Emami Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emami Bundle

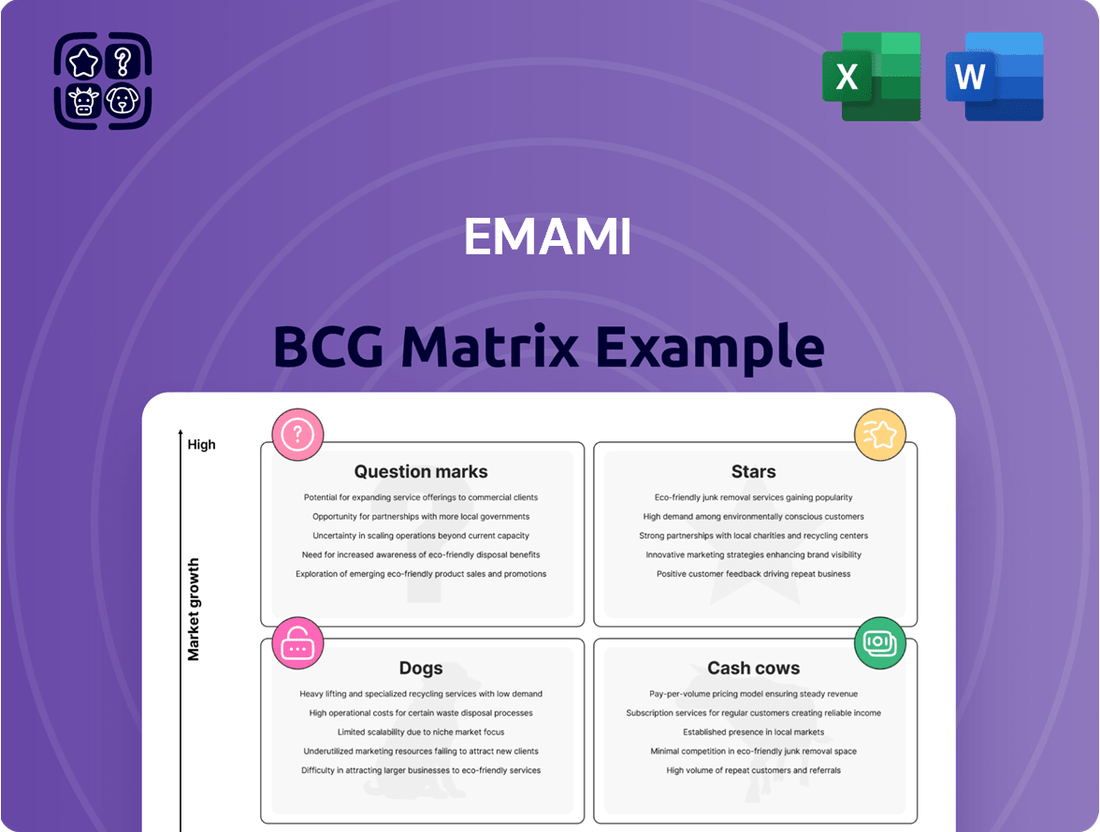

Curious about Emami's product portfolio performance? This glimpse into their BCG Matrix reveals how their brands are positioned across Stars, Cash Cows, Dogs, and Question Marks, highlighting potential growth areas and resource drains.

Understanding these dynamics is crucial for any business aiming for sustained success in competitive markets.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

BoroPlus Antiseptic Cream is a prime example of a Star product within the Emami portfolio. Its market leadership is undeniable, evidenced by a commanding 59.4% volume market share as of March 2024. This strong position in a growing market segment, with the overall BoroPlus range expanding by 33% in Q4 FY2024, signifies its status as a high-performing product that warrants continued investment in promotion to sustain its momentum and leadership.

Emami's Zandu healthcare range, including popular items like Zandu Ayurvedic Cough Syrup, Mugdha Rasa, and Zandu Health Juices, demonstrated impressive momentum. These products achieved a solid 10% year-on-year growth during the fourth quarter of fiscal year 2024. This performance highlights the sustained consumer demand and the efficacy of Emami's Ayurvedic offerings.

The company anticipates its entire healthcare portfolio will experience double-digit growth in the upcoming fiscal year. This positive outlook is underpinned by the strong market trust associated with the Zandu brand, a legacy built over many years. The combined strength of growth and brand equity positions these healthcare products as Stars in Emami's business portfolio.

As Stars, these Zandu healthcare products are characterized by high market share and high growth. They require significant investment to maintain their expansion and competitive edge, thus consuming cash. However, their strong market position and anticipated continued growth promise substantial future returns for Emami.

The Man Company and Brillare represent Emami's strategic ventures into high-growth market segments. The Man Company demonstrated a remarkable 86% growth in Q4 FY2024, highlighting its strong performance in the premium male grooming sector. Brillare also showcased significant upward momentum, achieving 59% growth for the full fiscal year 2024 in the natural salon products category.

These subsidiaries are positioned as Stars within Emami's business portfolio due to their impressive growth trajectories. Their increasing contribution to the company's revenue underscores their potential to capture substantial market share. Continued strategic investment will be crucial to sustain this expansion and capitalize on the burgeoning demand in their respective premium markets.

Dermicool Range

The Dermicool range demonstrated remarkable resilience in FY2024, achieving robust double-digit growth despite facing headwinds from prolonged winter conditions in certain regions. This performance highlights its strong market position and consumer demand.

Dermicool holds a commanding volume market share within the prickly heat talc category, a segment characterized by high growth potential and relatively low market penetration. This strategic advantage positions Dermicool favorably for future expansion.

Emami's continued commitment to enhancing the Dermicool brand is evident through significant investments in brand engagement, media promotion, and an expanded distribution network. The introduction of innovative products, such as Dermicool Sweat Reliever Super Active Talc and Ice Cool Shower Gel, further solidifies its Star potential.

- FY2024 Performance: Achieved robust double-digit growth despite challenging weather patterns.

- Market Position: Commands significant volume market share in the high-growth, low-penetration prickly heat talc category.

- Strategic Investments: Ongoing investment in brand building, media, and distribution expansion.

- Product Innovation: Launched new variants like Dermicool Sweat Reliever Super Active Talc and Ice Cool Shower Gel to capture evolving consumer needs.

Fair and Handsome Cream (rebranded as Smart & Handsome)

Smart & Handsome, formerly Fair and Handsome, is a Star in Emami's portfolio. It commands a substantial 68.8% volume market share in India's male fairness cream segment as of Q4 FY2024. This strong position in a niche but established market, coupled with aggressive rebranding and expansion into the broader male grooming sector, signals significant growth potential.

The company is strategically investing in Smart & Handsome to capitalize on the burgeoning male grooming market, which is projected to double by 2032. This expansion beyond fairness creams into a wider array of products positions the brand for sustained high growth. The investment is crucial to solidify its leadership and capture a larger share of this expanding market.

- Market Dominance: Holds 68.8% volume market share in India's male fairness cream segment (Q4 FY2024).

- Strategic Pivot: Rebranding to Smart & Handsome and expanding into the wider male grooming market.

- Growth Potential: Targets the male grooming market, expected to double in size by 2032.

- Investment Focus: Requires significant marketing investment to build its broader male grooming portfolio.

Emami's Star products are those with high market share in high-growth industries. These products generate significant cash but also require substantial investment to maintain their leading positions and fuel further growth. Their strong performance makes them key contributors to Emami's overall success and future potential.

What is included in the product

The Emami BCG Matrix offers a strategic framework to analyze its product portfolio based on market share and growth potential.

It guides decisions on investment, divestment, and resource allocation for each Emami product or business unit.

The Emami BCG Matrix offers a clear, one-page overview, pinpointing each business unit's strategic position to alleviate decision-making bottlenecks.

Cash Cows

Navratna Cool Oil stands as a quintessential Cash Cow for Emami, consistently holding a commanding market leadership. Its volume market share was a robust 62.8% in March 2024, even nudging up to 63.6% by the fourth quarter of fiscal year 2024.

Despite facing headwinds from a prolonged winter season, the brand still managed to achieve a 1% growth in Q4 FY2024. This resilience highlights its stability within a mature market segment.

The brand's established market position and high household penetration mean it generates substantial and steady cash flow for Emami. This is achieved with comparatively lower investments in promotion and placement, a hallmark of a mature, successful product.

Zandu Balm and Mentho Plus Balm are undeniably Emami's cash cows, anchoring its robust pain management segment. These products have consistently generated substantial revenue for Emami, reflecting their deep market penetration and enduring consumer trust. In the fiscal year 2023-24, Emami's consumer healthcare segment, which prominently features these balms, demonstrated strong performance, contributing significantly to the overall company turnover.

Operating in a mature but stable market, these balms benefit from established brand equity and low marketing expenditure needs. Their consistent demand provides Emami with a reliable stream of cash flow, effectively funding investments in newer, high-growth potential business areas within the company's diversified portfolio. This steady financial contribution is crucial for Emami's strategic growth initiatives.

BoroPlus Antiseptic Cream, with its commanding 59.4% market share in the antiseptic cream category, is a prime example of a Cash Cow. Its enduring market leadership and deep penetration across millions of households underscore its consistent ability to generate significant cash flow for Emami. While recent growth might hint at Star-like potential, its established position in a mature market solidifies its Cash Cow status.

Emami's strategic approach to BoroPlus involves maintaining its market dominance through sustained investment focused on efficiency and brand relevance. This dual strategy allows BoroPlus to function as a reliable Cash Cow, providing stable earnings, while also positioning it to capitalize on favorable market conditions for further growth, showcasing its adaptability within the BCG framework.

7 Oils in One

Emami's 7 Oils in One, a long-standing player in the hair oil market, continues to be a significant, albeit maturing, asset within the company's portfolio. While Q2 FY2025 saw a slight dip in performance, this brand has historically been a reliable revenue generator for Emami's hair care division.

The strategic international expansion, particularly with shampoos and conditioners under the 7 Oils in One banner, highlights its established brand equity and its capacity to capture new markets. This move suggests Emami views it as a vehicle for sustained international growth.

As a product that has achieved maturity, 7 Oils in One can be characterized as a cash cow. This means it likely generates consistent, predictable income for Emami, providing the company with the financial flexibility to invest in other, potentially higher-growth areas of its business.

- Consistent Revenue: 7 Oils in One is a stable income source for Emami.

- International Expansion: New product lines in international markets demonstrate brand strength.

- Cash Generation: Its maturity allows it to be 'milked' for profits.

- Portfolio Support: Funds generated can fuel growth in other Emami brands.

Select Established Ayurvedic Products (e.g., Zandu Pancharishta)

Emami's established Ayurvedic products, exemplified by Zandu Pancharishta, are strong contenders within the Cash Cows quadrant of the BCG matrix. The company's strategic relaunch of these products in improved packaging, designed to prevent breakage and enhance market reach, underscores their enduring value and Emami's commitment to this segment. This focus on established brands taps into a growing consumer interest in Ayurveda, a sector where Emami boasts significant historical strength and brand recognition.

These products are characterized by their loyal customer bases and the generation of stable, albeit low-growth, cash flows. For instance, Zandu Pancharishta has seen consistent demand, reflecting its deep-rooted consumer trust. This reliable income stream is crucial, as it helps fund Emami's investments in other business units, such as its burgeoning question marks or promising stars, thereby supporting the overall portfolio's strategic objectives.

- Brand Strength: Zandu Pancharishta is a flagship product with decades of market presence, signifying a robust and loyal consumer following.

- Market Position: Emami leverages its deep understanding of the Ayurvedic market to maintain and grow the share of these established products.

- Financial Contribution: These Cash Cows provide consistent, predictable revenue streams that are vital for Emami's financial stability and strategic investments.

- Growth Prospects: While not high-growth, the segment benefits from the overall increasing consumer preference for natural and Ayurvedic healthcare solutions.

Emami's Navratna Cool Oil remains a dominant force, holding a substantial 62.8% market share in March 2024, and increasing to 63.6% by Q4 FY2024. Despite seasonal challenges, it achieved 1% growth in Q4 FY2024, demonstrating its resilience in a mature market and providing consistent cash flow with minimal investment.

Zandu Balm and Mentho Plus Balm are vital cash cows, powering Emami's pain management segment with significant revenue generation. The consumer healthcare division, featuring these balms, performed strongly in FY2023-24, contributing substantially to overall turnover and offering a stable cash stream to fund growth initiatives.

BoroPlus Antiseptic Cream, with its commanding 59.4% market share, exemplifies a cash cow. Its established leadership and household penetration ensure significant, consistent cash flow, enabling Emami to maintain dominance while potentially exploring growth opportunities.

7 Oils in One, a mature hair oil brand, continues to be a reliable revenue generator for Emami. Its strategic international expansion, particularly with shampoos and conditioners, highlights its brand equity and potential for sustained international growth, providing stable income to support other Emami brands.

Emami's Ayurvedic offerings, like Zandu Pancharishta, are strong cash cows benefiting from a strategic relaunch and growing consumer interest in Ayurveda. These products, with loyal customer bases, generate stable cash flows crucial for funding investments in other business units.

What You See Is What You Get

Emami BCG Matrix

The Emami BCG Matrix document you see here is precisely what you will receive after your purchase, offering a comprehensive breakdown of their product portfolio. This preview showcases the fully formatted, analysis-ready report, devoid of any watermarks or sample content. Upon purchase, you'll gain immediate access to this strategically valuable tool, ready for integration into your business planning and decision-making processes.

Dogs

Emami Realty Limited, a subsidiary of the Emami Group, exhibits traits of a Dog within the BCG Matrix framework. Its financial performance has been a significant concern, with earnings showing a steep decline. Specifically, the company's earnings have been shrinking at an average annual rate of -29.1% during a period when the broader real estate industry was experiencing growth.

Further underscoring its challenging position, Emami Realty reported a substantial net loss of ₹1,262.4 million for the fiscal year ending March 31, 2025. This financial setback is compounded by a consistent downward trend in the company's revenue streams, indicating a weakening market presence and operational difficulties.

The company's situation is characterized by a low market share within a real estate sector that is either growing at a low rate or, in some segments, even contracting. This combination of factors means Emami Realty is likely consuming capital without generating commensurate returns, a classic indicator of a Dog business unit.

Consequently, Emami Realty Limited presents a clear case for strategic review, with divestiture or significant restructuring being the most probable courses of action to address its underperformance and capital drain.

The Kesh King range has experienced a notable downturn, with a 9% year-on-year decline in Q4 FY2024 and a 10% drop in Q3 FY2025. This trend continued into the first nine months of the current financial year, showing a 12% decline.

While Kesh King maintains a presence in the hair oil market, it's grappling with intense competition and market challenges that are hindering its performance. This underperformance has led Emami to seek external expertise, engaging BCG to devise a strategy for revival.

The engagement with BCG underscores Kesh King's current classification as a 'Dog' within the BCG Matrix. This designation signifies a product with low market share in a slow-growing industry, requiring substantial strategic adjustments to reverse its declining trajectory and avoid further erosion of its market position.

Beyond the rebranded Fair & Handsome, Emami's general male grooming portfolio faced headwinds. Sales dipped 2% year-on-year in Q4 FY2024, followed by a sharper 13% decline in Q2 FY2025. This suggests a low growth trajectory and potential market share erosion in specific product lines within the broader category.

While Emami is actively introducing new products to revitalize this segment, some of the older or underperforming items within this extensive male grooming range may be acting as drags. These products likely contribute minimally to the company's overall profitability, potentially positioning them as question marks within the BCG matrix.

Older, Less Popular Variants/SKUs

Within Emami's vast product range, which boasts over 450 items, there exist older or less popular variants and SKUs. These products typically hold a low market share and are situated in mature or even declining market segments. For instance, Emami might have legacy formulations of certain personal care products that are overshadowed by newer, more innovative offerings. These items often operate at a break-even point or even consume cash due to ongoing maintenance expenses, without contributing substantially to revenue growth.

These less popular variants, often categorized as Dogs in the BCG Matrix, represent an opportunity for Emami to streamline its portfolio. By identifying these underperforming assets, the company can make strategic decisions about their future. For example, if a particular variant of a skincare cream is consistently showing declining sales and minimal profit margins, it might be a candidate for discontinuation.

The potential divestment or rationalization of these "Dogs" is crucial for efficient resource allocation. Emami can then redirect capital, marketing efforts, and research and development resources towards its Stars and Cash Cows, which offer greater potential for growth and profitability. This strategic pruning allows the company to focus on high-impact areas, enhancing overall financial performance and market competitiveness.

- Low Market Share: Products in mature or declining sub-segments with minimal sales volume.

- Break-Even or Cash Consumption: Incurring costs for maintenance without generating significant returns.

- Resource Reallocation: Opportunity to shift investment from underperformers to growth areas.

- Portfolio Optimization: Streamlining offerings to focus on high-potential products.

Certain Regional/Niche Products with Limited Scale

Emami's extensive product range likely includes several regional or niche offerings. These products, while catering to specific consumer needs, often face limitations in expanding their market reach and may possess a relatively small market share. For instance, a traditional Ayurvedic hair oil popular in a specific Indian state might not gain significant traction nationally due to differing consumer preferences or distribution challenges.

These types of products typically exhibit low market growth, contributing minimally to Emami's overall revenue. Without a strategic plan for significant investment or a viable expansion strategy, they can be categorized as "Dogs" within the BCG matrix. This classification highlights their potential to tie up valuable company resources that could be more effectively allocated to higher-growth or higher-share business units.

Consider Emami's acquisition of "Zandu" in 2008, which brought a portfolio of Ayurvedic products. While Zandu has strong brand equity, some of its older, more traditional formulations might fall into this niche category if their market growth has stagnated and their geographical reach remains limited. For example, if a specific Zandu balm variant has a loyal but shrinking customer base in a few select regions and faces intense competition from newer, more widely marketed pain relief solutions, it could represent a "Dog" if not revitalized.

- Limited Market Share: Products with a low percentage of sales within their specific market segment.

- Low Growth Potential: These products operate in markets that are not expanding significantly.

- Resource Drain: Investments in marketing, production, or distribution for these items might yield low returns.

- Strategic Re-evaluation: Often considered for divestment or repositioning to free up capital for more promising ventures.

Products classified as Dogs in Emami's portfolio are characterized by their low market share within slow-growing or declining segments. These offerings often consume resources without generating substantial returns, necessitating a strategic review for potential divestment or revitalization. For instance, some legacy formulations within Emami's personal care or male grooming lines might fit this description, especially if they face intense competition and have seen declining sales, such as the 13% drop in certain male grooming products in Q2 FY2025.

The company’s overall approach to managing these underperforming assets is crucial for optimizing its extensive product portfolio, which numbers over 450 items. By identifying and addressing these Dogs, Emami can free up capital and focus on its more promising Stars and Cash Cows, thereby enhancing overall profitability and market competitiveness. This strategic pruning is essential for efficient resource allocation and sustained growth.

The ongoing engagement with BCG for Kesh King, which saw a 10% sales decline in Q3 FY2025, exemplifies the challenges associated with products that have become Dogs. Such a move indicates a recognition of the need for significant strategic intervention to reverse negative trends and avoid further market erosion.

These underperforming units represent an opportunity for Emami to streamline operations and improve its financial health by divesting or discontinuing products that no longer align with its growth objectives.

Question Marks

Emami strategically introduced four new digital-first products on its Zanducare D2C portal during Q4 FY2024, reinforcing its focus on high-growth e-commerce and D2C channels. This move is part of a broader expansion, with over 50 products and variants launched in FY24, predominantly through digital channels. These new offerings represent Emami's "question marks" in the BCG matrix, characterized by low current market share but substantial growth potential.

The high growth trajectory for these digital-first products is fueled by the increasing consumer preference for online health and wellness solutions. Emami's investment in these nascent products aims to capture market share in a competitive landscape. The company's commitment to digital innovation signals a forward-looking strategy to leverage emerging market trends and build a strong presence in the D2C space, positioning for future market leadership.

Emami Pure Glow, launched in April 2025, is positioned as a Question Mark in the BCG matrix. This new entrant into the competitive brightening cream market, a segment projected for robust growth, is investing heavily to carve out its niche.

With its recent market entry, Emami Pure Glow naturally possesses a low market share. The company is channeling significant resources into marketing and distribution to build brand awareness and customer adoption in this high-potential, yet fiercely contested, skincare category.

Emami's international business strategically expanded in FY2024 by introducing a new Baby Care range under its Creme21 brand. This launch encompassed 15 new products and variants, aiming to tap into a typically high-growth market. However, as a new entrant, the Creme21 Baby Care range currently holds a low market share.

This positioning places the Creme21 Baby Care range squarely in the Question Mark quadrant of the BCG matrix. Significant investment will be crucial to build brand awareness and establish a competitive foothold within this established and growing baby care segment. Emami's success will hinge on its ability to gain market traction and transition this product line into a stronger market position.

Strategic Investments in New-Age Categories

Emami’s expansion into five new-age categories, such as premium male grooming, natural salon products, ayurvedic pet care, nutrition, and fruit juices, highlights a strategic diversification. These are often high-growth sectors, but Emami's entry signifies a low market share in these emerging ventures.

These investments are classified as Question Marks within the BCG matrix, demanding significant capital and careful strategic direction. The goal is to nurture these nascent businesses, assessing their potential to evolve into future market leaders or Stars.

- Premium Male Grooming: Emami's investment in this segment, beyond The Man Company, targets a rapidly expanding market driven by evolving consumer preferences.

- Natural Salon Products: This category taps into the growing demand for organic and natural ingredients in beauty and personal care.

- Ayurvedic Pet Care: A niche but burgeoning market, leveraging the trust in Ayurveda for pet wellness solutions.

- Nutrition and Fruit Juices: These segments cater to the increasing health consciousness among consumers, offering a broad customer base.

Specific International Market Expansions (e.g., new shampoo & conditioner under 7 Oils in One)

Emami's strategic expansion into international markets, exemplified by the launch of the 7 Oils in One shampoo and conditioner line, particularly targets regions like the MENA. This move aims to tap into new consumer bases and diversify revenue streams.

New product introductions in foreign markets, by their nature, usually begin with a modest market share. For Emami's 7 Oils in One haircare range internationally, this translates to a position as a challenger brand, requiring significant investment to gain ground.

These focused international expansions are critical for Emami's growth. They necessitate dedicated marketing campaigns and robust distribution networks to build brand awareness and secure shelf space against established competitors.

- Market Entry: Emami's 7 Oils in One shampoo and conditioner line entering new international territories, such as the MENA region, positions it as a new entrant.

- Low Initial Share: As a new product in these markets, it is expected to hold a low market share initially, characteristic of a "question mark" in the BCG matrix.

- Growth Potential: The expansion aims to capture significant growth potential in these untapped or under-served international markets.

- Investment Required: Substantial marketing and distribution investments will be needed to build brand recognition and market penetration.

Emami's "question marks" represent products or ventures with low current market share but operating in high-growth industries. These require significant investment to achieve their potential, and their future success is uncertain. The company is actively nurturing these by investing in digital channels, new product development, and international expansion to build market presence.

These question marks are characterized by their nascent stage and the substantial capital required to propel them forward. Emami's strategy involves careful market analysis and targeted marketing efforts to increase brand awareness and customer adoption. The ultimate goal is to transform these question marks into strong market players or even future stars.

The success of these question marks hinges on Emami's ability to effectively navigate competitive landscapes and capitalize on emerging consumer trends. The company's commitment to innovation and strategic resource allocation is key to unlocking the growth potential inherent in these ventures.

Emami's Q4 FY2024 results, for instance, showed a 10% year-on-year growth in revenue to ₹938 crore. This overall company performance provides the financial backdrop for investments in these high-potential, but currently low-share, question mark segments.

| Venture/Product | Market Characteristic | Growth Potential | Current Market Share | Investment Focus |

| Digital-First Products (e.g., Zanducare launches) | High Growth (Online Health & Wellness) | High | Low | D2C, Digital Marketing |

| Emami Pure Glow | High Growth (Brightening Creams) | High | Low | Brand Awareness, Distribution |

| Creme21 Baby Care (International) | High Growth (Baby Care) | High | Low | Brand Building, Market Penetration |

| New-Age Categories (Male Grooming, Pet Care, etc.) | High Growth (Emerging Segments) | High | Low | Strategic Nurturing, Capital Allocation |

| 7 Oils in One (International Expansion) | High Growth (Haircare in MENA) | High | Low | Market Entry, Marketing Campaigns |

BCG Matrix Data Sources

Our BCG Matrix is constructed from robust financial statements, comprehensive market research reports, and granular sales data, ensuring accurate strategic positioning.