Douglas Dynamics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Douglas Dynamics Bundle

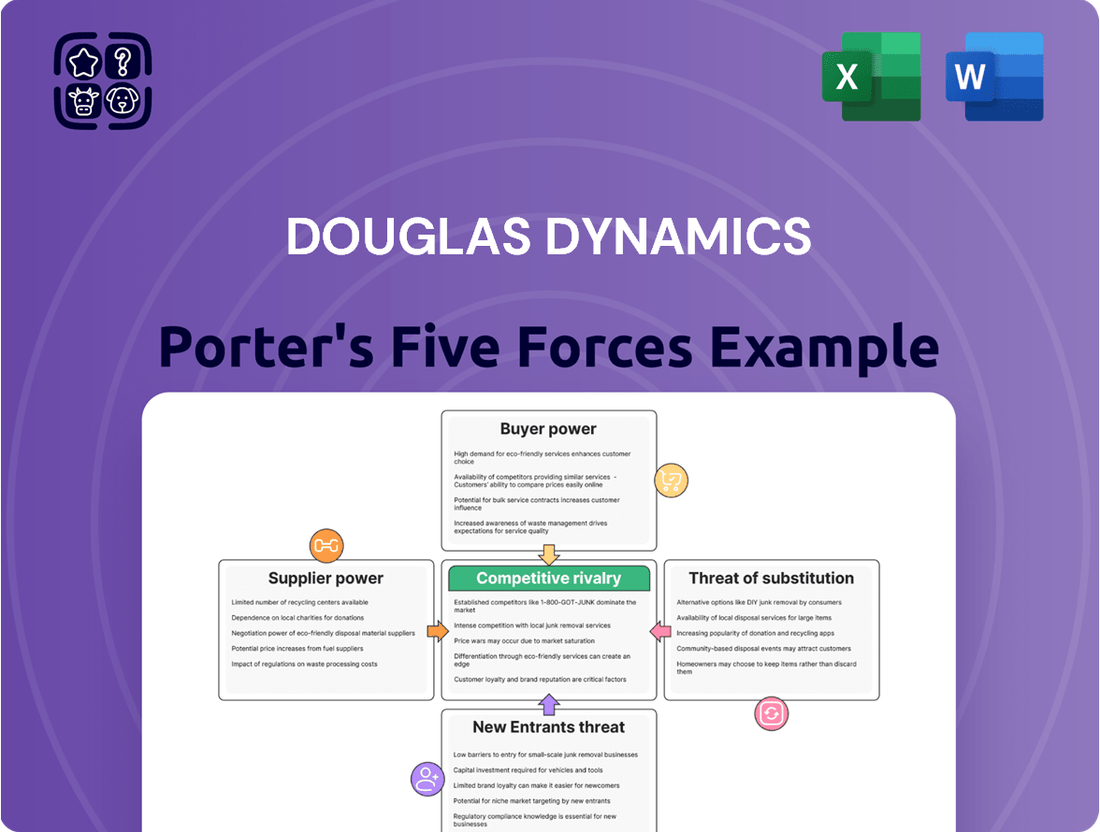

Douglas Dynamics operates in a market shaped by moderate buyer power and significant rivalry, with the threat of substitutes being a key consideration. Understanding these forces is crucial for any stakeholder looking to navigate this competitive landscape.

The complete report reveals the real forces shaping Douglas Dynamics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Douglas Dynamics is significantly influenced by the concentration of suppliers for critical components. If there are only a few companies providing specialized metals for snowplow blades or unique hydraulic systems, these suppliers gain considerable leverage. This limited supplier base means Douglas Dynamics has fewer options, making it harder to negotiate favorable terms or prices.

In 2024, the automotive and manufacturing sectors, which supply components to Douglas Dynamics, experienced varying degrees of consolidation. For instance, the global market for specialized steel alloys, crucial for durable snowplow blades, has seen some major players acquire smaller competitors. This trend suggests a potential increase in supplier concentration, thereby strengthening their bargaining position against original equipment manufacturers like Douglas Dynamics.

Douglas Dynamics' suppliers wield significant bargaining power if the company faces high switching costs. These costs can manifest as substantial investments in retooling manufacturing processes, the lengthy and complex process of requalifying new materials to meet stringent quality standards, or the disruption and expense associated with renegotiating existing contracts with new vendors. For instance, if a key supplier provides highly specialized components that require unique manufacturing equipment, the cost and time to adapt Douglas Dynamics' own production lines for a different supplier could be prohibitive, thus strengthening the original supplier's position.

When suppliers offer highly unique or proprietary components crucial for Douglas Dynamics' specialized snow and ice control equipment, their bargaining power significantly increases. This is especially potent if these specialized parts are difficult for competitors to replicate or for Douglas Dynamics to develop in-house.

For instance, if a key supplier provides a patented hydraulic system that is integral to the performance of Douglas Dynamics' flagship snowplows, that supplier holds considerable sway. In 2023, Douglas Dynamics reported that its revenue from its Work Truck Solutions segment, which includes much of this specialized equipment, reached $787.7 million, highlighting the importance of these unique components to its overall business.

Threat of Forward Integration by Suppliers

If suppliers can credibly threaten to move into Douglas Dynamics' snow and ice control equipment manufacturing business, their leverage grows significantly. This prospect of direct competition can pressure Douglas Dynamics into accepting less favorable terms.

For instance, if a key supplier of hydraulic components, like Parker Hannifin, were to begin producing finished plows or spreaders, it would directly challenge Douglas Dynamics' market position. This threat intensifies the bargaining power of such suppliers, potentially leading to higher input costs or more restrictive supply agreements for Douglas Dynamics.

- Supplier Threat: Suppliers may integrate forward, manufacturing snow and ice control equipment themselves.

- Impact on Douglas Dynamics: This increases supplier bargaining power, potentially forcing less favorable terms.

- Example: A hydraulic component supplier like Parker Hannifin could start producing finished plows.

- Consequence: Douglas Dynamics might face higher input costs or stricter supply contracts.

Importance of Douglas Dynamics to the Supplier

The significance of Douglas Dynamics as a client directly impacts a supplier's bargaining strength. If Douglas Dynamics accounts for a substantial portion of a supplier's overall sales, that supplier is likely to be more amenable to negotiating favorable terms and pricing.

For instance, if a key component supplier relies heavily on Douglas Dynamics for a large percentage of its business, perhaps in the tens of millions of dollars annually based on industry averages for similar B2B relationships, they would have less leverage to dictate terms.

Conversely, if Douglas Dynamics is a minor customer for a supplier, representing only a small fraction of their revenue, the supplier gains considerable power. They can afford to be less flexible, knowing that losing Douglas Dynamics as a client would not significantly harm their business.

- Supplier Dependence: The degree to which a supplier depends on Douglas Dynamics for revenue is a critical factor.

- Revenue Concentration: High revenue concentration from Douglas Dynamics weakens supplier power.

- Customer Size: Douglas Dynamics' relative size as a customer influences the supplier's willingness to negotiate.

- Market Dynamics: Suppliers with many other clients have more leverage over smaller customers like Douglas Dynamics.

The bargaining power of suppliers for Douglas Dynamics is amplified when they provide unique or proprietary components essential for the company's specialized equipment. This is particularly true if these parts are difficult for competitors to replicate or for Douglas Dynamics to produce in-house. For example, a patented hydraulic system integral to Douglas Dynamics' flagship snowplows grants significant leverage to its supplier. In 2023, Douglas Dynamics reported $787.7 million in revenue from its Work Truck Solutions segment, underscoring the critical nature of these specialized components.

Suppliers also gain power if they can credibly threaten to enter Douglas Dynamics' market by manufacturing snow and ice control equipment themselves. This potential competition pressures Douglas Dynamics to accept less favorable terms. For instance, if a key hydraulic component supplier like Parker Hannifin were to start producing finished plows, it would directly challenge Douglas Dynamics, potentially leading to higher input costs or stricter supply agreements.

Douglas Dynamics' position as a client also influences supplier leverage. If Douglas Dynamics represents a substantial portion of a supplier's sales, the supplier is more likely to negotiate favorable terms. Conversely, if Douglas Dynamics is a minor customer, the supplier has more power due to less dependence.

| Factor | Impact on Supplier Bargaining Power | Relevance to Douglas Dynamics |

|---|---|---|

| Supplier Concentration | Increases power with fewer suppliers | Consolidation in automotive/manufacturing sectors in 2024 may increase concentration for critical components. |

| Switching Costs | Increases power with high costs (retooling, requalification) | High costs to adapt to new suppliers for specialized components strengthen incumbent suppliers. |

| Component Uniqueness/Proprietary Nature | Increases power with difficult-to-replicate parts | Patented hydraulic systems for flagship plows give suppliers significant leverage. |

| Threat of Forward Integration | Increases power by threatening competition | A hydraulic supplier like Parker Hannifin entering the plow market would boost its power. |

| Douglas Dynamics' Importance to Supplier | Decreases power if Douglas Dynamics is a major client | Suppliers relying heavily on Douglas Dynamics are more amenable to negotiation. |

What is included in the product

Douglas Dynamics' Porter's Five Forces analysis reveals the intense competition and moderate bargaining power of buyers and suppliers within the work-ready vehicle accessory market.

Quickly identify and address competitive threats with a visual representation of market power, making strategic adjustments more intuitive.

Customers Bargaining Power

Douglas Dynamics caters to a broad spectrum of customers, from professional snow removal services and government entities to individual homeowners. This wide reach generally dilutes the power of any single buyer.

While the customer base is largely fragmented, large municipal contracts can sometimes consolidate buying power. For instance, in 2024, a significant portion of municipal fleet purchases might be concentrated among a few large city or county governments, potentially giving them more leverage in negotiations.

If Douglas Dynamics' customers can easily switch to competitors without incurring significant costs, their bargaining power grows. These costs can range from purchasing new equipment and retraining staff to ensuring compatibility with existing vehicle fleets.

Douglas Dynamics benefits from strong brand recognition with names like FISHER, SNOWEX, and WESTERN, which can help anchor customer loyalty and make switching less appealing. For instance, in 2023, Douglas Dynamics reported net sales of $533.6 million, indicating a substantial customer base that has likely invested in their ecosystem.

The availability of substitute products significantly influences the bargaining power of customers for Douglas Dynamics. When customers have numerous alternative solutions for snow and ice management, such as different types of plows, spreaders, or even outsourced services, they are less reliant on Douglas Dynamics' specific offerings. This broadens their choices and increases their leverage to negotiate better prices or demand more favorable terms. For instance, in 2024, the market for snow removal equipment saw continued innovation, with electric-powered alternatives and integrated smart technology becoming more prevalent, offering distinct value propositions that compete with traditional hydraulic systems.

Price Sensitivity of Customers

Customers' price sensitivity is a key driver of their bargaining power. For Douglas Dynamics, this means that buyers who are more focused on price have a greater ability to negotiate better terms.

Municipalities, for instance, often operate under strict budget limitations. This financial pressure makes them inherently price-sensitive when purchasing snowplow equipment. Similarly, individual consumers are looking for value and affordability, which amplifies their power to seek out lower prices.

While professional snowplowers prioritize equipment reliability and operational efficiency for their businesses, price remains a significant consideration. Their need to maintain profitability means they will weigh the total cost of ownership, including initial purchase price, against expected performance.

- Price Sensitivity Impact: Higher price sensitivity among customer segments like municipalities and individual consumers increases their bargaining power.

- Budget Constraints: Municipal budgets directly influence their willingness to pay, pushing for lower prices from suppliers like Douglas Dynamics.

- Professional User Considerations: While professionals value performance, cost-effectiveness remains a crucial factor in their purchasing decisions.

- Market Dynamics: In 2024, the economic climate and inflationary pressures likely heightened price sensitivity across many consumer and business segments, potentially increasing customer bargaining power for equipment manufacturers.

Customer's Ability to Backward Integrate

Douglas Dynamics' customers possess a degree of bargaining power if they can produce snow and ice control equipment themselves. This threat of backward integration is more pronounced for larger entities. For instance, a major municipality or a large commercial fleet operator with significant in-house maintenance and fabrication resources might consider developing their own equipment, thereby reducing their reliance on external suppliers like Douglas Dynamics. This capability directly impacts their leverage in price negotiations and contract terms.

While individual consumers are unlikely to backward integrate, large-scale buyers can exert considerable influence. Consider the potential for a large government agency or a major private property management firm that operates fleets across multiple regions. If such an entity has the capital and the technical expertise, they could explore in-house manufacturing. This possibility forces Douglas Dynamics to remain competitive in its pricing and product offerings to retain these valuable customers.

- Threat of Backward Integration: Customers may develop their own snow and ice control equipment.

- Impact on Bargaining Power: This capability increases customer leverage in negotiations.

- Key Customer Segments: Large municipalities and commercial entities are most likely to consider this.

- Douglas Dynamics' Response: Maintaining competitive pricing and product innovation is crucial.

The bargaining power of Douglas Dynamics' customers is moderate. While the customer base is diverse, including municipalities and individual homeowners, larger entities like major cities or large fleet operators can consolidate buying power, especially when securing municipal contracts in 2024. The threat of backward integration, though low for individuals, is a consideration for large buyers who might explore in-house equipment production, compelling Douglas Dynamics to remain competitive.

Customers' ability to switch suppliers is influenced by switching costs, which involve new equipment purchases and compatibility with existing fleets. Douglas Dynamics' strong brand names like FISHER and WESTERN, supported by $533.6 million in net sales in 2023, foster customer loyalty and mitigate this power. However, the increasing availability of substitutes, like electric snow removal equipment in 2024, offers customers more choices and thus greater leverage.

| Customer Segment | Bargaining Power Factors | Douglas Dynamics' Mitigating Factors |

|---|---|---|

| Municipalities | Consolidated buying power for large contracts; high price sensitivity due to budget constraints. | Strong brand loyalty; innovation in product offerings. |

| Professional Snowplowers | Price sensitivity impacting total cost of ownership; need for reliability and efficiency. | Reputation for durable and efficient equipment; ecosystem of compatible products. |

| Individual Homeowners | Price sensitivity; availability of lower-cost alternatives. | Brand recognition; accessibility through dealers. |

Same Document Delivered

Douglas Dynamics Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Douglas Dynamics, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you will receive immediately after purchase, ensuring no surprises. You can confidently download and utilize this analysis to understand the industry's profitability potential and identify key strategic opportunities.

Rivalry Among Competitors

The snow and ice control equipment market is quite competitive, with several established players. Companies like BOSS Products and Monroe Truck Equipment are significant competitors, meaning Douglas Dynamics doesn't operate in a vacuum. This presence of multiple strong contenders intensifies the rivalry for market share.

Douglas Dynamics holds a premier position as a manufacturer, but it's important to recognize it competes within the broader 'construction & farm machinery & heavy trucks' industry. This larger industry context includes numerous other companies, some of which may also offer snow and ice control solutions or could easily enter the market, further fragmenting the competitive landscape and increasing the number of potential rivals.

The global snow clearing vehicles market is expected to see a compound annual growth rate (CAGR) of 3.8% from 2025 to 2034. This growth is a positive sign for companies like Douglas Dynamics, as a growing market can temper intense competition. When the industry is expanding, businesses can increase their sales by capturing new demand rather than solely by stealing customers from rivals.

Douglas Dynamics heavily relies on product differentiation to stand out in a competitive landscape. They champion innovation and quality, underscored by their proprietary Douglas Dynamics Management System (DDMS). This focus allows them to offer trusted brands like FISHER, SNOWEX, and WESTERN, each recognized for specific features and reliability in the snow and ice control equipment market.

This strong brand recognition and commitment to quality significantly reduce direct price-based competition. Customers often choose these brands not just on price, but on the perceived value, durability, and performance associated with them. For instance, in 2023, Douglas Dynamics reported net sales of $535.2 million, reflecting the market's willingness to pay for their differentiated offerings.

Exit Barriers

Douglas Dynamics likely faces significant exit barriers, which can fuel competitive rivalry. These barriers might include specialized manufacturing equipment for their snowplows and vocational truck equipment, requiring substantial investment and making it difficult to repurpose or sell.

If leaving the market is costly and complex, existing players, including Douglas Dynamics, may remain highly competitive even when industry profitability is low. This can lead to prolonged price wars and persistent overcapacity as firms struggle to exit.

- Specialized Assets: The heavy machinery and tooling required for manufacturing their product lines represent a significant sunk cost.

- Brand Loyalty & Reputation: Decades of building trust and a strong reputation in the vocational equipment market create an attachment for both the company and its customers.

- Long-Term Contracts: Agreements with distributors or large fleet customers can bind Douglas Dynamics to ongoing commitments, making a swift exit impractical.

Fixed Costs

Industries that require significant upfront investment in plant and equipment, like manufacturing, often see fierce competition. Companies with high fixed costs are compelled to run their operations at maximum capacity to achieve economies of scale and spread those costs over a larger output. This pressure can lead to aggressive pricing strategies and a relentless pursuit of market share.

Douglas Dynamics, with its manufacturing base for snowplows, salt spreaders, and other work-ready vehicle equipment, undoubtedly faces substantial fixed costs. These costs include the depreciation of machinery, factory overhead, and the salaries of a permanent workforce, all of which remain relatively constant regardless of production volume.

- High Fixed Costs Drive Capacity Utilization: Companies like Douglas Dynamics with significant fixed costs in manufacturing are incentivized to maximize production to lower per-unit costs.

- Impact on Pricing and Rivalry: This drive for capacity utilization can intensify price competition as firms seek to gain sales volume to cover their fixed expenses.

- Manufacturing Sector Dynamics: The manufacturing sector, in general, is characterized by high fixed costs, which often translates into a more competitive landscape.

- Douglas Dynamics' Cost Structure: Douglas Dynamics' operations in producing heavy-duty equipment likely involve substantial investments in production facilities and machinery, contributing to high fixed costs.

The competitive rivalry within Douglas Dynamics' market is substantial, featuring established players like BOSS Products and Monroe Truck Equipment. This intense competition is further amplified by Douglas Dynamics' presence in the broader construction and farm machinery sector, which includes numerous other companies capable of offering similar equipment. The market's growth, projected at a 3.8% CAGR from 2025 to 2034, offers some relief by allowing companies to expand without solely relying on taking market share from rivals.

Douglas Dynamics differentiates itself through strong brands like FISHER and WESTERN, supported by its proprietary Douglas Dynamics Management System (DDMS), which emphasizes innovation and quality. This strategy helps mitigate direct price competition, as customers value the perceived durability and performance. For example, Douglas Dynamics reported net sales of $535.2 million in 2023, indicating market acceptance of their value proposition.

High exit barriers, including specialized manufacturing equipment and brand loyalty, contribute to sustained rivalry. Companies with high fixed costs, such as Douglas Dynamics due to its manufacturing operations, are driven to maximize capacity utilization, often leading to aggressive pricing and a strong focus on market share.

| Key Competitors | Market Context | Growth Projection (CAGR 2025-2034) | 2023 Net Sales | Differentiation Strategy |

| BOSS Products, Monroe Truck Equipment | Construction & Farm Machinery & Heavy Trucks | 3.8% | $535.2 million | Brand Innovation & Quality (FISHER, WESTERN) |

SSubstitutes Threaten

The threat of substitutes for Douglas Dynamics' snow and ice removal equipment is significant, primarily stemming from alternative removal methods. These include professional snow removal services that might employ different machinery or extensive manual labor, bypassing the need for owner-operated equipment. For instance, in 2024, the commercial snow removal market saw continued growth, with many businesses opting for bundled service contracts that encompass plowing, shoveling, and de-icing, often utilizing a mix of equipment and labor that may not directly compete with Douglas Dynamics' product line.

The attractiveness of substitutes for Douglas Dynamics' products hinges on their price-performance ratio. If alternative solutions, like advanced de-icing chemicals, offer comparable or superior effectiveness at a lower cost, the threat of substitution intensifies. For example, the increasing efficiency and reduced environmental impact of chemical de-icers could diminish the reliance on traditional plowing equipment, impacting demand for Douglas Dynamics' offerings.

The threat of substitutes for Douglas Dynamics is influenced by how readily its varied customers, including professional snowplowers, municipalities, and individual users, might switch to alternative solutions. For instance, a municipality might consider different types of de-icing agents if the cost or environmental impact of traditional salt, often applied with equipment like Douglas Dynamics', becomes prohibitive. In 2024, the increasing focus on sustainable practices and potential for stricter environmental regulations could accelerate this shift, making the availability and cost-effectiveness of alternatives a significant consideration.

Technological Advancements in Substitution

Technological progress constantly introduces new ways to tackle snow and ice. For instance, advancements in eco-friendly de-icing agents could reduce reliance on traditional salt-based products. In 2024, the market for sustainable de-icing solutions saw significant investment, with several startups attracting venture capital for their innovative formulations. This trend suggests a growing potential for substitutes that offer environmental benefits and potentially lower long-term costs.

The rise of autonomous technology presents another avenue for substitution. Automated snow plows and robotic de-icing systems are becoming more sophisticated. While still in early adoption phases, these technologies could eventually decrease the demand for human-operated equipment that Douglas Dynamics primarily serves. The global market for autonomous vehicles, including specialized industrial applications, is projected to grow substantially through 2030, indicating a future where automated solutions could become more prevalent.

Furthermore, innovative infrastructure designs that proactively manage snow and ice might emerge as substitutes. Think of heated roadways or advanced drainage systems that minimize ice formation. While these are often large-scale, capital-intensive projects, their increasing feasibility could indirectly impact the market for conventional snow removal equipment by reducing the overall need.

- Innovations in De-icing Materials: Development of environmentally friendly and more effective de-icing compounds.

- Autonomous Snow Removal: Emergence of self-driving plows and de-icing robots.

- Alternative Infrastructure: Heated surfaces and improved drainage systems to prevent ice buildup.

- Market Trends: Significant investment in sustainable de-icing and growth in autonomous vehicle technology.

Regulatory and Environmental Factors

Increasing environmental regulations or public pressure regarding the use of certain de-icing chemicals or the environmental impact of traditional snow removal methods could drive adoption of alternative, more environmentally friendly solutions, thus increasing the threat of substitutes. For instance, in 2024, several municipalities continued to explore or implement stricter guidelines on salt usage, with some regions reporting a 5-10% reduction in road salt application compared to previous years due to environmental concerns. This push for greener alternatives, such as brine or organic de-icers, presents a direct substitute threat to traditional plowing and salting equipment manufacturers like Douglas Dynamics.

The growing demand for electric vehicles (EVs) also introduces a subtle but emerging threat. As more EVs enter the market, there's a concurrent development in specialized snow removal equipment designed for EV fleets, potentially impacting the market share for traditional snowplow attachments. By mid-2024, EV adoption rates in North America had surpassed 10% of new vehicle sales, a trend that could gradually shift demand towards EV-compatible or entirely new forms of snow management solutions.

- Growing environmental scrutiny on traditional de-icing agents like road salt could spur demand for alternative, eco-friendlier snow removal methods.

- Stricter regulations in 2024 concerning salt usage in certain regions signal a potential shift towards substitutes.

- The rise of **electric vehicles (EVs)** may lead to the development of specialized snow removal equipment, posing a future threat to conventional attachments.

- Public pressure for **sustainable practices** in infrastructure maintenance can accelerate the adoption of substitute technologies.

The threat of substitutes for Douglas Dynamics is amplified by evolving de-icing technologies and alternative infrastructure solutions. For example, the market for sustainable de-icing agents saw significant investment in 2024, with new formulations promising reduced environmental impact and potentially lower long-term costs compared to traditional methods. Furthermore, the increasing feasibility of heated roadways, while capital-intensive, could gradually reduce the overall need for conventional snow removal equipment.

The growing adoption of electric vehicles (EVs) also presents an emerging substitute threat. By mid-2024, EVs represented over 10% of new vehicle sales in North America, driving the development of specialized snow removal equipment tailored for EV fleets. This trend could eventually shift demand away from traditional snowplow attachments that Douglas Dynamics primarily serves.

| Substitute Category | Key Developments (2024) | Potential Impact on Douglas Dynamics |

|---|---|---|

| De-icing Materials | Investment in eco-friendly and more effective compounds | Reduced demand for salt-spreading attachments if alternatives prove cost-effective |

| Autonomous Technology | Advancements in robotic plows and de-icing systems | Long-term threat to human-operated equipment market |

| Infrastructure | Increased feasibility of heated roadways | Reduced overall need for traditional snow removal |

| EV Integration | Development of EV-specific snow removal tools | Potential market share erosion for conventional attachments |

Entrants Threaten

Starting a business in the snow and ice control equipment sector demands a hefty initial investment. Companies need substantial funds for manufacturing plants, advanced machinery, cutting-edge research and development, and maintaining adequate inventory levels to meet demand. For instance, building a new, modern manufacturing facility alone can easily run into tens of millions of dollars, a significant hurdle for potential newcomers.

Douglas Dynamics benefits from its existing, robust manufacturing infrastructure and its ongoing commitment to innovation and product enhancement. This established operational capacity and consistent investment in improving its product lines create a formidable barrier for any new company attempting to enter the market and compete effectively.

Douglas Dynamics, a seasoned leader in the snow and cold weather attachment industry, leverages significant economies of scale. This advantage, built over years of operation, allows them to achieve lower per-unit costs in manufacturing, raw material purchasing, and logistics. For instance, their substantial production volumes in 2024 likely translate to more favorable pricing from suppliers compared to a new market entrant.

New companies entering the market would find it exceptionally challenging to replicate these cost efficiencies. Without the established infrastructure and purchasing power of Douglas Dynamics, they would face higher initial production costs, making it difficult to compete on price and potentially leading to substantial early financial losses.

Douglas Dynamics benefits from significant brand loyalty, with established names like FISHER, SNOWEX, and WESTERN having cultivated deep customer trust over decades. This loyalty acts as a substantial barrier, making it incredibly difficult for new players to gain traction. For instance, in 2023, Douglas Dynamics reported net sales of $571.6 million, showcasing the scale of its established market presence, which new entrants would struggle to replicate.

Access to Distribution Channels

Douglas Dynamics benefits from deeply entrenched relationships with a wide array of customers and well-established distribution networks across its Work Truck Attachments and Work Truck Solutions divisions. This existing infrastructure presents a significant hurdle for potential new entrants. For instance, in 2024, the aftermarket segment for vocational trucks, which Douglas Dynamics serves, continued to see strong demand driven by infrastructure spending and fleet upgrades.

New companies entering the market would face the considerable challenge of developing their own distribution channels from scratch or finding ways to penetrate Douglas Dynamics' existing networks. This process is not only time-consuming but also requires substantial capital investment, making it a less attractive proposition for emerging competitors.

The difficulty in accessing these established channels means that new entrants must either invest heavily in building their own sales and distribution infrastructure or seek less efficient, direct-to-consumer models. This barrier significantly moderates the threat of new entrants in the short to medium term.

- Established Distribution Networks: Douglas Dynamics leverages existing, robust relationships with dealers and end-users.

- High Capital Investment for New Entrants: Building comparable distribution channels requires significant financial resources and time.

- Customer Loyalty and Relationships: Long-standing ties with customers make it difficult for new players to gain traction.

- Market Access Barriers: Overcoming Douglas Dynamics' established market presence and distribution reach is a major challenge.

Government Policy and Regulations

Government policies and regulations significantly influence the threat of new entrants in the work-ready vehicle market, particularly concerning municipal contracts and vehicle upfitting. New companies must navigate a complex web of compliance requirements, which can be a substantial barrier.

These regulations often encompass stringent safety standards, environmental mandates, and specific tender stipulations. For instance, in 2024, many government procurement processes for vehicles and related equipment, like those Douglas Dynamics serves, require adherence to evolving emissions standards and rigorous safety certifications. Meeting these demands necessitates significant upfront investment in engineering, testing, and manufacturing processes, making it challenging for smaller or newer players to compete effectively.

- Regulatory Hurdles: New entrants face compliance costs related to safety, emissions, and operational standards.

- Municipal Contract Complexity: Bidding for and fulfilling government contracts often involves intricate documentation and adherence to specific procurement rules.

- Capital Investment: Meeting regulatory requirements for vehicle modification and equipment manufacturing demands substantial financial resources, deterring new competition.

- Industry Standards: Established players have already invested in adapting to and meeting current and anticipated regulatory shifts, creating a competitive advantage.

The threat of new entrants for Douglas Dynamics is moderate, primarily due to high capital requirements and established brand loyalty. Significant investment is needed for manufacturing, R&D, and inventory, a barrier that deterred many in 2024 as capital costs remained elevated.

Douglas Dynamics' established distribution networks and strong customer relationships, built over years, further solidify its market position. For example, their 2023 net sales of $571.6 million highlight the scale of their presence, making it difficult for newcomers to gain market share quickly.

Navigating complex government regulations and compliance standards, especially for municipal contracts, also presents a significant hurdle for potential new competitors entering the work-ready vehicle market in 2024.

The company's economies of scale, achieved through high production volumes, allow for lower per-unit costs, a competitive advantage that new entrants would struggle to match initially.

| Factor | Impact on New Entrants | Douglas Dynamics' Advantage |

|---|---|---|

| Capital Investment | High (Manufacturing, R&D, Inventory) | Established Infrastructure |

| Brand Loyalty | Difficult to Overcome | Decades of Trust (FISHER, SNOWEX) |

| Distribution Networks | Challenging to Replicate | Extensive Existing Channels |

| Economies of Scale | Limited Initial Production Cost Efficiency | Lower Per-Unit Costs from High Volume (2024) |

| Regulatory Compliance | Costly and Time-Consuming | Existing Compliance Framework |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Douglas Dynamics leverages data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate information from competitor filings and trade publications to gain a comprehensive understanding of the competitive landscape.