Emami Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emami Bundle

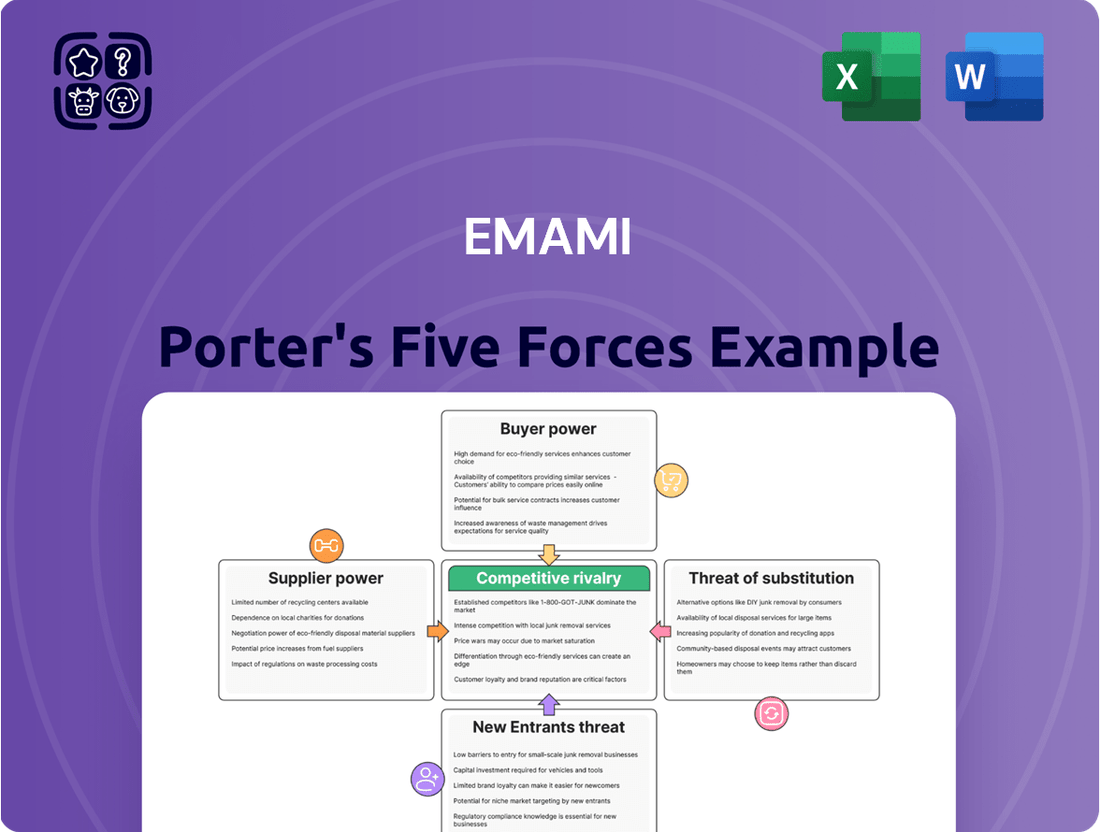

Emami's competitive landscape is shaped by several key forces. Understanding the bargaining power of buyers and suppliers is crucial for navigating its market. The threat of new entrants and the intensity of rivalry among existing players significantly impact Emami's strategic options. Furthermore, the availability of substitute products presents a constant challenge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Emami’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Emami's reliance on a range of raw materials, from natural herbs like neem and tulsi to essential chemicals and packaging, forms a critical aspect of its supply chain. The bargaining power of these suppliers directly influences Emami's input costs and production stability. For instance, in 2023-24, the volatility in global commodity prices, particularly for certain essential oils and specialty chemicals, presented a challenge, impacting the cost of goods sold for FMCG companies like Emami.

The uniqueness and availability of these inputs are key determinants of supplier leverage. If a particular herb is only cultivated in a specific region or if a specialized chemical has limited producers, those suppliers gain significant bargaining power. This can lead to price hikes or potential supply disruptions, forcing Emami to either absorb higher costs or seek alternative, potentially less ideal, sourcing options.

For certain specialized personal care or healthcare formulations, Emami's reliance on a limited number of suppliers for unique ingredients can significantly amplify supplier bargaining power. If these crucial components require specialized processing or are proprietary, suppliers gain considerable leverage, making it difficult for Emami to secure alternative sources or replicate the input.

This dependency is particularly relevant for Emami's Ayurvedic and natural product lines, where specific botanical extracts or rare ingredients may only be available from a few cultivators or processors. For instance, if a key ingredient in their popular BoroPlus range has a highly concentrated source, the supplier can dictate terms.

The inability to easily switch suppliers for these specialized inputs means that Emami may face higher raw material costs or less favorable payment terms. This directly impacts Emami's cost of goods sold and, consequently, its profit margins for those specific product categories.

Emami's reliance on a concentrated supplier base for key ingredients like menthol or specific herbal extracts significantly amplifies supplier bargaining power. If a small number of producers control the supply of these critical inputs, they can leverage this position to command higher prices or impose less favorable payment terms. For instance, in 2024, the global menthol market saw price volatility due to supply chain disruptions, directly impacting companies like Emami that depend on this ingredient.

Switching Costs for Emami

Emami faces moderate bargaining power from its suppliers, significantly influenced by switching costs. The ease with which Emami can shift from one supplier to another is a key determinant. If Emami incurs substantial costs in changing suppliers, such as retooling manufacturing equipment or reformulating its extensive product lines, then existing suppliers gain leverage.

Consider the sourcing of key ingredients for Emami's popular brands like Navratna Oil or BoroPlus. High switching costs here, perhaps due to specialized formulations or long-term supply agreements, would empower these suppliers. For example, if a particular herbal extract requires a unique processing method that only a few suppliers can provide, Emami's ability to switch is limited, thus increasing supplier power. As of Emami's financial reporting up to early 2024, the company emphasizes supply chain resilience, suggesting an ongoing effort to mitigate these dependency risks, though specific data on switching costs per ingredient category is proprietary.

- Switching Costs Impact: High costs to change suppliers increase supplier bargaining power.

- Examples: Retooling, reformulation, and contract renegotiations are key cost drivers.

- Emami's Brands: Sourcing specialized ingredients for brands like Navratna Oil and BoroPlus can involve significant switching hurdles.

- Strategic Mitigation: Emami's focus on supply chain resilience indicates efforts to manage supplier dependencies.

Backward Integration Potential

Emami's potential for backward integration, meaning they could start producing their own raw materials, acts as a check on supplier power. If Emami were to manufacture key ingredients themselves, suppliers would have less leverage. For example, if Emami decided to produce its own essential oils for skincare products, the suppliers of those oils would see their bargaining power diminish.

However, for a large, diversified Fast-Moving Consumer Goods (FMCG) company like Emami, full backward integration across all its product lines is often impractical and economically unviable. The sheer variety of inputs needed for products ranging from personal care to healthcare means that relying on external suppliers for certain specialized or high-volume raw materials remains necessary. This necessity means suppliers retain a degree of influence.

Consider Emami's diverse portfolio, which includes brands like BoroPlus, Navratna, and Zandu. Each of these product lines requires different sets of raw materials, from herbal extracts to chemical compounds. While Emami might explore backward integration for a few high-cost or strategically important inputs, the complexity and scale of their operations prevent complete self-sufficiency. This ongoing reliance on external suppliers means they still hold some bargaining power.

- Backward Integration Threat: Emami's ability to produce its own raw materials or components reduces supplier leverage.

- Feasibility Constraints: For a diversified FMCG company, full backward integration is often not cost-effective or practical for all inputs.

- Supplier Influence Remains: Despite integration potential, reliance on external suppliers for specialized or high-volume inputs means suppliers retain some bargaining power.

- Input Diversity: Emami's wide product range necessitates sourcing various raw materials, limiting the scope of effective backward integration.

Emami's supplier bargaining power is moderate, influenced by the concentration of suppliers for key inputs and the switching costs involved. For instance, in 2024, the company's reliance on specific herbal extracts for its popular Ayurvedic brands could give those cultivators leverage, especially if cultivation is geographically limited. While Emami aims for supply chain resilience, the cost and complexity of reformulating products or retooling machinery for new suppliers for specialized ingredients like menthol, as seen with 2024 market volatility, means suppliers retain some influence.

| Key Factor | Impact on Emami | 2024 Context/Example | Supplier Leverage |

| Supplier Concentration | High for specialized inputs | Limited producers for certain herbal extracts | Moderate to High |

| Switching Costs | Significant for reformulation/retooling | Reformulating BoroPlus or Navratna range | Moderate |

| Backward Integration Potential | Limited by input diversity | Impractical to produce all raw materials | Moderate |

What is included in the product

Emami's Porter's Five Forces analysis dissects the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the FMCG sector, providing a strategic view of its competitive environment.

Instantly identify and quantify competitive threats with a pre-built, customizable Emami Porter's Five Forces model, eliminating the guesswork in strategic planning.

Customers Bargaining Power

The price sensitivity of consumers in the mass-market segments where Emami operates significantly impacts its bargaining power. For instance, in the Indian FMCG sector, which Emami is a major player in, price remains a critical factor for a vast majority of the population. Reports from 2024 indicate that inflation has continued to put pressure on household budgets, making consumers more inclined to seek out value-for-money products and readily switch brands based on attractive pricing or discounts.

With a plethora of competing products readily available across categories like personal care and healthcare, consumers possess substantial power to switch brands. This ease of switching, often driven by promotional offers or a perception of better value, directly translates to increased bargaining power for the collective consumer base. In 2024, the competitive landscape remains intense, with both domestic and international players vying for market share, further empowering consumers to demand better prices and quality.

The personal care and healthcare markets are flooded with options. Consumers can pick from well-known national brands, smaller regional companies, and even store-brand alternatives. This sheer variety means customers aren't tied to any single company, giving them significant leverage.

For Emami, this translates directly into a reduced ability to dictate prices. If Emami's products become too expensive or don't meet a customer's expectations, there are plenty of other brands readily available. In 2023, the Indian personal care market alone was valued at over $15 billion, highlighting the competitive landscape Emami navigates.

Emami benefits from established brand recognition, but the strength of customer loyalty isn't uniform across its diverse product portfolio. While brands like Boroplus and Zandu have cultivated significant loyalty, other categories may face customers who are more price-sensitive and less attached, thereby increasing their bargaining power.

In 2024, the Indian FMCG market, where Emami operates, saw continued competition. For instance, the personal care segment, a key area for Emami, experienced growth, but also intense promotional activity from competitors. This environment means that while strong brands can command loyalty, a lack of perceived uniqueness in certain product lines can empower consumers to switch for better deals, impacting Emami's pricing flexibility.

Distribution Channel Power

Emami's distribution channels, comprising major retailers like Reliance Retail and DMart, along with prominent e-commerce platforms, hold considerable sway. These powerful entities, by virtue of their extensive customer reach and substantial order volumes, can negotiate favorable terms, including margin improvements and promotional assistance, directly influencing Emami's financial performance.

For instance, in 2023-24, the organized retail sector continued to consolidate, giving larger players even more leverage in their dealings with FMCG companies. The increasing reliance on these consolidated channels means Emami must carefully manage relationships to ensure mutually beneficial arrangements.

- Retailer Dominance: Large retail chains often account for a significant percentage of a company's revenue, granting them substantial bargaining power.

- E-commerce Influence: Major online marketplaces can dictate terms related to listing fees, advertising, and product placement, impacting Emami's online sales strategy.

- Margin Pressure: The ability of these channels to demand better margins can directly squeeze Emami's profitability on its products.

- Promotional Demands: Retailers and e-commerce platforms frequently request promotional support, such as discounts and marketing campaigns, adding to Emami's operational costs.

Information Asymmetry

Customers today wield significant power due to readily available product information, online reviews, and price comparison tools. This heightened transparency drastically reduces information asymmetry, enabling consumers to make more educated purchasing choices and effectively negotiate for better value. For instance, in the fast-moving consumer goods (FMCG) sector, where Emami operates, consumers can easily access detailed ingredient lists, nutritional information, and user feedback on various products, directly impacting their brand perception and purchasing habits.

This increased access to data empowers customers to scrutinize product quality, pricing, and competitor offerings. Consequently, they are less reliant on brand reputation alone and can make decisions based on a more comprehensive understanding of the market. In 2024, the proliferation of e-commerce platforms and review aggregators has further amplified this trend, providing customers with an unprecedented level of insight before committing to a purchase.

- Informed Decisions: Customers can easily compare product features, pricing, and reviews across multiple brands, reducing reliance on brand loyalty alone.

- Price Sensitivity: Greater transparency in pricing and readily available discounts online make customers more sensitive to price differences, pressuring companies to remain competitive.

- Review Impact: Online reviews and social media sentiment significantly influence purchasing decisions, giving customers collective power to impact a brand's reputation and sales.

- Access to Alternatives: The internet provides easy access to a wide array of substitute products, further strengthening the customer's bargaining position.

Emami faces considerable customer bargaining power due to the highly competitive FMCG market, where price sensitivity is a major driver. With numerous alternatives available, consumers can easily switch brands, especially when faced with attractive pricing or promotional offers. Reports from 2024 highlight ongoing inflation, making consumers more value-conscious and inclined to seek out the best deals, directly impacting Emami's pricing flexibility and profitability.

The sheer volume of available products across personal care and healthcare categories empowers customers to demand better value and quality. This ease of switching, amplified by online price comparison tools and reviews, means Emami cannot solely rely on brand reputation. In 2023, the Indian personal care market, valued at over $15 billion, underscores the intense competition where customer loyalty can be fluid, particularly in product lines lacking distinct differentiation.

The bargaining power of customers is further amplified by the dominance of large retail chains and e-commerce platforms. These intermediaries, due to their significant market reach, can negotiate favorable terms, including margin improvements and promotional assistance. For instance, the consolidation within organized retail in 2023-24 has granted these players increased leverage, necessitating careful relationship management from Emami's side to ensure mutually beneficial arrangements.

| Factor | Impact on Emami | Supporting Data (2024 Context) |

| Price Sensitivity | Reduces pricing power, increases demand for discounts. | Inflationary pressures in 2024 made consumers more value-driven. |

| Ease of Switching | Threatens brand loyalty, necessitates competitive pricing. | Intense promotional activity observed in the personal care segment. |

| Information Availability | Empowers informed decisions, reduces brand reliance. | Proliferation of review aggregators and price comparison sites. |

| Retailer/E-commerce Power | Demands margin concessions and promotional support. | Ongoing consolidation in organized retail sector. |

Full Version Awaits

Emami Porter's Five Forces Analysis

This preview shows the exact Emami Porter's Five Forces analysis you'll receive immediately after purchase—no surprises, no placeholders. The document details Emami's competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its markets. This comprehensive analysis is ready for your immediate use, offering deep insights into Emami's strategic positioning. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file.

Rivalry Among Competitors

The Indian Fast-Moving Consumer Goods (FMCG) sector is a crowded arena, featuring a substantial number of both domestic and international companies. Emami faces formidable rivals such as Hindustan Unilever Limited (HUL), Dabur India, Marico, ITC, and Patanjali Ayurved, all of which possess significant market presence and resources.

This high density of powerful competitors intensifies market share battles, forcing Emami to constantly innovate and differentiate its product offerings. The presence of these large players also translates into considerable pricing pressure, as competitors often engage in promotional activities and price adjustments to gain or retain customers.

For instance, in the fiscal year 2023-24, HUL reported revenues exceeding INR 59,000 crore, Dabur India reported revenues of approximately INR 11,900 crore, and Marico's revenue for the same period was around INR 10,900 crore, highlighting the scale of Emami's competitors.

These substantial financial capabilities allow Emami's rivals to invest heavily in marketing, distribution, and research and development, creating a challenging environment for Emami to carve out and protect its market share.

The Indian Fast-Moving Consumer Goods (FMCG) market, especially within personal care and healthcare, has shown strong growth. However, certain niche categories within these segments might be experiencing a more moderate expansion rate.

When market growth slows down in specific FMCG sub-segments, the intensity of competitive rivalry naturally increases. Companies tend to focus more on capturing existing market share rather than on tapping into new, rapidly expanding demand.

This heightened competition can manifest in aggressive pricing strategies, increased advertising spending, and a greater emphasis on product innovation to differentiate from rivals. For instance, in 2024, the personal care segment in India continued to be a battleground, with established players and new entrants vying for consumer attention.

The overall Indian FMCG market was projected to grow at a compound annual growth rate (CAGR) of around 9-11% between 2023 and 2028, according to various industry reports. While this is a healthy figure, pockets of slower growth within specific product categories can amplify competitive pressures.

Many of Emami's products, particularly in categories like basic skincare and hair oils, face significant hurdles in achieving strong product differentiation. This lack of distinctiveness can often lead to competition being driven by price alone, which in turn can put pressure on profit margins.

However, Emami actively works to overcome this by focusing on building robust brands and developing unique product formulations. For instance, in the competitive hair oil market, Emami's Navratna brand has successfully carved out a niche by emphasizing its cooling properties and ayurvedic heritage, moving beyond just a functional hair oil.

This brand-led differentiation strategy is crucial. In 2023-2024, Emami's advertising and sales promotion expenses were ₹449.85 crore, a substantial investment aimed at reinforcing brand recall and highlighting product uniqueness. This spend underscores the company's commitment to standing out in crowded markets.

The effectiveness of this approach is reflected in their market position. Emami holds a leading share in several categories, such as men's grooming with its Fair and Handsome range, demonstrating that strategic branding can indeed create perceived differentiation even in product categories that might otherwise be considered commoditized.

Exit Barriers

For Emami, high exit barriers in the consumer goods sector, particularly in personal care and healthcare, can make it difficult for companies to leave the market, even when facing declining profits. This is often due to substantial investments in manufacturing facilities, established distribution networks, and significant brand loyalty built over years. For instance, the FMCG industry often requires large capital outlays for production lines and marketing campaigns, making divestment costly.

These entrenched positions mean that even struggling firms may continue to compete aggressively, potentially leading to price wars or increased promotional spending. This dynamic can suppress overall industry profitability. A company like Emami, with its diverse portfolio of established brands, faces this reality. The cost of exiting these established product lines, which have significant brand equity, can be prohibitive.

- Significant Fixed Assets: FMCG companies like Emami often have substantial investments in manufacturing plants, machinery, and warehouses, which are difficult to repurpose or sell without significant loss.

- Specialized Labor and Know-how: Retaining skilled labor and proprietary manufacturing processes adds to the cost and complexity of exiting a market.

- Brand Equity and Customer Loyalty: The value of established brands and the associated customer relationships are hard to liquidate, incentivizing companies to maintain operations.

- Government Regulations: Certain sectors within consumer goods may also have regulatory hurdles or requirements that complicate a company's departure.

Advertising and Promotional Intensity

The fast-moving consumer goods (FMCG) sector, particularly in India, is characterized by intense advertising and promotional activities, requiring substantial investment in distribution networks. Emami, like its peers, must consistently allocate significant capital towards marketing and sales to ensure brand visibility and remain competitive, which in turn drives up operational expenses and intensifies competitive pressures.

This high level of advertising expenditure is a critical factor in maintaining market share. For instance, in the fiscal year 2023-24, Emami reported significant spending on brand building and advertising to support its diverse product portfolio. This continuous investment is essential to cut through the clutter and capture consumer attention in a crowded marketplace.

- Advertising Spend: FMCG companies like Emami often dedicate a substantial portion of their revenue to advertising, with budgets frequently ranging from 10-15% or more of sales, depending on the product lifecycle and competitive landscape.

- Promotional Intensity: Frequent discounts, offers, and in-store promotions are standard practice, leading to price wars and margin pressures for all players.

- Distribution Network: Building and maintaining an extensive distribution network across India's vast and diverse geography requires ongoing investment in logistics and channel management.

- Brand Visibility: High advertising and promotional intensity directly impacts brand visibility, a key determinant of sales volume and market share in the FMCG sector.

Emami operates within a highly competitive Indian FMCG market, facing intense rivalry from large, well-established players like Hindustan Unilever, Dabur, Marico, and ITC. These competitors boast significant financial resources and market presence, driving aggressive pricing and marketing strategies that pressure Emami's market share and profitability.

The intensity of this rivalry is amplified in slower-growing product categories where companies battle fiercely for existing market share. Emami counters this by focusing on brand differentiation, as seen with its Navratna brand, and by investing significantly in advertising and sales promotion, as evidenced by its ₹449.85 crore spend in FY 2023-24, to maintain brand visibility and perceived uniqueness.

High exit barriers, including substantial investments in manufacturing and brand equity, ensure that even less profitable firms remain active competitors, contributing to sustained price wars and promotional intensity across the sector. This dynamic necessitates continuous investment in brand building and distribution to remain competitive.

| Competitor | FY 2023-24 Revenue (Approx.) | Key Product Categories |

|---|---|---|

| Hindustan Unilever Limited (HUL) | INR 59,000+ crore | Personal Care, Home Care, Foods |

| Dabur India | INR 11,900 crore | Health Care, Personal Care, Foods |

| Marico | INR 10,900 crore | Personal Care, Health & Beauty |

| ITC | Varies (FMCG segment significant) | Personal Care, Packaged Foods, Stationery |

SSubstitutes Threaten

Consumers are always weighing if other products or solutions provide a better bang for their buck compared to Emami's. This price-performance trade-off is a constant consideration.

For instance, in the personal care sector, cheaper generic brands, local unbranded items, or even DIY homemade remedies can present compelling alternatives to Emami's established products, potentially siphoning off demand.

In 2024, the penetration of private label brands in the Indian personal care market continued to grow, with some categories seeing increases of up to 15% year-on-year, directly challenging established players like Emami.

This dynamic forces Emami to continuously innovate and justify its pricing through superior quality, branding, and efficacy to maintain its market share against these more budget-friendly substitutes.

Consumer willingness to switch from Emami's products to alternatives plays a crucial role in assessing the threat of substitutes. If customers find it easy and inexpensive to switch, and the alternative offers comparable benefits, this threat is amplified. This is especially true in product categories where consumers don't exhibit strong brand loyalty.

In India, traditional and homemade remedies present a significant threat of substitution for packaged personal care and healthcare products. This cultural preference for natural or DIY solutions means consumers often bypass commercially available items. For instance, many households regularly use turmeric for skin ailments or neem for oral hygiene, directly competing with Emami's offerings like BoroPlus antiseptic cream or Fair and Handsome men's grooming products.

This inclination is amplified by cost-effectiveness and a perceived lack of chemicals, making these remedies a constant alternative. Reports from 2024 indicate a growing consumer interest in Ayurveda and natural ingredients, a trend that directly challenges mass-produced goods. The widespread availability and deep-rooted acceptance of these traditional methods create a persistent competitive pressure, impacting market share for established brands.

Technological Advancements Creating New Alternatives

Technological advancements are a significant driver of substitute threats for companies like Emami. Innovations can birth entirely new product categories or services that satisfy similar customer needs, potentially diverting demand from established offerings. For example, the burgeoning field of advanced cosmetic procedures, like minimally invasive treatments, could increasingly serve as a substitute for certain premium skincare products, impacting Emami's beauty and personal care segment. Similarly, the rapid growth in digital health solutions, including AI-powered diagnostics and personalized wellness apps, might reduce consumer reliance on some traditional over-the-counter health supplements that Emami offers.

The impact of these technological shifts is already visible. By the end of 2024, the global market for non-invasive cosmetic procedures was projected to reach over $20 billion, indicating a growing consumer preference for alternatives to topical treatments. Furthermore, the digital health market is expected to surpass $650 billion by 2026, with a significant portion dedicated to wellness and preventative care solutions that could overlap with the traditional supplement market. These trends suggest a heightened risk of substitution, as consumers gain access to innovative and potentially more effective or convenient alternatives.

- Growing non-invasive cosmetic procedures market: Projected to exceed $20 billion globally by the end of 2024.

- Expanding digital health market: Expected to reach over $650 billion by 2026, offering new wellness solutions.

- Consumer adoption of tech-driven alternatives: Increasing willingness to try advanced procedures and digital health services.

- Potential impact on Emami's product lines: Skincare and health supplement categories face direct substitution risks.

Cross-Category Product Innovation

Cross-category product innovation presents a significant threat as companies develop entirely new offerings that address customer needs previously met by established products. For instance, the booming functional beverage market in 2024, with products like enhanced waters and plant-based drinks, increasingly encroaches on the traditional territory of vitamin and mineral supplements. This shift means consumers might opt for a readily available fortified drink over a dedicated supplement pill, impacting sales in the latter category.

This trend is further exemplified in the beauty and personal care sector. Specialized salon treatments, offering advanced formulations and professional application, are gaining traction as substitutes for at-home hair care routines. Consumers are willing to pay a premium for perceived superior results, potentially diverting spending from mass-market shampoos and conditioners. In 2023, the global professional hair care market was valued at approximately $92.8 billion, indicating a substantial market where cross-category innovation can thrive.

- Functional beverages are blurring lines with traditional health supplements.

- Advanced salon treatments are substituting for at-home hair care.

- This innovation creates new competitive pressures by redefining customer needs fulfillment.

- Companies must monitor adjacent markets for potential substitute product emergence.

The threat of substitutes for Emami is significant, stemming from both direct product alternatives and entirely new solutions addressing similar needs. Consumers readily compare Emami's offerings against cheaper generics, local options, or even DIY remedies, especially in personal care. The increasing popularity of private label brands in India's personal care sector, with some segments growing by up to 15% year-on-year in 2024, directly challenges Emami's market position.

Technological advancements also fuel this threat. For instance, the global market for non-invasive cosmetic procedures was projected to exceed $20 billion by the end of 2024, offering alternatives to Emami's skincare products. Similarly, the expanding digital health market, expected to surpass $650 billion by 2026, presents new wellness solutions that could reduce reliance on traditional health supplements.

Cross-category innovation further intensifies this threat. Functional beverages are increasingly seen as substitutes for vitamin supplements, while advanced salon treatments are replacing at-home hair care routines. The global professional hair care market, valued at approximately $92.8 billion in 2023, highlights a substantial area where such innovations can emerge.

| Substitute Category | Emami's Potential Impact | Key Data Point (2024/2023) | Consumer Driver |

|---|---|---|---|

| Private Label Personal Care | Market Share Erosion | Up to 15% YoY growth in penetration (2024) | Price Sensitivity |

| Non-invasive Cosmetic Procedures | Reduced Demand for Skincare | Global market > $20 billion (end of 2024) | Perceived Efficacy, Innovation |

| Digital Health & Wellness Apps | Decreased Reliance on Supplements | Global market > $650 billion (by 2026) | Convenience, Personalization |

| Functional Beverages | Shift from Traditional Supplements | Growing market segment | Health Consciousness, Convenience |

| Professional Salon Treatments | Reduced Sales of At-Home Hair Care | Global Professional Hair Care market ~$92.8 billion (2023) | Desire for Premium Results |

Entrants Threaten

Entering the Fast-Moving Consumer Goods (FMCG) market, particularly with a broad product range akin to Emami's, necessitates significant upfront capital. This includes establishing state-of-the-art manufacturing plants, robust research and development capabilities, extensive marketing campaigns, and building widespread distribution channels. For instance, in 2023, major FMCG companies reported capital expenditure in the billions for capacity expansion and new product launches, indicating the scale of investment required.

These considerable capital requirements act as a formidable barrier, effectively deterring many aspiring new entrants from posing a serious competitive threat. The sheer financial commitment needed to compete with established players like Emami, who have already invested heavily in infrastructure and brand building over decades, makes market entry exceedingly challenging and risky for newcomers.

Emami's substantial brand equity, cultivated over decades, presents a significant barrier to new entrants. Established consumer trust in flagship products like Boroplus and Navratna Oil makes it difficult for newcomers to gain traction.

Building comparable brand awareness and credibility requires immense marketing investment and time. For instance, in FY23, Emami's marketing expenditure was ₹307 crore, a substantial figure that new competitors would need to match or exceed to even begin challenging Emami's market position.

This high cost of entry, coupled with the lengthy process of fostering genuine consumer loyalty, significantly deters potential new players from entering Emami's core markets. Overcoming decades of established brand perception is a daunting task for any fledgling brand.

Access to a robust distribution network presents a considerable hurdle for new entrants aiming to compete with established players like Emami in the Indian FMCG market. Building a comparable reach, from metropolitan supermarkets to remote rural kirana stores, requires substantial investment and time, a challenge many startups face. Emami's deep-rooted distribution infrastructure, honed over years, allows for efficient product placement and availability, which is a significant competitive advantage.

Regulatory Hurdles and Licenses

The personal care and healthcare sectors in India present significant entry barriers due to stringent regulatory requirements. New entrants must navigate a complex web of approvals, quality control standards, and licensing procedures, which can be both time-consuming and resource-intensive. For instance, the Food Safety and Standards Authority of India (FSSAI) mandates specific licenses for food and cosmetic products, adding to the compliance burden.

These regulatory hurdles act as a substantial deterrent to new players. Companies must invest heavily in understanding and adhering to these rules, including Good Manufacturing Practices (GMP) certifications. The Bureau of Indian Standards (BIS) also imposes quality standards on various consumer products, requiring rigorous testing and compliance.

- Regulatory Approvals: Obtaining necessary product registrations and approvals from bodies like the Central Drugs Standard Control Organization (CDSCO) for healthcare products.

- Quality Standards: Adherence to Indian Pharmacopoeia (IP) standards for pharmaceuticals and specific quality norms for cosmetics and personal care items.

- Licensing: Securing manufacturing licenses, import licenses, and distribution permits, which often involve detailed inspections and documentation.

- Compliance Costs: Significant financial outlay required for testing, certifications, and legal consultations to meet regulatory demands.

Economies of Scale for Incumbents

Emami, as a well-established player in the FMCG sector, leverages significant economies of scale. This advantage is evident in its procurement of raw materials, where bulk purchasing leads to lower per-unit costs compared to smaller, emerging competitors. For instance, Emami's extensive distribution network and large-scale manufacturing facilities, like its plant in Ambala which has a significant production capacity, contribute to reduced operational expenses.

The cost advantage stemming from these economies of scale presents a substantial barrier for new entrants. A new company entering the market would likely operate at a much smaller volume, inheriting higher per-unit production and marketing costs. This inherent cost disadvantage makes it challenging for them to compete on price with Emami or achieve comparable profit margins, thus deterring entry.

Consider the marketing spend: Emami's established brand recognition allows for more efficient marketing campaigns. In 2023, Emami reported a marketing and advertising expense of INR 468.13 crore, a figure that smaller entrants would struggle to match while achieving similar market penetration. This significant investment in brand building and advertising further solidifies Emami's position and raises the entry cost for newcomers.

The threat of new entrants is therefore moderated by Emami's established economies of scale in:

- Procurement: Bulk purchasing power for raw materials and packaging.

- Manufacturing: Lower per-unit production costs due to high-volume output and efficient plant utilization.

- Distribution: Wider reach and lower logistics costs per unit through an established supply chain.

- Marketing: Ability to spread large advertising budgets across a vast customer base, reducing cost per impression.

The threat of new entrants for Emami is significantly dampened by the substantial capital requirements for establishing manufacturing, R&D, and distribution networks. In 2024, capital expenditures by leading FMCG players often ran into billions, underscoring the immense financial groundwork needed to compete. This financial hurdle, coupled with Emami's established brand equity and deep-rooted distribution channels, creates a formidable barrier for any newcomer seeking to capture market share.

| Factor | Emami's Advantage | Impact on New Entrants |

|---|---|---|

| Capital Investment | Decades of investment in infrastructure and brand building. | Requires substantial upfront capital, making entry difficult. |

| Brand Equity | Strong consumer trust in brands like Boroplus and Navratna. | New entrants struggle to build comparable brand awareness and loyalty. |

| Distribution Network | Extensive reach across urban and rural India. | Challenging and costly for new players to replicate Emami's market penetration. |

| Economies of Scale | Lower per-unit costs in procurement, manufacturing, and marketing. | New entrants face higher operational costs, impacting price competitiveness. |

| Regulatory Compliance | Established processes for navigating complex regulations. | New entrants face time-consuming and resource-intensive compliance hurdles. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Emami leverages data from their annual reports, investor presentations, and public filings. We also incorporate insights from reputable market research firms and industry-specific publications to understand the competitive landscape.