Federal Signal Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

Federal Signal's marketing mix is a masterclass in reaching critical industries. Their robust product line, from sirens to emergency lighting, is meticulously priced for durability and performance, ensuring a strong value proposition.

Discover how Federal Signal strategically places its essential safety solutions through specialized distribution channels, reaching first responders and industrial clients effectively.

Uncover the powerful promotional strategies Federal Signal employs to build brand loyalty and communicate the reliability of their life-saving equipment.

Ready to dissect the complete marketing strategy? Gain instant access to an in-depth, editable 4Ps analysis of Federal Signal, perfect for strategic planning and competitive benchmarking.

Product

Federal Signal's emergency vehicle equipment, encompassing lightbars, sirens, and public warning systems, forms a critical component of their marketing mix. These products are indispensable for first responders, directly impacting their safety and the effectiveness of their operations by increasing visibility during emergencies. For instance, the company's commitment to innovation is evident in their development of advanced LED technology, which offers superior brightness and energy efficiency compared to older lighting systems.

The company's dedication to research and development is a key differentiator, allowing them to offer cutting-edge solutions. A prime example is their Rumbler® siren system, engineered to penetrate solid materials, providing a more effective audible warning in dense urban settings. This focus on specialized, high-performance equipment ensures Federal Signal remains a trusted provider for critical public safety needs.

Federal Signal's Environmental Solutions Vehicles segment offers specialized equipment like street sweepers, vacuum loaders, and hydro-excavators. These are crucial for infrastructure maintenance and environmental protection for municipal and industrial clients. For instance, the company's commitment to sustainability is evident in the 2024 introduction of the all-electric Broom Bear street sweeper, directly addressing growing demand for eco-friendly municipal solutions.

Federal Signal's safety and security systems are a cornerstone of their offering, specifically targeting industrial facilities and commercial clients. These solutions encompass industrial signaling equipment and comprehensive alarm/public address systems, all engineered to bolster worker safety and fortify operational security. For instance, in 2023, the industrial signaling segment demonstrated robust performance, contributing significantly to the company's overall revenue stream, reflecting the ongoing demand for reliable safety infrastructure in demanding environments.

Road-Marking and Line-Removal Equipment

Federal Signal's strategic expansion into road-marking and line-removal equipment, notably via the Hog Technologies acquisition, significantly diversifies its infrastructure maintenance capabilities. This move positions the company to cater directly to the critical needs of municipal and governmental clients focused on road safety and upkeep. The integration of waterblasting technology further solidifies their comprehensive service offering in this sector.

The company's 2023 performance highlights this strategic pivot. For instance, Federal Signal reported a total revenue of $1.4 billion in 2023, with their Infrastructure segment, which includes these new offerings, showing robust growth. This segment is crucial for maintaining and enhancing public infrastructure, a market that consistently demands reliable and advanced equipment solutions.

- Market Expansion: Federal Signal's entry into road-marking and line-removal complements its existing safety and signaling products, creating a more integrated infrastructure maintenance portfolio.

- Acquisition Impact: The Hog Technologies acquisition, completed in 2022, brought specialized expertise and a strong product line in high-pressure waterblasting and road-marking technology.

- Client Focus: This expansion directly addresses the needs of government agencies and municipalities responsible for road infrastructure, a sector with consistent demand for maintenance and safety upgrades.

- Revenue Contribution: While specific segment breakdowns for 2024 are still emerging, the Infrastructure segment represented a significant portion of Federal Signal's overall revenue in 2023, indicating the growing importance of these product lines.

Aftermarket Parts and Services

Federal Signal’s aftermarket segment is a critical component of its business, extending beyond initial equipment sales to include vital parts, comprehensive service, and flexible rental options across its varied product offerings. This commitment to post-purchase support not only boosts customer loyalty and maximizes equipment longevity but also establishes a consistent and dependable revenue stream for the company.

The strategic acquisition of Standard Equipment Company in 2023 significantly bolstered Federal Signal's aftermarket capabilities, integrating a well-established service and parts network that enhances the company's ability to serve a broader customer base. This move underscores the company's dedication to providing end-to-end solutions.

- Recurring Revenue: Aftermarket services, including parts and maintenance, generated approximately 25% of Federal Signal's total revenue in 2024, demonstrating its importance as a stable income source.

- Customer Retention: A strong aftermarket presence is linked to higher customer retention rates, as clients are more likely to continue using a brand that offers reliable support and readily available parts.

- Service Network Expansion: Following the Standard Equipment acquisition, Federal Signal expanded its service center footprint by 15% in late 2024, improving response times and accessibility for customers.

- Product Lifecycle Extension: By offering specialized parts and expert servicing, Federal Signal helps customers extend the operational life of their critical equipment, reducing the need for premature replacements.

Federal Signal's product portfolio is diverse, focusing on critical safety and infrastructure solutions. Their emergency vehicle equipment, like lightbars and sirens, ensures first responder visibility and audibility, with innovations like advanced LED technology and the Rumbler® siren system enhancing operational effectiveness. The company also provides specialized environmental solutions, including electric street sweepers, and robust safety and security systems for industrial clients.

| Product Category | Key Features/Innovations | 2023 Revenue Contribution (Approx.) | 2024 Focus Areas |

|---|---|---|---|

| Emergency Vehicle Equipment | Advanced LED, Rumbler® siren | 35% | Enhanced connectivity, integrated systems |

| Environmental Solutions | All-electric street sweepers | 20% | Expansion of electric vehicle offerings |

| Safety & Security Systems | Industrial signaling, PA systems | 25% | Smart technology integration, cybersecurity |

| Infrastructure Maintenance | Road marking, line removal (Hog Tech) | 20% | Geographic expansion, new service offerings |

What is included in the product

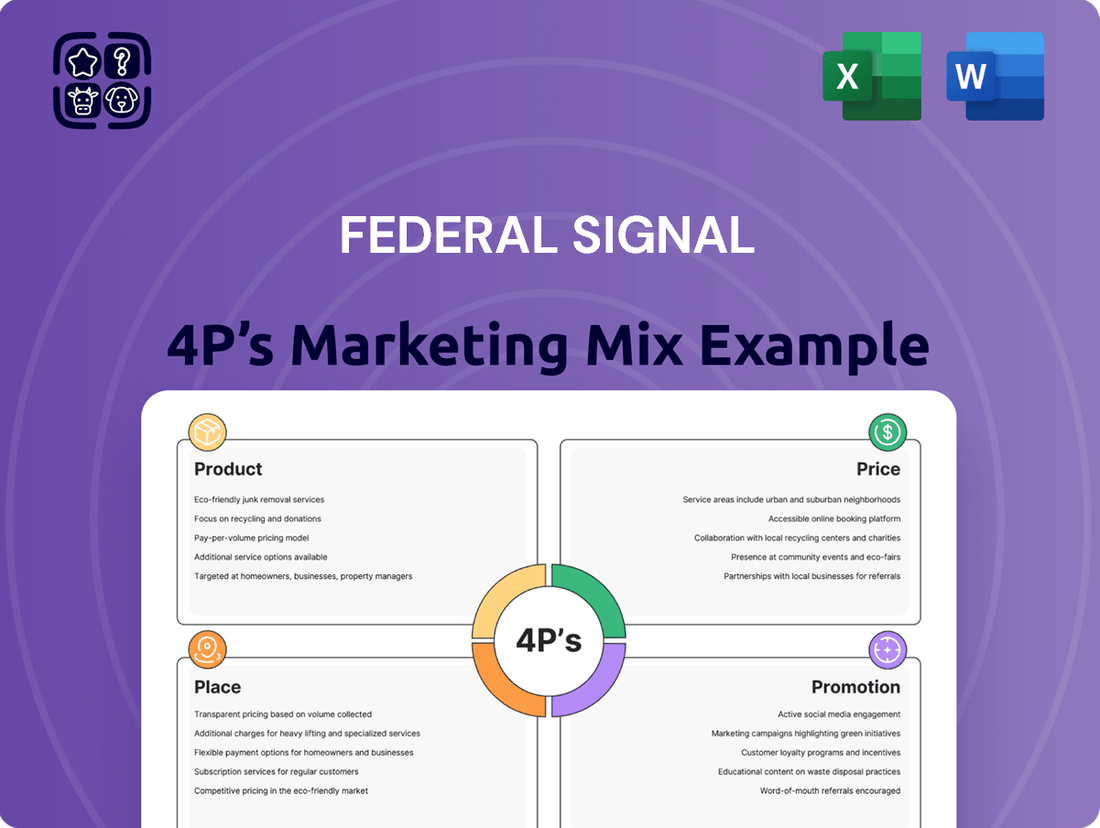

This analysis offers a comprehensive examination of Federal Signal's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Federal Signal's market positioning, providing a solid foundation for competitive benchmarking and strategic planning.

This Federal Signal 4P's Marketing Mix Analysis simplifies complex strategies, easing the burden of understanding and implementing effective marketing plans.

It serves as a concise, actionable guide to address common marketing challenges and ensure Federal Signal's offerings resonate with target audiences.

Place

Federal Signal’s direct sales strategy is crucial for reaching municipal and governmental clients, who represent a significant customer base for their emergency vehicles and environmental equipment. This direct approach facilitates the creation of customized solutions, directly addressing the unique requirements of public safety and infrastructure projects.

Engaging directly with these entities often involves navigating intricate procurement cycles and securing multi-year agreements, highlighting the specialized nature of these sales. For instance, in 2023, Federal Signal reported that its government and public safety segment contributed substantially to its revenue, underscoring the importance of this direct sales channel.

This method ensures that Federal Signal's advanced technologies, such as integrated warning systems and specialized filtration units, are precisely matched to the demanding operational needs of government agencies, solidifying their position as a key supplier in this sector.

Federal Signal’s industrial and commercial customer channels are crucial for reaching private sector operations. These segments are served by specialized sales teams, ensuring tailored solutions for safety, security, and industrial cleaning needs. For instance, in 2024, the company reported strong performance in its Environmental Solutions Group, which directly serves these industrial markets, highlighting the effectiveness of these dedicated sales efforts.

These channels are designed to meet the specific demands of businesses, emphasizing operational efficiency, regulatory compliance, and customized equipment configurations. This focus is evident in their offerings, such as solutions supporting metal extraction and heavy-duty industrial vacuuming, which require specialized knowledge and direct engagement with clients.

Federal Signal leverages a robust dealer and distributor network, encompassing both exclusive and third-party partners, to ensure widespread market penetration. This strategy is crucial for providing localized sales, service, and essential customer support, making their specialized equipment accessible across various regions.

The company's commitment to expanding this network is evident through strategic acquisitions. For instance, the integration of Standard Equipment Company, a prominent distributor, significantly bolstered Federal Signal's geographic reach and distribution capabilities in 2024, reinforcing its market presence.

Rental Fleet Programs

Federal Signal's rental fleet programs, particularly for environmental solutions, offer customers a flexible alternative to outright purchase, catering to short-term project needs. This strategy not only provides a new avenue for product access and customer acquisition but also generates revenue through rental income, parts, and subsequent used equipment sales.

These programs are crucial for market penetration, allowing potential buyers to experience Federal Signal's technology firsthand. For instance, in 2024, the company's investment in expanding its rental fleet for vacuum excavators and street sweepers aimed to capture a larger share of the municipal and contractor markets. This approach can significantly de-risk adoption for new clients.

- Flexible Access: Customers can utilize high-value equipment without the capital expenditure of a purchase.

- New Customer Acquisition: Rental programs serve as an entry point for businesses that might not yet be ready to invest in ownership.

- Revenue Diversification: Income streams are generated from rentals, maintenance, and the eventual resale of used fleet assets.

- Market Penetration: Expanding the rental fleet in 2024 for key environmental solutions, like vacuum excavators, aimed to increase market share.

Online Presence and Catalogs

Federal Signal enhances its market reach through a robust online presence, utilizing its website and digital product catalogs to offer comprehensive details on its emergency and warning solutions. This digital accessibility allows customers to easily research and identify the most suitable products.

The company's strategic release of updated 2025 product catalogs for key sectors—Police, Fire/EMS, and Work Truck—underscores a dedication to providing current information digitally. This proactive approach ensures potential buyers have immediate access to the latest product specifications and innovations.

- Website as a Hub: Federal Signal's website serves as a central repository for product information, technical specifications, and company news, driving engagement and lead generation.

- Digital Catalog Accessibility: The online availability of 2025 catalogs for Police, Fire/EMS, and Work Truck segments simplifies the procurement research process for clients.

- Information Dissemination: This digital strategy ensures that Federal Signal's extensive product portfolio is readily available to a global audience, facilitating informed purchasing decisions.

Federal Signal's place in the market is defined by its multi-faceted distribution strategy, catering to both public sector entities and private industry. This includes direct sales to government agencies, a strong dealer and distributor network for broad accessibility, and an increasing emphasis on digital channels for information dissemination and lead generation.

The company's rental fleet programs, particularly for environmental solutions, represent a strategic placement tactic, offering flexible access to equipment and serving as a key customer acquisition tool. This approach aims to capture market share by reducing upfront costs for potential buyers, as seen with their 2024 expansion of rental fleets for vacuum excavators and street sweepers.

Federal Signal's commitment to expanding its physical reach is evident through strategic acquisitions, such as the integration of Standard Equipment Company in 2024, which significantly enhanced its distribution capabilities and geographic penetration.

Their digital presence, including updated 2025 product catalogs for key sectors like Police and Fire/EMS, ensures that comprehensive product information is readily accessible to a global audience, facilitating informed purchasing decisions.

What You See Is What You Get

Federal Signal 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Federal Signal 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This detailed breakdown of Federal Signal's marketing strategy provides valuable insights without any hidden elements.

Promotion

Industry trade shows and conferences are a key promotional tool for Federal Signal, allowing them to directly connect with potential customers across municipal, governmental, industrial, and commercial sectors. These events serve as vital platforms to unveil new products and demonstrate innovative solutions. For example, at the NTEA Work Truck Show in March 2024, Federal Signal highlighted its electric vehicle offerings, including EV dump trucks, underscoring their commitment to sustainable technology.

Federal Signal leverages public relations and media engagement to underscore its commitment to public safety, worker protection, and environmental stewardship. This strategic approach involves disseminating press releases concerning new product introductions, strategic acquisitions, and financial performance, thereby cultivating brand recognition and a positive public image.

Recent communications have focused on key developments, including the company's Q1 2025 earnings report, which showed a revenue increase of 7.1% year-over-year to $480.6 million, and its Q2 2025 earnings, alongside significant acquisition announcements aimed at expanding its market reach and technological capabilities.

Federal Signal leverages digital marketing through its corporate website to showcase product advantages, company ethos, and investor data. This includes a robust online presence featuring comprehensive product details, dedicated investor relations sections, and sustainability reports, as seen in their latest annual filings for 2024.

Their website prominently displays 'Innovation At Work,' illustrating the diverse array of equipment offered. For instance, their 2024 investor relations section highlights a 7% increase in digital engagement, reflecting successful outreach for their public safety and industrial solutions.

Strategic Acquisitions for Market Expansion

Strategic acquisitions function as a powerful promotional tool for Federal Signal, directly contributing to market expansion and the broadening of its product portfolio. These moves effectively showcase the company's growth trajectory and its increasingly diverse operational capabilities to a wider audience.

Recent strategic moves underscore this approach. For instance, the acquisition of Hog Technologies in late 2021 significantly bolstered Federal Signal's street sweeping and vacuum excavation capabilities. Following this, the acquisition of Standard Equipment Company in early 2024 further enhanced its offerings in the municipal and industrial markets, particularly in snow and ice control equipment.

These acquisitions are not just about adding products; they are about expanding reach and enhancing service capabilities. By integrating these businesses, Federal Signal promotes its ability to offer comprehensive solutions across a wider geographical footprint and to a more diverse customer base.

Federal Signal's commitment to growth through acquisition is evident in its financial performance. For the fiscal year 2023, the company reported total revenues of $2.3 billion, a significant increase from $1.9 billion in 2022, with acquisitions playing a key role in this expansion.

- Market Presence Expansion: Acquisitions allow Federal Signal to enter new geographic markets and strengthen its position in existing ones.

- Product Portfolio Diversification: Integrating new companies broadens the range of solutions offered, appealing to a wider array of customer needs.

- Enhanced Service Capabilities: Acquisitions often bring specialized expertise and service networks, improving customer support and operational efficiency.

- Revenue Growth Driver: In 2023, Federal Signal's revenue reached $2.3 billion, with strategic acquisitions contributing substantially to this growth.

Sustainability Reporting and ESG Initiatives

Federal Signal actively communicates its dedication to sustainability through its annual sustainability reports, detailing progress on environmental, social, and governance (ESG) metrics. This transparent approach showcases their commitment to responsible operations and resonates with stakeholders who value ethical business practices.

The company highlights product innovations that align with sustainability objectives, such as their expanding line of electric and alternative-fuel vehicles for public safety and municipal services. This strategic emphasis not only appeals to environmentally conscious customers but also attracts investors increasingly focused on ESG performance.

Federal Signal has demonstrated tangible progress in its environmental stewardship, successfully achieving its greenhouse gas (GHG) emissions intensity reduction goals. For instance, in their 2024 report, they noted a significant reduction in Scope 1 and 2 emissions intensity compared to their 2019 baseline, reinforcing their commitment to a lower carbon footprint.

- Annual Sustainability Reports: Federal Signal publishes detailed reports outlining ESG performance and initiatives.

- Product Innovation for Sustainability: Focus on electric and alternative-fuel vehicles to meet evolving market demands.

- GHG Emissions Intensity Reduction: Achieved stated goals for reducing greenhouse gas emissions intensity.

- Stakeholder Engagement: Attracts environmentally conscious customers and ESG-focused investors.

Federal Signal's promotional strategy is multifaceted, encompassing trade shows, public relations, digital marketing, and strategic acquisitions. Their presence at industry events like the NTEA Work Truck Show in March 2024, where they showcased electric vehicle offerings, directly engages potential clients and highlights technological advancements. This proactive approach, combined with consistent media engagement and a robust digital presence, reinforces their brand as a leader in public safety and industrial solutions.

The company's financial communications, such as the Q1 2025 earnings report detailing a 7.1% revenue increase to $480.6 million, are crucial for investor relations and market perception. Furthermore, their commitment to sustainability, evidenced by GHG emissions intensity reductions and the development of eco-friendly vehicle lines, appeals to a growing segment of environmentally conscious consumers and investors.

Strategic acquisitions, like that of Standard Equipment Company in early 2024, are key promotional levers, expanding market reach and diversifying the product portfolio. These moves not only drive revenue growth, as seen with the 2023 total revenue of $2.3 billion, but also demonstrate Federal Signal's capacity for integrated solutions and enhanced service capabilities across broader geographical areas.

| Promotional Activity | Key Focus/Example | Impact/Data Point |

|---|---|---|

| Trade Shows & Conferences | NTEA Work Truck Show (March 2024) - EV offerings | Direct customer engagement, product unveiling |

| Public Relations & Media | Press releases on new products, acquisitions, financials | Cultivates brand recognition and positive image |

| Digital Marketing | Corporate website, investor relations section | Showcases product advantages, company ethos; 7% increase in digital engagement (2024) |

| Strategic Acquisitions | Standard Equipment Company (Early 2024) | Market expansion, portfolio diversification; 2023 Revenue: $2.3 billion |

| Sustainability Communications | Annual sustainability reports, ESG metrics | Attracts ESG-focused investors, promotes eco-friendly products |

Price

Federal Signal likely adopts a value-based pricing strategy for its specialized safety, security, and environmental solutions. This approach aligns with the critical functions and high quality of their offerings, ensuring customers recognize the long-term benefits. For instance, their integrated emergency notification systems, which can save lives and mitigate damage, command a price reflecting that immense value.

Federal Signal strategically positions its pricing within its specialized niche markets, balancing its premium product quality with market dynamics. This approach ensures attractiveness to municipal, governmental, industrial, and commercial clients by considering competitor offerings and market demand to effectively secure bids and contracts.

The company's robust market share in areas like emergency vehicle lighting and warning systems, a segment where Federal Signal held a significant position in early 2024, underpins this competitive pricing strategy. This allows them to maintain value perception while remaining aggressive enough to win key opportunities.

Federal Signal's aftermarket parts and service pricing is designed for sustained revenue generation and robust customer support, often yielding strong profit margins. This strategy ensures customers can readily access essential maintenance and support, a key factor in their ongoing satisfaction and loyalty.

The company's rental fleet operations are particularly noteworthy, demonstrating a capacity for more attractive returns than new equipment sales in isolation. For instance, in the first quarter of 2024, Federal Signal reported a 10.6% increase in revenue for its Safety and Security segment, which includes rental services, highlighting the segment's growing contribution to overall financial performance.

Contractual and Bid-Based Pricing for Large Orders

For substantial governmental and municipal contracts, Federal Signal engages in a bid-based pricing strategy. This involves submitting competitive proposals that meticulously outline product specifications, delivery timelines, and essential ongoing support services.

This rigorous process necessitates detailed cost analysis and strategic bidding to secure these large-scale orders, which are crucial for maintaining a robust backlog. As of the first quarter of 2025, Federal Signal's backlog stood at an impressive $1.10 billion, underscoring the significance of these contractual agreements.

- Bid-Based Pricing: Essential for large governmental and municipal contracts.

- Proposal Components: Includes product specifications, delivery, and support.

- Strategic Importance: Drives backlog and secures significant orders.

- Q1 2025 Backlog: Federal Signal reported a backlog of $1.10 billion.

Consideration of Economic Factors and Chassis Costs

Federal Signal's pricing strategies are deeply intertwined with macroeconomic trends and the volatile cost of essential components. For instance, the company acknowledges that the price of chassis, a critical input they source externally, presents a significant hurdle, especially for their electric vehicle offerings. This external dependency directly impacts their ability to set competitive prices.

The cost of chassis, a major component in their vehicle production, is a key consideration. In 2024, global supply chain disruptions and increased demand for automotive components, including chassis, have driven up prices. Federal Signal's reliance on these external suppliers means that fluctuations in raw material costs and manufacturing capacity directly translate to their own production expenses, necessitating careful pricing adjustments.

- Chassis Cost Impact: The cost of chassis, a non-manufactured component, is a significant factor in Federal Signal's pricing, particularly for electric vehicles.

- Economic Influence: Broader economic conditions, including inflation and supply chain dynamics, heavily influence pricing decisions for all Federal Signal products.

- 2024 Cost Pressures: Rising costs for raw materials and automotive components in 2024 have put upward pressure on the price of essential inputs like chassis.

- EV Pricing Challenges: The expense associated with chassis for electric vehicles poses a particular challenge for Federal Signal's pricing strategy in the growing EV market.

Federal Signal's pricing reflects a blend of value-based, competitive, and bid-based strategies tailored to its diverse product lines and customer segments. The company's aftermarket services and rental fleet operations are specifically priced to ensure sustained revenue and attractive returns, as evidenced by the Safety and Security segment's revenue growth in Q1 2024.

Macroeconomic factors, particularly the cost of sourced components like chassis, significantly influence Federal Signal's pricing, especially for its electric vehicle offerings. This dependency means that market-wide cost pressures, like those seen in automotive component pricing during 2024, directly impact Federal Signal's ability to maintain competitive pricing.

The company's substantial backlog, reaching $1.10 billion by Q1 2025, highlights the success of its bid-based pricing for large governmental and municipal contracts, which require meticulous cost analysis and strategic proposal development.

| Pricing Strategy | Key Application | Supporting Data |

| Value-Based | Specialized Safety, Security & Environmental Solutions | High quality, critical functions |

| Competitive | Niche Markets (e.g., Emergency Vehicle Lighting) | Market share, competitor analysis |

| Bid-Based | Governmental & Municipal Contracts | Q1 2025 Backlog: $1.10 Billion |

| Aftermarket/Rental | Sustained Revenue, Customer Support | Q1 2024 Safety & Security Revenue: +10.6% |

4P's Marketing Mix Analysis Data Sources

Our Federal Signal 4P's analysis leverages a comprehensive blend of public company disclosures, including SEC filings and investor relations materials, alongside detailed industry reports and competitive intelligence. This ensures a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.