Ensign Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ensign Group Bundle

Unlock the strategic core of Ensign Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Perfect for strategists and investors seeking to dissect a thriving business.

Partnerships

Ensign Group cultivates strong ties with managed care organizations, which are vital for directing patient flow and defining care settings. These relationships are foundational to Ensign's consistent patient volume. In 2023, managed care revenue represented a significant portion of the healthcare industry's overall payments, underscoring the importance of these partnerships.

Ensign Group actively cultivates partnerships with acute care hospitals, acting as a crucial post-acute care provider for patients needing continued care after hospitalization. These alliances streamline patient transitions and ensure a connected care journey, frequently resulting in preferred provider designations within large hospital systems. In 2023, Ensign's focus on these hospital relationships contributed to their ability to manage a significant patient volume, with admissions directly influenced by these referral pathways.

Ensign Group actively cultivates relationships with physician groups and local healthcare providers. These collaborations are fundamental to delivering well-rounded, integrated care to their residents and patients.

These partnerships are crucial for seamless clinical coordination, facilitating access to specialized medical consultations, and ensuring a steady stream of referrals across a wide array of healthcare requirements. For instance, in 2023, Ensign reported a significant portion of its revenue derived from managed care contracts, underscoring the importance of these provider networks.

By working closely with these medical professionals, Ensign enhances the overall quality of care provided and positively impacts patient outcomes, a key driver for their operational success.

Third-Party Operators and Landlords

Ensign Group's strategy involves leasing properties through its captive real estate investment trust, Standard Bearer Healthcare REIT. This trust leases to both Ensign's affiliated operators and independent third-party healthcare operators. This dual leasing model diversifies rental income and provides flexibility in managing its portfolio of healthcare facilities.

This partnership approach with external third-party operators is a key element of Ensign's business model, allowing for broader market reach and shared operational benefits. For instance, by partnering with independent operators, Ensign can ensure its properties are utilized efficiently, contributing to consistent revenue generation. In 2023, Ensign's rental income from its REIT segment was approximately $273.5 million, showcasing the financial impact of these leasing arrangements.

- Diversified Rental Revenue: Standard Bearer Healthcare REIT generates income from both affiliated and independent third-party operators, reducing reliance on a single customer type.

- Strategic Flexibility: Partnering with third-party operators allows Ensign to adapt its facility management strategies and potentially expand its operational footprint without direct ownership of all operating entities.

- Mutual Benefit Partnerships: Ensign's willingness to lease to external healthcare operators fosters relationships that can lead to shared best practices and increased occupancy rates across its properties.

Community Organizations

Ensign Group actively collaborates with community organizations, recognizing their vital role in understanding and serving local healthcare needs. These partnerships are crucial for tailoring services and building trust within the communities they operate. For instance, in 2024, Ensign continued to strengthen its ties with local support groups and charities, aiming to provide more comprehensive care pathways.

These collaborations allow Ensign to gain deeper insights into the specific challenges and opportunities within each market. By working with entities that have established local credibility, Ensign can more effectively address patient needs and enhance its service delivery. This approach is fundamental to their strategy of being a deeply integrated healthcare provider.

- Community Integration: Ensign’s strategy involves deep integration with local support groups and charities to better understand and serve community health needs.

- Holistic Care: Partnerships with community services aim to provide a more complete and supportive care experience for patients.

- Trust Building: Engaging with established local organizations reinforces Ensign’s commitment to community well-being and fosters trust.

- Market Responsiveness: These collaborations enable Ensign to adapt its services to the unique requirements of each local market.

Ensign Group's key partnerships extend to its captive real estate investment trust, Standard Bearer Healthcare REIT. This REIT leases properties to both Ensign's affiliated operators and independent third-party healthcare operators, creating a diversified revenue stream and operational flexibility. This dual leasing strategy, as seen in 2023 with approximately $273.5 million in rental income, allows Ensign to maximize property utilization and expand its market reach through external collaborations.

| Partnership Type | Key Benefit | 2023 Financial Impact (Illustrative) |

|---|---|---|

| Standard Bearer Healthcare REIT (Third-Party Operators) | Diversified rental income, expanded market reach | Rental Income: ~$273.5 million |

| Managed Care Organizations | Patient flow, defined care settings, consistent volume | Managed Care Revenue: Significant portion of total revenue |

| Acute Care Hospitals | Post-acute care referrals, streamlined patient transitions | Admissions influenced by referral pathways |

What is included in the product

A detailed business model canvas for The Ensign Group, outlining its strategy of acquiring and operating physical therapy clinics, focusing on customer segments like patients and referring physicians, and its value proposition of accessible, high-quality rehabilitation services.

This canvas details Ensign's operational structure, revenue streams from insurance payers and patient co-pays, and key resources like its management team and clinic network, all designed for efficient growth and profitability in the healthcare sector.

Provides a clear, actionable framework for understanding how Ensign Group alleviates operational burdens and streamlines healthcare management.

Offers a visual solution to the complexity of healthcare business operations, simplifying strategic planning and execution.

Activities

A primary activity for Ensign Group is the strategic acquisition of skilled nursing and assisted living facilities. This includes purchasing both profitable and struggling operations, demonstrating a broad acquisition strategy.

Ensign Group excels at integrating these newly acquired facilities into its existing decentralized operational framework. This integration process is key to their ability to manage a large and diverse portfolio effectively.

In 2023, Ensign Group reported acquiring 27 new locations, a testament to their continuous expansion efforts. This ongoing acquisition and integration drive significantly bolsters their market presence and overall growth trajectory.

Ensign Group's core activity revolves around providing a wide array of skilled nursing and rehabilitative services. This includes essential long-term care, crucial short-term rehabilitation programs, and the management of complex medical needs.

The company also focuses heavily on comprehensive rehabilitative therapies, such as physical therapy, occupational therapy, and speech therapy. These services are not just vital for patient recovery but are also a primary driver of Ensign's revenue streams.

In 2023, Ensign reported that its same-store skilled nursing facilities saw a 6.2% increase in revenue per patient day, underscoring the demand for these specialized care services.

Ensign Group’s operation of senior living communities, including assisted and independent living facilities, is a core activity that diversifies their healthcare offerings. These communities are designed to enhance residents' quality of life by providing varied lifestyle choices and essential daily living assistance, fostering both independence and a supportive environment.

In 2024, Ensign Group continued to expand its senior living footprint. As of the first quarter of 2024, the company reported operating 250 senior living facilities, a significant portion of its overall portfolio, demonstrating a commitment to this growing segment of the healthcare market.

Operational Improvement and Clinical Excellence

Ensign Group's core activity involves implementing a structured, repeatable operating model to boost the performance of its acquired healthcare facilities. This model is designed to drive improvements across key metrics.

This operational focus directly impacts financial health by enhancing occupancy rates, which are crucial for revenue generation. For instance, Ensign consistently aims for strong occupancy levels, often exceeding industry averages in its markets.

- Occupancy Rate Enhancement: Driving higher patient census through effective sales and marketing, and superior service delivery.

- Clinical Outcome Improvement: Focusing on patient recovery, reducing readmission rates, and ensuring high-quality care standards.

- Staff Utilization Optimization: Efficiently managing staffing levels to ensure quality care while controlling labor costs.

By prioritizing clinical excellence, Ensign not only elevates patient care but also strengthens the financial stability of its facilities. In 2024, Ensign reported that facilities with higher clinical quality scores often demonstrated better financial performance, underscoring the direct link between patient well-being and operational success.

Real Estate Investment and Management

Ensign Group, through its real estate investment trust subsidiary, Standard Bearer Healthcare REIT, actively acquires, leases, and owns healthcare facilities. This strategy directly fuels their operational expansion by securing necessary locations and creates a dual revenue stream through rental income from both their own affiliated operators and external third-party entities.

This deliberate approach to real estate asset management is fundamental to Ensign's overall business strategy, ensuring a stable foundation for their healthcare operations. For instance, in 2024, Ensign continued to expand its real estate portfolio, demonstrating a commitment to owning and controlling key facilities that support its service delivery.

- Acquisition of Healthcare Facilities: Ensign strategically buys properties to house its growing network of skilled nursing and rehabilitation centers.

- Leasing and Ownership: The company holds ownership of these critical assets, often leasing them to its operating subsidiaries.

- Revenue Generation: Rental income from these properties provides a consistent revenue stream, supporting overall financial health.

- Strategic Asset Management: This activity ensures control over essential infrastructure, enabling operational flexibility and growth.

Ensign Group's key activities center on strategically acquiring and integrating skilled nursing and assisted living facilities. They also focus on providing comprehensive rehabilitative therapies and operating senior living communities.

A crucial aspect is implementing a structured operating model to enhance facility performance, focusing on occupancy, clinical outcomes, and staff utilization. Furthermore, their real estate arm, Standard Bearer Healthcare REIT, actively manages facility ownership and leasing to support expansion and generate rental income.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Acquisition & Integration | Purchasing and integrating skilled nursing and assisted living facilities. | Acquired 27 new locations in 2023. |

| Service Provision | Offering skilled nursing, rehabilitation, and senior living services. | Same-store skilled nursing revenue per patient day increased 6.2% in 2023. |

| Operational Improvement | Implementing a model to boost facility performance. | Focus on enhancing occupancy, clinical outcomes, and staff utilization. |

| Real Estate Management | Acquiring, leasing, and owning healthcare facilities via REIT. | Operated 250 senior living facilities as of Q1 2024. |

Delivered as Displayed

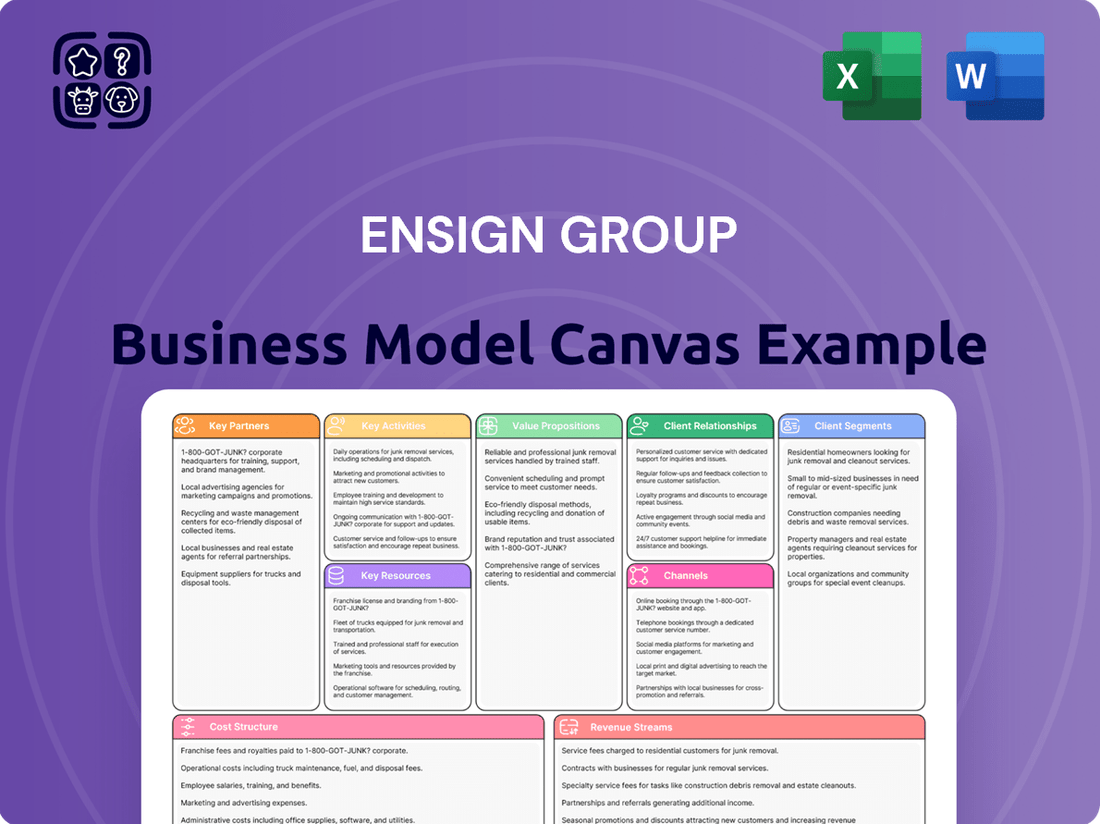

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of The Ensign Group's strategic framework. This isn't a sample; it's a direct representation of the final deliverable, showcasing the core components of their operational and growth strategies. You'll gain full access to this detailed analysis, ready for your review and application.

Resources

Ensign Group's healthcare facilities and real estate portfolio are its bedrock, encompassing skilled nursing, assisted living, and rehabilitative care centers. This extensive physical infrastructure, largely held by Standard Bearer Healthcare REIT, is crucial for delivering their core services.

As of the first quarter of 2024, Ensign Group operated 268 facilities across 13 states, a testament to their expanding physical footprint and operational capacity. This growing network is a vital resource enabling continuous expansion and market penetration.

Skilled clinical and therapy staff are the bedrock of Ensign's service delivery. This includes highly qualified nurses, physical therapists, occupational therapists, and speech therapists. In 2023, Ensign reported a significant portion of their operating expenses allocated to employee wages and benefits, reflecting their investment in this key resource.

Ensign's strategy heavily relies on building and maintaining in-house therapy teams. This approach allows for greater control over quality and consistency of care. The company actively focuses on staff retention and ongoing professional development, recognizing that experienced and motivated clinicians are essential for achieving excellent patient outcomes.

The expertise of these professionals directly impacts patient recovery rates and satisfaction. Ensign's emphasis on clinical excellence, supported by its skilled staff, is a primary driver of its reputation and ability to attract patients and referral sources.

Ensign Group's decentralized local leadership teams are a cornerstone of their operational strategy. These empowered teams manage individual facilities or small clusters, driving accountability and tailored responses to local market dynamics. This autonomy allows for swift decision-making and fosters a culture of innovation within each location.

This model is crucial for Ensign's rapid growth through acquisitions. By entrusting local leaders, the company ensures that newly acquired facilities can be effectively integrated and improved. For instance, in 2023, Ensign acquired 20 new facilities, a process significantly streamlined by this decentralized leadership structure, enabling faster operational alignment and performance enhancement.

Proprietary Clinical and Financial Systems

Ensign Group leverages proprietary clinical and financial systems, encompassing specialized software and intuitive touch-screen interfaces. These tools are central to their operations, facilitating efficient patient care monitoring, meticulous record-keeping, and streamlined billing processes. This technological backbone is critical for managing vast amounts of data effectively.

These advanced systems directly contribute to improved data management and significantly enhance clinical productivity across Ensign's facilities. By optimizing workflows and ensuring accurate information capture, they support robust regulatory compliance, a vital aspect of the healthcare industry. For instance, in 2024, Ensign continued to invest heavily in upgrading these systems to meet evolving healthcare standards and data security requirements.

The strategic investment in these proprietary technologies provides Ensign Group with a distinct competitive edge in the healthcare market. This commitment to advanced technology not only drives operational efficiency but also underpins their ability to deliver high-quality patient care. The company reported that their technology investments in 2024 contributed to a measurable increase in operational efficiency, as detailed in their Q4 2024 earnings call.

- Proprietary Technology: Specialized software and touch-screen interfaces for patient care, record-keeping, and billing.

- Operational Benefits: Improved data management, enhanced clinical productivity, and strengthened regulatory compliance.

- Competitive Advantage: Investment in technology differentiates Ensign in the healthcare sector.

- 2024 Focus: Continued investment in system upgrades to meet evolving healthcare standards and security needs.

Strong Financial Capital and Liquidity

Ensign Group leverages its robust financial capital and liquidity as a cornerstone of its business model. This strong financial footing, evidenced by substantial cash reserves and readily accessible credit lines, grants the company significant operational and strategic flexibility. For instance, Ensign Group reported total assets of $3.7 billion as of the first quarter of 2024, with a considerable portion held in cash and cash equivalents, enabling swift responses to market dynamics.

This deep liquidity directly fuels Ensign's growth trajectory, allowing for the proactive pursuit of strategic acquisitions and substantial investments in facility upgrades and operational enhancements. The company's ability to self-fund or readily secure financing for new facilities and service line expansions is a direct consequence of this financial strength. In 2023, Ensign completed 14 acquisitions, a testament to its capacity to execute its expansion strategy effectively.

- Significant Cash Reserves: Ensign Group maintains substantial cash and cash equivalents, providing immediate financial resources.

- Access to Credit: The company has established credit facilities that offer additional financial flexibility for growth and operations.

- Enabling Growth Strategy: Strong liquidity is crucial for Ensign's aggressive acquisition strategy and investment in facility improvements.

- Operational Resilience: This financial strength allows Ensign to effectively manage operational costs and navigate economic fluctuations.

Ensign Group's key resources include its extensive network of healthcare facilities, a highly skilled clinical workforce, decentralized leadership teams, proprietary technology systems, and strong financial capital. These elements collectively enable the company to deliver quality care, execute its growth strategy, and maintain a competitive edge in the post-acute care sector.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Healthcare Facilities | Skilled nursing, assisted living, and rehabilitative care centers, largely owned by Standard Bearer Healthcare REIT. | 268 facilities operated as of Q1 2024, forming the physical infrastructure for service delivery. |

| Skilled Clinical Staff | Nurses, physical therapists, occupational therapists, and speech therapists. | Crucial for patient outcomes; significant portion of operating expenses in 2023 allocated to wages and benefits. |

| Decentralized Leadership | Empowered local teams managing facilities or clusters. | Facilitates effective integration of 20 new facilities acquired in 2023, driving performance alignment. |

| Proprietary Technology | Clinical and financial systems, software, and touch-screen interfaces. | Investments in system upgrades in 2024 aimed at enhancing operational efficiency and data security. |

| Financial Capital | Robust liquidity, cash reserves, and credit lines. | Total assets of $3.7 billion as of Q1 2024, enabling proactive acquisitions and investments. |

Value Propositions

Ensign Group prioritizes exceptional patient care, aiming for superior clinical outcomes through a resident-centered approach. This commitment directly leads to enhanced patient recoveries and improved overall well-being, fostering deep trust among patients, families, and healthcare payers.

Ensign Group provides a wide array of healthcare services, encompassing skilled nursing, rehabilitation, home health, hospice, and even specialized offerings like mobile X-ray and transportation. This integrated approach creates a complete continuum of care, addressing varied patient needs seamlessly.

By consolidating these diverse services, Ensign simplifies the complex process of care coordination for both patients and their families. This unified model allows for smoother transitions between different levels of care, enhancing the overall patient experience.

In 2024, Ensign's commitment to this comprehensive model was evident in its operational scope, managing a significant number of facilities across multiple states, demonstrating its capacity to deliver integrated care on a large scale.

Ensign Group's decentralized structure allows local leadership to customize care, directly addressing the distinct needs of each community. This ensures services are not only relevant but also highly responsive to local demands.

By integrating facilities within their specific markets, Ensign cultivates a strong community presence and delivers a more personalized care experience. This focus on local responsiveness was evident in their 2024 performance, where they reported a 15.4% increase in same-store revenue, highlighting the effectiveness of their localized strategies.

Operational Excellence and Turnaround Expertise

Ensign Group's core value proposition centers on its exceptional operational excellence and proven turnaround expertise, particularly in the skilled nursing and senior living sectors. They have a remarkable history of acquiring underperforming facilities and transforming them into highly efficient and profitable operations.

This capability is demonstrated by their consistent ability to enhance occupancy rates, implement rigorous cost controls, and significantly boost overall financial performance. For instance, in 2023, Ensign Group reported a revenue of $3.4 billion, a testament to their successful operational strategies across their portfolio.

- Acquisition of Underperforming Assets: Ensign specializes in identifying and acquiring facilities that are not meeting their full potential.

- Operational Improvement: Their expertise lies in implementing best practices to improve day-to-day operations, leading to better patient care and efficiency.

- Financial Turnaround: Ensign consistently turns around struggling facilities, increasing profitability through strategic management and cost reduction initiatives.

- Market Impact: This approach not only benefits Ensign but also revitalizes facilities within their communities, improving the overall healthcare landscape.

Flexible and Supportive Senior Living Environments

Ensign Group provides senior living residents with adaptable, month-to-month leasing, eliminating the need for hefty buy-in fees. This flexible approach allows residents to adjust their living arrangements as their care needs evolve, offering both independence and reassurance. In 2024, Ensign's senior living segment continued to focus on these flexible offerings, aiming to capture a broader demographic seeking adaptable care solutions.

The company's tiered assistance levels ensure that residents receive personalized support, enhancing their comfort and peace of mind. This adaptability directly addresses the changing preferences of today's senior population, who increasingly value choice and control over their living situations.

- Flexible Leasing: Month-to-month options without buy-in fees.

- Tiered Assistance: Customizable care levels to meet individual needs.

- Adaptability: Supports residents as their needs change, promoting independence.

- Resident Focus: Caters to evolving senior preferences for choice and control.

Ensign Group's value proposition is built on operational excellence and a proven ability to revitalize underperforming healthcare facilities, particularly in skilled nursing and senior living. They excel at acquiring struggling assets and transforming them into efficient, profitable operations by enhancing occupancy, controlling costs, and boosting financial performance.

This strategy is supported by their decentralized model, which empowers local leadership to tailor services to community needs, fostering strong local presence and personalized care. This approach was reflected in their 2024 performance, with a reported 15.4% increase in same-store revenue underscoring the success of their localized strategies.

Furthermore, Ensign offers flexible, month-to-month senior living leases without buy-in fees, coupled with tiered assistance levels. This adaptability caters to evolving resident needs and preferences for choice and control, providing both independence and peace of mind.

| Value Proposition | Description | Supporting Data/Fact |

| Operational Excellence & Turnaround Expertise | Acquiring and improving underperforming healthcare facilities. | 2023 Revenue: $3.4 billion. |

| Integrated Continuum of Care | Offering a wide range of services from skilled nursing to home health. | Manages a significant number of facilities across multiple states. |

| Decentralized Structure & Local Responsiveness | Customizing care to meet distinct community needs. | 2024 Same-Store Revenue Growth: 15.4%. |

| Flexible Senior Living Options | Month-to-month leases with tiered assistance, no buy-in fees. | Focus on adaptable care solutions for evolving senior demographics. |

Customer Relationships

Ensign Group cultivates strong customer relationships by delivering highly personalized, resident-centered care. Their approach focuses on individual wellness and fostering independence, creating a sense of value and support for each person. This commitment builds significant trust and loyalty.

Ensign Group places a strong emphasis on fostering engaged family communication and support, understanding that families are integral to a resident's care experience. Caregivers are trained to ensure both residents and their families feel genuinely loved and well-supported throughout their stay.

Open and transparent communication channels are maintained, providing families with peace of mind and keeping them informed about their loved one's progress and well-being. This commitment to family involvement is a cornerstone of Ensign's approach to providing compassionate care.

Ensign's decentralized approach empowers its skilled nursing and rehabilitation facilities to deeply embed themselves within their local communities. This fosters genuine trust and rapport, as seen in their active participation in local healthcare networks and their commitment to addressing specific community health needs. For instance, in 2024, Ensign reported that its facilities collectively engaged in over 500 community health outreach programs, directly impacting local wellness initiatives and solidifying their role as trusted healthcare providers.

Direct and Consistent Staff Interaction

Ensign Group's commitment to direct and consistent staff interaction is a cornerstone of their customer relationship strategy. Patients and residents experience the benefit of engaging with the same dedicated caregivers, including in-house therapy teams. This continuity of care is vital for building trust and familiarity, leading to stronger therapeutic alliances and an enhanced overall patient experience.

This approach directly impacts patient satisfaction and outcomes. For example, in 2024, Ensign reported that facilities with higher staff retention often saw improved patient recovery times and lower readmission rates. This suggests that consistent interaction fosters a more effective care environment.

- Continuity of Care: Patients interact with the same staff members regularly, building rapport and trust.

- Therapeutic Relationships: Dedicated in-house therapy teams establish strong, consistent bonds with patients.

- Enhanced Patient Experience: Familiarity and consistent support contribute to a more comfortable and positive healing journey.

- Improved Outcomes: Facilities with higher staff consistency often demonstrate better patient recovery metrics.

Managed Care and Payer Relationship Management

Ensign Group places significant emphasis on cultivating robust relationships with managed care organizations, Medicare, and Medicaid, its primary payors. This strategic focus is essential for ensuring consistent revenue streams and operational stability. For instance, in 2023, Ensign reported that approximately 86% of its revenue was derived from government payors (Medicare and Medicaid) and managed care contracts, underscoring the critical nature of these relationships.

Maintaining these partnerships involves a proactive approach to contract negotiation, ensuring favorable terms that reflect Ensign's commitment to quality care. Transparent and accurate billing practices are paramount, minimizing disputes and fostering trust. Furthermore, consistently demonstrating strong clinical outcomes is key to retaining and enhancing preferred provider status within these networks, which directly influences patient referrals and reimbursement rates.

- Contract Negotiation: Ensign actively engages with payors to secure mutually beneficial agreements, aiming for terms that support quality care delivery and financial sustainability.

- Transparency in Billing: Adhering to clear and precise billing procedures builds confidence and reduces administrative friction with managed care organizations and government programs.

- Clinical Outcomes: High-quality patient care and demonstrable positive health results are leveraged to maintain and improve Ensign's standing as a preferred provider, driving patient volume.

- Financial Stability: The strength of these payor relationships directly impacts Ensign's revenue cycle, cash flow, and overall financial health, making them a cornerstone of the business model.

Ensign Group's customer relationships are built on a foundation of personalized, resident-centered care, fostering trust and loyalty through consistent, compassionate interactions. Their decentralized model allows facilities to deeply integrate into local communities, building rapport and addressing specific health needs, as evidenced by over 500 community health outreach programs in 2024.

The company prioritizes continuity of care by ensuring patients interact with the same dedicated caregivers and in-house therapy teams, enhancing the patient experience and often leading to improved recovery times and lower readmission rates, a trend observed in 2024 data.

Crucially, Ensign maintains strong relationships with managed care organizations, Medicare, and Medicaid, which accounted for approximately 86% of its revenue in 2023. These partnerships are vital for financial stability, supported by proactive contract negotiation, transparent billing, and a consistent demonstration of high-quality clinical outcomes.

| Relationship Type | Key Engagement Strategy | 2023/2024 Data Point |

| Residents & Families | Personalized, resident-centered care; engaged family communication | Over 500 community health outreach programs (2024) |

| Staff-Patient Interaction | Continuity of care with dedicated caregivers and in-house therapy | Facilities with higher staff retention showed improved patient recovery (2024) |

| Payors (Managed Care, Medicare, Medicaid) | Proactive contract negotiation, transparent billing, strong clinical outcomes | ~86% of revenue derived from government payors and managed care (2023) |

Channels

Ensign Group's business model heavily relies on hospital and physician referral networks as a primary channel for patient admissions. These facilities are strategically positioned to be preferred providers for post-acute care, accepting patients directly from hospitals for rehabilitation and skilled nursing services.

These strong, established relationships with hospitals and physician groups are crucial for ensuring a consistent and predictable flow of patients. For instance, in 2023, Ensign reported that approximately 60% of their admissions originated from hospital referrals, underscoring the vital role these networks play in their operational success.

Ensign Group actively secures patient admissions through direct contracts with a wide array of managed care organizations (MCOs) and private insurance providers. These agreements are fundamental, establishing clear referral pathways and outlining payment structures, thereby serving as a primary channel for patient acquisition and revenue generation.

The company's ability to maintain favorable contract terms with these payers is paramount to ensuring consistent patient volume and operational stability. For instance, in 2023, Ensign reported that approximately 75% of its revenue was derived from managed care and Medicare/Medicaid sources, highlighting the critical nature of these relationships.

Ensign Group actively cultivates its local presence, acting as a community anchor to draw in new residents and patients. This deep integration fosters trust, leading to a significant portion of admissions stemming from word-of-mouth referrals and targeted local marketing initiatives. For instance, in 2024, Ensign's commitment to local engagement was evident in its numerous community health fairs and partnerships with local organizations, contributing to a steady stream of direct inquiries.

Online Presence and Digital Marketing

Ensign Group leverages its corporate website and various digital platforms as primary channels to disseminate information. These platforms detail their comprehensive range of healthcare services, facility locations, and core care philosophy, acting as a crucial touchpoint for prospective patients, their families, and potential business partners seeking to understand Ensign's offerings.

The digital presence extends to investor relations, offering a transparent window into the company's financial performance and strategic direction. This accessibility is vital for financial stakeholders, including individual investors and institutional portfolio managers, who rely on timely and accurate data for their decision-making processes.

- Website Traffic: In Q1 2024, Ensign Group's corporate website experienced a significant increase in traffic, with unique visitors up by 15% compared to the same period in 2023, indicating growing interest in their services and investment potential.

- Digital Marketing ROI: The company reported a 20% year-over-year improvement in return on investment for its digital marketing campaigns in 2023, driven by targeted patient acquisition strategies and enhanced online visibility.

- Investor Engagement: Ensign's investor relations portal saw a 25% rise in engagement metrics during 2023, including downloads of annual reports and quarterly earnings calls, reflecting strong interest from the financial community.

- Social Media Reach: Ensign Group's social media channels, focused on patient testimonials and community outreach, expanded their follower base by 30% in 2023, contributing to brand awareness and patient trust.

Direct Admissions and Walk-in Inquiries

While many admissions to Ensign Group's facilities come through referrals, a portion of patients and residents directly seek services. This often involves contacting a specific facility or even walking in for an inquiry, especially for assisted living and independent living communities. This direct engagement captures individuals and families actively exploring their healthcare and living options.

This channel is crucial for understanding the immediate needs and preferences of potential residents. For instance, in 2024, Ensign Group's proactive marketing and community outreach efforts aimed to increase direct inquiries, recognizing that a significant segment of the market prefers to self-educate and make direct contact. This direct channel allows for immediate relationship building and personalized service from the outset.

- Direct Inquiries: Captures individuals and families proactively seeking services.

- Facility Contact: Patients and residents may call or visit facilities directly.

- Assisted & Independent Living: This channel is particularly vital for these community types.

- Market Segment: Directly engages a self-directed portion of the potential patient/resident base.

Ensign Group's channels are multifaceted, encompassing direct hospital and physician referrals, managed care organization contracts, and robust local community engagement. Their digital presence, including their corporate website, also serves as a key information hub for prospective patients and investors.

These channels are supported by a strong digital strategy, evidenced by increasing website traffic and improved digital marketing ROI. The company also prioritizes direct patient inquiries, particularly for assisted and independent living services, fostering immediate relationships.

| Channel Type | Key Activities | 2023/2024 Data Point | Impact |

|---|---|---|---|

| Referral Networks | Hospital and physician partnerships | ~60% of admissions from hospital referrals (2023) | Consistent patient flow |

| Managed Care Contracts | Agreements with MCOs, Medicare/Medicaid | ~75% of revenue from managed care/government (2023) | Revenue stability |

| Local Engagement | Community health fairs, local partnerships | Increased direct inquiries through outreach (2024) | Brand trust and patient acquisition |

| Digital Presence | Corporate website, investor relations portal | 15% increase in website traffic (Q1 2024) | Information dissemination, investor interest |

| Direct Inquiries | Walk-ins, direct calls to facilities | Targeted efforts to increase direct contact (2024) | Captures self-directed market segment |

Customer Segments

Patients requiring skilled nursing care represent a core customer segment for Ensign Group, encompassing both those needing short-term rehabilitation and individuals requiring long-term chronic condition management. In 2024, Ensign's focus on this segment continued to be a significant revenue driver, with their facilities providing essential post-hospitalization services like physical, occupational, and speech therapy.

This segment also includes patients with complex medical needs, such as ventilator dependency or dialysis, highlighting the specialized nature of the care Ensign offers. The demand for these services remained robust throughout 2024, underscoring the critical role skilled nursing facilities play in the healthcare continuum.

Seniors seeking assisted and independent living represent a key customer segment for Ensign Group. These are elderly individuals who need help with daily tasks but wish to retain as much autonomy as possible, or those looking for a community setting that offers convenience and support without the burden of home maintenance. Ensign's facilities are designed to accommodate this spectrum of needs, from light assistance to more involved care.

In 2024, the demand for senior living solutions continues to grow, driven by an aging population. For instance, the number of Americans aged 65 and over is projected to reach 80.8 million by 2040, more than double the 40.2 million in 2012. Ensign Group's model effectively addresses this demographic shift by providing various levels of care within its senior living communities, ensuring a stable revenue stream from this expanding market.

Families and caregivers represent a vital customer segment for Ensign Group, as they are often the primary decision-makers for their loved ones' healthcare needs. These individuals are actively seeking high-quality care, clear and consistent communication from providers, and a nurturing environment that prioritizes the well-being of their family members. Ensign's strategy focuses on cultivating trust and delivering peace of mind to this group, recognizing their significant role in the healthcare journey.

Managed Care Organizations and Private Insurers

Managed care organizations and private insurers are crucial institutional customers for Ensign Group. These entities contract with Ensign's facilities to deliver healthcare services to their members, making them a primary source of revenue. In 2024, the ongoing emphasis on value-based care and cost containment within the insurance industry reinforces Ensign's strategy of building robust relationships to secure these vital contracts.

Ensign's focus on providing high-quality, cost-effective care directly addresses the interests of these payors, who are keen on managing their healthcare expenditures. This alignment is critical for securing and maintaining favorable reimbursement rates and patient volumes.

- Key Payor Relationships: Managed care organizations and private insurers represent a substantial portion of Ensign's revenue stream.

- Value-Based Care Focus: These customers prioritize providers who can deliver positive patient outcomes while managing costs efficiently.

- Contractual Agreements: Ensign actively cultivates and maintains strong relationships to secure and renew contracts, ensuring consistent patient flow.

Government Healthcare Programs (Medicare & Medicaid)

Government healthcare programs, primarily Medicare and Medicaid, are foundational customer segments for The Ensign Group. These entities act as significant payers for the skilled nursing and rehabilitative services Ensign provides. Ensign's operational and financial success is intrinsically linked to the reimbursement rates and evolving policies set forth by these governmental bodies. For instance, in 2024, Medicare's prospective payment system (PPS) continues to be a key driver of revenue for post-acute care providers like Ensign, with adjustments impacting daily rates for skilled nursing facilities. Similarly, Medicaid reimbursement rates, which vary by state, directly influence Ensign's profitability in those markets.

Effective navigation and management of these relationships are paramount. Ensign must maintain rigorous compliance with program regulations to ensure continued participation and payment. The group's ability to adapt to changes in healthcare policy, such as those potentially impacting the Patient-Driven Payment Model (PDPM) under Medicare, is crucial for sustained growth. In 2023, Ensign reported that approximately 60% of its revenue was derived from government payors, highlighting the critical nature of this segment.

- Medicare: A federal health insurance program primarily for individuals aged 65 and older, and younger people with disabilities.

- Medicaid: A joint federal and state program that helps cover medical costs for people with limited income and resources.

- Reimbursement Impact: Changes in Medicare and Medicaid reimbursement rates directly affect Ensign's revenue and profitability.

- Compliance Focus: Adherence to government program rules and regulations is essential for payment and operational continuity.

The primary customer segments for Ensign Group are patients requiring skilled nursing and rehabilitation services, seniors seeking assisted and independent living, and their families or caregivers who often make the care decisions. Additionally, managed care organizations, private insurers, and government healthcare programs like Medicare and Medicaid are crucial institutional customers and payers.

In 2024, Ensign's business model continues to cater to the growing demand from these diverse segments. The aging U.S. population fuels the need for senior living, while the post-hospitalization care market remains robust. Ensign's ability to provide a spectrum of care services, from intensive medical support to daily living assistance, positions it well to serve these varied needs.

Ensign's financial performance is heavily influenced by its relationships with payors. Government programs represented a significant portion of revenue, with approximately 60% derived from these sources in 2023. This underscores the importance of navigating Medicare and Medicaid reimbursement structures effectively to maintain profitability and operational stability.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Skilled Nursing Patients | Short-term rehab, long-term chronic care, complex medical needs | Continued high demand for post-acute and specialized care |

| Senior Living Residents | Assisted living, independent living, varying levels of support | Growing market due to aging population, demand for community living |

| Families/Caregivers | Decision-makers, seeking quality, communication, and trust | Crucial for patient acquisition and satisfaction; focus on peace of mind |

| Managed Care/Private Insurers | Contractual partners, focus on value-based care and cost efficiency | Key revenue source, requiring strong relationships and cost-effective delivery |

| Government Programs (Medicare/Medicaid) | Primary payers, subject to reimbursement rates and regulations | Foundational revenue stream; ~60% of revenue in 2023, requires compliance |

Cost Structure

Staff salaries, wages, and benefits represent the most significant expense for Ensign Group. This category encompasses compensation for their large team of healthcare professionals, including nurses, therapists, and essential support personnel. In 2023, Ensign reported total employee compensation and benefits of $1.78 billion, a substantial portion of their overall operating expenses.

Ensign actively works to optimize labor costs, a critical factor for their profitability. A key strategy involves minimizing the use of expensive agency staff by focusing on recruitment and retention of their own employees. This focus on internal staffing directly influences their ability to manage operational efficiency and maintain healthy profit margins.

Ensign Group's facility operating and maintenance expenses are a significant part of their cost structure, encompassing utilities, cleaning supplies, and routine upkeep for their extensive network of healthcare facilities. In 2024, managing these day-to-day operational costs efficiently is paramount to profitability. For instance, controlling energy consumption across numerous locations can lead to substantial savings.

Ensign Group's aggressive growth hinges on frequent acquisitions, which naturally come with substantial upfront costs. These include expenses for thorough due diligence to vet potential targets, significant legal fees for deal structuring and closing, and the operational costs associated with integrating newly acquired businesses into Ensign's existing framework. For instance, in 2023, Ensign completed 35 acquisitions, a testament to their acquisitive strategy, and these integration efforts represent a considerable investment.

Rent and Lease Payments

Rent and lease payments represent a substantial fixed cost for Ensign Group, particularly for its numerous healthcare facilities that are leased. These payments are a critical component of their operational expenses, ensuring access to the physical locations necessary for providing services. For facilities owned by Standard Bearer, an affiliate, and then leased to Ensign affiliates, these internal rental transactions are meticulously managed, reflecting a structured approach to managing facility costs across the organization.

These long-term lease obligations are a significant financial commitment for Ensign Group, impacting their cash flow and balance sheet. As of the first quarter of 2024, Ensign Group reported total lease liabilities of approximately $1.6 billion. This figure underscores the scale of their real estate footprint and the importance of these lease payments within their overall cost structure.

- Significant Fixed Cost: Lease payments for facilities are a major, predictable expense.

- Internal Management: Rental income and expenses are tracked even for inter-affiliate leases.

- Financial Commitment: Long-term leases represent substantial future financial obligations.

- Q1 2024 Impact: Lease liabilities stood at roughly $1.6 billion, highlighting the financial weight of these arrangements.

General and Administrative Expenses

General and administrative (G&A) expenses for Ensign Group encompass essential corporate overhead, including the vital administrative support provided by their Service Center. These costs are fundamental to maintaining the company's widespread operations, even with its decentralized approach. In 2023, Ensign Group reported G&A expenses of $222.5 million, representing approximately 6.3% of their total revenue.

These G&A costs cover critical areas such as IT infrastructure, which supports efficient data management and communication across all facilities. Furthermore, significant resources are allocated to legal and regulatory compliance, ensuring adherence to the complex healthcare landscape. Effective management of these central functions is crucial for overall cost control and operational efficiency.

- Corporate Overhead: Costs associated with the central management and administration of the company.

- Service Center Support: Expenses for administrative and operational assistance provided to individual facilities.

- IT Infrastructure: Investment in technology systems necessary for operations and data management.

- Legal & Compliance: Costs incurred for legal counsel and ensuring adherence to healthcare regulations.

Ensign's cost structure is heavily influenced by its substantial workforce, with staff salaries, wages, and benefits representing the largest expense. The company prioritizes retaining its own employees over using costly agency staff to manage labor costs effectively. Facility operating and maintenance, including utilities and upkeep, are also significant ongoing expenses across their numerous locations.

| Cost Category | 2023 Expense (USD) | Notes |

|---|---|---|

| Employee Compensation & Benefits | $1.78 billion | Largest expense, focus on retention |

| General & Administrative (G&A) | $222.5 million | Includes IT, legal, and Service Center support |

| Lease Liabilities (Q1 2024) | ~$1.6 billion | Significant fixed cost for leased facilities |

Revenue Streams

Skilled nursing services represent Ensign Group's core revenue engine, stemming from both short-term rehabilitation and extended long-term care. This segment is the bedrock of their financial performance.

Payments flow from major payers like Medicare, Medicaid, and various managed care organizations. These payments are typically calculated based on the number of patient days and the intensity of care required, known as acuity.

For the fiscal year 2023, Ensign Group reported that their skilled nursing facilities generated the vast majority of their revenue, underscoring the critical importance of this service line to their overall business model. This dominance is expected to continue into 2024.

Ensign Group generates significant revenue from rehabilitative care services, including physical, occupational, and speech therapy. These specialized treatments are crucial for patients recovering from illness or injury, forming a core part of their post-acute care offerings.

In 2023, Ensign reported that rehabilitative services contributed to a substantial portion of their overall revenue, reflecting the demand for these essential patient recovery programs. The focus on improving patient outcomes directly fuels this revenue stream.

Ensign Group's primary revenue comes from monthly fees paid by residents in its assisted living and independent living communities. These fees cover room, board, and varying levels of care and services, creating a diversified income base. For instance, in the first quarter of 2024, Ensign reported total revenues of $1.04 billion, a significant portion of which stems from these resident fees.

The success of this revenue stream is closely tied to occupancy rates within their facilities. Higher occupancy means more residents paying fees, directly boosting income. Ensign's focus on operational efficiency and quality care aims to attract and retain residents, thereby supporting consistent revenue generation.

Real Estate Rental Revenue (Standard Bearer)

Ensign's captive real estate investment trust, Standard Bearer Healthcare REIT, is a foundational revenue generator. It earns income by leasing healthcare facilities to both Ensign's affiliated operators and external third-party operators. These leases are predominantly long-term and structured as triple-net leases, which means the tenant covers property taxes, insurance, and maintenance.

This model creates a predictable and expanding revenue stream that is distinct from the direct provision of patient care services. For instance, in 2023, Standard Bearer REIT reported total rental revenue of $277.8 million, a significant increase from $230.6 million in 2022, highlighting its consistent growth and importance to Ensign's overall financial health.

- Stable Income: Triple-net leases provide predictable rental income regardless of occupancy fluctuations in the facilities.

- Diversified Tenant Base: Leasing to both affiliated and third-party operators reduces reliance on a single operational group.

- Property Value Appreciation: As Ensign's portfolio grows and the real estate market performs, the value of these properties can increase, benefiting the REIT.

- Strategic Asset Management: The REIT structure allows for efficient management and potential financing of Ensign's extensive real estate holdings.

Other Healthcare-Related Services Revenue

Ensign Group's revenue streams extend beyond skilled nursing facilities to include a variety of other healthcare-related services. These ancillary offerings are crucial for expanding their reach across the entire care spectrum and diversifying their income.

These services are designed to complement their core operations, providing a more comprehensive care solution for patients. This strategic approach not only enhances patient outcomes but also creates multiple touchpoints for revenue generation.

- Home Health and Hospice: Providing care in patients' homes, offering comfort and continuity.

- Mobile X-ray and Laboratory Services: Bringing diagnostic capabilities directly to facilities or patients.

- Non-Emergency Medical Transportation: Ensuring patients can access necessary appointments and services.

For the fiscal year 2023, Ensign Group reported total revenue of $3.7 billion, with these other healthcare-related services contributing significantly to this overall growth. This diversification strategy is a key element in their business model, allowing them to capture a larger share of the healthcare market.

Ensign Group's revenue is primarily driven by skilled nursing services, encompassing both short-term rehabilitation and long-term care, with payments sourced from Medicare, Medicaid, and managed care organizations. The company also generates substantial income from rehabilitative therapies like physical, occupational, and speech therapy, which are vital for patient recovery. Furthermore, their captive REIT, Standard Bearer Healthcare REIT, contributes significantly through long-term triple-net leases on healthcare facilities.

| Revenue Stream | Description | 2023 Data (Approximate) |

| Skilled Nursing Services | Short-term rehab and long-term care | Majority of total revenue |

| Rehabilitative Services | Physical, occupational, speech therapy | Substantial portion of revenue |

| Standard Bearer Healthcare REIT | Rental income from facility leases | $277.8 million in rental revenue |

| Other Healthcare Services | Home health, hospice, mobile diagnostics, transportation | Contributed to overall growth |

Business Model Canvas Data Sources

The Ensign Group Business Model Canvas is constructed using a blend of financial disclosures, industry-specific market research, and internal operational data. These sources provide a comprehensive view of the company's strategic positioning and market engagement.