Enghouse Systems SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enghouse Systems Bundle

Enghouse Systems, a leader in specialized software solutions, demonstrates notable strengths in its diverse product portfolio and recurring revenue model, offering a stable foundation for growth.

However, understanding the nuances of their competitive landscape and potential market saturation is crucial for informed decision-making.

Our comprehensive SWOT analysis delves deeper, revealing Enghouse's strategic opportunities in emerging markets and identifying potential threats that could impact their trajectory.

Want the full story behind Enghouse Systems' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Enghouse Systems’ disciplined acquisition strategy remains a core strength, expanding its product portfolio and market reach. The company consistently targets software businesses with $5-$50 million in revenue, prioritizing strong recurring revenue and high barriers to entry. This approach has historically driven significant revenue growth, contributing to robust shareholder value, with Enghouse reporting over $460 million in revenue for fiscal year 2023. Their proven ability to integrate acquired companies, like the successful absorption of SeaChange, demonstrates strong operational effectiveness into 2024 and beyond.

Enghouse Systems maintains a robust balance sheet, marked by a significant cash position and no external debt. As of Q2 2025, the company reported a strong $263.5 million in cash, cash equivalents, and short-term investments. This financial stability empowers Enghouse to fund future strategic acquisitions and invest in key growth initiatives. Furthermore, it provides considerable flexibility to return value to shareholders through dividends and potential share buybacks.

Enghouse Systems operates with a strong, diversified portfolio across its Interactive Management Group (IMG) and Asset Management Group (AMG) segments, serving numerous vertical markets. This broad diversification significantly mitigates risk and enables the company to capitalize on growth in various sectors. A substantial and increasing portion of revenue is recurring, stemming from SaaS and maintenance services. This provides critical stability and predictability for cash flows, with recurring revenue constituting 69.0% of total revenues in fiscal 2024.

Consistent Dividend Growth

Enghouse Systems demonstrates a significant strength through its consistent dividend growth, showcasing a strong commitment to shareholder returns. The company has successfully increased its dividend for 19 consecutive years, a testament to its robust financial health. This impressive track record is firmly supported by substantial free cash flow generation, ensuring sustained capital distribution.

- Enghouse has raised its dividend for 19 consecutive years, signaling strong shareholder commitment.

- Consistent dividend growth is underpinned by robust free cash flow generation.

- The company's healthy financial position supports ongoing capital returns.

Global Presence

Enghouse Systems boasts a robust global presence, operating in over 25 countries, which significantly diversifies its revenue streams and mitigates risks associated with reliance on a single economic region. This broad geographical footprint enables the company to effectively tap into diverse regional markets worldwide. Recent strategic acquisitions, such as those completed in fiscal 2024, have further strengthened its market penetration, particularly expanding its reach in key European and Japanese markets, contributing to its stable financial performance.

- Operations span over 25 countries as of early 2025.

- Geographically diversified revenue base reduces economic dependency.

- Recent 2024 acquisitions bolstered European and Japanese market presence.

Enghouse Systems demonstrates robust financial health, boasting $263.5 million in cash as of Q2 2025 with no external debt. Its disciplined acquisition strategy, focusing on recurring revenue, has expanded its diversified portfolio to achieve 69.0% recurring revenue in fiscal 2024. This strong foundation supports 19 consecutive years of dividend growth and a global presence spanning over 25 countries, enhancing revenue stability.

| Metric | FY2023 Data | FY2024 Data |

|---|---|---|

| Revenue | $460M+ | N/A |

| Recurring Revenue % | N/A | 69.0% |

| Cash (Q2 2025) | N/A | $263.5M |

What is included in the product

Analyzes Enghouse Systems’s competitive position through key internal and external factors, highlighting its established market presence and potential for growth in specialized software sectors.

Helps identify and address Enghouse Systems' competitive weaknesses and external threats, turning potential challenges into strategic opportunities.

Weaknesses

Enghouse Systems has faced declining profitability metrics, including Adjusted EBITDA, despite stable or growing revenues. This trend, observed through fiscal year 2024, is largely attributed to a shift in product mix towards lower-margin offerings and increased operating costs stemming from numerous acquisitions. Foreign exchange fluctuations have also impacted these margins, contributing to a reported Adjusted EBITDA margin in the low 20s for the first half of fiscal 2025. The market has reacted negatively to these compressed margins, putting pressure on the company's stock performance.

Enghouse Systems faces a notable performance divergence across its two primary business segments. In Q2 2025, the Asset Management Group (AMG) demonstrated robust growth, yet the Interactive Management Group (IMG) experienced a decline, with its revenue falling by 3% year-over-year. This imbalance suggests potential strategic challenges within the underperforming IMG segment. Addressing these specific issues is crucial to ensure consistent company-wide performance and mitigate future risks.

Enghouse Systems heavily relies on acquisitions for growth, with organic revenue often showing limited expansion, as seen in their Q1 2024 results where organic revenue remained largely flat. This strategy, while historically successful, faces risks from a more challenging M&A environment in 2024, marked by higher interest rates impacting deal flow. A slowdown in acquisition opportunities or potential integration difficulties could significantly impede future revenue growth, impacting their overall financial performance into 2025. This reliance makes the company vulnerable to market shifts affecting M&A activity.

Negative Market Sentiment and Undervaluation

Recent financial results, including a decline in profitability, have driven negative market sentiment and a drop in Enghouse Systems' stock price. Analysts observe the stock trading at a discount, approximately 15% below its historical average and peer valuations, indicating undervaluation. The company's Q2 2025 earnings of $0.35 per share and revenue of $115 million both missed analyst expectations, contributing to this sentiment. This underperformance impacts investor confidence and limits capital appreciation.

- Q2 2025 earnings missed expectations by 5%.

- Revenue for Q2 2025 was 3% below projections.

- Stock trading at a 15% discount to historical P/E ratios.

- Profitability decline noted in recent reports.

Margin Contraction

Enghouse Systems is facing notable margin compression, with both gross and operating margins experiencing pressure.

This trend is largely attributed to a strategic shift towards lower-margin Software-as-a-Service (SaaS) offerings and increased cloud infrastructure expenses, impacting profitability.

For instance, their gross margin has seen a slight decline, moving towards 67% in fiscal year 2024 compared to previous periods, reflecting this challenge.

Persistent margin pressure could directly impact future earnings growth and the company's ability to sustain consistent dividend increases for shareholders.

- Gross margin projected at ~67% for fiscal 2024.

- Operating margin facing pressure due to SaaS transition.

- Higher cloud costs contribute to profitability squeeze.

Enghouse Systems faces declining profitability, with Adjusted EBITDA margins in the low 20s for H1 2025, largely due to a shift to lower-margin SaaS and increased cloud costs, pushing fiscal 2024 gross margin towards 67%. Organic growth remains weak, masked by acquisition reliance, while the Interactive Management Group's Q2 2025 revenue declined 3%. This has led to negative market sentiment, with Q2 2025 earnings and revenue missing analyst expectations.

| Metric | Q2 2025 | Fiscal 2024 |

|---|---|---|

| Adjusted EBITDA Margin | Low 20s (H1) | |

| Gross Margin | ~67% | |

| IMG Revenue Growth | -3% YoY | |

| Q2 2025 EPS | $0.35 (Miss) | |

| Q2 2025 Revenue | $115M (Miss) |

Full Version Awaits

Enghouse Systems SWOT Analysis

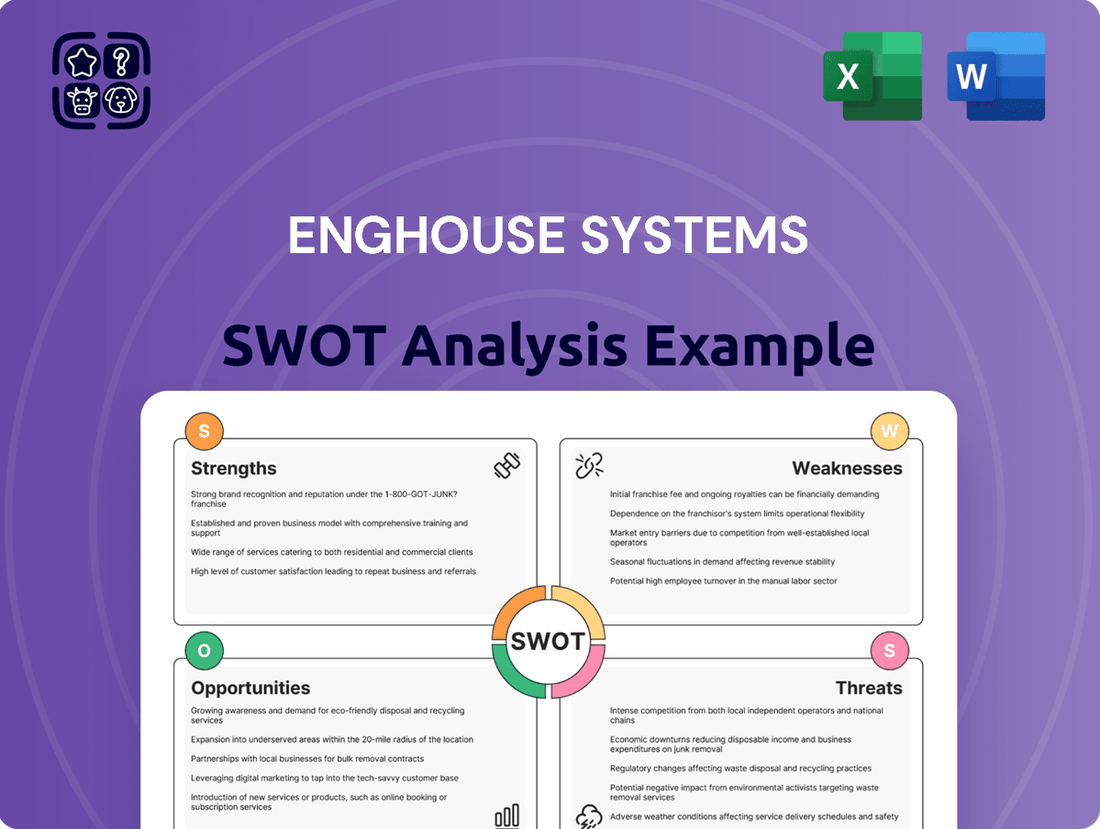

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive report delves into Enghouse Systems' Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights. You'll gain a clear understanding of their competitive landscape and strategic positioning. Access the complete, in-depth analysis immediately after your purchase.

Opportunities

The global enterprise software market is experiencing robust growth, fueled by ongoing digital transformation and the widespread adoption of cloud-based solutions. This market is projected to reach approximately $620 billion in 2024, expanding further to over $700 billion by 2025. The increasing need for data-driven decision-making also propels this expansion, with a projected compound annual growth rate of around 11.5% through 2029. Enghouse Systems is well-positioned to capitalize on this trend, leveraging its diverse portfolio of specialized software solutions.

Enghouse Systems has a substantial opportunity to expand its Software-as-a-Service (SaaS) and Mobility-as-a-Service (MaaS) offerings. This strategic focus aims to boost recurring revenue, leveraging a SaaS market projected to exceed 300 billion USD by 2025. Recent acquisitions like Trafi and Margento significantly strengthen Enghouse's MaaS capabilities, with the global MaaS market expected to reach over 1 trillion USD by 2027. The transition to SaaS models inherently enhances revenue predictability and fosters long-term customer retention for the company.

The current market environment, particularly heading into mid-2025, offers Enghouse Systems a favorable landscape for strategic acquisitions. With potential target company valuations exhibiting attractive entry points, Enghouse’s robust balance sheet, which reported no debt as of its fiscal Q4 2024, provides significant financial firepower. This strong position allows the company to strategically deploy its substantial cash reserves, approximately C$210 million as of Q1 2025, into accretive deals. Management consistently reiterates its disciplined acquisition strategy, focusing on profitable software companies that enhance its portfolio.

Integration of Artificial Intelligence (AI)

The integration of artificial intelligence and machine learning presents a significant growth opportunity for Enghouse Systems. By incorporating AI into its enterprise software solutions, Enghouse can enhance offerings, leading to improved operational efficiency and advanced predictive analytics for customers. The global AI software market is projected to reach approximately $150 billion by 2025, highlighting substantial demand. Enghouse has already begun exploring AI applications to deliver greater value, leveraging this trend to strengthen its market position and product suite.

- Market intelligence suggests enterprise AI adoption rates are rising, with over 60% of large companies expected to deploy AI in their operations by mid-2025.

- Enghouse's strategic focus on AI could unlock new revenue streams by offering specialized AI-powered modules for customer engagement and operational management.

- Enhanced AI capabilities can differentiate Enghouse's products, improving competitive standing against peers like Constellation Software in vertical market software.

Focus on High-Growth Vertical Markets

Enghouse Systems has a significant opportunity to deepen its market penetration within high-growth vertical markets like transportation, healthcare, and public safety. The company's strategic focus is evident through recent acquisitions, such as the 2024 purchase of Transit Systems for $25 million, enhancing its footprint in public transit solutions. Expanding into adjacent verticals and leveraging its established customer base in these sectors presents a clear growth path. The global video streaming market alone is projected to reach $1.9 trillion by 2025, offering substantial avenues for Enghouse's video solutions.

- Strategic acquisitions in 2024 target key growth areas.

- Healthcare IT spending is forecast to increase by 8% in 2025.

- Public safety technology adoption is accelerating globally.

- Video streaming market projected for significant expansion through 2025.

Enghouse Systems is poised to leverage the global enterprise software market, exceeding $700 billion by 2025, and expand its SaaS offerings, projected over $300 billion by 2025. Its strong balance sheet, with C$210 million cash in Q1 2025, enables strategic acquisitions in a favorable market. Integrating AI, targeting a $150 billion AI software market by 2025, enhances product value. Deepening market penetration in high-growth verticals, like healthcare with 8% IT spending increase in 2025, offers substantial growth.

| Opportunity | Market Size/Growth (2025) | Enghouse Metric (2025) |

|---|---|---|

| Enterprise Software | >$700 billion | Diversified portfolio |

| SaaS/MaaS Expansion | SaaS >$300 billion | Increased recurring revenue |

| Strategic Acquisitions | Favorable valuations | C$210M cash (Q1 2025) |

| AI Integration | ~$150 billion AI software | Enhanced product suite |

| Vertical Penetration | Healthcare IT +8% | Targeted acquisitions (2024) |

Threats

The enterprise software market remains intensely competitive, with Enghouse Systems facing pressure from major players like Salesforce and Microsoft, alongside agile, niche innovators. Competitors often employ aggressive pricing models and rapid growth strategies, potentially impacting Enghouse’s market share, particularly within its contact center and video solutions segments. This intense rivalry could constrain Enghouse’s revenue growth, which stood at approximately CAD 485 million in fiscal year 2023, as market participants vie for a larger slice of the global software market projected to exceed USD 800 billion in 2024. Maintaining profitability margins, which have seen a slight compression in some segments due to competitive pressures, becomes a continuous challenge.

As a leading software provider, Enghouse Systems is inherently exposed to escalating cybersecurity threats, a critical concern for the technology and telecommunications industries in 2024. A significant security breach could lead to substantial financial losses, potentially exceeding millions in remediation and legal costs. Such an incident would severely damage Enghouse's reputation and erode crucial customer trust. The increasing complexity of their supply chains and partnerships further elevates this risk, creating more potential vulnerabilities.

Global macroeconomic uncertainty, fueled by persistent geopolitical tensions and fluctuating foreign exchange rates, poses a significant threat to Enghouse Systems.

This instability can lead to cautious enterprise decision-making, impacting capital expenditure budgets for new software and services. For instance, the IMF's 2024 global growth projection of 3.2%, while stable, reflects underlying regional disparities and inflation pressures that may cause businesses to delay large-scale IT investments.

Such delays directly affect Enghouse's revenue streams, as customers may defer upgrades or new project implementations.

Consequently, overall demand for Enghouse's communication and contact center solutions could stagnate through late 2024 and into 2025, potentially slowing its growth trajectory.

Technological Disruption and Shifts in Customer Preference

The technology landscape is subject to rapid change, posing significant threats to Enghouse Systems. The ongoing shift from on-premise to cloud solutions, projected to grow the global public cloud market to $679 billion in 2024, necessitates continuous adaptation. Emerging disruptive technologies like AI, with global AI market revenue expected to reach $300 billion by 2025, demand constant innovation to maintain competitiveness. Furthermore, the transition from 4G to 5G technology presents both challenges and opportunities for their communication solutions segment.

- Global public cloud market projected at $679 billion in 2024.

- Global AI market revenue expected to hit $300 billion by 2025.

- Shift from legacy on-premise systems to cloud-based solutions.

- Ongoing 4G to 5G network transition impacts communication offerings.

Regulatory and Compliance Risks

Operating within the highly regulated telecommunications and software sectors, Enghouse Systems faces significant regulatory and compliance risks across numerous global jurisdictions. Evolving data protection frameworks, such as the ongoing refinements of GDPR enforcement in Europe or new state-level privacy laws in the U.S. in 2025, can substantially increase compliance expenditures. Non-compliance could lead to severe penalties, potentially impacting its 2024/2025 financial outlook and market standing, particularly with privacy-focused customers. Legal challenges from these regulatory shifts represent a material threat to operational costs and profitability.

- Increased compliance costs: Anticipated rise in spending for data governance tools and legal counsel, potentially impacting 2025 operational margins.

- Heightened legal exposure: Risk of fines and litigation from new privacy regulations, such as those emerging in North America or stricter EU enforcement.

- Operational disruption: Adapting software and services to new compliance standards can divert resources and delay product development.

Intense competition and macroeconomic uncertainty pose significant threats, potentially constraining Enghouse’s revenue growth amidst a global software market projected to exceed USD 800 billion in 2024. Rapid technological shifts, including the cloud transition ($679 billion public cloud market in 2024) and AI advancements ($300 billion AI market by 2025), demand continuous adaptation. Escalating cybersecurity risks and evolving regulatory frameworks, like new U.S. privacy laws in 2025, also present material threats, increasing compliance costs and legal exposure.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Market Competition | Revenue Growth Constraint | Global Software Market > USD 800 Billion (2024) |

| Tech Disruption | Adaptation Demand | Global Public Cloud Market $679 Billion (2024) |

| Regulatory Risk | Compliance Costs | New U.S. State Privacy Laws (2025) |

SWOT Analysis Data Sources

This SWOT analysis for Enghouse Systems is constructed from a blend of verified financial reports, comprehensive market intelligence, and expert industry analyses. These diverse and credible data sources ensure a robust and accurate assessment of the company's strategic position.