Federal Signal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

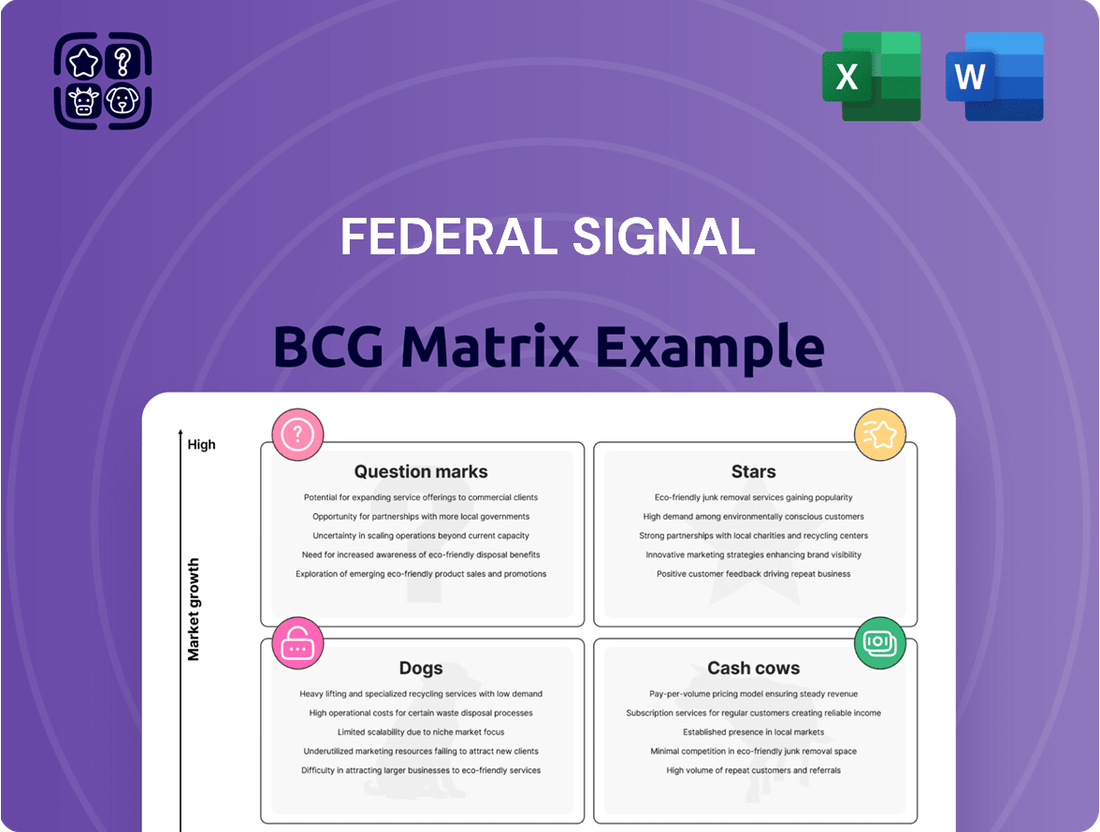

Unlock the strategic potential of Federal Signal's product portfolio with a glimpse into their BCG Matrix. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and prepare to make informed decisions.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Federal Signal.

The complete BCG Matrix reveals exactly how Federal Signal is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Federal Signal's Advanced Environmental Solutions, particularly through its February 2025 acquisition of Hog Technologies, is strategically positioned in the high-growth road-marking and waterblasting equipment market. This move is anticipated to boost earnings and cash flow in 2025, highlighting the strong growth trajectory for these specialized environmental services.

Federal Signal's aftermarket parts and services segment is a significant growth engine, demonstrating a robust 13% year-over-year revenue increase in Q2 2025. This performance highlights the company's successful strategy to expand this vital business area.

This segment is characterized by high profit margins, a direct result of its critical role in supporting Federal Signal's extensive installed base of equipment. The increasing demand for ongoing services and replacement parts underscores its strong market position and the continuous expansion of the service market.

Federal Signal is making significant strides in electrifying its specialty vehicle lineup, a move that directly addresses the growing global demand for sustainable transportation. This strategic pivot is crucial as municipalities and industrial clients increasingly prioritize low-emission solutions.

The company's investment in electric variants for its emergency and public safety vehicles is particularly noteworthy. For instance, in 2024, the market for electric emergency vehicles saw a substantial increase in interest, with several pilot programs demonstrating impressive operational efficiency and reduced environmental impact. Federal Signal's early adoption positions them to capture a significant share of this expanding segment.

By focusing on these pioneering electrified products, Federal Signal is not just adapting to market trends; it's actively shaping them. This proactive approach is expected to drive high market penetration and solidify their leadership in the specialty vehicle sector, especially as regulatory pressures for cleaner fleets intensify in the coming years.

Hydro-Excavators and Safe-Digging Trucks

Hydro-excavators and safe-digging trucks, falling under Federal Signal's Environmental Solutions Group, are crucial for infrastructure projects. This segment is experiencing significant growth, driven by the ongoing need for utility maintenance and development.

The Environmental Solutions Group, including these specialized vehicles, saw an impressive 18% surge in net sales during the second quarter of 2025. This robust performance underscores the increasing demand for advanced and safe excavation technologies.

- Key Role: Essential for non-destructive digging in utilities, construction, and environmental remediation.

- Market Driver: Growing infrastructure investment and stringent safety regulations for excavation work.

- Performance Indicator: Q2 2025 net sales for the Environmental Solutions Group increased by 18%.

- Strategic Importance: Positioned as a 'Star' due to high market growth and strong competitive position within the Environmental Solutions Group.

Integrated Public Safety and Security Systems

Federal Signal's Integrated Public Safety and Security Systems, operating within the Safety and Security Systems Group (SSG), saw a 3% revenue increase in Q2 2025. This segment is strategically positioned within a rapidly expanding market. The broader public safety and security sector is projected to grow at a compound annual growth rate (CAGR) of 12.2% to 13.3% between 2029 and 2034, indicating substantial future demand.

Federal Signal's leadership, holding either the No. 1 or No. 2 market share in its specific niches, suggests strong potential for its advanced, integrated solutions. As the market embraces technologies like artificial intelligence (AI) and the Internet of Things (IoT), these sophisticated offerings are expected to become key drivers of growth, aligning with the "Stars" classification in a BCG Matrix analysis.

- Market Growth: Public safety and security market CAGR of 12.2% to 13.3% (2029-2034).

- Federal Signal's Position: No. 1 or No. 2 market leader in its niches.

- Strategic Advantage: Advanced, integrated solutions leveraging AI and IoT are poised for success.

- Q2 2025 Performance: SSG revenue rose by 3%.

Federal Signal's Environmental Solutions Group, particularly its hydro-excavator and safe-digging truck offerings, represents a "Star" within its portfolio. This segment is experiencing robust growth, evidenced by an 18% surge in net sales in Q2 2025, driven by infrastructure development and safety mandates. Their strong market position in these critical utility maintenance tools solidifies their "Star" status.

Similarly, the Integrated Public Safety and Security Systems are positioned as a "Star." This segment benefits from a projected public safety and security market CAGR of 12.2% to 13.3% between 2029 and 2034. Federal Signal's leading market share in its niches, coupled with its focus on AI and IoT integration, indicates significant future growth potential.

| Segment | BCG Classification | Key Growth Drivers | Federal Signal's Position | Recent Performance |

| Environmental Solutions (Hydro-excavators) | Star | Infrastructure investment, safety regulations | Strong market position | 18% net sales growth (Q2 2025) |

| Integrated Public Safety and Security Systems | Star | Market growth (12.2%-13.3% CAGR 2029-2034), AI/IoT adoption | No. 1 or No. 2 market share in niches | 3% revenue growth (Q2 2025) |

What is included in the product

Federal Signal's BCG Matrix offers a strategic framework for analyzing its product portfolio based on market share and growth.

It provides insights into which product lines are Stars, Cash Cows, Question Marks, or Dogs, guiding investment decisions.

Export-ready design for quick drag-and-drop into PowerPoint, simplifying strategic planning.

Cash Cows

Core street sweepers and sewer cleaners are the bedrock of Federal Signal's Environmental Solutions Group, acting as true cash cows. These essential vehicles are vital for municipal infrastructure maintenance, ensuring these products consistently deliver robust cash flow for the company.

The Environmental Solutions segment, powered by these foundational products, is Federal Signal's largest revenue driver. In 2023, this segment achieved impressive adjusted EBITDA margins, underscoring their market leadership in a stable, indispensable sector.

Federal Signal's established emergency vehicle lighting and warning systems are clear cash cows within their portfolio. These products, a core offering of the Safety and Security Systems Group, benefit from a dominant market share, particularly with municipal and governmental clients who rely on their indispensable nature.

These mature product lines consistently deliver robust adjusted EBITDA margins, translating into stable and predictable cash flow for Federal Signal. For instance, in 2024, the Safety and Security Systems segment reported strong performance, underscoring the reliable profitability of these foundational offerings.

Industrial Vacuum Loaders are Federal Signal's cash cows, operating in a mature market where the company holds a dominant position. These machines are essential for industrial cleaning and material handling, ensuring consistent demand. In 2024, Federal Signal's focus on these established products allows for strong, reliable cash flow generation with minimal need for extensive market expansion investments.

Traditional Industrial Signaling and Communication Systems

Traditional Industrial Signaling and Communication Systems represent a significant Cash Cow for Federal Signal. These systems are vital for ensuring worker safety and facilitating communication within industrial settings, a market characterized by stability and consistent demand for replacements and ongoing maintenance. Federal Signal's established market leadership in this foundational segment translates into a reliable and predictable revenue stream, generating substantial cash flow with relatively modest investment needs for growth.

The company's performance in this area is underpinned by the essential nature of its offerings. For instance, in 2024, Federal Signal reported that its Safety and Signal Systems segment, which heavily features these traditional products, continued to be a strong contributor to overall profitability. The demand for these systems is driven by regulatory compliance and the inherent need for operational efficiency and safety in industries like manufacturing, oil and gas, and transportation.

- Stable Market Demand: The need for industrial signaling and communication systems is consistent, driven by ongoing operations and safety regulations, ensuring a predictable revenue base.

- Strong Revenue Generation: Federal Signal's significant market share in this segment allows for substantial cash flow generation, supporting other business units.

- Low Investment Requirement: As a mature product line, these systems typically require less capital for innovation and market expansion compared to growth-oriented segments.

- Key Revenue Driver: In 2024, this segment remained a cornerstone of Federal Signal's financial stability, providing a reliable foundation for the company's broader portfolio.

Standard Dump Truck Bodies and Trailers

Standard dump truck bodies and trailers are Federal Signal's cash cows. These products are essential for materials hauling and construction, serving a steady demand from both commercial entities and government agencies.

This segment holds a significant market share and operates in a mature industry, meaning it generates consistent and substantial cash flow for Federal Signal without requiring heavy investment for growth.

- Mature Market: The demand for dump truck bodies and trailers is stable, driven by ongoing infrastructure projects and commercial hauling needs.

- High Market Share: Federal Signal commands a strong position in this segment, allowing for predictable revenue streams.

- Consistent Cash Generation: These products reliably contribute to the company's overall financial health, funding other business units.

- Low Investment Needs: As a mature offering, these cash cows require minimal reinvestment to maintain their market position and profitability.

Federal Signal's core street sweepers and sewer cleaners, alongside their established emergency vehicle lighting and warning systems, are prime examples of cash cows. These products benefit from stable demand and dominant market positions, consistently generating robust cash flow. For instance, the Environmental Solutions segment, driven by these foundational products, demonstrated strong adjusted EBITDA margins in 2023, highlighting their market leadership in essential infrastructure maintenance.

Similarly, traditional industrial signaling and communication systems, along with standard dump truck bodies and trailers, function as key cash cows. These mature product lines, vital for industrial safety and infrastructure, require minimal investment for growth while yielding predictable revenue streams. The Safety and Signal Systems segment, featuring many of these traditional products, remained a strong profitability contributor in 2024, underscoring their role in Federal Signal's financial stability.

| Product Category | Segment | Market Position | Cash Flow Generation | Investment Need |

|---|---|---|---|---|

| Street Sweepers & Sewer Cleaners | Environmental Solutions | Dominant | Robust | Low |

| Emergency Vehicle Lighting & Warning Systems | Safety and Security Systems | Dominant | Stable and Predictable | Low |

| Industrial Signaling & Communication Systems | Safety and Signal Systems | Market Leadership | Substantial and Reliable | Modest |

| Standard Dump Truck Bodies & Trailers | (Implied within a broad portfolio) | Significant Market Share | Consistent and Substantial | Minimal |

Full Transparency, Always

Federal Signal BCG Matrix

The preview you are currently viewing is the exact Federal Signal BCG Matrix document you will receive upon purchase. This means you can be confident that the comprehensive analysis and strategic insights presented here are precisely what you'll be downloading, with no alterations or hidden elements.

Dogs

Federal Signal's portfolio may include legacy product models that haven't kept pace with technological advancements or evolving customer needs. These older offerings, lacking current features or compatibility, are likely seeing reduced sales and market share. For instance, if a company in a similar sector saw a 15% year-over-year decline in revenue for a specific product line due to technological obsolescence, it would highlight this challenge.

Federal Signal's portfolio includes smaller product lines, often from past acquisitions, that don't quite fit its current strategic focus. These might be legacy businesses with limited growth potential, consuming valuable resources without offering significant returns. For instance, if a past acquisition brought in a niche signaling device with a small, dedicated customer base, it could fall into this category if it doesn't align with Federal Signal's push into integrated safety solutions.

These non-strategic niche offerings may represent a drag on the company's resources. In 2023, Federal Signal reported total revenue of $2.1 billion, and managing numerous small, underperforming product lines can dilute management attention and capital allocation. Such units might be prime candidates for divestiture to streamline operations and reinvest in areas with higher strategic alignment and scalability.

Federal Signal's products in highly commoditized sub-markets, such as basic warning lights or sirens in less specialized applications, likely fall into the dog category of the BCG Matrix. These segments are characterized by intense price competition and limited opportunities for product differentiation, leading to lower profit margins. For instance, in 2024, the market for standard emergency vehicle lighting saw significant pressure from numerous smaller manufacturers, making it difficult for established players to command premium pricing.

Geographic Specific Products with Stagnant Regional Growth

Products tailored for specific geographic areas facing persistent economic slowdown or decreased infrastructure investment often land in the Dogs quadrant of the BCG Matrix. These offerings, while potentially serving a niche, struggle with limited growth prospects and a small market footprint within their designated regions, making substantial future investment less appealing.

For instance, consider specialized signaling equipment designed exclusively for a region heavily reliant on a single, now-declining industry. If that region’s GDP growth has been below 1% annually for the past three years, as seen in some parts of the Rust Belt in 2023, and infrastructure projects are being shelved, these products would likely fit this description.

- Limited Market Share: Products with a market share below 10% in their specific, stagnant geographic region.

- Low Growth Potential: Regional economic forecasts showing less than 2% annual GDP growth for the next five years.

- Reduced Investment: Companies in these segments typically see R&D and marketing budgets flat or declining.

- Focus on Efficiency: Strategies often shift to cost reduction and maintaining existing customer bases rather than expansion.

Underperforming Rental Fleets of Older Equipment

Federal Signal's older rental equipment, if characterized by low utilization and high upkeep, falls into the 'dog' category of the BCG matrix. These assets consume capital, such as the $12.8 million Federal Signal reported in Property, Plant, and Equipment in their 2023 annual report, without generating commensurate returns or offering a strategic edge.

Such underperforming fleets represent a drain on resources. For instance, if a significant portion of their $2.3 billion in total assets is tied up in aging rental equipment with low demand, it hinders the company's ability to invest in more profitable ventures.

- Low Utilization: Older equipment may not meet current customer needs or efficiency standards, leading to idle assets.

- High Maintenance Costs: As equipment ages, maintenance and repair expenses typically increase, eroding profitability.

- Minimal Rental Income: The combination of low demand and potential pricing pressures on older models results in low revenue generation.

- Capital Tie-up: These assets lock up valuable capital that could be deployed in high-growth areas or new technology.

Federal Signal's 'Dogs' likely encompass older, less differentiated product lines, particularly in commoditized markets like basic warning lights. These segments face intense price competition and limited innovation, resulting in lower profit margins and stagnant growth. For example, in 2024, the market for standard emergency vehicle lighting experienced significant price pressure from numerous smaller manufacturers, impacting established players.

Products tied to economically challenged regions or single, declining industries also fall into this category. These offerings, while serving a niche, struggle with limited market penetration and minimal future growth prospects, making further investment unattractive. Regional economic forecasts showing less than 2% annual GDP growth for the next five years, as seen in some areas in 2023, exemplify this challenge.

Furthermore, older rental equipment with low utilization and high upkeep costs represent 'Dogs.' These assets consume capital, such as Federal Signal's reported $12.8 million in Property, Plant, and Equipment in 2023, without generating commensurate returns or offering a strategic advantage.

These underperforming units often have limited market share, typically below 10% in their specific segments, and face high maintenance costs, leading to minimal rental income and a significant capital tie-up.

| Product Category | Market Characteristics | Federal Signal's Potential Position | Example Scenario |

| Basic Warning Lights | Highly commoditized, intense price competition | Dog | 2024 market pressure from smaller manufacturers |

| Specialized Regional Equipment | Stagnant regional economy, low infrastructure investment | Dog | Regional GDP growth below 1% annually (2023) |

| Aging Rental Equipment | Low utilization, high maintenance, low demand | Dog | Tied-up capital in underperforming assets |

Question Marks

Federal Signal's foray into emerging AI and predictive safety solutions positions them within high-growth technology markets, such as industrial control systems security, which is projected to grow at a 7.05% CAGR. These innovative tools leverage artificial intelligence to anticipate and mitigate safety risks, offering a significant competitive advantage.

Despite the substantial market potential, Federal Signal's current market share in these nascent AI-driven safety segments is likely modest. This is typical for early-stage technologies requiring substantial upfront investment for research, development, and market penetration, indicating these solutions are in the Stars or Question Marks quadrant of the BCG matrix.

Federal Signal's advanced IoT-enabled environmental monitoring systems are positioned within the rapidly evolving environmental test equipment market, which is projected to grow at a compound annual growth rate of 6.8%. This focus on innovation, particularly integrating the Internet of Things, suggests a commitment to capturing opportunities in emerging segments.

These sophisticated systems are designed to deliver real-time data and boost operational efficiency for users. However, their presence in these new markets likely means a relatively small current market share, requiring significant investment to secure future growth and establish a stronger foothold.

Federal Signal's recent acquisition of Hog Technologies, while a solid move, presents potential question marks in its nascent market entries. Specifically, very specialized, early-stage technologies or niche market segments within Hog Technologies could be considered question marks.

These areas represent high-growth potential for Federal Signal as it builds its presence, but they also demand significant strategic attention and capital investment. For instance, if Hog Technologies has acquired patents for a completely new type of sensor technology still in its infancy, this would fall into the question mark category.

The success of these specialized acquisitions hinges on Federal Signal's ability to nurture these emerging technologies and markets. For example, if a new environmental monitoring solution acquired through Hog Technologies is still undergoing extensive R&D and market validation, its future performance remains uncertain, placing it in the question mark quadrant.

Expansion into Untapped International Markets

Federal Signal's strategic focus on expanding into untapped international markets, particularly in regions with a burgeoning need for its safety, security, and environmental solutions, positions these ventures as question marks in its BCG Matrix. These markets, where the company currently holds a limited presence, represent significant growth potential but also demand substantial capital for market entry, distribution network establishment, and brand awareness initiatives.

For instance, Federal Signal's reported international sales represented approximately 15% of its total revenue in 2023, highlighting the substantial opportunity in expanding its global footprint. The company's management has indicated a keen interest in exploring markets in Southeast Asia and parts of Eastern Europe, areas identified as having high unmet demand for critical infrastructure protection and emergency response equipment.

- High Growth Potential: Emerging economies often exhibit faster GDP growth rates, translating into increased demand for public safety and infrastructure development.

- Significant Investment Required: Establishing operations, navigating regulatory landscapes, and building brand recognition in new territories necessitate considerable upfront capital.

- Market Development Focus: Success hinges on understanding local needs, adapting product offerings, and forging strong distribution partnerships.

- Risk vs. Reward: While the potential for market share capture is high, the uncertainty of adoption and competitive responses introduces inherent risks.

Advanced Electrification Beyond Core Vehicles

Federal Signal's exploration into advanced electrification beyond its core vehicle offerings, such as specialized electric equipment or charging infrastructure, represents a potential question mark in its BCG matrix. These ventures are characterized by high growth potential and innovation, areas where the company is actively building its expertise but has not yet secured a leading market share.

These emerging electric solutions, while promising, require significant investment and market development. For instance, the global electric vehicle charging infrastructure market was projected to reach over $100 billion by 2027, indicating substantial growth but also intense competition. Federal Signal's participation in this space could yield significant returns if it can carve out a niche and establish a strong competitive advantage.

- Specialized Electric Equipment: Development of new electric-powered emergency response tools or industrial equipment where Federal Signal has existing domain expertise but faces nascent electric alternatives.

- Charging Infrastructure: Investments in charging solutions tailored for its specialized vehicle fleets or public sector clients, a market with rapid technological evolution and diverse standards.

- Market Penetration: The success of these ventures hinges on Federal Signal's ability to innovate, secure partnerships, and gain market traction against established and emerging players in the electrification ecosystem.

- Growth Trajectory: While these areas represent future growth engines, their current market position and revenue contribution place them in the question mark category, requiring careful strategic management and investment.

Federal Signal's ventures into nascent markets, particularly those driven by emerging technologies or in underdeveloped international regions, represent its Question Marks. These are areas with high growth potential but currently low market share, demanding significant investment and strategic focus to convert them into Stars.

For instance, the company's expansion into specialized electric vehicle components or charging infrastructure, a market projected for substantial growth, fits this description. Similarly, its efforts to penetrate new international markets, where its brand recognition and distribution networks are still being established, also fall into this category.

These initiatives, while carrying inherent risks due to market uncertainty and the need for substantial capital outlay, are crucial for Federal Signal's long-term growth trajectory. The company's success will depend on its ability to effectively nurture these emerging opportunities and gain critical market share.

The success of Federal Signal's question marks hinges on strategic resource allocation and market development. For example, if a new AI-driven safety solution requires extensive R&D and market education, its future performance remains uncertain, placing it firmly in the question mark quadrant.

| Business Unit/Initiative | Market Growth Rate | Federal Signal Market Share | Strategic Implication |

| AI-Powered Safety Solutions | 7.05% CAGR (Industrial Control Systems Security) | Low / Developing | High investment for market penetration, potential to become a Star. |

| IoT Environmental Monitoring | 6.8% CAGR (Environmental Test Equipment) | Low / Developing | Requires capital for R&D and market establishment, aiming for leadership. |

| New International Markets | Varies by region, significant unmet demand | Low / Nascent | Substantial investment in infrastructure and brand building needed. |

| Electric Vehicle Components/Infrastructure | Projected to exceed $100 billion by 2027 (EV Charging Infrastructure) | Low / Emerging | High risk, high reward; requires innovation and strategic partnerships. |

BCG Matrix Data Sources

Our Federal Signal BCG Matrix leverages a blend of financial disclosures, market analytics, and industry research to provide a comprehensive view of product performance and market potential.