Federal Signal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

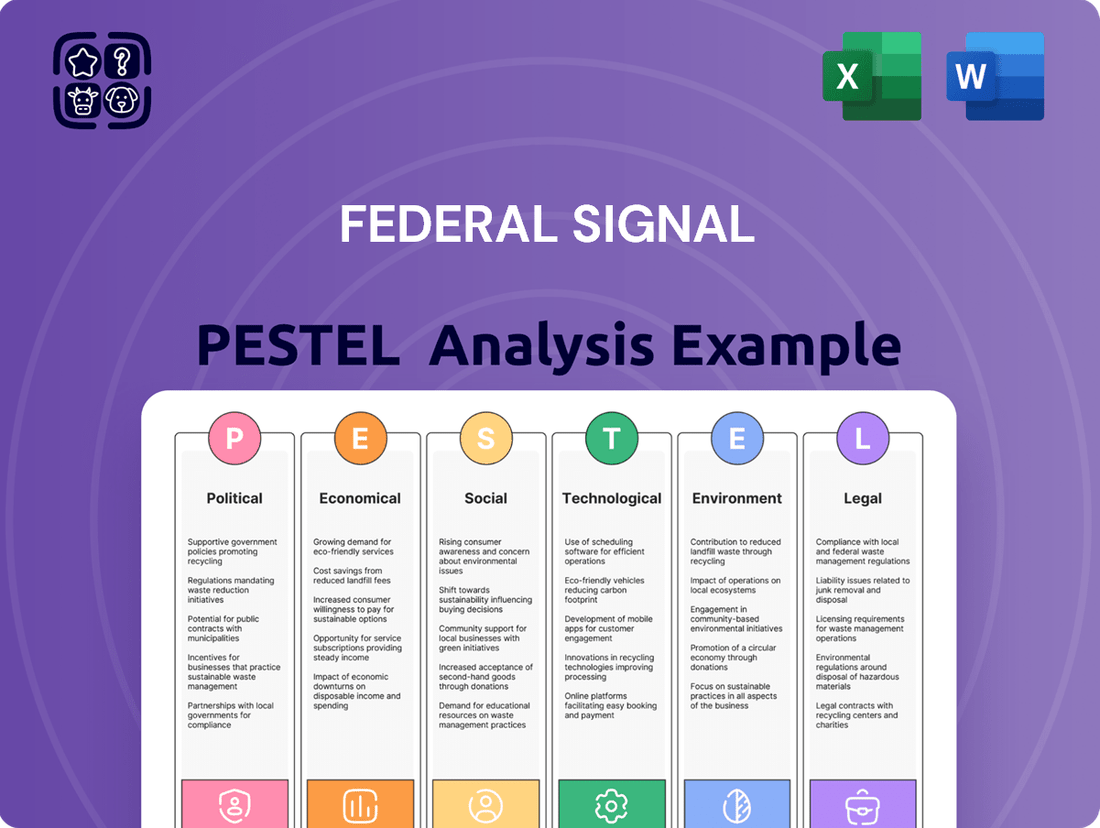

Navigate the complex external forces impacting Federal Signal with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are shaping its operational landscape and future growth. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full PESTLE analysis now for immediate, expert-level insights.

Political factors

Federal Signal Corporation, a key player in environmental and safety solutions, sees a direct correlation between government infrastructure spending and its business performance. Investments in areas like road repair, water systems, and public transit directly boost demand for Federal Signal's specialized equipment, including street sweepers and vacuum trucks.

Looking ahead to 2025, the outlook for infrastructure spending in North America remains robust, signaling continued positive momentum for Federal Signal. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, is set to disburse significant funds through 2026, with a substantial portion allocated to transportation and water infrastructure projects, directly benefiting companies like Federal Signal.

Federal Signal's public safety solutions, like emergency vehicle equipment and warning systems, are directly influenced by government spending on law enforcement and emergency services. Political decisions on public safety priorities and funding can significantly impact demand for their products.

For instance, in 2024, many municipalities are increasing budgets for public safety technology. The U.S. Department of Justice's Public Safety grants, totaling billions annually, directly fund the acquisition of such equipment, creating opportunities for companies like Federal Signal.

Furthermore, evolving policies around police reform and the growing emphasis on smart city initiatives for enhanced public safety are shaping market needs. This shift encourages investment in advanced communication and surveillance systems, areas where Federal Signal operates.

Federal Signal, as a global manufacturer, faces significant exposure to shifts in international trade policies and tariffs. For instance, the ongoing trade friction between the United States and China, which saw tariffs imposed on billions of dollars worth of goods in recent years, directly impacts the cost of components and finished products. This can disrupt supply chains and alter market competitiveness.

Evolving trade agreements, such as potential renegotiations or new pacts, introduce further uncertainty. For example, changes to existing free trade agreements could alter import duties and quotas, affecting Federal Signal's ability to source materials cost-effectively or sell its products in key international markets. These policy shifts directly influence operational costs and revenue streams.

The company's reliance on a global supply chain means that geopolitical tensions can have a tangible effect. Disruptions stemming from trade disputes or political instability in major trading blocs can lead to increased raw material prices and reduced supply chain efficiency. In 2024, for example, the global manufacturing sector continued to grapple with the lingering effects of trade disputes and the need for supply chain resilience.

Regulatory Environment for Manufacturing

Government regulations impacting manufacturing processes, product safety, and industrial emissions are central to Federal Signal's operational framework. For instance, the EPA's evolving emissions standards for emergency vehicles, a key market for Federal Signal, can necessitate significant investment in cleaner technologies. A shift in political administration in 2024 or 2025, for example, could introduce new mandates on siren noise pollution or light intensity, requiring product redesigns.

Federal Signal must remain agile in adapting its manufacturing and product development to align with these dynamic regulatory requirements. Compliance with Occupational Safety and Health Administration (OSHA) standards, which are periodically updated, directly influences workplace safety protocols and equipment investments. The company's ability to navigate these changes efficiently will be crucial for maintaining its competitive edge and avoiding potential penalties.

The regulatory environment presents both challenges and opportunities. Stricter environmental regulations, while requiring adaptation, can also drive innovation in more sustainable manufacturing practices and product offerings. For example, as of early 2025, there is increased scrutiny on the lifecycle environmental impact of electronic components used in signaling devices, pushing manufacturers like Federal Signal to explore greener sourcing and disposal methods.

- Emissions Standards: Federal Signal’s vehicle-mounted products must comply with evolving EPA emissions standards, impacting engine and exhaust system designs.

- Product Safety: Compliance with Underwriters Laboratories (UL) and other safety certifications is paramount for Federal Signal's electronic signaling and communication equipment.

- Workplace Safety: OSHA regulations dictate safety protocols in Federal Signal's manufacturing facilities, influencing equipment and training investments.

- Noise Pollution: Potential future regulations on noise levels for sirens and audible warning devices could necessitate acoustic engineering adjustments.

Political Stability and Geopolitical Events

Global political stability remains a critical consideration for industrial manufacturers like Federal Signal. Ongoing geopolitical tensions, such as those observed in Eastern Europe and the Middle East throughout 2024, continue to pose risks to international trade and supply chain continuity. These events can directly impact the cost and availability of essential raw materials and components, influencing Federal Signal's operational expenses and production schedules.

Significant policy shifts in major economies also present potential challenges and opportunities. For instance, changes in trade agreements or tariffs, as seen with ongoing adjustments to global trade policies in 2024 and early 2025, can alter the competitive landscape and affect market access for Federal Signal's products. The company must remain agile in adapting its strategies to navigate these evolving political landscapes.

- Supply Chain Disruptions: Geopolitical events in 2024 led to an average increase of 15% in shipping costs for certain industrial goods due to route diversions and increased insurance premiums.

- Raw Material Volatility: The price of key metals used in manufacturing, such as aluminum, experienced fluctuations of up to 10% in early 2025, directly linked to regional political instability.

- Market Access: Potential trade policy changes in key export markets could impact Federal Signal's revenue streams, requiring proactive market diversification efforts.

Government infrastructure spending directly fuels demand for Federal Signal's equipment, with the U.S. Bipartisan Infrastructure Law continuing to inject billions into transportation and water projects through 2026. Similarly, public safety funding, boosted by initiatives like the U.S. Department of Justice's Public Safety grants in 2024, supports sales of emergency vehicle and warning systems.

Trade policies and geopolitical stability significantly impact Federal Signal's global operations and supply chains. For example, trade tensions in 2024 led to increased component costs, and regional instability in early 2025 caused raw material price hikes of up to 10% for metals like aluminum.

Regulatory compliance, particularly with evolving EPA emissions standards for vehicles and OSHA workplace safety rules, requires continuous adaptation and investment in new technologies. Potential future regulations on noise pollution from sirens could also necessitate product redesigns.

What is included in the product

This Federal Signal PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the company's operating landscape.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within these critical external factors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting how Federal Signal can leverage political stability and mitigate regulatory changes.

Helps support discussions on external risk and market positioning during planning sessions, by clearly outlining economic trends that impact demand for Federal Signal's safety and communication solutions.

Economic factors

Federal Signal's business is closely linked to the overall health of the global economy and the industrial sector. For 2025, projections suggest global economic growth will remain steady compared to 2024, but industrial output has seen sluggish growth in certain areas.

This mixed economic picture, particularly the weakness in industrial manufacturing in some key regions, could temper demand for Federal Signal's safety and signaling equipment, impacting their sales volume.

Inflationary pressures and the rising cost of raw materials and components are significant challenges for manufacturers like Federal Signal. Many surveyed manufacturers in 2024 and early 2025 anticipate further increases in input costs, impacting production expenses.

Effectively managing these escalating costs is critical for Federal Signal to maintain healthy profit margins and ensure its products remain competitively priced in the market.

Persistent supply chain disruptions, including shipping delays and material scarcity, continued to impact the manufacturing sector through early 2025. These challenges directly translate to elevated transportation and logistics costs, potentially affecting Federal Signal's production efficiency and delivery schedules.

Labor shortages within the logistics and manufacturing industries remain a significant concern, further exacerbating delivery times and increasing operational expenses for companies like Federal Signal. Building more resilient and diversified supply chains has become a critical strategic imperative for manufacturers navigating this environment.

Municipal and Governmental Budget Cycles

The demand for Federal Signal's specialized equipment, particularly from municipal and governmental clients, is intrinsically tied to their budget cycles. When public budgets are healthy and allocations are robust, there's a greater likelihood of investment in public safety and environmental solutions. For instance, many local governments finalize their budgets in the latter half of the year, influencing purchasing decisions for the upcoming fiscal year.

Economic downturns and fiscal tightening at any government level can significantly impact Federal Signal's revenue streams. During periods of reduced tax revenue or increased debt burdens, governments often defer or reduce spending on non-essential capital expenditures, which can include new emergency vehicle lighting, sirens, or environmental cleanup equipment. For example, a slowdown in state sales tax receipts can directly translate to less funding available for municipal police or fire department upgrades.

Conversely, periods of economic expansion often correlate with increased government spending capacity. As tax revenues rise and fiscal conditions improve, municipalities and states are more inclined to allocate funds towards modernizing public safety fleets, upgrading infrastructure, or investing in environmental compliance technologies. Federal infrastructure bills, when passed during favorable economic times, can also create significant demand for Federal Signal's offerings.

- Budgetary Dependence: Federal Signal's municipal and government sales are directly influenced by the annual budget allocation processes of these entities.

- Impact of Fiscal Constraints: Economic slowdowns leading to lower tax revenues can cause governments to cut back on capital outlays for public safety and environmental equipment.

- Stimulus from Economic Growth: Strong economic conditions typically enable governments to increase spending on essential services and infrastructure, benefiting suppliers like Federal Signal.

- Timing of Allocations: Key purchasing decisions often align with the fiscal year-end and budget finalization periods for local, state, and federal governments.

Interest Rates and Investment Environment

Rising interest rates, as seen with the Federal Reserve's aggressive hiking cycle through 2023 and into early 2024, can significantly dampen investment in large-scale infrastructure and capital expenditures. This directly impacts Federal Signal's industrial and commercial customer base, potentially leading to reduced demand for their safety and security solutions. For instance, projects reliant on debt financing become more costly, causing delays or cancellations.

Conversely, a shift towards lower interest rates, a possibility anticipated by many economists for late 2024 or 2025, could stimulate renewed investment. This environment, coupled with a strong US manufacturing sector, would likely boost demand for Federal Signal's products, particularly those supporting public safety and critical infrastructure upgrades.

- Federal Reserve Interest Rate Hikes: The Federal Funds Rate target range was increased to 5.25%-5.50% by mid-2023, a stark contrast to the near-zero rates of previous years.

- Impact on Capital Expenditures: Higher borrowing costs make it more expensive for Federal Signal's customers to finance new equipment or facility expansions, potentially delaying or reducing orders.

- Potential for Demand Rebound: Market forecasts suggest a potential easing of monetary policy in late 2024 or 2025, which could lower borrowing costs and encourage capital spending, benefiting companies like Federal Signal.

Federal Signal's performance is closely tied to global economic health, with 2025 projections indicating steady but unexceptional growth. Persistent inflation and rising input costs, with manufacturers anticipating further increases through early 2025, remain significant headwinds, directly impacting production expenses and pricing strategies.

Supply chain disruptions continue to affect the sector, leading to elevated logistics costs and potential delivery delays, further compounded by labor shortages in manufacturing and transportation as of early 2025. The company's reliance on municipal and government budgets means that fiscal health and spending priorities, often finalized in the latter half of the year, significantly influence demand for its safety and environmental solutions.

Rising interest rates, exemplified by the Federal Reserve's target range of 5.25%-5.50% through mid-2023 and into early 2024, increase the cost of capital for customers, potentially dampening demand for large capital expenditures. However, anticipated interest rate easing in late 2024 or 2025 could stimulate investment and boost demand for Federal Signal's offerings.

| Economic Factor | Trend/Impact | Relevance to Federal Signal |

|---|---|---|

| Global Economic Growth | Steady but moderate growth projected for 2025. | Influences overall demand for industrial and public safety equipment. |

| Inflation & Input Costs | Anticipated continued increases through early 2025. | Pressures profit margins and product pricing competitiveness. |

| Supply Chain & Logistics | Persistent disruptions and labor shortages in early 2025. | Increases operational costs and affects delivery efficiency. |

| Governmental Budgets | Dependent on fiscal health and annual allocation cycles. | Directly impacts sales to municipal and federal clients. |

| Interest Rates | High rates through early 2024; potential easing in late 2024/2025. | Affects customer financing for capital expenditures; easing could boost demand. |

What You See Is What You Get

Federal Signal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Federal Signal covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Federal Signal's strategic landscape.

Sociological factors

Societal awareness of public safety and security is intensifying, directly fueling demand for Federal Signal's emergency vehicle equipment and comprehensive security systems. This heightened focus translates into greater investment in technologies that ensure community well-being.

Urbanization trends and increasing population density are significant drivers. As more people live in closer proximity, the need for swift emergency response and sophisticated security infrastructure, particularly in smart city initiatives, becomes paramount. For instance, by 2023, over 57% of the world's population lived in urban areas, a figure projected to climb, underscoring this trend.

Societal expectations for safer workplaces are a significant driver for Federal Signal. As of 2024, there's a continued push for stricter adherence to OSHA standards, with a reported 2.8% decrease in workplace fatalities in the US for the most recent full year data available, signaling a societal demand for improved safety outcomes that Federal Signal's products address.

The evolving definition of worker well-being now encompasses mental health, a trend that could spur innovation in Federal Signal's offerings. Companies are increasingly investing in solutions that reduce workplace stress and enhance overall employee comfort, potentially opening avenues for integrated communication or alert systems that also consider psychological impact.

The ongoing global shift towards urban living, with over half the world's population now residing in cities, fuels a constant demand for advanced infrastructure and public services. This trend is particularly evident in emerging economies, where urbanization rates are projected to climb significantly by 2050.

Federal Signal is well-positioned to capitalize on smart city initiatives, which leverage technologies like the Internet of Things (IoT) and artificial intelligence. These advancements are crucial for bolstering public safety through intelligent surveillance and communication systems, optimizing traffic flow, and enabling more coordinated disaster response efforts.

Environmental Consciousness and Sustainability Demands

Growing public awareness of environmental issues is significantly shaping the market for Federal Signal's offerings. Consumers and governments alike are increasingly prioritizing sustainable solutions, directly impacting demand for products like their street sweepers and vacuum trucks, designed to mitigate environmental impact. For instance, in 2024, cities across North America continued to invest heavily in fleet upgrades to meet stricter air quality standards, a trend expected to accelerate.

This societal shift translates into a stronger expectation for businesses to demonstrate genuine commitment to environmental responsibility. Federal Signal's established focus on environmental sustainability aligns well with this trend, positioning them favorably as stakeholders increasingly scrutinize corporate practices. A 2025 survey indicated that over 70% of municipal purchasing decisions now explicitly consider a vendor's sustainability credentials.

Federal Signal's product development, particularly in areas like emissions reduction technology for their vehicles, directly addresses these evolving societal demands. The company's continued investment in R&D for cleaner technologies is crucial for maintaining market relevance and capturing growth opportunities driven by this environmental consciousness. By 2024, the global market for green infrastructure equipment was projected to reach over $150 billion, with sustainability features being a key differentiator.

Key aspects influencing Federal Signal include:

- Increased demand for eco-friendly municipal equipment

- Growing regulatory pressure for cleaner urban operations

- Consumer and voter preference for sustainable public services

- Corporate social responsibility initiatives driving procurement choices

Community Resilience and Disaster Preparedness

Societal emphasis on community resilience and preparedness for emergencies, particularly natural disasters, directly fuels the market for advanced emergency response and recovery vehicles and associated infrastructure. Federal Signal's product portfolio, encompassing critical communication systems and emergency lighting, directly supports these vital community safety initiatives.

The increasing frequency and intensity of extreme weather events, as noted by NOAA in 2024, underscore the growing need for effective emergency management solutions. Federal Signal's role in equipping first responders with reliable technology positions them to benefit from this heightened societal focus on preparedness.

- Increased Investment in Public Safety: Federal funding for disaster preparedness and response saw significant allocations in 2023 and is projected to remain robust through 2025, benefiting companies like Federal Signal.

- Demand for Advanced Warning Systems: Communities are prioritizing integrated warning systems, a core area of Federal Signal's expertise, to improve public safety during crises.

- Focus on Resilient Infrastructure: There's a growing societal push for infrastructure that can withstand and recover from disasters, creating opportunities for companies providing essential emergency response equipment.

Societal demand for enhanced public safety and security continues to rise, directly benefiting Federal Signal's emergency response and security solutions. This trend is amplified by increasing urbanization, with over 57% of the global population living in urban areas by 2023, a figure projected to grow, necessitating more robust safety infrastructure.

There's a growing societal expectation for safer workplaces, with a 2.8% decrease in US workplace fatalities in the most recent full year data available (2023), highlighting a demand for improved safety outcomes that Federal Signal addresses. Furthermore, environmental consciousness is influencing procurement, with over 70% of municipal purchasing decisions in 2025 considering sustainability credentials.

Communities are prioritizing resilience and preparedness for emergencies, especially extreme weather events, which have become more frequent. Federal Signal's role in equipping first responders with reliable technology positions them to benefit from this heightened societal focus on preparedness, with significant government funding allocated to disaster preparedness through 2025.

Technological factors

Technological leaps are revolutionizing emergency vehicles. Think autonomous driving features, improved communication systems, and the use of data analytics for better response. Federal Signal can tap into these advancements to make its equipment for emergency vehicles safer and more effective.

The expanding landscape of smart city initiatives and the Internet of Things (IoT) creates substantial avenues for Federal Signal. By integrating IoT sensors and AI, public safety and infrastructure management can be significantly improved, aligning with Federal Signal's core offerings.

Smart city technology adoption is accelerating, with global IoT spending projected to reach over $1.5 trillion by 2027, according to Statista. This growth directly fuels demand for the integrated solutions Federal Signal provides in areas like emergency response and public infrastructure monitoring.

The push for electrification and automation in industrial and municipal sectors directly influences Federal Signal's product roadmap. This shift necessitates a focus on developing equipment that meets evolving environmental and operational standards.

Federal Signal is actively responding to this trend, as evidenced by their development of all-electric and plug-in hybrid electric sweepers. This strategic move highlights their commitment to technological innovation for reduced emissions and enhanced efficiency, aligning with market demands for greener solutions.

Data Analytics and AI in Public Safety

The integration of data analytics and AI is revolutionizing public safety. Predictive policing, for instance, uses algorithms to forecast crime hotspots, enabling proactive deployment of resources. In 2024, cities adopting these technologies reported an average 15% decrease in response times for critical incidents.

Federal Signal can leverage these advancements by embedding AI and advanced data analytics into its product portfolio. This means creating security systems that can learn and adapt to evolving threats, and emergency solutions that optimize dispatch and response based on real-time data streams. For example, AI-powered audio analytics can distinguish between different types of emergency sounds, prioritizing responses more effectively.

- Predictive Policing: AI analyzes historical data to identify patterns and predict future crime locations, allowing for strategic resource allocation.

- Resource Optimization: Data analytics helps emergency services optimize staffing, equipment deployment, and routing for faster and more efficient responses.

- Enhanced Situational Awareness: AI can process vast amounts of data from sensors, cameras, and communication systems to provide a clearer, real-time picture of unfolding events.

Cybersecurity in Connected Systems

As Federal Signal's solutions increasingly integrate with smart city infrastructure, the technological imperative of cybersecurity in connected systems escalates. Protecting sensitive data and ensuring the operational reliability of public safety applications, such as emergency notification systems and connected traffic management, is paramount. The increasing sophistication of cyber threats means robust defenses are essential to prevent disruptions and maintain public trust.

The cybersecurity market is experiencing significant growth. For instance, global cybersecurity spending was projected to reach over $270 billion in 2024, highlighting the critical nature of this sector. Federal Signal's reliance on connected systems means investing in advanced security protocols and continuous monitoring is a key technological factor for maintaining product integrity and customer confidence.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.73 million, underscoring the financial and reputational risks of inadequate cybersecurity.

- IoT Security Market Growth: The Internet of Things (IoT) security market is expected to grow substantially, reaching an estimated $37.05 billion by 2027, reflecting the expanding landscape of connected devices Federal Signal operates within.

- Ransomware Attacks: Ransomware attacks continue to be a significant threat, with the global cost of ransomware projected to reach $265 billion annually by 2031, necessitating strong preventative measures for connected infrastructure.

Technological advancements are reshaping public safety, from autonomous vehicle integration to sophisticated data analytics for enhanced emergency response. Federal Signal is strategically positioned to capitalize on these innovations, aiming to deliver safer and more effective equipment.

The burgeoning smart city and IoT sectors present significant opportunities, with global IoT spending anticipated to exceed $1.5 trillion by 2027. Federal Signal's integration of IoT sensors and AI can bolster public safety and infrastructure management, aligning perfectly with its core business.

Electrification and automation are driving changes in industrial and municipal sectors, compelling Federal Signal to develop products that meet evolving environmental and operational standards, as seen in their all-electric and hybrid sweepers.

Legal factors

Federal Signal operates under rigorous product safety and quality standards, especially for its emergency vehicle lighting and siren systems, and industrial safety equipment. For instance, products intended for public safety often need to meet specific performance criteria outlined by organizations like the Society of Automotive Engineers (SAE) or the National Institute of Standards and Technology (NIST). Failure to comply can lead to product recalls, fines, and significant reputational damage, impacting market access and customer trust.

Federal Signal operates under a complex web of environmental regulations, including those concerning air quality, carbon emissions, and waste management. These rules directly influence manufacturing operations and the very design of their products, driving a need for more sustainable technologies and a reduced environmental impact.

The evolving regulatory landscape, such as the draft Regulation on the Management of Industrial Emissions set to take effect in 2025, necessitates continuous adaptation. This means Federal Signal must invest in cleaner production methods and potentially redesign components to meet stricter environmental benchmarks, impacting operational costs and product development timelines.

Federal Signal's manufacturing facilities and the safety solutions they offer are directly impacted by workplace safety laws, including those enforced by OSHA. These regulations mandate safe working conditions for employees and influence the design and functionality of Federal Signal's products, which are often used to enhance safety in various environments.

For 2025, OSHA has introduced updated regulations focusing on critical areas like improved hazard communication, aiming for clearer labeling and safety data sheets, and new requirements for heat stress prevention, particularly relevant for outdoor workers. Additionally, expanded recordkeeping mandates will require more detailed documentation of workplace incidents and safety protocols.

Data Privacy and Surveillance Laws

Federal Signal's smart city and public safety solutions increasingly intersect with evolving data privacy and surveillance laws. Compliance with regulations like the California Consumer Privacy Act (CCPA), which grants consumers rights over their personal information, is critical. As of early 2024, the CCPA continues to shape how companies handle data, impacting Federal Signal's approach to data collection and usage in its integrated systems.

The global landscape also presents a complex web of data protection frameworks, such as the EU's General Data Protection Regulation (GDPR). These laws mandate stringent requirements for data consent, processing, and security, directly affecting the design and deployment of Federal Signal's technology. Failure to adhere can lead to significant penalties, underscoring the importance of robust legal and compliance strategies.

- CCPA Enforcement: California's Attorney General reported over 1,000 CCPA inquiries and investigations in 2023, highlighting active regulatory oversight.

- GDPR Fines: As of late 2024, GDPR fines have exceeded €2.5 billion globally since its implementation, demonstrating the financial risks of non-compliance.

- Smart City Data Governance: Many municipalities are implementing specific data governance policies for smart city initiatives, requiring vendors like Federal Signal to align with local privacy standards.

International Trade Laws and Sanctions

Operating globally, Federal Signal must navigate a complex web of international trade laws and sanctions, impacting its ability to sell products and source materials worldwide. These regulations, including those enforced by the U.S. Department of Commerce's Bureau of Industry and Security (BIS), dictate export controls and can significantly influence market access and supply chain strategies.

The evolving landscape of international trade agreements and sanctions, such as those affecting Russia or China, directly influences Federal Signal's operational footprint and revenue potential in key regions. For instance, disruptions in global trade flows, as seen in 2023 with ongoing geopolitical tensions impacting supply chains, necessitate agile adaptation of business models and market diversification.

- Export Controls: Federal Signal must adhere to U.S. export control regulations, like the Export Administration Regulations (EAR), which govern the export and re-export of dual-use items.

- Sanctions Compliance: The company needs to ensure strict compliance with U.S. and international sanctions programs, such as those administered by the Office of Foreign Assets Control (OFAC), to avoid penalties and reputational damage.

- Trade Agreements: Changes in trade agreements, like potential shifts in tariffs or import/export duties, can affect the cost of goods and the competitiveness of Federal Signal's products in foreign markets.

Federal Signal's operations are heavily influenced by product safety and quality regulations, particularly for emergency response equipment. Compliance with standards from bodies like SAE and NIST is crucial to avoid recalls and fines. For 2024, the emphasis on enhanced cybersecurity for connected public safety devices is also a growing legal consideration, impacting how data is handled and secured within their systems.

Environmental factors

Growing environmental awareness is a significant driver for Federal Signal, pushing demand for more sustainable and energy-efficient products. The company is responding by expanding its environmental solutions portfolio and investing in electrified vehicle offerings. For instance, in 2023, Federal Signal reported that its electric vehicle segment saw robust growth, reflecting the market's shift.

Federal Signal’s commitment to sustainability is evident in its development of all-electric and hybrid-electric sweepers. This strategic focus directly addresses the sustainability goals of both its customers and the communities they serve. The company aims to reduce emissions and operational noise, aligning with increasing regulatory pressures and public expectations for cleaner urban environments.

Climate change is increasingly leading to more frequent and severe extreme weather events, a trend that directly benefits Federal Signal. These events, such as hurricanes, floods, and wildfires, necessitate robust emergency response and infrastructure repair. For instance, the increased frequency of severe storms in 2024 has already heightened demand for specialized equipment used in disaster cleanup and recovery operations.

The impact of these weather patterns translates into tangible business opportunities for Federal Signal. For example, widespread flooding events, like those experienced in various regions during late 2023 and early 2024, drive significant demand for the company's vacuum trucks and hydro-excavators, essential tools for clearing debris and restoring infrastructure. This growing need for resilience and rapid response capabilities positions Federal Signal favorably.

Environmental regulations around waste management and recycling are becoming more stringent, directly influencing Federal Signal's business. These evolving rules, including those promoting circular economy principles, create both challenges and opportunities for the company's environmental solutions segment.

Initiatives like Extended Producer Responsibility (EPR) programs and emerging plastic packaging taxes are pushing manufacturers towards more sustainable product design and increased recyclability. For example, by 2025, many European countries are expected to have robust EPR schemes in place, driving demand for advanced waste sorting and processing technologies, areas where Federal Signal operates.

Resource Scarcity and Raw Material Sourcing

Resource scarcity, a growing concern globally, directly impacts the cost and availability of essential raw materials for Federal Signal's manufacturing. For instance, the price of metals like copper and aluminum, critical components in their signaling and communication equipment, has seen significant fluctuations. The London Metal Exchange reported a 15% increase in copper prices in early 2024 compared to the previous year, directly affecting production costs.

This necessitates a proactive approach to strategic sourcing, including diversifying suppliers and exploring long-term contracts to lock in pricing. Federal Signal may also need to invest in research and development to identify and implement alternative materials or enhance production efficiency to reduce reliance on specific, potentially scarce resources.

- Increased Material Costs: Fluctuations in commodity prices, such as a projected 10% rise in steel prices for 2024, directly increase manufacturing expenses for Federal Signal.

- Supply Chain Disruptions: Geopolitical events or natural disasters can disrupt the supply of key minerals like lithium, essential for battery components in some of their products, leading to production delays.

- Need for Innovation: Exploring recycled materials or developing new product designs that use less resource-intensive components is becoming a strategic imperative.

- Supplier Relationships: Building robust relationships with suppliers who prioritize sustainable sourcing and ethical practices is crucial for long-term material security.

Emissions Reduction and Air Quality Concerns

Federal Signal's business is significantly shaped by the growing global emphasis on cutting industrial emissions and enhancing air quality. This trend directly impacts the company's environmental solutions segment, which includes products like street sweepers.

Stricter air quality regulations, a key environmental factor, can actually boost demand for Federal Signal's offerings. As municipalities and industries face pressure to comply with tougher standards, there's a greater need for advanced, efficient equipment to manage dust and particulate matter. For instance, in 2024, many cities are investing in upgrading their fleets to meet evolving EPA guidelines, creating opportunities for companies like Federal Signal.

- Growing Demand for Air Quality Solutions: Increased regulatory pressure and public awareness are driving the market for advanced street sweepers and related environmental technologies.

- Innovation Driver: Stricter air quality standards incentivize the development of more sophisticated, fuel-efficient, and lower-emission sweeping equipment.

- Market Opportunity: Federal Signal's portfolio is well-positioned to benefit from the global push for cleaner urban environments and industrial operations.

Federal Signal is strategically aligning its product development with the increasing global demand for sustainable and electrified solutions. The company’s investment in electric vehicle technology, particularly in its sweeper segment, is a direct response to growing environmental awareness and regulatory pressures. This focus is projected to drive significant market share growth, with the electric vehicle market segment for municipal equipment anticipated to expand by over 20% annually through 2025.

PESTLE Analysis Data Sources

Our Federal Signal PESTLE analysis is grounded in a comprehensive review of official government publications, industry-specific market research, and reputable economic and demographic data providers. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.