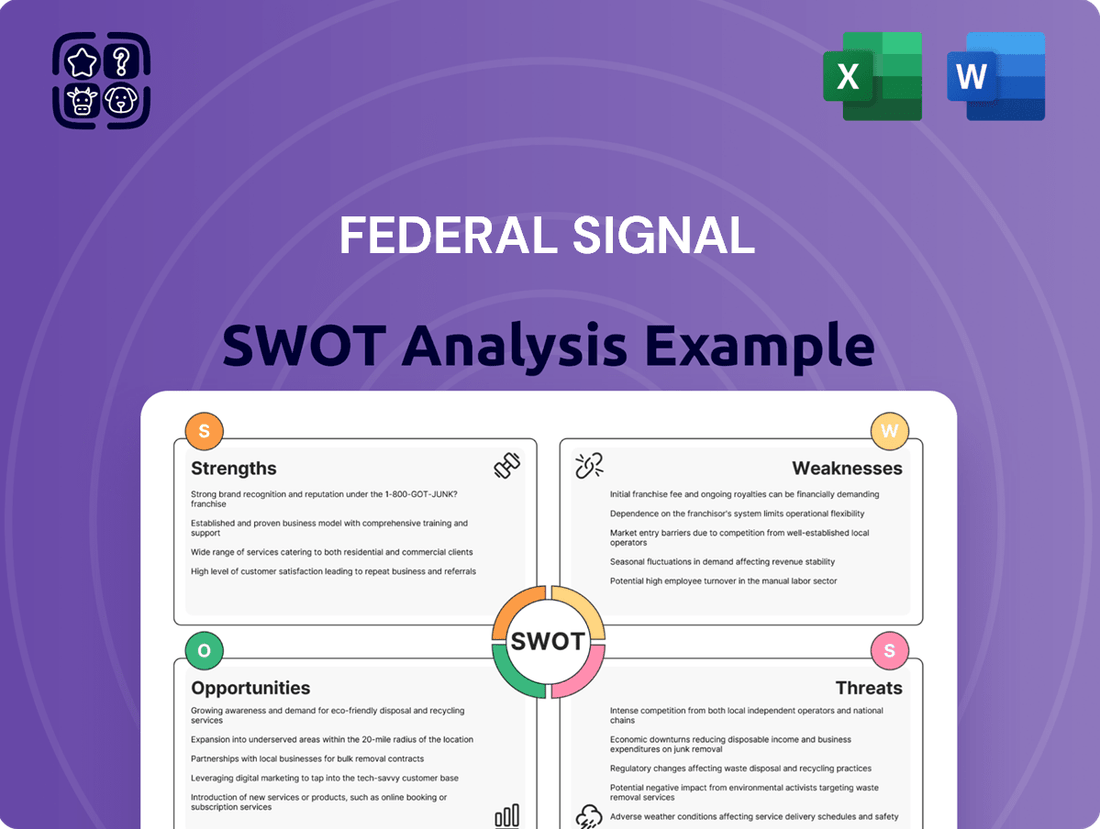

Federal Signal SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

Federal Signal's strong brand recognition and diverse product portfolio are key strengths, but potential reliance on specific industries presents a vulnerability. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Federal Signal's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Federal Signal's strength lies in its impressively diverse product range, covering safety, security, and environmental solutions. This breadth means they serve a wide customer base, including municipal, governmental, industrial, and commercial sectors. Think emergency vehicle lighting, signaling devices, and even specialized equipment like street sweepers and vacuum trucks.

Federal Signal is showcasing impressive financial strength, with record-breaking net sales, operating income, and adjusted EBITDA reported in both the first and second quarters of 2025. This consistent upward trend is a direct result of significant organic growth and skillful cost control, underscoring the company's operational prowess and the strong market appetite for its offerings.

The company's financial achievements are further bolstered by its decision to raise its full-year 2025 guidance, a clear signal of management's confidence in sustained robust performance. This proactive adjustment reflects a deep understanding of market dynamics and Federal Signal's ability to capitalize on emerging opportunities.

Federal Signal's strategic acquisition approach is a significant strength, as demonstrated by its recent purchases of Hog Technologies in February 2025 and Standard Equipment Company in October 2024. These moves are aimed at broadening market presence, improving product offerings, and bolstering aftermarket services.

These inorganic growth efforts are specifically structured to boost earnings and cash flow, playing a crucial role in the company's ongoing expansion. This consistent focus on acquiring complementary businesses has been a primary engine for Federal Signal's growth over the last ten years.

Commitment to Innovation and Sustainability

Federal Signal's dedication to innovation and sustainability is a significant strength. The company actively invests in research and development, focusing on creating advanced, environmentally friendly products. This includes the development of fully electric street sweepers and other electrified vehicle options, directly addressing the growing global demand for sustainable infrastructure solutions.

This strategic focus on sustainability is not just aspirational; it's backed by tangible results. Federal Signal has successfully met its greenhouse gas emission reduction targets, demonstrating a genuine commitment to environmental stewardship. This proactive approach positions the company favorably in a market increasingly prioritizing eco-conscious operations and products.

- Innovation Focus: Significant R&D investment in cutting-edge and sustainable products.

- Electrification: Development of fully electric street sweepers and electrified vehicle solutions.

- Sustainability Achievement: Met greenhouse gas emission reduction goals, underscoring environmental responsibility.

- Market Alignment: Addresses growing global demand for greener infrastructure and safety solutions.

Strong Order Backlog and Demand Visibility

Federal Signal's strong order backlog, which surpassed $1 billion as of early 2025, offers significant revenue visibility extending through 2026. This substantial order book underscores consistent demand for their critical safety and warning solutions. The company's ability to secure such a large backlog directly translates to predictable future earnings and supports efficient operational and production planning.

The sustained high level of order intake, consistently hitting record figures, demonstrates the enduring market need for Federal Signal's product portfolio. This robust demand, reflected in the backlog, provides a solid foundation for the company's financial performance and strategic growth initiatives in the coming years.

- Record Order Intake: Federal Signal has consistently achieved record levels of new orders.

- Backlog Exceeds $1 Billion: As of early 2025, the company's backlog stands above $1 billion.

- Revenue Visibility: This backlog provides clear revenue visibility through the remainder of 2025 and into 2026.

- Sustained Demand: The strong order book signals ongoing high demand for essential products and services.

Federal Signal's diverse product portfolio, encompassing safety, security, and environmental solutions, caters to a broad customer base across municipal, governmental, industrial, and commercial sectors. This wide reach, from emergency vehicle lighting to specialized equipment like street sweepers, is a significant advantage.

What is included in the product

Analyzes Federal Signal’s competitive position through key internal and external factors, highlighting its strengths in established brands and market presence, while also identifying potential weaknesses in product diversification and opportunities in emerging technologies and international expansion, alongside threats from increased competition and regulatory changes.

Offers a clear, actionable framework to identify and address critical market vulnerabilities, reducing the risk of competitive disruption.

Weaknesses

While Federal Signal excels in its specialized areas, its market share within the much larger industrial and automotive manufacturing sectors is modest compared to global giants. For instance, in 2023, the company's revenue was approximately $2.1 billion, a fraction of the hundreds of billions generated by diversified industrial conglomerates.

This limited overall market penetration means Federal Signal's growth potential in broader markets is constrained. Although it leads in niches like emergency vehicle lighting and signaling devices, its presence in general industrial equipment or automotive components is less pronounced.

The company's focused strategy, a strength in its chosen segments, inherently restricts its share of the vast industrial marketplace. This specialization, while fostering deep expertise, also means it captures a smaller percentage of the total addressable market across all manufacturing industries.

Federal Signal's acquisition strategy, while potentially beneficial, introduces significant integration challenges. Merging disparate corporate cultures, IT systems, and operational processes from acquired entities can prove complex and time-consuming. This often diverts crucial management focus and financial resources away from existing core business activities, potentially impacting day-to-day performance.

Furthermore, realizing the projected revenue synergies and cost savings from these acquisitions carries inherent risks. For instance, in the first quarter of 2024, Federal Signal reported $30.1 million in acquisition-related expenses, highlighting the immediate financial impact of integration efforts. The company must effectively navigate these hurdles to ensure that the acquired businesses contribute positively to overall profitability and strategic goals, rather than becoming a drain on resources.

Federal Signal's significant reliance on municipal and governmental clients, which accounted for approximately 50% of its revenue in recent years, exposes it to the unpredictable nature of public sector budget cycles. Economic slowdowns or shifts in political priorities can directly curtail spending on essential infrastructure and public safety equipment, thus affecting demand for Federal Signal's offerings. This dependency inherently introduces a cyclical pattern to the company's revenue streams.

Increased Corporate Operating Expenses

Federal Signal's operating expenses have seen an uptick, with recent reports highlighting increased costs related to post-retirement benefits and stock-based compensation. For instance, in the first quarter of 2024, the company reported a rise in selling, general, and administrative expenses, partly due to these factors. While some expense growth is expected with business expansion, persistent increases in overhead, if not matched by corresponding revenue growth, could negatively impact profit margins.

Key factors contributing to this weakness include:

- Rising Post-Retirement Expenses: Increased obligations for employee benefits after retirement are adding to the company's cost structure.

- Higher Stock Compensation Costs: The use of stock options and awards as part of employee compensation packages has led to higher non-cash expenses.

- Potential Margin Pressure: If these rising operating costs outpace revenue generation, it could compress the company's profitability and overall financial performance.

Reliance on Adjusted Financial Metrics

Federal Signal's reliance on adjusted financial metrics can be a weakness. While they often present adjusted earnings per share (EPS) to showcase core operational performance, excluding items like acquisition and integration costs, investors must scrutinize these figures. For instance, in their Q1 2024 earnings, the company reported adjusted EPS of $0.62, compared to GAAP EPS of $0.47, highlighting the impact of these exclusions.

This practice necessitates careful analysis by stakeholders to understand the true financial health and the full impact of all expenses. Without a thorough review of the reconciling items, the adjusted numbers might present an overly optimistic view of profitability.

- Adjusted vs. GAAP: Investors must bridge the gap between reported adjusted figures and standard GAAP accounting.

- Acquisition Impact: Costs associated with integrating acquired businesses, a key growth strategy for Federal Signal, are often excluded from adjusted metrics.

- Transparency Concerns: Over-reliance on adjusted figures can sometimes obscure the real costs of doing business, potentially impacting investor confidence if not clearly explained.

Federal Signal's limited market share in broader industrial and automotive sectors, despite its niche leadership, restricts its overall growth potential. Its focused strategy, while a strength in specific areas, inherently caps its penetration into the vast industrial marketplace, capturing a smaller percentage of the total addressable market.

The company's reliance on municipal and governmental clients, representing about 50% of its revenue, makes it susceptible to public sector budget fluctuations. Economic downturns or changes in political priorities can directly impact demand for its equipment, introducing a cyclical pattern to its revenue streams.

Federal Signal faces challenges with rising operating expenses, including increased post-retirement benefit obligations and stock-based compensation costs. For instance, Q1 2024 saw a rise in SG&A expenses, potentially pressuring profit margins if not offset by revenue growth.

The company's use of adjusted financial metrics, such as adjusted EPS, can obscure the full financial picture. In Q1 2024, adjusted EPS was $0.62 compared to GAAP EPS of $0.47, highlighting the impact of excluded items like acquisition costs, which requires careful investor scrutiny.

Same Document Delivered

Federal Signal SWOT Analysis

This is the actual Federal Signal SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt that showcases the depth and structure of the full report. Purchase unlocks the complete, in-depth version for your strategic planning needs.

Opportunities

The global push for sustainability, especially with electric vehicles (EVs) entering municipal and industrial fleets, is a major opportunity for Federal Signal. This trend directly supports customer environmental goals.

Federal Signal is actively developing electric and hybrid products, like its electric Broom Bear street sweeper, to meet this demand. This strategic investment places them to benefit from the growing electrification market.

The global EV market is projected to reach over $800 billion by 2027, with significant growth in commercial fleets anticipated. This expansion offers Federal Signal a clear path for increased sales and market share.

Government initiatives and increased public investment in infrastructure development, particularly in North America, are a significant opportunity. For instance, the Infrastructure Investment and Jobs Act (IIJA) in the US, enacted in late 2021, allocated $1.2 trillion, with a substantial portion directed towards transportation and infrastructure upgrades through 2026. This sustained trend provides a robust tailwind for Federal Signal's environmental and safety solutions, as communities focus on improving and safeguarding public spaces.

Federal Signal has a significant opportunity to expand its high-margin aftermarket services, encompassing parts, maintenance, rentals, and used equipment. This strategic focus can lead to more predictable, recurring revenue and a stronger customer base.

By growing the aftermarket segment, the company can boost its overall profitability. For instance, in the first quarter of 2024, Federal Signal reported a 15.6% increase in its Aftermarket and Other segment revenue, reaching $81.7 million, highlighting the segment's growth potential.

Acquisitions, such as the purchase of Standard Equipment Company, are designed to strengthen Federal Signal's capabilities in these aftermarket areas, further capitalizing on this lucrative business avenue.

Untapped International Markets

Federal Signal has a solid international footprint, with recent reports indicating growth in key areas like Europe and Australia. However, the company can still tap into substantial untapped potential by expanding into other global territories and strengthening its presence in existing international markets.

Diversifying its revenue streams geographically can significantly lessen its dependence on the North American market. This strategic move opens up new avenues for sustained revenue growth and can help buffer against regional economic downturns. For instance, exploring markets in Asia or Latin America, where infrastructure development and public safety investments are increasing, presents a compelling opportunity.

Federal Signal’s proactive assessment of global markets is crucial for identifying these expansion opportunities. By understanding the specific needs and regulatory landscapes of different regions, the company can tailor its product offerings and market entry strategies for maximum impact. This approach ensures that growth is not just about presence, but about meaningful penetration and market share acquisition.

- International Revenue Contribution: While specific figures for 2024/2025 are still emerging, Federal Signal's international segments have historically contributed to overall revenue, indicating a foundation for further expansion.

- Emerging Market Growth: Many developing economies are prioritizing public safety and infrastructure upgrades, creating a demand for Federal Signal's specialized equipment.

- Competitive Landscape: Analyzing the competitive intensity in potential new markets will be key to developing effective market entry strategies and securing market share.

- Regulatory Environment: Understanding and adapting to diverse international regulations and standards is vital for successful product deployment and market acceptance.

Technological Advancements and Smart Solutions

Federal Signal's commitment to research and development, especially in areas like the Internet of Things (IoT) and data analytics, presents a significant opportunity. By integrating these advanced technologies, the company can develop smart solutions for public safety and environmental management, setting its products apart.

These innovations are key to unlocking new revenue streams and bolstering Federal Signal's competitive position in a market that's constantly being reshaped by technology. For instance, the company's focus on customer-centric product development ensures these advancements directly address user needs.

- IoT Integration: Expanding smart capabilities in emergency vehicle lighting and communication systems.

- Data Analytics: Leveraging data from connected devices to improve operational efficiency for customers.

- New Product Development: Launching next-generation warning systems with enhanced connectivity and intelligence.

- Market Differentiation: Creating unique value propositions through technologically advanced, integrated solutions.

Federal Signal is well-positioned to capitalize on the growing demand for electric and hybrid vehicles, particularly within municipal and industrial sectors. The company's investment in developing electric alternatives, such as its electric street sweeper, directly addresses the increasing environmental consciousness and regulatory pressures driving fleet electrification. This strategic pivot aligns with a global market trend, with projections indicating substantial growth in the electric commercial vehicle segment, offering a clear avenue for increased sales and market penetration.

Threats

Federal Signal navigates a fiercely competitive arena, contending with both seasoned industry veterans and emerging disruptors. This intense rivalry can significantly impact pricing strategies and profit margins.

While Federal Signal actively pursues strategies to bolster its competitive edge, the persistent pressure from rivals could erode its market share. For instance, in the broader vehicle and industrial equipment sectors, companies like BYD, Yamaha Motor, and Ford demonstrate the scale and scope of competition Federal Signal operates within, even if not always direct rivals in every segment.

Broader economic uncertainties, including persistent inflationary pressures on raw materials, labor, and transportation costs, pose a significant threat to Federal Signal's profit margins. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase throughout 2024, impacting input costs.

Potential economic slowdowns or recessions could dampen capital expenditures by municipal and industrial customers, directly reducing demand for Federal Signal's critical safety and signaling equipment. This is particularly relevant given the cyclical nature of some of their end markets.

Furthermore, ongoing geopolitical conflicts contribute to this economic instability, creating supply chain disruptions and increasing the volatility of global commodity prices, which can indirectly affect Federal Signal's operational costs and market demand.

As a global manufacturer, Federal Signal faces considerable threats from supply chain disruptions. Events like the semiconductor shortages experienced in 2021-2022, which impacted numerous industries including automotive and electronics, highlight the vulnerability of relying on a complex global network for critical components. These disruptions can lead to significant production delays and increased costs, as seen when companies had to pay premiums for available parts or reroute logistics.

Regulatory and Environmental Policy Changes

While Federal Signal's offerings often aid compliance, shifts in environmental, health, or safety regulations pose a significant threat. For instance, stricter emissions standards for emergency vehicles or new mandates for hazardous material containment could require substantial R&D investment and product re-engineering. Such regulatory evolution could impact Federal Signal's existing product portfolio and necessitate costly adaptations to maintain market competitiveness.

The company's reliance on government and municipal contracts, which are often subject to evolving public policy, amplifies this risk. A sudden tightening of environmental protection laws, for example, could increase the cost of raw materials or manufacturing processes for their signaling and safety equipment. Federal Signal's 2023 annual report noted that approximately 40% of its revenue came from government entities, highlighting the sensitivity to public sector policy changes.

- Increased Compliance Costs: New regulations could force Federal Signal to invest in updated manufacturing technologies or product certifications, potentially impacting margins.

- Product Obsolescence: Rapidly changing environmental standards might render existing product lines less desirable or non-compliant, requiring accelerated innovation cycles.

- Supply Chain Disruptions: Stricter environmental regulations on suppliers could lead to increased costs or limited availability of key components.

Interest Rate Increases and Access to Capital

Rising interest rates present a significant threat to Federal Signal. As borrowing costs climb, both the company and its customers may face increased expenses for capital. For instance, the Federal Reserve's decision to maintain its benchmark interest rate in early 2024, following several hikes in 2023, signals continued pressure on borrowing costs for businesses and municipalities. This can directly impact Federal Signal's ability to finance its operations and for its clients, particularly in the municipal sector, to fund large equipment acquisitions.

Higher interest rates can dampen demand for Federal Signal's products. Municipalities often rely on debt financing for infrastructure projects, and increased borrowing costs can make these projects less feasible, potentially delaying or reducing orders for the company's emergency vehicles, street sweepers, and other specialized equipment. Similarly, industrial customers may postpone capital expenditures if financing becomes more expensive, directly impacting Federal Signal's sales volumes and growth potential in these key markets.

- Increased Borrowing Costs: Higher interest rates directly increase the cost of capital for Federal Signal and its customers.

- Reduced Customer Investment: Municipal and industrial clients may scale back or delay large equipment purchases due to more expensive financing.

- Impact on Public Projects: Rising rates can slow down public infrastructure spending, a key market for Federal Signal.

- Slower Sales Growth: The combined effect of these factors could lead to slower sales volume and reduced growth opportunities for the company.

Federal Signal faces intense competition from established players and new entrants, potentially squeezing profit margins and market share. Economic volatility, including inflation and potential slowdowns, directly impacts demand for its specialized equipment, especially as government and municipal spending can be cyclical. Supply chain vulnerabilities, highlighted by past component shortages, continue to pose a risk to production timelines and costs.

Regulatory shifts, particularly in environmental and safety standards, could necessitate costly product redesigns and R&D investments, potentially affecting existing product lines. Furthermore, rising interest rates increase borrowing costs for both Federal Signal and its customers, which may lead to delayed or reduced capital expenditures, particularly impacting the municipal sector's ability to fund large equipment acquisitions.

SWOT Analysis Data Sources

This Federal Signal SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analysis to ensure a well-informed strategic perspective.