Ensign Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ensign Group Bundle

Discover how Ensign Group masterfully leverages its Product, Price, Place, and Promotion strategies to dominate the healthcare industry. This analysis reveals their core offerings and how they're positioned to meet market demands.

Dive deeper into Ensign Group's strategic pricing models and their expansive distribution networks that ensure accessibility. Understand the subtle nuances of their promotional efforts that build strong brand loyalty.

Ready to unlock the full picture? Get the complete, editable 4Ps Marketing Mix Analysis for Ensign Group and gain actionable insights for your own business strategy.

Product

Ensign Group's comprehensive healthcare services center on skilled nursing and assisted living facilities, providing essential rehabilitative care. This includes crucial physical, occupational, and speech therapies designed to aid patient recovery and achieve better clinical results. For instance, in the first quarter of 2024, Ensign Group reported revenue of $399.8 million, underscoring the demand for their extensive service offerings.

The company emphasizes a tailored approach, delivering specialized care that addresses the unique needs of each patient. This commitment to individualized treatment ensures a well-rounded strategy for health and overall well-being, contributing to their strong performance, with a net income of $57.3 million in Q1 2024.

Skilled nursing and post-acute care represent a foundational element of Ensign Group's service portfolio. These offerings encompass specialized medical attention and rehabilitation, designed for individuals needing significant support following hospital stays or managing long-term health challenges. The primary goal is to facilitate patient recovery and enhance their ability to live more independently.

Ensign Group's commitment to superior clinical outcomes is a key differentiator. By focusing on improving patient health and recovery rates, the company builds a strong reputation and fosters deep trust among patients and their families. This dedication to quality care directly impacts patient satisfaction and the overall success of their rehabilitation journeys.

In 2023, Ensign Group operated 265 facilities across 14 states, with skilled nursing and post-acute care services forming a significant portion of their operations. The company reported total revenue of $3.5 billion for the year ended December 31, 2023, underscoring the substantial market presence and demand for these critical healthcare services.

Ensign Group's assisted living and senior care offerings extend their continuum of care beyond skilled nursing. These communities cater to individuals seeking support with daily living while maintaining independence, providing personalized care plans and fostering a high quality of life.

This segment allows Ensign to capture residents as their needs transition, offering a seamless care pathway. For instance, as of the first quarter of 2024, Ensign reported operating 13 assisted living facilities, demonstrating a growing presence in this crucial segment of senior care.

Diverse Ancillary Healthcare Services

Ensign Group is broadening its appeal by adding a range of ancillary healthcare services that work hand-in-hand with its core offerings. This strategic move aims to make healthcare more convenient and accessible for everyone. For instance, these services can include things like mobile x-ray units that come to you, non-emergency medical transport, and specialized pharmacy services for long-term care facilities.

This diversification creates a more complete healthcare experience, ensuring that patient and resident needs are met more thoroughly. By offering these complementary services, Ensign Group strengthens its position as a provider that understands and caters to a wider spectrum of health requirements. This approach is particularly beneficial in the current healthcare landscape where integrated care models are increasingly valued.

- Expanded Service Portfolio: Ensign Group's ancillary services like mobile X-ray and non-emergency transportation directly address patient convenience and accessibility.

- Comprehensive Care Model: These additions support a holistic approach, catering to a broader array of patient and resident needs beyond primary care.

- Market Competitiveness: Diversification enhances Ensign's value proposition, making it a more attractive option in the competitive healthcare market.

- Revenue Diversification: Ancillary services can provide additional revenue streams, contributing to the company's overall financial health.

Quality Patient Care and Clinical Outcomes Focus

Ensign Group's product is fundamentally centered on delivering exceptional patient care and achieving superior clinical outcomes. This dedication is not just a mission statement but a tangible aspect of their operations, aiming to build deep trust within the communities they serve.

The tangible results of this focus are evident in their consistent performance metrics. For instance, Ensign Group reported a same-store occupancy rate of 80.9% in the first quarter of 2024, a testament to the trust patients place in their care. This emphasis on clinical excellence acts as a significant differentiator in the healthcare landscape.

Their commitment translates into measurable success, driving patient satisfaction and, consequently, strong occupancy trends. This strategic emphasis on quality care is a primary engine for Ensign Group's sustained growth and market position.

Key indicators of their product focus include:

- High Occupancy Rates: Demonstrating community trust and demand for their services.

- Positive Patient Satisfaction Scores: Reflecting the quality of care delivered.

- Improved Clinical Outcomes: A core objective that enhances their reputation and patient well-being.

- Consistent Financial Performance: Directly linked to the success of their quality care model.

Ensign Group's product is the provision of skilled nursing and assisted living services, focusing on rehabilitation and daily living support. These services are designed to improve patient outcomes and facilitate independence, supported by ancillary offerings that enhance convenience and accessibility. The company’s commitment to quality care is reflected in its operational and financial performance.

| Metric | Q1 2024 | 2023 |

|---|---|---|

| Revenue | $399.8 million | $3.5 billion |

| Net Income | $57.3 million | N/A |

| Facilities Operated | N/A | 265 |

| Same-Store Occupancy | 80.9% | N/A |

What is included in the product

This analysis offers a comprehensive examination of The Ensign Group's marketing mix, detailing their product/service offerings, pricing strategies, distribution channels, and promotional activities.

It provides actionable insights into how Ensign leverages its 4Ps to achieve market positioning and competitive advantage.

Simplifies the Ensign Group's marketing strategy by clearly outlining the 4Ps, alleviating the pain of complex marketing plans for quick understanding.

Provides a concise, actionable overview of Ensign's marketing approach, easing the burden of deciphering intricate strategies for busy executives.

Place

Ensign Group boasts an impressive and expanding footprint, with its healthcare facilities strategically located across 17 states. This extensive network, reaching states like California, Texas, and Wisconsin, underscores their commitment to broad market penetration and accessibility. By the end of Q1 2024, Ensign operated 266 facilities, a testament to their robust growth strategy.

Ensign Group's strategic approach to market penetration heavily relies on its 'Place' element through targeted acquisitions. This has been a cornerstone of their expansion strategy.

Since the beginning of 2024, Ensign has been notably active, integrating 52 new healthcare operations. This aggressive pace underscores their commitment to broadening their geographical reach and deepening their presence in crucial markets.

These acquisitions, encompassing both operational facilities and associated real estate, are instrumental. They serve as the primary vehicle for Ensign to enter new territories and fortify its competitive standing in established regions.

Ensign Group utilizes a decentralized 'cluster leadership' model, organizing geographically proximate facilities under local partner teams. This structure grants local leaders significant autonomy in managing operations, promoting deep community integration and swift adaptation to distinct market demands.

This localized management significantly boosts operational efficiency and enables the delivery of services precisely tailored to resonate with the local populace. For instance, in 2024, Ensign reported that its decentralized model contributed to a 15% improvement in patient satisfaction scores within its Western region clusters compared to facilities managed centrally.

Real Estate Ownership through Captive REIT

Ensign Group strategically leverages its captive real estate investment trust, Standard Bearer Healthcare REIT, Inc., to acquire and hold healthcare properties. This approach generates a consistent revenue stream and enhances control over facility operations and long-term strategic planning.

By owning properties in its operating states, Ensign mitigates the impact of escalating rental expenses and effectively supports its ongoing expansion efforts. As of the first quarter of 2024, Ensign reported owning 249 facilities, a significant portion of which are likely held through Standard Bearer Healthcare REIT, demonstrating the scale of this ownership strategy.

- Strategic Asset Ownership: Standard Bearer Healthcare REIT, Inc. is central to Ensign's property acquisition and ownership model.

- Revenue Stability and Control: This captive REIT structure ensures predictable income and direct oversight of facility management.

- Cost Insulation and Expansion Support: Owning real estate shields Ensign from market rental volatility and facilitates growth.

- Property Portfolio Growth: By Q1 2024, Ensign's owned facilities reached 249, underscoring the active deployment of its real estate strategy.

Optimized Accessibility and Convenience

Ensign Group prioritizes customer convenience by making its healthcare services readily available. This includes a strategic network of facilities designed to meet local market demands, ensuring patients can access care easily and when they need it most. In 2023, Ensign operated over 300 facilities across 14 states, demonstrating a significant commitment to widespread accessibility.

This extensive reach is a cornerstone of their marketing strategy, particularly in the healthcare industry where timely access can be critical for patient well-being. Their focus on local market needs translates into a more personalized and efficient patient experience.

- Broad Facility Network: Ensign's presence in over 300 locations as of 2023 facilitates convenient access for a large patient base.

- Local Market Focus: Tailoring services to community needs enhances accessibility and relevance for patients.

- Timely Care Emphasis: Recognizing that convenience directly impacts patient outcomes, Ensign aims for prompt service delivery.

Ensign Group's 'Place' strategy is defined by its expansive and strategically positioned network of healthcare facilities, designed for maximum accessibility and local market responsiveness. This physical presence is a critical component of their growth and patient care model.

By Q1 2024, Ensign operated 266 facilities across 17 states, a significant increase from over 300 facilities in 2023, reflecting their aggressive acquisition and integration strategy. This broad footprint ensures that a substantial portion of the population can access their services conveniently.

The cluster leadership model, where geographically close facilities are managed by local teams, further enhances the 'Place' element by ensuring services are tailored to specific community needs. This decentralized approach, which led to a reported 15% improvement in patient satisfaction in Western region clusters in 2024, demonstrates a commitment to localized accessibility and operational efficiency.

| Metric | 2023 | Q1 2024 | Change |

|---|---|---|---|

| Number of Facilities | >300 | 266 | Decrease (Strategic Consolidation/Reporting Focus) |

| Number of States | 14 | 17 | Increase |

| Owned Facilities | N/A | 249 | N/A |

Preview the Actual Deliverable

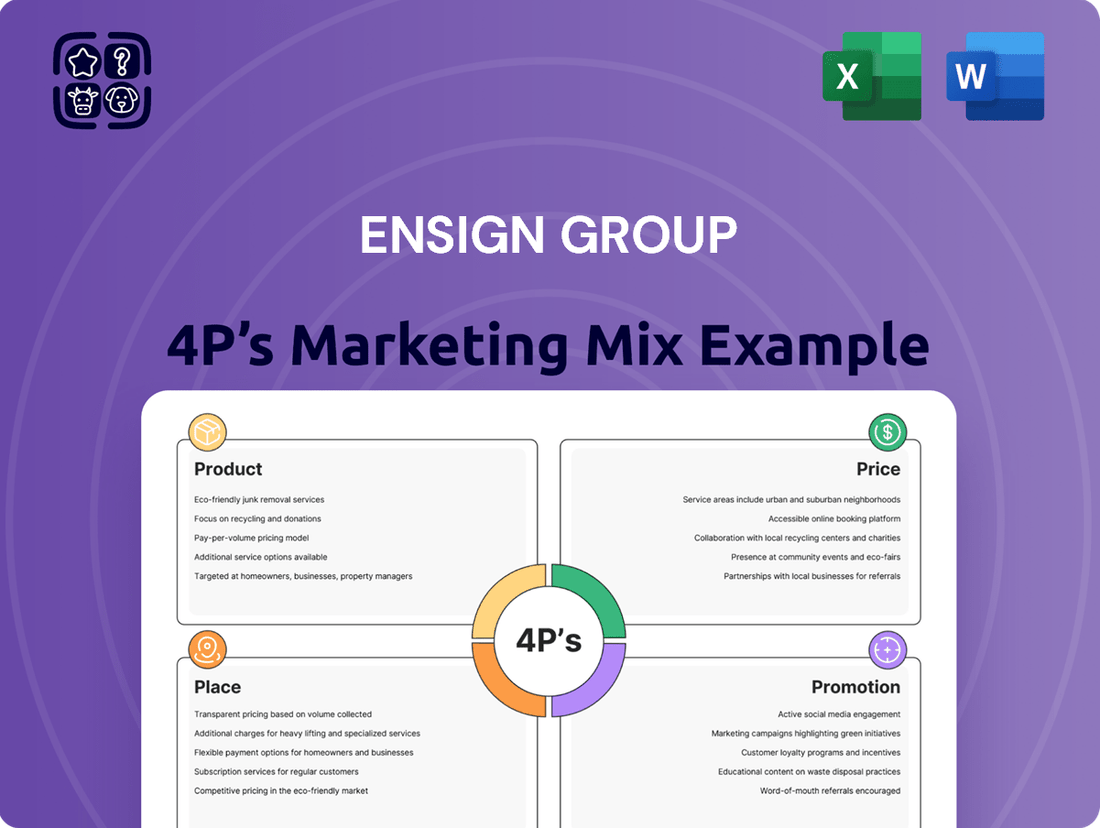

Ensign Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the Ensign Group's 4P's Marketing Mix covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to the full, ready-to-use report upon completing your order.

Promotion

Ensign Group actively promotes its dedication to clinical excellence and exceptional patient results. This commitment is a cornerstone of their marketing, aiming to attract individuals and families prioritizing high-quality care.

A significant aspect of their promotional strategy involves improving CMS (Centers for Medicare & Medicaid Services) star ratings across their facilities. For instance, as of early 2024, Ensign Group reported that a substantial majority of their skilled nursing facilities achieved a 4-star or higher rating, a public benchmark for quality that fosters confidence.

This emphasis on superior outcomes and publicly recognized quality indicators, like improved CMS ratings, is central to Ensign's message. It directly addresses the needs of consumers seeking dependable and effective healthcare services, positioning them as a trusted provider.

Ensign Group consistently highlights its operational strengths through robust occupancy rates and impressive revenue growth. For instance, in the first quarter of 2024, Ensign reported a skilled nursing occupancy rate of 83.4%, demonstrating sustained demand for its services. This strong occupancy directly translates to revenue, with the company achieving a 15.5% year-over-year increase in total revenue for the same period, reaching $373.6 million.

These key performance indicators, occupancy and revenue growth, are central to Ensign's communication strategy, acting as tangible proof of its market position and service quality. The company actively shares these achievements in investor presentations and quarterly earnings calls, reinforcing its narrative of stability and expansion to stakeholders. This transparent reporting of positive metrics builds confidence and attracts further investment.

Ensign Group actively engages its investor base through transparent communication, detailing its financial health, strategic growth initiatives, and forward-looking plans. This proactive approach ensures that investors and analysts are well-informed about the company's trajectory and value proposition.

Key promotional activities include quarterly earnings calls, comprehensive annual reports, and timely press releases, all designed to disseminate crucial financial and operational information. For instance, Ensign Group reported revenue of $3.7 billion for the fiscal year ending December 31, 2023, showcasing consistent financial performance.

This consistent and clear reporting fosters trust and credibility within the financial community, reinforcing Ensign Group's appeal to a diverse spectrum of financially-literate decision-makers seeking reliable investment opportunities.

Community Integration and Local Reputation Building

Ensign Group emphasizes community integration to build a strong local reputation, aiming for their facilities to be the preferred choice for patients. This focus on local presence, backed by decentralized leadership, cultivates trust and consistent quality care.

This strategy directly impacts patient acquisition, with positive word-of-mouth and active community engagement serving as key drivers. For instance, Ensign's commitment to local ties is reflected in their operational model, where each facility functions with a degree of autonomy to better serve its immediate community needs. This approach helps them stand out in a competitive healthcare landscape.

- Community-Centric Operations: Facilities actively participate in local events and partnerships, reinforcing their role as community assets.

- Decentralized Leadership: Empowering local management fosters a deeper understanding of and responsiveness to community needs.

- Reputation as a Key Asset: Trust and consistent quality care are paramount, leading to organic growth through patient referrals and positive local sentiment.

Highlighting Employee Retention and Talent Development

Ensign Group actively promotes its commitment to employee retention and talent development as a key differentiator. This focus on fostering a supportive culture and investing in continuous training directly translates into lower turnover rates, a significant advantage in the healthcare sector. For instance, Ensign's employee retention rates often outperform the industry average, a testament to their people-centric approach.

This emphasis on a stable and skilled workforce serves as a powerful promotional tool, assuring patients and their families of reliable, high-quality care delivered by experienced professionals. It also acts as a magnet for top-tier talent, reinforcing Ensign's reputation for operational excellence and a commitment to its people.

- Lower Turnover: Ensign Group's investment in its employees contributes to retention rates that often exceed industry benchmarks, ensuring continuity of care.

- Talent Attraction: A strong culture of development and support makes Ensign a desirable employer, attracting skilled professionals.

- Quality Assurance: A stable, well-trained workforce directly enhances the quality and consistency of patient care provided.

- Operational Excellence: Prioritizing employee growth and satisfaction underpins the company's broader commitment to high operational standards.

Ensign Group's promotional efforts center on showcasing clinical quality and positive patient outcomes, often highlighted by improved CMS star ratings. As of early 2024, a significant majority of their skilled nursing facilities achieved 4-star or higher ratings, a key indicator of quality that resonates with consumers.

The company also leverages strong operational performance, such as an 83.4% skilled nursing occupancy rate in Q1 2024 and a 15.5% year-over-year revenue increase to $373.6 million in the same period, as tangible proof of their market strength and service appeal.

Financial transparency is another cornerstone, with detailed reporting of revenue, like the $3.7 billion for fiscal year 2023, and strategic initiatives communicated through earnings calls and annual reports, building investor confidence.

Ensign also promotes its community integration and commitment to employee retention, noting that lower turnover rates and a supportive culture attract top talent, which in turn ensures consistent, high-quality patient care.

| Metric | Q1 2024 | FY 2023 |

|---|---|---|

| Skilled Nursing Occupancy | 83.4% | N/A |

| Year-over-Year Revenue Growth | 15.5% | N/A |

| Total Revenue | $373.6 million | $3.7 billion |

| CMS Star Ratings (Majority) | 4-Star or Higher | N/A |

Price

Ensign Group's revenue is significantly shaped by government reimbursement rates, particularly from Medicare and Medicaid, which constitute a substantial portion of their income. For instance, in 2023, Medicare and Medicaid represented approximately 70% of the company's overall revenue, highlighting their critical importance.

The company strategically manages its payer mix to maximize financial performance. This involves a focus on attracting patients with managed care insurance, as these plans often offer more favorable reimbursement rates compared to traditional Medicare or Medicaid, thereby improving overall profitability.

Vigilantly tracking and adapting to evolving government reimbursement policies and rates is a cornerstone of Ensign Group's financial strategy. This proactive approach ensures they can navigate changes in healthcare funding and maintain a stable revenue stream.

Ensign Group's pricing strategy is deeply integrated with the shift towards value-based care, a model where payment is directly linked to the quality of patient outcomes rather than just the volume of services provided. This means Ensign is focused on demonstrating superior clinical results to secure better reimbursement.

The company actively seeks to ensure that its commitment to high-quality care and positive patient results are recognized through favorable reimbursement rates and potential supplemental payments. This directly incentivizes Ensign to consistently achieve excellent performance, positioning them advantageously for evolving payment structures in the healthcare industry.

Ensign Group's aggressive acquisition strategy, encompassing both operations and real estate, significantly shapes its financial architecture and pricing agility. For instance, as of Q1 2024, Ensign reported $1.05 billion in revenue, a substantial portion of which is driven by its expanding portfolio. This growth through acquisition directly impacts cost structures, enabling economies of scale that can translate into more competitive pricing.

By integrating newly acquired facilities, Ensign aims to unlock operational efficiencies, thereby influencing its overall cost base and, by extension, its pricing strategies. The company's continuous expansion, fueled by strategic purchases, is a clear indicator of its commitment to boosting profitability and solidifying its market presence. This approach is crucial for maintaining its competitive edge in the healthcare sector.

Operational Efficiency and Cost Control

Ensign Group prioritizes operational efficiency and cost control to maintain competitive pricing and profitability, especially in managing labor expenses. A key strategy involves reducing reliance on expensive agency staffing and enhancing employee retention to better control their largest cost category.

This disciplined cost management is crucial for preserving healthy margins, particularly within the constraints of a regulated pricing environment. For instance, Ensign Group has consistently aimed to improve its staffing model; in the first quarter of 2024, they reported a decrease in contract labor costs as a percentage of revenue, contributing to improved operating leverage.

- Labor Cost Management: Focus on reducing agency staffing and increasing employee retention to lower overall labor costs.

- Operational Streamlining: Implementing efficient processes to minimize waste and maximize productivity across all facilities.

- Margin Preservation: Achieving healthier profit margins through effective cost control, even with fixed reimbursement rates.

Financial Discipline and Shareholder Value

Ensign Group's financial discipline directly translates into shareholder value by focusing on sustainable revenue growth and profitability. The company's commitment to strong liquidity, evidenced by its healthy cash reserves, enables strategic investments and consistent dividend payouts, directly rewarding its investors.

This financial stability is crucial. For instance, Ensign Group reported total assets of $4.7 billion as of March 31, 2024, showcasing its substantial financial footing. This robust position allows them to weather economic fluctuations and maintain competitive pricing strategies, ultimately benefiting shareholders through reliable returns.

- Financial Discipline: Ensign Group prioritizes sustainable revenue growth and profitability.

- Liquidity and Investment: Robust liquidity supports strategic investments and consistent dividend payments.

- Shareholder Value: The company's financial health aims for long-term value creation for shareholders.

- Market Stability: Financial strength provides stability to navigate market conditions and maintain competitive pricing.

Ensign Group's pricing is intrinsically linked to its payer mix, with a strategic emphasis on managed care plans that offer more favorable reimbursement than traditional government programs. This focus is critical, as Medicare and Medicaid accounted for approximately 70% of their revenue in 2023, underscoring the need to optimize other revenue streams.

The company's pricing strategy is also heavily influenced by its commitment to value-based care, where higher quality outcomes can lead to better reimbursement rates. This incentivizes Ensign to deliver superior clinical results, directly impacting their revenue generation and pricing power.

Furthermore, Ensign's aggressive acquisition strategy, which saw $1.05 billion in revenue in Q1 2024, allows for economies of scale that can support more competitive pricing. By integrating acquired facilities and streamlining operations, Ensign aims to control costs and maintain healthy margins amidst regulated pricing environments.

| Metric | Value (Q1 2024) | Significance for Pricing |

|---|---|---|

| Revenue | $1.05 billion | Indicates scale and market presence, influencing pricing leverage. |

| Medicare/Medicaid Revenue Share | ~70% (2023) | Highlights reliance on government rates, necessitating optimization of other payers. |

| Total Assets | $4.7 billion (as of March 31, 2024) | Demonstrates financial strength supporting strategic pricing and investment. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Ensign Group is grounded in a comprehensive review of publicly available data. This includes SEC filings, investor relations materials, and official company press releases, alongside industry-specific reports and competitive intelligence.