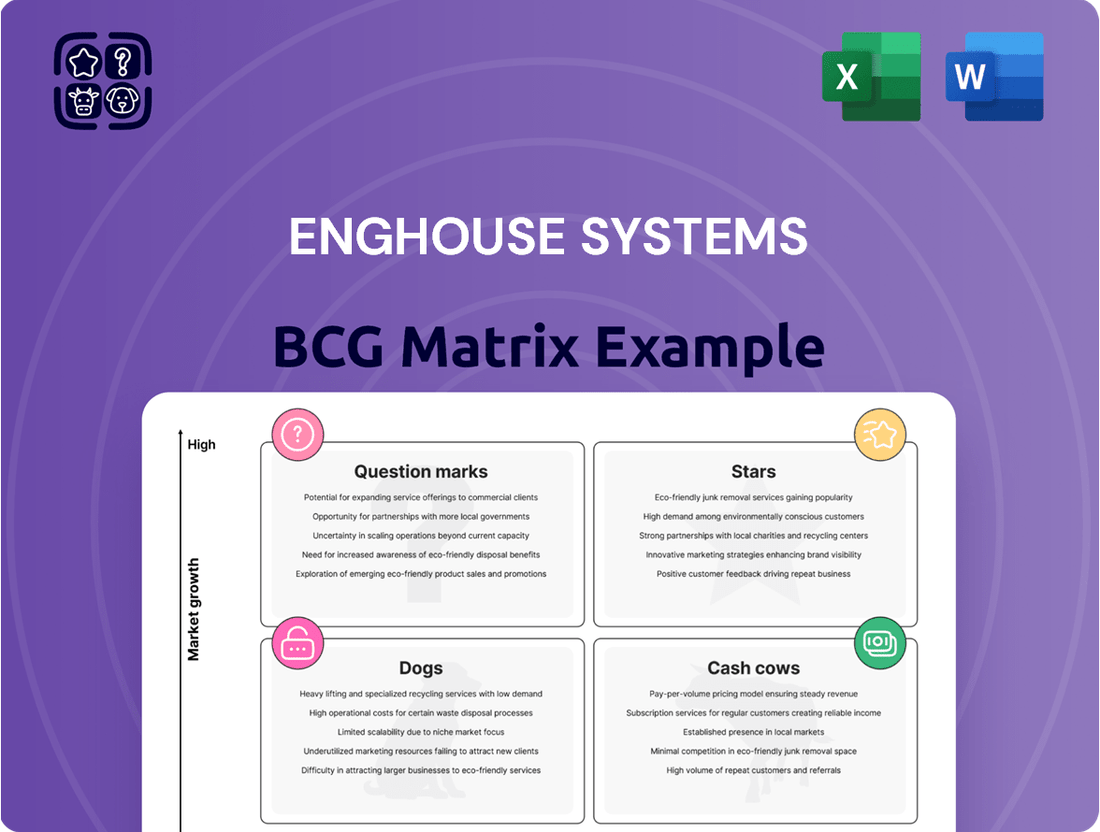

Enghouse Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enghouse Systems Bundle

Enghouse Systems' BCG Matrix reveals a snapshot of its diverse product portfolio. Discover which offerings are market leaders and which need strategic attention. Understanding these dynamics is crucial for informed decision-making. This preliminary view barely scratches the surface of their competitive standing. The full BCG Matrix unveils a deeper analysis. Purchase the complete report for strategic insights.

Stars

Enghouse Systems prioritizes growth via acquiring vertical market software companies, a core strategy. This bolsters their market presence and product offerings, potentially transforming acquisitions into Stars. In 2024, Enghouse's acquisition strategy continued, adding to its diverse portfolio.

Enghouse Systems is emphasizing recurring revenue, particularly from SaaS and maintenance, which is growing. In 2024, these streams make up a considerable share of their revenue. This steady income allows for investing in growth sectors, potentially turning them into Stars.

Enghouse Systems' investment in AI, particularly for its customer experience market, is a strategic move. Since 2019, Enghouse has been developing AI solutions, culminating in the recent launch of its EnghouseAI suite. This initiative aligns with the growing demand for AI in contact centers. The global AI in the contact center market was valued at USD 1.6 billion in 2023 and is projected to reach USD 5.8 billion by 2028, according to Mordor Intelligence.

Expansion in Transportation and Public Safety

Enghouse Systems is strategically expanding in transportation and public safety, aiming for growth. Recent acquisitions, including Margento and Trafi, strengthen its offerings, especially in Mobility-as-a-Service (MaaS). These sectors show significant potential for Enghouse. Successful integration and market penetration of these solutions are key.

- Enghouse's revenue in fiscal year 2024 was approximately $580 million.

- The global MaaS market is projected to reach $1.7 trillion by 2030.

- Enghouse acquired Trafi in 2023 to enhance its transportation solutions.

- Public safety technology spending is expected to grow steadily in the coming years.

Strategic Partnerships

Enghouse Systems actively cultivates strategic partnerships to bolster its market presence and expand its service offerings. A key example is its collaboration with Voxtron to extend cloud contact center technology in the Middle East, demonstrating a proactive approach to entering new geographic markets. These alliances are crucial for driving growth and innovation, providing Enghouse with access to new customer bases and technological capabilities. In 2024, strategic partnerships contributed significantly to Enghouse's revenue streams.

- Partnerships are essential for market expansion.

- Collaborations drive innovation and access to new technologies.

- Enghouse's revenue benefits from these strategic moves.

- The Voxtron partnership exemplifies geographic growth.

Enghouse Systems’ AI solutions and its expanding presence in the high-growth Mobility-as-a-Service (MaaS) sector are poised as key Stars. The global AI in contact center market is projected to grow to $5.8 billion by 2028, reflecting high market growth. Similarly, the MaaS market's projected $1.7 trillion by 2030 highlights significant growth potential for Enghouse, especially with acquisitions like Trafi in 2023.

| Area | 2023 Value | 2028/2030 Projection |

|---|---|---|

| AI in Contact Center Market | $1.6 Billion | $5.8 Billion (2028) |

| Global MaaS Market | N/A | $1.7 Trillion (2030) |

| Enghouse Fiscal 2024 Revenue | $580 Million | N/A |

What is included in the product

Strategic assessment of Enghouse's business units using BCG Matrix, suggesting investment, hold, or divest decisions.

Clear quadrant placement simplifies strategy. Easy share & print.

Cash Cows

Enghouse Systems' Interactive Management Group (IMG), encompassing contact center solutions, is a significant revenue driver. This segment likely operates as a cash cow due to its established market position. Recurring revenue from maintenance and SaaS subscriptions solidifies its cash-generating capability. In fiscal year 2024, Enghouse reported a revenue of CAD 607 million, with a notable portion coming from its IMG segment.

Enghouse Systems' Asset Management Group (AMG) provides solutions for telecom service providers, including network infrastructure and revenue generation. These established products likely represent cash cows, generating steady revenue. For instance, in 2024, the AMG segment contributed significantly to Enghouse's overall revenue, demonstrating its financial stability. This stable customer base ensures consistent cash flow, crucial for funding other business areas.

Enghouse Systems' maintenance and support services are a significant cash cow. Recurring revenue, including maintenance, forms a large portion of their total income. These services for their software base offer dependable, high-margin cash flow. In fiscal year 2024, recurring revenue accounted for over 70% of total revenue. This steady income stream supports strategic investments.

Legacy Systems in Utilities and Government

Enghouse Systems supports legacy systems in utilities and government, sectors often characterized by slow growth. This segment generates consistent, predictable revenue, fitting the cash cow profile. For example, in 2024, Enghouse's public sector revenue was $200 million. These systems require ongoing maintenance and support, ensuring stable cash flow.

- Steady revenue from legacy system maintenance.

- Public sector revenue in 2024 was $200M.

- Predictable cash flow.

- Lower growth potential.

Profitable Transportation Division

Enghouse Systems' transportation division is a Cash Cow. This division remains profitable despite market headwinds, suggesting its solutions generate robust cash flow. As of 2024, the transportation segment's revenue contributed significantly to Enghouse's overall financial performance, showcasing its strong market position.

- Profitability despite market challenges.

- Solutions generate strong cash flow.

- Significant revenue contribution.

Enghouse Systems’ cash cows, including its Interactive and Asset Management Groups, along with maintenance services, consistently generate high-margin recurring revenue. These established segments provide stable cash flow, critical for strategic investments. In fiscal year 2024, recurring revenue exceeded 70% of Enghouse's CAD 607 million total revenue. The legacy systems and transportation divisions further contribute to this reliable cash generation.

| Cash Cow Segment | Key Characteristic | 2024 Contribution | ||

|---|---|---|---|---|

| Maintenance & Support | Recurring Revenue | >70% of total revenue | ||

| Public Sector (Legacy) | Stable Revenue | $200M revenue | ||

| Total Revenue | Overall Performance | CAD 607M |

Full Transparency, Always

Enghouse Systems BCG Matrix

This preview delivers the identical Enghouse Systems BCG Matrix you'll receive after purchase. It’s a complete, ready-to-implement strategic tool, offering data-driven insights immediately accessible for your analysis.

Dogs

Enghouse Systems, known for acquisitions, faces challenges with underperforming businesses. Some acquired companies or product lines may struggle to gain market share or meet growth targets. In 2024, the company reported a 5% decrease in revenue from certain acquired segments. Integration issues and market fit challenges often contribute to this underperformance.

Enghouse Systems likely has products in low-growth, low-market share segments, sometimes called "Dogs." These could be older or niche offerings in markets where Enghouse doesn't have a strong position. Such products might need continued support without delivering significant profits. For instance, a specific legacy software might have minimal revenue growth, reflecting its status. In 2024, Enghouse's overall revenue was approximately $460 million.

In fiercely competitive software spaces, some Enghouse products could lag in market share. They might struggle against bigger rivals, especially if innovation is slow.

Products with Declining Demand

In Enghouse Systems' portfolio, "Dogs" represent products with waning demand, often due to tech advancements or evolving customer preferences. The post-pandemic period saw a decline in demand for some video conferencing tools, impacting Enghouse's related offerings. These products face low growth and potentially low market share unless addressed. For example, Enghouse’s revenue decreased by 2.3% in 2023.

- Revenue Decline: Enghouse Systems experienced a 2.3% revenue decrease in 2023, signaling potential issues with some product lines.

- Market Share: Products in this category may have shrinking market share if not actively managed.

- Strategic Action: Divestiture or revitalization is crucial for these underperforming products.

- Post-Pandemic Impact: The drop in demand for video conferencing tools highlights the volatility.

Non-Core or Divested Assets

In the BCG Matrix, "Dogs" represent business units with low market share in a slow-growing market, a fitting description for Enghouse's non-core assets. Enghouse might have units that don't align with its current strategic focus. These units, with limited growth prospects, become prime candidates for divestiture. Enghouse's acquisition-heavy strategy often leads to the identification of assets that underperform or no longer fit the overall vision.

- Enghouse Systems reported revenue of $564.8 million in fiscal year 2023.

- The company has made numerous acquisitions over the years.

- Divestitures can free up capital for core growth initiatives.

- Non-core assets may include older software or niche products.

Enghouse Systems' Dogs are typically legacy products or niche offerings with low market share in slow-growth markets. These segments might include older software that saw a 5% revenue decrease in 2024 from certain acquired segments. Such units often require continued support without generating significant profits, potentially impacting Enghouse's overall revenue, which was approximately $460 million in 2024.

| Category | Characteristics | 2024 Impact |

|---|---|---|

| Dogs | Low Market Share, Low Growth | 5% Revenue Decrease (certain segments) |

| Financials | Legacy Products, Niche Offerings | Approx. $460M Overall Revenue |

| Strategic Action | Divestiture, Minimal Investment | Focus on Core Growth Initiatives |

Question Marks

Newly acquired companies like Aculab, Margento, and Trafi represent potential "Question Marks" in Enghouse Systems' BCG matrix. These firms operate in growing markets, yet their immediate impact is limited by their small market share. For instance, Aculab's market share in 2024 was 3% within its specific sector, demonstrating the need for integration. Success hinges on effective integration and scaling within Enghouse's existing structure. The goal is to transition these acquisitions into "Stars" or "Cash Cows" by increasing their market presence.

Enghouse Systems' venture into AI is ongoing, but it's still early days. The market's embrace of their AI solutions, especially fresh or cutting-edge ones, remains uncertain. For instance, revenue from AI-driven products accounted for about 8% of total revenue in 2024. This area is still evolving, and its future is not yet fully defined.

Enghouse's new product ventures are initially question marks within its BCG matrix. These solutions aim for high-growth markets, but their market share success is pending. In 2024, Enghouse allocated a significant portion of its R&D budget toward these initiatives, totaling $85 million. The market response and revenue generation from these products will determine their future classification.

Expansion into New Vertical Markets

Expansion into new vertical markets can be a strategic move for Enghouse Systems, but it often comes with challenges. When entering new markets, Enghouse's initial offerings might experience slower growth. This is typical as they build brand recognition and customer base. The success hinges on effective integration and understanding of the new market dynamics.

- Revenue Growth: Enghouse Systems reported a revenue of $580.7 million in Q1 2024.

- Acquisition Strategy: Enghouse has a history of acquisitions, such as the purchase of Altitude Software in 2023.

- Market Presence: Establishing a significant market presence takes time and resources.

- Vertical Focus: The company serves various verticals including telecommunications and healthcare.

Solutions in Rapidly Evolving Technologies (e.g., 5G, Cloud, IoT)

Enghouse Systems has a presence in rapidly evolving tech sectors, including 5G, cloud services, and IoT. These areas are marked by fast changes and competition. Enghouse aims to grow its market share in these dynamic sectors. The demand for 4G to 5G solutions has been slower than expected.

- Enghouse's focus includes communication software and service offerings that are relevant to 5G, cloud, and IoT.

- Market dynamics in these areas involve quick shifts and intense competition.

- The company is working to capitalize on opportunities in the growing markets of 5G, cloud, and IoT.

- Sales for the year 2024 are projected to be $598.8 million.

Enghouse Systems' ventures into rapidly evolving tech sectors like 5G, cloud services, and IoT represent Question Marks. These areas offer high growth potential but come with significant competition and uncertain market share. For instance, the demand for 4G to 5G solutions has been slower than expected, impacting immediate market penetration. Despite this, Enghouse is actively working to expand its presence, with projected 2024 sales of $598.8 million.

| Sector | Growth Potential | Market Share (2024) |

|---|---|---|

| 5G Solutions | High | Developing |

| Cloud Services | High | Developing |

| IoT | High | Developing |

BCG Matrix Data Sources

Enghouse Systems' BCG Matrix leverages financial statements, market analysis, and industry research for data-driven positioning.