Emami Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emami Bundle

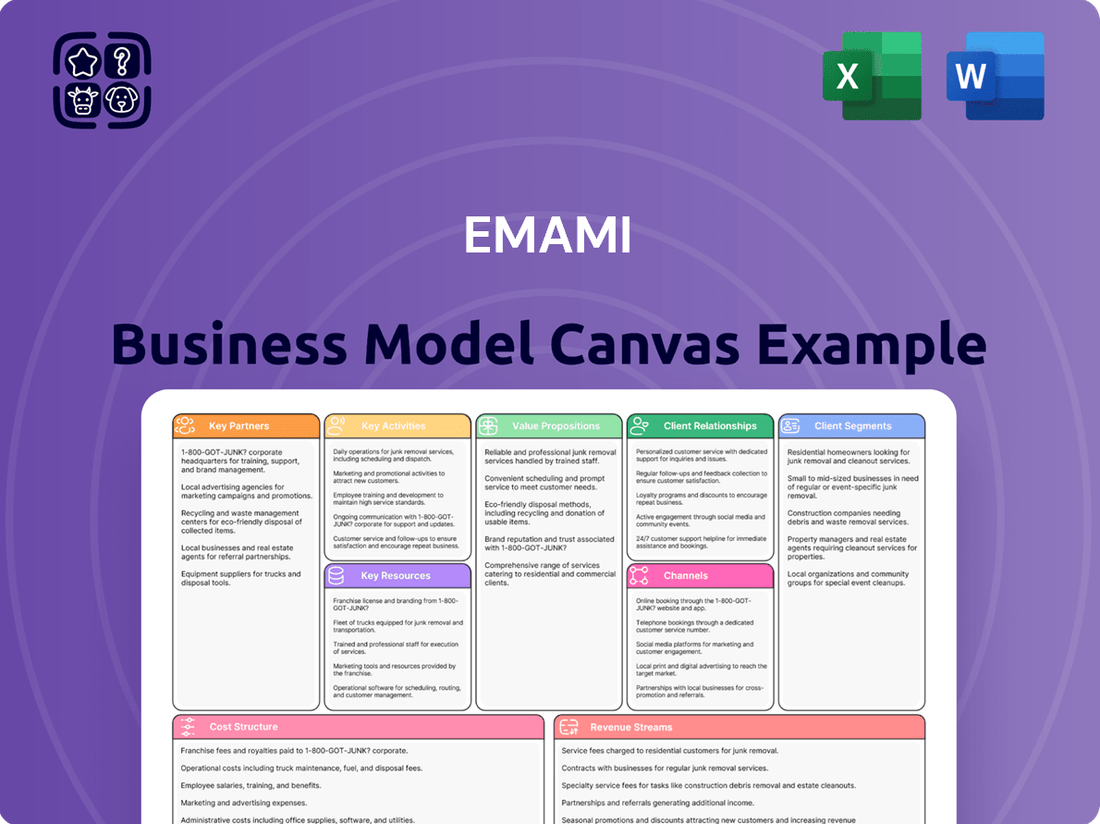

Discover the strategic engine driving Emami's success with our comprehensive Business Model Canvas. This detailed breakdown unveils how Emami effectively reaches its diverse customer segments and builds strong relationships. Understand their key resources and activities that create unique value propositions in the competitive FMCG market.

Explore Emami's strategic partnerships and revenue streams that fuel its growth and profitability. This canvas illuminates their cost structure and how they optimize operations for sustained market leadership. It’s an invaluable tool for anyone seeking to understand the intricacies of a thriving consumer goods business.

Unlock the full strategic blueprint behind Emami's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Emami's distribution network partners are the backbone of its market penetration strategy. The company relies on a multi-tiered system of super-stockists, distributors, and sub-distributors to ensure its products reach every corner of India.

This expansive network is vital for Emami's success in the fast-moving consumer goods (FMCG) sector, enabling access to an estimated 5.4 million retail outlets as of 2023.

By fostering strong relationships with these partners, Emami maintains a competitive advantage through consistent product availability and efficient supply chain management.

These collaborations are instrumental in reaching diverse consumer segments, from bustling urban centers to remote rural villages, solidifying Emami's widespread market presence.

Emami partners with a vast network of over 200 raw material suppliers worldwide to secure high-quality natural ingredients. These partnerships are crucial for its extensive range of personal care and wellness products. The company prioritizes sourcing essential oils, herbal extracts, and organic materials to maintain product efficacy and consumer trust.

Emami collaborates with numerous marketing and advertising agencies to amplify its extensive product range across various consumer segments. These alliances are crucial for orchestrating impactful celebrity endorsements and executing dynamic digital marketing initiatives, including seasonal campaigns. For instance, in the fiscal year 2023-24, Emami continued to invest heavily in advertising and sales promotion, with a significant portion allocated to media spends that leverage these agency partnerships to boost brand awareness and consumer interaction.

E-commerce and Online Platform Collaborations

Emami's strategy to boost its online footprint includes forging alliances with major e-commerce players and quick commerce services, directly targeting digitally connected consumers. This approach is crucial for reaching a younger, tech-savvy demographic. For instance, Emami's own direct-to-consumer platform, Zanducare, complements its presence on popular marketplaces.

Collaborations with platforms like Udaan and Jio Mart are central to Emami's distribution network, ensuring its diverse product range is readily available to a wide online audience. This multi-channel approach maximizes accessibility and caters to evolving consumer purchasing habits.

- E-commerce Reach: Partnerships with platforms like Flipkart and Amazon India are vital, with online sales contributing a significant portion to overall revenue growth. In FY23, Emami reported a substantial increase in its direct-to-consumer (D2C) business, with online channels playing a key role.

- Quick Commerce Integration: Emami is actively integrating with quick commerce providers to offer faster delivery of its products, tapping into the demand for instant gratification. This is particularly relevant for impulse purchases in categories like personal care.

- Platform Diversification: By partnering with both large marketplaces and emerging quick commerce players, Emami ensures a diversified online sales strategy, mitigating risks and capturing a broader market share.

Strategic Acquisition Targets and Integration Partners

Emami's key partnerships often revolve around strategic acquisitions, a cornerstone of its inorganic growth. For instance, the acquisition of Zandu Pharmaceutical in 2008 for approximately ₹150 crore significantly broadened Emami's presence in the Ayurvedic healthcare segment. This move wasn't just about acquiring a brand; it was about integrating a legacy and tapping into a vast consumer base seeking traditional remedies. Similarly, the acquisition of Kesh King hair oil from Sanjeev Juneja Co. in 2015 for ₹165 crore bolstered Emami's position in the hair care market. These strategic integrations require careful planning and often involve leveraging the expertise of existing teams or external integration partners to ensure smooth operational transitions and maximum value realization.

Further illustrating this strategy, Emami acquired the Dermicool brand from Lighthouse India Fund III in 2015 for ₹130 crore. This acquisition allowed Emami to enter the cooling and anti-itch segment, further diversifying its consumer products portfolio. The success of these integrations hinges on identifying synergistic opportunities and efficiently merging operations, distribution networks, and marketing strategies. By acquiring established brands, Emami not only diversifies its revenue streams but also gains immediate market share and consumer trust, often facilitated by partnerships that help navigate complex market landscapes.

These strategic acquisitions are critical for Emami's business model, enabling it to:

- Diversify its product portfolio across multiple consumer segments.

- Expand its market reach and penetration into new territories and demographics.

- Leverage established brand equity and consumer loyalty from acquired entities.

- Strengthen its competitive position against larger players in the FMCG sector.

Emami's partnerships extend to contract manufacturers and research institutions, ensuring product innovation and quality control. These collaborations are vital for developing new formulations and maintaining high standards in its diverse product lines, especially in niche segments like Ayurvedic healthcare.

The company also collaborates with financial institutions and logistics providers to streamline its operations and ensure efficient supply chain management and access to capital for expansion. These relationships are foundational for supporting Emami's extensive distribution network and its ongoing growth initiatives.

Emami's key partnerships are crucial for its market penetration and product diversification, as seen in its strategic acquisitions. For instance, the 2008 acquisition of Zandu Pharmaceutical for ₹150 crore significantly boosted its Ayurvedic portfolio. More recently, in FY23-24, Emami continued to leverage its distribution network, reaching over 5.4 million retail outlets, underscoring the importance of its partner relationships.

| Partnership Type | Key Partners/Focus | Impact/Benefit | Example/Data Point (FY23-24) |

|---|---|---|---|

| Distribution | Super-stockists, Distributors, Retailers | Market penetration, Product availability | Access to 5.4 million retail outlets |

| Raw Material Sourcing | Global Suppliers | Product quality, Ingredient diversity | Sourcing of essential oils and herbal extracts |

| E-commerce & Digital | Flipkart, Amazon India, D2C platforms | Online sales growth, Digital consumer reach | Significant contribution to D2C business growth |

| Strategic Acquisitions | Zandu Pharmaceutical, Kesh King | Portfolio diversification, Market share expansion | Zandu acquisition in 2008 for ₹150 crore |

What is included in the product

A strategic blueprint detailing Emami's customer focus, product offerings, and market approach, presented within the standard 9 Business Model Canvas blocks.

Emami's Business Model Canvas acts as a pain point reliever by providing a clear, structured framework to visualize and address complex business challenges.

It simplifies the identification of inefficiencies and opportunities, enabling targeted solutions to common strategic pain points.

Activities

Emami's primary activity centers on producing a wide array of personal care and healthcare items, with a strong emphasis on maintaining superior quality. The company manages eight manufacturing facilities, seven located within India and one internationally, all adhering to stringent quality assurance protocols.

These rigorous quality control measures are validated by certifications such as ISO 9001, underscoring Emami's dedication to excellence. This focus on quality directly contributes to their impressive reported customer satisfaction rate, which stands at 98%, demonstrating a consistent delivery of reliable products.

Emami's Research and Development (R&D) and Innovation are central to its business model, driving the creation of new and improved personal care products. The company consistently invests in R&D to develop novel formulations, focusing heavily on natural and Ayurvedic ingredients. This commitment is underscored by their goal to achieve 100% natural and vegan-compatible product lines.

In fiscal year 2024, Emami demonstrated its innovative drive by launching an impressive portfolio of over 35 new products and product variants. A significant portion of these launches were strategically introduced as digital-first offerings, reflecting Emami's adaptability to evolving consumer purchasing habits and market trends.

Emami's strategy hinges on aggressive marketing and brand promotion to stand out in a crowded marketplace. This involves utilizing high-profile celebrity endorsements and comprehensive multi-channel campaigns across television, digital platforms, and print media to ensure widespread consumer reach and engagement.

To bolster brand loyalty and maintain strong consumer awareness, Emami strategically employs seasonal promotions and consistent advertising efforts. For instance, the company allocated a significant ₹694 crore towards advertisement and sales promotion in the fiscal year 2025, underscoring its commitment to keeping its brands top-of-mind.

Supply Chain and Distribution Management

Emami's key activity revolves around managing an exceptionally efficient and far-reaching supply chain and distribution network. This ensures their diverse product portfolio, ranging from personal care to healthcare, consistently reaches consumers when and where they need it. Their robust infrastructure is critical for maintaining product availability across varied markets.

The company operates a comprehensive network that includes numerous depots, a vast array of distributors, and their own direct retail outlets. This multi-pronged approach allows Emami to effectively penetrate both bustling urban centers and more remote rural areas within India. Furthermore, their reach extends significantly beyond domestic borders, serving over 70 countries worldwide.

A core focus on supply chain efficiency directly combats stockouts, a common challenge in fast-moving consumer goods. By optimizing inventory levels across this extensive network, Emami minimizes waste and maximizes sales opportunities. For instance, in fiscal year 2024, Emami reported a robust distribution reach, ensuring their products were accessible to a significant portion of the Indian population.

- Extensive Network: Emami leverages depots, distributors, and direct retail for broad market coverage.

- Geographic Reach: Operations span India's urban and rural areas and over 70 international markets.

- Inventory Optimization: Focus on efficiency minimizes stockouts and manages inventory levels effectively.

- Timely Delivery: The supply chain is designed to ensure prompt product availability for consumers.

Strategic Acquisitions and Portfolio Diversification

Emami strategically seeks acquisitions to broaden its product offerings and solidify its presence in specialized markets. This involves pinpointing promising companies, performing thorough evaluations, and integrating acquired brands such as Zandu, Kesh King, and Dermicool into its operational framework.

These acquisitions enable Emami to penetrate new product categories and reduce reliance on its existing portfolio. For instance, the acquisition of Kesh King in 2015 significantly expanded Emami's hair care segment.

- Strategic Acquisitions Emami actively pursues acquisitions to enhance its market position and product diversity.

- Portfolio Diversification This strategy reduces reliance on single product lines, spreading risk across various categories.

- Brand Integration Successful integration of acquired brands like Zandu and Kesh King is crucial for realizing synergies.

- Niche Market Penetration Acquisitions allow Emami to enter and establish leadership in specialized consumer segments.

Emami's key activities are multifaceted, encompassing manufacturing, robust R&D, aggressive marketing, and efficient supply chain management. The company prioritizes quality across its eight manufacturing facilities and invests heavily in innovation, aiming for 100% natural product lines, evidenced by over 35 new launches in FY24. Their marketing strategy relies on celebrity endorsements and substantial advertising spend, with ₹694 crore allocated in FY25. Crucially, Emami manages an extensive supply chain reaching over 70 countries, ensuring product availability.

Strategic acquisitions are another vital activity, allowing Emami to diversify its product portfolio and enter niche markets, as seen with the integration of brands like Kesh King and Zandu.

| Key Activity | Description | Impact |

|---|---|---|

| Manufacturing & Quality Control | Producing personal care and healthcare items across 8 facilities, adhering to strict quality standards (e.g., ISO 9001). | 98% customer satisfaction rate. |

| Research & Development (R&D) and Innovation | Developing new products, focusing on natural and Ayurvedic ingredients; aiming for 100% natural/vegan lines. | Launched over 35 new products/variants in FY24, with many digital-first. |

| Marketing & Brand Promotion | Utilizing celebrity endorsements and multi-channel campaigns; significant ad spend. | ₹694 crore allocated for advertisement and sales promotion in FY25. |

| Supply Chain & Distribution Management | Operating a vast network of depots, distributors, and retail outlets across India and over 70 countries. | Ensures timely product availability and minimizes stockouts. |

| Strategic Acquisitions | Acquiring and integrating brands to expand product offerings and market presence. | Strengthened segments like hair care with brands like Kesh King. |

Delivered as Displayed

Business Model Canvas

The Emami Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing the precise structure, formatting, and content that will be delivered, ensuring no surprises and full transparency regarding the final product. Once your order is processed, you will gain immediate access to this exact file, ready for your strategic analysis and customization.

Resources

Emami's strength lies in its robust brand portfolio, featuring household names like BoroPlus, Navratna, Fair and Handsome, Zandu Balm, and Kesh King. These established brands are a testament to significant intellectual property, driving market share and fostering deep consumer trust.

This strong brand equity translates directly into competitive advantage. Emami's commitment to innovation is underscored by its ownership of over 150 patents, safeguarding its unique product formulations and manufacturing processes.

Emami’s extensive manufacturing and R&D facilities represent a core strength. The company operates six manufacturing units strategically located across India, alongside one international facility, ensuring broad production capacity and market reach. In fiscal year 2023, Emami's production output supported a robust product portfolio, contributing to its reported revenue of INR 3,300 crore.

These state-of-the-art facilities are instrumental in maintaining Emami's commitment to quality and efficiency in producing a diverse array of personal care and healthcare items. The company’s investment in advanced manufacturing technology allows for streamlined production processes, meeting the growing consumer demand for its products.

Furthermore, Emami’s dedicated Research and Development (R&D) laboratory is a vital resource for driving product innovation. This R&D focus enables the company to continuously develop new formulations and enhance existing products, staying competitive in the dynamic consumer goods market. In 2023, Emami launched several new products, a testament to its R&D pipeline.

Emami's strength lies in its vast distribution network, reaching an impressive 10 lakh retailers across India, supported by 3,200 distributors and 10,500 sub-stockists. This extensive reach ensures their products are available in both urban and rural markets, a critical factor for consumer goods companies.

The company's global footprint is also substantial, with products distributed in over 70 countries. This widespread accessibility is a key driver for Emami's market penetration and brand visibility on an international scale.

Human Capital and Experienced Management

Human capital and experienced management are foundational to Emami's success, guiding innovation and operational excellence. The company actively cultivates a positive work culture, invests in employee training, and prioritizes leadership advancement.

As of January 2025, Emami Limited's core team comprised 37 employees, supporting a vast workforce of 25,000 individuals across its operations. This extensive human resource base, coupled with seasoned leadership, is crucial for driving the company's strategic objectives and maintaining its competitive edge in the market.

- Skilled Workforce: Emami’s strength lies in its large, diverse workforce of 25,000 employees, ensuring broad operational capabilities.

- Experienced Management: A core team of 37 experienced managers at Emami Limited provides strategic direction and oversight.

- Talent Development: Focus on training programs and leadership development fosters continuous growth and innovation within the company.

- Operational Efficiency: The combination of skilled labor and expert management directly contributes to Emami's efficient operations and market performance.

Financial Capital and Robust Balance Sheet

Emami’s financial capital is a critical resource, underpinned by strong accruals and healthy profitability margins. This financial robustness allows the company to self-fund significant investments in research and development, crucial for product innovation in the competitive FMCG sector. For instance, Emami has consistently demonstrated operational efficiency, contributing to its strong financial position.

The company’s balance sheet is characterized by a very minimal debt level, positioning it as a zero-debt entity. This zero-debt status is a powerful enabler, providing substantial flexibility for strategic initiatives, including potential acquisitions and market expansion. Being cash-rich without significant leverage greatly enhances Emami's capacity for strategic agility and long-term growth.

Emami’s financial strength directly fuels its ability to undertake ambitious marketing campaigns and brand-building activities. This financial capacity ensures that the company can invest consistently in reaching its target consumers and maintaining brand visibility. The company’s financial stability is a testament to its sound management and operational success.

- Strong Accruals and Profitability: Emami consistently generates robust internal funds, supporting operational needs and growth initiatives.

- Zero-Debt Capital Structure: The absence of significant debt provides immense financial flexibility and reduces financial risk.

- Capacity for Strategic Investments: Being cash-rich allows Emami to pursue R&D, marketing, and inorganic growth opportunities without external financing constraints.

- Financial Stability: This financial health acts as a key resource, enabling sustained investment and resilience in market fluctuations.

Emami's key resources are its strong brand portfolio, extensive manufacturing and R&D capabilities, vast distribution network, and skilled human capital, all supported by a robust, debt-free financial position.

The company's intellectual property, including over 150 patents, safeguards its unique product formulations. Its six Indian and one international manufacturing unit produced a diverse range of products, contributing to its fiscal year 2023 revenue of INR 3,300 crore.

Emami's distribution network reaches 10 lakh retailers across India, with products available in over 70 countries, ensuring broad market penetration.

Human capital, comprising a core team of 37 managers and a total workforce of 25,000 as of January 2025, drives operational excellence and innovation.

| Key Resource | Description | Impact |

| Brand Portfolio | Established brands like BoroPlus, Navratna, Fair and Handsome, Zandu Balm, Kesh King | High market share, consumer trust, competitive advantage |

| Manufacturing & R&D | Six Indian and one international manufacturing unit, over 150 patents | Production capacity, product innovation, quality assurance |

| Distribution Network | 10 lakh retailers in India, presence in over 70 countries | Extensive market reach, brand visibility |

| Human Capital | 25,000 employees, 37 core managers (Jan 2025) | Operational efficiency, strategic direction, innovation |

| Financial Capital | Zero-debt, strong accruals, healthy profitability | Flexibility for strategic investment, R&D, marketing, resilience |

Value Propositions

Emami’s core value proposition centers on trusted Ayurvedic and herbal formulations. This means consumers receive personal care and healthcare solutions built on centuries of ancient wisdom and natural ingredients. This approach inherently targets those seeking efficacy without adverse physiological effects.

The company's dedication to nature-based, organic, and Ayurvedic products is a significant draw. Certifications like Ecocert and NPOP underscore this commitment, assuring health-conscious consumers that they are choosing genuinely natural remedies. This trust is vital in a market increasingly wary of synthetic ingredients.

In 2024, the global Ayurvedic products market was valued at approximately $11.7 billion and is projected to grow significantly. Emami's strong presence in this sector, with brands like Zandu, capitalizes on this expanding consumer preference for natural and scientifically validated traditional medicine.

Emami offers a vast array of products, covering everything from hair and skin care to health supplements and pain relief. This broad selection ensures they can meet diverse customer needs across many personal and healthcare categories.

With over 300 stock-keeping units (SKUs), Emami's comprehensive portfolio provides consumers with numerous options to address their specific concerns. This depth allows customers to rely on Emami for a variety of solutions.

Well-established brands like Navratna for cooling oil, Boroplus for skin protection, and Zandu Balm for pain relief are central to this diverse offering. These trusted names resonate with consumers seeking effective personal and health solutions.

Emami’s value proposition centers on making quality personal care products attainable for everyone. They achieve this by offering a range of pack sizes, from smaller, more affordable options to larger family packs, ensuring a fit for diverse budgets and needs. This strategy is key to their widespread market penetration.

The company’s pricing approach is a smart blend of value-based and competitive strategies. This means they price products not just based on cost, but also on the perceived value to the consumer, while keeping a close eye on what competitors are charging. This dual focus makes Emami products appealing even to the most price-sensitive shoppers.

For instance, Emami’s Navratna oil, a flagship product, is available in various sizes, with smaller SKUs often priced around INR 30-50, making it an impulse purchase for many. This accessibility is crucial for reaching the vast rural consumer base, where affordability is a primary driver of purchasing decisions.

By providing options that cater to different income levels and consumption patterns, Emami effectively bridges the gap between urban and rural markets. This broad accessibility ensures that their product portfolio resonates with a wide socio-economic spectrum, solidifying their market presence.

Innovation and Modernized Traditional Remedies

Emami’s value proposition centers on breathing new life into traditional Ayurvedic and herbal remedies. They achieve this by constantly innovating and modernizing these products, making sure they appeal to today’s consumers while still delivering the benefits people expect from natural ingredients.

The company’s commitment to research and development is a key driver here. For instance, Emami invests significantly in creating new product variations and formulations. This includes developing fresh herbal hair care ranges and specialized balms designed for various types of pain relief, effectively merging ancient wisdom with contemporary scientific progress. In the fiscal year 2023, Emami’s R&D expenditure represented a notable portion of their operational focus, underscoring this dedication to product enhancement and innovation.

- Modernizing Tradition: Emami bridges the gap between ancient Ayurvedic practices and modern consumer demands.

- R&D Investment: Significant financial commitment to research and development fuels product innovation.

- Product Diversification: Introduction of new herbal hair care and targeted pain relief solutions showcases this approach.

- Consumer Relevance: Ensuring traditional benefits resonate with contemporary lifestyles and preferences.

Enhanced Customer Well-being and Trust

Emami's core vision is deeply rooted in improving customer well-being, a commitment reflected in its extensive range of health-focused and innovative products. This dedication fosters a strong sense of trust and loyalty among consumers, who rely on Emami for solutions that genuinely enhance their lives. For instance, in 2024, Emami's portfolio continued to see strong demand, particularly in categories like skincare and healthcare, contributing to its overall market presence.

The company's unwavering focus on quality is a cornerstone of its value proposition. This is substantiated by consistent high customer satisfaction ratings and the attainment of various quality certifications, reinforcing Emami's image as a dependable and trustworthy brand. This commitment is not just about product efficacy but also about ensuring consumer safety and satisfaction, which are paramount.

- Customer Well-being Focus: Emami prioritizes products that contribute positively to health and lifestyle.

- Trust and Loyalty Building: Through consistent quality and ethical practices, Emami cultivates deep consumer trust.

- Product Innovation for Life Improvement: The company actively develops offerings designed to genuinely enhance consumers' daily lives.

- Quality Assurance: High customer satisfaction and certifications underscore Emami's commitment to product excellence.

Emami's value proposition is built on delivering trusted Ayurvedic and herbal solutions that enhance consumer well-being. This commitment is evident in their broad product portfolio, catering to diverse personal care and healthcare needs. By blending ancient wisdom with modern scientific advancements, Emami ensures its offerings are both effective and relevant to today's consumers.

Customer Relationships

Emami cultivates deep brand loyalty by consistently offering high-quality products, exemplified by its strong performance in categories like personal care. For instance, Emami's skincare brands, such as Boroplus, have been trusted by consumers for decades, a testament to enduring quality. This consistent delivery builds a strong foundation of trust, encouraging repeat purchases and fostering a loyal customer base.

The company strategically links its established, trusted brands to new product introductions, creating immediate familiarity and reducing the perceived risk for consumers. This approach leverages the equity of brands like Navratna to introduce new product lines, as seen in their expansion into various personal care segments. This familiarity is crucial in building confidence and driving trial for their offerings.

Emami regularly invests in brand-strengthening activities and targeted marketing campaigns that align with evolving consumer values and aspirations. In 2023, the company continued its focus on digital marketing and celebrity endorsements to connect with younger demographics, further solidifying brand perception. These efforts are vital for maintaining consumer confidence and ensuring sustained market presence.

Emami actively cultivates customer relationships through robust digital engagement, leveraging social media and targeted digital marketing campaigns to connect with its audience. This approach fosters direct interaction and allows for personalized communication, directly addressing the preferences of today's digitally savvy consumers.

The company's commitment to its direct-to-consumer (D2C) platforms, such as Zanducare, is a cornerstone of this strategy. These platforms not only facilitate immediate feedback but also serve as crucial channels for the swift introduction of new and innovative products, ensuring Emami stays responsive to market demands.

Emami strategically utilizes celebrity endorsements and influencer collaborations to bolster brand trust and connect with a wide consumer base. This approach fosters deep emotional bonds, particularly within the personal care and healthcare segments, significantly boosting brand recognition and desirability, especially among younger demographics. For instance, Emami's successful association with Bollywood stars like Amitabh Bachchan for their Navratna range has consistently driven sales and brand recall.

Customer Service and Feedback Mechanisms

Emami maintains customer relationships through dedicated customer service channels and robust feedback mechanisms. These touchpoints are crucial for addressing consumer queries promptly and resolving any issues that may arise. For instance, in FY2024, Emami reported a significant increase in customer engagement across digital platforms, indicating a growing reliance on these channels for interaction and support.

Gathering consumer insights is a core component of Emami's strategy. By actively soliciting and analyzing feedback, the company identifies areas for product enhancement and service improvement. This data-driven approach ensures that Emami's offerings remain relevant and competitive in the fast-moving consumer goods sector.

- Customer Service Channels: Emami likely utilizes a mix of phone, email, and digital platforms to offer customer support.

- Feedback Mechanisms: Surveys, social media monitoring, and direct customer outreach are probable methods for gathering feedback.

- Impact on Satisfaction: Efficient problem resolution and responsiveness directly contribute to higher customer satisfaction scores.

- Relationship Strengthening: Consistently positive customer service experiences foster loyalty and encourage repeat business.

Community Engagement and Social Responsibility

Emami's commitment to corporate social responsibility and community engagement is a cornerstone of its strategy, indirectly fostering stronger customer relationships by cultivating a positive brand image. This focus aligns with contemporary consumer values that increasingly prioritize ethical and sustainable business practices.

Initiatives such as environmental sustainability programs, a dedication to employee well-being, and the upholding of ethical business practices all contribute to Emami being perceived as a responsible and caring organization. For example, Emami's work in rural development and healthcare access, often highlighted in their CSR reports, resonates with a broad customer base.

- Brand Perception: Emami's CSR activities, like its support for healthcare initiatives in underserved communities, enhance its reputation as a socially conscious brand.

- Consumer Alignment: A significant portion of consumers, particularly younger demographics, actively seek out and support brands demonstrating genuine commitment to social and environmental causes, a trend observed globally and within India.

- Indirect Loyalty Building: By investing in community well-being and environmental stewardship, Emami builds goodwill that translates into increased customer trust and potential loyalty, even if not directly transactional.

- Ethical Practices: Emami's emphasis on ethical sourcing and transparent operations further reinforces its image as a trustworthy company, appealing to customers who value integrity.

Emami actively fosters customer loyalty through consistent product quality and leveraging trusted brand equity for new launches. In fiscal year 2024, the company continued its focus on digital engagement and strategic celebrity endorsements to strengthen its connection with consumers, particularly younger demographics.

The expansion of its direct-to-consumer (D2C) platforms, such as Zanducare, allows for direct customer feedback and rapid product introductions, ensuring responsiveness to market needs. Emami's commitment to robust customer service channels and feedback mechanisms in FY2024 saw increased digital interaction, signifying a growing reliance on these avenues for support and engagement.

Emami's customer relationship strategy is deeply intertwined with its brand building, utilizing celebrity associations like Amitabh Bachchan for Navratna to drive sales and recall. The company's corporate social responsibility initiatives further bolster its image, aligning with consumer preferences for ethical and sustainable brands, a trend increasingly prominent in purchasing decisions.

| Customer Relationship Aspect | Description | FY2024 Impact/Focus |

|---|---|---|

| Brand Trust & Quality | Consistent high-quality products build enduring trust. | Strong performance in personal care, exemplified by decades-long trust in brands like Boroplus. |

| Brand Leveraging | Using established brand equity for new product introductions. | Familiarity drives trial and confidence in new offerings, leveraging equity from brands like Navratna. |

| Digital Engagement | Utilizing social media and targeted digital marketing. | Increased customer engagement across digital platforms; focus on connecting with younger demographics. |

| D2C Platforms | Direct customer interaction and rapid product introduction. | Zanducare facilitates immediate feedback and swift launch of innovative products. |

| Customer Service & Feedback | Prompt query resolution and gathering consumer insights. | Robust feedback mechanisms ensure product relevance; increased reliance on digital channels for support. |

| CSR & Brand Image | Building positive brand perception through social responsibility. | Initiatives in rural development and healthcare resonate with consumers valuing ethical and sustainable practices. |

Channels

Emami's extensive retail network, often referred to as general trade, is the backbone of its product distribution across India. This channel encompasses a vast array of outlets, from the ubiquitous corner kirana stores to larger department stores and supermarkets, ensuring products are accessible in both bustling cities and remote villages.

This traditional retail approach is paramount for Emami's market penetration, allowing it to connect with a broad consumer base. In fiscal year 2024, the company reported direct engagement with approximately 10 lakh retailers, alongside an indirect reach to an additional 41 lakh retailers, underscoring the sheer scale of its distribution capabilities.

Emami leverages modern trade outlets and organized retail chains extensively, reaching a significant urban consumer base. These channels, including hypermarkets and supermarkets, are crucial for driving domestic sales and brand visibility.

The strategic focus on organized retail continues to yield strong results. In Q3 of the fiscal year 2025, Emami reported that these modern trade channels contributed approximately 28.6% to its domestic business, underscoring their growing importance and robust performance.

Emami leverages a dual approach to reach consumers through online channels. This includes established e-commerce marketplaces, which provide broad reach, and its dedicated direct-to-consumer (D2C) portal, Zanducare. This strategy is particularly effective in engaging tech-savvy customers who increasingly prefer the convenience of online shopping.

The online channel has demonstrated significant momentum, reflecting a strong consumer shift towards digital purchasing. In fiscal year 2024 (FY24), this channel accounted for approximately 12% of Emami's domestic business, showcasing robust double-digit growth. This indicates a successful penetration into the online retail space.

Emami's commitment to this channel is further evidenced by its ongoing strategic focus on expansion. The company is actively working to scale its presence on major e-commerce marketplaces and to enhance its capabilities within the burgeoning quick commerce sector. This proactive approach aims to capture a larger share of the online market.

Pharmacy and Healthcare

Emami strategically utilizes pharmacies and healthcare facilities as key distribution channels for its diverse range of healthcare and wellness products. This approach ensures that specialized items, such as Ayurvedic medicines and pain relief balms, reach their intended health-conscious consumers effectively. For instance, popular products like Zandu Balm and Mentho Plus Balm are widely accessible through these outlets, reinforcing Emami's presence in the health sector.

The pharmacy channel is crucial for Emami's business model, allowing for targeted placement and professional endorsement of health-related products. This network of chemists and healthcare providers acts as a trusted point of sale, building consumer confidence in Emami's offerings. In 2023, the Indian pharmaceutical market, which includes many of Emami's product categories, was valued at approximately USD 42 billion, demonstrating the significant potential within these distribution channels.

- Targeted Reach: Pharmacies provide direct access to consumers actively seeking health and wellness solutions.

- Product Synergy: Channels are optimized for products like Ayurvedic medicines and pain relief balms.

- Market Penetration: Emami's presence in over 100,000 pharmacies across India bolsters its market share.

- Brand Trust: Association with healthcare professionals enhances brand credibility and consumer purchasing decisions.

International Distribution and Export

Emami’s international distribution strategy is robust, ensuring its products reach consumers in over 70 countries. This expansive global reach spans key markets including SAARC, CIS, GCC, and Africa, demonstrating a commitment to diverse geographies.

The company’s international business is a vital revenue driver, with its performance significantly bolstered by strategic alliances with local distributors. These partnerships are crucial for navigating diverse market landscapes and ensuring efficient product placement.

Overseas marketing subsidiaries play a pivotal role in tailoring Emami’s brand presence and product offerings to specific international consumer preferences. This localized approach enhances market penetration and brand loyalty.

Emami manages its export operations through a network of dedicated agents situated worldwide. These agents act as the frontline force, facilitating sales and ensuring smooth logistical operations, thereby contributing to Emami's strong international presence.

- Global Reach: Products available in over 70 countries across SAARC, CIS, GCC, Africa, and beyond.

- Revenue Contribution: International business forms a significant part of Emami's overall revenue.

- Distribution Model: Relies on partnerships with local distributors and overseas marketing subsidiaries.

- Export Management: Exports are effectively managed through a global network of agents.

Emami's distribution is multifaceted, covering traditional retail, modern trade, online platforms, pharmacies, and international markets. This diverse approach ensures broad consumer access and caters to varied purchasing habits.

The company actively engages with over 10 lakh retailers directly and reaches an additional 41 lakh indirectly through its general trade network. Modern trade channels, including supermarkets, contributed around 28.6% to domestic sales in Q3 FY25, highlighting their increasing significance.

Online channels accounted for approximately 12% of Emami's domestic business in FY24, with ongoing expansion into quick commerce. Pharmacies are crucial for health products, with the Indian pharma market valued at USD 42 billion in 2023. Internationally, Emami products reach over 70 countries, supported by local distributors and agents.

| Channel | FY24 Domestic Contribution | Key Characteristics |

|---|---|---|

| General Trade | Dominant | Extensive network of kirana stores to larger outlets; direct reach to ~10 lakh retailers. |

| Modern Trade | ~28.6% (Q3 FY25) | Hypermarkets, supermarkets; targets urban consumers; drives sales and visibility. |

| Online (E-commerce & D2C) | ~12% (FY24) | Broad reach via marketplaces, D2C portal (Zanducare); growing importance. |

| Pharmacies | Significant | Targeted for health/wellness products; builds trust via healthcare professionals. |

| International | Vital Revenue Driver | Presence in 70+ countries; leverages local distributors and marketing subsidiaries. |

Customer Segments

Emami's customer base is predominantly the mass market, spanning both bustling urban centers and more remote rural areas throughout India. Their product portfolio is designed to address the fundamental personal care and healthcare requirements of a vast population, making them relevant to daily life.

The company's success hinges on an expansive distribution network that reaches deep into diverse communities, ensuring product availability. This accessibility is further amplified by an affordable pricing strategy, a crucial factor for widespread adoption across varied socio-economic segments.

For instance, in the fiscal year 2023-2024, Emami reported a robust revenue, demonstrating the broad appeal and purchasing power of its mass-market consumer segments. Their reach into rural markets is particularly significant, often serving as a primary gateway for branded FMCG products.

Health-conscious individuals represent a crucial customer segment for Emami. This group actively seeks out products that offer natural, Ayurvedic, and herbal benefits for their personal care and overall wellness. Brands such as Zandu, known for its Ayurvedic formulations, and Boroplus, with its focus on skin protection using natural ingredients, directly cater to these consumers who prioritize holistic well-being and traditional remedies.

The demand for health supplements, a key area for Emami, has seen substantial growth. For instance, the Indian nutraceutical market, which includes health supplements, was projected to reach approximately USD 10 billion by 2025, indicating a strong and expanding consumer interest in products that support health and prevent illness. Emami's offerings in this space align perfectly with the preferences of this health-aware demographic.

Emami effectively targets specific demographic groups, notably men, with its specialized grooming lines. A prime example is the Fair and Handsome brand, which has become synonymous with men's skincare. This strategic focus allows Emami to develop products that directly address the unique needs and preferences of this segment, enhancing brand loyalty and market penetration.

In 2024, Emami's commitment to the male grooming segment was further underscored by the repositioning of its Smart and Handsome range. This move signifies a strategic pivot to offer a comprehensive suite of male grooming solutions, moving beyond single-product focus to a more holistic approach. This expansion aims to capture a larger share of the growing men's grooming market, which saw significant growth in emerging economies.

Consumers Seeking Pain Relief and Wellness Solutions

Consumers actively seeking relief from everyday aches, pains, and overall well-being are a core focus for Emami. Brands such as Zandu Balm, Mentho Plus Balm, and Fast Relief directly cater to this segment by offering trusted and effective solutions. This group prioritizes products that deliver tangible therapeutic benefits and have a proven track record of efficacy. For instance, Emami’s pain management portfolio demonstrated strong performance, with the Zandu brand alone contributing significantly to the company's revenue growth in recent years.

This segment is particularly responsive to products that offer both immediate relief and a sense of holistic wellness. They are often influenced by brand heritage and the perceived natural efficacy of ingredients. The demand for such products remained robust, even amidst evolving market dynamics, highlighting the enduring need for accessible and reliable pain relief solutions.

Key characteristics of this customer segment include:

- Focus on Efficacy: Prioritize products that deliver noticeable pain relief.

- Brand Trust: Value established brands with a history of quality.

- Wellness Orientation: Seek solutions that contribute to overall physical well-being.

- Accessibility: Prefer readily available and affordable over-the-counter options.

Digitally Connected Consumers and Online Shoppers

Digitally connected consumers and online shoppers represent a vital customer segment for Emami. This group actively seeks products and brand interactions through digital platforms, prioritizing convenience and online purchasing. Emami caters to this by strengthening its e-commerce footprint, including direct-to-consumer (D2C) channels, and executing targeted digital marketing initiatives. This focus is essential for reaching a modern consumer base that increasingly makes purchasing decisions online.

- Growing Online Market Share: India's e-commerce market is projected to reach $350 billion by 2028, with online shoppers forming a significant portion of this growth.

- Digital Engagement Strategy: Emami leverages social media and digital advertising, reaching millions of consumers who actively engage with brands online.

- D2C Growth: The company's D2C platforms provide direct access to these digitally savvy consumers, fostering brand loyalty and enabling personalized marketing.

- Key for New Launches: This segment is crucial for generating initial buzz and driving early adoption of new products, as demonstrated by successful digital campaigns for recent Emami launches.

Emami's customer segments are diverse, ranging from the mass market in both urban and rural India to health-conscious individuals seeking natural and Ayurvedic products. The company also specifically targets men with specialized grooming lines and consumers looking for effective pain relief solutions.

A significant and growing segment includes digitally connected consumers who prefer online purchasing, a trend Emami actively supports through its e-commerce and D2C initiatives.

In fiscal 2023-24, Emami's revenue growth highlights the broad appeal and purchasing power of these varied customer bases. For example, the men's grooming market in India is expanding, with brands like Fair and Handsome capturing substantial interest.

The wellness and health supplement market is also a key area, with projections indicating continued strong consumer demand for products supporting overall well-being.

Cost Structure

Emami dedicates a considerable part of its expenses to marketing and advertising, a crucial strategy for staying visible and boosting sales in a crowded marketplace. This investment is key to building brand recognition and reaching a wide consumer base.

In fiscal year 2025, Emami's expenditure on advertisements and sales promotions reached ₹694 crore. This significant outlay underscores their commitment to robust brand building and extensive consumer engagement initiatives.

These marketing efforts often feature prominent celebrity endorsements and are amplified through comprehensive multi-channel advertising campaigns to maximize reach and impact.

Emami's cost structure is heavily influenced by raw material and manufacturing expenses. These include the procurement of natural and herbal ingredients, which are central to many of their products. In 2024, the company continued its focus on optimizing these procurement costs through strategic sourcing and supplier relationships.

Operating multiple manufacturing facilities necessitates careful management of associated costs. This encompasses energy consumption, direct labor, and the maintenance of production lines. Emami's commitment to operational efficiency in 2024 aimed to keep these manufacturing overheads in check, directly impacting their profit margins.

Efficient supply chain management is a cornerstone of Emami's strategy to control raw material and manufacturing costs. By streamlining logistics and inventory, the company seeks to minimize wastage and ensure timely availability of inputs, a critical factor for sustained profitability in the competitive FMCG sector.

Emami incurs substantial expenses in maintaining its vast distribution network. These costs encompass transportation, warehousing, and the management of a large sales force and numerous distributors across India.

For instance, in the fiscal year 2023-24, Emami's consolidated revenue was INR 3,440 crore, with a significant portion of this revenue being directly tied to the operational efficiency of its supply chain and distribution.

Managing an efficient supply chain to ensure timely product delivery and prevent stockouts is critical, directly influencing logistics expenditures.

Furthermore, fluctuating fuel prices and general operational costs for transporters directly impact the overall distribution and logistics expenses, a key component of Emami's cost structure.

Research and Development (R&D) Investment

Emami's commitment to innovation is reflected in its significant Research and Development (R&D) investments, a key component of its cost structure. For fiscal year 2023, Emami dedicated approximately 5% of its total revenue to R&D, which translated to INR 170 crore. This substantial allocation fuels the development of novel products and the refinement of existing formulations, ensuring the company remains at the forefront of the consumer goods market. Such strategic R&D spending is vital for maintaining a competitive edge and adapting to changing consumer preferences.

- R&D as a Cost Driver: Emami's R&D expenditure directly impacts its overall cost structure, supporting innovation and product development.

- FY23 R&D Allocation: The company invested INR 170 crore in R&D during fiscal year 2023, representing 5% of its revenue.

- Strategic Importance: This investment is crucial for Emami to stay competitive, introduce new products, and enhance existing ones to meet evolving market demands.

Employee Salaries and Administrative Overheads

Employee salaries and benefits represent a significant cost for Emami. This includes compensation for its direct workforce, such as the 37 employees as of January 2025, and extends to the broader group workforce of 25,000 individuals. Training programs designed to enhance employee skills also contribute to this expenditure.

Beyond direct compensation, administrative overheads are a crucial part of Emami's cost structure. These costs encompass the expenses related to managing the organization, ensuring a supportive work environment, and maintaining compliance with various regulatory frameworks. These operational necessities contribute to the overall expenditure.

- Employee Compensation: Includes salaries, wages, and benefits for direct staff and the wider group workforce.

- Training and Development: Investment in programs to upskill employees.

- Administrative Overheads: Costs associated with general business operations and management.

- Compliance and Workplace Support: Expenses for regulatory adherence and maintaining a conducive work environment.

Emami's cost structure is significantly shaped by its marketing and advertising expenditures, aiming for brand visibility and sales growth. In fiscal year 2025, the company allocated ₹694 crore to advertisements and sales promotions, reflecting a strong emphasis on brand building and consumer engagement through celebrity endorsements and multi-channel campaigns.

Raw material and manufacturing costs are also a substantial part of Emami's expenses, particularly the sourcing of natural and herbal ingredients. The company's operational efficiency in 2024 focused on managing manufacturing overheads, including energy and labor, to maintain profit margins.

Distribution and logistics represent another major cost area, involving transportation, warehousing, and sales force management. For fiscal year 2023-24, Emami's consolidated revenue stood at INR 3,440 crore, with efficient supply chain operations being critical for its profitability, while fluctuating fuel prices impact these logistics expenses.

Research and Development (R&D) is a key investment, with Emami dedicating approximately 5% of its revenue, or INR 170 crore, to R&D in fiscal year 2023. This investment fuels product innovation and maintains competitiveness. Employee costs, including salaries, benefits for a workforce of 25,000 individuals, and administrative overheads for smooth operations and compliance, also form a significant portion of the cost structure.

| Cost Category | FY2025 (₹ crore) | FY2024 (₹ crore) | FY2023 (₹ crore) |

|---|---|---|---|

| Marketing & Advertising | 694 | N/A | N/A |

| Raw Materials & Manufacturing | N/A | N/A | N/A |

| Distribution & Logistics | N/A | N/A | N/A |

| Research & Development | N/A | N/A | 170 (5% of Revenue) |

| Employee Costs & Admin | N/A | N/A | N/A |

Revenue Streams

Emami's core revenue generation stems from the sales of its wide array of personal care products. This includes everything from skincare and hair care solutions to deodorants, all under well-recognized brand names.

Brands such as BoroPlus, Navratna, Fair and Handsome, and Kesh King are key drivers of this segment's performance. This category consistently represents the largest portion of Emami's total income, highlighting its significance to the business.

For the fiscal year 2024, the personal care segment demonstrated its dominance by contributing approximately 65% to Emami's overall revenue. This substantial share underscores the strong market acceptance and consumer demand for their personal care offerings.

Emami’s revenue streams are significantly bolstered by the sale of its diverse healthcare and wellness products. This category includes everything from traditional Ayurvedic medicines and popular pain relief balms to essential health supplements, catering to a broad consumer base seeking natural and effective health solutions.

Key brands driving this revenue include household names like Zandu Balm, Mentho Plus Balm, and Zandu Pancharishta, which have established strong market presence and consumer trust over time. These products represent a consistent and substantial portion of Emami's overall sales performance.

The health supplement segment, in particular, showcased impressive growth, reporting a notable 15% sales increase in 2023. This demonstrates a growing consumer demand for fortified products and vitamins, a trend Emami is well-positioned to capitalize on with its established brands and distribution network.

Emami's international business is a vital revenue generator, with its products reaching consumers in over 70 countries worldwide. This broad geographical spread not only expands market reach but also significantly diversifies the company's income streams, reducing reliance on any single market.

In fiscal year 2025, Emami's international operations brought in ₹649.7 crore. This figure represented a substantial 17.47% of the company's total revenue for that year, highlighting the growing importance of its global footprint in its overall financial performance.

Revenue from Strategic Investments and Acquisitions

Emami strategically leverages revenue streams from its investments and acquisitions, significantly diversifying its business beyond its initial FMCG focus. This approach has allowed the company to enter new product categories and capture additional market share. For example, the acquisition of Zandu Pharmaceutical brought in the healthcare segment, while Kesh King expanded its reach in the hair care market.

These acquired brands are crucial contributors to Emami's overall financial performance. The company reported that in the fiscal year 2024, a substantial 45% of its total revenue, or top-line, was generated from these acquired entities. This highlights the success of Emami's inorganic growth strategy in bolstering its financial standing and broadening its market presence.

- Acquired Brands Contribution: In FY24, 45% of Emami's top-line revenue originated from its acquired brands, demonstrating the significant impact of its inorganic growth strategy.

- Portfolio Diversification: Brands like Zandu Pharmaceutical, Kesh King, and Dermicool have introduced new product categories, reducing reliance on traditional FMCG and expanding market reach.

- Revenue Growth Driver: Acquisitions have directly contributed to Emami's overall top-line growth by adding new revenue streams and capturing market share in diverse segments.

- Strategic Value: These investments and acquisitions not only generate direct revenue but also enhance Emami's brand portfolio and competitive positioning in the market.

Sales through E-commerce and Modern Trade Channels

Sales through e-commerce and modern trade channels are a vital and growing revenue stream for Emami. These organized retail environments are proving to be increasingly significant for the company's top line.

In fiscal year 2025, these channels collectively contributed 28.6% to Emami's domestic revenues, highlighting their expanding importance. This growth is fueled by a strategic focus on reaching consumers through these modern, accessible platforms.

Emami's direct-to-consumer digital-first strategy is demonstrating considerable success and is a key driver of online sales. This approach allows for direct engagement with customers and efficient scaling of digital operations.

New product innovations are playing a crucial role in bolstering online sales, indicating that Emami's efforts in product development are resonating well with the digital consumer base.

- Growing Contribution: E-commerce and modern trade channels are becoming increasingly important revenue generators.

- FY25 Performance: These organized channels accounted for 28.6% of Emami's domestic revenues in FY25.

- Digital-First Strategy: Emami's direct-to-consumer digital approach is scaling effectively.

- Product Innovation Impact: New product launches are significantly boosting online sales performance.

Emami's revenue streams are diversified across personal care, healthcare, international sales, and contributions from acquired brands. The company also sees significant income from modern trade and e-commerce channels, driven by a digital-first strategy and new product innovations.

| Revenue Stream | FY24 Contribution (Approximate) | Key Brands/Segments | Notes |

| Personal Care | 65% | BoroPlus, Navratna, Fair and Handsome | Core revenue driver, wide product range. |

| Healthcare & Wellness | Significant | Zandu Balm, Mentho Plus Balm, Zandu Pancharishta | Includes Ayurvedic medicines and health supplements; 15% sales increase in health supplements in 2023. |

| International Business | 17.47% (FY25) | Global distribution | Sales of ₹649.7 crore in FY25, reaching over 70 countries. |

| Acquired Brands | 45% (FY24) | Zandu Pharmaceutical, Kesh King, Dermicool | Key to inorganic growth and portfolio diversification. |

| Modern Trade & E-commerce | 28.6% (FY25, Domestic) | Online sales, organized retail | Growing importance, boosted by digital-first strategy and product innovation. |

Business Model Canvas Data Sources

The Emami Business Model Canvas is meticulously constructed using a blend of internal financial reports, extensive market research on consumer behavior and preferences, and strategic insights from industry expert analyses. This multi-faceted approach ensures each component of the canvas is robust and strategically sound.