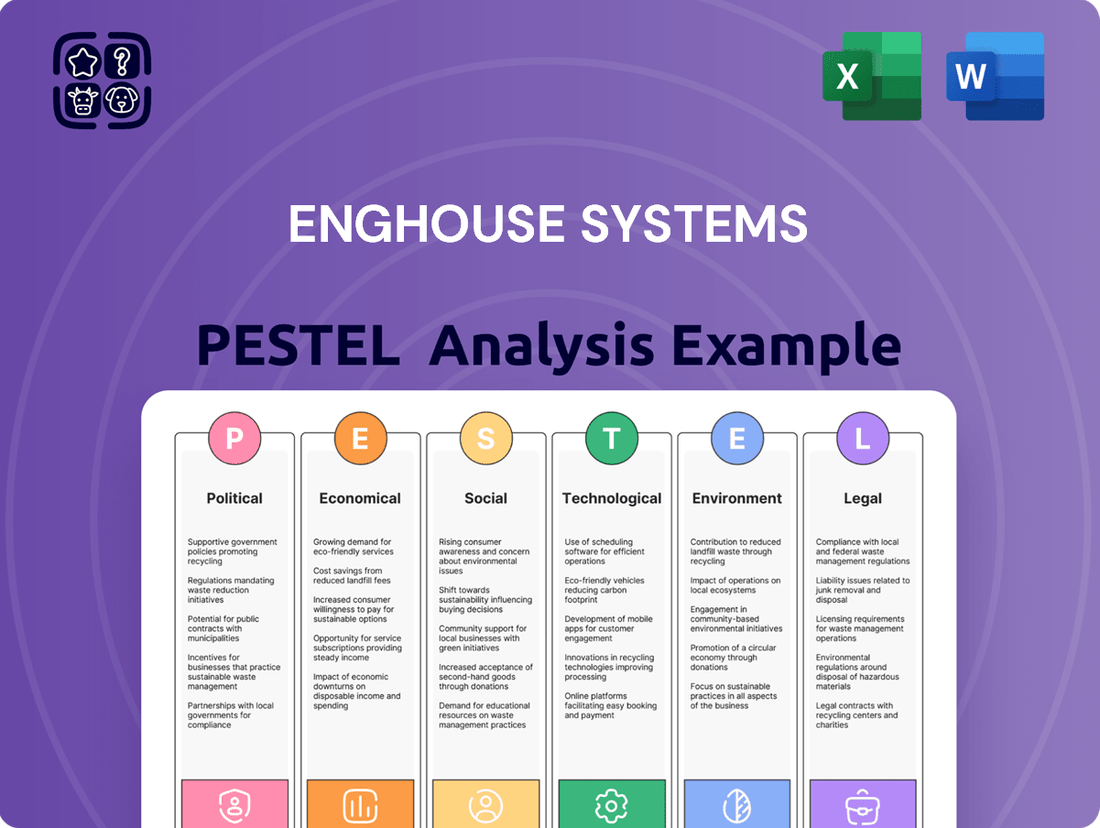

Enghouse Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enghouse Systems Bundle

Unlock the strategic advantages Enghouse Systems holds by understanding the intricate web of external forces. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors that are shaping its operational landscape and future growth potential. Don't just react to market shifts; anticipate them.

Gain a competitive edge with our meticulously researched PESTLE Analysis of Enghouse Systems. Discover how evolving regulations, economic fluctuations, and technological advancements are creating both opportunities and challenges. Arm yourself with the critical insights needed to refine your own market strategy.

Ready to make informed decisions about Enghouse Systems? Our comprehensive PESTLE analysis offers a clear, actionable roadmap of the external influences impacting its trajectory. From emerging tech trends to shifting consumer behaviors, understand what matters most.

Invest with confidence or plan your next strategic move by leveraging our expert-crafted PESTLE analysis for Enghouse Systems. We dissect the complex external environment, providing you with the foresight to navigate risks and capitalize on emerging opportunities. Download the full version now for unparalleled market intelligence.

Political factors

The volatile global political landscape and shifting trade policies create a cautious investment climate for Enghouse's customers, potentially leading to longer purchasing decision cycles for its enterprise software solutions. Geopolitical instability, such as ongoing tensions in Eastern Europe and the Middle East in early 2025, can disrupt customer operations and supply chains, indirectly affecting Enghouse's demand. The company's extensive global presence, with operations across North America, Europe, Asia, and Oceania, makes it susceptible to international trade disputes and tariffs. For instance, potential changes in US-China trade relations or EU digital services taxes could impact Enghouse's profitability and market expansion strategies for its 2024-2025 fiscal year. Navigating these complex geopolitical dynamics is crucial for maintaining stable revenue streams and continued growth.

Enghouse Systems actively pursues government contracts, particularly within the public safety and transportation sectors. The company has notably secured significant agreements, such as providing emergency response systems for the Norwegian government, underscoring its expertise. By mid-2025, global government digital transformation initiatives, including the EU's Digital Decade goal for 100% online public services by 2030, offer substantial opportunities. Enghouse's Asset Management Group is well-positioned to leverage these ongoing shifts, enhancing its public sector footprint.

Governments are increasingly implementing data sovereignty laws, requiring citizen data to be stored within national borders, a trend intensifying into 2025 with new regulations in regions like APAC. This directly impacts Enghouse Systems cloud offerings, necessitating adaptation of its data center and cloud infrastructure strategy. Compliance with these diverse regulations is crucial for global operations and can affect the architecture and cost of delivering SaaS solutions. This political factor mandates a flexible deployment model, which Enghouse addresses through its private cloud, multi-tenant cloud, and on-premise solutions. For instance, the demand for localized data processing capacity is projected to increase enterprise cloud spending by 15-20% annually in some regulated sectors through 2024.

International Relations and Market Access

Enghouse Systems growth strategy, heavily reliant on acquisitions, is directly influenced by political stability and foreign investment regulations in potential target countries. For instance, the company's continued expansion into European markets and other global regions depends significantly on maintaining favorable political relationships and ensuring open market access, which directly impacts deal feasibility and integration. Political events, such as trade disputes or shifts in international alliances, can cause notable fluctuations in currency exchange rates. These fluctuations directly impact the cost of international acquisitions for Enghouse, as well as the company's reported financial results in Canadian dollars, affecting profitability and investment returns.

- Foreign investment regulations in key markets like the EU influence acquisition opportunities for Enghouse.

- Political stability in target countries directly impacts the success and integration of acquired entities.

- Currency volatility, such as CAD versus EUR or USD, affects the reported value of international revenues and acquisition costs.

- Open market access remains critical for Enghouse's software and services deployment across diverse jurisdictions.

Public Safety and Emergency Services Mandates

Governments worldwide are increasingly mandating advanced communication systems for public safety, creating robust demand for Enghouse's specialized solutions. This includes the ongoing global shift towards 5G networks for first responders, driving new business opportunities. Enghouse's proven track record, like its involvement in Norway's nationwide emergency network, positions it favorably for similar large-scale government initiatives. For instance, the Canadian government's Public Safety Broadband Network (PSBN) initiative, with its 2024-2025 development phases, represents a significant growth area.

- Global public safety communications market is projected to reach over $15 billion by 2027.

- Governments are allocating significant budgets towards modernizing emergency services infrastructure.

- Enghouse's public safety division benefits from mandates for next-generation 5G readiness in critical communications.

- The Canadian PSBN continues its development, signaling future contractual opportunities for specialized vendors like Enghouse.

Political factors significantly influence Enghouse's global operations, with evolving data sovereignty laws and foreign investment regulations impacting its cloud offerings and acquisition strategy into 2025. Government digital transformation initiatives, including the EU's Digital Decade goals, offer substantial opportunities for Enghouse's public sector solutions. Geopolitical instability and currency fluctuations, like CAD versus EUR, directly affect international revenues and acquisition costs. Compliance with diverse global mandates for public safety communication systems, such as Canada's PSBN development through 2025, remains a key driver for demand.

| Political Factor | 2024/2025 Impact on Enghouse | Relevant Data Point |

|---|---|---|

| Data Sovereignty Laws | Increases compliance costs, necessitates flexible cloud solutions | APAC regulations intensifying in 2025; 15-20% projected annual enterprise cloud spending increase in regulated sectors |

| Government Digital Transformation | Creates significant public sector opportunities | EU's Digital Decade for 100% online public services by 2030; Canadian PSBN development phases in 2024-2025 |

| Foreign Investment Regulations | Influences acquisition feasibility and market access | Impacts deals in European markets and other global regions |

What is included in the product

This Enghouse Systems PESTLE analysis meticulously examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

It offers actionable insights and forward-looking perspectives to guide proactive decision-making and identify potential opportunities and threats within the business environment.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions to quickly address external threats and opportunities impacting Enghouse Systems.

Economic factors

The global economy faces significant volatility in 2024, driven by persistent inflationary pressures and geopolitical instability, leading to a cautious investment climate. This economic uncertainty is causing customers to delay purchasing decisions, impacting Enghouse Systems' revenue growth, which saw a 1% decline in the nine months ending July 2024 compared to the previous year. Despite these headwinds, Enghouse's focus on operational efficiency, reflected in its strong cash flow from operations of CAD 120.4 million for the same period, helps mitigate some economic pressures. The company's robust financial position allows it to navigate these challenging market conditions more effectively.

Enghouse Systems, as a global enterprise, faces significant exposure to foreign exchange volatility, particularly from movements in the U.S. dollar, euro, and pound sterling. These currency fluctuations directly impact both reported revenues and expenses, introducing considerable financial uncertainty. For instance, in its fiscal Q2 2024 results, Enghouse reported a foreign exchange loss of approximately CAD 2.5 million. This volatility necessitates careful financial management to mitigate its effects on overall profitability and operational stability.

Rising interest rates, with the Bank of Canada policy rate at 5.00% in mid-2024, have made disciplined M&A more challenging. Despite Enghouse Systems holding CAD 214.3 million in cash and no debt as of April 2024, the tougher macroeconomic environment has slowed its acquisition pace. However, periods of market volatility could create opportunities for Enghouse to acquire strategic targets at potentially compressed valuations in 2025.

Shift to Recurring Revenue Models

Enghouse Systems is strategically pivoting towards increasing its predictable, long-term recurring revenue streams, primarily through Software-as-a-Service and maintenance services. This focus reflects a broader economic trend in the software industry towards subscription-based models, offering greater revenue stability. For fiscal year 2024, recurring revenue is projected to constitute over 70% of total revenue, significantly insulating the company from the volatility of one-time licensing sales. This robust shift enhances financial predictability and supports sustained growth.

- Recurring revenue for Enghouse is projected to exceed 70% of total revenue in fiscal year 2024.

- SaaS and maintenance contracts are key drivers of this predictable revenue growth.

- This model significantly reduces exposure to fluctuating one-time licensing sales.

- The shift aligns with the software industry's prevailing subscription economy trend for 2024-2025.

Inflationary Pressures and Operating Costs

Persistent inflationary pressures are significantly increasing Enghouse Systems operating costs. The company has reported a notable decline in net income, reflecting not only these rising costs but also expenses tied to the integration of recent acquisitions. Enghouse is actively focusing on cost management and optimization to support margin expansion and ensure long-term growth through 2024 and into 2025.

- Enghouse reported a 15.3% decline in net income for Q1 fiscal 2024, partly due to increased operating expenses.

- Operating expenses rose to CAD 37.1 million in Q1 fiscal 2024 from CAD 31.9 million in the prior year.

- The company aims to optimize its cost structure to improve profitability margins in fiscal 2025.

Global economic volatility and inflation are increasing Enghouse Systems' operating costs and slowing revenue growth, with a 1% decline in the nine months ending July 2024. Foreign exchange fluctuations, notably a CAD 2.5 million Q2 2024 loss, add financial uncertainty. Despite high interest rates slowing M&A, Enghouse is strategically pivoting to recurring revenue, projected to exceed 70% in fiscal year 2024, enhancing predictability.

| Metric | 2024 Data | Impact |

|---|---|---|

| Revenue Growth (9M ending July) | -1% | Economic slowdown |

| FX Loss (Q2 2024) | CAD 2.5M | Currency volatility |

| Recurring Revenue (FY2024 Proj.) | >70% | Increased predictability |

What You See Is What You Get

Enghouse Systems PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis of Enghouse Systems delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides an in-depth understanding of the external forces shaping its strategic landscape. You'll gain insights into market trends, competitive pressures, and regulatory considerations vital for informed decision-making.

Sociological factors

The widespread shift to remote and hybrid work models significantly boosts demand for Enghouse's core offerings, including contact center and video collaboration software. Companies are actively investing in robust technologies to support their distributed workforces, creating a sustained market for solutions enabling effective virtual collaboration and customer service. By early 2025, Gartner reported that over 80% of organizations plan to maintain hybrid work structures, cementing this as a long-term strategic shift. This trend directly fuels Enghouse's revenue growth, with their Q1 2025 report noting increased adoption of their cloud-based communication tools.

Consumers increasingly expect seamless, hyper-connected, and personalized service across all channels, driving significant demand for advanced contact center solutions. This trend necessitates platforms that manage interactions via voice, email, chat, and social media efficiently. In 2025, ensuring customer trust and robust security against threats are paramount CX priorities for businesses. This fuels the need for secure communication platforms like those provided by Enghouse, with global spending on CX technology projected to exceed $650 billion by 2025 as companies prioritize these capabilities.

The increasing presence of Gen Z, projected to comprise 27% of the global workforce by 2025, profoundly reshapes workplace expectations, emphasizing flexibility and digital collaboration. This demographic shift accelerates the demand for remote work solutions and advanced communication platforms, with 75% of Gen Z prioritizing work-life balance. Companies are adapting recruitment and management for a digital-first environment, often seeing a 20% increase in productivity with hybrid models. Enghouse’s solutions are well-positioned to support these evolving needs for seamless, technology-enabled workplaces.

Growing Importance of Digital Health

The growing importance of digital health, significantly accelerated by the 2020 pandemic, continues to reshape healthcare delivery. This societal shift sees telehealth and virtual care solutions becoming integral, with projections indicating a global digital health market value exceeding $800 billion by 2025. Enghouse, through subsidiaries like Vidyo, directly capitalizes on this trend by providing essential ambulatory care and video health monitoring solutions. This sustained demand for remote healthcare services presents a robust growth opportunity for Enghouse’s specialized software offerings within the healthcare sector.

- Global telehealth market projected to reach $455 billion by 2025.

- Enghouse’s Vidyo platform supports over 100 million video minutes monthly in healthcare.

- North America leads digital health adoption, comprising over 40% of the market.

- Increased patient preference for virtual consultations drives continued investment in digital health infrastructure.

Demand for Digital Transformation in Traditional Sectors

Traditional sectors like telecom, utilities, and government, where many Enghouse customers operate, increasingly demand digital transformation to modernize legacy systems. This broad societal shift towards automation and cloud-based solutions represents a significant tailwind for Enghouse. Organizations are actively investing to enhance efficiency and analytics, with global digital transformation spending projected to reach over $3.4 trillion by 2026, up from an estimated $2.8 trillion in 2024, highlighting the sustained market opportunity.

- Global spending on digital transformation is forecast to exceed $3.4 trillion by 2026, showing robust growth.

- Utilities and government sectors are prioritizing investments in cloud migration and workflow automation in 2024/2025.

- Over 70% of enterprise IT budgets in traditional sectors are now allocated to modernization efforts.

Societal shifts towards hybrid work models, with over 80% of organizations planning to maintain them by early 2025, significantly boost demand for Enghouse's collaboration tools. The increasing presence of Gen Z, comprising 27% of the global workforce by 2025, further accelerates the need for flexible, digital-first communication solutions. Moreover, rising consumer expectations for seamless digital services and the rapid adoption of digital health, projected to exceed an $800 billion market by 2025, drive robust demand for Enghouse's specialized software.

| Sociological Trend | 2024/2025 Data Point | Impact on Enghouse |

|---|---|---|

| Hybrid Work Adoption | Over 80% of organizations plan to maintain hybrid work by early 2025. | Increased demand for collaboration and contact center solutions. |

| Gen Z Workforce Growth | Gen Z projected to comprise 27% of global workforce by 2025. | Drives need for flexible, digital-first communication platforms. |

| Digital Health Market | Global digital health market value to exceed $800 billion by 2025. | Strong growth opportunity for telehealth and virtual care software. |

Technological factors

Enghouse Systems is deeply integrating Artificial Intelligence (AI) and Machine Learning into its offerings to enhance efficiency, automation, and security. For example, AI is critical for fault management in complex network environments and for adaptive SMS fraud detection, bolstering communication integrity. The company also uses AI to glean actionable insights from customer interactions, refining service. However, Enghouse notes that despite AI's prominence, monetizing its full value often faces client caution and a wait-and-see adoption approach, impacting immediate revenue growth in these advanced areas.

The telecommunications industry's shift from 4G to 5G presents both significant opportunities and challenges. Enghouse Systems has proactively adapted its product portfolio, ensuring solutions are cloud-native and support 5G network functions. This includes making solutions available as containerized network functions (CNFs), a critical move as global 5G connections are projected to exceed 2 billion by late 2024. This technological transition fuels demand for sophisticated network infrastructure and management tools, a core focus for Enghouse's Asset Management Group, aligning with the industry's estimated 2025 5G infrastructure market size of over $30 billion.

The widespread shift from on-premise software to cloud-based Software-as-a-Service (SaaS) significantly impacts Enghouse Systems. The company strategically offers customers both on-premise and cloud deployment options to maintain revenue streams during this ongoing transition. While cloud growth remains a key strategic priority for Enghouse, it noted in its Q1 2024 financials that cloud business typically yields lower profit margins than traditional on-premise licenses, primarily due to associated platform and infrastructure costs. Enghouse continues to balance this evolving market demand with its profitability goals.

Cybersecurity and Data Privacy Technologies

The escalating cyber threat landscape fuels a critical demand for secure software solutions, compelling Enghouse Systems to prioritize robust embedded security and data protection measures. Enghouse focuses on delivering secure platforms, evident in features like encrypted call recording that meet stringent regulatory compliance, such as GDPR. Integrating advanced security technologies, including voice and facial biometrics, is essential for enhancing product offerings and sustaining customer trust. The global cybersecurity market is projected to exceed $270 billion by 2025, underscoring the urgency for such investments. This strategic emphasis helps mitigate risks, as the average cost of a data breach reached $4.45 million in 2023.

- Global cybersecurity market forecast to surpass $270 billion by 2025.

- Average cost of a data breach globally was $4.45 million in 2023.

- Enghouse prioritizes encrypted solutions for GDPR and similar compliance.

Growth of Unified Communications and Collaboration (UCC)

The burgeoning demand for unified communications platforms, integrating voice, email, chat, and video, significantly drives Enghouse Systems technological landscape. Enghouse Interactive's solutions directly address this, offering omnichannel capabilities seamlessly integrated with CRM systems. This strategic integration fosters a unified ecosystem, notably reducing operational complexity for clients. It also enables a more agile and innovative approach to customer and employee engagement, crucial for businesses in 2024/2025.

- Global UCC market is projected to reach approximately $100 billion by 2025, highlighting robust growth.

- Businesses adopting integrated UCC solutions report up to a 25% improvement in internal communication efficiency.

- CRM integration with UCC platforms can reduce average customer handling time by over 15%.

- Enghouse Interactive's focus on cloud-based UCC solutions aligns with over 60% of enterprise digital transformation initiatives in 2024.

Enghouse Systems is actively integrating AI and adapting to the 5G transition, with global 5G connections projected to exceed 2 billion by late 2024, driving demand for cloud-native solutions. The company navigates the significant shift to cloud-based SaaS, balancing lower cloud margins with traditional on-premise offerings. Escalating cybersecurity threats, with the market expected to surpass $270 billion by 2025, compel Enghouse to prioritize robust security features. Moreover, the burgeoning unified communications market, projected at $100 billion by 2025, shapes its product development, focusing on integrated, omnichannel platforms.

| Technological Trend | 2024/2025 Market Data | Enghouse Response |

|---|---|---|

| 5G Infrastructure | Over $30 billion by 2025 | Cloud-native, containerized solutions |

| Global Cybersecurity | Exceeds $270 billion by 2025 | Robust embedded security, encrypted platforms |

| Unified Communications & Collaboration (UCC) | Approximately $100 billion by 2025 | Omnichannel, CRM-integrated platforms |

Legal factors

Enghouse Systems operates under a complex global web of data privacy laws, notably the GDPR in Europe and various state-level regulations in the US, like California's CCPA. Non-compliance carries substantial risks, with potential GDPR fines reaching up to 4% of annual global turnover or €20 million, impacting profitability. These regulations mandate stringent data handling, robust security protocols, and transparency, directly influencing Enghouse's product development and data management strategies for 2024 and 2025. Adapting to these evolving legal frameworks is crucial for maintaining customer trust and avoiding significant financial penalties.

Enghouse Systems, serving sectors like healthcare and finance, navigates stringent industry-specific compliance standards such as HIPAA for health data and PCI DSS for payment security. Their software solutions must be meticulously designed to meet these requirements, especially given that global healthcare IT spending is projected to reach over $400 billion by 2025, with compliance a key driver. The evolving regulatory landscape, including new data privacy amendments for 2024-2025, mandates continuous adaptation of Enghouse's offerings to ensure robust protection of sensitive information, mitigating potential fines that can exceed millions for non-compliance.

New regulations like the EU AI Act, set to fully apply by mid-2026, and the Digital Operational Resilience Act (DORA), effective January 2025, are shaping the legal landscape for technology providers. The AI Act implements a risk-based approach to AI systems, impacting development and deployment. DORA, meanwhile, mandates stringent IT security and resilience standards for financial entities and their ICT suppliers, including software vendors like Enghouse. Enghouse must ensure its products and services, particularly those serving its substantial European client base, comply with these evolving requirements to avoid penalties and maintain market access.

Intellectual Property and Software Licensing Laws

As a software company, Enghouse Systems relies heavily on robust intellectual property protection, encompassing patents, copyrights, and comprehensive software licensing agreements. This legal framework is vital for safeguarding the company's core assets and its substantial revenue streams derived from proprietary software products. Enghouse's aggressive growth-by-acquisition strategy, evidenced by recent deals like the Altitude Software acquisition in February 2024, necessitates rigorous legal due diligence to assess and integrate the IP portfolios of acquired entities. Protecting these digital assets is paramount, especially given the global nature of software sales and the potential for infringement.

- Enghouse's licensing and maintenance revenue typically accounts for a significant portion of its total revenue, underscoring the importance of IP protection.

- The acquisition of new software companies, like Altitude, requires meticulous legal review of their patent and copyright portfolios to mitigate future risks.

- Global IP laws and regional variations directly impact Enghouse's ability to operate and enforce its rights across diverse markets.

Fair Trade and Competition Laws

Operating globally requires Enghouse Systems to meticulously comply with diverse fair trade and competition laws across its markets. These regulations, which govern practices like pricing, marketing, and strategic acquisitions, are crucial for fostering a fair business environment. Adherence is paramount for maintaining Enghouse's strong corporate reputation and mitigating risks of significant legal disputes or financial penalties, especially given increasing regulatory scrutiny in 2024-2025.

- The European Commission's Digital Markets Act (DMA), effective March 2024, exemplifies stricter global competition frameworks affecting tech companies.

- Antitrust enforcement actions globally saw a notable increase in H1 2024, with fines and divestitures becoming more common.

- Enghouse's acquisition strategy, involving over 50 companies since 2000, necessitates rigorous competition law due diligence in each jurisdiction.

Enghouse Systems operates within a complex global legal framework, meticulously adhering to data privacy regulations like GDPR and new mandates such as DORA, effective January 2025, which impact IT security standards. Robust intellectual property protection, encompassing patents and licensing, is crucial for its revenue streams and acquisition strategy, like the February 2024 Altitude Software deal. Compliance with fair trade and competition laws, including the DMA effective March 2024, is vital to avoid significant penalties and maintain market access across its diverse operational regions.

| Legal Factor | Key Regulation/Impact | 2024/2025 Data Point |

|---|---|---|

| Data Privacy | GDPR / CCPA Non-Compliance Fines | Up to 4% of annual global turnover or €20M |

| New Tech Regulations | DORA (Digital Operational Resilience Act) | Effective January 2025 for financial entities and ICT suppliers |

| Intellectual Property | Acquisition Due Diligence (e.g., Altitude Software) | Acquired February 2024, requiring IP integration |

Environmental factors

Enghouse Systems' software solutions significantly contribute to enabling customer sustainability by reducing their carbon footprints. For instance, their transportation optimization software helps transit agencies reduce fuel consumption, with some estimates showing potential for over 15% fuel savings and corresponding emission cuts in optimized urban routes by 2025. Furthermore, Enghouse's robust video conferencing and remote work platforms, widely adopted post-2020, continue to reduce the need for physical commuting and business travel, directly lowering transportation-related greenhouse gas emissions. This strategic focus aligns with increasing global corporate mandates for environmental responsibility and operational efficiency.

Enghouse Systems prioritizes minimizing its direct environmental impact through a comprehensive Environmental, Health, Safety and Sustainability (EHSS) Policy. The company acknowledges that addressing environmental challenges, such as reducing its carbon footprint, is fundamental for its continued corporate existence. While specific 2024 environmental performance metrics are generally not publicly detailed, Enghouse remains committed to continuous improvement in its operational sustainability practices. This commitment reflects a strategic response to increasing regulatory pressures and stakeholder expectations regarding corporate environmental responsibility.

The broader industry shift from on-premise hardware to cloud-based software services carries significant environmental implications. While cloud data centers are energy-intensive, with global data center energy consumption projected to increase by 20% by 2025, their consolidated computing resources can be more efficient than individual on-premise servers. Enghouse Systems' strategy of offering both cloud and on-premise solutions allows customers to choose the model that best fits their operational and potential environmental goals. This hybrid approach helps manage the carbon footprint associated with IT infrastructure. Enterprises migrating to cloud solutions often achieve energy savings, contributing to broader sustainability efforts.

Stakeholder and Investor Expectations on ESG

Stakeholders, including a growing base of investors, customers, and employees, increasingly demand robust Environmental, Social, and Governance (ESG) performance from companies by 2024 and into 2025. Enghouse Systems acknowledges this shift, with its Corporate Governance Committee actively overseeing ESG initiatives to ensure accountability. The company commits to transparent reporting on its ESG progress, demonstrating its dedication to responsible corporate management. This commitment is crucial as global sustainable investing assets are projected to exceed $50 trillion by 2025, emphasizing the financial imperative of strong ESG practices.

- By Q1 2025, over 80% of institutional investors consider ESG factors in investment decisions.

- Enghouse's Corporate Governance Committee ensures alignment with evolving ESG disclosure standards.

- Customer and employee preference for ESG-aligned companies impacts talent retention and market share.

- ESG performance is increasingly tied to access to capital and lower borrowing costs in 2024-2025.

Supply Chain and Partner Conduct

Enghouse Systems extends its sustainability commitment to its supply chain and business partners, reflecting a growing focus on environmental responsibility. The company maintains a robust Business Partner Code of Conduct, which explicitly outlines expectations for partners, including adherence to environmental standards. Ensuring that suppliers and partners align with Enghouse's ESG principles is crucial for mitigating supply chain risks and enhancing overall corporate environmental performance as of 2024. This integrated approach helps Enghouse maintain its sustainability goals across its operational footprint.

- Enghouse's ESG report highlights its commitment to responsible supply chain management.

- The Business Partner Code of Conduct sets clear environmental compliance expectations for all collaborators.

- Vendor adherence to environmental standards is increasingly scrutinized, impacting partner selection and relationships in 2024.

Enghouse Systems addresses environmental factors by enabling customer carbon footprint reduction, with transportation software potentially yielding over 15% fuel savings by 2025. The company maintains an EHSS Policy, committing to minimize its direct environmental impact and aligning with increasing global corporate mandates for sustainability. While global data center energy consumption is projected to increase by 20% by 2025, Enghouse's hybrid cloud strategy helps manage IT infrastructure carbon footprints efficiently. This strategic focus, coupled with robust supply chain environmental standards, responds to stakeholder demands, as global sustainable investing assets are expected to exceed $50 trillion by 2025.

| Metric Category | 2024/2025 Projections/Status | Relevance to Enghouse |

|---|---|---|

| Customer Carbon Reduction Potential | 15%+ fuel savings in optimized routes by 2025 | Demonstrates software's direct environmental benefit |

| Global Data Center Energy Consumption | Projected 20% increase by 2025 | Context for cloud solutions' environmental footprint |

| Sustainable Investing Assets (AUM) | Exceed $50 trillion by 2025 | Highlights financial imperative of ESG performance |

| Institutional Investor ESG Consideration | Over 80% by Q1 2025 | Reflects growing demand for corporate environmental responsibility |

PESTLE Analysis Data Sources

Our Enghouse Systems PESTLE Analysis is built on a robust foundation of publicly available data, including government reports, industry publications, and financial market analyses. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and societal trends to provide a comprehensive overview.