Emami Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emami Bundle

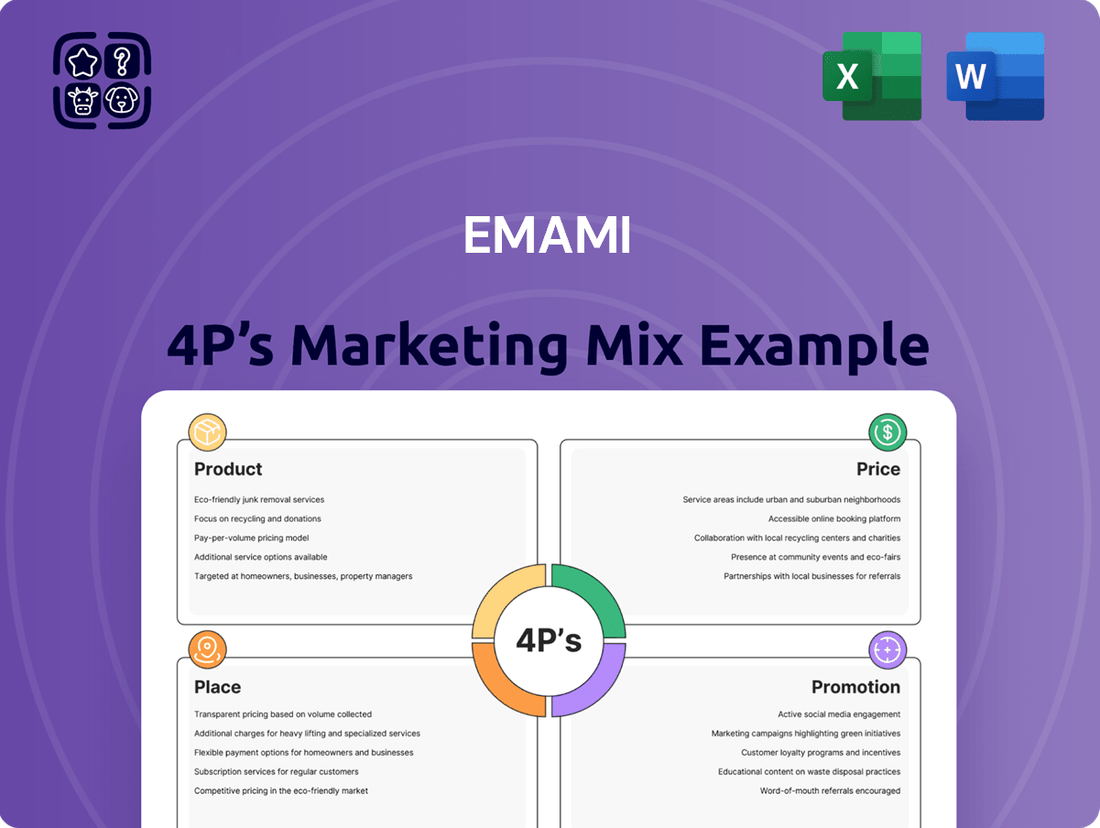

Discover how Emami masterfully blends its Product innovations, strategic Pricing, widespread Place distribution, and impactful Promotion to capture market share.

This analysis delves into the core of Emami's marketing approach, revealing the synergy between their diverse product portfolio and targeted customer outreach.

Understand the pricing psychology and channel strategies that make Emami a household name across various demographics.

Uncover the promotional tactics that build brand loyalty and drive consistent sales for Emami's extensive product range.

Gain actionable insights into Emami's marketing success by exploring the complete 4Ps analysis, available for immediate download and customization.

Elevate your own marketing strategies by learning from Emami's proven framework – get the full, detailed 4Ps analysis now!

Product

Emami boasts a comprehensive portfolio spanning both personal care and healthcare, featuring well-established brands such as Boroplus, Navratna, Fair and Handsome, Zandu Balm, and Kesh King. This diverse range caters to a broad spectrum of consumer needs, from skin protection to pain relief and hair care.

The company's product strategy hinges on diversification and strategic brand extensions. By capitalizing on the strong equity of its existing brands, Emami effectively introduces new products and targets various market segments, thereby expanding its reach and customer base. For instance, the success of Boroplus has paved the way for line extensions into different product categories.

Innovation is a cornerstone of Emami's approach, with a consistent focus on developing new and enhanced solutions. A significant portion of these innovations are rooted in ayurvedic formulations, aligning with growing consumer demand for natural and traditional wellness products. This commitment to ayurvedic science underpins many of their successful product launches.

In fiscal year 2023-24, Emami's personal care segment continued to be a significant revenue driver, with brands like Navratna and Boroplus showing robust performance. The company's healthcare offerings, particularly the Zandu range, also contributed substantially, reflecting sustained consumer trust in its ayurvedic heritage.

Emami's product strategy deeply emphasizes the health and wellness segment, tapping into the rising consumer demand for natural and Ayurvedic remedies. This focus is evident in their range of health supplements and therapeutic products, designed to build customer loyalty through strong perceived value and effectiveness.

Trusted brands like Zandu Balm and Mentho Plus Balm are cornerstones of Emami's pain management offerings, consistently delivering reliable relief to consumers. In the fiscal year 2023-24, Emami's healthcare segment, which includes these wellness products, demonstrated robust growth, contributing significantly to the company's overall revenue, with specific balm brands showing double-digit volume growth.

Emami has embraced a digital-first strategy for its product launches, leveraging its Direct-to-Consumer (D2C) platform, Zanducare, and various e-commerce channels. This approach is central to their marketing mix, allowing for agility in addressing shifting consumer preferences and capitalizing on the robust online retail environment.

The company demonstrated this commitment by introducing over 50 new products and variants during FY24 and FY25, with a significant portion of these being digital-first introductions. This rapid product development cycle is a direct result of their digitally-enabled go-to-market strategy.

This digital-first initiative enables Emami to gain faster market insights and respond with tailored offerings, a crucial advantage in today's dynamic consumer landscape. It also supports a more efficient inventory management and direct customer engagement model.

Strategic Acquisitions for Portfolio Expansion

Emami strategically enhances its portfolio through targeted acquisitions, aiming to bolster its presence in specialized market areas. This approach allows the company to quickly gain market share and integrate new product lines. For example, by acquiring brands like Zandu Pharmaceutical, Kesh King, and Dermicool, Emami has significantly broadened its product offerings across healthcare and personal care segments.

These strategic moves are designed to create substantial operational synergies. By merging distribution networks, marketing efforts, and research and development capabilities, Emami can achieve greater efficiency and market reach. Leveraging the established brand equity of acquired companies, such as Kesh King's premium positioning in hair oil, enables faster penetration into consumer markets.

The impact of these acquisitions on Emami's market position is evident. For instance, the acquisition of Kesh King in 2015 for approximately ₹165 crore (around $25 million USD at the time) significantly boosted its presence in the premium hair oil category. Similarly, the acquisition of Dermicool, a leading prickly heat powder brand, further solidified its standing in the seasonal wellness market.

- Acquisition Strategy: Emami actively seeks acquisitions to expand its product range and reinforce its position in niche segments.

- Key Acquisitions: Notable examples include Zandu Pharmaceutical (healthcare), Kesh King (premium hair oil), and Dermicool (prickly heat powder).

- Synergistic Benefits: Acquisitions foster synergies in distribution, marketing, and R&D, leveraging established brands and deepening market penetration.

- Market Impact: The Kesh King acquisition, valued at approximately ₹165 crore, significantly strengthened Emami's premium hair oil segment.

Innovation and Differentiation

Emami consistently drives innovation to set its products apart, drawing heavily on its established ayurvedic and herbal expertise. This strategy is evident in recent product introductions such as Agni Balm, Navratna Cool Talc Arctic Blossom, and BoroPlus Aloe Neem Body Lotion, all designed to capture specific consumer needs and preferences.

The company's commitment to evolution is further highlighted by the rebranding of Fair and Handsome to Smart and Handsome. This strategic shift broadens the brand's appeal within the male grooming sector, acknowledging and adapting to changing consumer perceptions and the expanding market for men's personal care products.

- Product Differentiation: Emami leverages its ayurvedic and herbal legacy for unique product offerings.

- Recent Innovations: Key launches include Agni Balm, Navratna Cool Talc Arctic Blossom, and BoroPlus Aloe Neem Body Lotion.

- Brand Evolution: The rebranding of Fair and Handsome to Smart and Handsome signifies a broader male grooming focus.

- Market Adaptation: This rebranding reflects Emami's responsiveness to evolving consumer perceptions and market trends.

Emami's product strategy is characterized by a strong focus on leveraging its heritage in Ayurveda and personal care, alongside strategic brand extensions and acquisitions. The company continuously innovates, introducing new products and variants that cater to evolving consumer demands, particularly in the health and wellness space.

The company's diverse product portfolio, encompassing personal care and healthcare, is a key strength. In FY24, the personal care segment, driven by brands like Navratna and Boroplus, showed strong performance, while the healthcare segment, including the Zandu range, also contributed significantly. Emami actively pursued product development, launching over 50 new products and variants in FY24 and FY25, many with a digital-first approach.

Strategic acquisitions have played a crucial role in expanding Emami's product offerings and market reach. Notable examples include Zandu Pharmaceutical, Kesh King, and Dermicool, which have bolstered its presence in healthcare, premium hair care, and seasonal wellness, respectively. These moves aim to create operational synergies and capitalize on established brand equity.

Emami's commitment to product innovation is evident in its Ayurvedic and herbal formulations, meeting the growing demand for natural products. The rebranding of Fair and Handsome to Smart and Handsome exemplifies its adaptation to market trends and evolving consumer perceptions in the male grooming sector. This agility ensures sustained relevance and market penetration.

| Product Category | Key Brands | FY24 Performance Highlight | Strategic Focus |

| Personal Care | Boroplus, Navratna, Fair and Handsome (Smart and Handsome) | Robust performance in FY24, continued strong consumer demand. | Brand extensions, male grooming evolution, digital-first launches. |

| Healthcare | Zandu Balm, Mentho Plus Balm, Kesh King | Substantial contribution to revenue in FY24, double-digit volume growth for balms. | Ayurvedic formulations, pain management solutions, premium hair care. |

| Seasonal Wellness | Dermicool | Solidified standing in the seasonal wellness market. | Targeted acquisitions to enhance niche segment presence. |

What is included in the product

This Emami 4P's Marketing Mix Analysis provides a comprehensive breakdown of their Product, Price, Place, and Promotion strategies, offering actionable insights into their market positioning and competitive advantages.

Simplifies complex marketing strategies by offering a clear, actionable breakdown of Emami's 4Ps, alleviating the confusion of broad marketing plans.

Place

Emami's extensive pan-India distribution network is a cornerstone of its marketing strategy, ensuring products reach consumers across the diverse Indian landscape. This network includes 32 depots and is supported by 3,500 distributors and 60 super-stockists, demonstrating significant reach.

The company further strengthens its presence through 4,000 sub-distributors, enabling access to an estimated 5 lakh direct retail stores. This robust infrastructure ensures Emami's products are widely available, a critical factor for a fast-moving consumer goods (FMCG) company.

By reaching over 4.9 million retail outlets, Emami effectively penetrates both urban centers and remote rural areas. This widespread availability is key to driving sales volume and maintaining brand visibility in a competitive market.

Emami's deep rural market penetration is a cornerstone of its growth strategy, with initiatives like 'Project Khoj' designed to significantly expand its rural footprint. The company's objective was to double its rural coverage, a critical step in accessing untapped consumer potential.

By the end of fiscal year 2024, Emami had successfully targeted an impressive reach, aiming to cover approximately 60,000 towns spread across 13 states. This expansive effort directly addresses the substantial, yet often underserved, rural consumer base in India. Such initiatives are key for seeding new markets and building brand presence where it matters most.

Emami is strategically expanding its reach in modern retail and online sales to connect with urban consumers who value convenience. This digital push is significant, with their e-commerce operations covering 94% of India's pin codes, reaching over 17,000 locations.

This expanded digital footprint is translating into substantial business. In the fiscal year 2024, these online channels accounted for roughly 12% of Emami's domestic sales, demonstrating a growing reliance on these platforms.

The company is also actively enhancing its presence on major e-commerce marketplaces and is increasing its involvement in the rapidly growing quick commerce sector, aiming to meet evolving consumer purchasing habits.

Global Footprint and International Distribution

Emami's reach extends well beyond India, with its products available in more than 60 countries. Key international markets include the SAARC, CIS, and GCC regions, as well as significant footholds in Asia and Africa. This broad global footprint is supported by a robust distribution network that leverages local partnerships.

In the fiscal year 2024, Emami's international business played a substantial role in its overall performance. It accounted for approximately 17.47% of the consolidated sales, underscoring the success of its global expansion strategy. This growth is a testament to Emami's ability to adapt its offerings and distribution models to diverse international markets.

- Geographic Reach: Products available in over 60 countries.

- Key Regions: SAARC, CIS, GCC, Asia, Africa, Middle East.

- FY24 International Contribution: 17.47% of consolidated sales.

- Distribution Strategy: Relies on effective local partnerships.

Strategic Channel Optimization

Emami is actively refining its distribution strategy, shifting away from a heavy reliance on wholesale. The company is prioritizing a direct-to-retailer approach to gain better market control and efficiency.

This strategic pivot is evident in recent performance data. Over the past six years, the wholesale channel's contribution to Emami's sales has seen a notable decrease, dropping from 50% to 42%. Concurrently, Emami has significantly expanded its direct reach, adding over 3.3 lakh retail outlets to its network.

This enhancement in direct distribution is crucial for several reasons:

- Increased Efficiency: Streamlining the supply chain by bypassing intermediaries reduces logistical complexities and associated costs.

- Enhanced Market Control: Direct engagement with retailers allows for better inventory management, pricing consistency, and quicker response to market demands.

- Improved Brand Visibility: A stronger direct presence ensures consistent product availability and better on-ground execution of marketing initiatives.

- Data-Driven Insights: Direct relationships provide valuable firsthand data on sales patterns and consumer preferences, enabling more targeted strategies.

This strategic channel optimization is a key element in Emami's ongoing efforts to strengthen its market position and ensure sustained growth in the competitive FMCG landscape.

Emami's "Place" strategy is defined by its extensive and multi-layered distribution network. This network encompasses over 5 lakh direct retail stores, reaching approximately 4.9 million retail outlets across India, ensuring widespread product availability. The company is also focusing on modern retail and online channels, with its e-commerce operations covering 94% of India's pin codes.

| Distribution Channel | Reach/Coverage | FY24 Contribution |

| Direct Retail (Pan-India) | 5 lakh retail stores | N/A |

| Rural Market Penetration | Targeted 60,000 towns across 13 states | N/A |

| E-commerce | 94% of India's pin codes | ~12% of domestic sales |

| International Markets | Over 60 countries | ~17.47% of consolidated sales |

Full Version Awaits

Emami 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Emami 4P's Marketing Mix Analysis delves into Product, Price, Place, and Promotion strategies. You'll gain insights into how Emami effectively positions its diverse product portfolio, its pricing tactics across various segments, its distribution channels, and its promotional campaigns. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with actionable intelligence.

Promotion

Emami employs an aggressive advertising and brand investment strategy, dedicating a substantial 17-18% of its sales revenue to marketing in FY24-FY25. This commitment fuels prominent brand visibility and strong consumer recognition across diverse media platforms.

The company's advertising expenditure saw a notable increase, reaching Rs 694 crore in FY25, a 6.4% rise compared to the previous fiscal year.

Emami effectively utilizes celebrity endorsements as a cornerstone of its promotional efforts, aiming to bolster brand trust and connect with consumers on a personal level. The company has strategically partnered with prominent figures such as Amitabh Bachchan, Shah Rukh Khan, Sonu Sood, and Kartik Aaryan, associating them with key Emami brands like Smart and Handsome and Navratna.

These high-profile associations are designed to lend credibility and aspirational appeal to Emami's product offerings. For instance, celebrity association for brands like Navratna Oil, which has seen endorsements from various Bollywood stars over the years, contributes significantly to its widespread recognition and market penetration, especially in its target segments.

In 2023, Emami reported a consolidated revenue of ₹3,490.8 crore, with its personal care segment being a major contributor, underscoring the impact of their marketing strategies, including celebrity endorsements, in driving sales and brand equity.

Emami strategically utilizes a multi-channel marketing approach to ensure extensive reach. Their campaigns span traditional media like television and print, alongside robust digital initiatives and on-ground activations, effectively covering both urban and rural consumer segments.

A significant portion of their marketing budget is allocated to digital platforms. This includes targeted digital advertising, active social media engagement, and collaborations with influencers to connect with younger, digitally savvy demographics.

For instance, in the fiscal year ending March 2024, Emami reported a substantial increase in marketing expenditure, reflecting their commitment to these diverse promotional channels to drive brand awareness and sales growth across their product portfolio.

Seasonal s and Targeted Campaigns

Emami excels in seasonal and targeted campaigns, a key aspect of its promotion strategy. The company strategically rolls out discounts and limited-time offers during major Indian festivals like Diwali and Holi, aiming to boost sales and generate consumer buzz. For instance, during the festive season of 2023-24, Emami likely saw increased demand for its personal care and healthcare products, mirroring historical trends of heightened consumer spending during these periods.

Beyond national festivals, Emami leverages localized promotions to resonate with specific regional demographics. This includes initiatives like bus branding in key urban centers and sponsorships of local fairs or melas. Such targeted approaches allow Emami to connect directly with diverse consumer groups, enhancing brand visibility and driving sales in distinct markets. For example, a campaign in West Bengal might focus on local traditions and preferences, using regional media channels.

- Festive Season Boost: Emami anticipates significant sales uplifts during major Indian festivals, a trend consistent with the FMCG sector's performance in 2023-24, where festive sales often contribute 20-30% of annual revenue for leading players.

- Localized Reach: Regional campaigns, such as bus branding in cities like Kolkata and Lucknow, ensure Emami’s products remain top-of-mind for consumers in specific geographic areas, a tactic that proved effective in driving market share gains in tier 2 and tier 3 cities during 2024.

- Mela Sponsorships: Sponsoring local fairs and melas allows Emami to engage directly with rural and semi-urban populations, a critical segment for brands like Boroplus and Navratna, contributing to their sustained growth in these markets throughout 2024.

Digital Engagement and D2C Focus

Emami has strategically amplified its digital engagement, leveraging its direct-to-consumer (D2C) platform, Zanducare, to foster direct consumer interaction and introduce new products. This enhanced digital footprint includes expanding its reach on marketplaces and quick commerce channels, a move supported by targeted college activations.

The company has also revitalized its e-commerce presence for newer product lines, such as Emami Pure Glow, ensuring a seamless and engaging online shopping experience. In the fiscal year 2023-24, Emami reported a notable increase in its digital sales contribution, reflecting the success of these initiatives.

- Digital Sales Growth: Emami's digital channels saw a significant uplift in sales during FY24, contributing to overall revenue diversification.

- Zanducare Performance: The D2C platform, Zanducare, has become a key channel for product innovation and direct customer feedback, with user engagement metrics showing positive trends.

- Marketplace Expansion: Emami's presence on major e-commerce marketplaces and quick commerce platforms has expanded, reaching a wider consumer base.

- E-commerce Revamp: New product lines like Emami Pure Glow experienced a refreshed online presence, leading to improved conversion rates.

Emami's promotional strategy is robust, marked by a significant investment in advertising, with 17-18% of sales revenue dedicated to marketing in FY24-FY25. This spending, which increased to Rs 694 crore in FY25, fuels extensive brand visibility across various media.

The company effectively leverages celebrity endorsements, featuring stars like Amitabh Bachchan and Kartik Aaryan, to enhance brand trust and appeal. This approach, coupled with a multi-channel marketing mix encompassing traditional media, digital platforms, and on-ground activations, ensures broad consumer reach, particularly in urban and rural segments.

Seasonal and localized campaigns are also key. Emami utilizes festive discounts and sponsorships of local events to connect with diverse demographics and drive sales, a strategy that contributed to a notable increase in digital sales contribution in FY23-24.

| Marketing Metric | FY25 (Rs Crore) | YoY Change | Key Initiatives |

| Advertising Expenditure | 694 | 6.4% | Celebrity endorsements, multi-channel campaigns |

| Digital Sales Contribution | (Data Available for FY23-24) | Significant Uplift | D2C platform (Zanducare), marketplace expansion |

| Festive Sales Impact | (Anticipated) | High | Targeted discounts, promotions during major festivals |

Price

Emami utilizes a dynamic pricing approach, blending value-based strategies with a keen awareness of market competition. This means prices are calibrated not just on what consumers perceive as valuable, factoring in Emami's strong brand equity, product quality, and innovative features, but also on competitor pricing to ensure market competitiveness.

For instance, in the competitive skincare segment, Emami's pricing for its flagship brands often sits within a range that acknowledges premium quality while remaining accessible. This strategy is crucial for capturing market share across different consumer segments. In 2023, Emami's revenue reached ₹3,490 crore, reflecting the success of such balanced pricing strategies in driving sales volume.

The company's ability to adjust prices based on market dynamics and consumer response, particularly evident in product launches or during promotional periods, allows it to maintain a strong market presence. This agility in pricing is a key component of their strategy to attract and retain a broad customer base, from those seeking premium benefits to the more price-sensitive shopper.

Emami employs value-based pricing, tailoring product prices to what consumers in different segments perceive as fair for the benefits received. This strategy is crucial for maintaining brand relevance across a wide economic spectrum, from its mass-market offerings to more specialized, premium products. For instance, Emami's diverse portfolio, which includes popular brands like Boroplus and Navratna, demonstrates this by offering accessible price points for everyday consumers while also catering to those seeking advanced skincare or wellness solutions. This approach ensures broad market penetration and customer loyalty by aligning price with perceived value.

Emami frequently employs promotion-driven pricing, leveraging sales, discounts, and bundled offers, particularly during peak seasons and festive periods like Diwali or summer to boost demand and create a sense of urgency among consumers. For instance, during the fiscal year 2023-24, the company reported robust sales growth, partly attributed to successful festive season promotions across its key brands.

These strategic price adjustments are meticulously crafted to attract a wider customer base and significantly increase sales volumes, thereby contributing substantially to Emami's overall revenue generation. The company's approach focuses on making its popular products more accessible and appealing during these promotional windows.

Tiered Pricing for Accessibility

Emami employs a tiered pricing strategy to ensure its diverse product range is accessible across various income segments. This means offering products in different sizes and quantities, making them affordable for a wider customer base. For instance, smaller sachets or value packs cater to lower-income households, enabling trial and regular use, thereby fostering deeper market penetration, especially in rural and semi-urban markets. This approach is crucial for brands like Emami, which often target everyday consumer needs.

This accessibility is a key driver for Emami's market reach. By providing smaller, more affordable units, the company effectively lowers the barrier to entry for new customers. This strategy has proven particularly effective in India's vast rural and semi-urban landscapes, where purchasing power can be more constrained. Emami's focus on these tiered options allows them to compete effectively even with unorganized sector players.

Key aspects of Emami's tiered pricing include:

- Variable Pack Sizes: Offering products from single-use sachets to larger family packs.

- Affordability Focus: Ensuring a low entry price point for mass-market appeal.

- Market Penetration: Facilitating wider adoption, particularly in price-sensitive regions.

- Volume Sales: Driving overall sales volume through accessibility and repeat purchases.

Premium and Niche Product Pricing

Emami strategically positions certain products within its extensive portfolio as premium or niche offerings, commanding higher price points. This approach targets consumers who value exclusivity, specialized benefits, or a superior product experience, thereby contributing to enhanced brand perception and overall profitability. For instance, Emami's premium skincare lines often reflect this strategy.

This premium pricing strategy allows Emami to diversify its revenue streams and cater to a broader consumer base with varying purchasing power. By offering these higher-priced options, the company not only captures a segment of the market willing to pay for perceived value but also reinforces its brand image as capable of delivering high-quality, specialized solutions. The financial year 2023-2024 has seen continued investment in premium product development and marketing.

- Targeted Consumer Segment: Emami focuses its premium pricing on consumers seeking unique formulations, advanced benefits, or a luxurious brand experience, such as those using its specialized hair oils or advanced skincare products.

- Profitability Enhancement: Higher margins on premium products contribute significantly to overall company profitability, balancing the volume-driven sales of mass-market items.

- Brand Diversification: This strategy broadens Emami's market reach by appealing to different consumer segments and price sensitivities, showcasing a comprehensive product portfolio.

- Market Positioning: Premium pricing elevates Emami's brand image, fostering an association with quality and innovation, which can positively influence the perception of its entire product range.

Emami's pricing strategy effectively balances value-based approaches with competitive market realities, ensuring accessibility across diverse consumer segments. This is evident in their tiered pricing, offering smaller, affordable pack sizes to penetrate rural markets and cater to varying income levels, a strategy crucial for brands like Boroplus and Navratna.

The company also leverages promotion-driven pricing, particularly during festive seasons, to stimulate demand and boost sales volume. This approach contributed to Emami's robust sales growth in FY 2023-24. Furthermore, Emami strategically positions premium products at higher price points, targeting consumers seeking specialized benefits and enhancing overall brand perception and profitability.

| Pricing Strategy | Description | Key Benefit | Example/Data Point |

| Value-Based & Competitive | Prices reflect perceived value and competitor pricing. | Market competitiveness and share capture. | Revenue of ₹3,490 crore in 2023. |

| Tiered Pricing | Variable pack sizes and low entry price points. | Market penetration, especially in rural areas. | Small sachets for mass-market accessibility. |

| Promotion-Driven | Discounts, sales, and bundled offers during peak periods. | Demand stimulation and increased sales volume. | Contribution to robust sales growth in FY 2023-24. |

| Premium/Niche Pricing | Higher price points for specialized or exclusive offerings. | Enhanced brand perception and profitability. | Investment in premium product development in FY 2023-24. |

4P's Marketing Mix Analysis Data Sources

Our Emami 4P's Marketing Mix Analysis is meticulously crafted using a blend of official company disclosures, including annual reports and investor presentations, alongside in-depth industry research. We also incorporate data from e-commerce platforms and competitor analysis to ensure a comprehensive view of Emami's strategies.