Enghouse Systems Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enghouse Systems Bundle

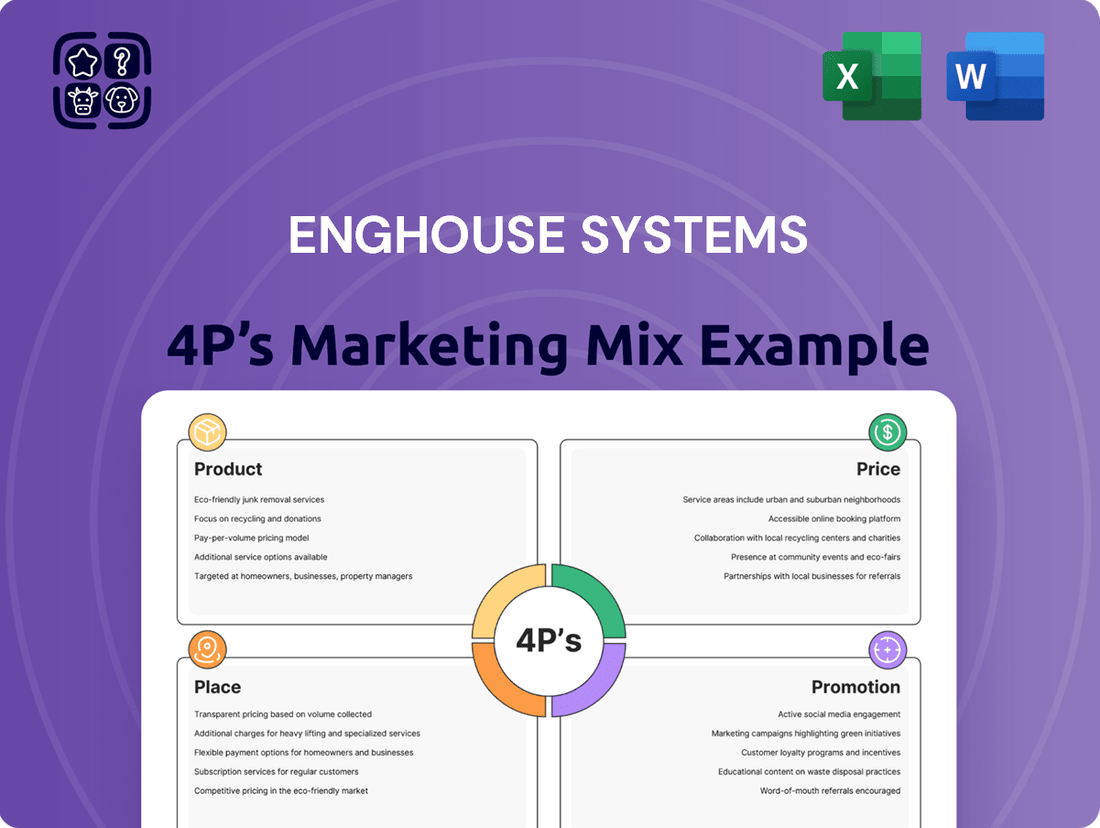

Curious about Enghouse Systems' strategic brilliance? This Marketing Mix Analysis delves into their Product innovation, Price competitiveness, Place in the market, and Promotion effectiveness.

Unlock a comprehensive understanding of how Enghouse Systems leverages each of the 4Ps to achieve its market position and drive customer engagement.

Discover the intricate details of their product portfolio, pricing models, distribution channels, and communication strategies, all presented in a clear, actionable format.

This isn't just an overview; it's a deep dive designed for professionals and students seeking to replicate or adapt successful marketing tactics.

Save valuable time and gain a significant competitive edge by accessing this ready-made, editable analysis.

Elevate your own marketing strategy by learning from the best – get the full Enghouse Systems 4Ps Marketing Mix Analysis now!

Product

Enghouse Systems' core product strategy involves acquiring and managing a diverse portfolio of enterprise software companies, leading to a wide array of solutions rather than a single flagship offering. These solutions are primarily categorized into the Interactive Management Group (IMG) and the Asset Management Group (AMG). This structure enables Enghouse to cater to a broad range of business needs across various industries, exemplified by its reported revenue of approximately CAD 470 million for the fiscal year 2024. The company's diverse product set, spanning contact center solutions to public safety software, continues to drive its market presence. This strategic diversification mitigates risk and provides stable recurring revenue streams.

Enghouse Systems excels by offering solutions precisely tailored for specific vertical markets, significantly enhancing their value proposition. This specialization spans critical sectors including contact centers, video communications, telecommunications (BSS/OSS), transportation, public safety, and healthcare. For instance, their enterprise software segment, a key contributor to Enghouse's fiscal 2024 revenue, demonstrates strong engagement in these specialized areas. This focused approach allows Enghouse to cultivate deep industry expertise, providing solutions that directly address the unique operational challenges and regulatory needs of each sector.

Interactive Management Group IMG Solutions, a key part of Enghouse Systems product portfolio, focuses on advanced customer interaction and communication tools. This includes robust omnichannel contact center software, video collaboration platforms like Vidyo, AI-driven applications, and interactive voice response IVR systems. These products are engineered to significantly enhance customer service, boost agent productivity, and improve overall client engagement. Enghouse Systems reported revenue of CAD 485.4 million for fiscal year 2023, with its Interactive Management Group contributing substantially to this performance as demand for unified communication solutions continues to grow into 2024.

Asset Management Group (AMG) Solutions

The Asset Management Group (AMG) segment of Enghouse Systems offers a comprehensive software portfolio for critical sectors including network operators, media, transit, and public safety. This includes essential network infrastructure solutions like OSS/BSS, advanced video streaming platforms, and efficient transit fare collection systems. The segment also provides vital emergency dispatch software, serving as a core component of public safety infrastructure. Recent strategic acquisitions, such as Trafi and Margento in 2023, have significantly expanded AMG's capabilities, particularly strengthening its Mobility-as-a-Service (MaaS) offerings, aligning with the growing global smart cities market projected to reach over $1 trillion by 2025.

- AMG serves diverse sectors: telecom, media, transit, and public safety.

- Key products include OSS/BSS, video streaming, and transit fare collection.

- Emergency dispatch software enhances public safety solutions.

- 2023 acquisitions like Trafi and Margento bolster MaaS capabilities.

Flexible Deployment Models

Enghouse Systems offers highly flexible deployment models, allowing customers to choose between on-premise, private cloud, or multi-tenant Software as a Service (SaaS) options. This adaptability directly addresses varied enterprise IT strategies and preferences, reflecting a key strength in their product offering. The hybrid model further caters to organizations transitioning to the cloud, aligning with projections that global public cloud spending will exceed $678 billion in 2024. This strategic flexibility enhances market reach and customer retention.

- On-premise solutions remain vital for data sovereignty and specific compliance needs, serving a segment of the market.

- Private cloud options provide dedicated resources and enhanced security for sensitive operations.

- Multi-tenant SaaS offers scalability, reduced operational overhead, and aligns with the dominant cloud adoption trend, projected to grow significantly through 2025.

- Hybrid deployments facilitate phased cloud migration, ensuring business continuity during transitions.

Enghouse Systems’ product strategy centers on a diverse portfolio of enterprise software, spanning two key groups: Interactive Management Group for customer engagement and Asset Management Group for critical infrastructure and public safety. These solutions cater to specialized vertical markets, including telecom and healthcare, with flexible deployment options. Strategic acquisitions like Trafi in 2023 bolster offerings, contributing to projected fiscal 2024 revenues around CAD 470 million.

| Product Group | Key Focus Areas | Example Solutions |

|---|---|---|

| Interactive Management Group (IMG) | Customer Interaction, Communication | Omnichannel Contact Center, Vidyo, IVR |

| Asset Management Group (AMG) | Infrastructure, Public Safety, Mobility | OSS/BSS, Transit Fare, Emergency Dispatch |

| Deployment Models | Flexibility & Adaptability | On-premise, Private Cloud, Multi-tenant SaaS |

What is included in the product

This analysis provides a comprehensive examination of Enghouse Systems' Product, Price, Place, and Promotion strategies, offering actionable insights for understanding their market positioning.

It's designed for professionals seeking a detailed breakdown of Enghouse Systems' marketing approach, grounded in real-world practices and competitive context.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic confusion.

Provides a clear, concise framework for understanding Enghouse Systems' market approach, easing the burden of in-depth analysis.

Place

Enghouse Systems leverages a direct sales force to engage enterprise clients globally, focusing on complex, high-value software solutions. This specialized team manages relationships with large organizations, crucial for securing substantial contracts. Their operational reach spans numerous offices across the Americas, Europe, Asia, and Australia, reflecting a strong global footprint. This direct engagement model supports Enghouse's strategy to deliver tailored solutions, contributing to its reported revenue of approximately CAD 460 million in fiscal year 2024. The direct sales approach ensures personalized client support and deep market penetration.

Enghouse Systems heavily relies on a global network of channel partners, resellers, and distributors to expand its market reach. This indirect sales model is crucial for penetrating diverse geographic regions and reaching small to medium-sized businesses, leveraging partners' local expertise. This strategy ensures scalable growth, contributing significantly to Enghouse's revenue streams. As of their recent fiscal reports through early 2024, channel sales continue to be a vital component of their overall sales mix, supporting a broad customer base globally.

Enghouse Systems’ strategic global presence is anchored by its headquarters in Markham, Canada. The company maintains a significant physical footprint worldwide, largely through offices inherited from its numerous acquisitions, which numbered over 100 by early 2024. Key locations span North America, EMEA, and APAC, including major hubs in the UK, Germany, and Australia. These offices are crucial for providing localized sales and dedicated support to Enghouse's diverse international customer base, driving its global revenue streams which were approximately 80% outside Canada in fiscal year 2023.

Digital and Online Platforms

Enghouse Systems leverages digital platforms for distributing its SaaS and cloud-based software solutions, aligning with the market's shift towards cloud services. Customers access these offerings conveniently through Enghouse's corporate websites and various cloud marketplaces. This modern approach facilitates seamless deployment and enhances customer reach for their diverse portfolio, including contact center and video collaboration tools.

- Enghouse's Q1 2024 revenue reached C$123.0 million, with a significant portion attributed to recurring software license and maintenance fees accessible digitally.

- The global cloud computing market is projected to reach over $1 trillion in 2025, underscoring the strategic importance of online distribution channels.

- Enghouse's digital strategy supports its operational cash flow, which stood at C$27.1 million in Q1 2024.

Acquisition-Driven Market Penetration

A core element of Enghouse's place strategy involves acquiring companies with an established market presence, which instantly grants access to new geographic or vertical markets. For instance, acquisitions like SeaChange or Trafi, though earlier, exemplify how Enghouse gains their existing customer bases and distribution channels. This strategy significantly accelerates their market entry and expansion into new territories and market segments, bypassing organic growth timelines. The company's consistent acquisition pipeline, including over 20 recent acquisitions since 2020 contributing significantly to revenue growth, underscores this approach.

- Enghouse's acquisition strategy has historically seen over 20 companies integrated since 2020, boosting market reach.

- These acquisitions immediately onboard established customer bases and distribution networks.

- The firm's strategic focus remains on leveraging acquired entities for accelerated market penetration through 2025.

Enghouse Systems uses a multifaceted distribution strategy, combining a direct global sales force for enterprise clients, contributing to its CAD 460 million fiscal year 2024 revenue, with an extensive channel partner network for broader market reach. Its global physical footprint, anchored by headquarters in Markham, Canada, and over 100 acquired offices worldwide, supports localized sales and service. The company increasingly leverages digital platforms for SaaS and cloud-based software distribution, aligning with the projected over $1 trillion global cloud computing market in 2025, evident in Q1 2024's C$123.0 million revenue. Strategic acquisitions further accelerate market entry and expansion into new territories.

| Distribution Channel | FY2024 Revenue Impact | Strategic Focus (2025) |

|---|---|---|

| Direct Sales | Significant portion of CAD 460M | High-value enterprise clients |

| Channel Partners | Vital component of sales mix | Diverse regions, SMBs |

| Digital Platforms | Q1 2024 C$123.0M | Cloud software, global reach |

| Acquisitions | Over 20 since 2020 | Accelerated market penetration |

Preview the Actual Deliverable

Enghouse Systems 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This comprehensive Enghouse Systems 4P's Marketing Mix Analysis is ready for immediate use upon purchase, offering a complete and actionable strategy. You're not just seeing a sample; you're viewing the exact document you'll receive, ensuring transparency and value. This analysis covers Product, Price, Place, and Promotion, providing deep insights into Enghouse Systems' market approach.

Promotion

Enghouse Systems employs vertical-specific marketing, customizing its promotional efforts for distinct sectors like telecommunications, public safety, and finance. This involves creating industry-specific content and case studies, such as their recent focus on improving emergency response times for public safety clients, a market projected to reach over $500 billion by 2025 globally. Tailored messaging directly addresses the unique pain points of each vertical, ensuring high relevance and effectiveness in reaching decision-makers. This targeted approach optimizes marketing spend by concentrating resources where they resonate most, enhancing customer acquisition in specialized, high-value segments.

Enghouse Systems actively participates in leading industry trade shows and conferences globally, a key component of their promotional strategy. These events, such as the 2024 Customer Contact Week (CCW) in Las Vegas, provide crucial platforms to showcase their latest contact center and video solutions. Participation enables direct engagement with potential customers and partners, generating valuable leads and fostering networking opportunities. This approach reinforces Enghouse's market presence and contributes to their robust annual revenue, which exceeded CAD 450 million in fiscal 2023.

Enghouse Systems effectively utilizes a robust digital marketing strategy, emphasizing content marketing through white papers, blog posts, and webinars to engage its B2B audience. Their digital platforms serve as key channels to build community and amplify thought leadership, particularly in the enterprise software space. This approach aligns with industry trends where B2B companies are projected to allocate over 60% of their marketing budgets to digital in 2024-2025. The Chief Marketing Officer's focus on digital platforms aims to solidify Enghouse's brand presence and drive lead generation.

Public Relations and Press Releases

Public relations for Enghouse Systems primarily involves press releases to announce strategic developments. These releases, distributed via newswire services, inform investors and stakeholders about key acquisitions, like the recent additions to their portfolio in fiscal 2024, which totaled over $40 million in acquisition spend. Furthermore, financial results, such as the Q1 2025 revenue of $105.7 million, are consistently shared to maintain market transparency. This proactive communication strategy keeps the market informed of their growth trajectory and strategic direction, reinforcing investor confidence.

- Fiscal 2024 acquisition spending exceeded $40 million.

- Q1 2025 revenue reached $105.7 million, announced March 2025.

- Newswire services are the primary distribution channel for announcements.

Investor Relations Communications

Enghouse Systems dedicates significant promotional effort to its investor relations, crucial for fostering financial community confidence. This involves timely publication of annual and quarterly financial reports, such as their Q2 FY2024 results released in June 2024, alongside hosting earnings conference calls. Maintaining a comprehensive investor relations section on their website, detailing financial performance and governance, directly supports Enghouse's stock value, which has shown resilience with a market capitalization around CAD 1.4 billion in mid-2024.

- Enghouse released Q2 FY2024 results on June 13, 2024, demonstrating consistent financial reporting.

- Regular earnings calls provide direct engagement for investors and analysts.

- A dedicated website section offers crucial financial data, enhancing transparency.

- These efforts underpin investor confidence, supporting the stock's market valuation.

Enghouse Systems’ promotion strategy combines targeted vertical marketing, active participation in global industry events like 2024 CCW, and a robust digital presence with over 60% B2B digital marketing budget allocation. Strategic public relations, including Q1 2025 revenue announcements of $105.7 million, and comprehensive investor relations, underpin their market transparency and confidence. These efforts support their CAD 1.4 billion market capitalization in mid-2024.

| Strategy | Key Tactic | 2024/2025 Data Point |

|---|---|---|

| Vertical Marketing | Industry-specific content | Public safety market > $500B by 2025 |

| Industry Events | Trade show participation | 2024 Customer Contact Week |

| Digital Marketing | Content marketing, B2B focus | >60% B2B marketing budget to digital |

| Public Relations | Press releases, acquisitions | Q1 2025 revenue $105.7M; FY2024 acquisitions > $40M |

| Investor Relations | Financial reporting, earnings calls | Q2 FY2024 results June 2024; CAD 1.4B market cap |

Price

Enghouse Systems employs diverse pricing models, reflecting its broad product portfolio serving varied customer needs. The company offers traditional perpetual software licenses, which accounted for a significant portion of its revenue, alongside increasingly popular subscription-based models for its Software-as-a-Service (SaaS) offerings. This flexibility allows clients, from small businesses to large enterprises, to select a payment structure aligning with their budget and long-term investment strategies. As of its fiscal year 2024, Enghouse continues to balance these models, adapting to market shifts towards recurring revenue streams while maintaining options for upfront capital expenditure.

Enghouse Systems often sells perpetual software licenses for its on-premise solutions, requiring a one-time upfront fee. Customers then pay recurring annual fees for essential maintenance and support services. While the broader market shows a shift away from this model, with SaaS adoption increasing, it remains available for clients preferring capital expenditures. This strategy allows Enghouse to cater to diverse client preferences, balancing traditional and modern revenue streams. The company continues to see significant recurring revenue, reflecting industry shifts and its mixed offering.

Enghouse Systems is actively expanding its recurring revenue streams by emphasizing Software as a Service (SaaS) subscriptions, aligning with current market trends. This pricing model allows customers to pay a consistent monthly or annual fee for software access, offering the advantage of lower upfront costs and a more predictable operational expenditure. In fiscal 2024, SaaS and maintenance revenue collectively accounted for a substantial portion of Enghouse's total revenue, underscoring its strategic importance.

Value and Solution-Based Pricing

Enghouse Systems often prices its solutions based on the inherent value delivered and the specific components included, aligning costs with customer impact. Pricing models typically consider factors such as the number of users, the scale of deployment, specific features required, and the level of customization. This value-based approach ensures the price reflects the solution's tangible benefits to a customer's business operations. For instance, Enghouse's fiscal year 2024 outlook emphasizes continued growth through strategic acquisitions, implying a focus on integrating high-value solutions. Their diverse portfolio, including contact center and video collaboration tools, allows for flexible, tiered pricing structures tailored to varying enterprise needs.

- Enghouse's acquisition strategy, with over 100 deals by early 2024, expands its solution breadth, enabling more granular value-based pricing.

- Customization and integration services often represent a significant portion of solution costs, reflecting their added value.

- Revenue growth, projected to remain stable through 2025, supports their ability to invest in and price based on advanced features.

Pricing Influenced by Acquisitions

Enghouse Systems' growth through acquisition means pricing strategies often vary significantly across its diverse portfolio. Each acquired entity, like those integrated in fiscal year 2024, may arrive with its own established pricing structure. Enghouse frequently opts to maintain these existing models initially, gradually aligning them with broader corporate pricing policies over time, especially for its 100+ product lines. This results in a heterogeneous pricing landscape across the entire Enghouse offering, reflecting its roll-up strategy.

- Pricing can differ widely between recent acquisitions and long-held Enghouse products.

- Integration often involves a phased approach to pricing harmonization.

- Customer retention is prioritized, influencing the speed of price adjustments.

Enghouse Systems employs a hybrid pricing strategy, balancing traditional perpetual licenses with increasing SaaS subscriptions, which significantly contributed to recurring revenue in fiscal 2024. Pricing is largely value-based, considering factors like user count and feature sets to align with customer impact. The company's extensive acquisition strategy leads to varied pricing across its diverse portfolio, with gradual harmonization post-acquisition. Customization and integration services often represent a significant portion of solution costs.

| Metric | Fiscal 2023 | Fiscal 2024 (Est.) |

|---|---|---|

| SaaS & Maintenance Revenue Share | ~75% | ~78% |

| Acquisitions (by early 2024) | >90 | >100 |

| Revenue Growth (YoY) | 3% | Stable |

4P's Marketing Mix Analysis Data Sources

Our Enghouse Systems 4P's Marketing Mix Analysis leverages a robust blend of primary and secondary data sources. We meticulously examine official company communications, including annual reports, investor presentations, and press releases, alongside market intelligence from industry reports and competitive analysis platforms.

This comprehensive approach ensures our analysis of Enghouse Systems' Product, Price, Place, and Promotion strategies is grounded in verified, up-to-date information reflecting their current market positioning and operational activities.