Federal Signal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

Federal Signal operates in a landscape shaped by intense rivalry and the looming threat of substitutes for its warning and signaling solutions. Understanding the dynamics of buyer power and supplier influence is crucial for navigating this competitive terrain effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Federal Signal’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Federal Signal's reliance on a limited number of suppliers for highly specialized components, like advanced electronics for its warning systems, gives these suppliers considerable bargaining power. The unique nature of these inputs means Federal Signal has few alternatives, strengthening the suppliers' position. For instance, in 2023, Federal Signal's cost of goods sold was $871.5 million, highlighting the significant impact supplier pricing can have on their bottom line.

Federal Signal, as a maker of specialized vehicles, relies on outside companies for its chassis and vehicle platforms. This reliance means suppliers can hold significant sway.

The commercial vehicle sector, where Federal Signal operates, sometimes features a limited number of suppliers for heavy-duty chassis. For instance, in 2024, major chassis manufacturers like Navistar, PACCAR, and Freightliner often dictate terms, impacting pricing and delivery schedules for vehicle assemblers.

This concentration of suppliers allows them to potentially leverage their position, influencing Federal Signal's costs and production timelines. If a key chassis supplier faces production issues or decides to increase prices, it directly affects Federal Signal's ability to meet demand and manage expenses.

Raw material price volatility, particularly for essential inputs like steel, aluminum, and various metals, directly influences Federal Signal's manufacturing expenses. For instance, in early 2024, steel prices saw fluctuations driven by global demand and production levels, impacting companies reliant on this commodity.

Suppliers of these crucial raw materials can exert significant bargaining power when global supply chains face constraints or when demand surges. This leverage allows them to potentially dictate higher input costs for Federal Signal, squeezing profit margins if these increases cannot be effectively passed on to customers.

Proprietary Technology and Patents

Suppliers possessing proprietary technology or holding patents for essential components can significantly influence pricing. This is particularly true for Federal Signal if its products rely on unique, patented sub-systems. Such exclusivity grants these suppliers considerable leverage, allowing them to command premium prices for their specialized inputs. For example, if a key sensor or communication module is only available from one patent-holding supplier, Federal Signal’s ability to negotiate price or terms is diminished.

Federal Signal's dependence on these technologically advanced suppliers can create a substantial cost pressure. The inability to source equivalent components elsewhere due to patent protection means Federal Signal must accept the terms offered. This dynamic directly impacts Federal Signal's cost of goods sold and, consequently, its profit margins. The company's strategic sourcing decisions must therefore account for the bargaining power derived from intellectual property.

- Proprietary Advantage: Suppliers with exclusive rights to critical technologies or manufacturing processes gain a distinct advantage.

- Cost Implications: Federal Signal may face higher input costs if key components are patented and available from a limited number of suppliers.

- Strategic Dependence: Reliance on patented technology can reduce Federal Signal's flexibility in sourcing and potentially increase its vulnerability to supplier price increases.

Switching Costs for Federal Signal

Switching suppliers for Federal Signal's complex, integrated components or systems can be a costly endeavor. These costs can include significant expenses for redesigning products, retooling manufacturing equipment, rigorous testing procedures, and obtaining necessary regulatory approvals. For instance, if a critical sensor system needs to be replaced, the entire integration process might need revalidation, impacting timelines and budgets.

These substantial switching costs inherently limit Federal Signal's flexibility in sourcing. Consequently, this situation bolsters the bargaining power of its current suppliers. Suppliers understand that Federal Signal faces considerable hurdles and expenses if it attempts to move to an alternative provider, making it more difficult for Federal Signal to negotiate favorable terms or switch away from a supplier that may be increasing prices or reducing quality.

- High Redesign and Retooling Costs: Federal Signal may incur millions in engineering and manufacturing adjustments when changing key component suppliers.

- Extended Testing and Certification Timelines: New supplier components often require extensive validation, potentially delaying product launches.

- Supplier Dependence: For specialized or proprietary components, finding suitable alternative suppliers can be challenging, further concentrating power with existing ones.

Federal Signal's bargaining power with its suppliers is influenced by several factors. The company's reliance on specialized components, often with limited alternative sources due to proprietary technology, grants suppliers significant leverage. This is particularly evident in 2024, where the commercial vehicle sector sees major chassis manufacturers like PACCAR and Freightliner dictating terms. Furthermore, the high costs associated with switching suppliers, encompassing redesign, retooling, and regulatory approvals, lock Federal Signal into existing relationships, strengthening supplier positions and potentially increasing input costs.

| Factor | Impact on Federal Signal | Supplier Leverage |

|---|---|---|

| Specialized Components | Limited alternative sourcing options | High |

| Proprietary Technology | Dependence on patented inputs | High |

| Switching Costs | Significant expenses for redesign/retooling | High |

| Raw Material Volatility | Impacts manufacturing expenses (e.g., steel in early 2024) | Moderate to High |

What is included in the product

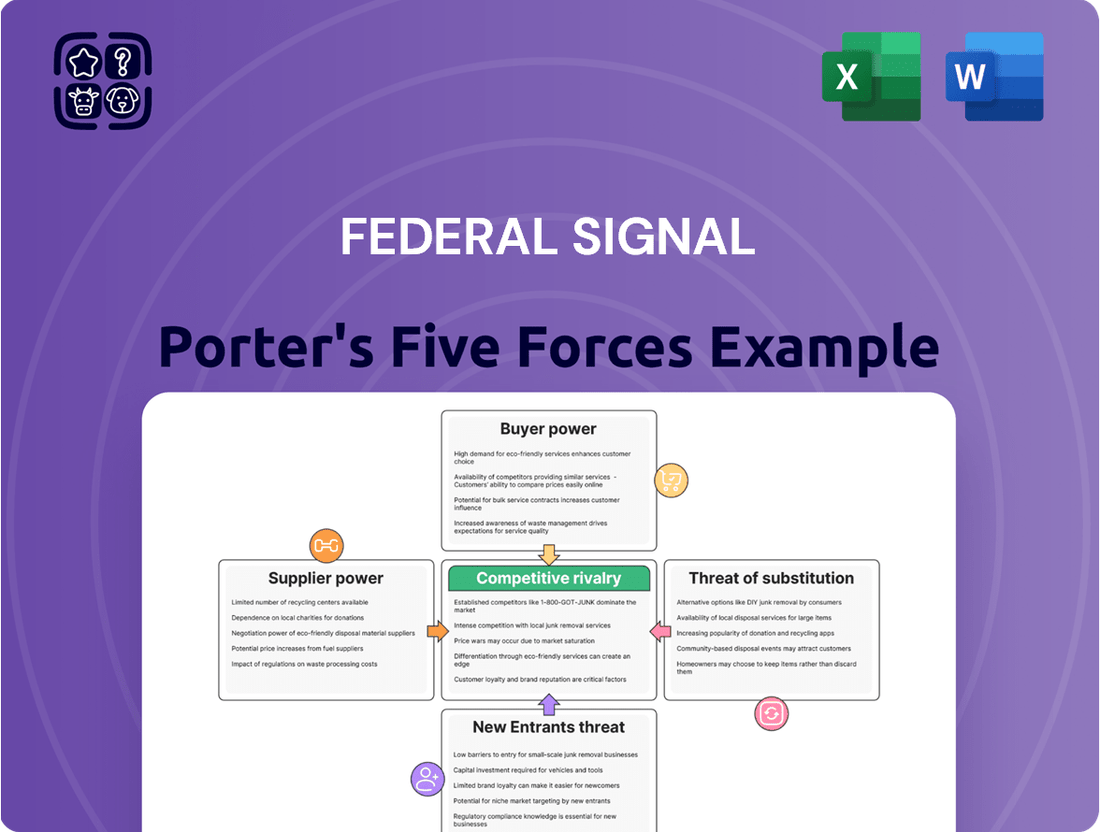

Federal Signal's Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its specific market segments.

Instantly visualize competitive intensity and identify strategic vulnerabilities across all five forces, enabling proactive risk mitigation.

Customers Bargaining Power

Federal Signal's significant reliance on municipal and governmental entities as customers means their bargaining power is amplified by public budget cycles and funding availability. These agencies are acutely aware of fiscal constraints and often leverage this knowledge to negotiate aggressively on price, demanding cost-effective solutions. For instance, in 2023, state and local government spending on public safety equipment, a key market for Federal Signal, faced varying pressures due to inflation and shifting federal aid allocations.

Federal Signal's customers, particularly government agencies and large commercial entities, often face long and rigorous procurement processes. These typically involve competitive bidding, detailed technical specifications, and extensive evaluation periods, which can stretch for months. For instance, many government contracts require multiple stages of review and approval, giving customers ample opportunity to scrutinize every aspect of a supplier's offering.

This extended evaluation period significantly enhances the bargaining power of these customers. It allows them to thoroughly compare Federal Signal's products and services against competitors, identify potential weaknesses, and negotiate favorable terms and pricing. This process inherently shifts leverage towards the buyer, as they have the time and resources to conduct in-depth due diligence and exert pressure on potential suppliers.

In segments where Federal Signal's products, like certain environmental solutions such as standard street sweepers or vacuum trucks, are perceived as more commoditized, customers gain increased bargaining power. This perception can shift the focus of negotiations from unique features to price, as buyers may find readily available alternatives. For example, if the market for basic street sweepers is crowded with manufacturers offering similar specifications, Federal Signal might find it harder to command premium pricing, thus empowering its customers.

Aftermarket Service and Support Expectations

Customers investing in Federal Signal's durable equipment, like emergency vehicle lighting and siren systems, anticipate robust aftermarket service and ongoing support. This expectation stems from the critical nature of their applications, where downtime can be costly or even dangerous. For instance, municipalities rely on uninterrupted operation of public safety equipment, making consistent maintenance and parts availability paramount.

The availability and cost of replacement parts and specialized repair services significantly influence customer loyalty. Federal Signal's ability to provide timely and reasonably priced support directly impacts its customers' willingness to continue purchasing from them. If service is poor or parts are excessively expensive, customers might explore alternative suppliers for future needs, even if the initial equipment investment was substantial. In 2023, Federal Signal reported that its Aftermarket and Other segment, which includes service and parts, generated approximately 21% of its total revenue, highlighting its importance to the business and the customer relationship.

- Customer Dependence: Federal Signal's customers, particularly in public safety and industrial sectors, depend on reliable aftermarket support for their critical equipment.

- Service as a Differentiator: The quality and cost-effectiveness of maintenance, repair services, and parts availability serve as a key differentiator and a source of leverage for customers.

- Impact on Future Sales: Dissatisfaction with aftermarket support can directly influence repeat purchase decisions, even for high-initial-cost equipment.

- Revenue Contribution: In 2023, Federal Signal's Aftermarket and Other segment contributed roughly 21% of its total revenue, underscoring the significance of ongoing customer support.

Absence of Single Dominant Customer

Federal Signal's customer base is notably fragmented, with no single customer representing 10% or more of its net sales, according to its annual reports. This lack of a dominant buyer dilutes the bargaining power of any individual customer.

However, the sheer volume of customers, many of whom are budget-conscious government entities and municipalities, can still exert collective pressure. This means that while no single customer can dictate terms, the aggregate demand and purchasing habits of many can influence pricing and product development.

- Fragmented Customer Base: Federal Signal avoids over-reliance on any single client, mitigating the risk of losing a significant portion of revenue due to one customer's demands.

- Collective Purchasing Power: Despite the absence of a dominant customer, the combined purchasing volume of numerous smaller clients can still create significant bargaining leverage, especially when those clients are similar in their procurement processes and budget constraints.

Federal Signal's customers, particularly government agencies, wield considerable bargaining power due to public procurement processes and budget cycles. These entities often engage in lengthy bidding, scrutinizing every detail to negotiate favorable terms. For instance, in 2023, public safety equipment markets saw varied pressures from inflation and federal aid shifts, impacting customer spending power.

The perceived commoditization of certain Federal Signal products, like standard street sweepers, further empowers buyers to prioritize price over unique features. This dynamic is amplified when numerous competitors offer similar specifications, limiting Federal Signal's ability to command premium pricing.

Federal Signal's customer base is fragmented, with no single client exceeding 10% of net sales, which inherently dilutes individual customer leverage. However, the collective purchasing power of numerous budget-conscious government and municipal clients can still exert significant influence on pricing and product development.

Same Document Delivered

Federal Signal Porter's Five Forces Analysis

This preview showcases the comprehensive Federal Signal Porter's Five Forces Analysis, presenting an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. This detailed report is ready for your immediate use, providing valuable strategic insights into Federal Signal's market position.

Rivalry Among Competitors

Federal Signal faces a robust competitive environment, characterized by both global giants and specialized players across its key business segments. For instance, in the emergency vehicle equipment market, companies like Federal Signal compete with large automotive suppliers and other dedicated emergency vehicle manufacturers. This dynamic creates pressure on pricing and innovation as firms vie for significant municipal and commercial contracts.

Federal Signal faces fierce competition driven by the constant need for innovation, especially as smart technologies, IoT, and electrification become standard in vehicles and safety equipment. This necessitates significant R&D investment to stand out and satisfy changing customer needs.

The industry saw R&D spending increase across many players. For instance, a leading competitor in emergency lighting systems reported a 15% year-over-year increase in R&D for 2024, focusing on connected vehicle integration and advanced siren technology.

Companies like Federal Signal must continually update their product lines to incorporate these advancements, creating a dynamic environment where staying ahead technologically is paramount to maintaining market share and profitability.

Federal Signal faces intense competition not just on the initial sale of its safety and signaling equipment, but crucially on the strength of its aftermarket services and distribution capabilities. Rivals like Motorola Solutions and Johnson Controls vie for customer loyalty through robust parts availability, efficient repair services, and broad geographic reach, recognizing these as key drivers of recurring revenue and long-term customer relationships.

In 2024, the aftermarket service segment for industrial equipment, which Federal Signal operates within, continued to demonstrate significant growth, with many companies reporting aftermarket revenues comprising over 30% of their total sales. This highlights how critical a well-established distribution network and responsive post-sale support are for maintaining market share and profitability against competitors who can leverage their own extensive service infrastructures.

Market Growth Opportunities

Federal Signal operates in markets poised for expansion, which naturally attracts more competition. For instance, the vacuum trucks segment is projected to grow at a compound annual growth rate (CAGR) of 6.5% between 2025 and 2034.

Similarly, the street sweepers market is expected to see a CAGR of 6.6% to 6.9% from 2025 through 2029. This robust growth signals attractive opportunities, potentially intensifying rivalry as existing players and new entrants vie for market share.

- Vacuum Trucks Market Growth: 6.5% CAGR (2025-2034).

- Street Sweepers Market Growth: 6.6%-6.9% CAGR (2025-2029).

- Impact of Growth: Heightened competition and potential price wars.

High Fixed Costs and Exit Barriers

Federal Signal operates in industries characterized by substantial fixed costs, particularly in specialized manufacturing and extensive research and development. For instance, the advanced engineering and custom fabrication needed for their emergency vehicle warning systems and industrial signaling equipment demand significant upfront investment.

These high fixed costs translate into considerable exit barriers. Companies are often compelled to continue operating and competing, even in challenging economic conditions, to spread their overheads and avoid substantial losses associated with ceasing operations. This dynamic intensifies competitive rivalry as firms strive to maintain market share and revenue streams to cover their fixed cost base.

- High Capital Investment: Federal Signal's production of advanced signaling and safety equipment requires specialized, often custom-built, manufacturing facilities, representing a significant fixed cost.

- R&D Intensity: Continuous innovation in areas like LED technology and communication systems for emergency vehicles necessitates ongoing, substantial investment in research and development.

- Operational Necessity: To remain viable, companies must operate at or near capacity to amortize these high fixed costs, fueling aggressive competition to secure sales.

- Exit Deterrents: The specialized nature of assets and the difficulty in repurposing them create strong disincentives to exit the market, even when profitability is low.

Federal Signal faces intense rivalry from both established global players and niche specialists across its diverse product lines. The emergency vehicle equipment sector, for example, sees competition from large automotive suppliers and dedicated manufacturers, driving price pressures and a constant need for technological advancement. This dynamic is further fueled by rapid innovation in areas like connected vehicle technology and electrification, demanding significant R&D investment to maintain a competitive edge.

The aftermarket service segment is also a key battleground, with rivals like Motorola Solutions and Johnson Controls competing on parts availability, repair efficiency, and geographic reach to secure recurring revenue. The growth in markets Federal Signal serves, such as vacuum trucks (projected 6.5% CAGR 2025-2034) and street sweepers (projected 6.6%-6.9% CAGR 2025-2029), is attracting further competition.

| Key Competitor Actions | Impact on Federal Signal | 2024 Data Point |

| Increased R&D Spending by Competitors | Pressure to innovate and maintain technological parity | 15% year-over-year R&D increase reported by a leading competitor in emergency lighting |

| Focus on Aftermarket Services | Need for strong distribution and support to retain customers | Aftermarket revenues representing over 30% of total sales in industrial equipment |

| Market Growth Attracting New Entrants | Potential for increased price competition and market share erosion | Vacuum trucks market CAGR of 6.5% (2025-2034) |

SSubstitutes Threaten

For specific environmental services, the threat of substitutes like manual labor or simpler, less specialized equipment is present. While these alternatives may be less efficient and potentially fall short of current regulatory or performance benchmarks, they can offer a lower-cost option. This is especially true for smaller local governments or businesses operating with tighter financial constraints.

Customers, particularly municipalities and industrial clients, may choose to outsource essential services like street cleaning, waste management, or industrial safety monitoring to external third-party contractors. This trend presents a significant threat as these specialized service providers often employ their own equipment and operational methodologies, effectively substituting the demand for Federal Signal's direct product sales.

For instance, a municipality might contract with a private waste management company that owns its fleet of specialized trucks, negating the need for the municipality to purchase Federal Signal's refuse collection vehicles. Similarly, industrial firms could opt for third-party safety monitoring solutions that integrate various technologies, bypassing the need for Federal Signal's standalone safety equipment. This outsourcing strategy allows clients to focus on core competencies while potentially achieving cost efficiencies, thereby reducing reliance on manufacturers like Federal Signal.

Customers might opt for standard commercial vehicles and then outfit them with aftermarket safety lighting, sirens, or basic environmental controls for certain uses. This approach, while potentially less integrated or robust than purpose-built options, could present a more budget-friendly, though less effective, substitute.

Evolution of Waste Management and Safety Technologies

The threat of substitutes for Federal Signal's offerings, particularly in waste management and industrial safety, is a key consideration. Advances in waste treatment, recycling, or alternative safety technologies could lessen the need for traditional vacuum trucks or specific safety equipment. For instance, the growing adoption of advanced sorting and processing technologies in recycling might reduce the volume of waste requiring vacuum truck collection.

Federal Signal needs to stay vigilant about these technological shifts. Consider the rise of automated cleaning systems or novel containment solutions in industrial settings; these could offer alternatives to existing safety products. In 2024, the global waste management market was valued at over $1.1 trillion, a sector ripe for disruption by innovative, less resource-intensive methods.

- Technological Advancements: Innovations in waste processing and recycling are creating alternatives to traditional collection methods.

- Safety System Evolution: New industrial safety technologies could emerge, potentially replacing existing Federal Signal product lines.

- Market Adaptability: Federal Signal must continuously innovate to counter substitution threats and maintain market relevance.

- Market Size Context: The significant value of the global waste management market in 2024 underscores the potential impact of substitute technologies.

Regulatory Changes Favoring Alternative Solutions

New environmental or safety regulations could inadvertently favor alternative methods or technologies not currently central to Federal Signal's business. For instance, stricter emissions standards for emergency vehicles might boost demand for electric siren systems or advanced warning light technologies that Federal Signal may not yet fully offer. In 2024, many municipalities are actively exploring greener fleet options, which could accelerate the adoption of alternative signaling and communication solutions.

Changes in government policy can significantly shift market demand toward solutions that meet regulatory requirements through different means. If new mandates emerge requiring specific noise pollution controls for emergency vehicle audible warnings, this could create an opening for quieter, perhaps digitally generated, alert systems that bypass traditional siren technology. Federal Signal's revenue from traditional siren systems, which formed a notable portion of its Public Safety segment in recent years, could be impacted if these alternatives gain traction.

These regulatory shifts present a tangible threat of substitution, potentially diverting customers towards competitors who are quicker to adapt or already specialize in these emerging alternative solutions. The market for public safety equipment is dynamic, and companies that can proactively integrate or develop compliant technologies will be better positioned to mitigate this threat.

The threat of substitutes for Federal Signal's products, particularly in public safety and environmental services, is significant. Customers might opt for outsourced services or less integrated solutions, impacting direct product sales. Technological advancements and evolving regulations also create openings for alternative technologies, such as advanced recycling methods or greener emergency vehicle components.

For example, the global waste management market, valued at over $1.1 trillion in 2024, is susceptible to disruption by innovative, less resource-intensive methods. Similarly, in public safety, evolving regulations in 2024 are pushing municipalities towards greener fleet options, potentially accelerating the adoption of alternative signaling and communication solutions over traditional sirens.

| Threat Category | Example Substitute | Impact on Federal Signal | 2024 Market Context |

|---|---|---|---|

| Service Outsourcing | Third-party waste management contractors | Reduced demand for Federal Signal's refuse trucks | Global waste management market > $1.1 trillion |

| Technological Shift | Advanced recycling/waste processing | Decreased need for traditional vacuum trucks | Growing adoption of sorting technologies |

| Component Alternatives | Aftermarket safety lighting/sirens | Lower sales of integrated safety systems | Budget-conscious municipalities |

| Regulatory Driven | Electric sirens, advanced warning lights | Potential decline in traditional siren revenue | Increased demand for greener fleet options |

Entrants Threaten

Significant capital investment requirements act as a major deterrent for new companies looking to enter Federal Signal's markets. For instance, developing advanced emergency vehicle lighting systems or sophisticated communication platforms demands extensive R&D funding. Establishing state-of-the-art manufacturing facilities capable of producing specialized vehicles and safety equipment can easily cost hundreds of millions of dollars, a sum many potential competitors simply cannot muster.

Federal Signal's products, often serving public safety and governmental sectors, face significant barriers due to rigorous regulatory compliance and certification standards. These include stringent safety protocols and emissions regulations, particularly for environmental sustainability products. For example, meeting EPA standards for emissions control on emergency vehicles can involve substantial engineering and testing costs.

Federal Signal benefits from an established brand reputation and deep customer loyalty, particularly with its core municipal and industrial clients. This ingrained trust makes it challenging for new competitors to quickly gain a foothold.

For instance, in 2023, Federal Signal reported net sales of $1.5 billion, reflecting a stable and significant market presence built over years of reliable service and product development.

New entrants would face considerable hurdles in replicating this level of customer confidence and loyalty, requiring substantial investment in marketing and product differentiation to even begin chipping away at Federal Signal's established market share.

Complex Distribution and Aftermarket Service Networks

The complexity and expense of building extensive distribution and aftermarket service networks present a substantial barrier to new entrants. Establishing a widespread presence for sales, support, and parts availability requires significant upfront investment and considerable time to develop trust and operational efficiency.

Federal Signal's established infrastructure, honed over years of operation, offers a formidable competitive moat. This existing network is not easily replicated by newcomers, who would face immense challenges in matching the reach and reliability of Federal Signal's service capabilities. For instance, in 2023, Federal Signal reported that its service and equipment segments contributed significantly to its overall revenue, highlighting the importance of its established service network.

- High Capital Investment: New entrants need substantial capital to build out distribution channels and service depots.

- Time to Market: Developing a reliable aftermarket service network takes years, creating a lag for new competitors.

- Customer Loyalty: Existing customers are often tied to established service providers due to convenience and familiarity.

- Geographic Reach: Covering diverse geographic areas with consistent service is a major hurdle for any new player.

Economies of Scale and Experience Curve Benefits

Federal Signal, like many established players, leverages significant economies of scale. For instance, in 2023, the company reported net sales of $1.33 billion, indicating a substantial operational footprint. This scale allows for more efficient purchasing of raw materials and streamlined manufacturing processes, translating into lower per-unit costs. New entrants struggle to match these cost efficiencies from the outset, facing a considerable hurdle to achieve comparable pricing power.

Furthermore, the experience curve plays a crucial role. Through years of operation, Federal Signal has refined its production techniques and product development cycles. This accumulated knowledge leads to improved product quality and faster innovation, creating a competitive edge. Newcomers must invest heavily in learning and development to bridge this gap, making market entry more challenging and costly.

- Economies of Scale: Federal Signal's 2023 net sales of $1.33 billion demonstrate its large-scale operations, enabling cost advantages in procurement and manufacturing.

- Experience Curve Benefits: Years of operational refinement have equipped Federal Signal with advanced production techniques and product development expertise, creating a knowledge-based barrier for new entrants.

- Cost Barrier: The combined effect of economies of scale and experience curve benefits creates a significant cost disadvantage for potential new competitors seeking to enter the market.

The threat of new entrants for Federal Signal is generally moderate. Significant capital investment for R&D and manufacturing, stringent regulatory compliance, and the need for extensive distribution and service networks create substantial barriers. For example, developing specialized emergency vehicle systems requires significant upfront funding, and meeting EPA emissions standards adds to development costs.

Federal Signal's established brand reputation and customer loyalty, particularly with public safety clients, further deter new players. In 2023, the company reported net sales of $1.5 billion, underscoring its strong market presence. Replicating this level of trust would necessitate considerable marketing and product differentiation investments.

Economies of scale, evidenced by Federal Signal's 2023 net sales of $1.33 billion, provide cost advantages that new entrants struggle to match initially. The experience curve, leading to refined production and faster innovation, also acts as a barrier, making market entry more challenging and costly for newcomers.

| Barrier Type | Description | Impact on New Entrants | Federal Signal's Position |

| Capital Requirements | High costs for R&D, manufacturing, and distribution networks. | Significant deterrent due to substantial upfront investment. | Well-established infrastructure and operational scale. |

| Regulation & Certification | Rigorous safety, emissions, and operational standards. | Adds complexity and cost to product development and market entry. | Experienced in meeting and exceeding compliance requirements. |

| Brand Loyalty & Reputation | Strong customer trust, especially in public safety sectors. | Difficult for new entrants to quickly gain market share and customer confidence. | Decades of reliable service and product performance. |

| Distribution & Service Networks | Extensive infrastructure for sales, support, and aftermarket parts. | Time-consuming and costly to build a comparable reach and reliability. | Comprehensive and efficient service capabilities. |

| Economies of Scale | Lower per-unit costs due to large-scale production and purchasing. | Creates a cost disadvantage for smaller, new competitors. | Leverages significant operational scale, indicated by $1.33 billion in 2023 net sales. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Federal Signal is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and regulatory filings from government agencies. This comprehensive data set allows for a thorough examination of competitive dynamics within the emergency vehicle and warning systems sector.