Emami PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emami Bundle

Uncover the political, economic, social, technological, legal, and environmental forces shaping Emami's trajectory. Our meticulously researched PESTLE analysis offers a critical look at the external landscape, providing you with the foresight needed to navigate market complexities. Understand regulatory shifts, economic headwinds, and evolving consumer behaviors that directly impact Emami's operations and growth potential. Gain a competitive edge by leveraging these actionable insights to refine your own strategic planning. Download the full PESTLE analysis now and equip yourself with the intelligence to make informed decisions.

Political factors

India's political landscape, characterized by a stable government at the federal level, generally fosters a predictable environment for businesses like Emami. This stability allows for consistent policy implementation, which is crucial for long-term strategic planning and investment in the fast-moving consumer goods (FMCG) sector. For instance, initiatives aimed at improving the ease of doing business and supporting consumer goods manufacturing create a more favorable operational climate.

Continuity in government policies, particularly those affecting taxation, import-export regulations, and consumer protection, directly impacts Emami's supply chain management and market access. A predictable regulatory framework reduces operational risks and encourages capital expenditure. For example, the government's continued focus on rural development and increasing disposable incomes in these areas, as seen in budget allocations for FY2024-25, directly benefits FMCG companies like Emami by expanding their potential customer base.

Government policies directly impact India's FMCG sector, influencing everything from product manufacturing and pricing to advertising and distribution channels. Emami must meticulously adhere to regulations concerning food safety, labeling requirements, and environmental standards for its production facilities. For instance, the Food Safety and Standards Authority of India (FSSA) sets stringent guidelines that Emami, like all FMCG players, must follow to ensure product quality and consumer safety.

Pricing controls, though less common now, can still emerge in specific product categories or during times of economic volatility, requiring Emami to be agile in its pricing strategies. Advertising standards, governed by bodies like the Advertising Standards Council of India (ASCI), dictate how Emami can promote its products, preventing misleading claims and ensuring fair competition. Recent amendments to advertising laws in 2024, for example, have further tightened rules around celebrity endorsements and health claims.

Navigating distribution policies, especially in a vast and diverse market like India, is crucial. Emami needs to comply with regulations related to warehousing, transportation, and retail operations. Understanding and adapting to changes in these policies, such as those related to GST compliance or e-commerce regulations, is vital for maintaining a competitive edge and ensuring smooth market access for its diverse product portfolio, which includes brands like Boroplus and Navratna.

India's trade policies, including tariffs and import/export regulations, directly influence Emami's international operations and its ability to source raw materials cost-effectively. For instance, changes in import duties on key ingredients can impact Emami's production costs and the competitiveness of its finished goods in global markets. The Indian government's commitment to trade facilitation aims to streamline these processes.

Government policies on Foreign Direct Investment (FDI) present a mixed landscape for Emami. While relaxed FDI norms in manufacturing can encourage partnerships and technology transfer, potentially boosting Emami's production capabilities, stricter regulations in certain retail segments could pose expansion challenges. As of early 2025, India continues to review its FDI policies to attract more foreign capital, presenting potential avenues for Emami's strategic growth.

Rural Development Initiatives

Government focus on rural development directly benefits Emami due to its strong market penetration in these areas. Initiatives to improve rural infrastructure, such as better roads and electricity, facilitate product distribution and increase accessibility for consumers. For example, the Pradhan Mantri Gram Sadak Yojana (PMGSY) has connected millions of previously unreached villages, enhancing Emami's logistical capabilities.

Schemes aimed at boosting rural disposable income, like increased agricultural subsidies or rural employment programs, directly translate to higher consumer spending power. In 2023-24, India's agricultural credit target was set at INR 20 lakh crore, demonstrating a significant push to support the rural economy and, consequently, demand for FMCG products like those offered by Emami.

Emami's business model is intrinsically linked to the economic well-being of rural India. Agricultural support programs that improve farmer incomes, coupled with efforts to enhance rural non-farm employment, directly increase the purchasing power of a substantial customer base for Emami's personal care and healthcare products. This creates a positive feedback loop where development leads to increased sales.

Specific policy interventions designed to uplift rural communities, such as the National Rural Employment Guarantee Act (NREGA), contribute to stable income streams in rural households. Increased household income in rural areas, which constituted a significant portion of Emami's sales growth in recent years, fuels demand for its diverse product portfolio.

- Increased Rural Connectivity: Initiatives like PMGSY improve Emami's supply chain efficiency in semi-urban and rural markets.

- Enhanced Farm Incomes: Agricultural support and credit targets (e.g., INR 20 lakh crore in 2023-24) boost rural purchasing power.

- Rural Employment Generation: Programs like NREGA provide stable income, driving consumer demand for FMCG products.

- Focus on Rural Infrastructure: Investments in power and other basic amenities make rural markets more accessible and attractive for sales.

Taxation Policies and Fiscal Reforms

Taxation policies significantly impact Emami's financial performance. For instance, changes in Goods and Services Tax (GST) rates can alter the cost of raw materials and finished goods, directly affecting profit margins. Corporate tax rate adjustments, like the reduction in India's corporate tax rate to 22% in 2019 (with a further option for manufacturing units at 15%), have aimed to boost business investment and profitability, potentially benefiting Emami.

Personal income tax reforms also play a crucial role. When the government implements measures leading to increased disposable income for the middle class, such as adjustments in income tax slabs or deductions, it can directly stimulate consumer spending. This increased purchasing power can lead to higher demand for Emami's wide range of consumer goods, from skincare to healthcare products, thus positively influencing sales volumes and revenue.

- GST Impact: Variations in GST rates on FMCG products affect Emami's cost of goods sold and pricing strategies.

- Corporate Tax Relief: Reductions in corporate tax rates, such as the 2019 cuts in India, can improve Emami's net profitability by lowering its tax burden.

- Disposable Income Boost: Government initiatives that increase personal disposable income, like potential changes in income tax slabs or deductions, can drive higher consumer demand for Emami's product categories.

- Fiscal Reforms: Anticipated fiscal reforms and their potential to encourage consumer spending are key considerations for Emami's sales projections and market strategy.

Political stability in India provides a predictable environment for Emami, facilitating long-term planning and investment in the FMCG sector. Government initiatives supporting consumer goods manufacturing and improving the ease of doing business create a favorable operational climate. For example, the government's continued focus on rural development, as evidenced by budget allocations for FY2024-25, directly benefits Emami by expanding its customer base.

What is included in the product

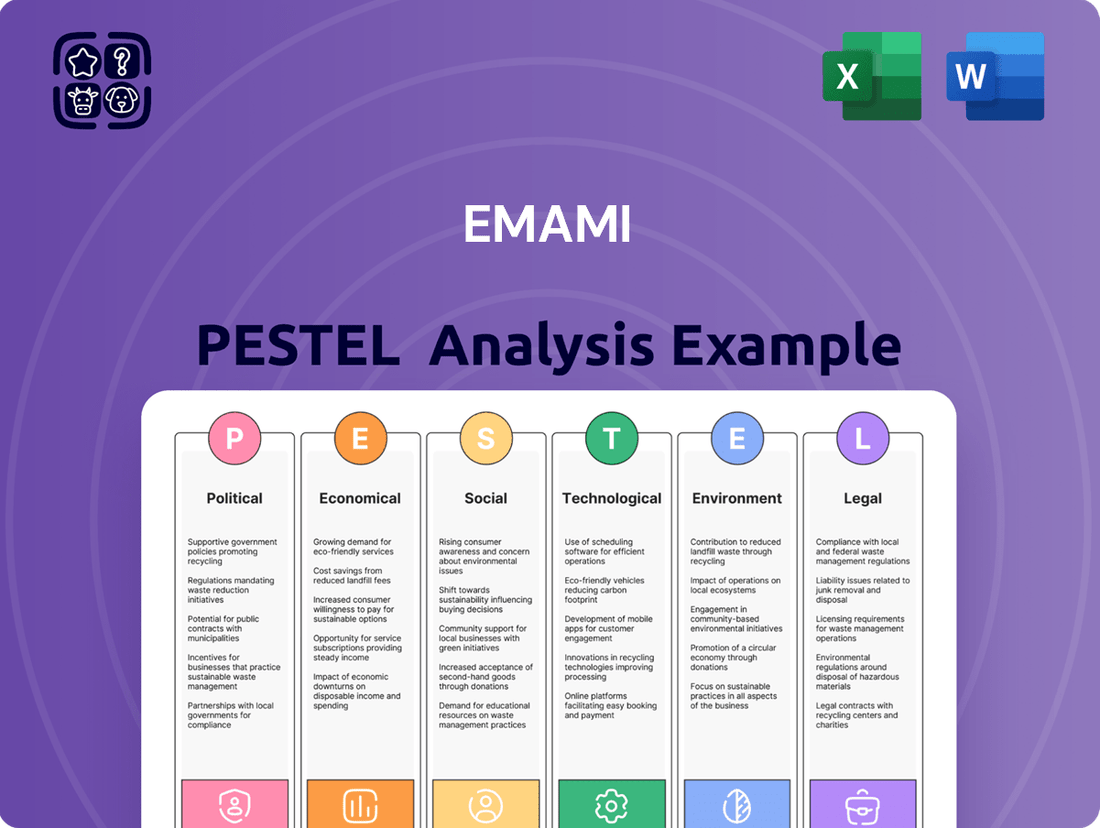

This Emami PESTLE analysis offers a comprehensive examination of the political, economic, social, technological, environmental, and legal factors influencing the company's operations and strategic decisions.

Offers a streamlined, actionable summary of Emami's PESTLE factors, transforming complex external analysis into easily digestible insights for swift strategic decision-making.

Economic factors

Inflation, especially food inflation, presents a significant challenge for Emami by increasing operational costs and potentially reducing consumer spending power. For instance, India's retail inflation averaged around 5.5% in the fiscal year 2023-24, with food prices often exceeding this average, directly impacting the affordability of everyday goods.

Rising raw material costs are a persistent issue in the Fast-Moving Consumer Goods (FMCG) sector. For Emami, this can compress gross margins. If input costs for key ingredients like edible oils or packaging materials surge, the company faces a difficult choice: absorb the costs, impacting profitability, or pass them on to consumers, risking a decline in sales volume as discretionary consumption tightens.

Indian consumer spending is showing robust growth, particularly in urban areas, driven by rising disposable incomes. Rural markets are also catching up, with increased spending power boosting demand for personal care and healthcare products. For instance, the Indian economy grew by 7.8% in the fiscal year 2023-24, signaling a healthy economic environment conducive to increased consumer expenditure.

Economic growth and employment rates directly impact disposable income levels. A growing economy with good employment opportunities means more people have money to spend. Government fiscal measures, such as tax relief or stimulus packages, can further enhance consumer confidence and purchasing power. These factors are crucial for companies like Emami, as they directly translate into higher sales volumes and revenue for their product categories.

India's economic growth is a key driver for Emami. The country's Gross Domestic Product (GDP) is projected to expand significantly, with estimates for FY25 often hovering around 6.5-7.0%. This robust growth fosters a more optimistic consumer environment.

Sustained economic expansion directly benefits Emami by widening the middle-class consumer base. As disposable incomes rise, more households can afford Emami's diverse range of personal care and healthcare products, leading to increased sales volumes and market penetration.

Improved market sentiment, a byproduct of healthy economic growth, encourages higher consumer spending on discretionary items, including beauty and wellness products. This positive sentiment, supported by a growing economy, translates into greater demand for Emami's offerings.

Exchange Rate Fluctuations

Emami's international ventures are significantly influenced by exchange rate fluctuations. A weakening Indian Rupee, for instance, generally benefits exporters like Emami by making their products cheaper for foreign buyers, potentially boosting international sales volume. Conversely, a stronger Rupee would have the opposite effect.

However, the impact isn't uniform. If Emami relies on importing raw materials or key components for its manufacturing processes, a depreciating Rupee would increase the cost of these inputs, directly impacting its cost of goods sold and potentially squeezing profit margins on both domestic and international sales. For example, if Emami imports a significant portion of its essential oils or packaging materials, a sharp depreciation of the INR against currencies like the USD or EUR in 2024 or early 2025 would elevate these expenses.

The volatility of exchange rates creates uncertainty, making it challenging for Emami to accurately forecast profitability from its overseas operations. Hedging strategies can mitigate some of this risk, but they also incur costs. The company's financial performance in 2024 and projected into 2025 will likely reflect how effectively it manages these currency exposures.

- Impact on International Sales: A weaker INR makes Emami's products more competitive abroad, potentially increasing sales volume.

- Cost of Imported Inputs: A depreciating INR increases the cost of raw materials and components sourced internationally, affecting profitability.

- Profitability Forecasts: Exchange rate volatility introduces uncertainty, complicating financial planning and profit projections for 2024/2025.

- Hedging Costs: While hedging can reduce currency risk, it adds an additional expense for Emami.

Interest Rates and Credit Availability

Interest rates significantly affect Emami's financial health. Higher rates translate to increased borrowing costs for expansion, capital expenditure, and even managing working capital. For instance, if Emami needs to secure new loans for a manufacturing plant upgrade in 2024, a 1% increase in interest rates could add millions to its annual interest payments.

The general availability and cost of credit in the market directly influence Emami's financial strategies. When credit is readily available and affordable, the company has more flexibility to fund new initiatives, such as launching new product lines or acquiring smaller businesses. Conversely, a tightening credit market, characterized by higher interest rates and stricter lending criteria, can constrain Emami's ability to pursue growth opportunities and may necessitate a focus on managing existing debt more conservatively.

- Borrowing Costs: Higher interest rates directly increase the cost of debt financing for Emami's operations and expansion plans.

- Credit Availability: The ease or difficulty of obtaining loans impacts Emami's capacity to fund new projects and manage its financial obligations.

- Financial Strategy Impact: Market credit conditions shape Emami's decisions regarding capital structure, investment, and debt management.

- 2024/2025 Outlook: As of mid-2024, many central banks have maintained relatively stable, albeit elevated, interest rate environments, influencing borrowing costs for companies like Emami.

India's economic growth is a significant tailwind for Emami, with projections for FY25 suggesting continued expansion. This robust growth translates to increased disposable incomes, particularly in urban centers, directly benefiting Emami's consumer product sales.

Rising inflation, especially in food prices, poses a challenge by potentially reducing consumer purchasing power for non-essential goods. For instance, India's retail inflation hovered around 5.5% in FY23-24, impacting affordability.

Exchange rate volatility, particularly for the Indian Rupee, presents a dual impact. A weaker Rupee can boost international sales but increases the cost of imported raw materials, affecting Emami's margins.

Interest rate policies by the Reserve Bank of India directly influence Emami's borrowing costs for expansion and working capital. Elevated rates can increase financial expenses, impacting overall profitability in 2024 and 2025.

Preview Before You Purchase

Emami PESTLE Analysis

The Emami PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Emami Limited, providing actionable insights for strategic planning.

You will gain a deep understanding of market dynamics, competitive landscapes, and potential growth opportunities for Emami.

What you're previewing here is the actual file—fully formatted and professionally structured, offering a complete and detailed PESTLE breakdown.

Sociological factors

Consumer preferences are shifting dramatically, with a significant surge in demand for natural, ayurvedic, and organic products. This trend is fueled by heightened health and wellness consciousness across demographics.

Emami is well-positioned to capitalize on this, given its deep roots in ayurvedic healthcare. For instance, in fiscal year 2024, Emami reported robust growth in its ayurvedic portfolio, indicating strong market acceptance of its natural offerings.

The company can further leverage these evolving lifestyles by innovating its product lines to align with modern consumer needs for holistic well-being. This includes expanding into new categories that emphasize natural ingredients and sustainable practices.

India's demographic landscape is undergoing significant transformation, with a substantial segment of its population being young and increasingly migrating to cities. This trend, coupled with the expanding middle class, presents a fertile ground for companies like Emami. For instance, by 2025, India's median age is projected to be around 29 years, indicating a large consumer base with evolving needs and preferences.

These demographic shifts directly translate into new consumer segments and burgeoning market opportunities for Emami. The growing urban population, estimated to reach over 40% of India's total population by 2025, signifies a concentrated market for Emami's products. This urbanization fuels demand for convenience, health, and wellness products, directly influencing Emami's product development and marketing strategies to cater to these evolving urban and semi-urban lifestyles.

The expanding middle class, characterized by increased disposable income, is a key driver for Emami's growth. This segment is more brand-conscious and willing to spend on personal care and healthcare solutions. Emami can leverage this by introducing premium product lines and focusing distribution channels in Tier 1 and Tier 2 cities, where this demographic is most concentrated and receptive to new offerings.

Consumer awareness regarding health and hygiene has surged dramatically, especially following the global pandemic. This heightened consciousness directly fuels demand for products in Emami's healthcare and personal hygiene segments. For instance, the ayurvedic and natural products market in India, where Emami has a strong presence, is projected to reach $10 billion by 2027, indicating significant growth potential.

Emami can leverage this trend by prominently showcasing the safety, cleanliness, and wellness benefits of its offerings. Highlighting natural ingredients and proven efficacy in its marketing campaigns can resonate deeply with consumers seeking trustworthy solutions. This focus aligns with the growing preference for preventive healthcare and personal care routines that promote overall well-being.

Cultural Influences and Traditional Values

Cultural influences and traditional values significantly shape consumer choices in India, particularly within the personal care and healthcare sectors. Many Indian consumers still prefer products that align with age-old Ayurvedic principles and natural ingredients, viewing them as safer and more effective. This deep-seated respect for tradition creates a strong market for brands that can authentically integrate these values into their offerings.

Emami's enduring brand presence, built on its foundation of traditional Indian remedies and formulations like Boroplus and Zandu Balm, is well-positioned to capitalize on this cultural affinity. By highlighting the natural origins and time-tested efficacy of its products, Emami can continue to foster trust and loyalty among consumers who prioritize heritage and holistic well-being. This is evident in the continued strong sales of its Ayurvedic product lines, which contribute significantly to its overall revenue.

- Ayurvedic Preference: A significant percentage of Indian households actively seek Ayurvedic or natural personal care products, reflecting a strong cultural inclination towards traditional wellness.

- Brand Trust: Emami's long-standing reputation, built over decades, leverages the cultural value placed on established and trusted brands, especially in the health and beauty categories.

- Festive Season Spending: Cultural traditions often involve increased spending on personal grooming and gifts during festivals, benefiting companies like Emami that offer relevant product ranges.

- Rural Market Penetration: Traditional values often hold greater sway in rural and semi-urban areas, where Emami has historically strong market penetration.

Digital Adoption and Social Media Influence

Digital adoption is rapidly reshaping consumer landscapes, particularly in India, where internet penetration continues to rise. As of early 2024, India's internet user base exceeded 700 million, with a significant portion actively engaging on social media platforms. This trend directly impacts purchasing decisions, with consumers increasingly relying on online reviews and influencer recommendations. For Emami, this presents a substantial opportunity to enhance its digital footprint.

Leveraging digital marketing strategies is paramount for Emami to connect with these evolving consumer habits. The company can utilize platforms like Instagram, Facebook, and YouTube for targeted advertising campaigns. Emami's investment in e-commerce capabilities, allowing direct-to-consumer sales, is crucial for capturing a share of the growing online retail market, which is projected to reach over $200 billion by 2026. Furthermore, strategic collaborations with relevant social media influencers can amplify brand reach and foster trust among younger, tech-savvy demographics.

- Digital Penetration: India's internet user base crossed 700 million in early 2024, indicating a vast digital audience.

- Social Media Engagement: A significant percentage of these users actively participate on social media, influencing purchasing behavior.

- E-commerce Growth: The Indian e-commerce market is on a strong growth trajectory, projected to exceed $200 billion by 2026.

- Influencer Marketing ROI: Collaborating with influencers offers a direct channel to engage tech-savvy consumers and drive sales.

The increasing preference for natural and Ayurvedic products, driven by a growing health consciousness, directly benefits Emami's core offerings. This trend is reinforced by India's youthful demographic and expanding urban population, creating a large and evolving consumer base for personal care and healthcare items.

Emami's strong brand equity, built on traditional values and trusted formulations, resonates deeply with cultural preferences for natural and time-tested remedies. This is further amplified by a significant increase in digital adoption and e-commerce growth, offering new avenues for consumer engagement and sales.

| Sociological Factor | Emami's Position/Opportunity | Relevant Data (2024/2025 Projections) |

|---|---|---|

| Consumer Preference for Natural/Ayurvedic | Leveraging deep roots in Ayurvedic healthcare; strong market acceptance | Ayurvedic and natural products market projected to reach $10 billion by 2027. |

| Demographics (Young Population & Urbanization) | Large consumer base with evolving needs; concentrated market in urban areas | India's median age projected around 29 by 2025; urban population over 40% by 2025. |

| Cultural Affinity for Tradition | Brand trust built on traditional Indian remedies; preference for heritage | Continued strong sales in Ayurvedic product lines demonstrating cultural resonance. |

| Digital Adoption & E-commerce | Opportunity to enhance digital footprint; direct-to-consumer sales | Internet users exceeded 700 million in early 2024; e-commerce market projected over $200 billion by 2026. |

Technological factors

The burgeoning e-commerce landscape in India, including rapid growth in quick commerce, presents a significant opportunity for Emami to enhance its distribution. In 2023, India's e-commerce market was valued at approximately $75 billion and is projected to reach $150 billion by 2027, indicating a strong shift towards online purchasing.

Emami can strategically optimize its online presence by investing further in direct-to-consumer (DTC) channels, allowing for greater control over brand experience and customer data. Leveraging established digital marketplaces, such as Amazon and Flipkart, which saw significant sales growth in 2024, will be crucial for expanding reach, especially in urban centers.

This digital push is vital for improving product accessibility and catering to the evolving shopping habits of Indian consumers, who increasingly seek convenience and wider product selections online. The ability to reach consumers directly through digital means can also lead to cost efficiencies and better inventory management for Emami.

Emami's production efficiency is significantly boosted by automation and advanced manufacturing technologies. These advancements, including robotics and AI-driven quality control, are crucial for reducing operational costs and elevating product consistency across its diverse FMCG portfolio. By integrating smart factory principles, Emami can streamline its manufacturing processes, leading to higher output volumes and quicker response times to market demands, which is vital in the competitive consumer goods sector.

Data analytics, AI, and machine learning are revolutionizing how companies understand their customers. By sifting through vast amounts of data, these technologies can pinpoint consumer behaviors, anticipate market shifts, and even craft hyper-personalized marketing messages. For Emami, this means moving beyond broad market segments to truly understand individual preferences and needs.

Emami can leverage these advanced tools to gain granular insights into what drives consumer choices for their personal care and healthcare products. Imagine predicting which new product formulations will resonate most or identifying the most effective channels to reach specific customer groups. This data-driven approach allows for more efficient resource allocation and a higher likelihood of marketing success.

The ability to predict market trends is a significant advantage. For instance, by analyzing search queries and social media sentiment around wellness and beauty, Emami can proactively adjust its product development pipeline. In 2024, global spending on AI in marketing was projected to reach over $50 billion, highlighting the significant investment and expected returns in this area.

Personalizing marketing efforts is key to engagement. Emami can use AI to tailor advertisements, email campaigns, and even website experiences based on individual consumer profiles. This not only enhances customer satisfaction but also drives conversions. Companies using AI for personalization have reported up to a 20% increase in sales and a 15% boost in customer retention rates.

Research and Development in Product Innovation

Continuous research and development (R&D) is crucial for Emami to innovate in personal care and healthcare. This focus allows them to create new and better products, keeping them ahead in a dynamic market. By investing in R&D, Emami can leverage the latest scientific breakthroughs to enhance its product portfolio and meet evolving consumer demands.

Technological advancements are key enablers for Emami's innovation pipeline. Innovations in formulation science, like improved ingredient stability and bioavailability, and advancements in product delivery systems, such as enhanced topical absorption or controlled release mechanisms, directly translate into competitive advantages. For example, advancements in nanotechnology could lead to more effective skincare ingredients.

- Investment in R&D: Emami has consistently allocated resources to R&D to fuel product innovation.

- Formulation Science: Exploring new ingredient combinations and delivery systems to improve product efficacy and user experience.

- Technological Integration: Incorporating digital tools and AI in R&D processes to accelerate discovery and development cycles.

- Market Responsiveness: R&D efforts are geared towards quickly adapting to emerging consumer trends and health concerns, a strategy vital in the fast-moving consumer goods (FMCG) sector.

Supply Chain Digitization and Logistics

Emami's supply chain is increasingly benefiting from digitization. The integration of technologies like the Internet of Things (IoT) for real-time tracking and blockchain for enhanced transparency is improving operational efficiency. For instance, by 2024, companies adopting advanced supply chain visibility platforms reported an average of 10% reduction in inventory holding costs and a 15% improvement in on-time delivery rates.

Advanced logistics software and optimized inventory management are crucial for Emami's diverse geographical reach. By leveraging these tools, the company can significantly reduce operational costs and ensure timely product delivery, a key competitive advantage in the FMCG sector. In 2023, the global logistics market size reached over $10 trillion, with technology adoption being a major growth driver, enabling businesses to streamline operations and manage complex networks more effectively.

- IoT for real-time tracking: Enhances visibility and reduces transit times.

- Blockchain for transparency: Improves traceability and reduces fraud risks.

- Advanced logistics software: Optimizes routing and warehouse management.

- Inventory management systems: Minimizes stockouts and reduces holding costs.

Technological advancements are reshaping Emami's operational efficiency and market responsiveness. The company's adoption of automation and AI in manufacturing, evident in its 2024 focus on smart factory principles, directly reduces costs and boosts product consistency. Furthermore, Emami's strategic investment in R&D, particularly in formulation science and nanotechnology, allows for the creation of more effective products, a crucial differentiator in the competitive FMCG sector.

Data analytics, AI, and machine learning are enabling Emami to achieve hyper-personalized marketing, with companies leveraging AI for personalization reporting up to a 20% sales increase. This data-driven approach allows for better resource allocation and a higher probability of marketing success. The company's supply chain is also benefiting from digitization, with IoT and blockchain enhancing transparency and efficiency. By 2024, advanced supply chain visibility platforms were reported to reduce inventory holding costs by an average of 10%.

| Technology Area | Impact on Emami | Example/Data Point (2023-2025) |

|---|---|---|

| Automation & AI in Manufacturing | Reduced operational costs, improved product consistency | Focus on smart factory principles in 2024 |

| Data Analytics & AI in Marketing | Hyper-personalized marketing, increased sales | Companies using AI for personalization saw up to 20% sales increase |

| R&D (Formulation Science, Nanotechnology) | Enhanced product efficacy, new product development | Investment in R&D for improved ingredient delivery |

| Supply Chain Digitization (IoT, Blockchain) | Increased transparency, operational efficiency | 10% average reduction in inventory holding costs with advanced visibility platforms (2024) |

Legal factors

The Food Safety and Standards Authority of India (FSSAI) imposes stringent regulations that directly impact Emami's healthcare and health supplement offerings. These rules govern everything from product formulation and ingredient sourcing to manufacturing practices and rigorous quality control. Compliance ensures consumer safety and builds trust, vital for Emami's brands.

For instance, FSSAI mandates specific labelling requirements, including nutritional information and allergen declarations, which Emami must adhere to across its product lines. Navigating these regulations requires significant investment in research, development, and quality assurance processes to maintain market access and consumer confidence in their health-focused products.

Emami operates under India's stringent product labeling and advertising laws, which are increasingly focused on consumer protection. These regulations, enforced by bodies like the Food Safety and Standards Authority of India (FSSAI) and the Advertising Standards Council of India (ASCI), mandate clear disclosure of nutritional information, ingredient lists, and manufacturing details. For instance, the FSSAI's Food Safety and Standards (Packaging and Labelling) Regulations, 2011, and subsequent amendments, require accurate representation of product contents.

The company must ensure its advertising claims are truthful and not misleading, a critical aspect given ASCI's role in monitoring and penalizing deceptive advertising. Recent amendments and proposed guidelines, such as those pushing for front-of-pack labeling (FOPL) for health-related products, necessitate even greater transparency. Failure to comply can result in significant legal penalties, product recalls, and damage to brand reputation. Emami’s adherence to these evolving legal frameworks is paramount for maintaining consumer trust and avoiding costly litigation.

Intellectual Property Rights (IPR) are vital for Emami, safeguarding its well-established brands like BoroPlus, Navratna, and Zandu through trademarks. Patents protect its product innovations and formulations, ensuring a competitive edge. Copyrights are utilized for packaging designs and marketing materials, preventing imitation.

In the highly competitive FMCG sector, Emami's robust IPR strategy is crucial. It actively combats counterfeiting and unauthorized use of its popular products, which can dilute brand value and erode market share. For instance, in 2023, the Indian government seized counterfeit goods valued at over ₹100 crore, highlighting the pervasive nature of this issue that Emami must actively address.

Consumer Protection Laws

Consumer protection laws in India, such as the Consumer Protection Act, 2019, significantly impact Emami's operations by granting consumers rights and holding businesses accountable. These regulations mandate adherence to product quality standards, fair trade practices, and transparent advertising, directly influencing Emami's product development and marketing strategies. For instance, the Act empowers consumers to seek redressal for defective goods or deficient services, necessitating robust quality control and customer service mechanisms within Emami.

Emami must prioritize product safety and efficacy, aligning with stringent regulatory requirements to prevent recalls or penalties. The company's approach to handling consumer grievances is critical; timely and effective resolution builds trust and safeguards its reputation. In 2023, India saw a substantial increase in consumer complaints filed through digital platforms, highlighting the growing awareness and expectation for prompt grievance redressal. Emami's commitment to ethical business practices, including transparent labeling and truthful advertising, is paramount for maintaining consumer confidence and avoiding legal challenges that could disrupt market performance.

- Product Safety Compliance: Emami must adhere to BIS standards and other safety regulations for its FMCG products, ensuring no compromise on quality.

- Grievance Redressal Mechanisms: Establishing efficient customer care channels and dispute resolution processes is vital, especially with the rise in consumer complaints filed online.

- Ethical Marketing and Advertising: Emami needs to ensure its promotional content is factual and avoids misleading claims, a key tenet of consumer protection laws.

- Data Privacy: With increasing digital transactions, Emami must also comply with data protection laws to safeguard consumer information.

Labor Laws and Employment Regulations

Emami's operations are significantly shaped by India's labor laws and employment regulations, which govern everything from minimum wages and working hours to workplace safety and employee benefits. For instance, the Code on Wages, 2019, aims to consolidate laws relating to wages, bonus payments, and related matters, potentially impacting Emami's compensation structures for its vast workforce. Compliance is crucial for maintaining operational continuity and fostering a stable industrial environment.

Adherence to these legal frameworks is non-negotiable for Emami to avoid penalties and maintain its reputation. This includes ensuring fair labor practices, providing adequate working conditions, and managing employee relations effectively. The company must stay updated on evolving regulations, such as those related to contract labor or social security contributions, to ensure its workforce management practices remain compliant and supportive of its employees.

- Minimum Wage Compliance: Emami must adhere to the Minimum Wages Act, 1948, and the new Code on Wages, 2019, ensuring all employees receive at least the prescribed minimum remuneration, which varies by region and skill level.

- Working Conditions and Safety: The Factories Act, 1948, and the Occupational Safety, Health and Working Conditions Code, 2020, mandate specific standards for workplace safety, health, and welfare, impacting Emami's manufacturing facilities.

- Employee Benefits and Social Security: Regulations concerning provident fund, gratuity, and employee state insurance (ESI) are vital for Emami to provide essential social security benefits to its employees, contributing to employee well-being and retention.

- Industrial Relations: Laws like the Industrial Disputes Act, 1947, govern the resolution of disputes between employers and employees, requiring Emami to maintain fair practices and effective communication channels to ensure harmonious industrial relations.

Emami operates within a robust legal framework in India, necessitating strict adherence to consumer protection laws like the Consumer Protection Act, 2019. This mandates transparency in advertising and product quality, impacting how Emami markets its diverse product portfolio. For instance, the company must ensure all claims are factually accurate and avoid misleading consumers, a critical factor given the increasing scrutiny on marketing practices.

The Food Safety and Standards Authority of India (FSSAI) imposes stringent regulations on Emami's healthcare and health supplement products, covering formulation, sourcing, manufacturing, and quality control. Compliance with FSSAI's Packaging and Labelling Regulations, 2011, ensures accurate nutritional information and allergen declarations, vital for consumer trust. Failure to comply can lead to product recalls and reputational damage.

Intellectual Property Rights (IPR) are crucial for Emami, protecting brands like BoroPlus and Zandu via trademarks and product innovations through patents. The company actively combats counterfeiting, a significant issue in the FMCG sector where counterfeit goods valued at over ₹100 crore were seized in India in 2023, underscoring the need for Emami's robust IPR strategy.

Emami's labor practices are governed by India's labor laws, including the Code on Wages, 2019, and the Occupational Safety, Health and Working Conditions Code, 2020. Compliance ensures fair wages, safe working conditions, and proper employee benefits, crucial for maintaining operational stability and employee morale. The company must also navigate industrial relations laws like the Industrial Disputes Act, 1947, to foster harmonious workplace environments.

Environmental factors

India's commitment to tackling plastic waste is intensifying, with stricter regulations on packaging becoming a significant environmental factor for companies like Emami. The nation is pushing for better waste management infrastructure and circular economy principles, directly impacting how consumer goods are packaged and disposed of.

Emami, like other fast-moving consumer goods (FMCG) players, must navigate Extended Producer Responsibility (EPR) mandates. These regulations, part of the Plastic Waste Management (PWM) Rules, require producers to manage the end-of-life of their packaging. For instance, the PWM Amendment Rules, 2022, have set ambitious targets for plastic waste collection and recycling, putting pressure on companies to invest in sustainable solutions and collection systems.

Exploring and adopting sustainable packaging materials, such as recycled plastics, biodegradable alternatives, or lightweight designs, is crucial for Emami. This not only helps in meeting evolving regulatory demands but also addresses growing consumer awareness about environmental impact. Companies failing to comply with EPR norms can face penalties, making proactive engagement with these regulations a strategic imperative for long-term business viability and brand reputation.

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. This trend is a major driver for companies like Emami to adopt greener practices. For instance, a 2024 report indicated that over 60% of consumers consider environmental impact when making purchasing decisions.

Emami can bolster its brand by integrating sustainability across its value chain. This includes ethically sourcing ingredients, optimizing manufacturing processes to reduce waste and energy consumption, and implementing eco-friendly packaging solutions. Such initiatives not only resonate with environmentally aware consumers but also position Emami favorably against competitors in the 2024-2025 market landscape.

Water scarcity presents a significant challenge for manufacturing industries, including Emami, necessitating robust resource management. In 2023, India faced widespread water stress, with the Central Water Commission reporting that many regions were operating with critical water deficits. Emami's production facilities, particularly those in water-stressed areas, must prioritize efficient water use.

Implementing advanced water conservation measures like rainwater harvesting and wastewater recycling is crucial for Emami. Optimizing water utilization in processes such as cooling and cleaning can significantly reduce consumption. For instance, adopting closed-loop water systems, which recirculate water, can lower freshwater intake by up to 70% in similar manufacturing contexts.

These strategies not only mitigate environmental risks but also ensure long-term operational sustainability by reducing reliance on increasingly scarce freshwater sources. By investing in water-efficient technologies, Emami can also potentially lower operational costs related to water procurement and treatment, especially as water prices are projected to rise in many regions by 2025.

Climate Change and Carbon Footprint Reduction

Climate change presents significant challenges, with growing global pressure on businesses to curb their carbon emissions. For Emami, this means actively pursuing strategies to reduce its environmental impact. The company can leverage cleaner energy alternatives and enhance its logistics to minimize its carbon footprint.

Emami can further contribute to environmental protection and meet climate targets by focusing on energy efficiency across all its manufacturing and operational facilities. This proactive approach not only addresses regulatory and consumer expectations but also offers potential cost savings through reduced energy consumption.

- Transition to Renewable Energy: Investing in solar power for its manufacturing units, as seen in many Indian companies aiming for sustainability. For instance, the Indian renewable energy sector saw significant growth, with solar power capacity reaching over 80 GW by early 2024.

- Logistics Optimization: Implementing route optimization software and exploring electric or hybrid vehicle fleets for product distribution to reduce fuel consumption and emissions.

- Energy-Efficient Practices: Upgrading to energy-efficient machinery and lighting systems in factories and offices, which can lead to substantial reductions in energy bills and carbon output.

- Waste Reduction and Recycling: Enhancing waste management protocols, increasing recycling rates, and exploring circular economy principles within its packaging and product lifecycle.

Waste and Pollution Control Norms

Emami operates under increasingly stringent waste and pollution control norms, a critical environmental factor. Regulations governing industrial waste management, wastewater treatment, and air emissions are becoming more rigorous across India, where Emami has significant operations. For instance, the Central Pollution Control Board (CPCB) continuously updates emission and effluent standards for various industries, including those relevant to Emami's manufacturing processes, such as chemicals and consumer goods. Failure to comply can result in substantial fines and operational disruptions.

Adherence to these strict environmental standards is not just a legal requirement but also crucial for maintaining Emami's social license to operate and its brand reputation. The company must invest in advanced pollution control technologies and robust waste disposal systems to prevent environmental damage and meet legal compliances. For example, wastewater treatment plants must meet specific biochemical oxygen demand (BOD) and chemical oxygen demand (COD) levels before discharge, and air emission controls are vital to limit particulate matter and gaseous pollutants. These measures are essential to prevent penalties and ensure the company's long-term sustainability.

Key aspects Emami must manage include:

- Industrial Waste Management: Proper segregation, treatment, and disposal of solid and hazardous waste generated from manufacturing processes.

- Wastewater Treatment: Ensuring all effluent discharged meets prescribed environmental quality standards for parameters like pH, suspended solids, and dissolved oxygen.

- Air Emission Control: Implementing measures to control particulate matter, volatile organic compounds (VOCs), and other harmful gases released into the atmosphere.

- Compliance Monitoring: Regular monitoring and reporting of environmental performance to regulatory bodies to demonstrate adherence to norms.

India's growing emphasis on environmental sustainability, particularly regarding plastic waste and water conservation, directly impacts Emami's operational strategies. Stricter regulations on packaging and waste management, coupled with increasing water scarcity, necessitate proactive measures from the company. These environmental shifts are driving consumer preferences towards eco-friendly products, making sustainable practices a key differentiator in the 2024-2025 market.

PESTLE Analysis Data Sources

Our Emami PESTLE Analysis is built on a robust foundation of data from official government publications, leading market research firms, and international economic bodies. We integrate insights from financial reports, industry-specific trends, and regulatory updates to ensure comprehensive coverage.