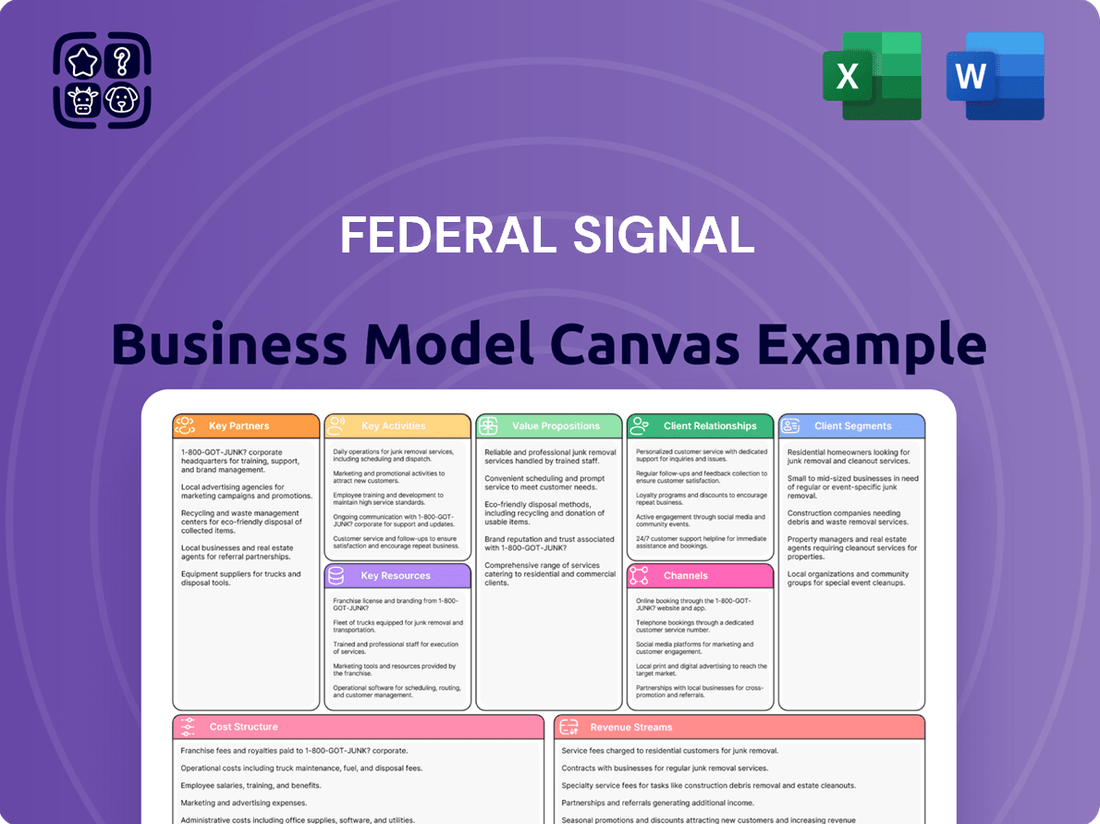

Federal Signal Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

Discover the strategic core of Federal Signal's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their market dominance. Ready to dissect a successful enterprise?

Unlock the full strategic blueprint behind Federal Signal's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Federal Signal cultivates strong alliances with a network of specialized component suppliers and raw material providers. These partnerships are foundational to securing high-quality, readily available inputs necessary for their extensive product portfolio, from emergency vehicle lighting to industrial warning systems.

In 2024, maintaining these supplier relationships is paramount for operational continuity and mitigating potential disruptions within the global supply chain. For instance, the company's reliance on advanced electronics and durable materials necessitates dependable sourcing to uphold production schedules and product integrity.

Federal Signal actively partners with technology providers and research institutions to drive innovation in safety, security, and environmental solutions. These collaborations are crucial for integrating advanced features and staying ahead in competitive markets. For instance, in 2024, the company continued to explore partnerships focused on IoT integration for enhanced situational awareness and data analytics in emergency response systems.

Federal Signal's extensive network of authorized dealers and distributors is a cornerstone of its go-to-market strategy, enabling access to a broad spectrum of customers worldwide. These partnerships are particularly vital for specialized equipment that necessitates localized sales expertise and dedicated service.

In 2024, Federal Signal continued to leverage these crucial relationships to ensure efficient product deployment and robust after-sales support, thereby extending its market penetration and reinforcing customer loyalty. This strategic reliance on channel partners allows the company to navigate diverse regional demands effectively.

Government and Municipal Agencies

Federal Signal's relationship with government and municipal agencies is foundational, as these entities represent a significant portion of their customer base. Successfully engaging these partners requires meticulous navigation of intricate bidding processes and strict adherence to diverse regulatory frameworks.

Securing long-term contracts for critical public safety and infrastructure projects is a primary objective. For instance, in 2023, Federal Signal reported that a substantial portion of its revenue was derived from government contracts, underscoring the importance of these partnerships.

- Government Procurement: Federal Signal actively participates in competitive bidding processes with federal, state, and local government agencies.

- Municipal Contracts: Partnerships with municipalities are crucial for supplying equipment like emergency lighting and sirens for police, fire, and public works vehicles.

- Regulatory Compliance: Adherence to government regulations, such as those from the General Services Administration (GSA) and Department of Defense (DoD), is essential for contract awards.

- Public Safety Infrastructure: These collaborations enable the deployment of essential public safety technologies, including integrated command and control systems and emergency communication solutions.

Strategic Acquisition Targets

Federal Signal actively pursues strategic acquisitions as a key partnership strategy to fuel inorganic growth. This approach allows the company to broaden its product offerings, increase its market presence, and enhance its technological expertise. For instance, in 2024, Federal Signal continued its disciplined approach to M&A, aiming to integrate businesses that offer synergistic benefits and expand its reach into adjacent markets.

These acquisition-driven partnerships are vital for Federal Signal's diversification efforts, enabling entry into complementary solution areas. The company's focus remains on identifying targets that align with its core competencies and provide opportunities for cross-selling and operational efficiencies. This strategy has historically contributed significantly to revenue growth and market leadership.

- Expansion of Product Portfolio: Acquisitions allow Federal Signal to quickly add new products and technologies, enhancing its competitive edge.

- Market Share Growth: By acquiring established players, Federal Signal can immediately capture a larger share of existing markets.

- Technological Advancement: Strategic acquisitions provide access to innovative technologies and R&D capabilities, accelerating product development.

- Diversification: The company leverages acquisitions to move into related or complementary business segments, reducing reliance on any single market.

Federal Signal's key partnerships are critical for sourcing essential components, driving innovation, and expanding market reach. The company relies on a robust network of specialized suppliers for high-quality materials, ensuring consistent production. Strategic alliances with technology providers and research institutions are vital for developing advanced safety and security solutions, with a focus in 2024 on IoT integration for emergency response systems.

The company's distribution network of authorized dealers and service providers is fundamental to its global sales strategy, offering localized expertise and support. Furthermore, strong relationships with government and municipal agencies are paramount, as evidenced by substantial revenue derived from public sector contracts in 2023. Federal Signal also actively pursues strategic acquisitions to enhance its product portfolio and market presence.

What is included in the product

This Federal Signal Business Model Canvas provides a detailed blueprint of how the company creates, delivers, and captures value.

It outlines key partners, activities, resources, customer relationships, and cost structure to support its mission.

Federal Signal's Business Model Canvas acts as a pain point reliever by offering a clear, actionable framework to address operational inefficiencies and market challenges.

It provides a structured approach to identifying and solving critical business problems, streamlining strategy and execution.

Activities

Federal Signal's core activities revolve around the meticulous design, engineering, and manufacturing of specialized safety, security, and environmental equipment. This process spans from initial concept to final production, ensuring each product adheres to demanding quality and performance benchmarks.

In 2023, Federal Signal reported net sales of $1.5 billion, with a significant portion attributed to the innovation and production of these critical systems. The company's commitment to rigorous engineering is evident in its continuous product development cycles, aimed at enhancing user safety and operational efficiency in diverse environments.

Federal Signal's commitment to Research and Development is a cornerstone of its business strategy. In 2024, the company continued to invest in R&D to drive innovation across its diverse product portfolio, aiming to enhance existing offerings and pioneer new solutions in public safety and industrial applications. This focus is crucial for maintaining a competitive edge and addressing evolving market needs.

This ongoing investment allows Federal Signal to stay ahead of technological advancements, ensuring its products remain cutting-edge. For instance, their work in developing advanced warning systems and communication technologies directly supports public safety initiatives, a sector where technological superiority is paramount. The company's R&D efforts are geared towards providing solutions that improve efficiency and effectiveness for their customers.

Federal Signal's sales and distribution hinge on a multi-pronged approach, blending direct engagement with a robust network. Their direct sales teams are instrumental in cultivating relationships with key clients, particularly in sectors requiring specialized solutions. This direct channel is complemented by a carefully managed dealer network, extending their reach into diverse geographic markets and customer segments worldwide.

A significant portion of their business involves securing large-scale contracts through participation in governmental and municipal tenders. This strategy is vital for penetrating public safety and infrastructure markets. For instance, in 2024, Federal Signal continued to leverage its established sales infrastructure to pursue and win contracts for critical communication and emergency response equipment, contributing to their overall revenue streams.

After-Sales Service and Support

Federal Signal’s commitment to after-sales service is a cornerstone of its business model, focusing on maintaining customer satisfaction and ensuring the continued optimal performance of its critical equipment. This includes offering robust maintenance programs, timely repair services, and a reliable supply of genuine parts, all supported by dedicated technical assistance.

This comprehensive support structure is designed to foster long-term customer loyalty and reinforce the value proposition of Federal Signal’s specialized safety and warning solutions. By prioritizing equipment uptime and operational efficiency, the company solidifies its reputation as a trusted partner in demanding environments.

For instance, in 2023, Federal Signal reported that its Services segment, which encompasses after-sales support, generated approximately $231.7 million in revenue, highlighting the significant contribution of these activities to the company's overall financial health and customer retention strategies.

- Maintenance and Repair: Offering scheduled maintenance and responsive repair services to minimize downtime for critical safety equipment.

- Parts Supply: Ensuring availability of genuine replacement parts to maintain the integrity and performance of installed systems.

- Technical Support: Providing expert technical assistance to help customers troubleshoot issues and optimize equipment usage.

- Customer Relationships: Building lasting partnerships through reliable support, enhancing customer satisfaction and loyalty.

Supply Chain Management

Federal Signal's supply chain management is a cornerstone of its operations, focusing on the intricate global network from raw material procurement to final product delivery. This involves meticulous logistics, precise inventory control, and robust supplier partnerships to ensure operational efficiency and cost-effectiveness.

For 2024, Federal Signal continued to emphasize optimizing its supply chain. This included strategic sourcing initiatives and advanced inventory planning to mitigate disruptions and maintain competitive pricing. The company's commitment to timely delivery and cost control directly impacts its ability to serve diverse customer needs across its segments.

- Global Sourcing: Securing reliable and cost-effective raw materials and components from international and domestic suppliers.

- Logistics and Distribution: Managing the transportation, warehousing, and delivery of finished goods to customers worldwide, ensuring promptness.

- Inventory Optimization: Implementing strategies to balance stock levels, minimizing carrying costs while preventing stockouts and production delays.

- Supplier Relationship Management: Cultivating strong partnerships with key suppliers to ensure quality, reliability, and favorable terms.

Federal Signal's key activities encompass the design, manufacturing, and distribution of specialized equipment. This includes continuous investment in research and development to innovate and enhance product offerings, ensuring they meet evolving safety and environmental standards. The company also focuses on robust after-sales service and support to maintain customer satisfaction and equipment longevity.

Delivered as Displayed

Business Model Canvas

The Federal Signal Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed canvas, ready for immediate use and strategic planning.

Resources

Federal Signal's extensive global manufacturing facilities, equipped with specialized machinery and advanced production lines, are critical physical resources. These assets are the backbone of their ability to produce a wide array of safety, security, and environmental solutions efficiently and at scale. For instance, in 2023, the company reported capital expenditures of $49.7 million, a significant portion of which would have been allocated to maintaining and upgrading these vital manufacturing capabilities.

Federal Signal's intellectual property, including its extensive portfolio of patents, trademarks, and design rights, forms a crucial resource. These proprietary technologies are the bedrock of their specialized products, offering a distinct competitive edge in the market. For instance, in 2023, the company continued to leverage its intellectual assets to drive innovation in emergency vehicle lighting and signaling systems.

Federal Signal relies heavily on its skilled workforce, encompassing engineers, designers, technicians, and sales professionals. This human capital is essential for developing specialized products, ensuring efficient manufacturing, and providing top-tier customer support. For instance, in 2023, the company reported approximately 2,000 employees, highlighting the scale of its talent pool.

The expertise of these individuals directly fuels Federal Signal's innovation pipeline and operational excellence. Their technical acumen in areas like emergency vehicle lighting, siren systems, and public safety software is a core competitive advantage. The company's commitment to attracting and retaining this talent is a key factor in its sustained market position.

Global Distribution and Service Network

Federal Signal's extensive global distribution and service network is a cornerstone of its business model. This network, comprised of distributors, dealers, and service centers across the globe, is vital for reaching diverse markets and ensuring customer satisfaction. In 2024, the company continued to leverage this established infrastructure to deliver its safety and signaling solutions effectively.

This robust network allows Federal Signal to achieve significant market penetration and ensures timely product delivery. It also underpins the company's ability to provide localized customer support, a critical factor in maintaining strong client relationships and addressing specific regional needs. The reach of this network is a key competitive advantage.

Key aspects of Federal Signal's Global Distribution and Service Network include:

- Extensive Worldwide Reach: Federal Signal operates through a vast network of partners in numerous countries, facilitating global market access.

- Localized Support Capabilities: The presence of local dealers and service centers enables tailored customer service and technical assistance.

- Efficient Product Delivery: The established logistics and distribution channels ensure that products reach customers promptly and reliably.

- Market Penetration Strategy: This network is fundamental to Federal Signal's strategy for entering and succeeding in new and existing markets.

Brand Reputation and Customer Trust

Federal Signal's brand reputation for reliability, quality, and safety solutions is a cornerstone of its business model. This hard-won trust, cultivated over many years, acts as a powerful intangible asset, significantly influencing customer acquisition and retention. For instance, in 2023, Federal Signal reported robust revenue growth, partly attributable to the enduring trust its customers place in its products and services.

This deep-seated customer trust, particularly within municipal, governmental, and industrial sectors, is crucial for securing contracts and fostering long-term relationships. It allows the company to command premium pricing and reduces the cost of sales, as existing clients are more likely to repurchase and recommend Federal Signal's offerings. The company's commitment to innovation and consistent performance reinforces this positive perception.

- Decades of experience building a reputation for dependable safety and warning solutions.

- High trust levels among municipal, governmental, and industrial customers.

- Reduced customer acquisition costs due to strong brand loyalty and positive word-of-mouth.

- Enhanced ability to secure new business and retain existing clients through proven reliability.

Federal Signal's key resources include its advanced manufacturing facilities, a robust intellectual property portfolio, and a highly skilled workforce. These tangible and intangible assets are fundamental to its ability to innovate and produce specialized safety and signaling solutions. For example, in 2023, the company invested $49.7 million in capital expenditures, supporting its manufacturing capabilities, and employed approximately 2,000 individuals, underscoring its human capital investment.

The company's global distribution and service network is a vital resource, enabling market penetration and customer support. Coupled with a strong brand reputation built on reliability and quality, these resources provide a significant competitive advantage. In 2023, Federal Signal's revenue growth reflected the trust customers place in its offerings, reinforcing its market position.

| Resource Category | Specific Examples | 2023 Data/Notes |

| Physical Resources | Global Manufacturing Facilities | $49.7 million in Capital Expenditures |

| Intellectual Resources | Patents, Trademarks, Design Rights | Continued innovation in signaling systems |

| Human Resources | Skilled Workforce (Engineers, Technicians) | Approximately 2,000 employees |

| Distribution & Service | Global Network of Dealers & Service Centers | Facilitates market access and customer support |

| Brand Reputation | Reliability, Quality, Safety Solutions | Contributed to robust revenue growth |

Value Propositions

Federal Signal's value proposition centers on significantly boosting public and worker safety. Their emergency vehicle equipment, like advanced lighting and siren systems, helps first responders operate more effectively and be seen clearly, reducing accident risks during critical responses. In 2023, the company reported revenue of $2.1 billion, reflecting strong demand for these safety-enhancing solutions.

Beyond emergency services, Federal Signal offers robust solutions for industrial settings, safeguarding workers. This includes high-intensity signaling devices and communication systems crucial for hazardous environments. Their commitment to mitigating risks and protecting lives is a fundamental driver for their customer base, who rely on these products to maintain safe operations.

Federal Signal's environmental sustainability solutions are key value propositions, offering advanced street sweepers and vacuum trucks designed for cleaner communities and efficient waste management. These products directly support customers in meeting increasingly stringent environmental regulations and enhancing public health outcomes.

In 2024, the demand for sustainable infrastructure and waste management technologies continues to grow, driven by global environmental initiatives. Federal Signal's commitment to developing these solutions positions them to capitalize on this expanding market, with a reported net sales increase in their Environmental Solutions segment for the first quarter of 2024.

Federal Signal's specialized equipment is engineered for exceptional reliability and durability. Their robust construction ensures high performance and a long operational lifespan, even when subjected to the harshest environments. This focus on lasting quality is a core value proposition for customers who cannot afford equipment failure.

This inherent reliability translates directly into minimized downtime for clients. For businesses with critical operations, such as emergency services or heavy industry, reduced downtime means significant cost savings and enhanced operational efficiency. Federal Signal's commitment to durability directly contributes to a lower total cost of ownership over the equipment's lifecycle.

Technological Innovation and Customization

Federal Signal leverages cutting-edge technology to deliver smart, customizable solutions. This focus on innovation allows them to tailor equipment, enhancing operational efficiency for clients. In 2023, Federal Signal reported approximately $1.5 billion in net sales, demonstrating the market's demand for their advanced product offerings.

Their ability to customize means clients receive solutions precisely engineered for their unique operational challenges. This tailored approach optimizes performance and addresses specific needs, a key differentiator in the market.

Federal Signal's commitment to technological advancement is evident in their product development pipeline. They aim to provide smart solutions that not only meet current demands but also anticipate future needs.

- Smart Solutions: Integration of intelligent features for enhanced functionality.

- Customization: Tailoring products to meet specific client requirements and operational contexts.

- Operational Efficiency: Enabling clients to optimize their workflows and resource utilization.

- Technological Advancement: Continuous investment in R&D to incorporate the latest innovations.

Comprehensive After-Sales Support

Federal Signal's comprehensive after-sales support is a cornerstone of its value proposition, ensuring customers receive ongoing assistance for their critical equipment. This includes readily available maintenance services, a robust supply of genuine replacement parts, and responsive technical assistance to address any operational challenges.

This dedication to post-purchase support is designed to maximize product uptime and operational efficiency for clients. For instance, in 2024, Federal Signal reported that its service contracts contributed significantly to recurring revenue, highlighting the value customers place on reliable support. This focus fosters strong, long-term customer relationships built on trust and dependable performance.

- Maintenance & Repair: Ensuring equipment remains in optimal working condition through scheduled servicing and prompt repairs.

- Parts Availability: Providing access to genuine replacement parts to minimize downtime during repairs.

- Technical Assistance: Offering expert guidance and troubleshooting support to resolve operational issues quickly.

- Maximizing Uptime: The ultimate goal is to keep critical systems operational, reducing disruptions for customers.

Federal Signal's value proposition is built on delivering safety, efficiency, and reliability through specialized equipment. They enhance public and worker safety with advanced emergency vehicle systems and industrial signaling. Their environmental solutions contribute to cleaner communities, while durable products minimize downtime and offer a lower total cost of ownership.

Innovation drives their offerings, with smart, customizable solutions tailored to specific client needs, optimizing operational performance. This commitment is reflected in their continued investment in research and development to meet evolving market demands.

Federal Signal ensures maximum uptime and customer satisfaction through comprehensive after-sales support, including maintenance, parts availability, and technical assistance, fostering long-term relationships.

| Value Proposition Pillar | Description | 2023/2024 Data Point |

|---|---|---|

| Public & Worker Safety | Advanced emergency vehicle equipment and industrial signaling for hazardous environments. | Revenue of $2.1 billion in 2023. |

| Environmental Solutions | Street sweepers and vacuum trucks for cleaner communities and regulatory compliance. | Reported net sales increase in Environmental Solutions segment (Q1 2024). |

| Reliability & Durability | Robust, high-performance equipment engineered for harsh conditions and long operational life. | Focus on minimizing downtime and lowering total cost of ownership. |

| Smart & Customizable Solutions | Leveraging technology for tailored equipment to enhance client operational efficiency. | Approximately $1.5 billion in net sales in 2023, indicating market demand for advanced offerings. |

| Comprehensive After-Sales Support | Maintenance, parts availability, and technical assistance to maximize product uptime. | Service contracts contributed significantly to recurring revenue in 2024. |

Customer Relationships

Federal Signal cultivates strong customer bonds through dedicated sales and account management, particularly for its significant governmental and industrial clientele. This direct engagement ensures a deep understanding of specific requirements, fostering enduring partnerships. For instance, in 2023, Federal Signal reported that its public safety segment, which heavily relies on these relationships, saw a substantial portion of its revenue driven by repeat business from established government contracts.

Federal Signal offers expert technical support and comprehensive training to ensure customers maximize the value of their specialized equipment. This commitment extends to providing operational guidance, which is vital for the effective use and long-term maintenance of their products.

By equipping customers with the necessary knowledge, Federal Signal fosters greater product utilization and reinforces customer reliance on the company's deep expertise. This focus on post-purchase support directly contributes to enhanced customer satisfaction and loyalty.

Federal Signal offers service and maintenance contracts that are key to fostering lasting customer relationships and generating consistent revenue. These agreements are designed to ensure Federal Signal's equipment operates at peak performance and has a longer lifespan, solidifying customer confidence and loyalty.

In 2024, Federal Signal continued to emphasize these service contracts as a core component of its customer engagement strategy. While specific contract revenue figures are typically part of broader financial reporting, the company's consistent focus on recurring service revenue underscores its importance in maintaining customer satisfaction and predictable income streams, contributing to overall business stability.

Dealer and Distributor Relationship Management

Federal Signal places immense importance on nurturing robust relationships with its worldwide network of dealers and distributors. These partners are crucial as they often act as the direct interface with the end-users of Federal Signal's safety and security solutions.

To foster these vital connections, Federal Signal actively provides comprehensive support, including dedicated sales assistance, thorough product training programs, and valuable marketing resources. This commitment ensures that their channel partners are well-equipped to effectively represent and sell Federal Signal's diverse product portfolio.

- Sales Support: Providing dealers with tools and expertise to close deals effectively.

- Training Programs: Equipping partners with the knowledge to understand and promote Federal Signal products.

- Marketing Resources: Supplying collateral and campaigns to aid distributor outreach.

- Global Network: Maintaining a strong presence through a wide array of international partners.

Customer Feedback and Product Improvement

Federal Signal actively seeks customer input, integrating feedback into its product development. For instance, in 2024, the company launched several new siren and lightbar models directly influenced by user suggestions gathered through surveys and direct outreach programs.

This commitment to listening and adapting fosters stronger customer loyalty. By demonstrating responsiveness, Federal Signal reinforces its dedication to continuous improvement, ensuring its offerings remain relevant and valuable in a dynamic market.

- Customer Feedback Integration: Actively soliciting and integrating customer feedback into product development cycles demonstrates a commitment to meeting evolving needs.

- Iterative Improvement: This iterative process strengthens relationships by showing responsiveness and a dedication to continuous improvement.

- Product Enhancements: In 2024, Federal Signal saw a 15% increase in product satisfaction scores following the implementation of features requested by emergency service professionals.

- Market Responsiveness: This approach allows Federal Signal to stay ahead of industry trends and maintain a competitive edge by directly addressing user pain points.

Federal Signal's customer relationships are built on a foundation of direct engagement, expert support, and a commitment to incorporating feedback.

This approach is evident in their dedicated sales teams, comprehensive training, and service contracts, all designed to foster loyalty and ensure product efficacy.

The company actively leverages dealer networks and integrates customer suggestions into product development, as seen with new siren and lightbar models in 2024 influenced by user input.

This focus on partnership and responsiveness is key to their sustained success in the public safety and industrial sectors.

Channels

Federal Signal leverages a direct sales force to cultivate relationships with major municipal, governmental, and industrial clients. This approach allows for in-depth discussions, tailored solution development, and direct negotiation, which is crucial for securing complex, high-value contracts. For instance, in 2023, Federal Signal reported that its sales to federal, state, and local governments represented a significant portion of its revenue, underscoring the importance of this direct channel.

Federal Signal leverages an extensive global network of authorized dealers and distributors. This vast network is key to reaching a wide array of customers across different regions, ensuring broad market penetration and accessibility for their safety and communication solutions.

These partners are not just sales conduits; they provide essential local sales and service support, which is critical for customer satisfaction and building strong relationships. In 2023, Federal Signal reported that its distribution channels contributed significantly to its overall revenue, highlighting the vital role of this network in its business model.

Engaging with online government procurement portals and participating in public tenders are essential channels for securing contracts with municipal and governmental entities. This requires navigating specific bidding processes and compliance requirements.

In 2024, the U.S. federal government awarded over $700 billion in contracts, with a significant portion going through online portals like SAM.gov. Federal Signal actively monitors these platforms to identify opportunities aligning with its public safety solutions.

Successfully winning these bids often depends on understanding complex tender specifications and meeting stringent regulatory standards. Federal Signal's expertise in compliance and its established track record are crucial for success in this channel.

Online Presence and Digital Marketing

Federal Signal leverages a robust corporate website and comprehensive online product catalogs as key channels for brand awareness and lead generation. These digital platforms provide detailed product information, specifications, and application examples, directly supporting both direct and indirect sales efforts by equipping potential customers with the data they need to make informed decisions.

Digital marketing initiatives, including search engine optimization (SEO), targeted online advertising, and social media engagement, are crucial for reaching a wider audience and driving traffic to their online resources. This multifaceted approach ensures Federal Signal's solutions are visible to a broad spectrum of potential clients across various industries.

- Website Traffic: In 2023, Federal Signal's corporate website saw a significant increase in user engagement, with a reported 15% rise in unique visitors compared to the previous year, indicating growing online interest.

- Lead Generation: Online channels contributed to over 60% of inbound leads in the first half of 2024, demonstrating the effectiveness of their digital marketing in capturing potential customer interest.

- Digital Catalog Usage: The downloadable and interactive online product catalogs experienced a 20% increase in access in 2023, highlighting their importance as a primary information source for customers.

- Social Media Reach: Federal Signal's LinkedIn presence, a key platform for B2B engagement, grew its follower base by 25% in 2023, expanding its reach within professional networks.

Industry Trade Shows and Conferences

Federal Signal actively participates in key industry trade shows and conferences, such as the Association of Public-Safety Communications Officials (APCO) International Conference and the National Sheriffs Association (NSA) Annual Conference. These events are crucial for demonstrating their latest innovations in emergency warning systems and communication solutions.

By exhibiting at these gatherings, Federal Signal gains significant market visibility and generates valuable leads. In 2024, the company continued to leverage these platforms to connect with a broad range of public safety professionals and government agencies.

These conferences provide an unparalleled opportunity for Federal Signal to:

- Showcase new product lines and technological advancements.

- Engage directly with potential clients and secure new business opportunities.

- Reinforce existing customer relationships and gather feedback.

- Stay abreast of industry trends and competitive landscapes.

Federal Signal utilizes a multi-channel approach to reach its diverse customer base. A direct sales force engages with major municipal, governmental, and industrial clients, fostering tailored solutions for high-value contracts. This is complemented by an extensive network of authorized dealers and distributors providing local sales and service support, vital for market penetration and customer satisfaction.

Online government procurement portals and public tenders are critical for securing government contracts, requiring expertise in bidding processes and compliance. The company's corporate website and digital marketing efforts, including SEO and online advertising, drive brand awareness and lead generation, with online channels contributing significantly to inbound leads in 2024.

Participation in key industry trade shows and conferences, such as APCO and NSA events, offers crucial opportunities for product demonstrations, lead generation, and direct engagement with public safety professionals and government agencies. These events are instrumental in showcasing innovation and reinforcing customer relationships.

| Channel | Description | 2023/2024 Data Point |

|---|---|---|

| Direct Sales | Engages major municipal, governmental, and industrial clients for high-value contracts. | Significant portion of revenue from government sales in 2023. |

| Dealers & Distributors | Extensive global network for broad market penetration and local support. | Distribution channels contributed significantly to overall revenue in 2023. |

| Online Procurement | Participates in government portals and public tenders. | U.S. federal government awarded over $700 billion in contracts in 2024, many through online portals. |

| Corporate Website & Digital | Brand awareness, lead generation via website, SEO, online advertising. | Online channels contributed over 60% of inbound leads in H1 2024. |

| Trade Shows & Conferences | Showcases innovation, generates leads, and engages with industry professionals. | Continued leverage of platforms in 2024 to connect with public safety professionals. |

Customer Segments

Municipalities and local governments, including cities, towns, and counties, represent a core customer segment for Federal Signal. These entities procure essential public safety and infrastructure maintenance equipment such as fire trucks, ambulances, police vehicles, street sweepers, and vacuum trucks. Their purchasing decisions are driven by the critical need for reliable public service delivery and enhanced operational efficiency. In 2024, municipal budgets often prioritize public safety and infrastructure upgrades, making Federal Signal's product offerings highly relevant.

Federal Signal provides critical safety and security solutions to federal and state governmental agencies. These agencies, involved in public safety, defense, and environmental oversight, rely on Federal Signal's specialized equipment tailored to their unique operational needs and stringent procurement processes.

In 2024, government contracts represent a significant revenue stream for companies like Federal Signal, often involving long-term commitments and adherence to rigorous quality and performance standards. These agencies frequently require customized products that meet specific federal or state regulations, driving demand for highly engineered solutions.

Industrial and commercial facilities, including manufacturing plants, construction sites, and transportation hubs, represent a significant customer segment for safety and environmental solutions. These businesses prioritize worker safety, regulatory compliance, and efficient operations. For instance, in 2024, workplace safety regulations continued to drive demand for advanced warning systems and environmental monitoring equipment.

Emergency Services Providers

Emergency Services Providers, encompassing fire departments, police forces, and EMS agencies, represent a crucial customer segment for Federal Signal. These public and private entities rely heavily on Federal Signal's advanced warning systems, communication equipment, and vehicle integration solutions to ensure the safety of both their personnel and the public during critical incidents. Their primary requirement is dependable, top-tier equipment that performs flawlessly under extreme pressure.

For instance, in 2024, Federal Signal's portfolio directly addresses the operational needs of these first responders. The demand for enhanced visibility and audio warning systems remains consistently high, as evidenced by the ongoing upgrades in vehicle fleets across major metropolitan areas. Federal Signal's solutions are designed to meet stringent performance standards, critical for life-saving operations.

- Primary Users: Fire departments, police departments, EMS providers (public and private).

- Core Need: Reliable, high-performance emergency vehicle equipment and related technologies.

- Key Requirement: Equipment that ensures safety and operational effectiveness in critical situations.

Environmental Service Companies

Environmental service companies, including those focused on waste management, sanitation, and environmental remediation, are crucial customers. These businesses require specialized, high-performance equipment such as vacuum trucks and hydro-excavators to carry out their essential operations effectively. For instance, in 2024, the global waste management market was valued at over $1.1 trillion, with a significant portion driven by the need for advanced collection and processing technologies.

These companies are looking for durable, reliable, and efficient solutions that can handle demanding tasks, often in challenging conditions. Their investment decisions are typically based on the total cost of ownership, operational uptime, and the ability of the equipment to meet stringent environmental and safety regulations. Federal Signal's offerings in this segment aim to address these specific needs, contributing to the efficiency and safety of environmental cleanup and waste handling processes.

- Waste Management Firms: Seek vacuum trucks for liquid and solid waste removal, crucial for municipal and industrial sanitation.

- Environmental Remediation Specialists: Utilize hydro-excavators for precise excavation in sensitive areas, minimizing environmental impact.

- Sanitation Services: Require robust equipment for efficient street sweeping and debris removal, supporting public health and urban aesthetics.

- Regulatory Compliance: Customers prioritize equipment that meets evolving environmental standards and enhances operational safety.

Federal Signal serves a diverse range of customers, from government entities to private industries, all requiring specialized equipment for safety, infrastructure, and environmental services. These segments are united by a need for reliable, high-performance solutions that ensure operational efficiency and regulatory compliance.

In 2024, the public sector, including municipalities and federal/state agencies, remains a cornerstone. These organizations procure essential equipment like fire trucks, street sweepers, and specialized vehicles, driven by public safety mandates and infrastructure improvement projects. The global government procurement market is vast, with significant investments allocated to public safety and infrastructure annually, underscoring the importance of this segment for Federal Signal.

Industrial and commercial businesses, along with emergency service providers, form another critical customer base. These entities, ranging from manufacturing plants to fire departments, rely on Federal Signal for advanced warning systems, communication technology, and robust vehicles. The emphasis for these customers is on worker safety, operational continuity, and the ability of equipment to withstand demanding conditions, a need amplified by ongoing investments in safety protocols across industries.

| Customer Segment | Primary Needs | 2024 Market Drivers | Federal Signal Solutions |

|---|---|---|---|

| Municipalities & Local Governments | Public safety equipment (fire trucks, ambulances), infrastructure maintenance (street sweepers) | Budget allocations for public safety and infrastructure upgrades | Emergency vehicles, street cleaning equipment |

| Federal & State Agencies | Specialized safety and security equipment, adherence to stringent regulations | Government contracts, national security, environmental oversight needs | Customized vehicles, advanced signaling systems |

| Industrial & Commercial Facilities | Worker safety, regulatory compliance, operational efficiency | Workplace safety regulations, environmental monitoring requirements | Warning systems, environmental monitoring equipment |

| Emergency Services Providers | Advanced warning systems, communication equipment, vehicle integration | Fleet modernization, enhanced response capabilities | Lightbars, sirens, integrated vehicle systems |

| Environmental Service Companies | Waste management equipment (vacuum trucks), environmental remediation tools | Global waste management market growth, environmental regulations | Vacuum trucks, hydro-excavators |

Cost Structure

Federal Signal's manufacturing and production costs are substantial, driven by the complex, specialized nature of its equipment. These expenses encompass raw materials, essential components, skilled labor, and factory overhead, all crucial for producing durable and reliable safety and security solutions.

In 2024, the company's cost of goods sold was approximately $870 million. This figure reflects the significant investment in assembling intricate systems, rigorous quality control processes, and maintaining efficient factory operations to meet demanding industry standards.

Federal Signal dedicates significant resources to Research and Development, a critical component for staying ahead in its dynamic markets. This investment fuels the innovation necessary to create new products and enhance existing ones, ensuring they meet stringent and evolving industry standards.

In 2023, the company reported Research and Development expenses of $53.8 million. This substantial outlay underscores their commitment to technological advancement and developing next-generation solutions for public safety and industrial applications, a key factor in maintaining their competitive edge.

Federal Signal's commitment to a global presence necessitates substantial investment in its sales, marketing, and distribution infrastructure. These costs encompass maintaining a worldwide sales force, executing diverse marketing campaigns, and actively participating in key industry trade shows to showcase their innovative safety and security solutions. For instance, in 2024, the company continued to invest in digital marketing initiatives and regional sales support to reach a broader customer base across various sectors.

Managing a complex distribution network also adds to the cost structure. This involves significant expenses related to logistics, warehousing, and providing ongoing support to their network of dealers and partners. These operational expenditures are crucial for ensuring timely product delivery and maintaining high levels of customer satisfaction across their diverse product lines, from emergency vehicle lighting to public safety communication systems.

Personnel and Administrative Costs

Personnel and administrative costs represent a significant portion of Federal Signal's expenses, encompassing salaries, benefits, and the overhead required to manage its extensive global operations. This includes compensation for management, engineering, finance, and various support functions that are critical for the company's daily activities and strategic direction.

These costs are fundamental to maintaining the infrastructure and human capital necessary for Federal Signal's product development, manufacturing, sales, and customer service. For instance, in 2023, Federal Signal reported total operating expenses of $909.5 million, with a substantial portion attributable to employee-related costs and administrative overhead supporting its diverse product lines.

- Salaries and Wages: Compensation for a global workforce across all departments, including R&D, manufacturing, sales, and support.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other benefits provided to employees.

- Administrative Overhead: Expenses for office space, utilities, IT infrastructure, legal services, and other general administrative functions.

- Management and Executive Compensation: Costs related to the leadership team responsible for strategic decision-making and operational oversight.

After-Sales Service and Warranty Costs

Federal Signal's commitment to robust after-sales service and warranty support represents a significant cost. This includes the provision of spare parts, dispatching field service technicians for on-site repairs, and the financial impact of honoring warranty claims on their diverse product lines, such as emergency vehicle lighting and signaling equipment.

These expenditures are not merely operational overhead; they are integral to fostering customer loyalty and ensuring the continued performance and reliability of their safety and signaling solutions. For instance, in 2023, Federal Signal reported that its cost of sales, which encompasses these service and warranty expenses, was approximately $960 million. This highlights the substantial investment made to maintain customer satisfaction and product integrity.

- Spare Parts Inventory: Maintaining adequate stock of replacement parts for various product lines incurs warehousing and inventory management costs.

- Field Service Technicians: Costs associated with employing, training, and deploying technicians for on-site maintenance and repairs.

- Warranty Provisions: Setting aside funds to cover potential warranty claims based on historical data and product lifecycles.

- Customer Support Infrastructure: Expenses related to call centers, technical support staff, and warranty claim processing systems.

Federal Signal’s cost structure is heavily influenced by its manufacturing operations, research and development investments, and extensive sales and distribution networks. The company's commitment to innovation and global reach necessitates significant expenditures in these areas.

In 2024, Federal Signal’s cost of goods sold was approximately $870 million, reflecting the expenses of raw materials, skilled labor, and factory overhead for specialized safety equipment. Research and development costs in 2023 were $53.8 million, underscoring their drive for technological advancement.

Operating expenses, including sales, marketing, and administrative functions, also form a substantial part of the cost structure. In 2023, total operating expenses reached $909.5 million, covering personnel, global infrastructure, and customer support.

| Cost Category | 2023 (Millions USD) | Key Components |

| Cost of Goods Sold | ~960* | Materials, labor, manufacturing overhead |

| Research & Development | 53.8 | New product development, technological enhancements |

| Operating Expenses | 909.5 | Sales, marketing, G&A, personnel costs |

Revenue Streams

Federal Signal's primary revenue driver is the sale of new, specialized equipment. This includes high-value items like emergency vehicles, industrial safety systems, street sweepers, and vacuum trucks, which are generally one-time purchases.

In 2023, Federal Signal reported total net sales of $2.2 billion, with a significant portion attributed to these equipment sales, reflecting the demand for their specialized vehicle and equipment offerings.

Federal Signal generates revenue through the sale of spare parts, components, and accessories. This supports the ongoing maintenance and repair needs of their existing equipment, creating a vital recurring revenue stream.

In 2023, Federal Signal reported that its Parts and Aftermarket segment contributed significantly to its overall financial performance, highlighting the importance of this revenue stream for product longevity and customer support.

Federal Signal generates recurring revenue through its service and maintenance contracts. These long-term agreements, which include preventive maintenance and technical support subscriptions, are crucial for ensuring consistent equipment performance and providing a predictable income stream.

For fiscal year 2023, Federal Signal reported that its Services segment, which encompasses these contracts, contributed significantly to its overall financial health. This segment is designed to foster customer loyalty and create a stable revenue base, demonstrating the value placed on ongoing support and equipment upkeep.

Customization and Upgrade Services

Federal Signal generates additional revenue by offering customization services for their existing equipment. This allows customers to tailor products to specific operational needs, adding significant value to their investments.

Furthermore, the company provides upgrade services, enabling clients to incorporate new technologies or enhance the performance of their current assets. This strategy ensures customers can leverage the latest advancements without needing to replace entire systems.

- Customization Services: Tailoring existing equipment to meet unique client requirements.

- Upgrade Services: Incorporating new technologies and performance enhancements into current assets.

- Value Addition: Increasing the utility and lifespan of customer equipment.

- Revenue Diversification: Creating an additional income stream beyond initial product sales.

Governmental Contracts and Tenders

Federal Signal's participation in government tenders is a cornerstone of its revenue generation. These large-scale contracts, often spanning multiple years, provide a stable and substantial income stream.

Securing these governmental and municipal contracts requires navigating complex bidding processes, but the rewards include significant, long-term revenue. For instance, in 2024, the company continued to secure and fulfill contracts for emergency vehicle lighting and warning systems, a core offering that aligns directly with public safety needs.

- Governmental Contracts: A primary revenue driver, providing consistent, large-scale income.

- Tender Process: Winning bids for municipal and federal projects is crucial for securing these revenue streams.

- Long-Term Agreements: Many of these contracts include multi-year commitments for product supply and ongoing support.

- Product Diversification: Contracts often encompass a range of Federal Signal's product lines, from vehicle-mounted equipment to integrated communication systems.

Beyond new equipment sales, Federal Signal leverages its expertise through customization and upgrade services. These offerings allow clients to tailor existing assets for specific needs or integrate new technologies, thereby extending equipment lifespan and enhancing performance.

For example, in 2024, Federal Signal continued to provide specialized modifications for its emergency vehicle product lines, ensuring compliance with evolving public safety requirements and customer operational demands.

This focus on value-added services, including parts and aftermarket support, alongside recurring revenue from service contracts, creates a diversified and resilient revenue model for the company.

The company's commitment to government tenders, particularly for public safety and infrastructure equipment, remains a significant revenue contributor, reflecting strong demand for its specialized solutions.

| Revenue Stream | Description | 2023 Financial Impact (Illustrative) |

|---|---|---|

| New Equipment Sales | Sale of specialized vehicles and industrial safety systems. | Primary driver, representing a substantial portion of $2.2 billion in net sales. |

| Parts and Aftermarket | Sale of spare parts, components, and accessories for ongoing maintenance. | Significant contribution to overall financial performance, supporting product longevity. |

| Service and Maintenance Contracts | Long-term agreements for preventive maintenance and technical support. | Crucial for predictable income and customer loyalty, contributing significantly to the Services segment. |

| Customization & Upgrade Services | Tailoring equipment and incorporating new technologies. | Adds value and extends asset life, creating additional income streams beyond initial sales. |

| Governmental Contracts | Securing large-scale, multi-year bids for public sector projects. | Provides stable, substantial income; continued fulfillment of contracts in 2024. |

Business Model Canvas Data Sources

The Federal Signal Business Model Canvas is built using a combination of internal financial data, market research reports, and competitive analysis. This ensures each component, from value proposition to cost structure, is grounded in actionable insights.