental, social, and governance metrics.

- Emission Reduction: The company reported a 20% reduction in Scope 1 and 2 GHG emissions by the end of 2023, against a 2019 baseline.

- Sustainable Financing: Over 60% of Ferrovial's financing in 2024 was tied to achieving defined sustainability objectives.

- Stakeholder Engagement: Transparent communication on ESG matters strengthens relationships with investors, partners, and the public, boosting brand value.

Robust Digital Presence and Corporate Communications

Ferrovial leverages a robust digital presence, maintaining a comprehensive corporate website and active engagement on professional platforms like LinkedIn. This digital strategy ensures all stakeholders have access to key information, from ongoing projects and company news to career opportunities and core values.

These channels are critical for broad reach and continuous interaction with a global audience. For instance, Ferrovial's commitment to transparency is evident in its readily available financial reports and sustainability disclosures online, facilitating informed decision-making by investors and partners.

- Website Traffic: Ferrovial's corporate website consistently attracts significant global traffic, with analytics for 2024 indicating millions of unique visitors annually, underscoring its role as a primary information hub.

- LinkedIn Engagement: The company's LinkedIn profile boasts a substantial follower base, consistently sharing updates on infrastructure development and corporate milestones, fostering professional networking and brand visibility.

- Digital Communications: Ferrovial utilizes digital platforms for investor relations, providing real-time updates and access to annual reports, with a notable increase in digital engagement for the 2024 fiscal year.

- Stakeholder Information: The digital presence serves as a vital conduit for communicating corporate values, sustainability initiatives, and project progress, ensuring a well-informed global stakeholder community.

Ferrovial's promotional efforts focus on building strong relationships with the financial community through detailed investor presentations and consistent earnings calls. The company highlights its financial performance, such as the €181 million net profit in Q1 2024, to attract investors and secure capital for its extensive project pipeline.

Strategic public relations, especially for major projects like the Port of Miami expansion, is key to showcasing economic benefits and gaining public trust. Favorable media coverage, such as reports on sustainable practices at Aberdeen Airport, amplifies Ferrovial's reputation and stakeholder confidence.

Executive participation in global conferences, like the World Economic Forum in 2024, positions Ferrovial as an industry leader and innovator. The company also actively promotes its sustainability commitment through ESG reports, noting a 20% reduction in Scope 1 and 2 GHG emissions by the end of 2023 and linking over 60% of its 2024 financing to sustainability targets.

Ferrovial maintains a robust digital presence, using its website and LinkedIn to share project updates, financial reports, and sustainability initiatives, ensuring broad access to information for its global stakeholders. Website analytics for 2024 show millions of unique annual visitors, reinforcing its role as a central information hub.

| Promotional Activity | Key Focus Areas | Data/Examples (2024/2025) |

| Investor Relations | Financial performance, strategic vision, growth opportunities | Q1 2024 Net Profit: €181 million; Consistent earnings calls and investor presentations |

| Public Relations | Project benefits, economic impact, community advantages | Port of Miami expansion media outreach; Sydney Gateway job creation reports |

| Industry Conferences | Innovation, future trends, technical capabilities | CEO keynote at World Economic Forum (2024); Presentation at International Transport Forum (2025 scheduled) |

| ESG Communications | Sustainability, environmental responsibility, social impact | 20% GHG emission reduction (Scope 1 & 2 vs 2019); 60%+ financing linked to sustainability targets (2024) |

| Digital Presence | Transparency, accessibility of information, brand visibility | Millions of unique annual website visitors (2024); Active LinkedIn engagement |

Price

Ferrovial's infrastructure assets, such as highways and airports, primarily utilize a pricing strategy based on long-term concession fees and user tolls. This model generates a stable and predictable revenue stream, often spanning many decades, reflecting the substantial value of convenience and time savings offered to end-users through high-quality infrastructure.

Ferrovial's approach to project pricing in its construction division is deeply rooted in competitive bidding. They actively participate in tender processes, meticulously preparing bids that reflect a deep understanding of project costs, potential risks, and the competitive landscape. This ensures they are well-positioned to win contracts by offering compelling value.

The pricing strategy itself involves detailed cost estimation, factoring in all project expenses, and a thorough risk assessment to account for unforeseen challenges. Crucially, Ferrovial conducts comprehensive competitive analysis, understanding what other firms might bid. This diligence in 2024 and going into 2025 allows them to set prices that are both profitable and attractive to clients.

Contractual pricing often takes the form of fixed-price agreements or cost-plus models. Fixed prices offer certainty for clients, while cost-plus arrangements provide flexibility and ensure Ferrovial covers its expenses plus a margin. For instance, in 2023, Ferrovial secured significant infrastructure contracts, such as the €1.1 billion A-32 motorway project in Spain, which likely involved competitive pricing structures.

Ferrovial's pricing strategy is deeply tied to the long-term valuation of its infrastructure assets and the expected returns for its investors. This requires complex financial modeling that accounts for future cash flows, discount rates, and current market dynamics. The company focuses on acquiring and developing assets that promise appealing risk-adjusted returns throughout their operational life.

For instance, in 2023, Ferrovial reported a net profit of €1.23 billion, a significant increase from €186 million in 2022, demonstrating its ability to generate value from its portfolio. This performance underscores the success of its strategy to invest in robust, long-life infrastructure projects that yield consistent returns.

Optimized Financing Structures and Debt Management

Ferrovial's financial strategy, viewed as its 'price' in the marketing mix, focuses on securing cost-effective financing for its extensive infrastructure portfolio. This involves expertly structuring deals using a mix of debt, equity, and specialized project finance to minimize the overall cost of capital. For instance, in 2023, Ferrovial's robust financial health allowed it to issue €500 million in sustainability-linked bonds, demonstrating its access to favorable market conditions.

The company's ability to manage its debt efficiently is crucial. By optimizing its capital structure, Ferrovial directly influences the profitability of its projects. As of the first half of 2024, Ferrovial reported a net financial debt of €5.5 billion, a figure managed through a diversified funding base and proactive debt management strategies.

- Debt Optimization: Ferrovial strategically employs various debt instruments to lower its weighted average cost of capital.

- Project Finance Expertise: The company excels in structuring complex project finance deals, crucial for large-scale infrastructure.

- Access to Capital Markets: Ferrovial's strong credit rating, affirmed by major agencies, ensures favorable access to global capital markets.

- Sustainability-Linked Financing: A growing focus on ESG factors allows Ferrovial to tap into green and sustainability-linked debt markets, often at competitive rates.

Market Demand and Regulatory Environment Influence

Ferrovial's pricing strategies are directly shaped by market demand for infrastructure projects and the regulatory landscape. For instance, government decisions on toll rates and user fees in countries like Spain and the UK significantly impact revenue streams. In 2024, continued government investment in transport infrastructure, such as the UK's commitment to HS2 (though revised) and Spain's NextGenerationEU funded projects, creates opportunities for competitive pricing on construction and operational contracts.

The regulatory environment dictates much of how Ferrovial can price its services. This includes concessions for highways, airports, and utilities, where governments often set return on investment parameters or fee structures. For example, airport charges at London Heathrow, where Ferrovial holds a significant stake, are subject to periodic reviews by the Civil Aviation Authority (CAA), influencing pricing for airlines and passengers. These reviews are critical in setting the financial framework for the 2024-2029 period.

Ferrovial actively monitors these external factors to ensure its pricing remains competitive and sustainable. This involves detailed analysis of:

- Government infrastructure spending plans: Tracking national and regional budgets for new projects and upgrades.

- Toll and user fee regulations: Understanding limits and frameworks for revenue generation on concessions.

- Inflationary pressures and economic outlook: Adjusting pricing to account for rising costs and market conditions.

- Competitor pricing strategies: Benchmarking against other major infrastructure players in key markets.

Ferrovial's pricing for its infrastructure concessions, like toll roads and airports, is fundamentally tied to long-term contracts and user fees, designed for stable, decades-long revenue. This strategy reflects the inherent value of reliable, time-saving infrastructure for its users.

In its construction arm, Ferrovial employs competitive bidding, meticulously pricing projects based on detailed cost analysis, risk assessment, and competitor intelligence to secure profitable contracts. This approach was evident in 2023 with significant wins like the €1.1 billion A-32 motorway project in Spain.

The company's financial strategy, acting as its 'price' element, focuses on cost-effective financing. This includes optimizing its capital structure, as seen with its €5.5 billion net financial debt as of H1 2024, and leveraging access to capital markets, including issuing €500 million in sustainability-linked bonds in 2023.

Market demand and regulatory frameworks heavily influence Ferrovial's pricing. Government decisions on tolls and fees, alongside infrastructure spending plans like Spain's NextGenerationEU projects and the UK's revised HS2 commitments in 2024, directly shape revenue potential and contract pricing.

| Pricing Strategy Element | Description | Key Data/Examples |

|---|---|---|

| Concession Pricing | Long-term contracts, user tolls, and concession fees | Stable revenue from highways and airports |

| Construction Bidding | Competitive tender pricing based on cost, risk, and market analysis | €1.1 billion A-32 motorway project (2023) |

| Financial Strategy (Cost of Capital) | Debt optimization, project finance, capital market access | €5.5 billion net debt (H1 2024); €500 million sustainability bonds (2023) |

| Market & Regulatory Influence | Government spending, toll regulations, economic outlook | NextGenerationEU projects (Spain), HS2 (UK) |

4P's Marketing Mix Analysis Data Sources

Our Ferrovial 4P's analysis leverages a comprehensive blend of official company disclosures, including annual reports and investor presentations, alongside granular data from industry-specific market research and competitive intelligence platforms. This ensures a robust understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.