Douglas Dynamics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Douglas Dynamics Bundle

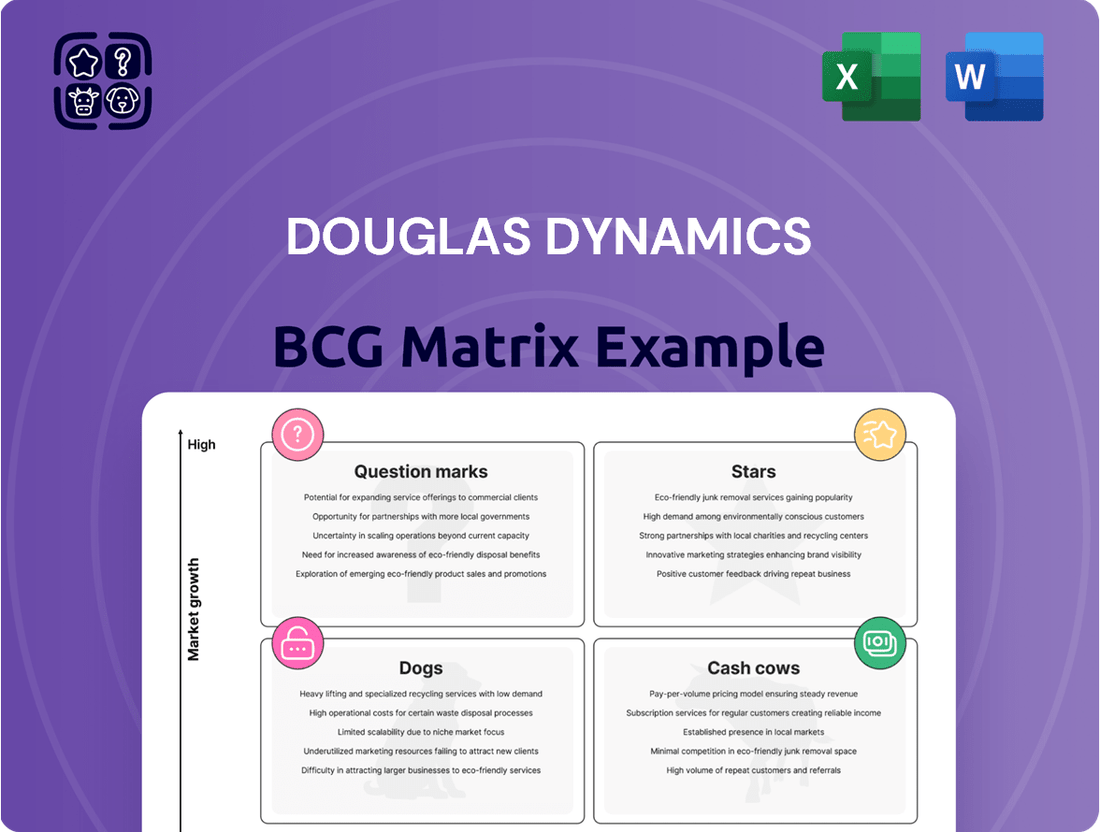

Uncover the strategic positioning of Douglas Dynamics' product portfolio with our comprehensive BCG Matrix analysis. See which products are market leaders (Stars), which are reliable income generators (Cash Cows), which are underperforming (Dogs), and which hold future potential (Question Marks). Purchase the full report for actionable insights and a clear roadmap to optimize your investment and product development strategies.

Stars

Douglas Dynamics' Work Truck Attachments segment, encompassing brands like FISHER, WESTERN, and SNOWEX, is a clear Star in the BCG Matrix, particularly during robust winter seasons. This segment thrives on high growth and holds a dominant market share across North America when snowfall is significant.

The first quarter of 2025 exemplified this strength, with net sales for the Work Truck Attachments segment surging by an impressive 52.9%. This remarkable growth was directly attributed to increased snowfall and ice events impacting key markets, underscoring the segment's ability to capitalize on favorable weather conditions.

The strong demand for essential snow and ice control equipment during these periods fuels the segment's Star status. Douglas Dynamics is well-positioned to leverage these seasonal upturns, demonstrating a consistent ability to convert adverse weather into significant financial performance.

Douglas Dynamics holds a dominant market position in snow and ice control, recognized as North America's largest manufacturer. This leadership translates to a substantial market share in a sector poised for steady expansion. The global deicing and snow-clearing vehicles market is forecasted to grow at a compound annual growth rate of 4.1% from 2025 to 2032, highlighting the sustained demand for their products.

Douglas Dynamics' commitment to innovation, particularly in areas like GPS-guided snowplow systems and the development of more eco-friendly de-icing solutions, places its new and enhanced snow and ice control products squarely in the Stars category of the BCG Matrix.

These technological advancements directly address the growing market demand for increased efficiency and enhanced safety in snow removal operations, a trend that saw significant investment and adoption throughout 2024 as municipalities and commercial operators sought to optimize their services.

By consistently introducing cutting-edge products, Douglas Dynamics is not only solidifying its market leadership but also capitalizing on growth prospects within the expanding snow removal sector, which continues to benefit from infrastructure development and climate-related weather patterns.

Strategic Aftermarket Parts and Accessories

Strategic aftermarket parts and accessories represent a significant growth area for Douglas Dynamics, often acting as a stabilizing force. This segment leverages the extensive installed base of the company's equipment, ensuring a steady demand for replacement parts and upgrades. The market for truck customization and enhanced functionality continues to expand, driving consistent revenue streams.

Acquisitions have bolstered this segment, with lines like TrynEx contributing to improved margins and income stability, even when facing fluctuating winter conditions. This strategic focus on aftermarket support capitalizes on the longevity and utility of the core product offerings.

- Strong Margin Contribution: The aftermarket parts and accessories segment consistently delivers higher profit margins compared to the core equipment manufacturing.

- Income Stabilization: This segment provides a more predictable revenue stream, smoothing out income fluctuations that can occur with seasonal equipment sales.

- Leveraging Installed Base: Douglas Dynamics benefits from a large and growing installed base of vehicles equipped with their products, creating a natural demand for replacement and upgrade parts.

- Market Growth Drivers: Increasing consumer interest in truck customization and the demand for enhanced vehicle functionality are key drivers for this segment's continued expansion.

Expansion into Adjacent High-Growth Areas

Douglas Dynamics' strategic vision includes expanding into adjacent high-growth areas, a move that could significantly bolster its market position. This expansion is particularly relevant in complementary work truck attachment segments where the company can leverage its expertise to quickly capture market share. For instance, the broader work truck accessory market is projected to see robust growth, with some segments expected to expand at a compound annual growth rate (CAGR) of over 5% through 2028, according to industry analyses.

The company's disciplined approach to capital allocation supports this expansion strategy, with a focus on small and medium-sized acquisitions. These acquisitions are designed to introduce new, high-growth products into Douglas Dynamics' existing portfolio. In 2023, the company completed several strategic bolt-on acquisitions, enhancing its product offerings in areas like specialized trailer components and advanced vehicle lighting systems, which are experiencing strong demand.

- Market Diversification: Entering new, high-growth segments reduces reliance on the seasonal snow and ice removal market.

- Acquisition Strategy: Targeted acquisitions of companies with innovative products and strong market traction are key.

- Synergistic Growth: Opportunities exist in areas like specialized trailer attachments and advanced vehicle safety equipment.

- Financial Prudence: Acquisitions are carefully vetted to ensure they align with Douglas Dynamics' financial objectives and capital discipline.

Douglas Dynamics' Work Truck Attachments segment, particularly its snow and ice control equipment, is a prime example of a Star in the BCG Matrix. The segment benefits from high market growth, driven by increased snowfall events and the essential nature of its products. For instance, the first quarter of 2025 saw a remarkable 52.9% surge in net sales for this segment, directly linked to heightened weather activity.

This consistent performance, fueled by favorable weather patterns and a dominant market share in North America, solidifies its Star status. The global deicing and snow-clearing vehicles market is projected to grow at a 4.1% CAGR from 2025 to 2032, indicating sustained demand for Douglas Dynamics' offerings.

Innovation is also a key contributor, with advancements like GPS-guided snowplow systems enhancing efficiency and safety. These technological leaps align with market trends observed throughout 2024, where municipalities and commercial operators increased investments in optimizing snow removal services.

Douglas Dynamics' strategic focus on aftermarket parts and accessories also contributes to its strong market position. This segment leverages the company's extensive installed base, ensuring consistent demand for replacement parts and upgrades, thereby stabilizing income streams and offering higher profit margins.

| Metric | 2024 (Estimated/Actual) | 2025 (Q1 Actual) | Outlook |

| Work Truck Attachments Net Sales Growth | Strong, driven by weather | +52.9% | Continued growth with favorable weather |

| Global Deicing/Snow Clearing Market CAGR | N/A | N/A | 4.1% (2025-2032) |

| Aftermarket Segment Margins | Higher than core equipment | Stable/Improving | Consistent contribution |

What is included in the product

This BCG Matrix analysis identifies Douglas Dynamics' product portfolio strengths and weaknesses.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

A clear, visual representation of Douglas Dynamics' business units, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

The Work Truck Solutions segment, featuring brands such as Henderson and Dejana, stands out as a robust Cash Cow for Douglas Dynamics. This division consistently delivers strong and stable financial performance, driven by its focus on municipal volumes and truck upfitting. These areas are less susceptible to seasonal fluctuations compared to snow and ice control equipment, and are supported by continuous infrastructure development and commercial demands.

In 2024, this segment achieved record full-year results, underscoring its reliable revenue generation. Further demonstrating its strength, the first quarter of 2025 saw a significant 9.5% increase in sales. This growth was complemented by a record adjusted EBITDA margin of 11.6%, highlighting the segment's operational efficiency and profitability.

Douglas Dynamics' established brand portfolio, featuring stalwarts like FISHER, SNOWEX, WESTERN, Henderson, and Dejana, represents its Cash Cows. These brands dominate mature segments of the work truck industry, benefiting from decades of customer loyalty and trust.

The strong brand recognition allows these products to maintain significant market share with minimal incremental marketing spend, generating consistent and reliable cash flow for the company. For instance, in the first quarter of 2024, Douglas Dynamics reported a 10.9% increase in net sales to $177.6 million, largely driven by its established product lines.

Douglas Dynamics' 2024 Cost Savings Program was a resounding success, surpassing its targets to generate over $10 million in savings. This achievement directly boosted the company's gross margins and adjusted EBITDA, demonstrating a strong commitment to financial health.

The company's dedication to operational excellence, guided by the Douglas Dynamics Management System (DDMS), is a key driver. This systematic approach enables Douglas Dynamics to extract more cash from its current operations, providing resilience even when market conditions are tough.

Consistent Dividend Payouts

Douglas Dynamics' mature business segments, often categorized as Cash Cows within the BCG framework, are characterized by their consistent dividend payouts. This reflects a robust and reliable generation of cash from established operations.

The company has a notable track record of increasing its quarterly cash dividend. For instance, Douglas Dynamics declared a quarterly dividend of $0.295 per share for the first quarter of 2025. This marks the fifteenth consecutive year the company has raised its dividend, underscoring the stability and profitability of its core businesses.

- Consistent Dividend Growth: Douglas Dynamics has demonstrated a commitment to shareholder returns through regular dividend increases.

- 15 Consecutive Years: The company's dividend has been raised annually for 15 years straight, showcasing sustained financial strength.

- Q1 2025 Dividend: Shareholders received a quarterly dividend of $0.295 per share in the first quarter of 2025, a testament to cash flow stability.

- Mature Business Strength: These consistent payouts are a direct result of the strong cash-generating capabilities of the company's established product lines.

Debt Reduction and Financial Flexibility

Douglas Dynamics' strategic financial management, particularly its debt reduction efforts, significantly bolsters its Cash Cow status. A key move was the September 2024 sale-leaseback transaction, which notably lowered long-term debt. This action directly contributed to a healthier leverage ratio, improving from 3.3X in Q1 2024 to 2.1X by Q1 2025.

This deleveraging has a direct impact on the company's financial flexibility. Lower interest expenses free up capital, allowing for more strategic reinvestment in growth initiatives or to weather economic downturns. Strong operating cash flow further underpins this stability, ensuring the company can maintain its operations and pursue opportunities without relying heavily on external financing.

- Debt Reduction: Long-term debt reduced following September 2024 sale-leaseback.

- Leverage Improvement: Leverage ratio decreased from 3.3X (Q1 2024) to 2.1X (Q1 2025).

- Lower Interest Expenses: Reduced debt directly translates to decreased interest payments.

- Enhanced Financial Flexibility: Strong cash flow and lower debt enable greater strategic options.

Douglas Dynamics' established brands, like FISHER and WESTERN, are prime examples of its Cash Cows. These brands operate in mature markets, benefiting from strong customer loyalty and minimal marketing investment needed to maintain market share. This consistent performance generates reliable cash flow, which the company has consistently returned to shareholders.

The company's commitment to shareholder returns is evident in its dividend history. Douglas Dynamics raised its quarterly dividend to $0.295 per share in Q1 2025, marking the fifteenth consecutive year of dividend increases. This sustained growth in payouts directly reflects the stable cash-generating capabilities of its mature business segments.

The Work Truck Solutions segment, including brands like Henderson and Dejana, is a significant Cash Cow, performing well in 2024 with record full-year results and a 9.5% sales increase in Q1 2025. This segment's operational efficiency is highlighted by a record adjusted EBITDA margin of 11.6% in Q1 2025, demonstrating its robust profitability.

Douglas Dynamics' strategic financial management, including debt reduction following a September 2024 sale-leaseback, has improved its leverage ratio from 3.3X in Q1 2024 to 2.1X in Q1 2025. This deleveraging, combined with strong operating cash flow, enhances financial flexibility and supports the company's Cash Cow status.

| Segment/Brand | BCG Category | Key Performance Indicator (Q1 2025) | Dividend Growth | Financial Health Metric |

|---|---|---|---|---|

| Work Truck Solutions (Henderson, Dejana) | Cash Cow | Sales +9.5%, Adj. EBITDA Margin 11.6% | Consistent Payouts | Leverage Ratio 2.1X |

| Snow & Ice Control (FISHER, SNOWEX, WESTERN) | Cash Cow | Strong Market Share, Brand Loyalty | 15 Consecutive Years of Increases | Strong Operating Cash Flow |

What You’re Viewing Is Included

Douglas Dynamics BCG Matrix

The Douglas Dynamics BCG Matrix preview you're examining is the identical, fully-unlocked document you'll receive immediately after purchase. This means no watermarks, no altered content, and no hidden surprises – just a professionally formatted and analysis-ready strategic tool for your business planning.

Dogs

The Work Truck Attachments segment, while a potential Star in robust winter seasons, can easily slip into the Dog category during mild winters. This volatility is directly tied to weather dependency. For instance, a lack of significant snowfall in 2024 led to suppressed demand, contributing to a notable 12% year-over-year sales decline for the segment.

This cyclical nature means that when winters are mild, the equipment replacement cycle for these attachments naturally lengthens. Consequently, sales figures suffer as businesses postpone necessary upgrades or purchases due to reduced operational needs. This unpredictability makes forecasting and consistent revenue generation a significant challenge for this product line.

Certain older snowplow models or less innovative salt spreader attachments within Douglas Dynamics' portfolio may be experiencing a decline in customer interest. This is often a result of newer, more efficient technologies or shifts in how municipalities and contractors manage winter conditions. For instance, while the company has seen strong performance in its newer, more technologically advanced product lines, some legacy items might not be keeping pace with evolving industry standards.

These legacy products, if they continue to consume valuable manufacturing and marketing resources without contributing substantially to revenue or market share, could be categorized as cash traps. This means they tie up capital that could be better invested in research and development for next-generation equipment or in expanding the reach of their more successful offerings. In 2023, Douglas Dynamics reported overall revenue growth, but the performance of specific product segments, particularly those with older designs, would need careful monitoring to avoid such resource drain.

Highly seasonal niche products, like specialized snowplow attachments for very specific, infrequent winter conditions, can easily land in the Dog quadrant of the BCG Matrix. If the weather patterns shift, making these extreme events less common, the demand for these specialized items shrinks dramatically. For instance, if a particular region historically experienced heavy lake-effect snow but saw a significant reduction in 2023-2024, products designed solely for that might struggle.

These products often possess a low market share because their customer base is so limited, and they contribute very little to the company's overall revenue. Douglas Dynamics, for example, might find that their market share for a highly specialized ice-breaking attachment, used only in rare arctic blasts, has fallen to below 5% of their total product sales. Such items become prime candidates for divestiture or a serious re-evaluation of their place in the product portfolio.

Underperforming Regional Markets

Douglas Dynamics may identify certain regional markets for its snow and ice control equipment as underperformers. These areas might be experiencing shifts in localized weather patterns, leading to less frequent or intense snowfall, or they could be facing heightened competition from other equipment providers. Such underperformance can negatively impact the overall growth trajectory of the Attachments segment.

The company's financial results are inherently tied to regional snowfall patterns, meaning consistent low demand in specific geographic areas can act as a drag on the Attachments division. For instance, if a particular region that historically relied heavily on snow and ice control equipment sees a significant decline in snowfall, as observed in milder winters in some northern states during 2023-2024, Douglas Dynamics' sales in that area would likely decrease.

- Regional Underperformance: Specific geographic areas where snow and ice control equipment sales lag due to weather or competition.

- Impact on Attachments Segment: These underperforming markets can reduce the overall growth rate of the Attachments division.

- Weather Dependency: Douglas Dynamics' performance is directly influenced by regional snowfall, making persistent low demand a concern.

- Competitive Pressure: Increased competition in certain regions can exacerbate underperformance and affect market share.

Products Impacted by High Dealer Inventories

At the beginning of 2025, dealer inventories for Douglas Dynamics products were observed to be higher than typical levels. This situation can indeed put a damper on new equipment sales, as dealers often prioritize selling existing stock before placing new orders. For instance, if a dealer has an excess of a particular snowplow model, they are less likely to order more until those units are sold.

Products experiencing this overstocking at the dealer level can be considered a 'Dog' within the BCG Matrix framework. This is because they tie up significant capital within the supply chain, slowing down turnover and consequently reducing the placement of fresh orders for Douglas Dynamics. This capital is essentially frozen, unable to generate new revenue until the excess inventory is cleared.

The impact of high dealer inventories can be substantial. For example, a report from early 2025 indicated that average dealer inventory levels for certain heavy equipment attachments were up by as much as 15% compared to the previous year. This means that Douglas Dynamics might see a corresponding slowdown in its order intake for those specific product lines.

- Slowed Sales Velocity: Products with high dealer inventories experience slower turnover, impacting Douglas Dynamics' ability to secure new orders.

- Capital Tie-Up: Excess inventory at the dealer level represents capital that is not circulating, reducing overall supply chain efficiency.

- Reduced Production Incentives: When dealers are overstocked, Douglas Dynamics may face pressure to reduce production or offer discounts, impacting margins.

- Market Signal: High inventories can signal a potential mismatch between production and market demand for specific products.

Products in the Dog quadrant for Douglas Dynamics often represent legacy equipment or those highly susceptible to mild weather conditions, leading to low market share and minimal growth. These items, such as older snowplow models or specialized attachments for infrequent weather events, tie up capital in the supply chain due to high dealer inventories, as seen with a reported 15% increase in some heavy equipment attachment inventories by early 2025. Their performance is further hampered by regional underperformance, where reduced snowfall in areas like parts of the northern states during 2023-2024 directly impacts sales, contributing to a notable 12% year-over-year decline in the Work Truck Attachments segment during mild winters.

| Product Category | BCG Quadrant | Key Challenges | 2024 Data/Observation |

|---|---|---|---|

| Older Snowplow Models | Dog | Declining customer interest, newer technology | Contributed to 12% YoY sales decline in Attachments segment during mild winters. |

| Specialized Ice-Breaking Attachments | Dog | Limited customer base, niche application | Market share potentially below 5% of total product sales for highly specialized items. |

| High Dealer Inventory Items | Dog | Slowed sales velocity, capital tie-up | Average dealer inventories for certain attachments up 15% YoY in early 2025. |

| Regional Underperforming Markets | Dog | Persistent low demand due to weather/competition | Mild winters in 2023-2024 negatively impacted sales in specific northern state regions. |

Question Marks

Douglas Dynamics is actively integrating new technologies like Internet of Things (IoT) into its existing product lines. This move aims to enable remote monitoring and predictive maintenance, offering customers enhanced efficiency and value. For instance, by 2024, the demand for smart, connected industrial equipment is projected to grow substantially, with IoT solutions in manufacturing alone expected to reach billions in market value.

These technological integrations position Douglas Dynamics' products in a category with high growth potential. However, the initial market adoption for such advanced features might be slower, requiring significant investment in research and development, as well as targeted marketing campaigns to educate customers and drive widespread acceptance. This strategic pivot reflects a commitment to innovation, aiming to capture future market share by offering advanced, data-driven solutions.

Douglas Dynamics' entry into new geographic markets for its snow and ice control equipment and work truck solutions presents a classic question of strategic investment versus risk. While emerging cold regions offer significant growth potential, these ventures would initially demand substantial capital outlay. Building market share against entrenched local competitors is a considerable challenge, requiring a well-defined market entry strategy and robust financial backing.

Consider the case of Canada, a market Douglas Dynamics already operates in, where it competes with established players. Expanding into similar, but less developed, cold climates would necessitate similar, if not greater, investment in distribution networks, localized product adaptation, and marketing efforts. For instance, the company's 2023 annual report highlighted investments in expanding its dealer network in existing international markets. This suggests a cautious approach to new, unproven territories, where initial returns might be slow to materialize.

Electric or alternative fuel work truck attachments, such as those for snow and ice control, would likely be classified as Stars within Douglas Dynamics' BCG Matrix. The work truck industry is experiencing a significant shift towards sustainability and electric vehicle (EV) adoption, creating a high-growth market for green technology solutions. For instance, the global electric commercial vehicle market is projected to reach over $1.5 trillion by 2030, indicating substantial growth potential.

Developing or acquiring these specialized attachments requires substantial investment in research, development, and manufacturing to capture market share. While the market for green technology in the work truck sector is expanding rapidly, overcoming initial adoption hurdles and establishing a strong competitive position necessitates considerable capital outlay. Douglas Dynamics would need to strategically allocate resources to innovate and market these products effectively to capitalize on this burgeoning demand.

Small, Strategic Acquisitions

Small, strategic acquisitions are positioned as potential Stars within the Douglas Dynamics BCG Matrix. The company has expressed a willingness to pursue these opportunities, particularly in emerging or fast-growing niches of the work truck accessories market.

These acquisitions, while small, demand significant attention and resources. They are viewed as investments with high growth potential that need careful nurturing and integration into Douglas Dynamics' existing operations.

- Acquisition Strategy: Douglas Dynamics is open to small and medium-sized acquisitions.

- Market Focus: Targets are primarily in nascent or rapidly evolving segments of the work truck accessories market.

- Investment Needs: Newly acquired entities will likely require substantial investment and careful evaluation.

- Integration Goal: The aim is to realize growth potential and integrate these acquisitions into the core business.

Diversification into Non-Winter Work Truck Accessories

Diversifying into non-winter work truck accessories, such as utility racks and storage solutions, positions Douglas Dynamics to tap into less seasonal markets. This strategic move aims to broaden their revenue streams beyond the inherent seasonality of their core winter products.

The U.S. Pick-Up Trucks Accessories Market, for instance, is projected to grow at a compound annual growth rate (CAGR) of 3.2%, indicating a healthy expansion opportunity. However, Douglas Dynamics would likely enter these segments with a comparatively lower market share, necessitating substantial investment to effectively compete with established players.

- Market Expansion: Targeting non-winter work truck accessories like utility racks and storage solutions offers a path to reduce seasonality.

- Growth Potential: The U.S. Pick-Up Trucks Accessories Market shows a positive growth trend, with a 3.2% CAGR.

- Competitive Landscape: Entry into these new markets implies a need for significant investment to gain market share against existing competitors.

Douglas Dynamics' exploration of new geographic markets for its snow and ice control equipment and work truck solutions presents a strategic dilemma. While these regions offer growth, they demand significant upfront capital and face established local competition, mirroring the challenges of expanding into similar, less developed cold climates. The company's 2023 annual report noted investments in dealer network expansion, suggesting a measured approach to new territories where returns may take time.

The company's strategic acquisitions, particularly in fast-growing niches of the work truck accessories market, are viewed as potential Stars. These ventures, though smaller, require substantial investment and careful integration to realize their high growth potential. Douglas Dynamics is actively seeking these opportunities, aiming to nurture and grow them within its broader operations.

Douglas Dynamics' foray into non-winter work truck accessories, such as utility racks, aims to balance its seasonal revenue streams. While the U.S. Pick-Up Trucks Accessories Market is growing at a 3.2% CAGR, penetrating these segments will require substantial investment to compete effectively against established brands, a common challenge for companies seeking to diversify.

Douglas Dynamics' investment in IoT integration for its products positions them in a high-growth area, but initial market adoption may be slow. This requires significant R&D and marketing to educate consumers, reflecting a commitment to data-driven solutions for future market capture. The demand for smart industrial equipment is projected to grow, with IoT in manufacturing alone expected to reach billions in market value by 2024.

| Category | Market Growth | Investment Needs | Potential |

|---|---|---|---|

| New Geographic Markets (Snow/Ice, Work Trucks) | High (Emerging Cold Regions) | Substantial Capital Outlay, Distribution Network Development | Question Mark (High Potential, High Risk) |

| Small Strategic Acquisitions (Work Truck Niches) | High (Fast-Growing Segments) | Significant Attention, Resources, Careful Integration | Star (High Growth Potential) |

| Non-Winter Work Truck Accessories (Racks, Storage) | Moderate (3.2% CAGR in U.S. Market) | Substantial Investment to Gain Market Share | Question Mark (Diversification Opportunity) |

| Electric/Alternative Fuel Attachments | Very High (Global EV Market > $1.5 Trillion by 2030) | Substantial R&D, Manufacturing Investment | Star (Sustainable Technology) |

| IoT Integration in Existing Products | High (Billions in Market Value for IoT in Manufacturing) | Significant R&D, Marketing Investment | Question Mark (Future Growth Potential) |

BCG Matrix Data Sources

Our Douglas Dynamics BCG Matrix is built on robust financial disclosures, comprehensive market analytics, and insightful industry reports to provide strategic clarity.