Emami SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emami Bundle

Emami, a prominent player in the FMCG sector, showcases a robust brand portfolio and a strong distribution network, key strengths driving its market presence. However, like any dynamic company, it faces potential challenges that warrant a deeper look.

Discover the complete picture behind Emami’s market position with our full SWOT analysis. This in-depth report reveals actionable insights into its strengths, the opportunities it can seize, and the threats it needs to mitigate.

Want the full story behind Emami's growth drivers and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Emami Limited boasts a robust and diversified product portfolio spanning personal care, healthcare, and even segments like edible oils. This broad range mitigates risks associated with over-reliance on any single product category, ensuring stability. For instance, in fiscal year 2024, the company reported strong performance across its key segments, with personal care and healthcare products forming the backbone of its revenue.

The company's strength lies in its well-established brands, including Navratna, BoroPlus, Fair and Handsome, and Zandu Balm. These brands have cultivated significant consumer loyalty and enjoy high recall, especially for their trusted ayurvedic and natural formulations. This strong brand equity translates directly into consistent demand and a competitive edge in the market.

Emami possesses an exceptionally strong distribution network, touching an impressive 4.9 million retail outlets throughout India. This vast reach isn't confined to cities; it extends deeply into semi-urban and rural areas, a significant advantage in the Indian market.

Through initiatives like 'Project Khoj,' Emami has actively broadened its direct engagement with rural consumers, ensuring its products are readily available even in remote locations. This deep penetration is a crucial differentiator, allowing Emami to capture a wider customer base than many competitors.

Emami's financial health is a significant strength. The company has consistently grown its revenue, with a notable figure of ₹3,624.89 crore reported for FY24. This growth is complemented by healthy profit margins, indicating efficient operations and strong market positioning.

Profitability metrics further underscore Emami's financial prowess. In FY24, the company achieved a Profit After Tax (PAT) of ₹727.86 crore. Furthermore, a Return on Equity (ROE) of 31.81% demonstrates the company's ability to effectively generate profits from shareholder investments.

The company's commitment to cost management and operational efficiencies is evident in its expanding gross and EBITDA margins. These improvements highlight Emami's focus on optimizing its operations, which directly contributes to its overall profitability and effective utilization of capital.

Strategic Acquisitions and Innovation Focus

Emami has a strong track record of strategic acquisitions, which have been instrumental in broadening its product portfolio and market reach. Notable acquisitions include Zandu, Kesh King, Creme 21, and Dermicool, each contributing to Emami's presence in various consumer segments. This inorganic growth strategy has allowed the company to quickly gain market share and access new customer bases.

The company's commitment to innovation is evident in its continuous launch of new products and variants. Emami is particularly focused on digital-first offerings, leveraging its Direct-to-Consumer (D2C) platform, Zanducare, to connect with modern consumers. This approach ensures that Emami remains relevant by adapting to changing consumer preferences and embracing new sales channels.

- Acquisition Success: Brands like Kesh King, acquired in 2015, have shown significant growth under Emami's management, becoming a leading player in the hair oil segment.

- Innovation Pipeline: Emami consistently invests in R&D, with a focus on natural and Ayurvedic products, aligning with growing consumer demand for wellness.

- D2C Expansion: The Zanducare platform has been a key area of investment, with Emami aiming to strengthen its digital presence and direct customer engagement.

- Market Penetration: Acquired brands have helped Emami penetrate deeper into rural and semi-urban markets, complementing its urban stronghold.

Growing International Presence

Emami's growing international presence is a significant strength, with its products reaching consumers in over 70 countries. This broad geographical spread across Asia, Africa, and the Middle East diversifies its revenue base, reducing reliance on any single market.

The international segment is a substantial contributor to Emami's financial performance. In FY23, international business accounted for roughly 21% of the company's total revenue. This demonstrates a well-established global strategy and successful market penetration.

Further highlighting this strength, Emami's international operations experienced a healthy 9% growth in FY24. This upward trend indicates strong demand for its products in overseas markets and effective execution of its international expansion plans, contributing to overall business resilience.

This global reach provides Emami with several advantages:

- Diversified Revenue Streams: Reduced dependence on the Indian market, offering stability.

- Market Expansion Opportunities: Access to a wider customer base and potential for future growth.

- Brand Recognition: Building a global brand presence and enhancing its reputation.

- Economies of Scale: Increased production volumes can lead to cost efficiencies.

Emami's diversified product portfolio is a cornerstone of its strength, offering resilience against market fluctuations. Its well-recognized brands, such as Navratna and BoroPlus, have cultivated deep consumer trust and loyalty, driving consistent sales. The company's expansive distribution network, reaching nearly 5 million retail outlets across India, ensures widespread product availability, particularly in rural and semi-urban areas.

Financially, Emami demonstrates solid performance, with FY24 revenue reaching ₹3,624.89 crore and a Profit After Tax (PAT) of ₹727.86 crore. The company also boasts an impressive Return on Equity (ROE) of 31.81% for FY24, showcasing its efficient use of capital. Strategic acquisitions, like Kesh King and Zandu, have effectively broadened its market presence and product offerings.

Emami's commitment to innovation is evident in its focus on digital-first strategies and its growing D2C platform, Zanducare. Furthermore, its international presence, contributing approximately 21% of total revenue in FY23 and showing 9% growth in FY24, diversifies its revenue streams and offers significant growth avenues across over 70 countries.

What is included in the product

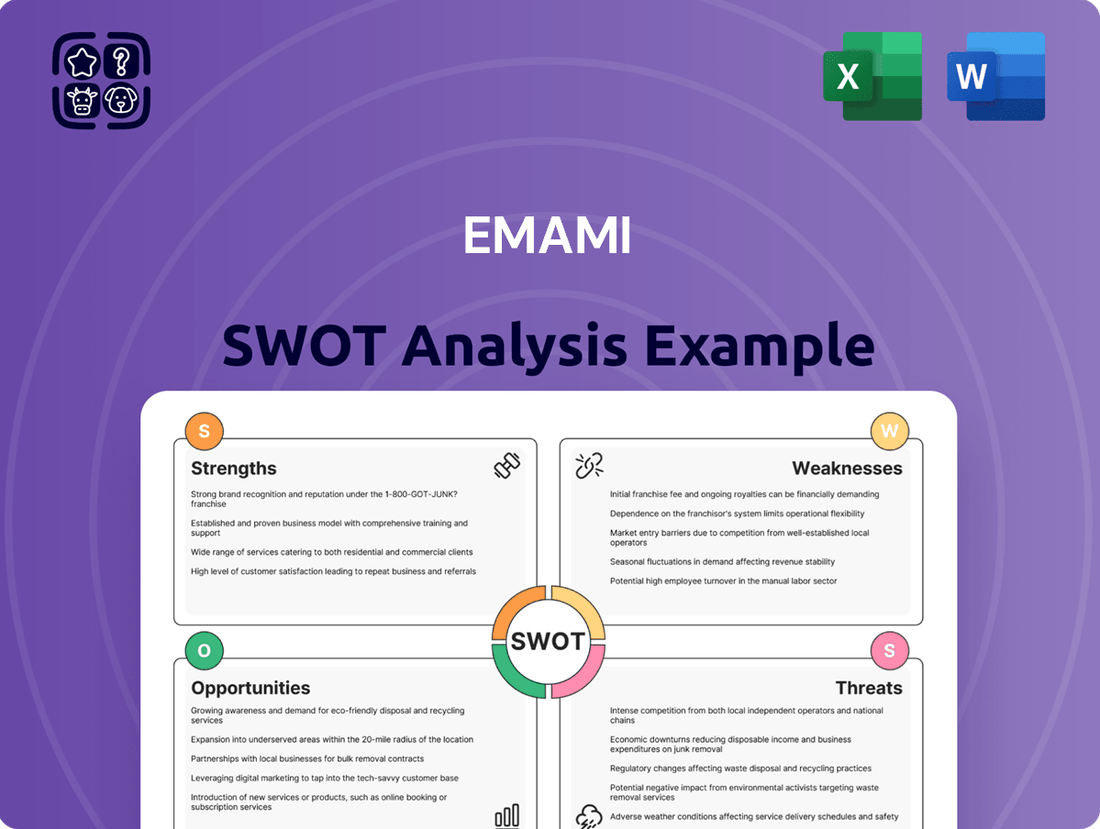

Analyzes Emami’s competitive position through key internal and external factors, highlighting its brand strength and market expansion opportunities while acknowledging potential challenges in evolving consumer preferences.

Provides a simple, high-level SWOT template for fast decision-making, streamlining Emami's strategic pain point identification.

Weaknesses

Emami's significant reliance on the Indian market, which accounted for approximately 85% of its total revenue in FY23, presents a notable weakness. This concentration makes the company vulnerable to domestic economic slowdowns, regulatory changes, and competitive pressures specific to India. While international sales are growing, they remain a smaller portion of the overall business.

Furthermore, the seasonality of some of Emami's flagship products, such as its cooling talc and hair oils, introduces revenue volatility. For instance, sales of Navratna oil typically peak during the summer months. This seasonal demand can lead to uneven sales performance across quarters, impacting predictable revenue streams and requiring careful inventory management.

Emami navigates a fiercely competitive FMCG landscape, contending with global giants such as Hindustan Unilever and Procter & Gamble, alongside formidable Indian rivals like Dabur and Marico. This crowded market demands substantial investments in advertising and promotions, which can strain profit margins and limit pricing power.

Emami's presence in the premium personal care and healthcare segments is notably less developed than its strong showing in the mass market. This gap is significant because consumers, particularly in urban India, are increasingly opting for higher-priced, differentiated products. For instance, while the overall Indian beauty and personal care market is projected to reach USD 28.6 billion by 2025, the premium segment is experiencing a faster growth trajectory, a segment where Emami's brand portfolio is less dominant.

Susceptibility to Raw Material Price Volatility

Emami's reliance on key natural ingredients like menthol, palm oil, and various herbs makes it vulnerable to price swings in these commodities. For instance, a sharp increase in menthol prices, a significant input for their cooling products, directly squeezes profit margins. While the company actively seeks cost efficiencies, a substantial and sustained rise in these input costs, such as a 15% increase in palm oil prices seen in early 2024, can challenge their ability to maintain current profitability without passing costs onto consumers, which could impact sales volume.

The impact of raw material price volatility can be significant:

- Margin Pressure: Fluctuations in the cost of key ingredients like menthol and palm oil can directly impact Emami's gross profit margins.

- Pricing Strategy Challenges: If input costs rise sharply, Emami faces the difficult decision of whether to absorb the costs, potentially reducing profits, or increase product prices, risking lower sales volumes.

- Operational Adjustments Needed: Significant volatility necessitates agile operational adjustments, including exploring alternative sourcing or hedging strategies to mitigate the financial impact.

- Profitability Impact: For example, during periods of high commodity prices, such as the global surge in edible oil prices affecting palm oil in late 2023 and early 2024, Emami's profitability can be noticeably affected if these costs are not effectively managed.

Challenges in Urban Demand and Liquidity Constraints

Recent macroeconomic trends have presented challenges for urban demand. Rising food inflation, a key concern for household budgets, has been a significant factor impacting consumer spending in cities. For instance, by mid-2024, food inflation remained a persistent issue, particularly affecting discretionary spending. This slowdown in urban consumption directly impacts Emami's domestic business, as urban markets typically drive a larger portion of sales for many consumer goods companies.

Liquidity constraints within retail and wholesale trade channels further exacerbate these urban demand headwinds. Businesses in these sectors often face tighter credit conditions, which can limit their ability to stock inventory and extend credit to consumers. This can create a ripple effect, reducing the availability of Emami's products and dampening sales momentum in urban areas. While rural demand has demonstrated resilience, the slowdown in urban consumption creates a significant headwind for Emami's overall domestic business growth targets for 2024-2025.

- Urban Demand Slowdown: Persistent inflation in essential goods like food has curtailed discretionary spending in urban centers throughout 2024.

- Liquidity Squeeze: Retail and wholesale trade channels have experienced tighter liquidity, impacting inventory levels and credit availability for Emami's products.

- Impact on Growth: A deceleration in urban consumption directly challenges Emami's projected domestic business growth for the 2024-2025 fiscal year.

- Rural vs. Urban Contrast: While rural demand has shown stability, the weakness in urban markets presents a significant imbalance for Emami's sales strategy.

Emami's significant dependence on the Indian market, which constituted about 85% of its revenue in FY23, makes it susceptible to domestic economic downturns and regulatory shifts. While international sales are growing, their contribution remains relatively small, limiting diversification benefits.

The company faces intense competition from both multinational corporations like Unilever and Procter & Gamble, and domestic players such as Dabur and Marico. This crowded market necessitates substantial spending on marketing and promotions, potentially impacting profitability and pricing flexibility.

Seasonal demand for products like Navratna oil creates revenue volatility, complicating consistent financial performance and inventory management. Emami's limited presence in the premium personal care segment, despite its rapid growth, is a missed opportunity as consumers increasingly favor higher-value products.

Exposure to volatile commodity prices, particularly for key ingredients like menthol and palm oil, poses a risk to profit margins. For instance, a 15% rise in palm oil prices in early 2024 directly pressured profitability.

Urban consumption slowdowns, driven by persistent food inflation into mid-2024, coupled with tighter liquidity in trade channels, negatively affect Emami's domestic sales momentum and growth targets for 2024-2025.

| Weakness | Description | Impact | FY23 Revenue Contribution (India) | Example Data Point |

|---|---|---|---|---|

| Market Concentration | High reliance on the Indian market. | Vulnerability to domestic economic factors. | ~85% | FY23: ~85% of total revenue from India. |

| Intense Competition | Operating in a crowded FMCG sector. | Pressure on margins and pricing power. | N/A | Competes with HUL, P&G, Dabur, Marico. |

| Seasonality | Demand fluctuations for certain products. | Revenue volatility and inventory challenges. | N/A | Navratna oil sales peak in summer. |

| Premium Segment Gap | Underdeveloped presence in premium personal care. | Missed growth opportunities in a fast-growing segment. | N/A | Indian beauty/personal care market to reach $28.6B by 2025. |

| Raw Material Price Volatility | Dependence on commodity ingredients. | Margin pressure and pricing strategy challenges. | N/A | Palm oil prices rose ~15% in early 2024. |

| Urban Demand Slowdown | Impact of inflation on discretionary spending. | Challenges domestic sales and growth targets. | N/A | Food inflation a persistent issue mid-2024. |

What You See Is What You Get

Emami SWOT Analysis

This is the actual Emami SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain a comprehensive understanding of the company's internal strengths and weaknesses, as well as external opportunities and threats. This detailed report is designed to be a valuable tool for strategic planning and decision-making.

Opportunities

The burgeoning e-commerce and quick commerce landscape in India is a prime avenue for Emami to bolster its market presence and sales. The company's strategic pivot towards direct-to-consumer (D2C) platforms like Zanducare, alongside a robust focus on modern trade, positions it well to capitalize on this digital shift.

As of fiscal year 2024, Emami reported that its organized trade channels accounted for approximately 30% of its total domestic business, a figure that continues to trend upwards. This expansion into new-age digital channels is crucial for reaching a wider consumer base more efficiently.

Consumer preference for natural, organic, and Ayurvedic products is a significant tailwind for Emami. This growing market segment, where Emami already boasts strong brand recognition and a broad product range, offers substantial growth potential. For instance, the global Ayurvedic products market was valued at approximately $5.5 billion in 2023 and is projected to reach over $14 billion by 2030, indicating a robust compound annual growth rate.

Rural India remains a significant engine for FMCG expansion, with rural spending often showing greater resilience than urban markets, particularly for essential and health-oriented goods. Emami's strong presence and focused rural outreach programs, like 'Project Khoj', are strategically aligned to capitalize on this ongoing trend, aiming to deepen penetration of its product portfolio in these areas.

The company's efforts in the rural sector are supported by data indicating continued growth in rural disposable incomes and increasing brand awareness for FMCG products. Emami's understanding of rural consumer needs, especially for value-for-money and health-conscious offerings, positions it favorably to increase its market share in these developing regions.

Strategic Acquisitions and Diversification into New Categories

Emami is strategically pursuing acquisitions to diversify its product portfolio and enter high-growth markets. The company is actively looking into inorganic growth opportunities, targeting new categories like premium men's grooming, natural salon products, and even venturing into ayurvedic pet care, nutrition, and fruit juices. This expansion strategy aims to tap into emerging consumer preferences and capture new revenue streams.

Acquiring direct-to-consumer (D2C) brands is a key part of this approach. These acquisitions allow Emami to quickly gain access to digitally native customer bases and leverage the agility of D2C models. For instance, Emami's acquisition of a significant stake in the D2C skincare brand, Brillare, in early 2024, highlights its commitment to this strategy. Brillare reported a revenue of approximately INR 60 crore in FY23, indicating the potential for rapid scaling within Emami's ecosystem.

- Expansion into Premium Male Grooming: Emami aims to capture a share of the growing premium men's grooming market, a segment that has shown robust growth, with market reports indicating a CAGR of over 10% in India.

- Entry into Natural Salon Products: The company is exploring opportunities in the natural salon product category, aligning with the increasing consumer demand for organic and chemical-free beauty solutions.

- Diversification into Ayurvedic Pet Care: Emami's interest in ayurvedic pet care signifies a move into a relatively untapped but rapidly expanding market, driven by increasing pet ownership and a focus on natural pet wellness.

- Growth in Nutrition and Fruit Juices: By entering the nutrition and fruit juice sectors, Emami seeks to capitalize on the health and wellness trend, offering healthier alternatives to consumers.

International Market Expansion and Deepening Presence

Emami has a significant opportunity to build on its existing international presence, which already spans over 70 countries and demonstrates strong growth. This global reach provides a solid foundation for further expansion.

Deepening its penetration in key emerging markets like the Middle East, North Africa (MENA), and Africa presents a strategic avenue for Emami. These regions offer substantial untapped potential for consumer goods.

For instance, the MENA region's personal care market was valued at approximately USD 20 billion in 2024, with a projected CAGR of over 5% through 2029. Africa's consumer market is also rapidly expanding, driven by a young and growing population.

By focusing on these regions, Emami can diversify its revenue streams, reducing its dependence on the Indian market and enhancing its overall financial resilience. This strategic move can also help mitigate risks associated with regional economic fluctuations.

Expanding internationally allows Emami to leverage its successful product portfolio and brand equity in new territories, potentially leading to increased market share and profitability.

Emami is well-positioned to capitalize on the expanding e-commerce and quick commerce channels in India, leveraging its D2C platforms and modern trade presence. The company's strategic acquisitions, such as its investment in Brillare in early 2024 (which had INR 60 crore revenue in FY23), further bolster its reach into digitally native consumer bases and new product categories.

The growing consumer preference for natural and Ayurvedic products presents a significant opportunity, with the global market projected to reach over $14 billion by 2030. Emami's established brand equity in this space, coupled with its expansion into premium male grooming (a segment with over 10% CAGR in India) and natural salon products, offers substantial growth potential. Furthermore, diversification into emerging areas like ayurvedic pet care and nutrition aligns with evolving consumer trends and untapped market segments.

Emami's international presence, spanning over 70 countries, provides a strong base for global expansion, particularly in high-growth regions like the MENA and Africa. The MENA personal care market alone was valued at approximately USD 20 billion in 2024 and is expected to grow at over 5% CAGR. This international focus allows Emami to diversify revenue streams and enhance overall financial resilience.

Threats

Emami operates in India's dynamic FMCG sector, a landscape characterized by fierce competition from both global giants and nimble domestic rivals. This intense rivalry poses a significant threat, potentially squeezing profit margins through aggressive pricing strategies and escalating advertising costs.

The constant battle for consumer attention and loyalty means Emami must continuously invest in product innovation and marketing to maintain its market position. Failure to do so could lead to a gradual decline in its market share, as seen with some legacy brands struggling to keep pace with evolving consumer preferences and new entrants.

For instance, by the end of FY24, the Indian FMCG market saw continued growth, but also increased promotional activities across categories. Companies like Hindustan Unilever and ITC have consistently expanded their product portfolios, directly challenging Emami's established brands in areas like personal care and healthcare.

Consumer tastes are constantly evolving, with a growing lean towards niche brands and direct-to-consumer (D2C) models that offer personalized experiences. For Emami, this presents a significant threat as established brands might struggle to retain loyalty if they don't adapt quickly. For instance, the rise of D2C skincare brands in India, which saw significant growth in 2023 and is projected to continue in 2024, highlights this shift. A failure to innovate and cater to these changing preferences could erode Emami's market share.

Economic slowdown and persistent inflationary pressures pose significant threats to Emami. Rising food inflation, a key concern in India, directly impacts disposable incomes, potentially reducing consumer spending on non-essential FMCG products, which Emami offers. For instance, India's retail inflation was reported at 4.83% in April 2024, a slight decrease but still elevated, impacting purchasing power.

Liquidity constraints within the broader economy can also dampen demand. A general slowdown in consumer spending, especially noticeable in urban centers where purchasing power is often higher, directly affects sales volumes for companies like Emami. This economic environment can make it harder for consumers to prioritize discretionary purchases.

Furthermore, geopolitical crises remain a persistent threat, capable of disrupting global supply chains and increasing the cost of raw materials. Such disruptions can lead to higher input costs for Emami, squeezing profit margins if these increased costs cannot be fully passed on to consumers in a price-sensitive market.

Counterfeit Products and Brand Image Risk

The proliferation of counterfeit products in the market presents a substantial threat to Emami's carefully cultivated brand image and, consequently, its revenue streams. These illicit goods not only erode consumer trust in genuine Emami offerings but also directly siphon sales away from the company, resulting in tangible financial losses.

Emami must contend with the significant financial implications of combating these fakes. This necessitates ongoing investment in sophisticated anti-counterfeiting strategies and technologies to protect its intellectual property and market share.

- Brand Dilution: Counterfeit products can significantly dilute Emami's brand equity by associating the name with inferior quality, damaging consumer perception.

- Revenue Loss: Direct sales are lost to the grey market, impacting Emami's top-line performance. For instance, the global market for counterfeit goods reached an estimated $461 billion in 2023, a figure that highlights the scale of this threat across industries.

- Increased Operational Costs: Emami incurs costs related to legal battles, product authentication technologies, and consumer education campaigns to combat counterfeiting.

- Reputational Damage: If consumers unknowingly purchase fakes and have negative experiences, it can lead to widespread reputational damage that is difficult to reverse.

Regulatory Changes and Compliance Costs

Changes in government regulations concerning product ingredients, marketing claims, or packaging materials could significantly increase Emami's operational expenses and necessitate product reformulation. For instance, stricter environmental standards for packaging, which have been a growing focus globally, might require substantial investment in new materials and processes. In 2023, the Indian government continued to emphasize plastic waste management, impacting the packaging choices for FMCG companies like Emami.

Adapting to evolving compliance norms, while potentially leveling the playing field by challenging less organized competitors, presents an immediate financial and logistical hurdle for Emami. The company must allocate resources to research, development, and manufacturing adjustments to ensure adherence to new mandates, which can divert capital from other growth initiatives.

- Increased Compliance Burden: New regulations on product safety and environmental impact can lead to higher operational costs for Emami.

- Packaging Material Shifts: Evolving waste management policies may force Emami to invest in sustainable or alternative packaging solutions.

- Market Access Challenges: Failure to comply with regulatory changes in different markets could restrict Emami's product distribution.

- R&D and Manufacturing Adjustments: Adapting formulations and production lines to meet new standards requires significant capital expenditure and time.

Intense competition from both established players and emerging D2C brands poses a significant threat, potentially impacting Emami's market share and profitability through aggressive pricing and marketing. Evolving consumer preferences towards niche offerings and personalized experiences necessitate continuous innovation, a challenge for legacy brands. For instance, during FY24, the Indian FMCG sector saw continued growth but also heightened promotional activities, with competitors like HUL and ITC expanding their portfolios, directly challenging Emami's core categories.

Economic headwinds, including inflation and potential slowdowns in consumer spending, directly affect Emami's sales volumes, particularly for discretionary items. Rising retail inflation, reported at 4.83% in April 2024, erodes purchasing power, making consumers more price-sensitive. Geopolitical instability also presents a threat by disrupting supply chains and increasing raw material costs, potentially squeezing margins if cost increases cannot be passed on.

The prevalence of counterfeit products undermines Emami's brand equity and leads to direct revenue loss. Combating these fakes requires substantial investment in anti-counterfeiting measures, adding to operational costs. The global market for counterfeit goods, estimated at $461 billion in 2023, underscores the magnitude of this challenge across industries.

Stricter government regulations on product ingredients, marketing, and packaging can increase operational expenses and necessitate costly product reformulations. For example, India's continued focus on plastic waste management in 2023 impacts packaging choices for FMCG companies. Adapting to these evolving compliance norms, while potentially benefiting the industry as a whole, presents an immediate financial and logistical hurdle for Emami.

| Threat Category | Specific Threat | Impact on Emami | 2023-2024 Data/Context |

|---|---|---|---|

| Competition | Intense Rivalry (Domestic & Global) | Margin pressure, market share erosion | Indian FMCG market saw increased promotional activities in FY24. |

| Consumer Preferences | Shift to D2C and Niche Brands | Reduced loyalty to established brands, need for rapid innovation | D2C skincare segment in India saw significant growth in 2023. |

| Economic Factors | Inflationary Pressures | Reduced consumer spending on non-essentials, price sensitivity | India's retail inflation at 4.83% (April 2024) impacts disposable income. |

| Supply Chain/Geopolitics | Disruptions and Cost Increases | Higher input costs, potential margin squeeze | Ongoing global geopolitical instability impacting raw material prices. |

| Brand Integrity | Counterfeit Products | Revenue loss, brand dilution, increased operational costs | Global counterfeit market estimated at $461 billion (2023). |

| Regulatory Environment | New Compliance Standards | Increased operational expenses, reformulation costs, packaging shifts | India's focus on plastic waste management influencing packaging in 2023. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of Emami's official financial statements, extensive market research reports, and expert opinions from industry analysts to provide a comprehensive and accurate assessment.