Douglas Dynamics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Douglas Dynamics Bundle

Douglas Dynamics boasts strong brand recognition and a loyal customer base, key strengths in a competitive market. However, understanding the full scope of their opportunities and the potential threats they face is crucial for informed decision-making.

Discover the complete picture behind Douglas Dynamics' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Douglas Dynamics holds a dominant position as North America's top manufacturer and upfitter of work truck attachments and equipment, boasting over 75 years of operational history. This extensive experience has cultivated deep customer loyalty and a strong market presence.

The company's portfolio includes highly recognized brands such as FISHER, WESTERN, and SNOWEX within its Work Truck Attachments segment, and HENDERSON and DEJANA in its Work Truck Solutions segment. This robust brand recognition is a significant asset, underpinning its leadership status.

Douglas Dynamics boasts a robust strength in its diverse product portfolio and clearly segmented operations, primarily divided into Work Truck Attachments and Work Truck Solutions. This strategic separation allows the company to cater to distinct market needs, with Attachments focusing on essential snow and ice control equipment, and Solutions concentrating on the upfitting of various attachments and storage systems. This diversification proved a significant advantage in 2024, as the Solutions segment delivered strong performance, effectively buffering the impact of lower snowfall that affected the Attachments segment.

Douglas Dynamics demonstrated robust financial performance in early 2025, achieving record net sales of $115.1 million in the first quarter. This represents a substantial 20.3% increase compared to the same period in 2024. The company also successfully returned to profitability, posting a net income of $0.1 million, a notable turnaround from the loss reported in Q1 2024.

Further strengthening its financial position, Douglas Dynamics experienced significant margin expansion. The gross margin climbed by an impressive 470 basis points, reaching 24.5% in Q1 2025. This improvement is attributed to the combined effects of higher sales volumes and effective cost management initiatives implemented by the company.

Operational Efficiency and Cost Savings Initiatives

Douglas Dynamics leverages its proprietary Douglas Dynamics Management System (DDMS) alongside lean manufacturing principles. This combination fosters adaptable production processes and robust cost management, crucial for maintaining competitive pricing and healthy profit margins.

The company's commitment to efficiency was evident in its 2024 cost savings program, which surpassed its targets. This initiative successfully generated over $10 million in savings, directly translating into enhanced profitability and a notable uplift in gross margins.

- Proprietary Management System: DDMS enables flexible production and cost control.

- Lean Manufacturing: Principles further optimize operational efficiency.

- 2024 Cost Savings: Exceeded expectations, delivering over $10 million in savings.

- Profitability Impact: Savings contributed to improved profitability and gross margins.

Solid Financial Position and Shareholder Returns

Douglas Dynamics demonstrates a robust financial standing, highlighted by a significant improvement in its leverage ratio. In the first quarter of 2025, this ratio stood at 2.1x, a notable decrease from 3.3x recorded in the same period of 2024. This reduction signifies enhanced financial flexibility and a stronger balance sheet.

The company's dedication to rewarding its shareholders is evident through its consistent dividend payouts. Douglas Dynamics regularly distributes a quarterly cash dividend, underscoring its commitment to providing tangible returns to its investors.

- Improved Leverage Ratio: Down to 2.1x in Q1 2025 from 3.3x in Q1 2024.

- Consistent Shareholder Returns: Regular quarterly cash dividend payments.

Douglas Dynamics' market leadership is a significant strength, built on over 75 years of experience and a portfolio of trusted brands like FISHER and WESTERN. This allows them to command strong customer loyalty and a dominant position in the work truck attachments and solutions market.

The company's diversified product offering, split between Work Truck Attachments and Work Truck Solutions, provides resilience. This was evident in early 2025, where the Solutions segment's strong performance helped offset weaker results in the Attachments segment due to lower snowfall.

Financially, Douglas Dynamics showed impressive gains in Q1 2025, with net sales reaching $115.1 million, a 20.3% increase year-over-year. They also returned to profitability with $0.1 million in net income, a substantial improvement from a loss in Q1 2024, driven by a 470 basis point gross margin expansion to 24.5%.

Operational efficiencies are a key strength, supported by the proprietary Douglas Dynamics Management System (DDMS) and lean manufacturing principles. Furthermore, a 2024 cost savings program exceeded its $10 million target, directly boosting profitability and margins.

| Metric | Q1 2024 | Q1 2025 | Change |

| Net Sales | $95.7M | $115.1M | +20.3% |

| Gross Margin | 19.8% | 24.5% | +470 bps |

| Net Income | ($1.7M) | $0.1M | Turnaround |

| Leverage Ratio | 3.3x | 2.1x | -1.2x |

What is included in the product

Douglas Dynamics' SWOT analysis identifies its strong brand reputation and diversified product portfolio as key strengths, while potential supply chain disruptions and increased competition represent significant threats.

Identifies key market opportunities and competitive threats, enabling proactive strategic adjustments for Douglas Dynamics.

Weaknesses

Douglas Dynamics' Work Truck Attachments segment, a significant contributor to its revenue, faces considerable risk due to seasonality and weather dependency, particularly its snow and ice control equipment. Periods of unusually low snowfall can directly translate to reduced sales and profitability for this division, a pattern observed in prior years. This inherent vulnerability to weather patterns introduces a degree of volatility into the company's overall financial performance.

Douglas Dynamics faces a challenge with its Attachments segment due to extended equipment replacement cycles, a direct consequence of milder winters in its primary markets during recent snow seasons. This trend, observed through 2023 and continuing into early 2024, has customers holding onto existing equipment longer, thereby dampening demand for new attachments. For instance, a 10% increase in the average age of snowplows in key regions could translate to a significant drop in replacement sales.

Douglas Dynamics' performance is closely tied to the broader economic climate. Significant downturns can lead to a noticeable softening in demand across its product lines.

Economic uncertainty, particularly prevalent in 2024 and projected into 2025, can cause businesses and municipalities to postpone crucial investments in new equipment or essential upfitting services. This hesitation directly impacts Douglas Dynamics' sales volumes.

Supply Chain and Component Availability

Douglas Dynamics, despite its largely domestic supply chain, faces potential vulnerabilities related to the availability of critical components like chassis. Disruptions from even a U.S.-based supplier network could hinder production. For instance, a shortage of specific truck chassis, a key input for their snowplows and other equipment, could directly limit output. In 2023, the automotive industry as a whole experienced ongoing supply chain pressures, impacting the availability of various vehicle components, a trend that could persist into 2024 and 2025.

The company's reliance on external suppliers means that any issues with meeting volume or quality specifications can have a ripple effect. If a primary supplier of hydraulic systems or steel, for example, cannot ramp up production to meet Douglas Dynamics' demand or maintain stringent quality standards, it directly impacts the company's ability to fulfill orders and generate revenue. This dependency was highlighted in industry reports throughout 2023, where manufacturers across sectors cited supplier capacity as a significant bottleneck.

- Component Dependency: Vulnerability to disruptions in the supply of essential components like chassis and hydraulic systems.

- Supplier Performance Risk: Potential impact on production and sales if suppliers fail to meet volume or quality requirements.

- Industry-Wide Pressures: Exposure to broader supply chain challenges affecting the automotive and manufacturing sectors, as seen in 2023 and anticipated for 2024-2025.

Potential Impact of Tariffs

Douglas Dynamics has noted that the ongoing tariff situation presents a potential weakness, as the landscape remains subject to change and could impact their operations. While the company's U.S.-centric supply chain is seen as a mitigating factor, a significant escalation in tariffs could directly translate to higher input costs. This could, in turn, put pressure on their profit margins, especially if these increased costs cannot be fully passed on to customers.

The company's 2023 annual report, filed in early 2024, acknowledged that while they have strategies in place to manage tariff impacts, the uncertainty persists. For instance, the cost of certain raw materials, which can be influenced by trade policies, is a key consideration for their manufacturing processes. Any adverse changes in trade agreements or the imposition of new tariffs could necessitate adjustments to their pricing or sourcing strategies.

- Tariff Volatility: The company views the unpredictable nature of tariffs as a significant risk.

- Cost Increases: Escalating tariffs could lead to higher raw material and component costs.

- Profitability Squeeze: Increased costs may negatively affect net income if not offset by pricing adjustments.

- Supply Chain Sensitivity: Despite a U.S. base, reliance on global inputs for some components creates vulnerability.

Douglas Dynamics' reliance on the Work Truck Attachments segment, especially for snow and ice control, makes it susceptible to weather-related sales fluctuations. Mild winters in key markets during 2023 and early 2024 led to customers extending the lifespan of existing equipment, thereby reducing demand for new attachments and impacting sales volumes.

The company also faces risks from broader economic downturns, which can cause delays in essential equipment purchases by businesses and municipalities, directly affecting sales. Furthermore, dependence on component suppliers, such as chassis manufacturers, exposes Douglas Dynamics to production disruptions, a challenge that persisted across the automotive sector in 2023 and is expected to continue into 2024-2025.

Trade policy uncertainty, including ongoing tariff situations, presents a weakness by potentially increasing input costs and pressuring profit margins if higher expenses cannot be fully passed on to customers.

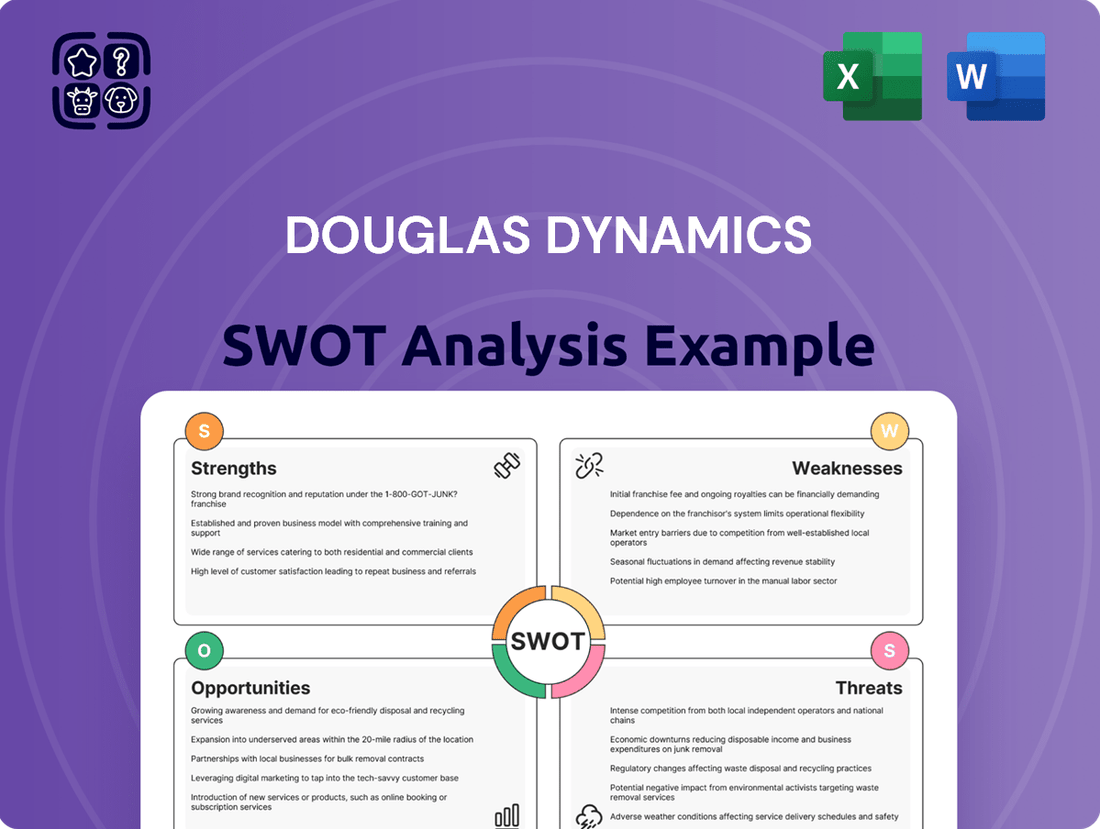

What You See Is What You Get

Douglas Dynamics SWOT Analysis

The preview you see is the actual Douglas Dynamics SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Douglas Dynamics SWOT analysis. Once purchased, you’ll receive the full, editable version, providing all the strategic details.

You’re viewing a live preview of the actual Douglas Dynamics SWOT analysis file. The complete version, offering a thorough examination of their strategic position, becomes available after checkout.

Opportunities

Douglas Dynamics' Work Truck Solutions segment is experiencing a significant upswing, fueled by strong demand from municipal sectors and a general increase in work truck volumes. This growth trajectory is a clear indicator of market receptiveness to their offerings.

The company has a prime opportunity to secure and leverage substantial, multi-year municipal contracts, which provide predictable revenue streams and solidify market position. Simultaneously, there's a strategic avenue to broaden their reach within the commercial vehicle upfitting space, tapping into a diverse and growing customer base.

Douglas Dynamics is capitalizing on a robust aftermarket for its work truck attachments, with the Work Truck Attachments segment experiencing substantial growth in parts and accessories sales. This trend highlights a significant opportunity to bolster revenue through a focus on replacement parts and add-ons.

By prioritizing the availability and sales of these components, the company can cultivate a more consistent and predictable revenue stream. This aftermarket focus offers a valuable hedge against the cyclical nature of new equipment sales, which can be heavily influenced by factors like snowfall and economic conditions.

Douglas Dynamics is actively pursuing product category expansion, aiming to broaden its offerings within both Work Truck Attachments and Work Truck Solutions. This strategic move involves introducing entirely new products and enhancing current ones to better align with shifting customer demands and emerging market trends, such as the increasing need for environmentally compliant snow and ice management solutions.

Strategic Acquisitions

Douglas Dynamics' robust financial health, evidenced by its strong balance sheet and enhanced liquidity, positions it favorably to pursue strategic acquisitions. This financial flexibility, as seen in its ability to manage debt effectively and maintain healthy cash reserves, opens doors for considering small to medium-sized acquisitions that align with its growth objectives.

Such strategic moves could significantly benefit the company by:

- Diversifying Product Portfolio: Acquiring companies with complementary product lines can broaden Douglas Dynamics' market appeal and reduce reliance on specific segments.

- Expanding Market Reach: Entry into new geographic regions or customer segments through acquisition can accelerate growth and market penetration.

- Enhancing Technological Capabilities: Integrating businesses with advanced technologies or innovative processes can boost operational efficiency and product development.

- Synergistic Opportunities: Acquisitions can unlock cost savings and revenue enhancements through the integration of operations and sales channels, potentially improving overall profitability.

Leveraging Improved Winter Conditions and Climate Adaptation

Anticipating and adapting to evolving winter weather, such as an increase in icy conditions, offers a significant opportunity for Douglas Dynamics. This adaptability can lead to more consistent demand for their snow and ice control equipment, even if overall snowfall amounts fluctuate.

The company's performance in Q1 2025 demonstrated the direct correlation between favorable winter weather and strong financial results. This suggests that strategic positioning and product availability during these periods can unlock substantial revenue growth.

- Increased Demand for Ice Control: While snowfall can vary, a trend towards more frequent ice events presents an opportunity for specialized equipment and services.

- Q1 2025 Performance: Douglas Dynamics saw a notable uplift in Q1 2025, directly attributed to improved winter conditions, highlighting the revenue potential of favorable weather.

- Climate Adaptation Strategy: Developing and marketing products that specifically address changing weather patterns, like increased ice, can capture a growing market segment.

Douglas Dynamics' strong financial position, including healthy liquidity and manageable debt, opens avenues for strategic acquisitions. This financial flexibility could allow them to acquire smaller companies that complement their existing product lines or expand their market reach, potentially enhancing their technological capabilities and creating synergistic opportunities.

The company is well-positioned to capitalize on the growing demand for specialized ice control equipment, especially given the observed trend towards more frequent icy conditions. This trend was evident in their Q1 2025 performance, where favorable winter weather directly contributed to a notable financial uplift, underscoring the revenue potential tied to adapting to evolving climate patterns.

| Opportunity Area | Description | Potential Impact |

|---|---|---|

| Strategic Acquisitions | Acquire complementary businesses to diversify product portfolio, expand market reach, and enhance technology. | Accelerated growth, reduced reliance on specific segments, improved operational efficiency. |

| Climate Adaptation | Develop and market specialized equipment for ice control, capitalizing on increased frequency of icy conditions. | Consistent demand, capture growing market segment, revenue growth even with variable snowfall. |

Threats

The most significant external threat for Douglas Dynamics is the unpredictable nature of snowfall, which directly impacts its Work Truck Attachments segment. Variations in winter weather patterns can drastically alter demand for their snow and ice control equipment.

Furthermore, the overarching influence of climate change presents a long-term risk. Projections suggest a potential for milder winters in many regions, which could lead to a sustained decrease in the need for snow removal solutions, thereby affecting a core part of Douglas Dynamics' revenue streams.

Douglas Dynamics faces significant rivalry from other North American manufacturers in the snow and ice management equipment sector. This intense competition can put downward pressure on their pricing strategies and potentially erode their market share.

Despite Douglas Dynamics' strengths in its broad distributor network and operational efficiencies, competitors with similar or even superior product offerings could challenge its market position. For instance, in 2023, the aftermarket snowplow parts market saw increased activity from both established players and new entrants, indicating a dynamic competitive landscape.

A worsening economic climate poses a significant threat to Douglas Dynamics. A potential recession or widespread economic slowdown in 2024-2025 could curb spending by key customer segments. Municipalities might cut back on infrastructure projects, businesses could delay vehicle upgrades, and individual consumers may postpone purchases of work trucks and attachments, directly impacting sales volumes.

Supply Chain Disruptions and Input Cost Volatility

Douglas Dynamics faces significant threats from supply chain disruptions and the resulting volatility in input costs. Events like the semiconductor shortage in 2021 and ongoing geopolitical tensions have highlighted the vulnerability of global supply chains, potentially impacting the availability of critical components for their snowplows and other equipment.

These disruptions can directly translate into higher production expenses. For instance, a surge in steel prices, a key raw material, could squeeze gross margins if not effectively passed on to customers. Similarly, escalating fuel and freight costs, as seen with oil prices fluctuating significantly in 2024, add another layer of cost pressure.

The company's ability to meet customer demand could also be compromised. If essential parts are delayed or unavailable, production lines may slow or halt, leading to longer lead times and potentially lost sales opportunities. This was a concern for many manufacturers throughout 2023, with reports of extended delivery times becoming commonplace.

- Supply chain vulnerabilities: Reliance on global suppliers for components can lead to shortages.

- Input cost fluctuations: Volatility in raw material prices (e.g., steel) and energy costs impacts profitability.

- Increased freight expenses: Rising fuel prices and shipping costs directly affect the cost of goods sold.

- Production and delivery delays: Disruptions can hinder the company's capacity to fulfill orders promptly.

Technological Disruption and Innovation by Competitors

Douglas Dynamics faces a significant threat if it cannot keep pace with technological advancements or if competitors launch groundbreaking innovations. Failing to develop new products or enhance existing ones to meet evolving customer demands, particularly in areas like advanced materials or smart towing technologies, could lead to a loss of market share. For instance, if a competitor introduces a lighter, more durable, or technologically integrated towing solution, it could quickly make Douglas Dynamics' current offerings less competitive.

The company's reliance on its established product lines means that a failure to innovate proactively could be particularly damaging. Competitors are actively investing in research and development; for example, the broader automotive aftermarket sector saw R&D spending increase by an estimated 5-7% in 2024. Douglas Dynamics must ensure its own R&D efforts translate into tangible product improvements or entirely new solutions to maintain its edge.

- Market Share Erosion: Competitors introducing disruptive technologies, such as advanced lightweight materials or integrated electronic systems in towing, could directly challenge Douglas Dynamics' market position.

- Product Obsolescence: A failure to adapt to changing end-user needs or integrate new technological capabilities, like enhanced connectivity or automation in towing equipment, risks making current product lines outdated.

- Innovation Gap: If competitors outpace Douglas Dynamics in R&D, it could lead to a widening innovation gap, impacting sales and profitability as customers opt for more advanced solutions.

Douglas Dynamics faces a significant threat from economic downturns projected for 2024-2025, which could reduce discretionary spending by its core customer segments, impacting sales volumes for work trucks and attachments.

Supply chain vulnerabilities, including the potential for component shortages and volatile input costs for materials like steel and energy, continue to pose a risk to production efficiency and profitability.

Intense competition within the work truck attachment and snow management equipment sectors could lead to pricing pressures and potential market share erosion if Douglas Dynamics cannot maintain its competitive edge through innovation and cost management.

The long-term impact of climate change, potentially leading to milder winters, presents a strategic threat to the demand for its snow and ice control equipment, necessitating diversification or adaptation strategies.

SWOT Analysis Data Sources

This Douglas Dynamics SWOT analysis is built upon a foundation of comprehensive data, including the company's official financial filings, detailed market research reports, and insights from industry experts. These sources provide a robust understanding of the company's internal capabilities and external market dynamics.