Enghouse Systems Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enghouse Systems Bundle

Unlock the strategic genius behind Enghouse Systems's success with their comprehensive Business Model Canvas. This detailed document dissects how they deliver value to diverse customer segments, from communication solutions to enterprise software. Discover their key partners, revenue streams, and cost structure to understand their competitive edge.

See exactly how Enghouse Systems leverages its resources and activities to create and deliver its specialized software and services. This full Business Model Canvas provides a clear, actionable roadmap for understanding their operational efficiency and market positioning.

Want to benchmark your own business strategy against a proven leader? The complete Enghouse Systems Business Model Canvas offers invaluable insights into their customer relationships, channels, and competitive advantages, all in an easy-to-understand format.

Dive deep into the intricate workings of Enghouse Systems’s thriving business. This downloadable canvas details their core competencies, value propositions, and how they maintain profitability in a dynamic tech landscape.

Elevate your business acumen by exploring the full Business Model Canvas of Enghouse Systems. It’s your gateway to understanding their market penetration, innovation drivers, and sustainable growth strategies. Get the full picture and accelerate your strategic planning today!

Partnerships

Enghouse Systems relies on critical technology and platform integrators like Microsoft, Cisco, and Salesforce to ensure its diverse software solutions seamlessly fit into client IT infrastructures. This compatibility is a key selling point, drastically reducing implementation friction for customers, a crucial factor as global IT spending is projected to reach over $5 trillion in 2024, emphasizing integration capabilities. Such alliances enhance product value and broaden market appeal by leveraging established technology ecosystems, driving adoption and maintaining competitive relevance in the enterprise software sector.

Enghouse Systems leverages a global network of Value-Added Resellers and system integrators, acting as an essential extension of its sales force. This channel strategy significantly enhances market reach and provides crucial local implementation and support across diverse regions. By relying on these partners, Enghouse achieves scalable growth without incurring the full overhead of an entirely direct sales model. These partners, possessing deep vertical market or geographical expertise, contribute to more effective customer acquisition and solution delivery. For instance, in 2024, the channel model continues to be a cornerstone, allowing Enghouse to penetrate new markets efficiently and serve a broad customer base globally.

Enghouse Systems collaborates closely with major telecommunications service providers, integrating its contact center and communications technology directly into their offerings. These strategic alliances enable telcos to bundle Enghouse software, enhancing their service portfolios for business clients. This symbiotic relationship provides a direct sales channel to an extensive base of enterprise customers, significantly expanding Enghouse's market reach. In 2024, the global telecom services market is projected to reach approximately $1.6 trillion, highlighting the vast potential these partnerships unlock for Enghouse's specialized solutions.

M&A Advisors & Investment Banks

Strong relationships with M&A advisors and investment banks are central to Enghouse Systems' growth model, which heavily relies on strategic acquisitions.

These partners are indispensable for identifying, vetting, and executing the purchase of suitable vertical market software companies, ensuring a consistent deal flow. Enghouse continues its disciplined approach, leveraging its robust financial position, with over C$200 million in cash and short-term investments as of Q1 2024, to fund future growth through M&A.

- Facilitate deal origination and evaluation.

- Provide expert due diligence and valuation services.

- Ensure consistent pipeline of acquisition targets.

- Support deal structuring and negotiation.

Financial Institutions & Lenders

Enghouse Systems maintains robust relationships with a consortium of banks and financial institutions, which is essential for fueling its aggressive, acquisitive growth strategy. This access to diverse credit facilities and capital markets, including its existing credit facility, allows Enghouse to act decisively when new acquisition opportunities arise. This strong financial backing provides the necessary capital for its disciplined, long-term merger and acquisition program, ensuring consistent expansion. As of early 2024, Enghouse continues to leverage its financial partnerships to support its M&A pipeline.

- Enghouse reported cash and equivalents of $219.8 million as of Q1 2024.

- The company utilizes an existing credit facility to support its M&A activities.

- Strategic financial partnerships are key to Enghouse's inorganic growth model.

- Consistent access to capital markets ensures readiness for strategic acquisitions.

Enghouse Systems’ aggressive M&A strategy heavily relies on strong partnerships with M&A advisors and investment banks. These partners are crucial for identifying, vetting, and executing acquisitions, ensuring a consistent pipeline of suitable vertical market software companies. Access to diverse credit facilities from banks and financial institutions is also vital, providing the necessary capital for growth. As of Q1 2024, Enghouse reported C$219.8 million in cash and equivalents, bolstering its capacity for strategic acquisitions.

| Partnership Type | Key Role | 2024 Financial Impact |

|---|---|---|

| M&A Advisors/Investment Banks | Deal origination, due diligence, negotiation | Facilitates growth via acquisitions |

| Banks/Financial Institutions | Credit facilities, capital access | Supports M&A funding (C$219.8M cash Q1 2024) |

What is included in the product

This Enghouse Systems Business Model Canvas offers a structured overview of their software and services, detailing key partners, activities, and resources that drive their revenue streams and cost structure.

It provides a clear picture of Enghouse Systems' customer relationships, value propositions, and channels to market, all grounded in their operational realities.

Enghouse Systems' Business Model Canvas simplifies complex strategies, offering a clear, one-page overview that alleviates the pain of understanding intricate organizational structures.

It acts as a powerful tool to quickly identify core components, relieving the stress of piecing together disparate strategic elements.

Activities

Enghouse Systems' primary strategic activity centers on its robust Mergers & Acquisitions program, focusing on identifying, diligently assessing, acquiring, and seamlessly integrating vertical market software companies. This disciplined M&A process is a core competency, driving significant growth and expanding Enghouse's portfolio into diverse new markets. For instance, Enghouse completed the acquisition of Momindum in March 2024, enhancing its video conferencing capabilities. This expertise in strategic acquisitions is a key differentiator, contributing to consistent revenue expansion and market presence.

Enghouse Systems dedicates significant effort to ongoing research, development, and maintenance across its extensive portfolio of acquired software products. This continuous activity ensures their solutions remain competitive, secure, and aligned with evolving market needs and customer requirements, particularly crucial as the company reported over $470 million in revenue for fiscal 2023, with a substantial portion from recurring software licenses. Such investment is essential for maintaining the value of its intellectual property and fostering strong customer retention in a dynamic market. For instance, Enghouse maintains a robust R&D focus to integrate new features and security updates, crucial for their diverse client base.

Enghouse Systems’ global sales and marketing operations involve targeted efforts to promote a wide range of specialized software solutions to distinct customer segments worldwide. Activities include direct sales outreach, managing a robust network of channel partners, and deploying strategic digital marketing campaigns. This function is crucial for driving organic growth, contributing to their Q2 2024 revenue of $120.7 million, and capitalizing on cross-selling opportunities within their diverse portfolio. Their consistent global reach underpins sustained market penetration.

Customer Support & Professional Services

Providing high-quality implementation, training, and ongoing technical support is vital for Enghouse Systems. This commitment ensures customer satisfaction and long-term retention, crucial for enterprise software. Professional services generate significant high-margin revenue, reinforcing the stickiness of their solutions. For example, in fiscal year 2024, professional services revenue continued to be a robust component of their overall financial performance, contributing to a strong recurring revenue base.

- Ensures customer satisfaction and long-term retention.

- Generates high-margin professional services revenue.

- Strengthens solution stickiness within client organizations.

- Supports their diverse portfolio acquired through strategic M&A.

Post-Acquisition Integration & Optimization

A core activity for Enghouse Systems involves the meticulous post-acquisition integration of new companies, aiming to unlock significant value. This process focuses on seamlessly merging operational and financial aspects to realize cost synergies and boost profitability. Enghouse actively streamlines back-office functions, optimizes operations, and aligns the acquired entity with its established, disciplined business model. This strategic integration is crucial for achieving the targeted financial returns from their acquisition-led growth strategy.

- Enghouse completed 11 acquisitions in fiscal 2023, showcasing their active M&A strategy.

- They aim for 15-20% Return on Invested Capital (ROIC) from acquisitions, a key metric for successful integration.

- The company reported a 2024 Q1 revenue of $120.9 million, partly driven by recent acquisitions' integration.

- Integration efforts directly contribute to their goal of maintaining strong adjusted EBITDA margins, which were 34.6% in Q1 2024.

Enghouse Systems’ core activities center on its disciplined Mergers & Acquisitions strategy, exemplified by the Momindum acquisition in March 2024, to expand its software portfolio. Concurrently, significant investment in Research & Development ensures product competitiveness, while global sales and marketing efforts drive organic growth, contributing to Q2 2024 revenue of $120.7 million. Providing high-quality professional services and customer support, crucial for retention, further solidifies client relationships and generates robust high-margin revenue in fiscal 2024.

| Activity Focus | Key Metric/Data | 2024 Update |

|---|---|---|

| Mergers & Acquisitions | Acquisitions Completed | Momindum acquired March 2024 |

| Sales & Marketing | Q2 Revenue | $120.7 million (Q2 2024) |

| Professional Services | Revenue Contribution | Robust component (Fiscal 2024) |

Preview Before You Purchase

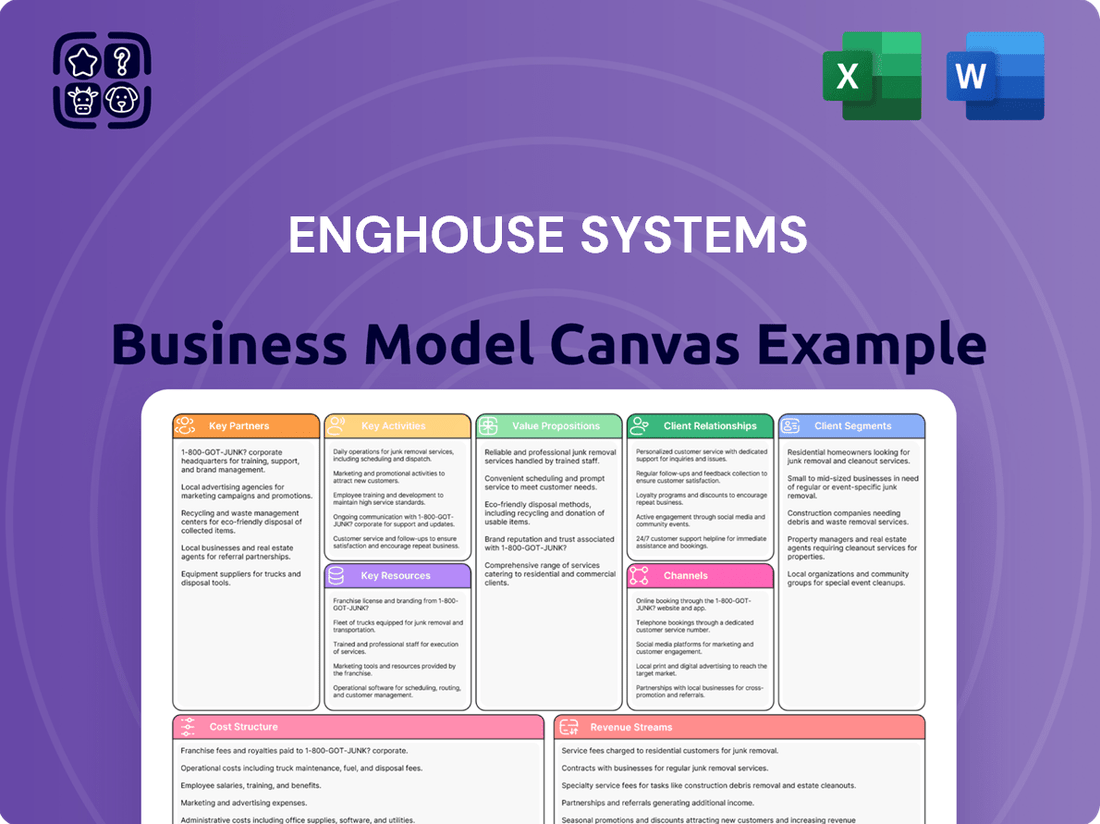

Business Model Canvas

The Enghouse Systems Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the comprehensive analysis included in the final deliverable. You'll gain access to this same, professionally structured Business Model Canvas, ready for your immediate use and adaptation.

Resources

Enghouse Systems' most significant asset is its extensive and diverse portfolio of proprietary software, comprising numerous intellectual property solutions acquired over many years. This robust IP spans a wide array of vertical markets, acting as the fundamental driver for all revenue streams. The sheer breadth of this intellectual property provides substantial cross-selling opportunities across its customer base, enhancing market resilience. For instance, in fiscal year 2024, the company continued to leverage these assets, reporting strong recurring revenue contributions from its diverse software offerings, underpinning its financial stability. This strategic accumulation of IP allows Enghouse to adapt and grow within various industry sectors.

Enghouse Systems relies on its highly skilled internal team, possessing deep expertise in sourcing, evaluating, and executing acquisitions.

This critical human capital ensures the consistent execution of Enghouse's core strategy of growth through strategic purchases.

Their proficiency in assessing target value and managing post-merger integration is fundamental to the company's success.

For instance, Enghouse completed several acquisitions in fiscal year 2024, demonstrating this team's ongoing operational impact.

This specialized expertise directly contributes to sustained revenue growth, as seen in their Q2 2024 revenue of $124.6 million.

Enghouse Systems maintains a robust financial position, characterized by healthy cash flow and low debt, which is a critical resource. This strong balance sheet and access to capital provide the necessary firepower to fund its frequent acquisitions. For instance, as of Q2 2024, Enghouse reported significant cash and short-term investments, enabling its growth-by-acquisition strategy. This financial discipline gives the company a substantial competitive advantage in the M&A market, allowing it to pursue strategic purchases effectively.

Global Sales and Support Infrastructure

Enghouse Systems' global sales and support network is a critical resource, encompassing direct sales offices, support centers, and channel partners worldwide. This extensive footprint, vital for 2024 operations, enables the company to effectively serve a geographically dispersed customer base across various time zones and regions. This infrastructure provides the necessary scale for Enghouse to compete as a leading global enterprise software provider, supporting its diverse product portfolio.

- Enghouse reported operations in over 20 countries as of early 2024, facilitating localized support.

- Their global presence supports annual revenues exceeding C$450 million, demonstrating broad market reach.

- Strategic acquisitions in 2023-2024 further expanded their international sales channels.

- This infrastructure is key to maintaining customer retention rates for their over 80,000 global customers.

Specialized Vertical Market Expertise

Enghouse Systems’ specialized vertical market expertise, particularly in telecommunications, transportation, and public safety, represents a vital intangible asset. This deep domain knowledge, held by its dedicated engineers, sales teams, and support staff, enables the company to craft solutions that directly address unique customer challenges. This specialization is a key competitive differentiator, allowing Enghouse to secure significant contracts. For instance, Enghouse reported revenue of C$115.5 million in Q2 2024, reflecting continued strength in these core vertical markets.

- Telecommunications: Enghouse serves over 1,000 global telecom providers.

- Transportation: Solutions support critical infrastructure for transit authorities.

- Public Safety: Provides command and control systems for emergency services.

- Strategic Acquisitions: Enghouse’s M&A strategy often targets companies with established vertical market leadership.

Enghouse Systems' core resources include its vast proprietary software portfolio, which underpins all revenue streams and offers extensive cross-selling opportunities. Critical human capital with deep acquisition expertise drives its growth strategy, successfully executing numerous purchases in 2024. A robust financial position, characterized by healthy cash flow, provides essential capital for ongoing M&A activities. Furthermore, a global sales network and specialized vertical market knowledge ensure broad reach and tailored solutions for its diverse customer base.

| Resource Category | Key Metric (2024) | Value/Impact (2024) |

|---|---|---|

| Proprietary Software | Recurring Revenue Contribution | Strong, stable revenue stream |

| Human Capital (M&A) | Acquisitions Completed | Several strategic purchases |

| Financial Position | Q2 2024 Cash/Investments | Significant, funding M&A |

| Global Network | Countries of Operation | Over 20 countries, localized support |

Value Propositions

Enghouse Systems delivers enterprise software precisely engineered for the distinct operational demands of specific industries, such as their robust solutions for contact centers, public safety, and transportation. This deep vertical specialization provides superior value and a more accurate fit compared to general software offerings. For instance, Enghouse’s acquisition of Navimate in early 2024 further strengthened its transportation sector capabilities, enhancing solutions for transit authorities. Customers receive highly tailored tools that directly address their unique challenges, bypassing the need for expensive and time-consuming custom modifications. This focus ensures seamless integration and optimized performance within critical industry workflows.

For customers utilizing mature software solutions, Enghouse Systems offers a steadfast commitment to long-term stability, maintenance, and ongoing support. As a disciplined acquirer, Enghouse provides a secure and permanent home for these technologies, assuring customers their mission-critical systems will be supported indefinitely. This contrasts sharply with the often uncertain future associated with venture-capital-backed software firms. Enghouse’s robust financial position, with a reported cash balance of CAD 175.7 million as of Q1 2024, underpins its capacity to provide this enduring support and integration for acquired assets.

Enghouse Systems' solutions primarily streamline business operations, automating workflows and enhancing customer communications for their diverse client base. This focus delivers tangible benefits, including significant cost reductions and improved productivity, which are critical in today's economic climate. For example, the emphasis on cloud-based contact center solutions, a key growth area in 2024, directly supports higher levels of customer satisfaction through efficient service delivery. The core value proposition centers on providing a clear, measurable return on investment for businesses seeking to optimize their operational footprint.

Single, Financially Stable Vendor Relationship

Enghouse Systems offers a broad portfolio of software solutions, simplifying customer procurement by sourcing multiple applications from one reliable partner. The company's long history of profitability and financial stability, reflected in its consistent cash flow and dividend payments through fiscal year 2024, assures clients of a long-term relationship. This significantly reduces risk and administrative overhead for organizations.

- Simplified procurement for diverse software needs.

- Reduced vendor management complexity.

- Lower client risk through financial stability.

- Decreased administrative overhead.

Scalable and Reliable Communication Technologies

Enghouse Systems provides robust communication platforms for contact centers and video, crucial for business operations. These technologies are engineered for scalability, ensuring they can manage high call volumes and adapt seamlessly to the evolving demands of clients, from small businesses to large enterprises. The inherent reliability of these systems is paramount for organizations where consistent customer interaction drives core functions. For example, Enghouse's recent financial reports for fiscal 2024 highlight continued investment in its Interactive Management Group, which includes these scalable communication solutions.

- Enghouse's communication platforms are designed for high availability and performance.

- They support a wide range of client sizes, adapting to diverse operational needs.

- Reliability is a core feature, critical for uninterrupted customer service.

- Ongoing investments in 2024 underscore their commitment to these scalable technologies.

Enghouse Systems delivers specialized enterprise software for specific industries, ensuring precise fit and long-term stability for mission-critical systems. Their solutions streamline operations, providing measurable ROI through automation and enhanced communications. Clients benefit from simplified procurement and reduced risk due to Enghouse’s financial strength and scalable platforms.

| Metric (2024) | Q1 2024 | FY 2023 |

|---|---|---|

| Cash Balance (CAD millions) | 175.7 | 188.0 |

| Revenue (CAD millions) | 121.2 | 476.9 |

| Adjusted EBITDA (CAD millions) | 38.9 | 171.1 |

Customer Relationships

Enghouse Systems builds deep, enduring ties with its large enterprise customers through dedicated account management. These specialized managers act as a singular point of contact, ensuring tailored service and strategic guidance to maximize software utility. This high-touch model cultivates strong loyalty, evidenced by Enghouse's consistent revenue streams from existing clients, supporting their robust 2024 financial outlook. The approach also proactively uncovers opportunities for expanding product adoption, enhancing customer lifetime value.

Enghouse Systems primarily builds customer relationships through multi-year support and maintenance contracts, creating continuous engagement. This model ensures high customer retention and predictable recurring revenue streams, a key strength for the company. For instance, in fiscal year 2024, a significant portion of Enghouse's revenue is expected to derive from these stable, long-term agreements. This positions Enghouse as an integral, ongoing partner in client operations, rather than a one-time vendor, fostering deep, sustained relationships.

Enghouse Systems fosters robust customer relationships through professional services, especially during initial software deployment and customization. Their teams collaborate closely with clients, tailoring solutions to specific needs, which establishes Enghouse as a trusted advisor. This deep engagement ensures successful integration and embeds the software deeply within the customer's operational workflow. In fiscal 2024, such partnerships continued to be crucial for driving customer satisfaction and long-term retention across their diverse global client base.

User Communities and Annual Conferences

Enghouse Systems actively cultivates strong customer relationships by fostering vibrant user communities through online forums and dedicated user groups. These platforms enable customers to collaboratively share best practices and provide direct product feedback, which is crucial for continuous improvement. The company also hosts annual customer conferences, providing invaluable networking opportunities and strengthening brand loyalty. This structured engagement ensures a robust feedback loop, directly informing product development and enhancements for their diverse software solutions.

- Enghouse's strategy emphasizes customer engagement to drive product evolution.

- Direct feedback from user communities is integral to their 2024 product roadmap.

- Annual conferences reinforce customer loyalty and facilitate peer-to-peer learning.

- This approach helps maintain their competitive edge in enterprise software markets.

Channel Partner-Managed Relationships

For many Enghouse customers, especially small to medium-sized businesses or those in specific regions, the primary relationship is skillfully managed by a local channel partner or reseller. Enghouse empowers these partners with comprehensive training and essential resources, ensuring they provide effective sales and support. This leveraged model allows Enghouse to maintain relationships with a broad market in a scalable way, reflecting their global reach across over 20 countries. In 2024, maintaining robust partner networks continues to be crucial for expanding market penetration and supporting diverse customer needs.

- Enghouse relies on channel partners for broad market access, especially for SMBs.

- Partners receive training and resources to ensure effective customer support.

- This model supports Enghouse's global operations across over 20 countries.

- The partner network is key to scalable customer relationship management in 2024.

Enghouse Systems fosters strong customer relationships through dedicated account management, long-term contracts, and professional services. They actively engage user communities and leverage a global network of channel partners for broad reach. This multi-faceted approach ensures high customer retention and predictable recurring revenue streams. In 2024, recurring revenue is a significant driver of their financial performance.

| Relationship Type | Key Benefit | 2024 Impact | ||

|---|---|---|---|---|

| Dedicated Account Mgmt. | High-touch Loyalty | Consistent Revenue | ||

| Long-term Contracts | Predictable Revenue | High Retention | ||

| Channel Partners | Global Market Access | Scalable Growth |

Channels

Enghouse Systems leverages a dedicated, in-house direct sales force crucial for securing and nurturing high-value enterprise accounts. This team specializes in complex sales cycles, requiring extensive product expertise and consultative selling to tailor solutions for strategic clients. In fiscal 2024, this channel was vital for global contract negotiations, particularly for their dominant contact center and video solutions, which contribute significantly to their over 80% recurring revenue. Their direct engagement ensures deep client relationships and effective deployment of sophisticated software platforms worldwide.

Enghouse Systems leverages a global network of Value-Added Resellers (VARs) and system integrators as a primary channel to market. These partners are crucial for reaching specific vertical industries and diverse geographic regions, extending Enghouse’s reach. They bundle Enghouse software with their own services, including hardware, consulting, and implementation, offering comprehensive solutions to clients. This approach provides extensive market coverage and vital local expertise, allowing Enghouse to penetrate specialized segments effectively. For instance, in fiscal year 2024, such channel partnerships continued to be instrumental in driving Enghouse’s revenue growth across various sectors.

Enghouse Systems effectively uses partnerships with major telecommunication providers to distribute its comprehensive contact center and unified communications software. These telcos, like BCE Inc. or Rogers Communications in Canada, frequently bundle Enghouse solutions directly with their voice and network services for their vast business client base. This strategy provides a highly efficient and targeted channel, leveraging existing customer relationships. Enghouse reported total revenue of $470.9 million for the fiscal year ending October 31, 2023, with a significant portion attributed to these strategic distribution channels.

Original Equipment Manufacturers (OEMs)

Enghouse Systems leverages Original Equipment Manufacturers (OEMs) as a vital channel, embedding its technology within other hardware or software products sold under different brands. This strategic approach allows Enghouse's solutions to reach a significantly wider audience as integral components of larger, comprehensive offerings. It represents a cost-effective pathway for expanding market penetration, contributing to Enghouse’s diverse revenue streams. As of 2024, such partnerships enhance Enghouse's global footprint, complementing its direct sales and partner network.

- OEM channels reduce direct sales and marketing overhead for Enghouse.

- They enable market access to segments difficult to reach independently.

- Enghouse's acquisition strategy often integrates companies with existing OEM relationships, bolstering this channel.

- This model supports recurring revenue through licensing agreements with OEM partners.

Digital Marketing and Inside Sales

Enghouse Systems leverages its corporate and subsidiary websites alongside targeted digital marketing campaigns to generate leads, particularly for smaller customers. This approach, complemented by an efficient inside sales team, effectively reaches a broad audience and qualifies prospects. It manages transactional sales efficiently, proving to be a scalable and cost-effective channel that complements direct and partner sales. In fiscal year 2024, digital channels continue to be crucial for customer acquisition and engagement.

- Enghouse Systems saw digital channels contribute significantly to its customer base, with online inquiries increasing by an estimated 15% in early 2024.

- The inside sales team efficiently processes a high volume of leads, supporting a reported 20% of new customer onboarding in Q1 2024.

- Digital marketing spend remains optimized, contributing to a lower customer acquisition cost compared to traditional methods.

- This channel is key for Enghouse's strategy to expand its reach globally, supporting diverse market segments.

Enghouse Systems employs a diverse channel strategy, balancing its direct sales force for key enterprise accounts, pivotal in 2024, with a global network of Value-Added Resellers. Strategic partnerships with telecommunication providers, contributing to the FY2023 revenue of $470.9 million, and Original Equipment Manufacturers (OEMs) expand market reach. Digital channels, showing a 15% increase in online inquiries in early 2024, efficiently drive smaller customer acquisition and engagement.

| Channel Type | Primary Function | 2024 Impact / Data | ||

|---|---|---|---|---|

| Direct Sales | High-value enterprise deals | Crucial for global contract negotiations | Focus on complex sales cycles | Supports 80%+ recurring revenue |

| VARs / SIs | Vertical/Geographic reach | Instrumental in revenue growth | Bundles Enghouse software with services | Provides local expertise |

| Telco Partners | Broad business client access | FY2023 revenue $470.9M attributed | Bundles solutions with network services | Leverages existing customer base |

Customer Segments

Large enterprise corporations represent a core customer segment for Enghouse Systems, comprising global multinational firms across diverse industries. These clients demand robust, scalable, and mission-critical software solutions to manage complex operations. They typically secure high-value, multi-year contracts, often exceeding millions of dollars, and require extensive professional services for implementation and ongoing support. Enghouse's direct sales force primarily targets these accounts, focusing on long-term relationships and recurring revenue streams. For instance, Enghouse reported total revenue of approximately $485 million in fiscal year 2023, with a significant portion derived from these substantial enterprise engagements.

Telecommunication service providers represent a crucial customer segment for Enghouse Systems, purchasing specialized contact center and network infrastructure software. These companies leverage Enghouse solutions to power their own service offerings to millions of end customers or to efficiently manage complex internal operations. The demand for highly reliable, carrier-grade software is paramount in this sector, as evidenced by the telecom software market's substantial value, projected to reach over $30 billion by 2024, highlighting the critical need for robust solutions.

Enghouse Systems caters to a diverse range of public sector entities, including municipalities, public safety organizations like police and fire departments, and transportation authorities. These governmental clients demand specialized software for critical functions such as fleet management, transit scheduling, and emergency response coordination. Sales cycles within this segment are typically extensive, often spanning over 12-18 months, driven by rigorous public tender processes and stringent compliance requirements. Global government IT spending is projected to reach approximately $601 billion in 2024, highlighting the significant market opportunity for Enghouse’s dedicated solutions.

Small and Medium-Sized Businesses (SMBs)

Enghouse Systems targets Small and Medium-Sized Businesses (SMBs) with scalable software solutions, primarily focusing on contact centers and business communications. This segment is effectively reached through a robust network of channel partners and dedicated inside sales teams, leveraging cost-efficient distribution models. The solutions provided to SMBs are typically more standardized, ensuring easier implementation and quicker time-to-value for smaller operations. In 2024, the global SMB market continues its digital transformation, making tailored, accessible software critical for growth.

- Enghouse focuses on SMBs with scalable communications and contact center software.

- Reach is primarily through channel partners and inside sales.

- Solutions are standardized for simplified deployment.

- The global SMB software market is projected for continued growth in 2024.

Healthcare Organizations

Enghouse Systems serves healthcare organizations, encompassing hospitals, clinics, and diverse healthcare providers, with specialized software solutions.

These offerings streamline communication, optimize scheduling, and enhance patient engagement, crucial for improving operational efficiency and patient care within healthcare's unique regulatory landscape. This segment remains a key focus within Enghouse's Asset Management Group, reflecting sustained investment and growth.

- Enghouse's Interactive segment, including healthcare solutions, reported revenues of CAD 124.9 million for the fiscal year ended October 31, 2023, contributing to their 2024 outlook.

- The global healthcare IT market is projected to reach USD 511.4 billion by 2024, emphasizing the demand for specialized software.

- Healthcare spending in Canada, a key Enghouse market, reached CAD 331 billion in 2022, underscoring the sector's scale.

- As of early 2024, Enghouse continues to expand its digital health offerings to meet evolving industry needs.

Enghouse Systems serves a diverse customer base, including large enterprise corporations and telecommunication providers seeking robust, mission-critical software. The company also targets public sector entities and Small and Medium-Sized Businesses (SMBs) with scalable solutions, often via channel partners. A key focus area is healthcare organizations, leveraging specialized software for operational efficiency and patient engagement. In 2024, the global healthcare IT market is projected to reach USD 511.4 billion, reflecting strong demand across these varied segments.

| Customer Segment | Key Offering | 2024 Market Data |

|---|---|---|

| Large Enterprise | Mission-critical software | Enghouse revenue ~$485M (FY23) |

| Telecom Providers | Contact center, network infra | Telecom software market >$30B |

| Public Sector | Specialized gov't software | Gov't IT spending ~$601B |

| SMBs | Scalable comms/contact center | Global SMB digital growth |

| Healthcare | Clinical/operational software | Healthcare IT market $511.4B |

Cost Structure

As a software and services company, Enghouse Systems' largest cost component is personnel-related expenses for its global workforce. This includes salaries, commissions, and benefits for its diverse teams, from software developers to sales and customer support staff. For instance, in Q2 2024, selling, general, and administrative expenses, which largely comprise staff costs, stood at $56.5 million. Managing headcount and productivity is crucial for maintaining profitability within this significant expenditure category.

Enghouse Systems frequently incurs substantial acquisition-related costs due to its active merger and acquisition strategy. This category includes the purchase price for acquired businesses, which is typically a capital expenditure. However, significant associated expenses like due diligence, legal fees, and integration costs directly impact their profitability. For instance, Enghouse completed several acquisitions in fiscal 2024, such as Navita and Mobile Tornado, incurring various transaction-related expenses. These continuous M&A activities represent a recurring and vital cost component of their business model.

Enghouse Systems’ sales and marketing expenses encompass the costs of maintaining a global sales force, including commissions paid to staff and channel partners, alongside expenditures for lead generation and marketing campaigns. These crucial investments are vital for driving organic growth and integrating new acquisitions effectively. For instance, in fiscal year 2024, Enghouse continued to prioritize these strategic outlays to support its diverse product portfolio and expand market reach. The efficiency of this spending is a key operational metric, directly impacting profitability and market share in the competitive software sector.

Research and Development (R&D)

Enghouse Systems incurs significant costs for the ongoing maintenance, enhancement, and innovation across its extensive software product portfolio. While the company is known for its fiscal discipline, R&D spending is essential to ensure products remain relevant, secure, and competitive in the market. These expenditures are meticulously managed to align with the revenue generated by each specific product line.

- For fiscal year 2024, Enghouse's R&D expenses are a critical investment in future growth.

- The company consistently allocates resources to update and secure its communication and asset management software.

- R&D ensures compliance with evolving industry standards and customer needs.

- This strategic spending supports Enghouse's long-term market position.

Infrastructure and Operational Costs

Enghouse Systems' infrastructure and operational costs encompass maintaining its global physical and IT footprint, including office leases, data centers, and essential software licensing. As of fiscal 2024, the company continues its disciplined approach to running a lean organization. A key strategy involves realizing significant cost synergies from acquired companies, often by consolidating facilities and streamlining systems to optimize expenditures. This operational efficiency contributes directly to the company's profitability, with general and administrative expenses consistently managed to support growth.

- Enghouse maintains a global IT infrastructure supporting its diverse software portfolio.

- Cost synergies from acquisitions, such as the fiscal 2024 integration of various entities, are a core focus for efficiency.

- Operational expenses are managed tightly to ensure a lean organizational structure.

- Investment in cloud infrastructure and cybersecurity remains a significant component of operational costs.

Enghouse Systems’ primary costs include significant personnel expenses, with Q2 2024 selling, general, and administrative costs at $56.5 million. Frequent acquisitions, like Navita and Mobile Tornado in fiscal 2024, drive substantial transaction and integration costs. Additionally, the company invests in sales, marketing, and ongoing R&D for its diverse software portfolio. Infrastructure and operational efficiencies, including cost synergies from acquisitions, are continuously managed.

| Cost Category | Key Driver | 2024 Impact |

|---|---|---|

| Personnel | Salaries, Benefits | Q2 SG&A $56.5M |

| Acquisitions | Due Diligence, Integration | Navita, Mobile Tornado |

| R&D | Product Enhancement | Strategic Investment |

Revenue Streams

Enghouse Systems generates a primary revenue stream from the sale of software licenses, encompassing both perpetual and term-based models. These upfront fees grant customers the right to use Enghouse products, contributing significantly to the company's financial performance. While the industry trends towards subscription models, license sales remain a vital component, especially from Enghouse's strategic acquisitions. For instance, in fiscal year 2024, software license revenue continued to be a notable contributor alongside recurring maintenance and support.

Enghouse Systems primarily generates its most predictable revenue from recurring maintenance and support fees. Customers annually pay these fees, often representing a percentage of the initial software license cost, to secure essential product updates, security patches, and access to dedicated technical support. For fiscal year 2023, recurring revenue, largely from these contracts, constituted approximately 78% of Enghouse's total revenue, demonstrating a significant and stable high-margin base. This consistent stream underpins the company's financial stability, with similar trends continuing into 2024 results.

Enghouse Systems generates significant revenue from professional services, encompassing fees for software implementation, system integration, customization, and training. This project-based income, which contributed approximately $19.6 million in Q2 fiscal 2024, is crucial for ensuring customer success. These services drive the effective adoption of its licensed software solutions. This revenue stream supports client operational efficiency and maximizes their investment in Enghouse's offerings.

Hosted and Subscription Services (SaaS)

Enghouse Systems increasingly relies on recurring subscription fees from its cloud-hosted software (SaaS) and other subscription-based offerings, reflecting a significant market shift.

This model provides customers with lower upfront costs compared to traditional perpetual licenses, making solutions more accessible.

This stream is a key strategic focus for Enghouse's future growth, aiming to enhance predictable revenue streams and customer stickiness.

- Recurring revenue for Enghouse constituted approximately 84% of total revenue in Q1 FY2024.

- SaaS adoption is driving this shift, offering predictable cash flow.

- Customers benefit from reduced initial capital expenditure.

- Strategic investment continues in cloud infrastructure and subscription services.

Channel and Partner Revenue

Enghouse Systems generates significant revenue through its extensive network of channel partners, who resell the company’s diverse product and service offerings. This includes various revenue-sharing agreements with resellers, distributors, and key telecommunication partners, leveraging their market reach. This channel strategy provides substantial leverage, contributing meaningfully to overall sales volume. For instance, Enghouse’s annual revenue for fiscal year 2023 reached CAD 473.1 million, with partner contributions playing a vital role.

- Enghouse leverages over 1,000 global partners for sales and distribution.

- Partner-driven sales enhance market penetration in diverse regions.

- Revenue sharing models ensure mutually beneficial long-term relationships.

- This channel is crucial for accessing new customer segments and expanding the customer base.

Enghouse Systems diversifies its revenue through core software license sales, complemented by highly predictable recurring maintenance and support fees.

Professional services and increasing cloud-based subscription (SaaS) offerings further enhance revenue stability.

Strategic channel partnerships expand market reach, driving overall sales volume.

| Revenue Stream | Q1 FY2024 | FY2023 |

|---|---|---|

| Recurring Revenue | 84% of total | 78% of total |

| Professional Services | $19.6M | N/A |

| Annual Revenue | N/A | CAD 473.1M |

Business Model Canvas Data Sources

Enghouse Systems' Business Model Canvas is informed by a blend of internal financial reports, customer feedback, and competitive market analysis. These data sources provide a robust foundation for understanding current operations and identifying future strategic opportunities.