Ensign Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ensign Group Bundle

The Ensign Group's robust operational model and strategic acquisitions present significant strengths, but potential regulatory shifts and market saturation pose notable threats. Understanding these dynamics is crucial for navigating the healthcare landscape effectively.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Ensign Group consistently delivers strong financial results, a key strength. In the second quarter of 2025, revenue climbed 18.5% to $1.23 billion, and adjusted diluted earnings per share saw a healthy 20.5% jump to $1.59. This ongoing financial robustness underpins the company's operational stability and capacity for future growth.

Ensign Group's proven acquisition strategy is a core strength, evident in its aggressive expansion. Since the start of 2024, the company has successfully integrated 52 new operations, with a notable addition of 8 facilities during the second quarter of 2025 alone. This consistent acquisition pace fuels revenue growth and broadens its market reach across multiple states.

Ensign Group's strategic real estate ownership, primarily through its captive Standard Bearer Healthcare REIT, is a significant strength. This structure means Ensign directly owns a vast portfolio of healthcare facilities, providing a consistent and predictable stream of rental income. For instance, as of the first quarter of 2024, Ensign reported that its owned and managed facilities generated substantial rental revenue, directly benefiting from the REIT's ownership.

This captive REIT insulates Ensign from the volatility of external rental markets, effectively hedging against potential increases in lease expenses. It also generates funds from operations that can be reinvested, offering greater financial flexibility. This internal ownership model underpins Ensign's long-term financial stability and strategic investment capacity.

Rising Occupancy Rates

Ensign Group has demonstrated a remarkable ability to boost occupancy rates, a key indicator of operational success. In early 2025, the company reported that both same-store and transitioning occupancy levels hit their highest points ever. This surge in occupied beds directly fuels revenue growth and ensures that Ensign's healthcare facilities are operating at peak efficiency.

This upward trend in occupancy signifies robust demand for the services Ensign provides and highlights their effective management strategies. For instance, the company's focus on acquiring and improving underperforming facilities has clearly resonated with patients and referral sources. This strong performance is a significant competitive advantage.

- Record Occupancy: Both same-store and transitioning occupancy rates reached all-time highs in early 2025.

- Revenue Enhancement: Higher occupancy directly translates to increased revenue generation.

- Operational Efficiency: Optimized utilization of healthcare facilities is a direct benefit of rising occupancy.

- Market Demand: The trend indicates strong demand for Ensign's healthcare services.

Diversified Healthcare Services

Ensign Group's strength lies in its extensive and varied healthcare service offerings, spanning skilled nursing, rehabilitation, home health, and hospice care. This broad portfolio acts as a significant buffer against market fluctuations affecting any single segment.

This diversification strategy not only minimizes risk but also positions Ensign to capture a wider patient demographic across the entire post-acute care spectrum. For instance, as of the first quarter of 2024, Ensign operated 279 facilities across 14 states, demonstrating its substantial reach and capacity to serve diverse patient needs.

- Broad Service Offering: Skilled nursing, rehabilitation, home health, and hospice care.

- Reduced Reliance: Minimizes dependence on any one service line.

- Market Resilience: Enhances stability through multiple revenue streams.

- Revenue Generation: Caters to various patient needs within the post-acute continuum.

Ensign Group's financial performance is a standout strength, consistently showing robust growth. In the second quarter of 2025, the company reported an impressive 18.5% revenue increase, reaching $1.23 billion, with adjusted diluted earnings per share rising 20.5% to $1.59. This financial health provides a solid foundation for continued expansion and operational stability.

The company's strategic real estate ownership, managed through its captive Standard Bearer Healthcare REIT, offers significant advantages. This model provides a stable rental income stream and insulates Ensign from external market volatility, enhancing long-term financial flexibility and investment capacity.

Ensign's acquisition strategy has been highly effective, with 52 new operations integrated since the start of 2024, including 8 in Q2 2025. This aggressive expansion fuels revenue growth and broadens its geographic footprint.

Furthermore, Ensign has achieved record occupancy rates for both same-store and transitioning facilities in early 2025, directly boosting revenue and operational efficiency. This strong demand for their services underscores their effective management and strategic positioning.

| Metric | Q2 2025 | Change vs. Prior Year |

|---|---|---|

| Revenue | $1.23 billion | +18.5% |

| Adjusted Diluted EPS | $1.59 | +20.5% |

| New Operations Acquired (YTD 2024-Q2 2025) | 52 | N/A |

| Occupancy Rates | All-time highs (early 2025) | N/A |

What is included in the product

Delivers a strategic overview of Ensign Group’s internal and external business factors, highlighting its strong market position and potential growth avenues while also acknowledging operational challenges and competitive pressures.

Identifies key market opportunities and competitive threats to inform strategic resource allocation.

Weaknesses

A significant portion of Ensign Group's revenue is directly linked to government reimbursement programs, particularly Medicare and Medicaid. While Medicare payments are slated for an increase in Fiscal Year 2025, the long-term stability and future reimbursement rates for Medicaid programs remain a key concern.

Any adverse policy shifts or reductions in these crucial government funding streams could have a material negative effect on Ensign Group's profitability and overall financial performance.

The healthcare sector, including skilled nursing and assisted living facilities, is experiencing significant staffing shortages, especially for nurses and direct care professionals. This widespread problem can drive up labor expenses, make it harder to maintain adequate staffing, and potentially affect the quality of patient services. Ensign Group, while operationally sound, faces these same industry-wide workforce challenges.

Ensign Group's aggressive acquisition strategy, with 52 new facilities added since early 2024, presents significant operational integration risks. Merging disparate cultures, management styles, and clinical protocols across such a volume of acquisitions is a complex undertaking.

Failure to efficiently integrate these new facilities could result in temporary declines in operational performance or unexpected increases in expenses. This complexity demands robust post-acquisition management to ensure continued high standards of patient care and financial stability.

High Regulatory Compliance Burden

Ensign Group operates within the highly regulated healthcare industry, presenting a substantial and ever-changing compliance burden. Recent trends, such as increased enforcement of HIPAA regulations and evolving state-level mandates for patient care standards, necessitate ongoing adaptation and resource allocation. Failure to adhere to these complex rules can lead to significant financial penalties and reputational damage.

The company must continually invest in systems and personnel to manage compliance, which can impact operational efficiency and profitability. For instance, updates to Medicare and Medicaid reimbursement rules, which often come with new reporting requirements, demand constant vigilance. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize stricter oversight in areas like quality reporting and staffing ratios, directly affecting providers like Ensign.

- Evolving Regulatory Landscape: Healthcare regulations are dynamic, requiring continuous monitoring and adaptation by Ensign Group to ensure ongoing compliance.

- Financial Penalties: Non-compliance can result in substantial fines, as demonstrated by past enforcement actions against healthcare providers for violations related to patient safety and billing practices.

- Operational Impact: Meeting stringent regulatory requirements demands significant investment in technology, training, and administrative processes, potentially affecting operational costs and agility.

- Reputational Risk: Regulatory breaches can severely damage Ensign Group's reputation among patients, partners, and investors, impacting future business opportunities.

Rising Operating Costs

The senior living and skilled nursing industries are grappling with significant increases in operating costs. This includes higher expenses for resident care, such as medical supplies and pharmaceuticals, as well as escalating labor costs due to wage pressures and staffing shortages. For instance, in early 2024, many healthcare providers reported labor cost increases of 5-10% year-over-year, impacting overall profitability.

These inflationary pressures can put a strain on profit margins, even when revenue growth is robust. The Ensign Group, like its peers, must navigate these rising expenditures to maintain financial health. Effective cost management strategies are therefore paramount for sustained profitability in this competitive landscape.

- Rising Labor Expenses: Increased wages and benefits to attract and retain staff.

- Higher Resident Care Costs: Escalating prices for medical supplies and pharmaceuticals.

- Inflationary Impact: General economic inflation affecting various operational inputs.

Ensign Group's heavy reliance on government reimbursement programs, particularly Medicare and Medicaid, poses a significant risk. While Medicare rates are set to increase in FY2025, the long-term stability of Medicaid funding remains uncertain, and policy changes could negatively impact profitability.

The company faces industry-wide staffing shortages, especially for nurses, which drive up labor costs and can affect service quality. Ensign's aggressive acquisition pace, with 52 new facilities added since early 2024, introduces substantial integration risks, potentially leading to operational disruptions or increased expenses if not managed effectively.

Operating in the highly regulated healthcare sector requires constant adaptation to evolving rules and compliance burdens. Failure to adhere to these complex regulations, such as stricter HIPAA enforcement and new patient care mandates, can result in significant financial penalties and reputational damage.

Preview the Actual Deliverable

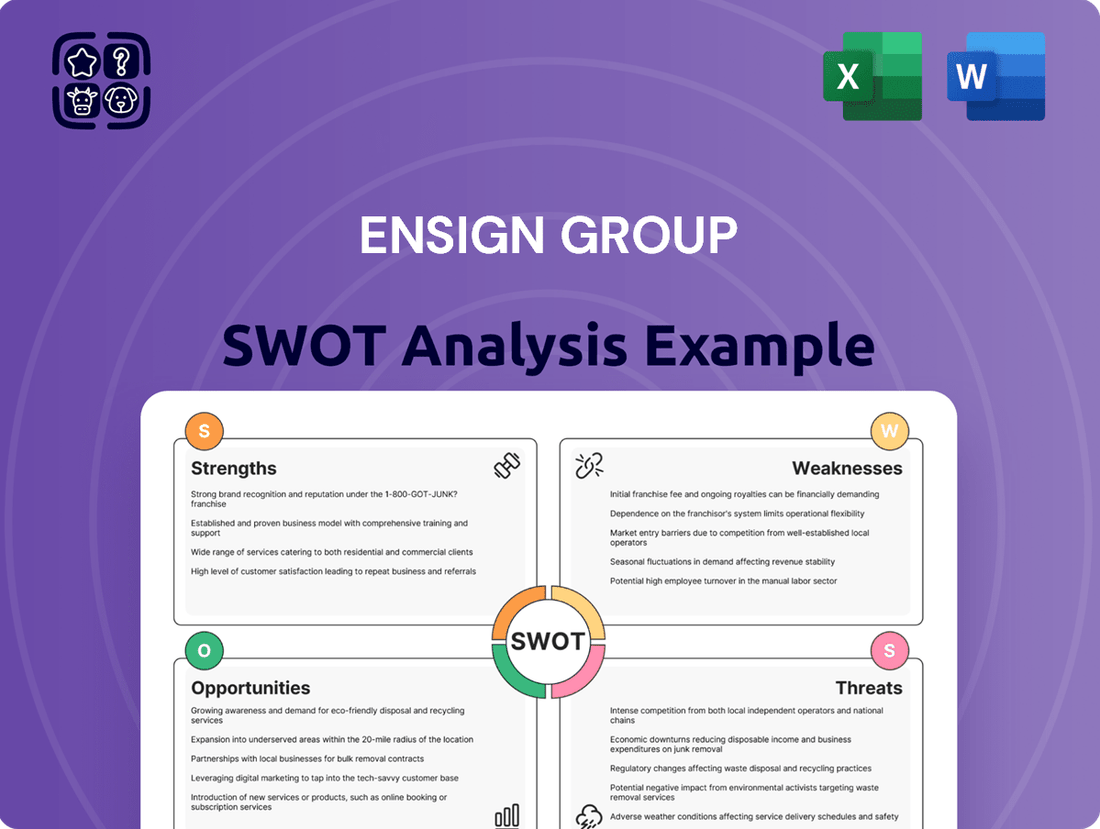

Ensign Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the Ensign Group's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of Ensign Group's strategic position.

Opportunities

The global population is aging rapidly, with the number of individuals aged 65 and over expected to reach 1.6 billion by 2050, according to the United Nations. This demographic trend, coupled with an increasing incidence of chronic diseases, directly fuels demand for skilled nursing and assisted living facilities. Ensign Group is well-positioned to capitalize on this expanding market for its diverse healthcare services.

The skilled nursing facility market is a significant growth area. In the United States alone, the market size was valued at approximately $100 billion in 2023 and is projected to grow at a compound annual growth rate of over 5% through 2030. This sustained expansion offers a robust opportunity for Ensign Group to leverage its expertise and infrastructure.

The skilled nursing and senior living industries remain highly fragmented, presenting a fertile ground for further consolidation. Ensign Group's established expertise in acquiring and integrating smaller facilities positions it to capitalize on this trend. For instance, as of early 2024, the senior living market alone is valued in the hundreds of billions, with many independent operators facing increasing regulatory and operational pressures.

With its robust liquidity and a successful track record of acquisitions, Ensign Group is strategically poised to acquire these smaller, independent facilities. This approach allows Ensign to not only expand its geographical footprint and market share but also to achieve greater economies of scale. In 2023, Ensign completed several strategic acquisitions, demonstrating their commitment to this growth strategy and solidifying their competitive advantage in an evolving landscape.

Ensign Group can capitalize on the rapid advancements in healthcare technology to boost patient care and operational efficiency. Technologies like telehealth, AI-driven administrative tools, and remote patient monitoring offer significant potential. For instance, the telehealth market was projected to reach $373.7 billion by 2028, showcasing substantial growth opportunities.

By integrating these innovations, Ensign can improve clinical outcomes and streamline workflows, a critical advantage given ongoing workforce shortages. The adoption of AI in healthcare alone is expected to save billions in administrative costs, freeing up resources for direct patient services.

Expansion into Underserved Geographic Markets

Ensign Group can leverage its established expertise to enter geographic markets where demand for post-acute and senior living services outstrips current supply. This strategy is supported by their proven track record of successful acquisitions and integrations in new territories. For instance, Ensign’s expansion into Alabama in 2024 demonstrates their commitment to identifying and capitalizing on these opportunities.

This geographic expansion allows Ensign to tap into new patient populations and diversify its revenue base, mitigating risks associated with over-reliance on existing markets. The company’s ability to acquire and operate skilled nursing and assisted living facilities efficiently positions it well for growth in these less saturated regions.

- Targeting states with a growing senior population and limited existing providers.

- Acquiring facilities in areas experiencing demographic shifts favoring senior care services.

- Leveraging operational efficiencies to achieve profitability in new markets quickly.

Shift Towards Value-Based Care

The healthcare landscape is rapidly transitioning to value-based care, prioritizing patient outcomes rather than the sheer volume of services. Ensign Group's core philosophy, centered on delivering high-quality patient care and enhancing clinical results, is perfectly positioned to capitalize on this industry-wide evolution. This strategic alignment with value-based initiatives presents a significant opportunity for Ensign to secure more favorable reimbursement rates and gain preferred status among payers who reward demonstrable excellence in care delivery.

This shift presents several key opportunities for Ensign Group:

- Enhanced Reimbursement: Organizations that meet or exceed quality benchmarks in value-based care models can see increased payment rates, directly boosting revenue.

- Preferred Provider Status: Demonstrating superior clinical outcomes can lead to preferred network inclusion, attracting more patients and referrals.

- Market Differentiation: A strong performance in value-based care can set Ensign apart from competitors, solidifying its reputation as a leader in quality healthcare.

- Improved Patient Loyalty: By focusing on outcomes, Ensign can foster greater patient satisfaction and long-term loyalty, contributing to sustainable growth.

Ensign Group is well-positioned to benefit from the increasing demand for senior living and skilled nursing services, driven by a rapidly aging global population. The company's strategy of acquiring and integrating smaller, fragmented facilities allows it to expand its market share and achieve economies of scale.

The company can also leverage technological advancements in healthcare, such as telehealth and AI, to improve patient care and operational efficiency. Furthermore, Ensign's focus on value-based care aligns with industry trends, potentially leading to enhanced reimbursement and preferred provider status.

| Opportunity Area | Key Driver | Ensign's Advantage | Market Data/Projection |

|---|---|---|---|

| Aging Population & Increased Demand | Global demographic shifts | Acquisition expertise, established infrastructure | 1.6 billion individuals aged 65+ by 2050 (UN) |

| Market Consolidation | Fragmented industry | Proven acquisition and integration track record | Senior living market valued in hundreds of billions (early 2024) |

| Technological Integration | Efficiency and care improvement | Adaptability to new healthcare technologies | Telehealth market projected to reach $373.7 billion by 2028 |

| Value-Based Care Transition | Focus on patient outcomes | Core philosophy aligns with quality-driven models | Potential for increased reimbursement rates and preferred status |

Threats

The escalating shortage of healthcare professionals, especially nurses and direct care staff, presents a significant threat to Ensign Group. Projections indicate this crisis will likely worsen, impacting the entire industry.

This intensifying workforce shortage directly translates to increased operational costs for Ensign Group, with a greater reliance on expensive temporary staffing agencies and upward pressure on wages. For example, in 2024, the demand for registered nurses in the U.S. is projected to outpace supply by a substantial margin, a trend expected to continue through 2030.

Furthermore, the critical lack of qualified personnel could restrict Ensign Group's ability to admit new patients or even expand its existing facilities, thereby capping revenue growth and potentially limiting the quality of care it can consistently provide.

Ensign Group faces the significant threat of adverse regulatory and policy changes. For instance, potential federal staffing mandates for nursing homes, as discussed in industry analyses throughout 2024, could substantially increase labor costs and operational complexity.

Evolving compliance requirements for data privacy and interoperability, particularly with the increasing digitization of healthcare records, also pose a risk. These shifts demand continuous investment in technology and training, potentially diverting resources from core services and impacting profitability.

The dynamic nature of healthcare policy means that Ensign must remain agile to adapt to new rules, with non-compliance carrying risks of fines and reputational damage. This was a recurring theme in healthcare sector reports during 2024, highlighting the need for robust compliance frameworks.

While Ensign Group has benefited from recent positive adjustments in Medicare and Medicaid reimbursement rates, the long-term stability of these payments presents an ongoing threat. Any future unfavorable changes or reductions in these government funding streams could directly impact Ensign's revenue and profitability, as its financial performance is closely linked to these policies.

Increased Competition in Key Markets

The senior living and skilled nursing industries are experiencing robust demand, which naturally attracts more players. This influx of both established companies and new entrants intensifies competition, potentially impacting Ensign Group's pricing power and acquisition costs.

This competitive pressure could make it harder for Ensign Group to secure favorable deals for new facilities or to maintain its current market share as competitors vie for patients and residents. For instance, in 2024, the average occupancy rate across skilled nursing facilities hovered around 85%, a figure that could face downward pressure with increased competition.

- Increased Market Saturation: More operators entering attractive markets can lead to a higher density of facilities.

- Pricing Pressure: To attract and retain residents, companies may be forced to lower prices or offer more concessions.

- Acquisition Challenges: The cost of acquiring existing facilities or businesses in desirable locations is likely to rise.

- Slower Organic Growth: Gaining new patients and residents might become more challenging, impacting the pace of organic expansion.

Economic Downturn and Inflationary Pressures

Broader macroeconomic shifts, like a potential economic recession or ongoing inflation, present a significant threat to Ensign Group's financial health. Inflation directly impacts operational costs, increasing expenses for essential resources such as staff wages, medical supplies, and utility services, which can squeeze profit margins. For instance, the U.S. experienced persistent inflation throughout 2023 and into early 2024, with the Consumer Price Index (CPI) showing notable increases in healthcare and labor costs.

Furthermore, an economic slowdown could negatively affect patient volumes and the capacity of families to pay for private-pay healthcare services, leading to reduced demand for Ensign's offerings. This economic sensitivity is a critical factor for companies in the healthcare sector, as discretionary spending on healthcare can decline during periods of financial uncertainty.

- Rising operational costs due to inflation

- Potential decrease in patient volumes during economic downturns

- Reduced affordability of private-pay services for consumers

- Impact on overall revenue and profitability

The persistent shortage of healthcare professionals, particularly nurses, poses a significant threat by driving up labor costs through increased reliance on temporary staff and higher wages. This crisis is expected to continue, impacting the industry’s ability to expand services and maintain quality of care.

Adverse regulatory changes, such as potential federal staffing mandates or evolving data privacy requirements, could substantially increase operational complexity and costs. Non-compliance risks further penalties and reputational damage, demanding continuous investment in technology and training.

Intensified competition from new and existing players in the senior living and skilled nursing sectors can lead to pricing pressure and higher acquisition costs. This market saturation may also slow Ensign Group's organic growth by making it harder to attract patients and residents.

Macroeconomic factors like inflation and potential recessions present financial risks, increasing operational expenses for supplies and wages while potentially reducing patient volumes and the affordability of private-pay services.

| Threat Category | Specific Risk | Potential Impact | Data Point (2024/2025 Projection) |

|---|---|---|---|

| Workforce Shortage | Increased labor costs (wages, temp staff) | Reduced profit margins, limited expansion | U.S. registered nurse supply deficit projected to widen through 2030. |

| Regulatory Changes | Federal staffing mandates, data privacy compliance | Higher operational costs, compliance burden | Potential for new federal regulations impacting nursing home staffing ratios discussed in 2024 analyses. |

| Competition | Market saturation, pricing pressure | Lower pricing power, increased acquisition costs | Skilled nursing facility occupancy rates around 85% in 2024 could face downward pressure. |

| Macroeconomic Factors | Inflation, economic downturn | Rising operational expenses, reduced patient revenue | U.S. CPI showed notable increases in healthcare and labor costs in early 2024. |

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, including Ensign Group's official financial filings, comprehensive market research reports, and expert industry commentary to provide a robust understanding of its strategic position.