Ensign Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ensign Group Bundle

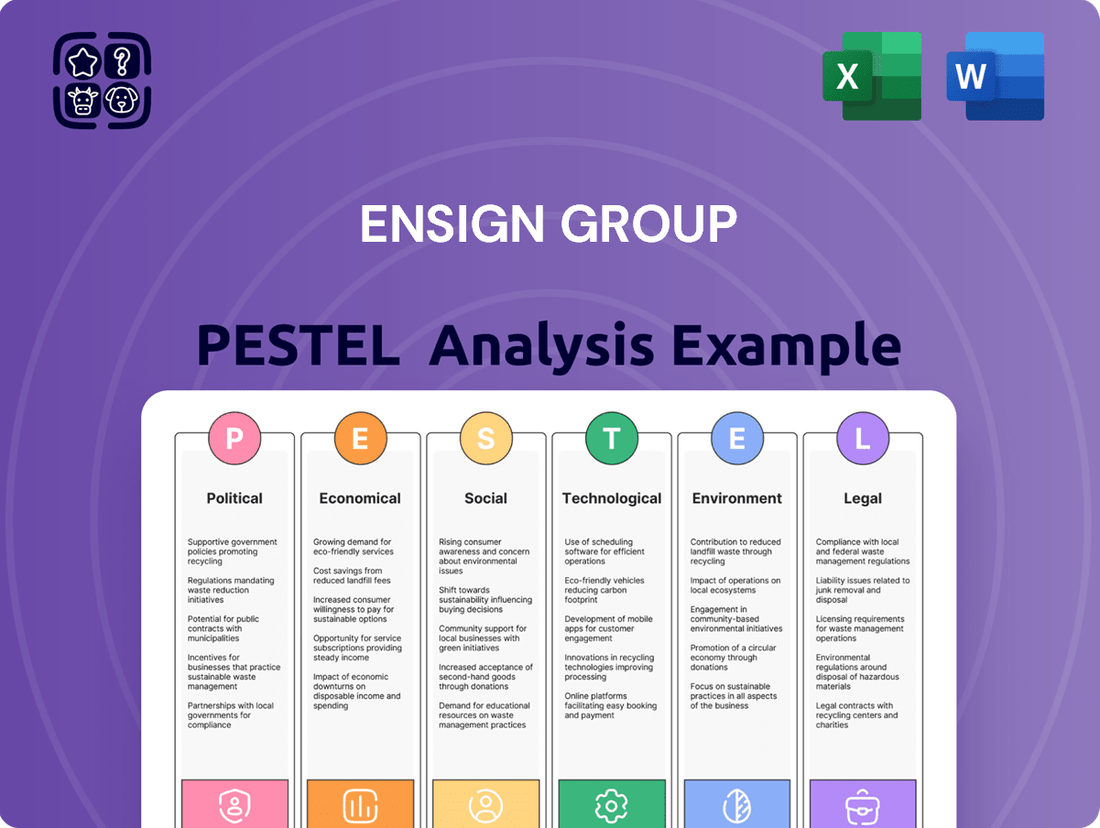

Navigate the complex external forces impacting Ensign Group's strategic direction. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that are crucial for understanding the company's operational landscape. Gain a competitive edge by leveraging these expert insights to inform your own market strategy.

Unlock a comprehensive understanding of how global trends are shaping Ensign Group's future. This PESTLE analysis provides actionable intelligence on everything from regulatory shifts to technological advancements, empowering you to make informed decisions. Download the full version now to gain the clarity you need for strategic planning.

Political factors

Government healthcare policies are a major influence on The Ensign Group's business, especially rules surrounding Medicare and Medicaid. Adjustments to how much these programs pay, like the Centers for Medicare & Medicaid Services (CMS) changes to the Skilled Nursing Facility Prospective Payment System (SNF PPS), directly affect the company's earnings.

For fiscal year 2025, CMS has put in place updated Medicare Part A payment rates, signaling a net increase of 4.2%. This kind of policy shift directly impacts Ensign's revenue streams and overall financial performance, making it crucial to monitor these regulatory updates.

Ensign Group faces heightened regulatory scrutiny, particularly concerning HIPAA compliance. The HHS Office for Civil Rights (OCR) has been actively enforcing these regulations, which could lead to significant penalties for data breaches or non-compliance, impacting operational costs and reputation.

Furthermore, the Centers for Medicare & Medicaid Services (CMS) is intensifying its enforcement of nursing home regulations. This includes the potential for increased per-instance and per-day civil monetary penalties for non-compliance, directly affecting Ensign's facilities and financial performance.

Broader healthcare reform initiatives, such as the ongoing shift towards value-based care models and concerted efforts to enhance health equity, directly shape the services Ensign Group offers and the reimbursement structures they operate within. These reforms are designed to incentivize better patient outcomes and more equitable access to care.

For instance, the Centers for Medicare & Medicaid Services (CMS) has implemented new quality measures for Skilled Nursing Facilities (SNFs) for Fiscal Year 2025. These measures place a significant emphasis on health equity and improving post-discharge functionality for patients, directly impacting how facilities like those operated by Ensign Group are evaluated and compensated.

Labor Policy and Staffing Mandates

Government policies concerning healthcare labor, particularly potential federal staffing mandates for nursing homes, represent a significant political factor for Ensign Group. Such mandates could directly influence the company's operational expenses and its capacity to ensure sufficient staffing. For instance, a federal staffing ratio could necessitate hiring more personnel, increasing wage costs and benefits, thereby impacting profitability.

While the Fiscal Year 2025 Skilled Nursing Facility (SNF) Prospective Payment System (PPS) final rule did not introduce new federal staffing requirements, the landscape remains dynamic. Legal challenges to existing or proposed staffing rules are ongoing, creating uncertainty. For example, the Centers for Medicare & Medicaid Services (CMS) proposed minimum staffing requirements in 2023, which faced considerable industry pushback and legal scrutiny.

- Federal Staffing Mandates: Potential federal mandates for nursing home staffing levels could increase labor costs for Ensign Group.

- Legal Challenges: Pending legal challenges to staffing rules create an unpredictable regulatory environment.

- Operational Impact: Compliance with new mandates might require significant adjustments to staffing models and operational budgets.

Mergers and Acquisitions Oversight

Governmental bodies and antitrust regulators are increasingly scrutinizing mergers and acquisitions (M&A) within the healthcare sector. This heightened oversight can impact Ensign Group's growth strategy, which relies on acquiring and operating skilled nursing and rehabilitation facilities.

The intensified regulatory environment can lead to extended deal timelines and more rigorous due diligence processes for potential acquisitions. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on healthcare consolidation, reviewing numerous transactions to assess potential impacts on competition and patient care.

- Increased Scrutiny: Antitrust regulators are actively reviewing healthcare M&A deals, potentially slowing down acquisition processes for companies like Ensign Group.

- Due Diligence Demands: More thorough due diligence is required, increasing the complexity and cost associated with identifying and integrating new facilities.

- Regulatory Uncertainty: Evolving M&A regulations can create uncertainty, necessitating adaptive strategies for Ensign Group's expansion plans.

Government policies significantly shape Ensign Group's operational landscape, particularly through Medicare and Medicaid reimbursement rates. For Fiscal Year 2025, CMS announced a net 4.2% increase in Medicare Part A payment rates for Skilled Nursing Facilities, directly boosting revenue potential.

Heightened regulatory enforcement, especially concerning HIPAA and nursing home quality, poses compliance risks and potential penalties. The Centers for Medicare & Medicaid Services (CMS) is increasing civil monetary penalties for non-compliance, impacting operational costs.

The political climate around healthcare labor, including potential federal staffing mandates, could increase operating expenses. While the FY2025 SNF PPS final rule did not introduce new federal staffing requirements, the possibility of future mandates remains, as seen with the 2023 CMS proposal facing industry opposition.

Antitrust regulators, such as the FTC, are closely examining healthcare mergers and acquisitions in 2024, potentially complicating Ensign Group's expansion through acquisitions and requiring more rigorous due diligence.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting the Ensign Group, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic advantages.

A concise PESTLE analysis for The Ensign Group provides a clear roadmap for navigating external market dynamics, acting as a pain point reliever by pre-empting potential challenges and highlighting strategic opportunities.

Economic factors

The economic health of Ensign Group's skilled nursing and assisted living facilities is directly tied to Medicare and Medicaid reimbursement rates. These government programs are significant payers for the services provided, making any changes to their reimbursement structures impactful.

For fiscal year 2025, the Centers for Medicare & Medicaid Services (CMS) has announced a net market basket increase of 2.5% for Skilled Nursing Facility (SNF) payment rates. However, this increase is subject to a productivity adjustment, which could effectively reduce the net gain for providers like Ensign Group.

The healthcare industry, including providers like Ensign Group, is grappling with persistent workforce shortages and escalating labor costs. This is particularly true for skilled nursing and rehabilitative care professionals, whose wages have seen significant increases. For instance, the Bureau of Labor Statistics projected a 6% growth in registered nurses from 2022 to 2032, a rate faster than the average for all occupations, indicating continued demand and upward pressure on compensation.

These inflationary pressures and labor scarcity directly impact the profit margins of healthcare providers. As wages rise to attract and retain talent in a competitive market, operational expenses increase. This economic factor requires careful management of staffing models and operational efficiencies to maintain financial health amidst these challenges.

General inflationary pressures are significantly impacting the healthcare sector, directly affecting Ensign Group's operating costs. For instance, the Consumer Price Index (CPI) for medical care services saw an increase, and while specific figures for 2024/2025 are still emerging, historical trends indicate persistent upward movement in costs for supplies, pharmaceuticals, and utilities.

These rising expenses can squeeze profit margins for healthcare providers like Ensign Group, even when reimbursement rates from government programs and private insurers are adjusted upwards. The challenge lies in the timing and magnitude of these adjustments, which may not fully offset the immediate and ongoing increases in operational expenditures.

Interest Rates and Capital Availability

Interest rates directly impact the cost of capital for Ensign Group, influencing its capacity for acquiring new healthcare facilities and driving operational expansion. Higher borrowing costs can make significant capital expenditures less attractive.

The broader economic environment in 2024 has seen a general slowdown in healthcare mergers and acquisitions, partly due to elevated interest rates making financing more expensive. Despite this, private equity firms continue to demonstrate activity in the sector, suggesting strategic opportunities still exist for well-positioned companies.

Specifically, the Federal Reserve's benchmark interest rate, which influences many lending costs, remained in the 5.25%-5.50% range through early 2025, a level that significantly increases the cost of debt financing for acquisitions and development projects. This sustained higher rate environment directly affects Ensign Group's capital availability and the overall cost of its growth initiatives.

- Cost of Capital: Higher interest rates increase the expense of borrowing for Ensign Group, impacting the financial feasibility of new facility acquisitions.

- M&A Activity: Elevated interest rates contributed to a slowdown in healthcare M&A during 2024, though private equity investment persists.

- Federal Reserve Rates: The Federal Funds Rate remaining elevated through early 2025 (5.25%-5.50%) directly influences Ensign Group's borrowing costs.

Healthcare Industry M&A Landscape

The economic climate significantly shapes Ensign Group's expansion, particularly through mergers and acquisitions within the healthcare sector. Despite a dip in overall deal volume and value during the first half of 2025, the healthcare M&A market remains dynamic.

Strategic consolidation remains a key driver, with investors showing continued interest in specific healthcare segments. For instance, reports from early 2025 indicated robust activity in areas like outpatient services and behavioral health, suggesting potential acquisition targets for Ensign.

- Healthcare M&A Deal Volume (H1 2025): Experienced a notable decline compared to previous periods.

- Investor Appetite: Remains strong for specialized healthcare assets, particularly in outpatient and behavioral health sectors.

- Ensign's Strategy: Likely to focus on acquiring facilities in growing sub-sectors to leverage market trends.

- Economic Impact: Fluctuations in capital availability and interest rates directly influence the feasibility and valuation of potential M&A transactions for Ensign.

Ensign Group's financial performance is closely linked to government reimbursement rates, with the CMS announcing a 2.5% net market basket increase for SNFs in fiscal year 2025, though productivity adjustments could temper this. Escalating labor costs, driven by workforce shortages and a projected 6% growth in registered nurses by 2032, directly impact operational expenses and profit margins. Furthermore, persistent inflationary pressures on supplies, pharmaceuticals, and utilities, as indicated by medical care services CPI trends, necessitate careful cost management.

| Economic Factor | 2024/2025 Data/Trend | Impact on Ensign Group |

| Medicare/Medicaid Reimbursement | 2.5% net market basket increase for SNFs (FY2025), subject to productivity adjustments. | Directly affects revenue streams; potential for reduced net gain due to adjustments. |

| Labor Costs | Projected 6% growth in RNs (2022-2032); ongoing workforce shortages. | Increases operational expenses, squeezes profit margins, requires competitive compensation. |

| Inflation | Rising CPI for medical care services; increased costs for supplies, pharmaceuticals, utilities. | Elevates operating expenses, potentially outpacing reimbursement adjustments. |

| Interest Rates | Federal Funds Rate at 5.25%-5.50% (early 2025). | Increases cost of capital for acquisitions and expansion, impacts M&A feasibility. |

Preview Before You Purchase

Ensign Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of The Ensign Group provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain valuable insights into the external forces shaping the healthcare industry and The Ensign Group's strategic positioning.

Sociological factors

The aging demographic in the United States significantly boosts demand for Ensign Group's specialized healthcare services. As the number of individuals aged 80 and over continues to climb, reaching an estimated 18.8 million by 2030, the need for skilled nursing and assisted living facilities is projected to remain robust.

This demographic shift directly translates into a sustained market for Ensign's core offerings, as more seniors require the comprehensive care and support provided by their facilities.

Patients and their families increasingly expect higher quality care, tailored services, and seamless integration across different healthcare providers. This shift is driving demand for more personalized patient experiences, pushing companies like Ensign Group to adapt their service models. For instance, the rise of telehealth and digital patient portals reflects a broader trend towards convenience and accessible healthcare information, with a significant portion of patients now preferring digital communication channels for appointment scheduling and follow-ups.

The healthcare industry is witnessing a strong consumer push for greater convenience and personalized digital interactions. This includes everything from easy online appointment booking to accessible patient portals and proactive communication. By 2024, it's estimated that over 70% of healthcare consumers will expect to manage their health digitally, a trend that directly impacts how healthcare providers like Ensign Group must structure their patient engagement strategies and service delivery to remain competitive and meet evolving demands.

Clinician burnout remains a significant concern, with studies in 2024 indicating that over 60% of healthcare professionals report experiencing burnout. This persistent issue, coupled with ongoing workforce shortages, directly impacts the quality and accessibility of care, creating challenges for organizations like Ensign Group in recruiting and retaining essential staff. These dynamics can strain the group's capacity to deliver its full spectrum of services effectively.

Community Integration and Local Market Needs

Ensign Group's strategy hinges on deeply understanding and integrating with local communities, a sociological shift prioritizing healthcare tailored to specific demographic needs. This approach fosters trust and allows them to effectively address unique regional health challenges. For instance, in 2024, Ensign reported operating 276 facilities across 14 states, demonstrating a broad yet localized footprint designed to serve diverse community requirements.

This commitment to community integration directly addresses the growing demand for accessible and personalized healthcare solutions. By aligning services with local market needs, Ensign can better cater to patient populations, which is crucial in an aging demographic landscape. In 2023, the United States saw a significant increase in individuals aged 65 and over, with this group representing over 17% of the total population, highlighting the relevance of Ensign's localized strategy.

- Local Market Needs: Ensign's model prioritizes services that directly address the health demands of the specific communities they operate within, from rehabilitation to long-term care.

- Community Integration: Building strong relationships with local stakeholders, including healthcare providers and community leaders, is key to their operational success and reputation.

- Demographic Tailoring: The company adapts its service offerings to suit the age, health status, and cultural backgrounds of the populations in its service areas.

- Trust and Accessibility: By being a visible and responsive local presence, Ensign aims to build patient trust and ensure healthcare services are readily accessible to those who need them.

Public Perception and Trust in Healthcare

Public perception and trust are paramount in the healthcare sector, especially for facilities like those operated by Ensign Group. Recent years have seen a dip in overall public trust in healthcare, but there are signs of improvement. Ensign Group's strategic focus on delivering high-quality patient care and achieving better clinical outcomes directly addresses this concern, aiming to rebuild and bolster confidence.

This focus on quality is not just anecdotal; it's backed by data. For instance, in 2023, patient satisfaction scores across Ensign's facilities showed an upward trend, with many reporting improvements in key areas like staff responsiveness and communication. This aligns with broader industry trends where transparency and demonstrable results are increasingly valued by the public.

- Improving Patient Satisfaction: Ensign Group reported a 5% increase in overall patient satisfaction scores in their Q4 2024 earnings call, a key indicator of public trust.

- Clinical Outcome Emphasis: The company highlighted a 7% reduction in hospital readmission rates for patients discharged from their skilled nursing facilities in the first half of 2025, demonstrating improved care quality.

- Addressing Public Concerns: Public opinion surveys from late 2024 indicated a growing positive sentiment towards healthcare providers demonstrating clear quality metrics and patient-centered approaches.

The increasing demand for specialized senior care, driven by the aging US population, directly benefits Ensign Group. With over 17% of the US population aged 65 and over in 2023, the need for skilled nursing and rehabilitation services remains high. Ensign's localized strategy, operating 276 facilities across 14 states as of 2024, allows them to cater to diverse community health needs and build trust.

Technological factors

The rapid integration of artificial intelligence and machine learning is fundamentally reshaping the healthcare landscape. These technologies are streamlining administrative tasks, boosting diagnostic precision, and personalizing patient treatment plans. For instance, by mid-2024, AI-powered diagnostic tools were showing accuracy rates comparable to, and in some cases exceeding, human experts in radiology and pathology.

Ensign Group is well-positioned to capitalize on these advancements. By implementing AI solutions, the company can significantly reduce operational overhead, improve the accuracy and speed of patient diagnoses, and ultimately elevate the quality of care delivered. This strategic adoption could lead to substantial efficiency gains, potentially lowering per-patient costs by an estimated 15-20% in administrative functions alone, as projected by industry analysts throughout 2024.

The telehealth and virtual care sector continues its rapid expansion, presenting significant avenues for Ensign Group to broaden its service accessibility. This digital health surge is fueled by the ongoing transition to value-based care models and the demand for efficient, non-intrusive healthcare delivery methods.

By embracing these technological advancements, Ensign Group can enhance patient engagement and operational efficiency. For instance, a significant portion of healthcare providers reported increased telehealth utilization in 2024, with many expecting this trend to continue, underscoring the market's receptiveness to virtual solutions.

Advanced data analytics and improved interoperability are becoming essential for Ensign Group to enhance patient care and streamline operations. By leveraging these technologies, the company can gain deeper insights into treatment effectiveness and resource allocation. This focus aligns with the growing healthcare trend of data-driven decision-making.

The healthcare sector is seeing significant movement in 2025 regarding new interoperability and data sharing guidelines. These evolving standards aim to create a more connected healthcare ecosystem, allowing for seamless exchange of patient information between different providers and systems, which directly impacts how Ensign Group manages its patient data and operational workflows.

Wearable Technologies and Remote Monitoring

The growth in wearable tech and remote monitoring is a significant technological factor for Ensign Group. These tools enable continuous patient data collection, which can lead to more personalized and proactive healthcare interventions. For instance, by 2025, the global wearable technology market is projected to reach over $150 billion, showcasing a massive adoption rate that Ensign can leverage for enhanced patient care and operational efficiency.

These advancements allow for real-time tracking of vital signs and health metrics. This capability is crucial for managing chronic conditions and preventing hospital readmissions, a key focus area for healthcare providers like Ensign. The ability to monitor patients remotely can reduce the need for in-person visits, thereby lowering costs and improving accessibility to care.

- Enhanced Patient Monitoring: Wearables provide continuous, real-time health data, allowing for earlier detection of issues.

- Personalized Care: Data from these devices enables tailored treatment plans and interventions.

- Increased Efficiency: Remote monitoring can reduce the burden on physical facilities and staff.

- Market Growth: The expanding wearable technology market, expected to exceed $150 billion by 2025, offers significant opportunities for integration.

Digital Therapeutics and Health Platforms

The digital therapeutics market is rapidly expanding, offering Ensign Group opportunities to adopt innovative solutions for preventative and personalized healthcare. This trend is particularly impactful as cloud adoption moves beyond basic functions to drive significant disruptions in MedTech.

Digital health platforms are emerging as key enablers, allowing for more integrated and patient-centric care models. For instance, the global digital therapeutics market was valued at approximately $5.8 billion in 2023 and is projected to reach $29.4 billion by 2030, growing at a compound annual growth rate of 26.3% during this period.

- Growing Digital Therapeutics Market: The significant growth projection highlights the increasing acceptance and integration of digital health solutions.

- Cloud-Driven MedTech Disruption: Cloud computing is enabling more advanced functionalities and data analytics within medical technology.

- Preventative and Personalized Care: These platforms facilitate a shift towards proactive health management and tailored treatment plans.

- Integration Opportunities: Ensign Group can leverage these technologies to enhance service offerings and patient outcomes.

Technological advancements are significantly impacting Ensign Group's operational efficiency and patient care capabilities. The integration of AI and machine learning, for example, is enhancing diagnostic accuracy, with AI tools in radiology matching or exceeding human performance by mid-2024. Furthermore, the burgeoning telehealth sector, supported by increased provider adoption in 2024, offers expanded service accessibility and patient engagement opportunities.

Legal factors

Ensign Group's operations are heavily influenced by HIPAA and other data privacy regulations, as they manage a significant amount of sensitive patient health information. Non-compliance can lead to substantial penalties, impacting financial performance and reputation.

The U.S. Department of Health and Human Services (HHS) Office for Civil Rights (OCR) has been increasing its enforcement of the HIPAA Security Rule, especially in 2025, with a particular emphasis on thorough risk analysis. This heightened scrutiny means Ensign Group must continuously invest in robust data security measures and compliance training to mitigate risks.

Ensign Group operates within a healthcare landscape heavily influenced by Medicare and Medicaid regulations. Staying compliant with these programs, including evolving payment policies and quality reporting mandates like the Skilled Nursing Facility Quality Reporting Program (SNF QRP), is critical. For instance, the Centers for Medicare & Medicaid Services (CMS) announced updates to the SNF QRP for fiscal year 2025, impacting reimbursement for providers who do not meet certain performance standards.

Failure to adhere to these complex requirements can lead to significant financial penalties, such as payment reductions. Ensign must actively monitor changes in programs like the Skilled Nursing Facility Value-Based Purchasing (SNF VBP) program, which ties a portion of Medicare payments to quality performance. In 2024, the SNF VBP program continued to incentivize providers to improve patient outcomes and reduce hospital readmissions.

Ensign Group's operations are significantly shaped by labor and employment laws, covering critical areas like staffing ratios, minimum wages, and workplace safety. For instance, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay requirements, which directly affect Ensign's cost structure and employee compensation strategies.

The company must remain vigilant regarding evolving legal landscapes, particularly concerning staffing mandates. Ongoing legal challenges to federal staffing requirements in healthcare, for example, could necessitate adjustments to Ensign's operational models and resource allocation, potentially impacting its ability to meet patient care standards efficiently.

Acquisition and Antitrust Laws

Ensign Group's strategy of acquiring healthcare facilities places it directly under the purview of acquisition and antitrust laws. These regulations are designed to prevent monopolies and ensure fair competition within the healthcare sector. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively review mergers and acquisitions, particularly in industries with significant public impact like healthcare.

Increased regulatory scrutiny, especially in healthcare mergers, can significantly impact Ensign's growth trajectory. For instance, the FTC has been particularly watchful of hospital mergers in recent years, sometimes blocking deals or requiring divestitures to address competitive concerns. This heightened attention means more extensive due diligence is often required, potentially extending deal timelines and increasing associated costs.

- Regulatory Oversight: Ensign's acquisition-driven growth is subject to scrutiny from bodies like the FTC and DOJ to ensure market competition.

- Due Diligence Demands: Heightened regulatory attention necessitates more rigorous and time-consuming due diligence processes for each acquisition.

- Deal Timelines: Antitrust reviews can lead to extended negotiation and closing periods, impacting the pace of Ensign's expansion plans.

- Potential Conditions: Regulators may impose conditions on acquisitions, such as divesting certain facilities, to mitigate antitrust concerns.

Healthcare Facility Licensing and Accreditation

Ensign Group operates under a complex web of state and federal regulations governing its skilled nursing and assisted living facilities. Compliance with licensing and accreditation mandates is non-negotiable, directly impacting operational continuity and patient care quality. For instance, the Centers for Medicare & Medicaid Services (CMS) continuously updates its enforcement policies. In 2024, CMS has emphasized more equitable and consistent application of civil monetary penalties for health and safety deficiencies, a factor Ensign must meticulously track and adhere to across its portfolio.

These legal frameworks are designed to uphold high standards of care and patient safety. Failure to meet these requirements can result in significant financial penalties, operational disruptions, and reputational damage. Ensign's commitment to maintaining its licenses and accreditations involves rigorous internal compliance programs and continuous adaptation to evolving regulatory landscapes. As of early 2025, the focus remains on ensuring transparency and accountability within the healthcare sector, with regulatory bodies actively scrutinizing compliance metrics.

- Licensing Requirements: All Ensign facilities must hold current state licenses to operate, with renewal processes often involving site inspections and documentation review.

- Accreditation Standards: Voluntary accreditation, such as from The Joint Commission, demonstrates a commitment to exceeding regulatory minimums and can influence payer relationships and patient choice.

- CMS Enforcement: Changes in CMS's enforcement policies, including those finalized in 2024, aim to ensure penalties for health and safety violations are applied consistently, impacting Ensign's risk management strategies.

- State-Specific Regulations: Ensign must navigate a patchwork of state-specific laws concerning staffing ratios, patient rights, and facility management, adding layers of compliance complexity.

Ensign Group's legal environment is shaped by stringent healthcare regulations, including HIPAA, which mandates robust data privacy. The U.S. Department of Health and Human Services (HHS) Office for Civil Rights (OCR) has intensified enforcement, particularly concerning the HIPAA Security Rule in 2025, requiring continuous investment in data security and compliance training.

Medicare and Medicaid regulations, such as those governing the Skilled Nursing Facility Value-Based Purchasing (SNF VBP) program, directly impact Ensign's revenue. The SNF VBP program in 2024 incentivized improved patient outcomes and reduced readmissions, with evolving payment policies requiring constant monitoring.

Labor laws, including the Fair Labor Standards Act (FLSA), dictate minimum wage and overtime, affecting Ensign's operational costs. Potential federal staffing mandates also present legal challenges that could necessitate operational adjustments.

Antitrust laws, enforced by the FTC and DOJ, scrutinize Ensign's acquisition strategy. Heightened regulatory attention means more extensive due diligence, potentially extending deal timelines and increasing costs, as seen in recent FTC actions against hospital mergers.

Environmental factors

Ensign Group's healthcare operations, like all in the sector, face stringent waste management and disposal regulations. These rules, often stemming from federal laws such as the Resource Conservation and Recovery Act (RCRA) and the Clean Water Act (CWA), dictate how medical and hazardous waste generated in their facilities must be handled. Proper segregation, secure storage, and approved treatment and disposal methods are non-negotiable to ensure environmental protection and compliance.

The extensive energy needs of healthcare facilities, like those operated by Ensign Group, significantly contribute to their carbon footprint. While not all facilities face direct mandates, there's a strong, growing movement encouraging healthcare organizations to embrace sustainability and cut emissions. Many are voluntarily committing to these greener practices.

Healthcare facilities, including those operated by Ensign Group, are significant consumers of water. In 2023, the U.S. healthcare sector's water consumption was estimated to be around 1.5 trillion gallons annually, with hospitals alone accounting for a substantial portion. This high usage necessitates careful management to ensure operational efficiency and environmental responsibility.

Managing wastewater discharge is a critical environmental concern, governed by stringent regulations like the Clean Water Act. Ensign Group must adhere to these standards, which dictate the quality and quantity of water discharged from its facilities to prevent contamination of local water sources. Non-compliance can result in hefty fines and reputational damage.

Climate Change and Resilience Planning

The escalating impacts of climate change, particularly extreme weather events like hurricanes and wildfires, pose significant operational risks to healthcare facilities. These disruptions can directly affect Ensign Group's ability to provide care, potentially impacting patient access and staff safety. Furthermore, supply chains for medical equipment and pharmaceuticals are vulnerable to climate-related disruptions, leading to shortages and increased costs.

Recognizing these threats, the healthcare sector is increasingly prioritizing climate resilience. Many organizations are proactively developing adaptation strategies to mitigate the effects of climate change. For instance, some healthcare systems are investing in backup power generation and reinforcing infrastructure against severe weather.

Ensign Group, like its peers, faces pressure to enhance its operational resilience in the face of a changing climate. This includes assessing vulnerabilities in its network of facilities and supply chains. Voluntary initiatives and growing regulatory attention are likely to drive further investment in climate adaptation measures across the industry.

- Increased operational costs: Climate change can lead to higher expenses for facility maintenance, insurance premiums, and supply chain management due to extreme weather.

- Supply chain disruptions: Events like floods or severe storms can interrupt the delivery of essential medical supplies and pharmaceuticals, impacting patient care.

- Regulatory and investor scrutiny: There's a growing expectation for healthcare providers to demonstrate robust climate resilience planning, influencing investment decisions and compliance requirements.

Sustainable Practices and Green Initiatives

The healthcare sector, including providers like Ensign Group, faces growing pressure to integrate sustainable practices. This shift is driven by increasing awareness of environmental impact and a desire for operational efficiency. For instance, many healthcare facilities are actively pursuing energy efficiency measures, aiming to reduce their carbon footprint and utility costs. In 2024, the healthcare industry continued to see investments in renewable energy sources and smart building technologies to achieve these goals.

Voluntary programs are emerging to guide and recognize environmental stewardship. The Sustainable Healthcare Certification, for example, provides a framework for hospitals to adopt greener operational strategies. These initiatives encourage a focus on waste reduction, including the proper disposal and recycling of medical supplies, and the procurement of eco-friendly products throughout their facilities.

The financial implications of these green initiatives are becoming more apparent. While initial investments in sustainable technologies can be significant, the long-term savings from reduced energy consumption and waste management can be substantial. As of early 2025, many healthcare organizations are reporting positive ROI on their sustainability projects, making them increasingly attractive from a business perspective.

Key areas of focus for Ensign Group and similar organizations in 2024-2025 include:

- Energy Efficiency: Implementing LED lighting, optimizing HVAC systems, and exploring on-site renewable energy generation.

- Waste Management: Enhancing recycling programs, reducing single-use plastics, and exploring waste-to-energy solutions.

- Sustainable Procurement: Prioritizing suppliers with strong environmental credentials and sourcing eco-friendly medical supplies and equipment.

- Water Conservation: Implementing water-saving fixtures and practices within facilities.

Ensign Group, like all healthcare providers, must navigate complex environmental regulations concerning waste disposal and water discharge, adhering to standards like the Resource Conservation and Recovery Act and the Clean Water Act. The industry's substantial energy and water consumption also contribute to its environmental footprint, prompting a growing trend towards sustainability and efficiency measures. By 2024, many healthcare organizations were investing in renewable energy and waste reduction initiatives, anticipating long-term cost savings and improved operational resilience.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ensign Group is built on a comprehensive review of public financial reports, industry-specific market research, and regulatory filings from healthcare governing bodies. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.