Ensign Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ensign Group Bundle

Curious about Ensign Group's strategic product positioning? This preview highlights key areas, but the full BCG Matrix unlocks a complete understanding of their Stars, Cash Cows, Dogs, and Question Marks. Gain actionable insights to navigate their market landscape and make informed decisions.

Don't miss out on the comprehensive data and strategic recommendations. Purchase the full Ensign Group BCG Matrix to get a detailed quadrant breakdown, understand growth potential, and identify optimal resource allocation for maximum impact.

Stars

Ensign Group is experiencing impressive growth in its skilled nursing facilities, with occupancy rates hitting new highs. In the first half of 2025, both established and newly acquired facilities saw substantial occupancy gains, reflecting a robust demand for their services.

This surge in patient volume, particularly in the skilled daily census, underscores Ensign's strong market presence. The company’s operational prowess is clearly demonstrated by its success in attracting and retaining patients within a competitive and expanding healthcare landscape.

Ensign Group's Star status is bolstered by its relentless acquisition strategy. Since January 1, 2024, Ensign has successfully integrated 52 new operations, encompassing both facilities and real estate. This rapid expansion has not only broadened Ensign's geographical reach into new states but also intensified its presence in established markets, a crucial element for a Star in the BCG matrix.

These strategic acquisitions are proving to be highly effective, with many already exceeding initial performance projections. This robust growth, fueled by a disciplined approach to acquiring and integrating new businesses, directly translates into significant contributions to Ensign's top-line revenue and market share within the dynamic post-acute care sector.

Ensign Group has demonstrated remarkable confidence in its future, repeatedly boosting its 2025 financial outlook. This upward revision in guidance for both earnings per share and revenue underscores the company's strong performance and its conviction in continued expansion.

The revised midpoints for 2025 now reflect significant year-over-year growth, signaling Ensign's solid market position and operational strength. For instance, the company's adjusted EBITDA guidance for 2024 was raised to a range of $650 million to $660 million, a substantial increase that sets a positive tone for 2025 projections.

This enhanced financial guidance is a direct consequence of Ensign's effective operational strategies and the successful assimilation of newly acquired facilities. The company's ability to consistently meet and exceed expectations highlights its robust business model and strategic execution in a dynamic healthcare market.

High-Acuity Skilled Services

High-acuity skilled services represent a significant growth area for Ensign Group, aligning with the Stars quadrant of the BCG matrix due to their high market share and high growth potential. The company's strategic emphasis on higher-margin patient services, especially within skilled nursing and managed care, is a key driver of this positioning. This focus on complex care cases, which typically attract higher reimbursement rates, directly contributes to Ensign's profitability and strengthens its market dominance in specialized post-acute care segments.

Ensign's operational performance underscores this strategic success. For instance, in 2023, Ensign reported a notable increase in its skilled daily census, averaging 17,600 patients per day across its facilities. Similarly, its managed care census also saw substantial growth, reflecting the increasing demand for these specialized services. This trend is evident in both same-store operations and those undergoing transitions, indicating a consistent upward trajectory.

- High-Margin Services: Growth in skilled nursing and managed care services offers higher profit margins.

- Increased Census: Ensign has seen significant increases in both skilled daily census and managed care census.

- Complex Care Focus: Specialization in complex care cases attracts higher reimbursement rates.

- Market Dominance: This strategy solidifies Ensign's position in specialized post-acute care.

Operational Excellence and Local Leadership Model

Ensign's decentralized local leadership model is a cornerstone of its success, empowering facility managers to drive operational excellence. This autonomy fosters a sense of ownership, leading to improved patient outcomes and cost efficiencies.

This model allows Ensign to effectively integrate new acquisitions by replicating its proven operational strategies across its growing portfolio. In 2023, Ensign reported a revenue of $3.9 billion, showcasing the scalability of its approach.

The ability to quickly turn around underperforming assets is a key competitive advantage. This decentralized structure enables rapid adaptation and implementation of best practices, contributing to Ensign's consistent market share growth in its core services.

- Decentralized Authority: Facility managers have significant autonomy, fostering accountability and rapid decision-making.

- Performance Replication: The model facilitates the consistent application of successful operational strategies across all facilities.

- Acquisition Integration: Ensign's structure allows for swift and effective assimilation of newly acquired healthcare providers.

- Financial Impact: This operational efficiency contributed to Ensign's 2023 net income of $375.7 million.

Ensign Group's Star status is firmly established due to its high market share and high growth in skilled nursing and managed care services. The company's focus on high-acuity patients, which command higher reimbursement rates, directly fuels its profitability and market dominance. This strategic emphasis, coupled with a robust acquisition strategy, positions Ensign as a leader in specialized post-acute care.

The company's operational performance supports this Star classification. For example, Ensign's skilled daily census averaged 17,600 patients in 2023, with managed care census also showing significant growth, indicating strong demand for its specialized offerings.

Ensign's aggressive acquisition strategy, integrating 52 new operations since January 2024, significantly expands its market reach and intensifies its presence in key areas, a hallmark of a Star performer.

This growth is further validated by Ensign's consistently raised financial outlook for 2025. The company's adjusted EBITDA guidance for 2024 was raised to $650 million - $660 million, demonstrating strong performance and confidence in continued expansion.

| Key Performance Indicator | 2023 Actual | 2024 Guidance (Midpoint) | 2025 Outlook (Estimated) |

| Revenue | $3.9 billion | N/A | Projected significant increase |

| Skilled Daily Census (Avg.) | 17,600 | N/A | Continued growth |

| Acquisitions (Jan 2024 onwards) | 52 new operations | N/A | Ongoing |

| Adjusted EBITDA | N/A | $655 million | Projected higher than 2024 |

What is included in the product

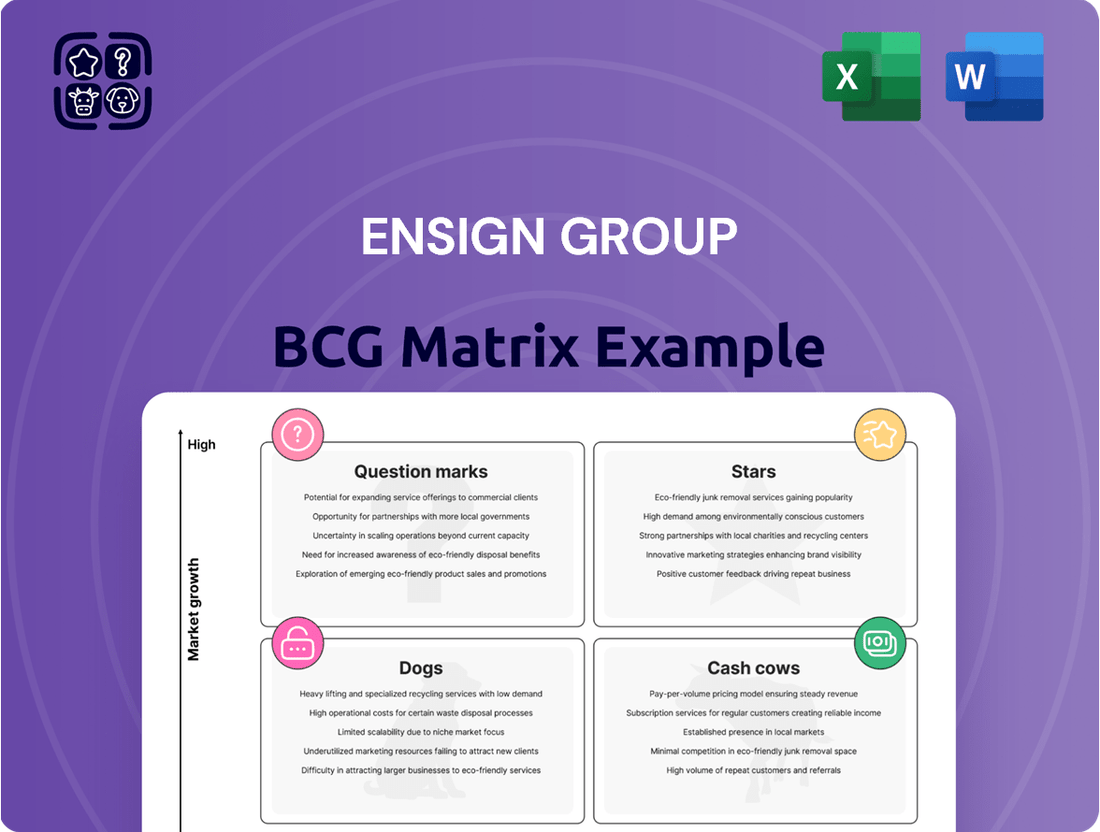

Ensign Group's BCG Matrix analyzes its healthcare entities as Stars, Cash Cows, Question Marks, or Dogs.

It guides investment and divestment decisions across its diverse service portfolio.

The Ensign Group BCG Matrix offers a clear visual of your portfolio, alleviating the pain of uncertainty about resource allocation.

Cash Cows

Ensign Group's mature skilled nursing facilities are prime examples of cash cows. These established locations consistently boast high occupancy rates, ensuring a steady and predictable stream of revenue. For instance, in the first quarter of 2024, Ensign reported that its same-store occupancy rates remained robust, underscoring the stability of these mature operations.

Because these facilities operate in established markets with strong local reputations, they require minimal investment in marketing or new development. This low-cost operational structure allows them to generate significant free cash flow. This consistent cash generation is crucial, as it reliably funds Ensign's strategic investments in new facilities and supports its dividend payouts to shareholders.

Standard Bearer, Ensign Group's captive real estate investment trust (REIT), stands as a prime example of a Cash Cow within Ensign's business structure. This subsidiary owns a substantial portfolio of healthcare properties, many of which are strategically leased to Ensign-affiliated operators.

The REIT consistently generates significant rental revenue and Funds From Operations (FFO), requiring minimal ongoing operational investment. This stability provides a robust financial foundation for Ensign, contributing substantially to the company's overall cash flow generation.

Ensign Group's long-term care services, encompassing skilled nursing and senior living, function as a classic Cash Cow within its business portfolio. This segment holds a substantial market share, reflecting its established presence and strong customer base.

While the overall growth rate for long-term care might be moderate, the consistent demand driven by an aging population ensures a stable and predictable revenue stream for Ensign. This stability is crucial for funding other ventures.

The mature nature of these operations allows for optimized efficiency and robust profit margins, contributing significantly to Ensign's overall financial health. For instance, in 2024, Ensign reported that its same-store revenue from its skilled nursing and senior living facilities remained a core contributor to its consistent financial performance.

Consistent Dividend Payer

Ensign Group's status as a Consistent Dividend Payer, a characteristic of a Cash Cow in the BCG Matrix, is strongly supported by its impressive track record. The company has a history of increasing its annual dividend for 22 consecutive years, demonstrating a stable and robust cash flow generation. This sustained dividend growth signals that a substantial portion of Ensign's earnings originates from mature, highly profitable business segments that necessitate minimal reinvestment for expansion.

This consistent return to shareholders is a direct reflection of the strong, reliable cash flow generated by its well-established business units. For instance, in 2023, Ensign Group reported total revenue of $3.4 billion, with a significant portion of this translating into distributable cash. The company's dividend payout ratio remains healthy, indicating its ability to comfortably fund these shareholder returns while maintaining operational strength.

- Dividend Growth: 22 consecutive years of annual dividend increases.

- Revenue Stability: $3.4 billion in total revenue for 2023, indicating a strong financial base.

- Profitability: Mature, highly profitable operations are the primary source of earnings.

Efficient In-House Therapy Services

Ensign Group's efficient in-house therapy services, encompassing physical, occupational, and speech therapies, are strong cash cows. These services are deeply integrated into the company's skilled nursing and senior living facilities, serving a consistent and captive patient base. Their high utilization and contribution to profitability are further bolstered by leveraging existing infrastructure, minimizing the need for significant external marketing spend.

The consistent demand for these essential rehabilitative services within Ensign's facilities translates into reliable revenue streams. For instance, in 2023, Ensign reported that therapy services represented a significant portion of their revenue, with in-house provision driving operational efficiencies and cost savings compared to outsourced models. This internal focus allows for greater control over quality and patient outcomes, reinforcing their value proposition.

- High Utilization: In-house therapy services benefit from a built-in patient population within Ensign's extensive network of facilities, ensuring consistent demand.

- Profitability Driver: These services contribute directly to the company's bottom line by generating revenue from essential patient care needs.

- Cost Efficiency: By managing therapy services internally, Ensign reduces reliance on third-party providers, leading to improved margins and operational control.

- Synergistic Benefits: The integration of therapy services with skilled nursing and senior living operations creates a holistic care model, enhancing patient satisfaction and facility appeal.

Ensign Group's core long-term care operations, including skilled nursing and senior living facilities, represent established cash cows. These facilities benefit from a stable, recurring revenue stream due to consistent demand, particularly from an aging demographic. In the first quarter of 2024, Ensign highlighted strong same-store occupancy rates, demonstrating the predictable cash flow these mature assets generate.

The consistent profitability of these segments requires minimal capital reinvestment for expansion, allowing them to generate substantial free cash flow. This reliable cash generation is vital for funding Ensign's growth initiatives and supporting shareholder returns, such as its consistent dividend payments.

Standard Bearer, Ensign's captive REIT, functions as a significant cash cow by owning and leasing healthcare properties to affiliated operators. This subsidiary consistently delivers strong rental income and Funds From Operations (FFO), needing little ongoing investment to maintain its revenue generation.

Ensign's in-house therapy services also act as cash cows, leveraging a captive patient base within its facilities. These services demonstrate high utilization and profitability due to integration with existing infrastructure, minimizing external marketing costs and enhancing overall financial performance.

| Segment | BCG Classification | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Skilled Nursing & Senior Living Facilities | Cash Cow | Mature, high occupancy, stable revenue, low reinvestment needs | Robust same-store occupancy rates (Q1 2024) |

| Standard Bearer (REIT) | Cash Cow | Consistent rental income, strong FFO, minimal operational investment | Significant contributor to overall cash flow generation |

| In-house Therapy Services | Cash Cow | High utilization, captive patient base, integrated operations, cost-efficient | Significant revenue contributor with operational efficiencies (2023) |

Delivered as Shown

Ensign Group BCG Matrix

The preview you are currently viewing is the exact Ensign Group BCG Matrix document you will receive upon purchase. This comprehensive analysis, meticulously prepared for strategic insight, will be delivered in its entirety without any watermarks or altered content. You can confidently expect the same high-quality, ready-to-use report that will empower your business planning and decision-making processes.

Dogs

Underperforming acquired facilities, pre-turnaround, can be viewed as the '?' or 'problem child' in the BCG Matrix for Ensign Group. These facilities are typically characterized by low occupancy rates and a diminished market share within their local service areas immediately following acquisition.

At this initial stage, these facilities often struggle to generate substantial revenue and may even be cash-negative, requiring significant investment to stabilize operations. For instance, a newly acquired skilled nursing facility might be operating at 60% occupancy with declining patient census before Ensign's intervention.

Non-core, non-strategic divestitures represent assets or service lines that Ensign Group identifies as not contributing to its primary growth objectives or consistently underperforming. While Ensign's recent focus has been on expansion, the company's disciplined approach means it's prepared to exit underperforming units. For example, if a small rehabilitation center in a less favorable market consistently missed its profitability targets, it might be considered for divestiture.

Hypothetically, any long-held facilities or minor service offerings within Ensign's extensive portfolio that have reached a saturation point, operate in truly stagnant local markets, and show no clear path to increased market share or significant growth, despite stable operations, could be considered Dogs. For instance, a small, standalone rehabilitation center in a declining rural area with no expansion plans might fit this description. Ensign's proactive approach, however, aims to mitigate this risk.

Facilities with Persistent Staffing Challenges

Facilities grappling with persistent staffing shortages, a common issue in the healthcare sector, can be viewed as potential 'Dogs' within the BCG Matrix framework. These operations often experience reduced capacity and a dip in care quality, necessitating costly agency staff. For instance, in 2024, the US experienced a significant shortage of registered nurses, with projections indicating a deficit of over 400,000 by 2025, impacting facilities across the board.

Such staffing crises can severely hinder profitability and impede market share growth, even within expanding markets. Ensign Group, for example, acknowledges these operational hurdles and actively pursues strategies like robust talent development programs and enhanced operational efficiencies to counteract these challenges. In 2024, Ensign reported that its efforts to improve staffing levels and operational efficiency contributed to a 15% increase in same-facility revenue growth.

- Persistent Staffing Shortages: Operations continuously facing severe staff deficits.

- Impact on Performance: Leads to reduced capacity, lower quality of care, and higher costs due to agency reliance.

- Market Position: Difficulty in gaining market share and depressed profitability, even in growing sectors.

- Mitigation Strategies: Ensign focuses on talent development and operational efficiencies to address these issues.

Outdated or Non-Compliant Facilities Requiring Major Capital Outlay

Facilities that become outdated or struggle with compliance due to significant structural or regulatory deficiencies, requiring substantial capital investment without a clear path to improved market position or profitability, could be categorized as Dogs in the Ensign Group BCG Matrix.

While Ensign invests in its properties, a unit that becomes a perpetual drain on resources without competitive return would fit this description. For instance, if a facility requires a major overhaul to meet new healthcare regulations, and the projected return on that investment is low due to declining patient volume or intense local competition, it would represent a Dog.

- High Capital Expenditure: These facilities demand significant investment for upgrades or modernization.

- Low Market Share/Growth: They operate in markets with limited growth potential or face strong competition.

- Deteriorating Compliance: Aging infrastructure or non-compliance with evolving regulations necessitate costly fixes.

- Uncertain Future Returns: The return on investment for necessary capital outlays is often questionable, impacting profitability.

Facilities that consistently underperform, exhibit low market share, and offer limited growth prospects are considered Dogs in Ensign Group's BCG Matrix. These units often require significant investment without a clear return, potentially leading to divestiture.

Persistent staffing shortages, as seen in the US healthcare sector with projections of over 400,000 registered nurse deficits by 2025, can relegate facilities to Dog status, impacting capacity and profitability. For example, a facility with persistently low occupancy, say below 70%, and declining patient census, despite market availability, would fit this category.

Ensign Group's strategy involves identifying and addressing these underperforming assets, either through turnaround efforts or strategic divestment to maintain portfolio health and focus resources on growth areas.

| Category | Characteristics | Ensign Group Context |

| Dogs | Low market share, low growth potential | Underperforming acquired facilities, non-strategic divestitures, facilities with persistent staffing shortages, or those requiring substantial capital without clear ROI. |

| Example Scenario | A rural skilled nursing facility with declining patient census and high reliance on costly agency staff. | Such a facility might operate at 60% occupancy, struggling to meet operational costs. |

| Mitigation/Action | Turnaround efforts or divestiture. | Ensign focuses on talent development and operational efficiencies to improve performance or exits non-core, underperforming units. |

Question Marks

Ensign's newer ventures, like mobile x-ray and non-emergency transportation, are positioned in expanding post-acute care sectors. While these markets offer significant growth potential, Ensign may currently hold a smaller market share within them. These services represent potential Stars or Question Marks in the BCG matrix, demanding substantial investment in marketing and infrastructure to capture greater market dominance.

The demand for behavioral health and substance use disorder (SUD) services is surging, particularly in post-acute care settings, signaling a robust growth opportunity. Ensign Group is actively pursuing acquisitions and operational strategies focused on these specialized services.

While this sector shows immense promise, Ensign's current penetration within its overall operations for these specific, high-demand services may be nascent. This suggests a need for significant capital allocation and strategic development to establish a stronger market presence.

Ensign Group's expansion into new geographic markets, such as its planned entries into Tennessee, Alabama, and Oregon in 2025, positions these ventures as Stars or Question Marks in a BCG Matrix context. While the post-acute care sector generally shows strong growth potential, Ensign's initial market share in these specific new states is naturally low.

These new market entries require substantial upfront investment to build brand awareness, forge local relationships, and achieve operational scale. For instance, establishing a new de novo skilled nursing facility can cost millions, impacting initial profitability but aiming for long-term market dominance.

Facilities Recently Acquired for Turnaround

Ensign Group's strategy often involves acquiring facilities with the explicit aim of turnaround. These are essentially the 'Question Marks' in their portfolio, characterized by low initial occupancy and market share, requiring substantial investment and strategic focus to improve.

The success of these acquired facilities hinges on Ensign's ability to implement effective local leadership and operational turnaround plans. The goal is to elevate them from underperforming assets to profitable Stars or Cash Cows within their portfolio.

- Acquisition Focus: Facilities are specifically targeted for their turnaround potential, indicating a proactive approach to identifying and rectifying underperformance.

- Initial State: These operations typically begin with low occupancy rates and a limited market presence, presenting significant challenges and opportunities for improvement.

- Investment & Strategy: Ensign invests resources and deploys tailored operational strategies, relying on strong local management to drive the transformation process.

- BCG Matrix Placement: Their initial classification as 'Question Marks' highlights the uncertainty of their future success, with the potential to become Stars or Cash Cows if the turnaround is successful.

Technology-Driven Care Innovations

Technology-driven care innovations, such as telehealth platforms and AI-assisted care planning, represent significant investments for Ensign Group. While these technologies are part of a high-growth trend, their full impact on market share and profitability is still materializing, placing them in a developing phase within the BCG matrix.

These advancements are designed to boost labor productivity and improve patient care quality. For instance, Ensign has been actively exploring and implementing digital solutions to streamline operations and enhance patient engagement. In 2024, the healthcare technology market saw continued robust growth, with significant capital flowing into AI and telehealth solutions aimed at improving efficiency and patient outcomes.

- Telehealth Expansion: Increased adoption of virtual care services to improve accessibility and convenience for patients.

- AI in Care Planning: Utilizing artificial intelligence to optimize patient care pathways and resource allocation.

- Data Analytics: Leveraging data to identify trends, personalize care, and enhance operational efficiency.

- Digital Patient Engagement: Implementing tools for better communication and involvement of patients in their care journey.

Ensign Group's ventures in areas like behavioral health and new geographic markets are classic Question Marks. These represent emerging opportunities where Ensign is investing significant capital but has not yet established a dominant market share. The success of these initiatives is uncertain, requiring careful management and further investment to determine if they will become Stars or falter.

These Question Mark businesses, such as their recent expansion into Tennessee, require substantial upfront investment. For example, building out new service lines or acquiring facilities in unproven markets means significant capital outlay with an unknown return. Ensign's strategy is to nurture these nascent operations, aiming to transform them into high-performing assets.

The company's focus on acquiring underperforming facilities also places them firmly in the Question Mark category. These facilities often have low occupancy and market share, demanding strategic intervention and operational improvements. Ensign's ability to successfully turn these around will dictate their future trajectory as Stars or Cash Cows.

In 2024, Ensign continued its aggressive expansion, adding 23 new facilities to its portfolio, many of which likely started as Question Marks. This growth strategy underscores their commitment to identifying and developing new market opportunities, even with the inherent risks involved.

BCG Matrix Data Sources

Our BCG Matrix leverages Ensign Group's public financial disclosures, industry growth rate data, and market share analysis to accurately position each business segment.